Şirket özeti

| China Galaxy İnceleme Özeti | |

| Kuruluş Yılı | 2011 |

| Kayıtlı Ülke/Bölge | Hong Kong |

| Düzenleme | Düzenlenmiş |

| Piyasa Araçları | Menkul KıymetlerVadeli İşlem ve OpsiyonlarTahvillerYatırım FonlarıYapılandırılmış Ürünler |

| Deneme Hesabı | ❌ |

| Kaldıraç | / |

| Spread | / |

| İşlem Platformu | SPTrader ProGalaxy Global Trading TerminalsSoft TokenAAStocks |

| Minimum Yatırım | / |

| Müşteri Desteği | Telefon: (852) 3698 6750 / 400 866 8833 |

| E-posta: cs@chinastock.com.hk | |

| Sosyal Medya: Wechat | |

| Fiziksel Adres:20 / F, Wing On Centre, 111 Connaught Road Central, Sheung Wan, Hong KongUnit 1, 36 / F, Cosco Building, Queen's Road, Hong Kong8 / F, Mei Mei Building, 683-685 Nathan Road, Kowloon, Hong Kong | |

China Galaxy Bilgileri

2011 yılında Hong Kong'da kurulmuştur. SFC tarafından düzenlenir ve aracılık ve satış, yatırım bankacılığı, yatırım araştırmaları, varlık yönetimi ve finansman dahil olmak üzere tam bir finansal hizmet yelpazesi sunar. Ayrıca, tüccarların seçebileceği 5 hesap türü ve 4 işlem platformu bulunmaktadır.

Artıları ve Eksileri

| Artıları | Eksileri |

| İyi düzenlenmiş | MT4/5 desteklenmiyor |

| 5 çeşit hesap | Hesap detayları yok |

| 4 işlem platformu |

China Galaxy Güvenilir mi?

| Kayıtlı Ülke/Bölge |  |

| Düzenleyici Kurum | SFC |

| Düzenlenen Kuruluş | China Galaxy International Futures (Hong Kong)Co., Limited |

