회사 소개

| Carlyle 리뷰 요약 | |

| 설립 연도 | 1987 |

| 등록 국가/지역 | 미국 |

| 규제 | 규제 없음 |

| 제품 및 서비스 | 글로벌 사모 펀드, 글로벌 신용, 투자 솔루션 |

| 데모 계정 | / |

| 레버리지 | / |

| 스프레드 | / |

| 거래 플랫폼 | / |

| 최소 입금액 | / |

| 고객 지원 | 전화: +1 212 813 4504 |

| 이메일: media@carlyle.com | |

| 소셜 미디어: X, YouTube, LinkedIn, Instagram | |

| 주소: 799 9th Street, NW, Suite 200, Washington, DC 20001 | |

Carlyle 정보

Carlyle는 미국에 본사를 둔 세계적인 투자 회사로, 1987년에 설립되었습니다. 소매 브로커로 규제되지 않으며 거래 계정을 제공하지 않습니다. 회사는 사모 펀드, 신용, 투자 솔루션을 위한 기관 자산 관리에 특화되어 있으며, 약 4530억 달러의 자산을 관리하고 있습니다.

장단점

| 장점 | 단점 |

| 오랜 역사를 자랑하는 글로벌 투자 회사 | 규제가 없음 |

| 다양한 연락 채널 | 거래 조건에 대한 정보 없음 |

| 다수의 글로벌 지점 |

Carlyle 합법적인가요?

Carlyle는 미국을 기반으로 하고 있지만 거기서는 어떤 금융 기관도 그를 주시하고 있지 않습니다. 또한 FCA(영국), ASIC(호주), 또는 CySEC(키프로스)와 같은 주요 국제 규제 기관으로부터 라이센스를 받지 않았습니다.

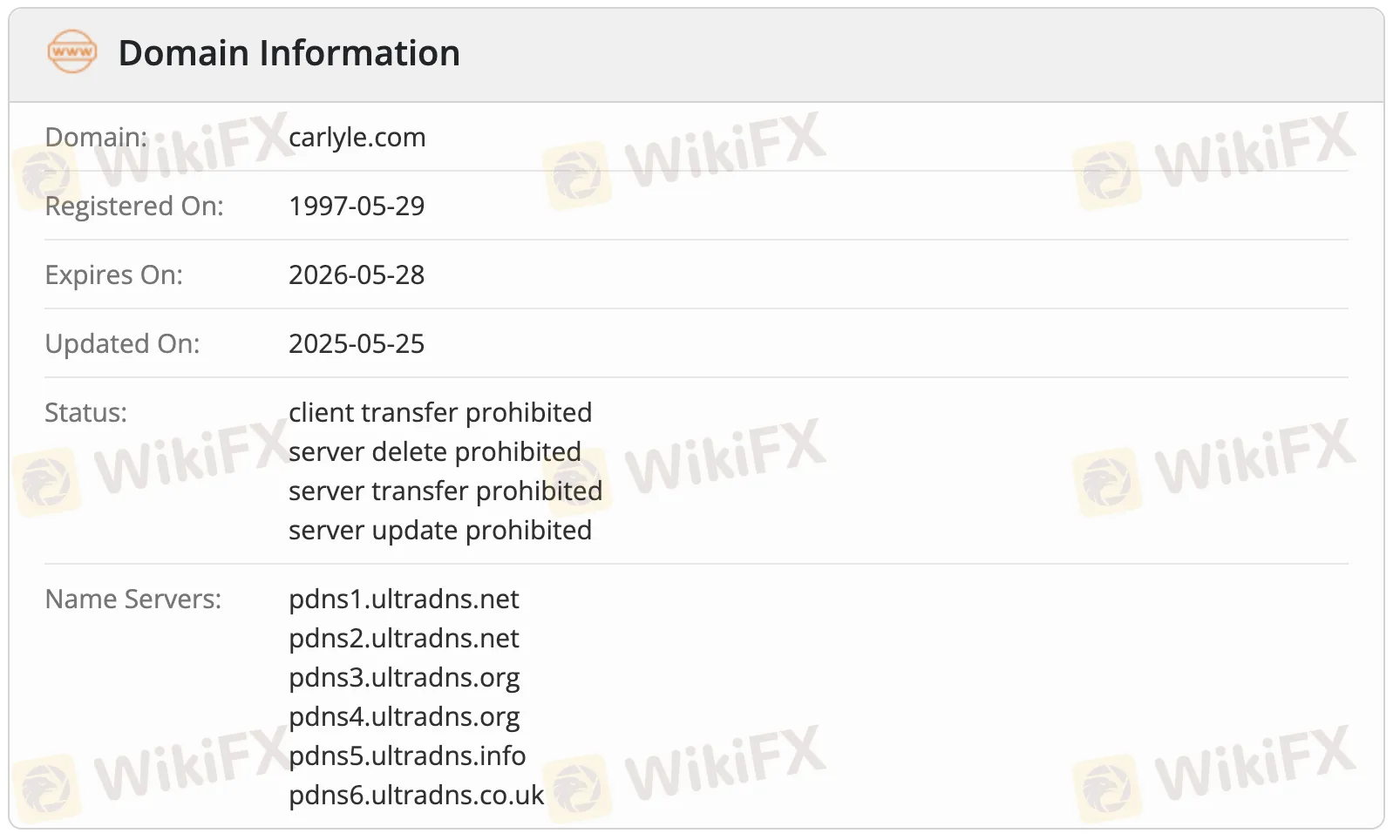

carlyle.com 도메인에 대한 WHOIS 검색 결과, 해당 도메인은 1997년 5월 29일에 처음 등록되었습니다. 도메인은 여전히 활성화되어 있으며, 등록은 2026년 5월 28일까지 유효합니다. 마지막으로 변경된 날짜는 2025년 5월 25일입니다. 도메인에는 클라이언트가 서버를 이동, 편집, 제거, 이전하는 것을 허용하지 않는 규칙이 있습니다.

제품 및 서비스

Carlyle는 주로 사모 펀드, 신용, 투자 솔루션을 중심으로 한 글로벌 투자 관리 서비스를 제공합니다. 전 세계의 다양한 세그먼트와 차량에서 4530억 달러 이상의 자산을 관리합니다.

| 제품 및 서비스 | 지원 |

| 글로벌 사모 펀드 | ✔ |

| 글로벌 신용 | ✔ |

| 투자 솔루션 | ✔ |