Présentation de l'entreprise

| China GalaxyRésumé de l'examen | |

| Fondé | 2011 |

| Pays/Région enregistré | Hong Kong |

| Régulation | Réglementé |

| Instruments de marché | TitresFutures et optionsObligationsFonds communs de placementProduits structurés |

| Compte de démonstration | ❌ |

| Effet de levier | / |

| Spread | / |

| Plateforme de trading | SPTrader ProGalaxy Global Trading TerminalsSoft TokenAAStocks |

| Dépôt minimum | / |

| Assistance clientèle | Téléphone : (852) 3698 6750 / 400 866 8833 |

| Email : cs@chinastock.com.hk | |

| Réseaux sociaux : Wechat | |

| Adresse physique : 20/F, Wing On Centre, 111 Connaught Road Central, Sheung Wan, Hong KongUnit 1, 36/F, Cosco Building, Queen's Road, Hong Kong8/F, Mei Mei Building, 683-685 Nathan Road, Kowloon, Hong Kong | |

China Galaxy Informations

Elle a été constituée à Hong Kong en 2011. Elle est réglementée par la SFC et propose une gamme complète de services financiers, notamment la courtage et la vente, la banque d'investissement, la recherche en investissement, la gestion d'actifs et le financement. De plus, il existe 5 types de comptes et 4 plateformes de trading parmi lesquelles les traders peuvent choisir.

Avantages et inconvénients

| Avantages | Inconvénients |

| Bien réglementé | MT4/5 n'est pas pris en charge |

| 5 types de comptes | Aucun détail de compte |

| 4 plateformes de trading |

China Galaxy est-il légitime ?

| Pays/Région réglementé |  |

| Autorité réglementée | SFC |

| Entité réglementée | China Galaxy International Futures (Hong Kong)Co., Limited |

| Type de licence | Opérations sur contrats à terme |

| Numéro de licence | AYH772 |

| Statut actuel | Réglementé |

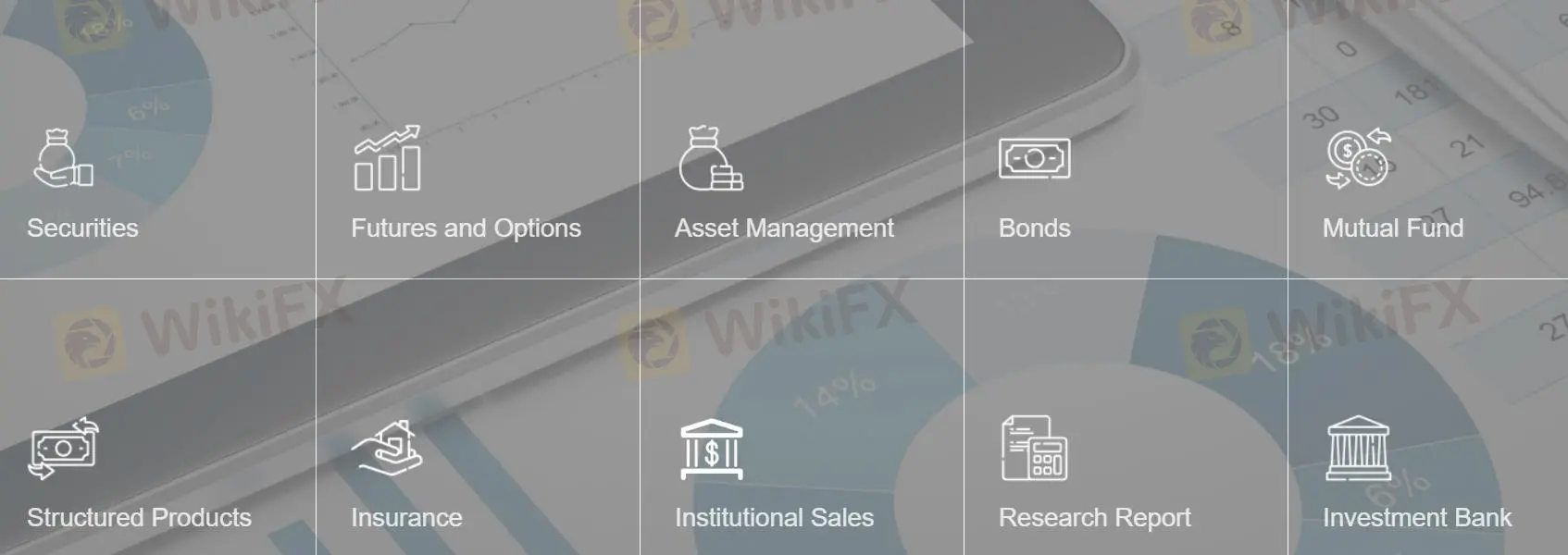

Que puis-je trader sur China Galaxy ?

Les traders peuvent négocier des valeurs mobilières, plus de 140 contrats à terme et options, obligations, fonds communs de placement comprenant des fonds d'actions, des fonds du marché monétaire, des fonds obligataires, des fonds équilibrés, des fonds multi-actifs, des fonds sectoriels, etc., produits structurés sur China Galaxy.

| Instruments négociables | Pris en charge |

| Valeurs mobilières | ✔ |

| Contrats à terme et options | ✔ |

| Obligations | ✔ |

| Fonds communs de placement | ✔ |

| Produits structurés | ✔ |

| Forex | ❌ |

| Métaux précieux et matières premières | ❌ |

| Indices | ❌ |

| Actions | ❌ |

| ETF | ❌ |

Types de compte

China Galaxy propose des comptes de trésorerie sur titres, des comptes sur marge sur titres, des comptes à terme et des comptes d'options sur actions. De plus, les clients peuvent choisir d'ouvrir un compte de trading électronique. Au total, 5 types de compte, aucun dépôt initial requis.