| Lisans Türü | Vadeli işlem sözleşmelerinde işlem yapma |

| Lisans Numarası | AYH772 |

| Mevcut Durum | Düzenlenmiş |

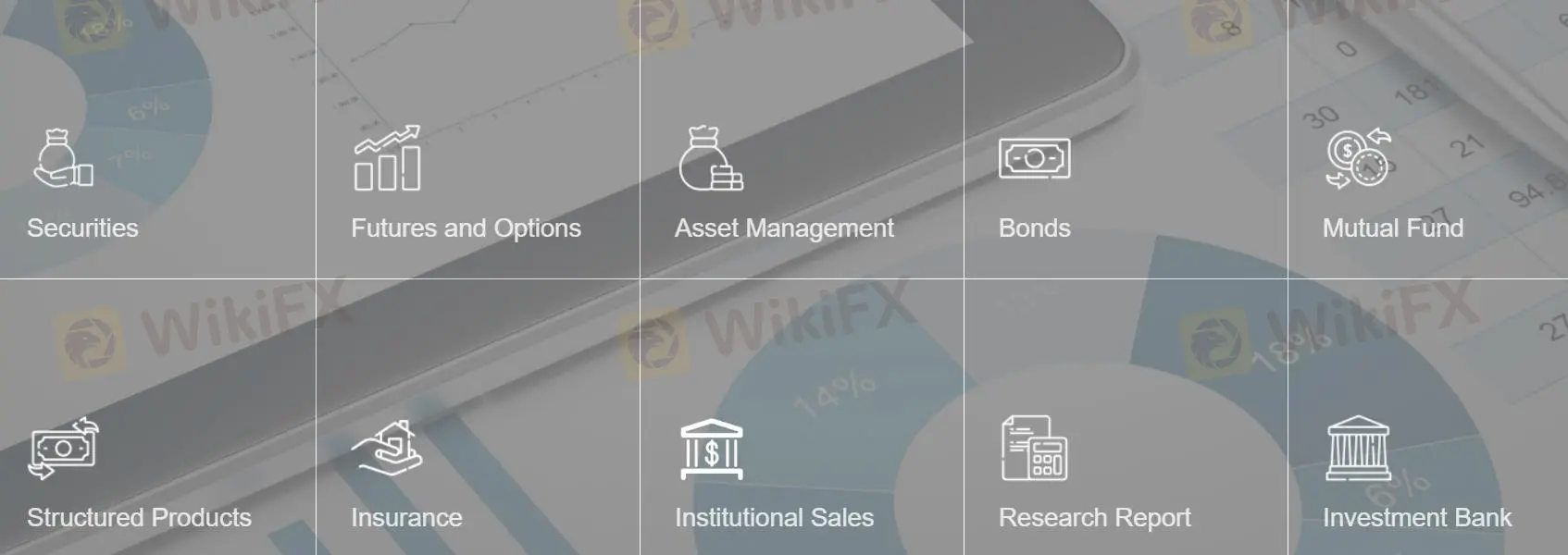

China Galaxy Üzerinde Ne İşlem Yapabilirim?

Tüccarlar, China Galaxy üzerinde menkul kıymetler, 140+ vadeli işlem ve opsiyon, bonolar, hisse fonları (hisse fonları, para piyasası fonları, tahvil fonları, dengeli fonlar, çok varlıklı fonlar, sektör fonları vb.), yapılandırılmış ürünler gibi hisse fonları dahil olmak üzere birçok farklı varlıkla işlem yapabilirler.

| İşlem Yapılabilir Enstrümanlar | Desteklenir |

| Menkul Kıymetler | ✔ |

| Vadeli İşlem ve Opsiyonlar | ✔ |

| Bonolar | ✔ |

| Hisse Fonları | ✔ |

| Yapılandırılmış Ürünler | ✔ |

| Forex | ❌ |

| Kıymetli Metaller ve Emtialar | ❌ |

| Endeksler | ❌ |

| Hisseler | ❌ |

| ETF | ❌ |

Hesap Türleri

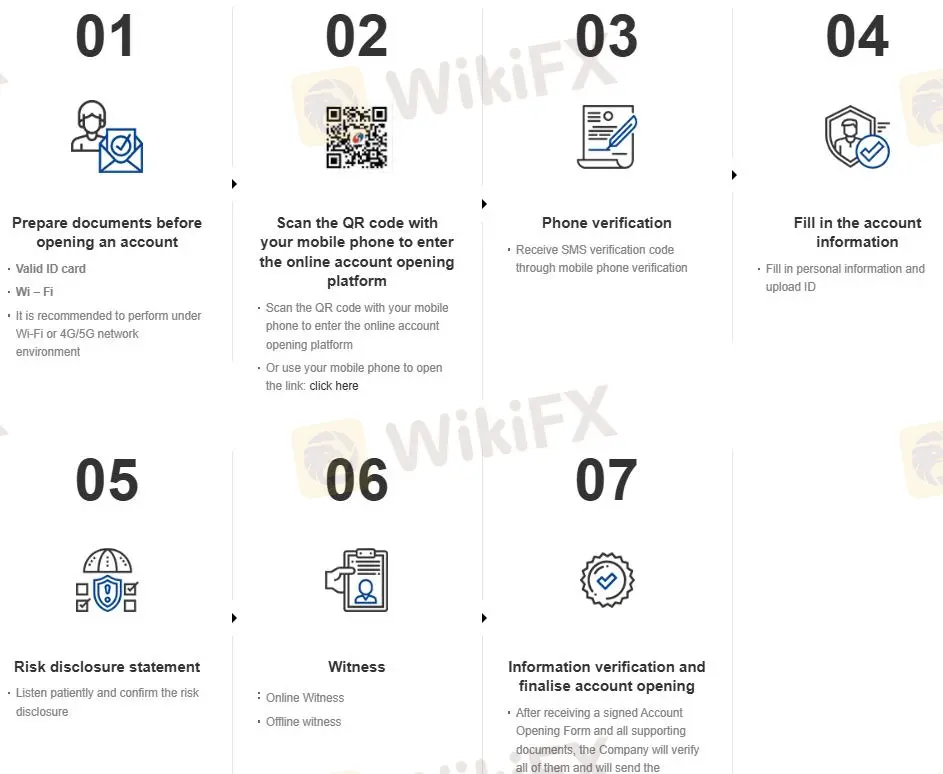

China Galaxy, menkul kıymetler nakit hesapları, menkul kıymetler marj hesapları, vadeli hesaplar ve hisse opsiyon hesapları sunmaktadır. Ayrıca, müşteriler elektronik bir işlem hesabı açmayı tercih edebilirler. Toplamda 5 hesap türü vardır, başlangıç depozitosu gerektirmez.

