Profil perusahaan

| China GalaxyRingkasan Ulasan | |

| Dibentuk | 2011 |

| Negara/Daerah Terdaftar | Hong Kong |

| Regulasi | Teregulasi |

| Instrumen Pasar | SekuritasFutures dan OpsiObligasiDana InvestasiProduk Terstruktur |

| Akun Demo | ❌ |

| Leverage | / |

| Spread | / |

| Platform Perdagangan | SPTrader ProGalaxy Global Trading TerminalsSoft TokenAAStocks |

| Deposit Minimum | / |

| Dukungan Pelanggan | Telepon: (852) 3698 6750 / 400 866 8833 |

| Email: cs@chinastock.com.hk | |

| Media Sosial: Wechat | |

| Alamat Fisik:20 / F, Wing On Centre, 111 Connaught Road Central, Sheung Wan, Hong KongUnit 1, 36 / F, Cosco Building, Queen's Road, Hong Kong8 / F, Mei Mei Building, 683-685 Nathan Road, Kowloon, Hong Kong | |

China Galaxy Informasi

Perusahaan ini didirikan di Hong Kong pada tahun 2011. Perusahaan ini diatur oleh SFC dan menyediakan berbagai layanan keuangan, termasuk perantara dan penjualan, perbankan investasi, riset investasi, pengelolaan aset, dan pembiayaan. Selain itu, terdapat 5 jenis akun dan 4 platform perdagangan yang dapat dipilih oleh para trader.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Teregulasi dengan baik | MT4/5 tidak didukung |

| 5 jenis akun | Tidak ada rincian akun |

| 4 platform perdagangan |

Apakah China Galaxy Legal?

| Negara/Daerah Teregulasi |  |

| Otoritas Teregulasi | SFC |

| Entitas Teregulasi | China Galaxy International Futures (Hong Kong)Co., Limited |

| Jenis Lisensi | Berurusan dengan kontrak berjangka |

| Nomor Lisensi | AYH772 |

| Status Saat Ini | Teregulasi |

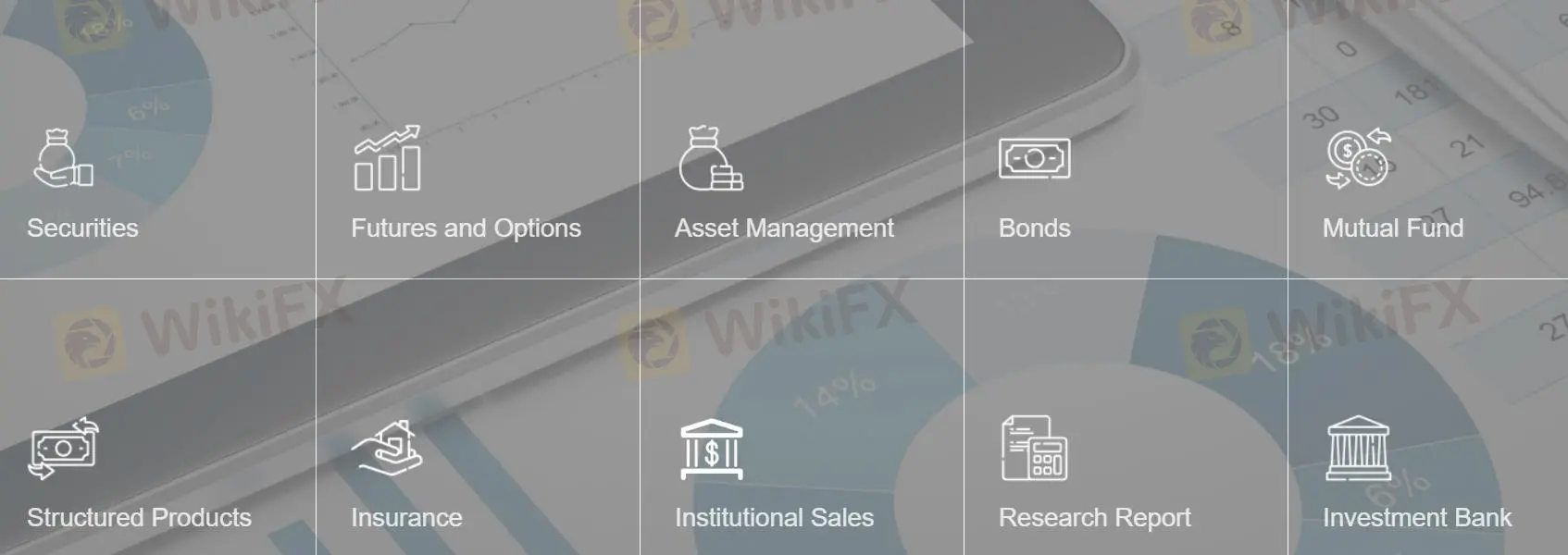

Apa yang Bisa Saya Perdagangkan di China Galaxy?

Para trader dapat melakukan perdagangan sekuritas, 140+ futures dan opsi, obligasi, dana investasi termasuk dana ekuitas, dana pasar uang, dana obligasi, dana seimbang, dana multi-aset, dana industri, dll., produk terstruktur di China Galaxy.

| Instrumen Perdagangan | Didukung |

| Sekuritas | ✔ |

| Futures dan Opsi | ✔ |

| Obligasi | ✔ |

| Dana Investasi | ✔ |

| Produk Terstruktur | ✔ |

| Forex | ❌ |

| Logam Mulia & Komoditas | ❌ |

| Indeks | ❌ |

| Saham | ❌ |

| ETF | ❌ |

Jenis Akun

China Galaxy mengatakan bahwa mereka menawarkan akun tunai sekuritas, akun margin sekuritas, akun futures, dan akun opsi saham. Selain itu, pelanggan dapat memilih untuk membuka akun perdagangan elektronik. Total 5, tidak diperlukan deposit awal.