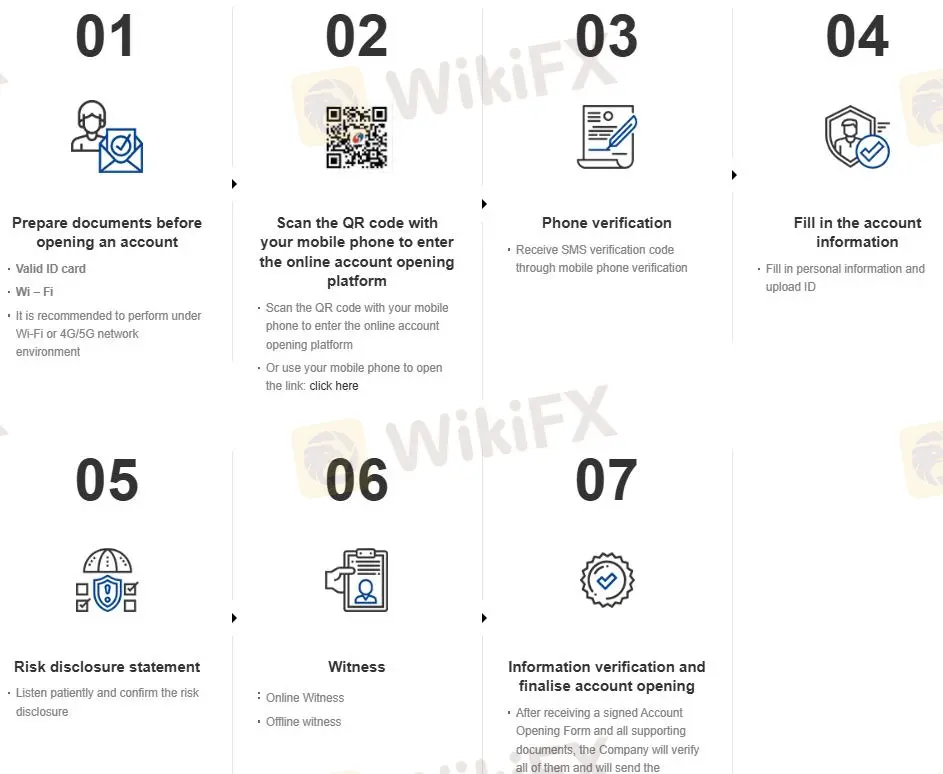

Il existe 2 options pour ouvrir un compte : en ligne et mobile. Vous pouvez vous référer au processus spécifique ici : https://en.chinastock.com.hk/customer/process/

Plateforme de trading

SPTrader Pro, Galaxy Global Trading Terminals, Soft Token et AAStocks sont les plateformes de trading de China Galaxy International, qui peuvent être utilisées sur mobile ou sur ordinateur.

| Plateforme de trading | Pris en charge | Appareils disponibles | Convient à |

| SPTrader Pro | ✔ | Mobile | Tous les traders |

| Galaxy Global Trading Terminals | ✔ | Ordinateur de bureau | Tous les traders |

| Soft Token | ✔ | Mobile | Tous les traders |

| AAStocks | ✔ | Ordinateur de bureau | Tous les traders |

| MT4 | ❌ | ||

| MT5 | ❌ |

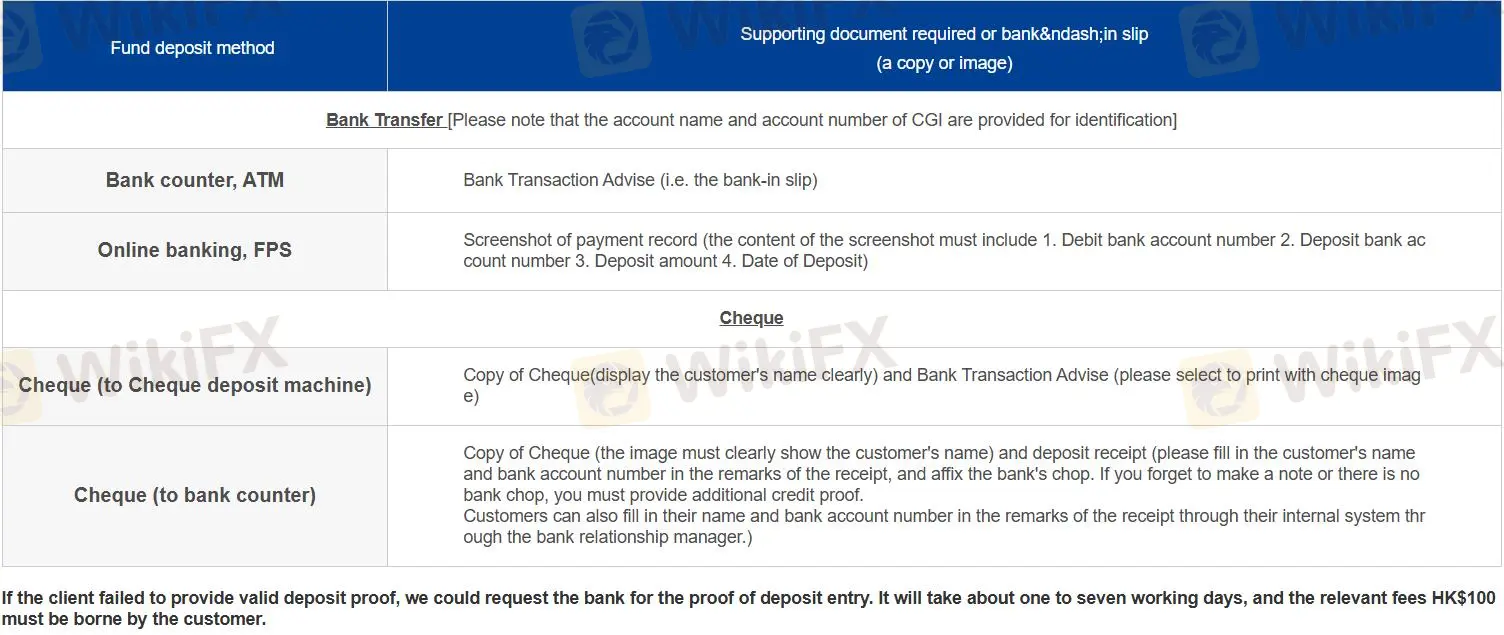

Dépôt et retrait

Il existe 4 types de dépôts répartis en 2 catégories :

Guichet bancaire, distributeur automatique de billets

Services bancaires en ligne, FPS

Chèque (pour machine de dépôt de chèques)

Chèque (au guichet bancaire)

Pour les retraits, les traders disposant de comptes bancaires enregistrés doivent contacter AE ou remplir le formulaire de retrait pour obtenir des instructions. Sinon, un formulaire de retrait est requis pour obtenir des instructions.