Hesap açmak için online ve mobil olmak üzere 2 seçenek bulunmaktadır. Detaylı süreç için şu adrese bakabilirsiniz: https://en.chinastock.com.hk/customer/process/

İşlem Platformu

SPTrader Pro, Galaxy Global Trading Terminals, Soft Token ve AAStocks , China Galaxy International'ın mobil veya masaüstü üzerinde kullanılabilen işlem platformlarıdır.

| İşlem Platformu | Desteklenir | Kullanılabilir Cihazlar | Uygun Kullanıcılar |

| SPTrader Pro | ✔ | Mobil | Tüm tüccarlar |

| Galaxy Global Trading Terminals | ✔ | Masaüstü | Tüm tüccarlar |

| Soft Token | ✔ | Mobil | Tüm tüccarlar |

| AAStocks | ✔ | Masaüstü | Tüm tüccarlar |

| MT4 | ❌ | ||

| MT5 | ❌ |

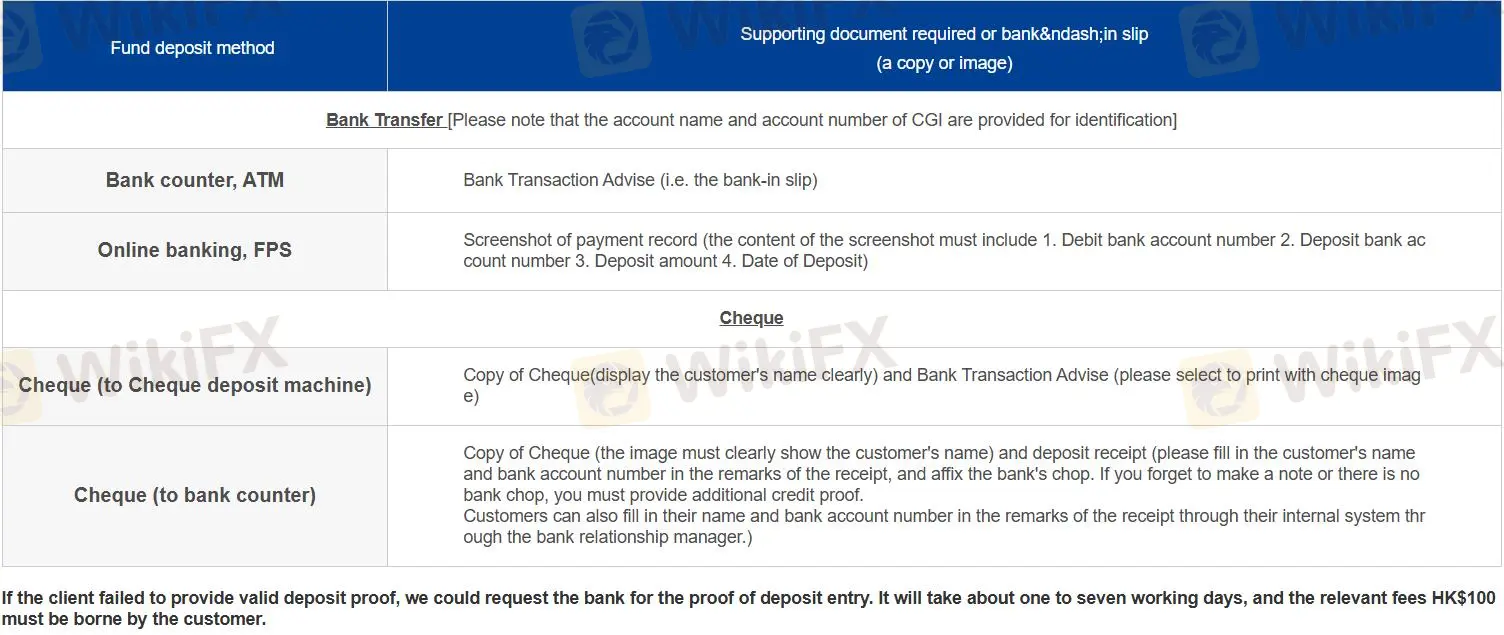

Para Yatırma ve Çekme

2 kategoride 4 tür para yatırma yöntemi bulunmaktadır:

Banka gişesi, ATM

Online bankacılık, FPS

Çek (çek yatırma makinesine)

Çek (banka gişesine)

Para çekme işlemleri için, kayıtlı banka hesabı olan işlemciler, talimatlar için AE ile iletişime geçebilir veya çekim formunu doldurabilirler. Aksi takdirde, talimatlar için bir çekim formu gereklidir.

