Buod ng kumpanya

| Carlyle Buod ng Pagsusuri | |

| Itinatag | 1987 |

| Rehistradong Bansa/Rehiyon | Estados Unidos |

| Regulasyon | Walang regulasyon |

| Mga Produkto at Serbisyo | Global na Pribadong Ekweyt, Global na Kredito, Mga Solusyon sa Pamumuhunan |

| Demo Account | / |

| Levage | / |

| Spread | / |

| Plataforma ng Paggagalaw | / |

| Minimum na Deposito | / |

| Suporta sa Kustomer | Telepono: +1 212 813 4504 |

| Email: media@carlyle.com | |

| Social Media: X, YouTube, LinkedIn, Instagram | |

| Address: 799 9th Street, NW, Suite 200, Washington, DC 20001 | |

Carlyle Impormasyon

Ang Carlyle ay isang pandaigdigang kumpanya sa pamumuhunan na may punong tanggapan sa Estados Unidos at itinatag noong 1987. Ito ay hindi regulado bilang isang broker sa retail at hindi nag-aalok ng mga trading account. Ang kumpanya ay espesyalista sa pangangasiwa ng institusyonal na ari-arian para sa pribadong ekweyt, kredito, at mga solusyon sa pamumuhunan, na humahawak ng halos $453 bilyon sa mga ari-arian.

Mga Benepisyo at Kons

| Mga Benepisyo | Kons |

| Matagal nang itinatag na pandaigdigang kumpanya sa pamumuhunan | Hindi regulado |

| Iba't ibang mga paraan ng pakikipag-ugnayan | Walang impormasyon sa mga kondisyon ng pagtetrading |

| Maraming global na sangay |

Tunay ba ang Carlyle?

Ang Carlyle ay nakabase sa US, bagaman walang anumang ahensiyang pinansyal doon ang nagbabantay dito. Hindi rin ito may lisensya mula sa anumang pangunahing internasyonal na mga awtoridad sa regulasyon, tulad ng FCA (UK), ASIC (Australia), o CySEC (Cyprus).

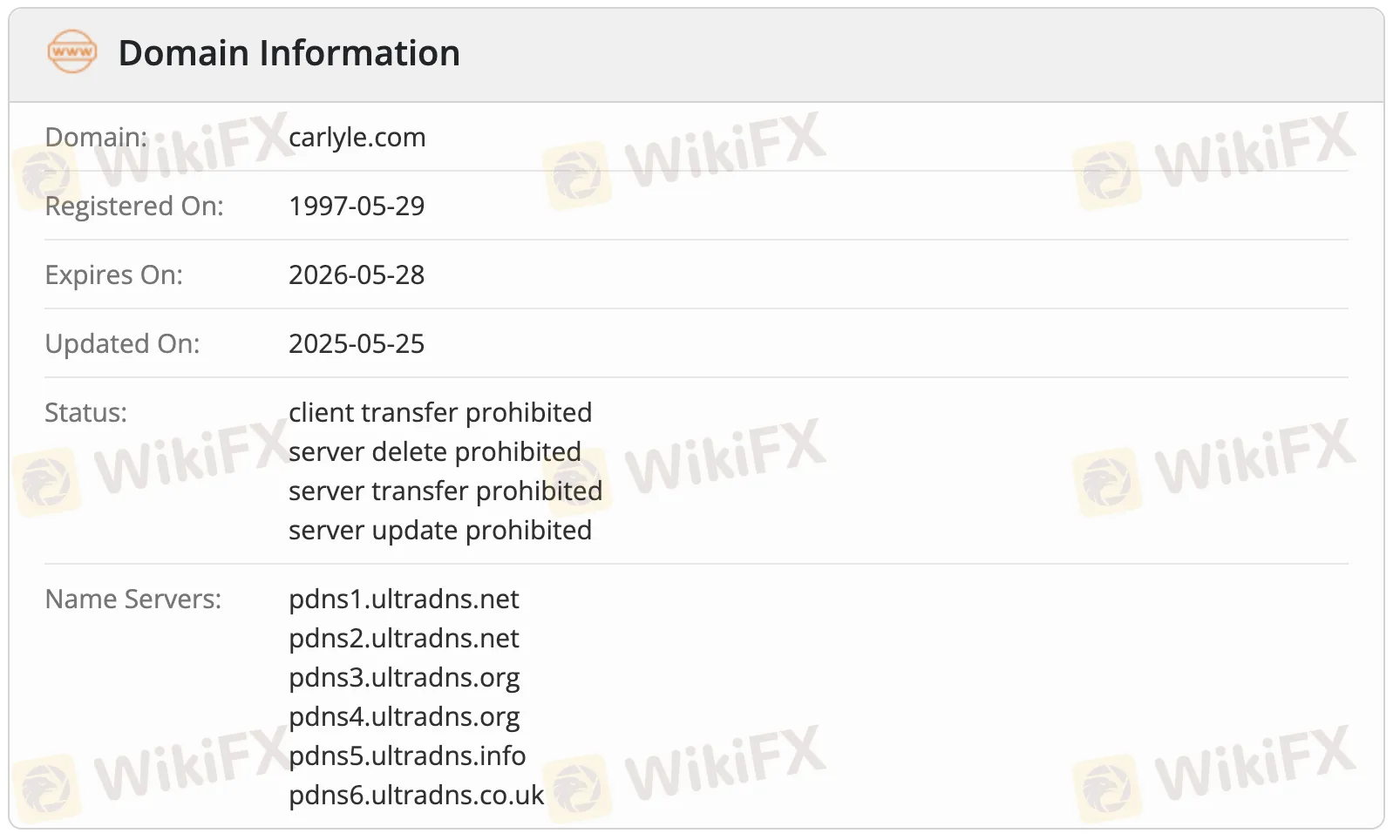

Ang isang WHOIS search para sa domain na carlyle.com ay nagpapakita na unang nirehistro ito noong Mayo 29, 1997. Ang domain ay patuloy na aktibo, at ang rehistrasyon nito ay mabuti hanggang Mayo 28, 2026. Ang huling pagbabago dito ay noong Mayo 25, 2025. May mga patakaran para sa domain, tulad ng hindi pagpayag sa mga kliyente na ilipat, baguhin, alisin, o ilipat ang mga server.

Mga Produkto at Serbisyo

Ang Carlyle ay nagbibigay ng mga serbisyong pandaigdig sa pamumuhunan, lalo na sa pribadong ekweyt, kredito, at mga solusyon sa pamumuhunan. Hinahawakan nito ang higit sa $453 bilyon sa mga ari-arian sa iba't ibang segmento at sasakyan sa buong mundo.

| Produkto & Serbisyo | Supported |

| Global na Pribadong Ekweyt | ✔ |

| Global na Kredito | ✔ |

| Mga Solusyon sa Pamumuhunan | ✔ |