1g h jv f f f

Hong Kong

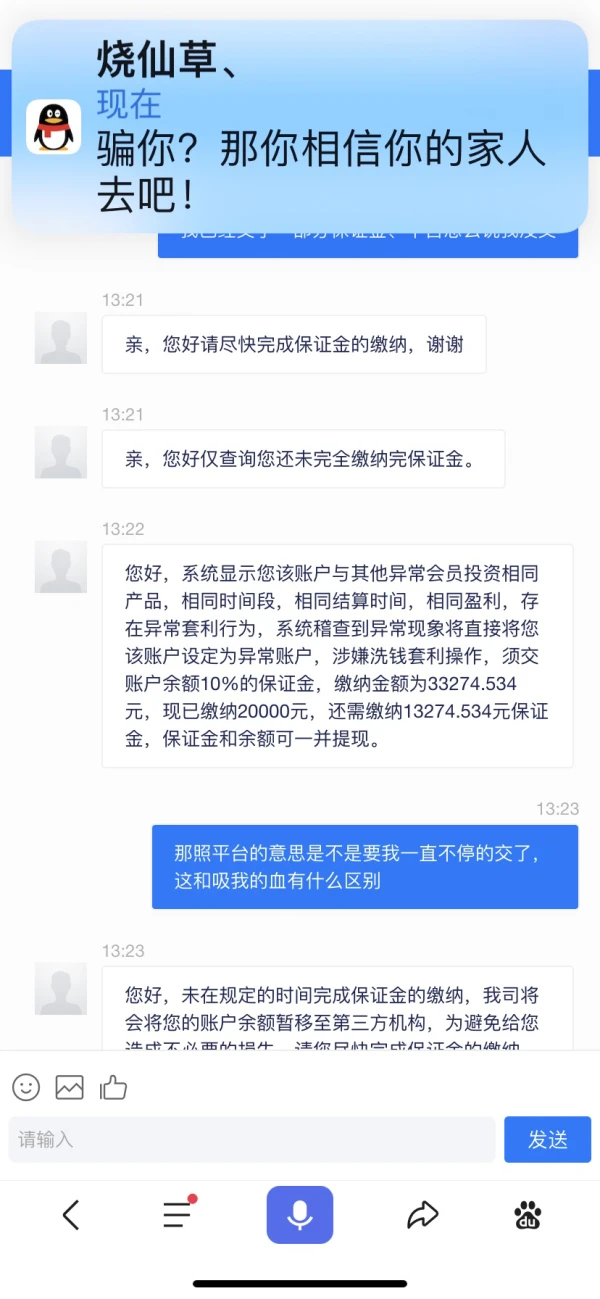

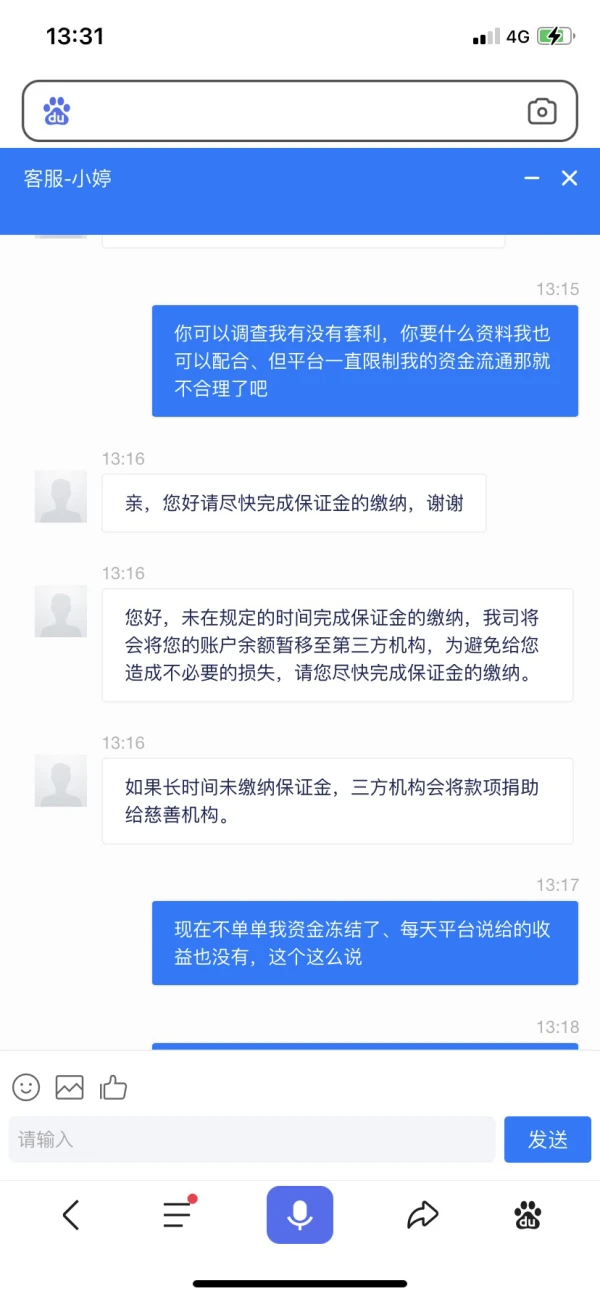

Plateforme noire

Divulgation

建雷

Hong Kong

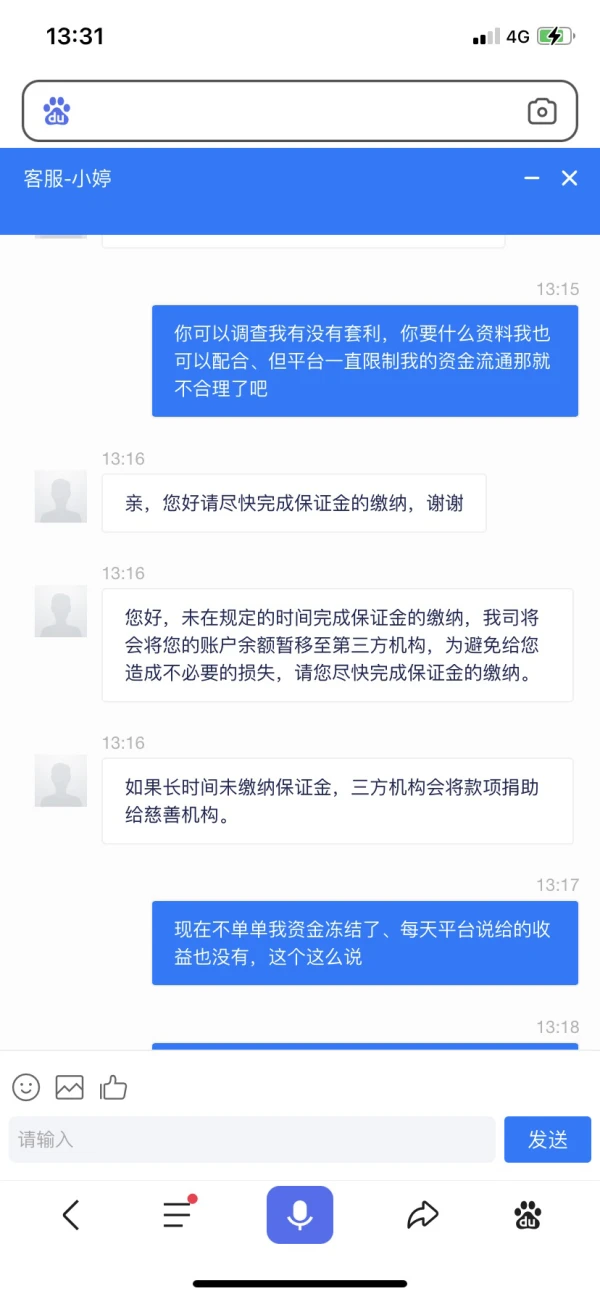