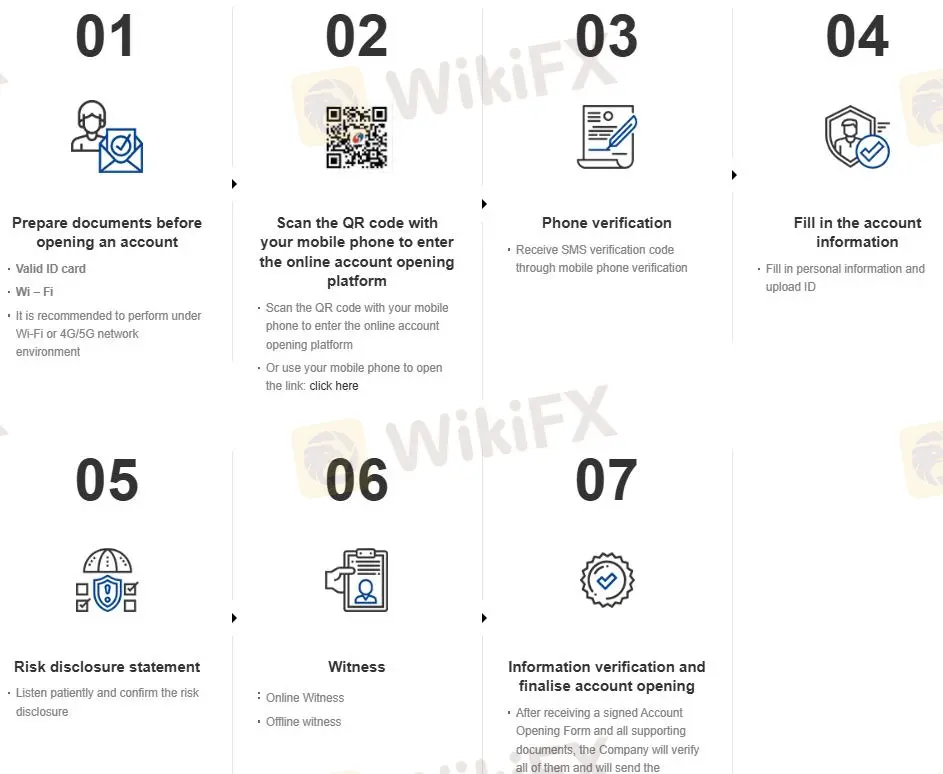

Ada 2 opsi untuk membuka akun: online dan mobile. Proses spesifik dapat Anda lihat di: https://en.chinastock.com.hk/customer/process/

Platform Perdagangan

SPTrader Pro, Galaxy Global Trading Terminals, Soft Token dan AAStocks adalah platform perdagangan China Galaxy International, yang dapat digunakan di perangkat mobile atau desktop.

| Platform Perdagangan | Didukung | Perangkat Tersedia | Cocok untuk |

| SPTrader Pro | ✔ | Mobile | Semua trader |

| Galaxy Global Trading Terminals | ✔ | Desktop | Semua trader |

| Soft Token | ✔ | Mobile | Semua trader |

| AAStocks | ✔ | Desktop | Semua trader |

| MT4 | ❌ | ||

| MT5 | ❌ |

Deposit dan Penarikan

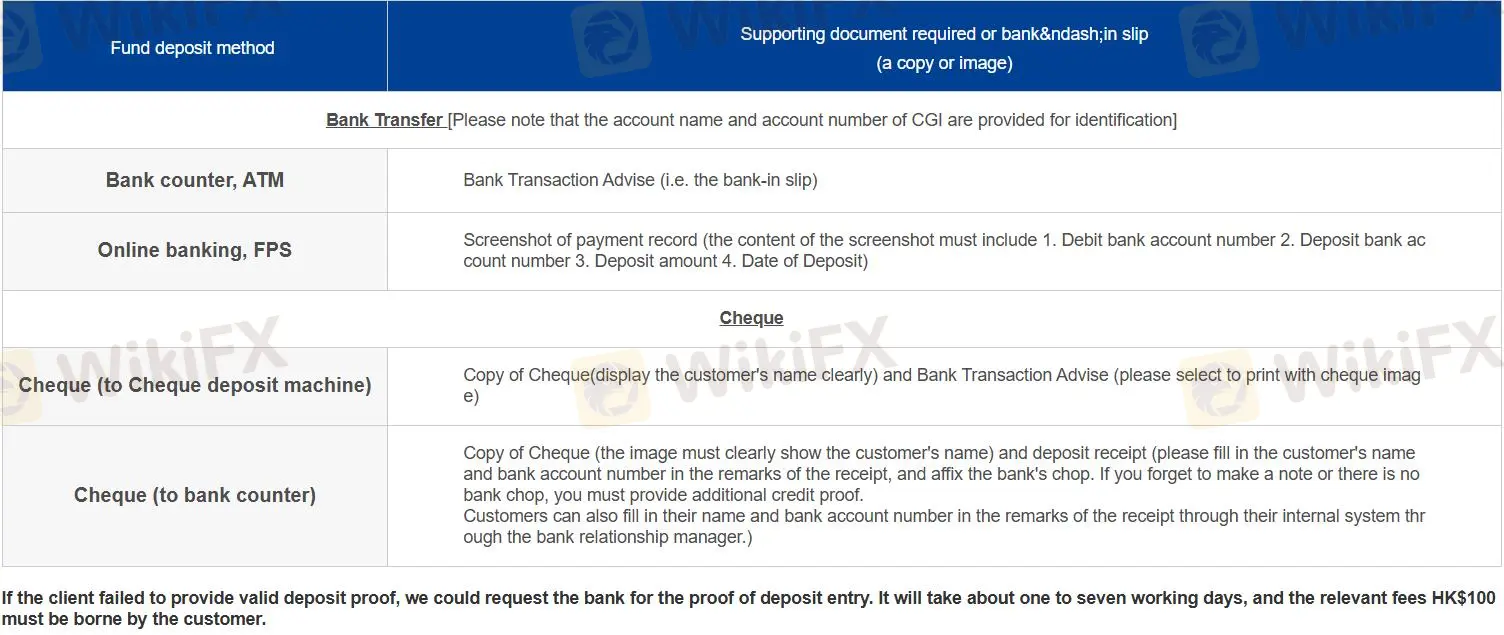

Ada 4 jenis deposit dalam 2 kategori:

Loket bank, ATM

Perbankan online, FPS

Cek (untuk mesin deposit cek)

Cek (ke loket bank)

Untuk penarikan, para trader dengan akun bank terdaftar, hubungi AE atau isi formulir penarikan untuk petunjuk. Jika tidak, formulir penarikan diperlukan untuk petunjuk.