1g h jv f f f

Hong Kong

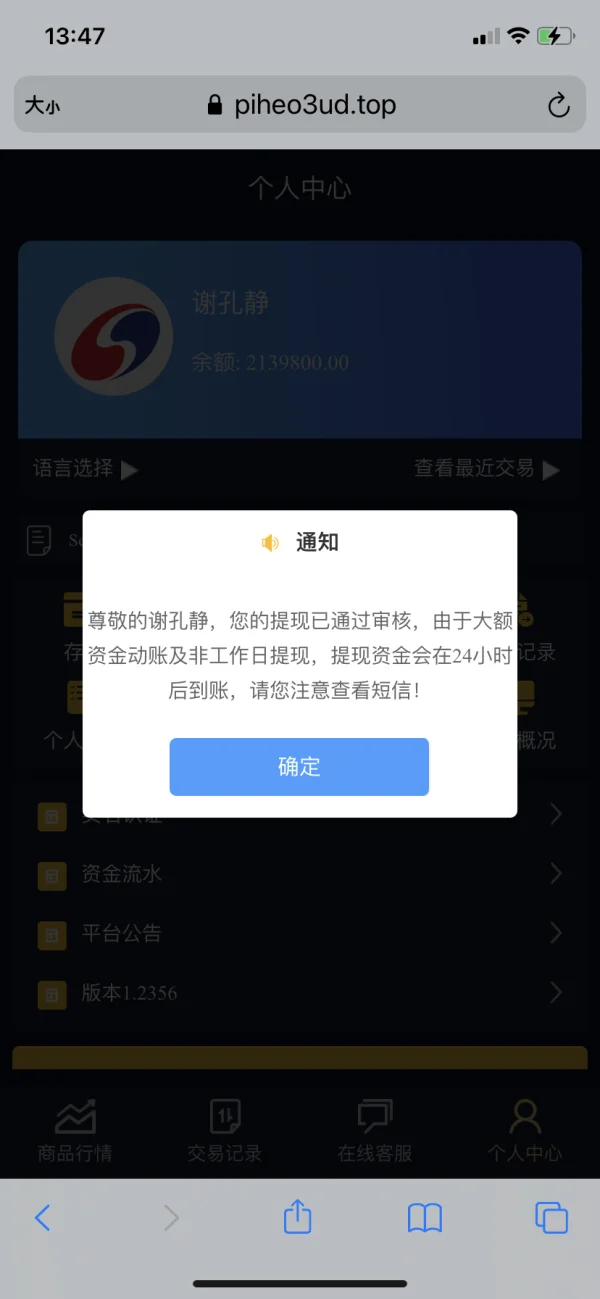

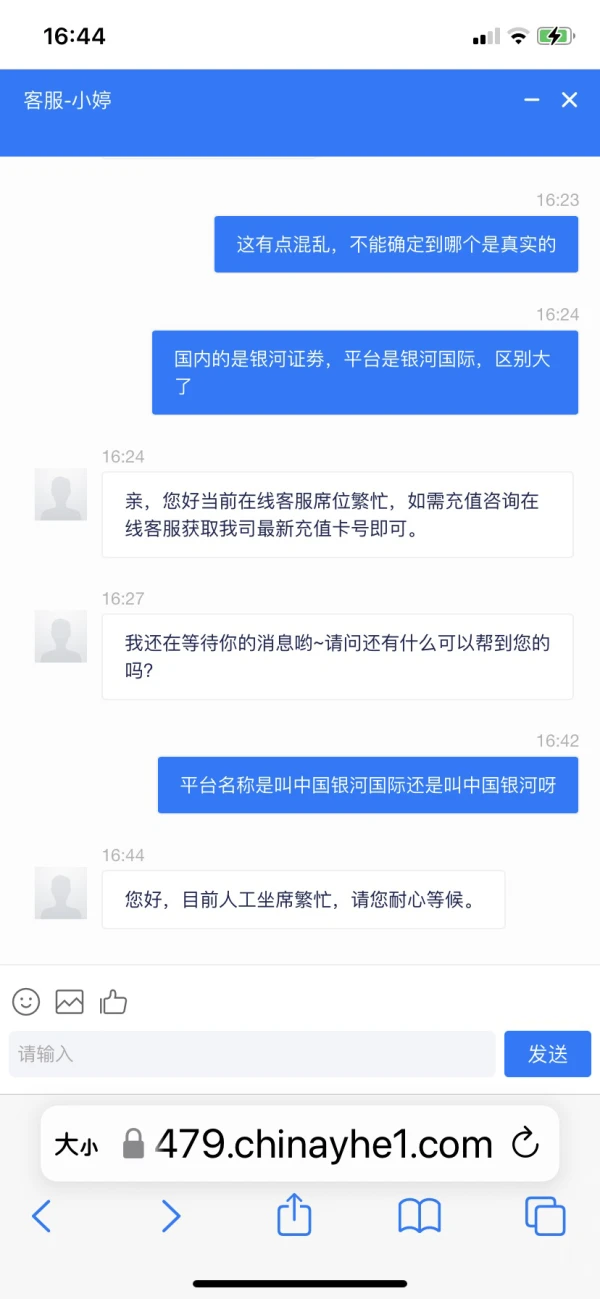