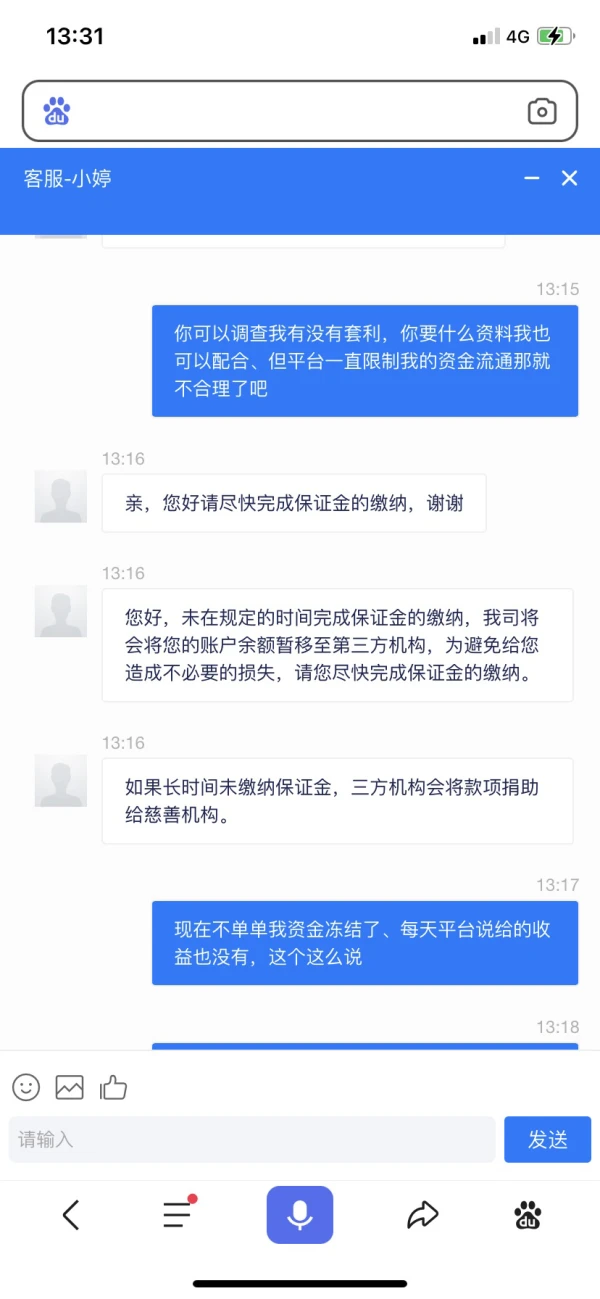

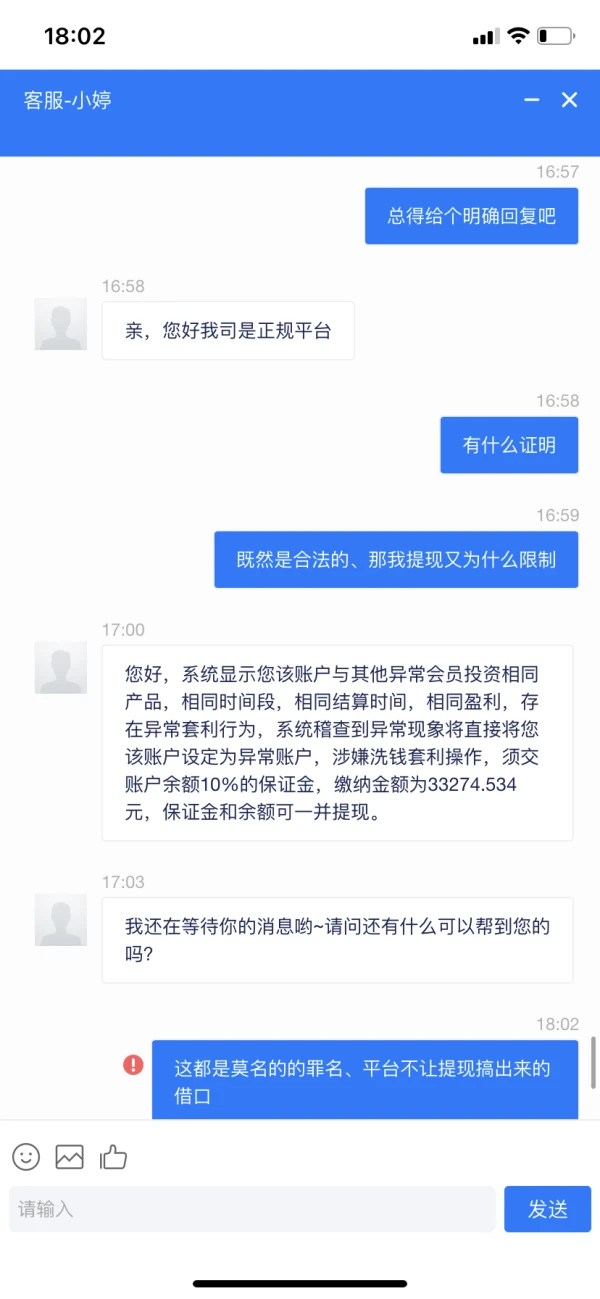

La demande de witdhrawal a toujours été refusée avec de nombreuses raisons. Votre attention s'il vous plaît.