1g h jv f f f

Hong Kong

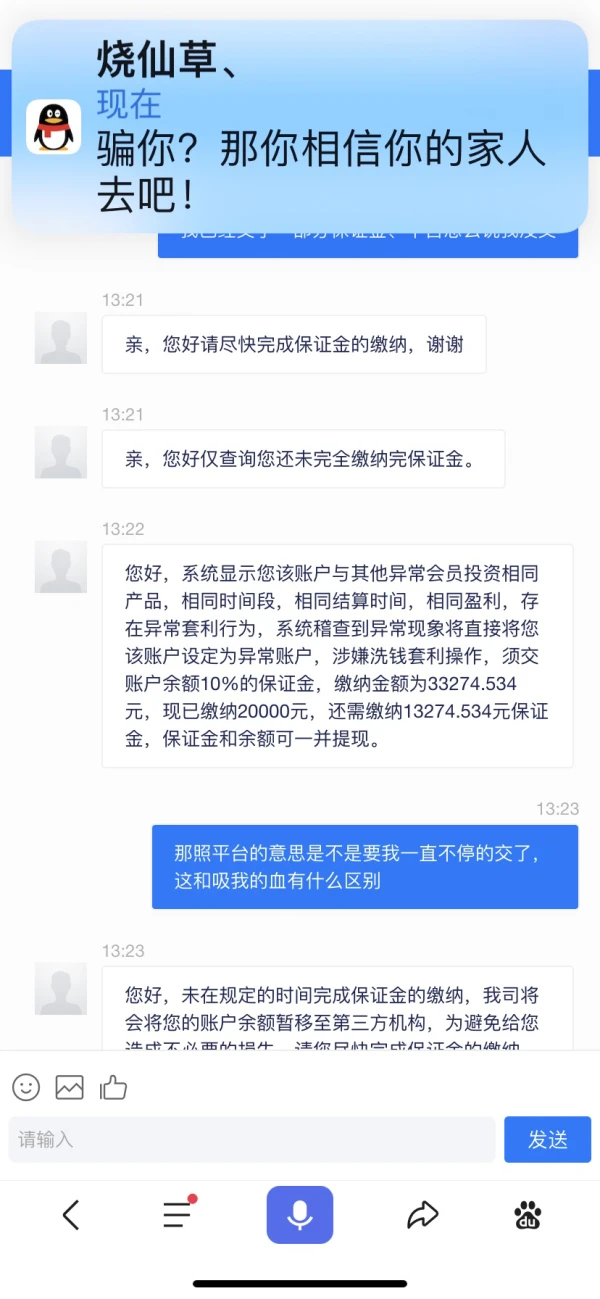

Platform hitam

Paparan

建雷

Hong Kong

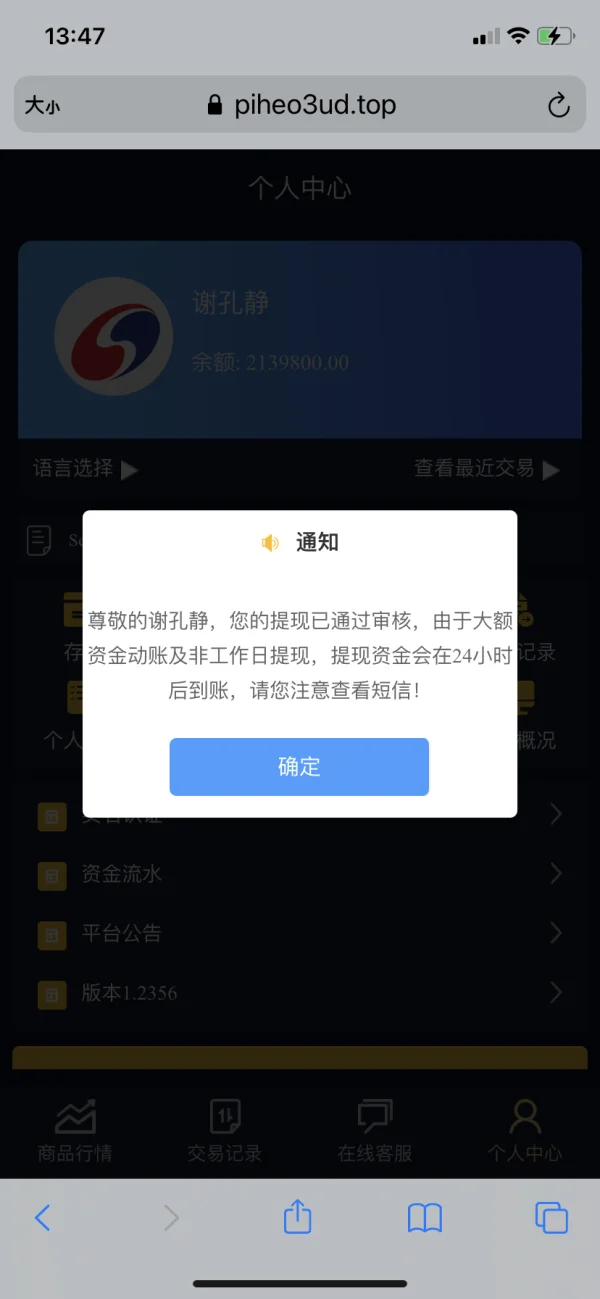

