公司简介

| 凯雷 评论摘要 | |

| 成立时间 | 1987 |

| 注册国家/地区 | 美国 |

| 监管 | 无监管 |

| 产品和服务 | 全球私募股权、全球信贷、投资解决方案 |

| 模拟账户 | / |

| 杠杆 | / |

| 点差 | / |

| 交易平台 | / |

| 最低存款 | / |

| 客户支持 | 电话:+1 212 813 4504 |

| 邮箱:media@carlyle.com | |

| 社交媒体:X,YouTube,LinkedIn,Instagram | |

| 地址:799 9th Street, NW, Suite 200, Washington, DC 20001 | |

凯雷 信息

凯雷 是一家总部位于美国的全球投资公司,成立于1987年。它不受零售经纪监管,也不提供交易账户。该公司专注于为私募股权、信贷和投资解决方案提供机构资产管理,管理资产约4530亿美元。

优缺点

| 优点 | 缺点 |

| 历史悠久的全球投资公司 | 无监管 |

| 多种联系渠道 | 没有关于交易条件的信息 |

| 多个全球分支机构 |

凯雷 是否合法?

凯雷 总部位于美国,尽管当地没有金融机构监督它。它也没有获得任何主要国际监管机构的许可,如FCA(英国)、ASIC(澳大利亚)或CySEC(塞浦路斯)。

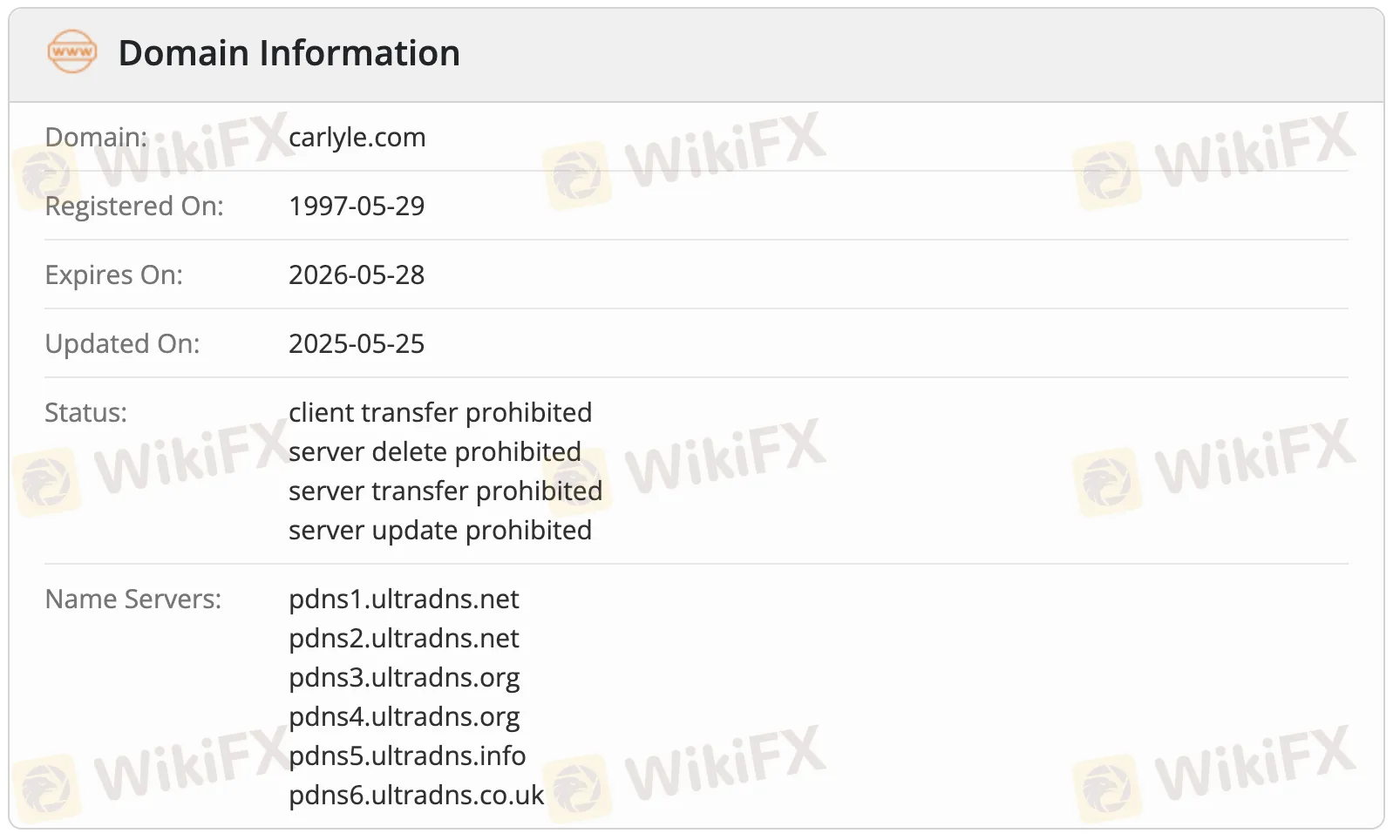

对carlyle.com域名进行WHOIS搜索显示,该域名于1997年5月29日首次注册。该域名仍然有效,注册有效期至2026年5月28日。最后一次更改是在2025年5月25日。该域名有一些规则,例如不允许客户移动、编辑、删除或转移服务器。

产品和服务

凯雷 提供全球投资管理服务,特别是私募股权、信贷和投资解决方案。它在全球不同领域和车辆中管理超过4530亿美元的资产。

| 产品和服务 | 支持 |

| 全球私募股权 | ✔ |

| 全球信贷 | ✔ |

| 投资解决方案 | ✔ |