Divulgation

徊眸

Hong Kong

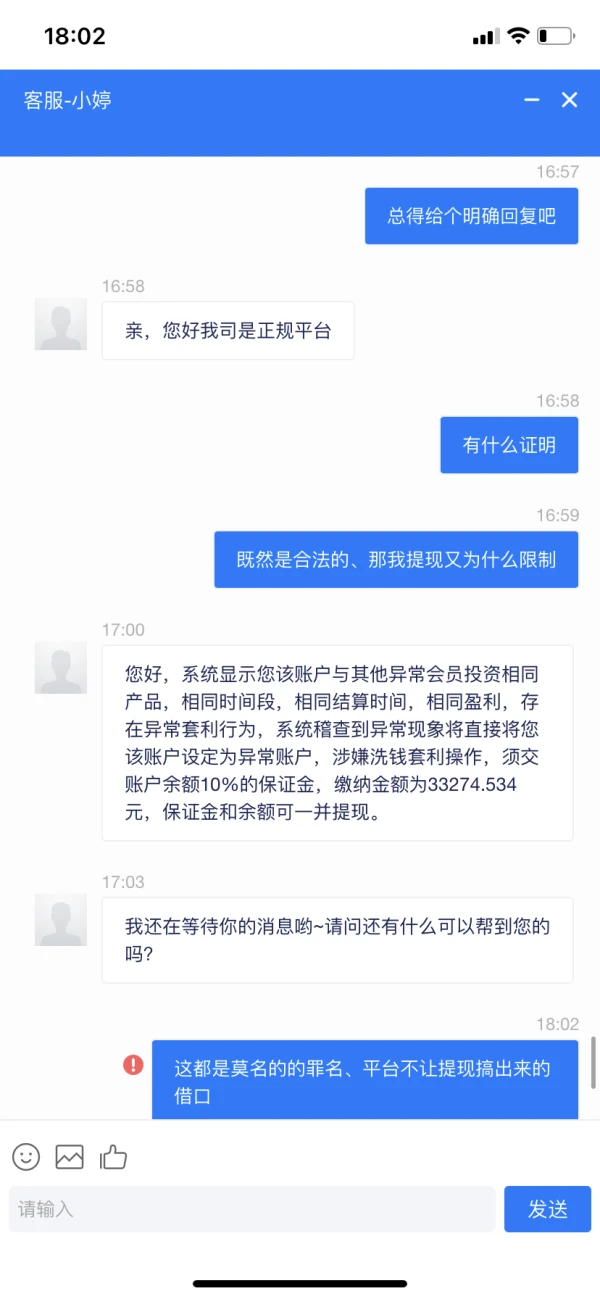

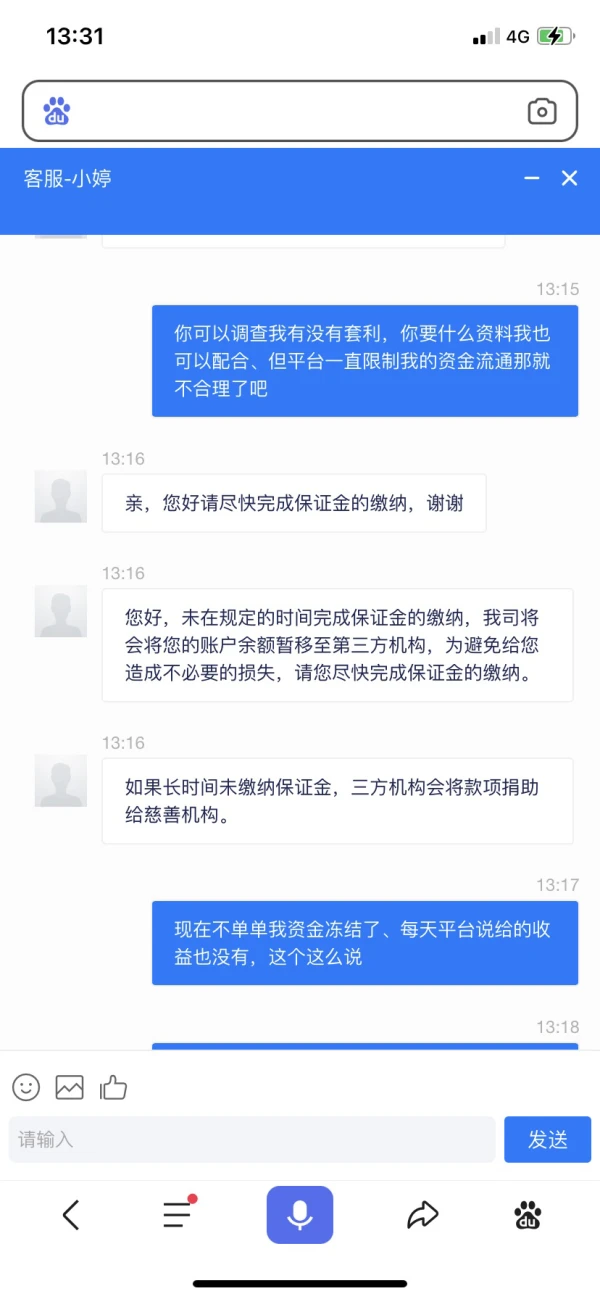

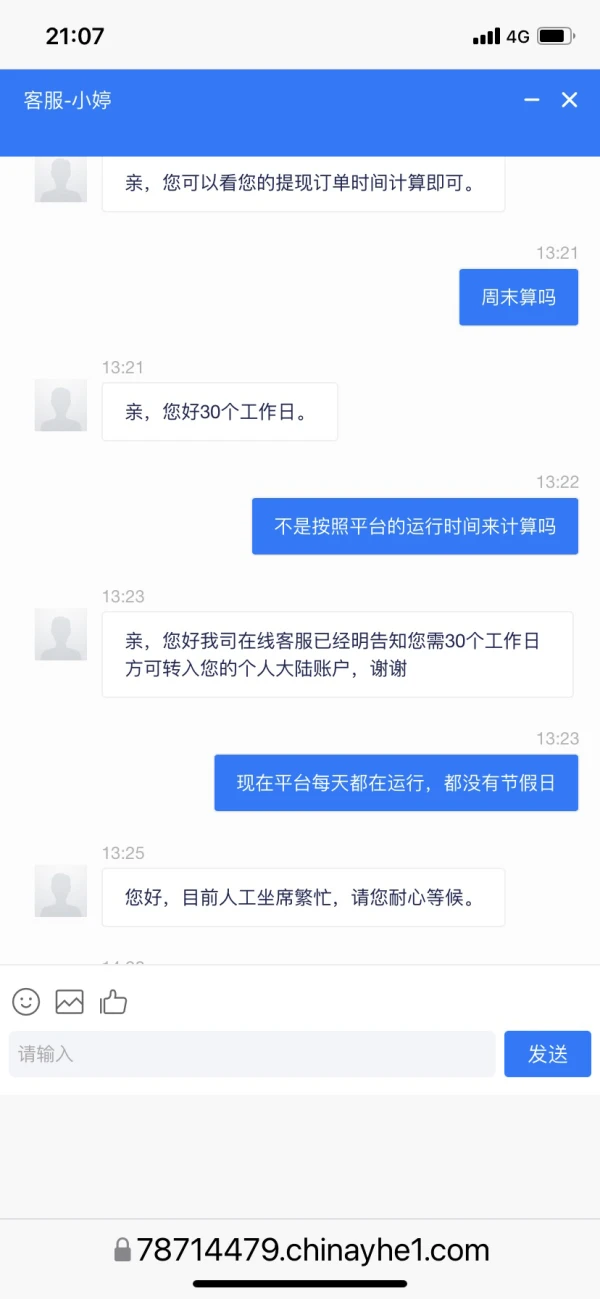

Le service client continue d'utiliser différentes excuses pour ne pas se retirer. Je demande quel est le problème, mais ils ne peuvent pas le dire. Je cherche juste des excuses.