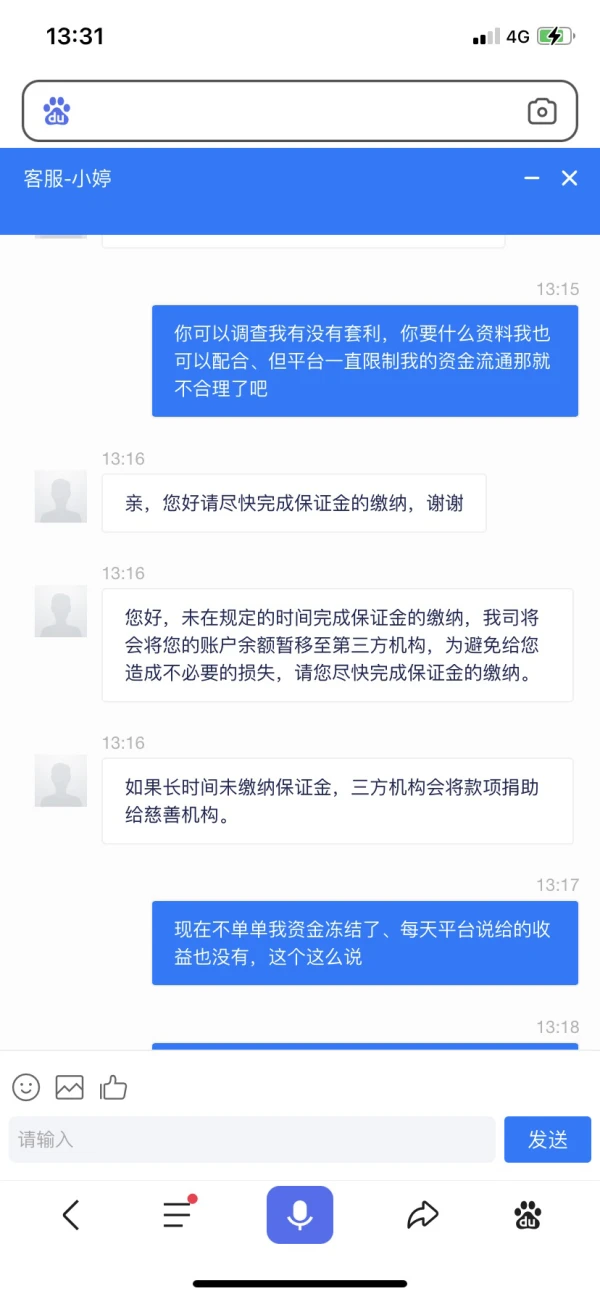

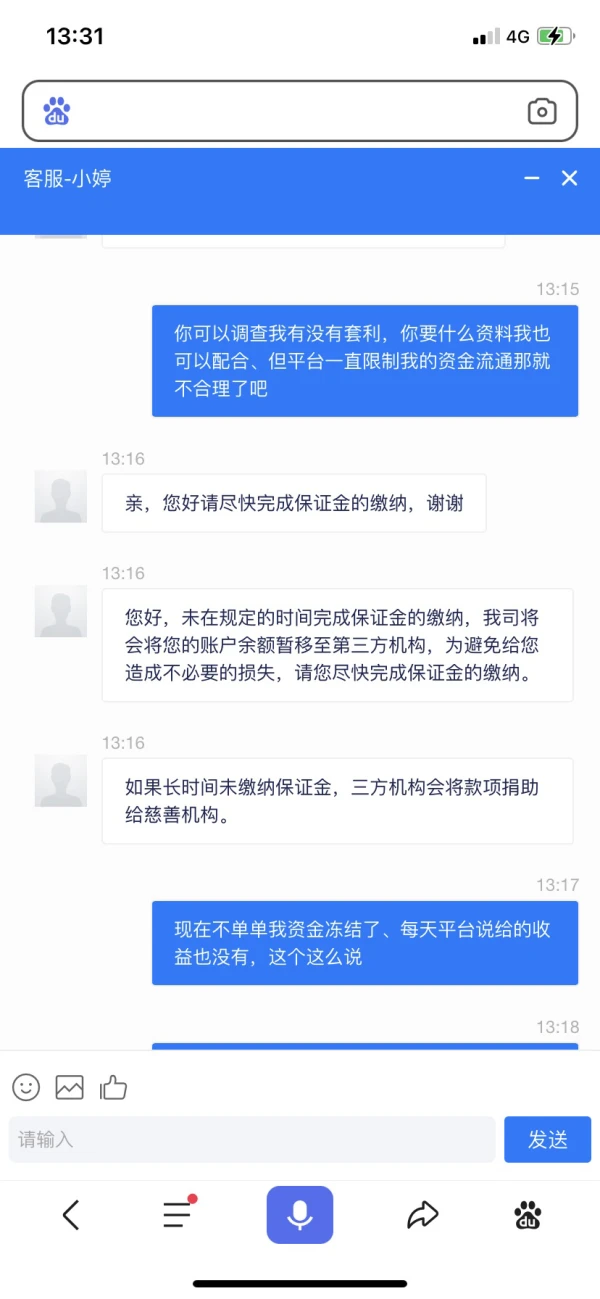

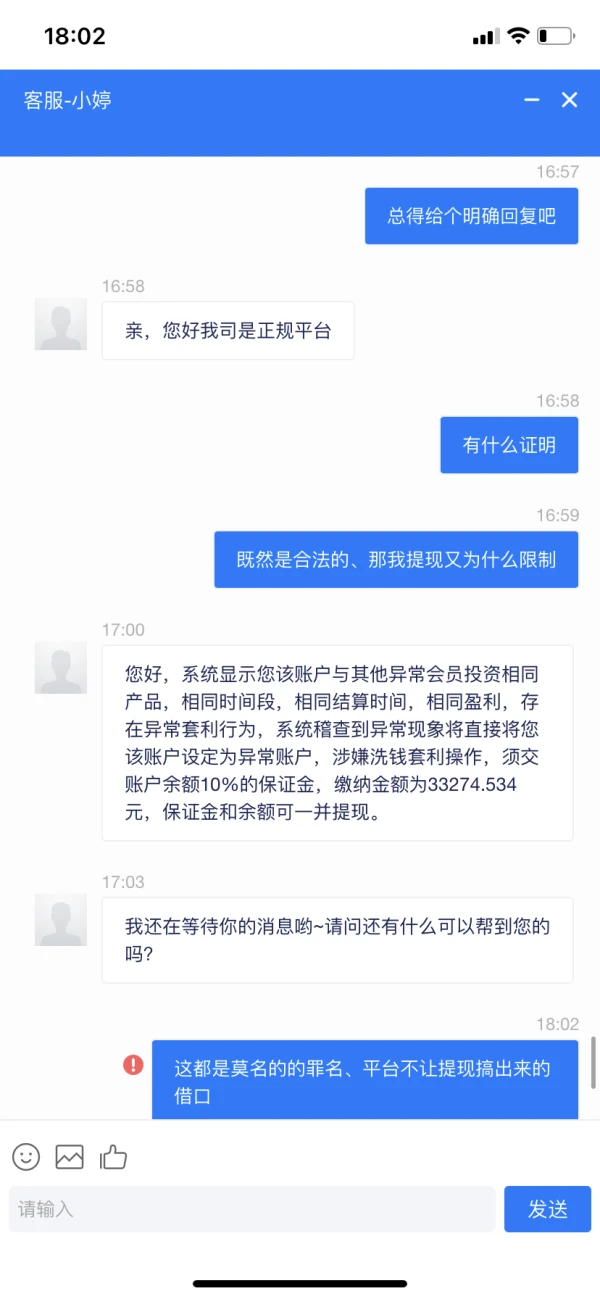

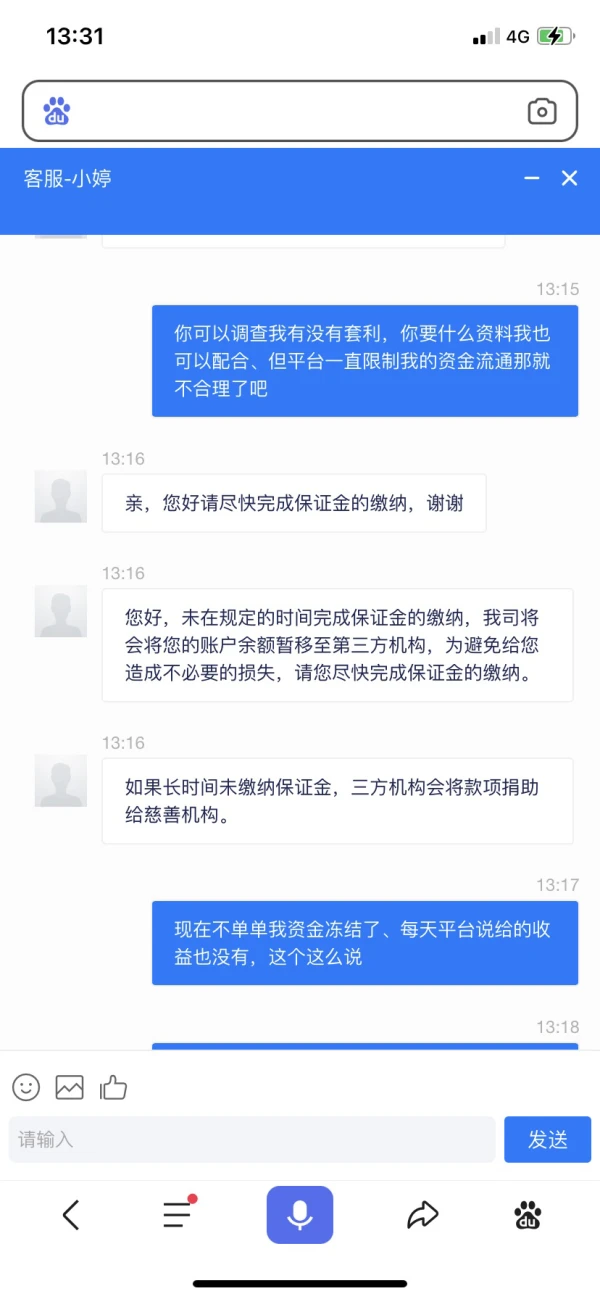

Aplikasi witdhrawal telah ditolak karena banyak alasan. Mohon perhatian.