Divulgation

徊眸

Hong Kong

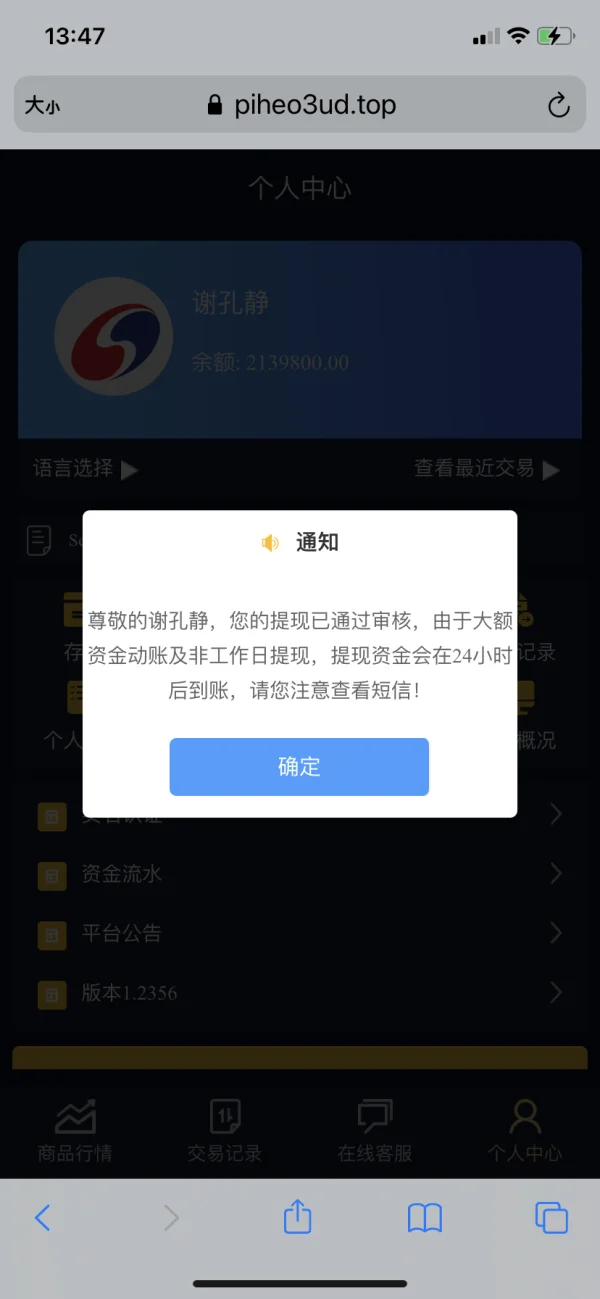

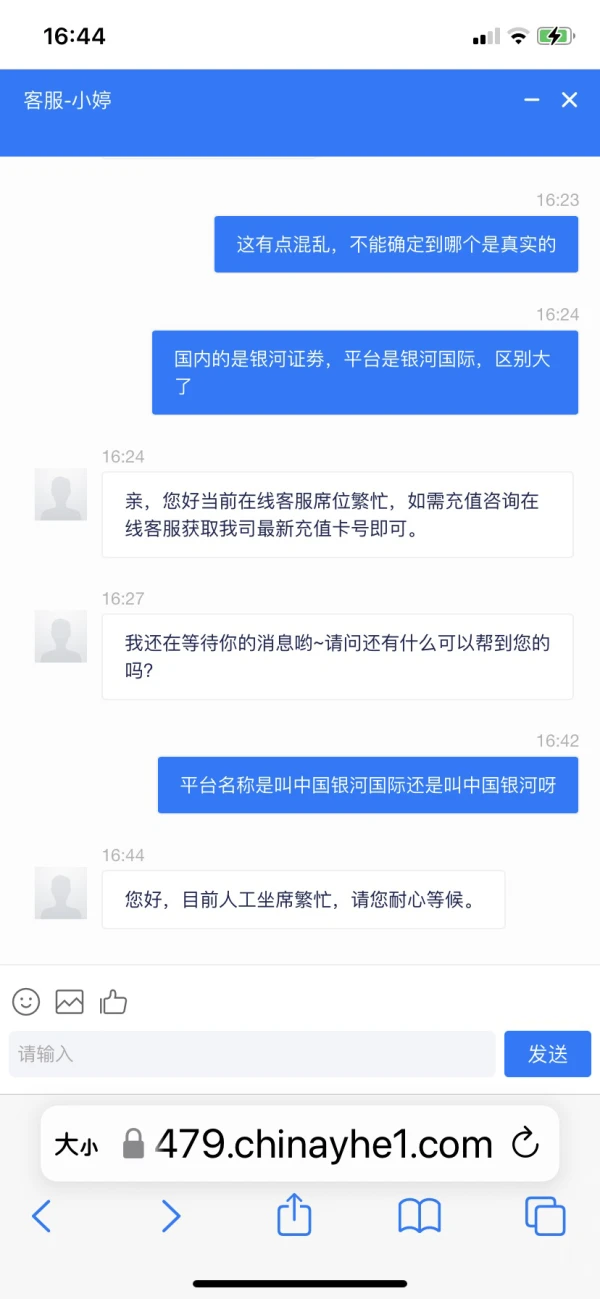

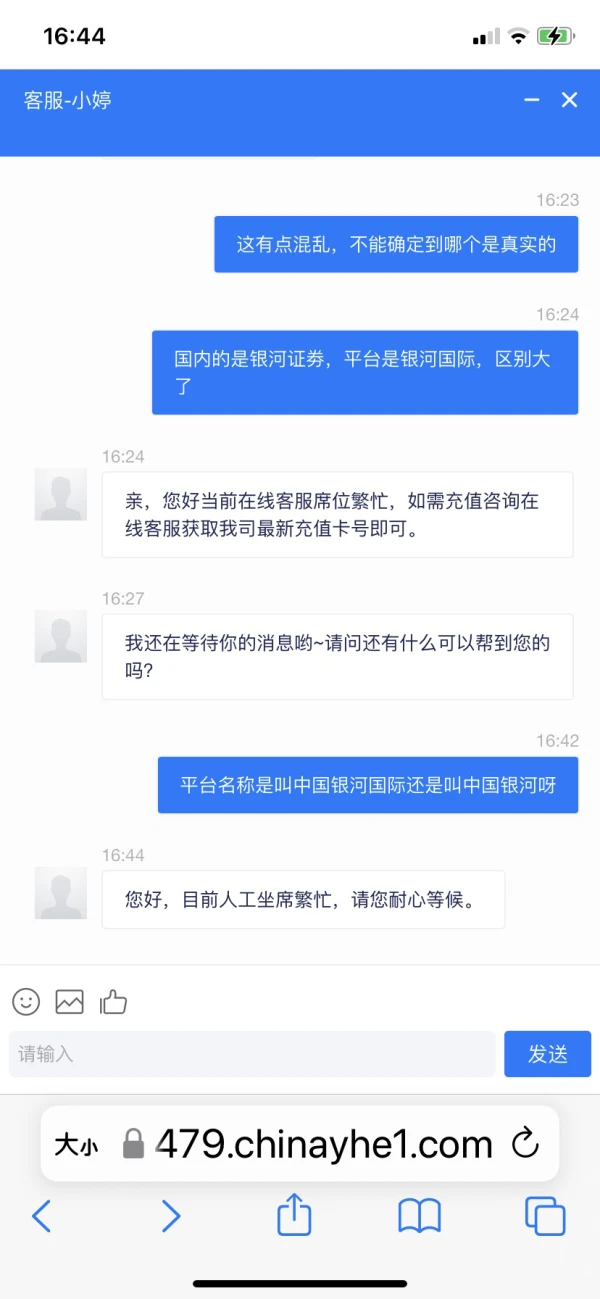

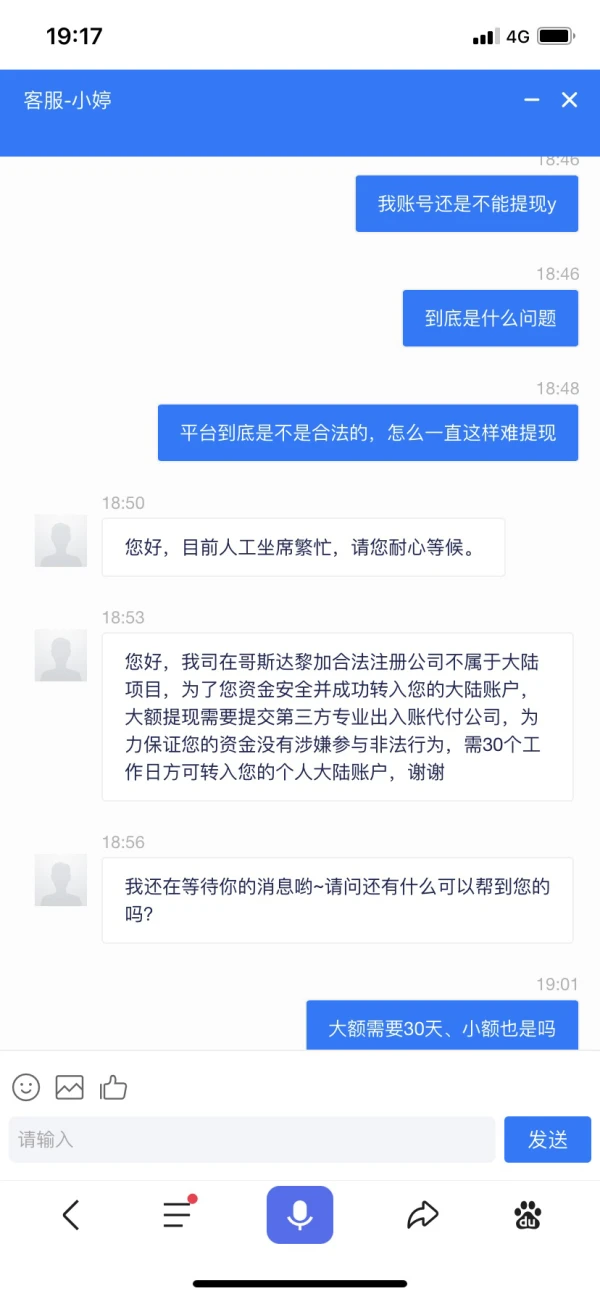

Le service client ne s'est pas retiré en utilisant différentes excuses, je ne sais pas s'il s'agit d'une plateforme légitime ou d'une plateforme de clonage frauduleux. Le site Web est https://78714479.chinayhe1.com/index/login/login/token/d6b70b5b8eef4ceef2e2765b7f46dd9b.html