Paparan

徊眸

Hong Kong

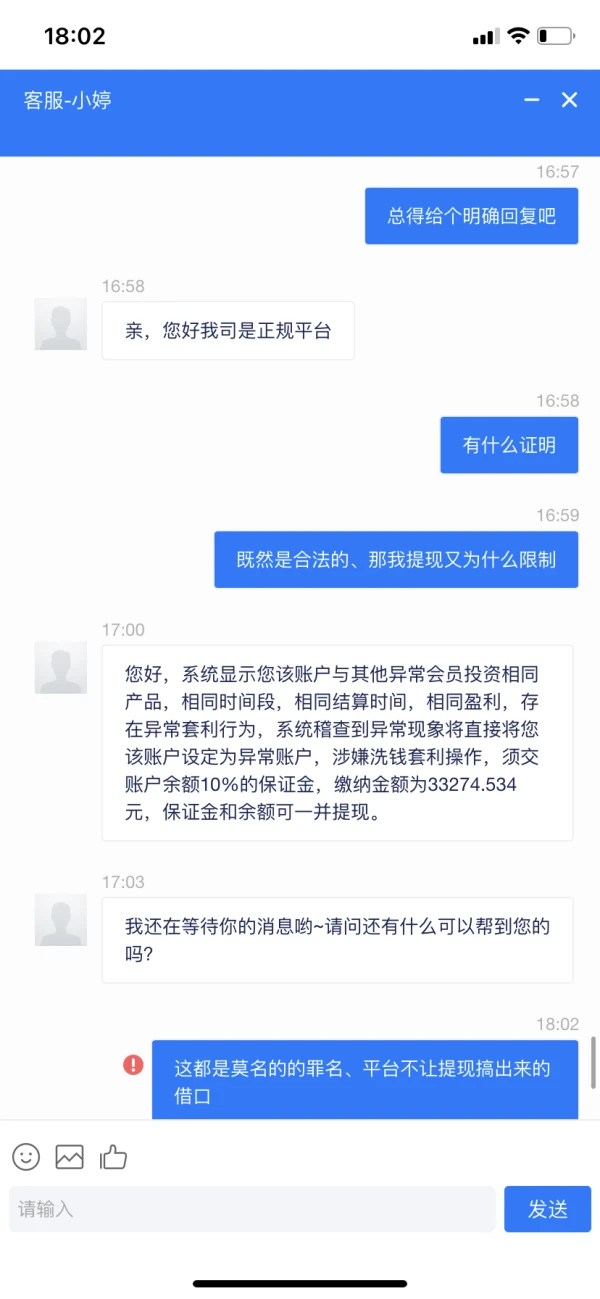

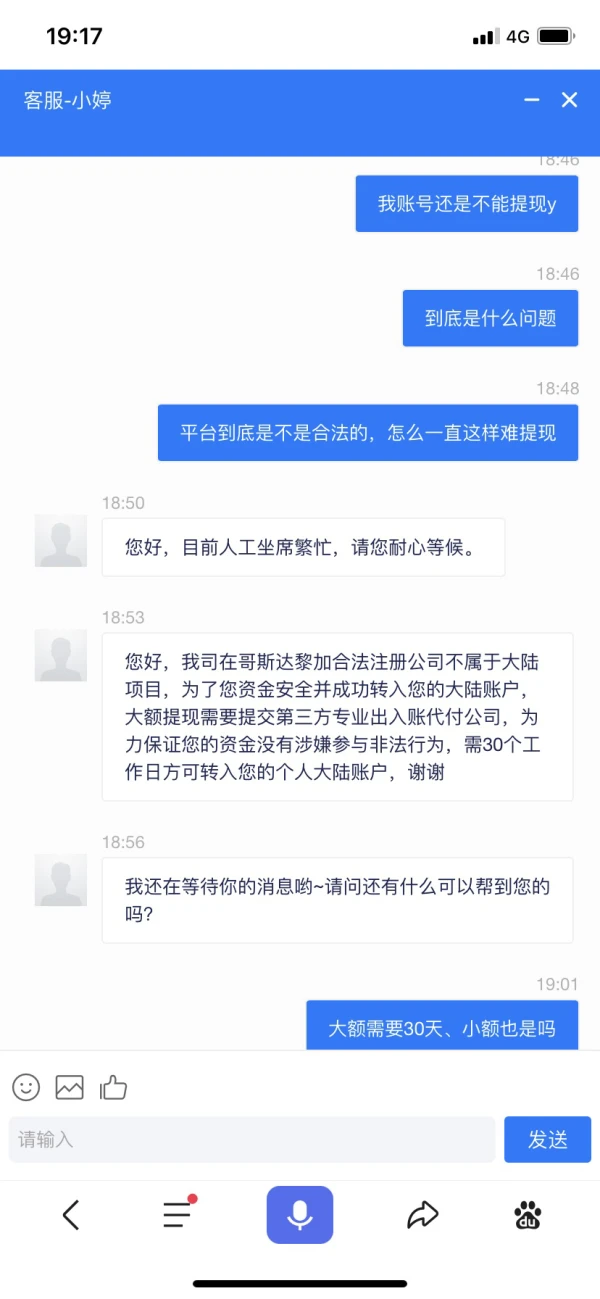

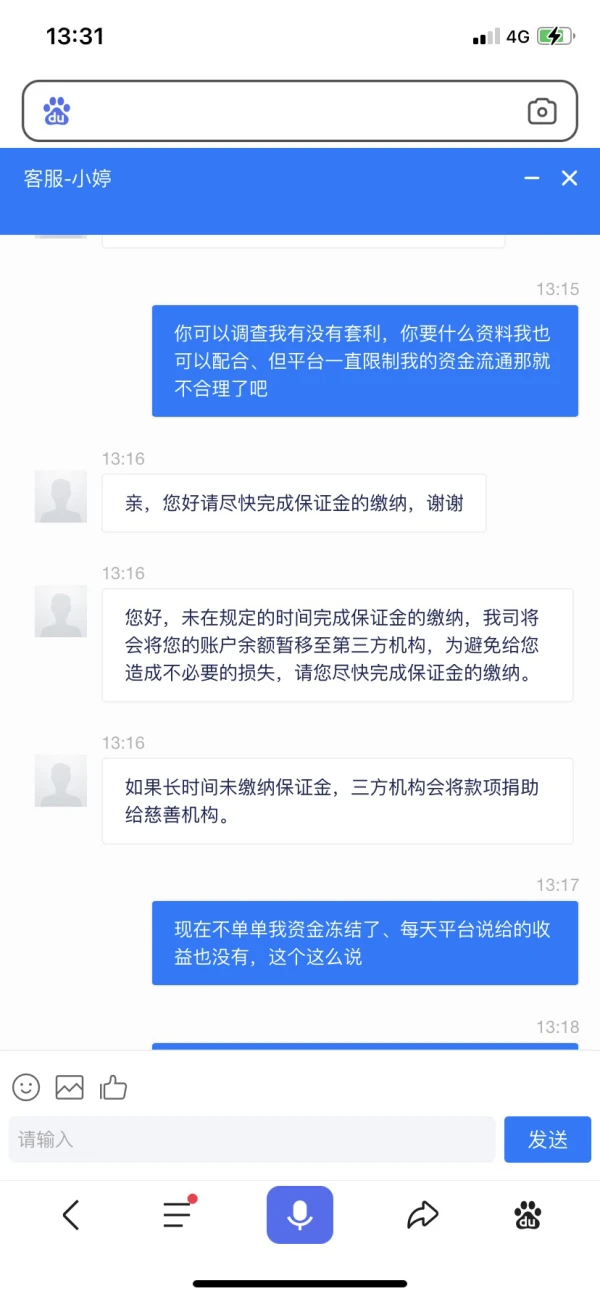

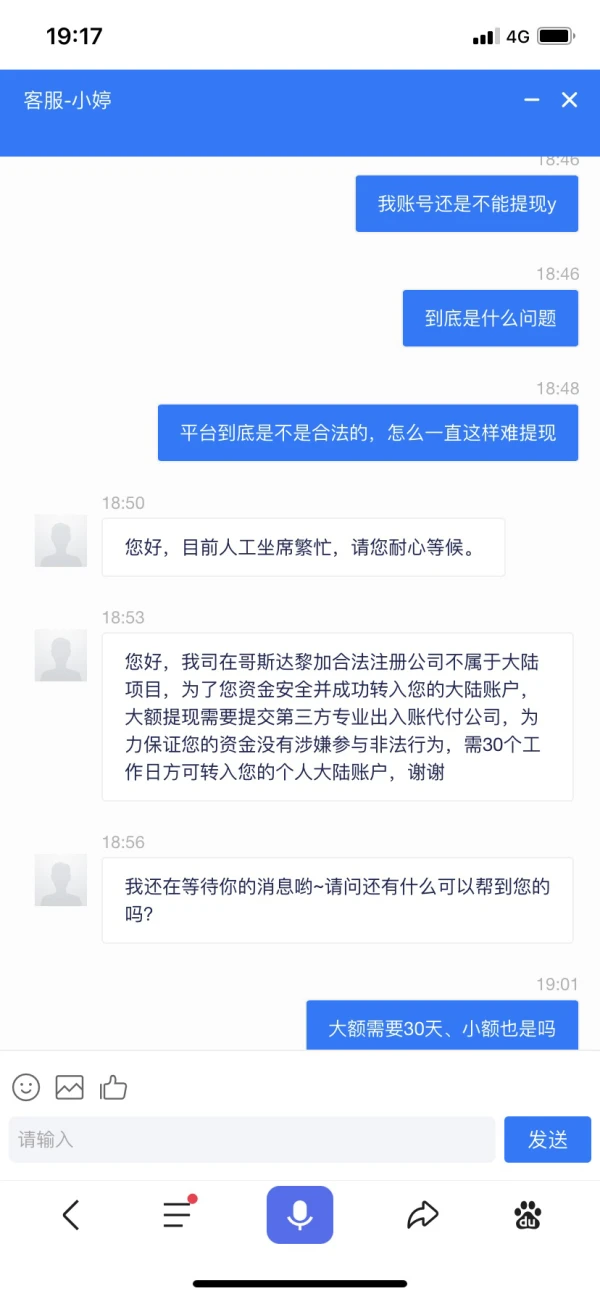

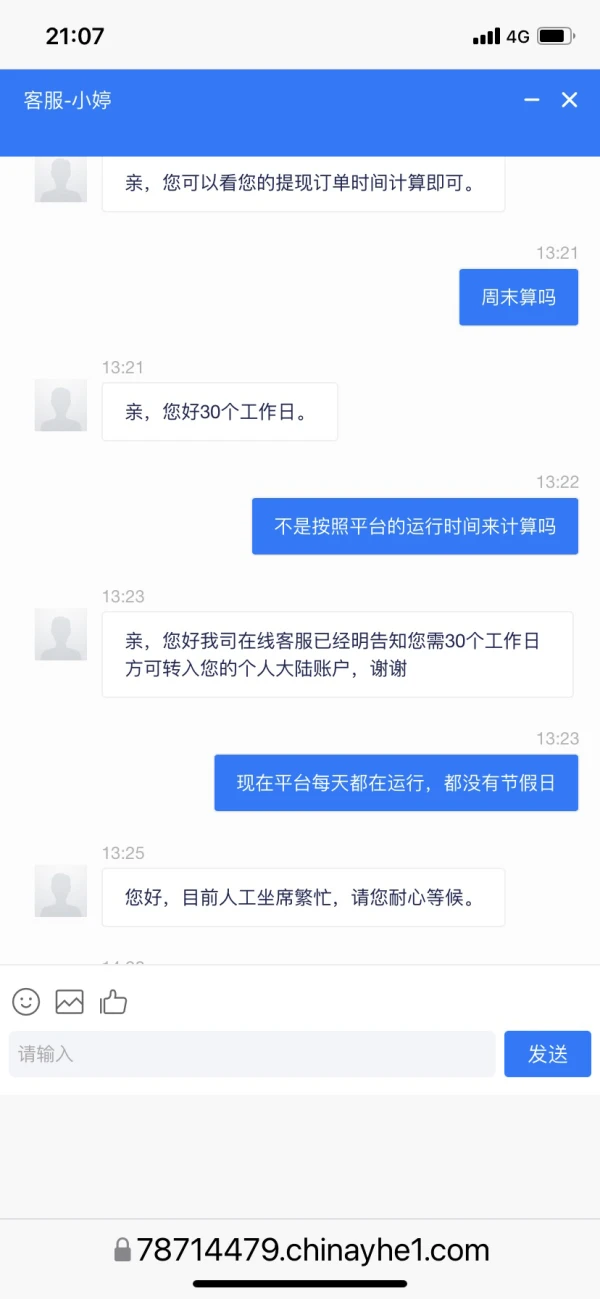

Layanan pelanggan terus menggunakan berbagai alasan untuk tidak menarik. Saya bertanya apa masalahnya, tetapi mereka tidak bisa menyatakannya. Hanya mencari alasan.