Divulgation

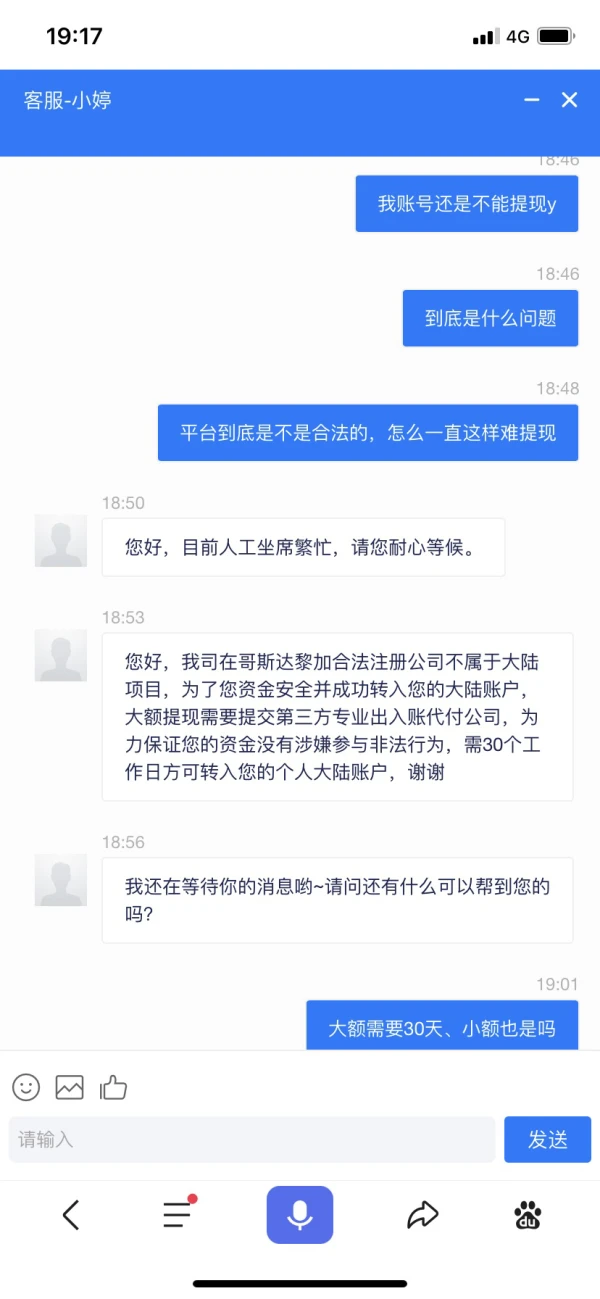

FX1433857007

Hong Kong

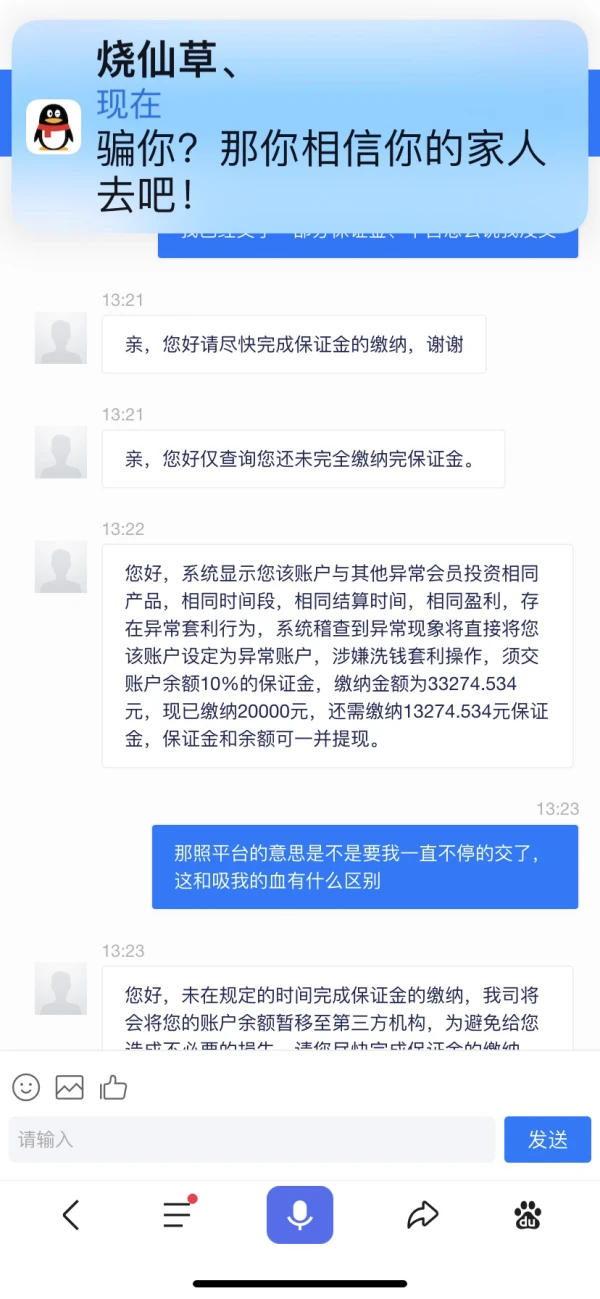

Il y a quelques jours, j'ai rencontré une personne d'un téléphone portable et m'a dit que je faisais du change. J'ai consulté quelques choses et laissé quelques commandes. C'était assez bon à l'époque. Quand je suis arrivé au sixième single, j'avais une mauvaise position de 35 000 yuans. Plus tard, il a dit qu'il ne devrait pas s'inquiéter, il allait payer. Après avoir négocié pour m'appeler un compte en devises de 17 500 yuans, permettez-moi d'ajouter 17500 yuans de plus, après la consultation, le suivi Retirer, mais je n'ai pas suivi. Jusqu'à présent, le livre est toujours à 93 400 yuans, mais je n'ose pas le retirer. Il y a des gens qui me contactent pour me tirer noir. Merci beaucoup

Divulgation