Paparan

徊眸

Hong Kong

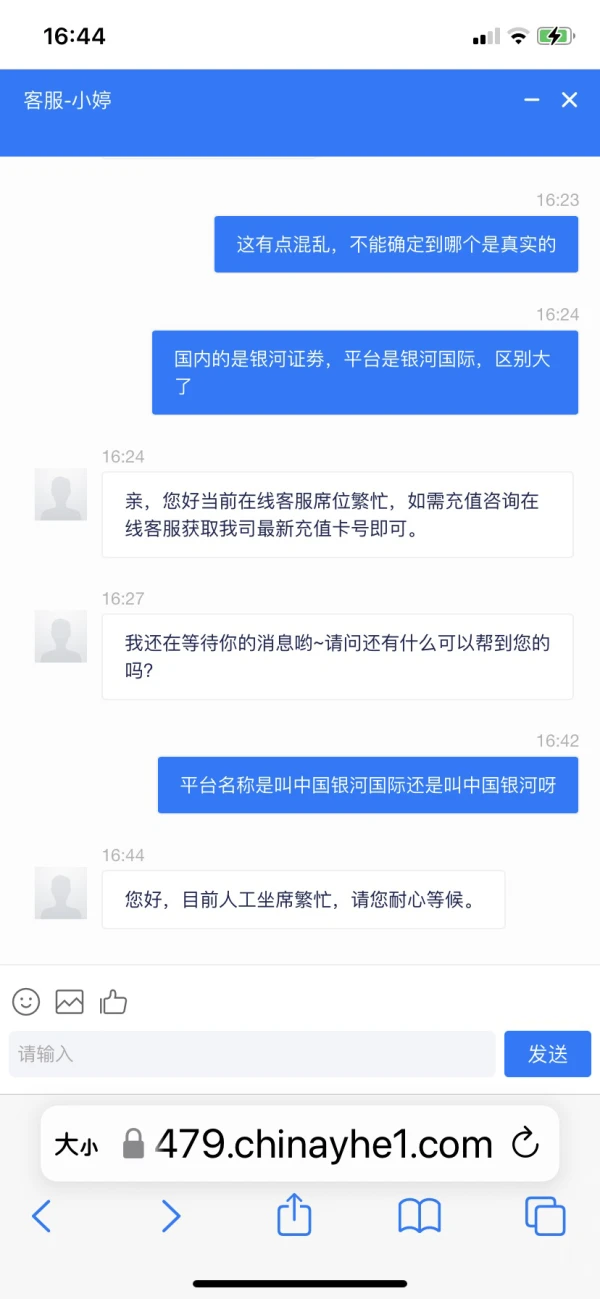

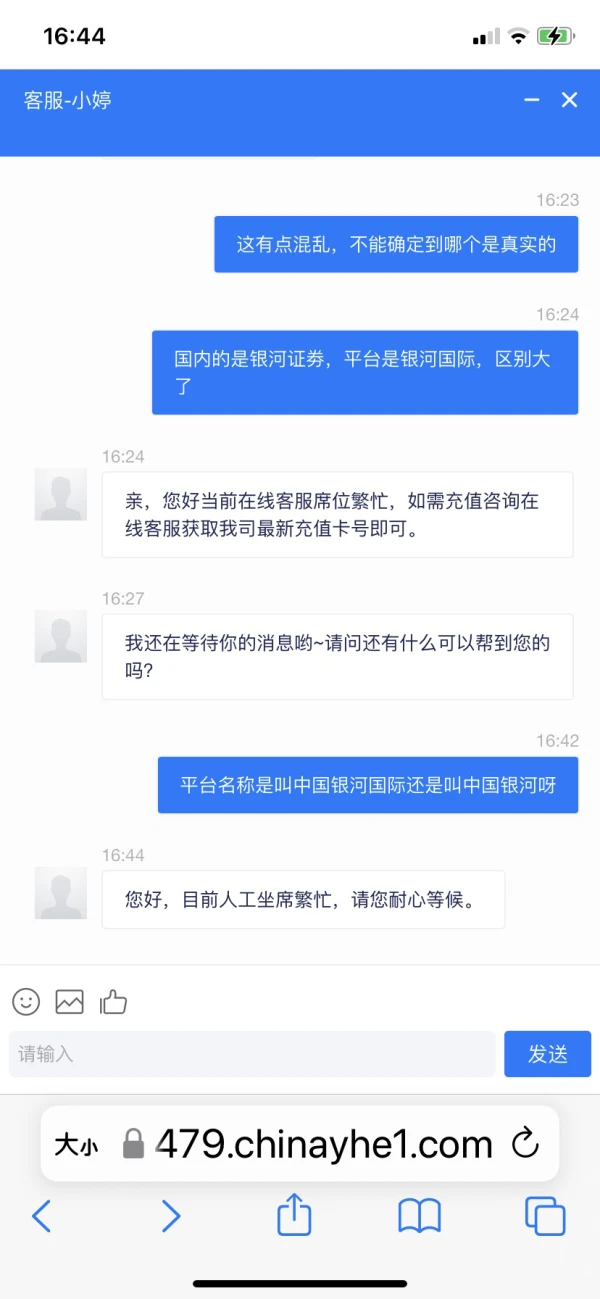

Layanan pelanggan tidak ditarik dengan menggunakan alasan yang berbeda, saya tidak tahu apakah itu platform yang sah atau platform tiruan penipuan. Situs webnya adalah https://78714479.chinayhe1.com/index/login/login/token/d6b70b5b8eef4ceef2e2765b7f46dd9b.html

Paparan

FX1433857007

Hong Kong

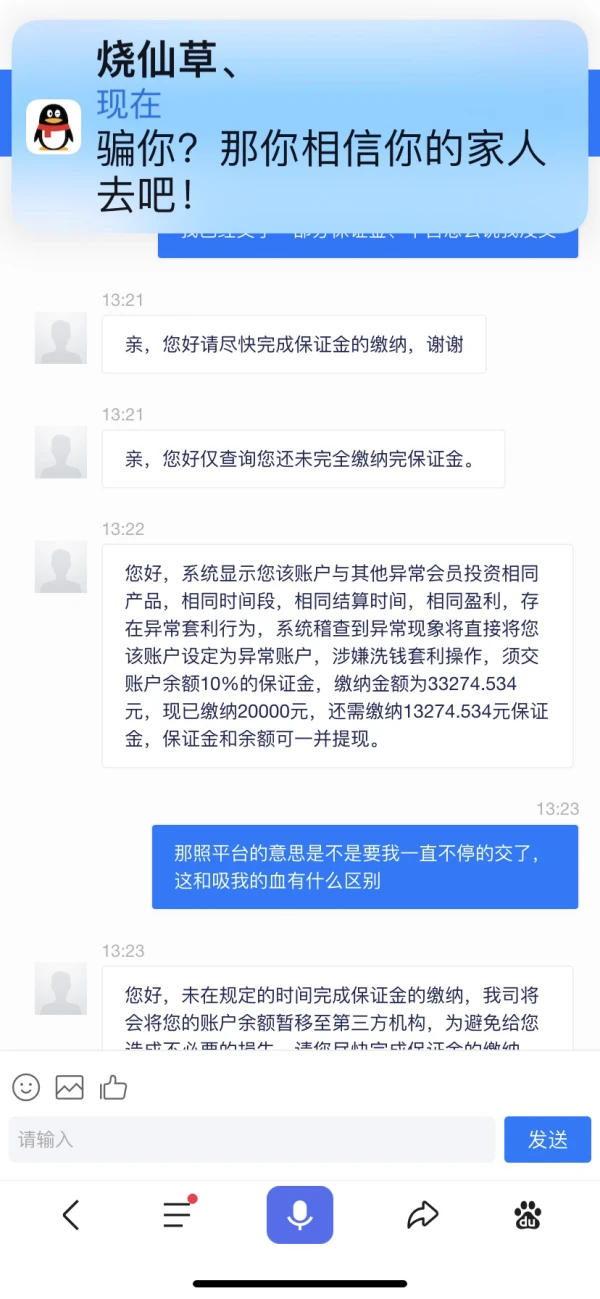

Beberapa hari yang lalu, saya bertemu seseorang dari telepon seluler dan berkata bahwa saya sedang melakukan pertukaran mata uang asing. Saya berkonsultasi beberapa hal dan membiarkan saya membuat beberapa pesanan. Itu cukup bagus pada saat itu. Ketika saya sampai ke single keenam, saya memiliki posisi buruk 35.000 yuan. Kemudian, dia berkata bahwa dia tidak perlu khawatir, dia akan membayarnya. Setelah mereka bernegosiasi untuk memanggil saya akun valuta asing 17.500 yuan, izinkan saya menambahkan 17500 yuan, setelah konsultasi, tindak lanjut, biarkan pos 35.000 yuan, setelah penyelesaian pesanan ini, tetapi tidak dapat menarik, katakanlah untuk pesanan lain, dapat Mundur, tapi saya tidak mengikuti. Hingga sekarang, buku itu masih di 93.400 yuan, tapi saya tidak berani menariknya. Ada orang yang menghubungi saya untuk menarik saya hitam. Terima kasih

Paparan