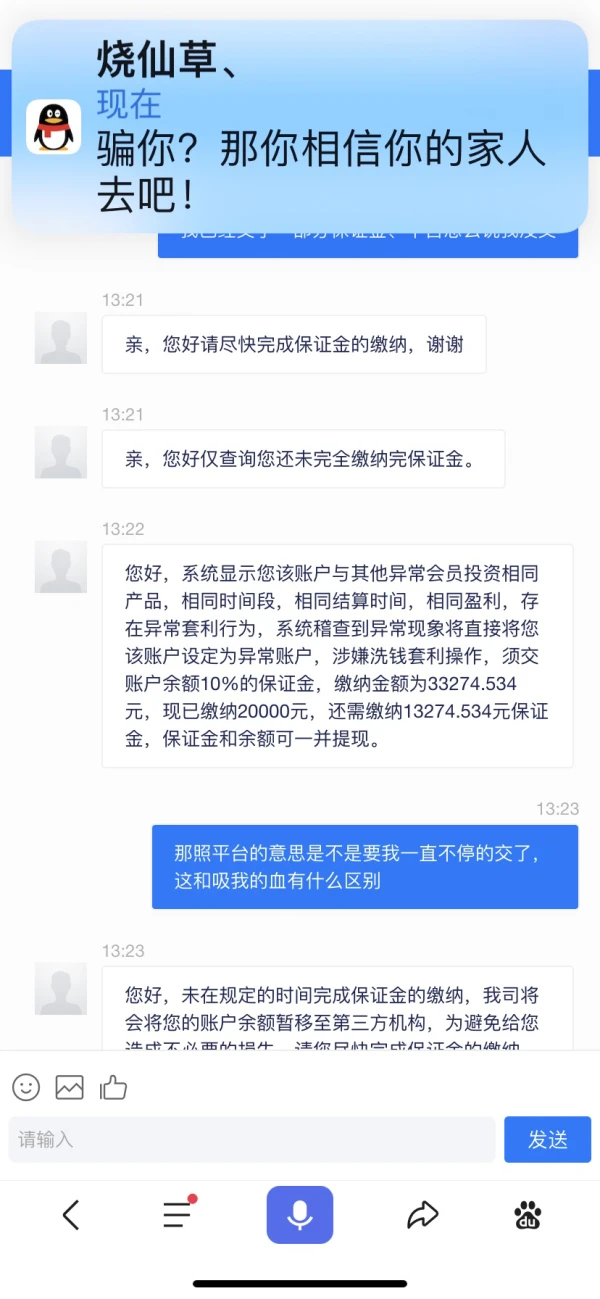

Siyah platform

Teşhir

建雷

Hong Kong

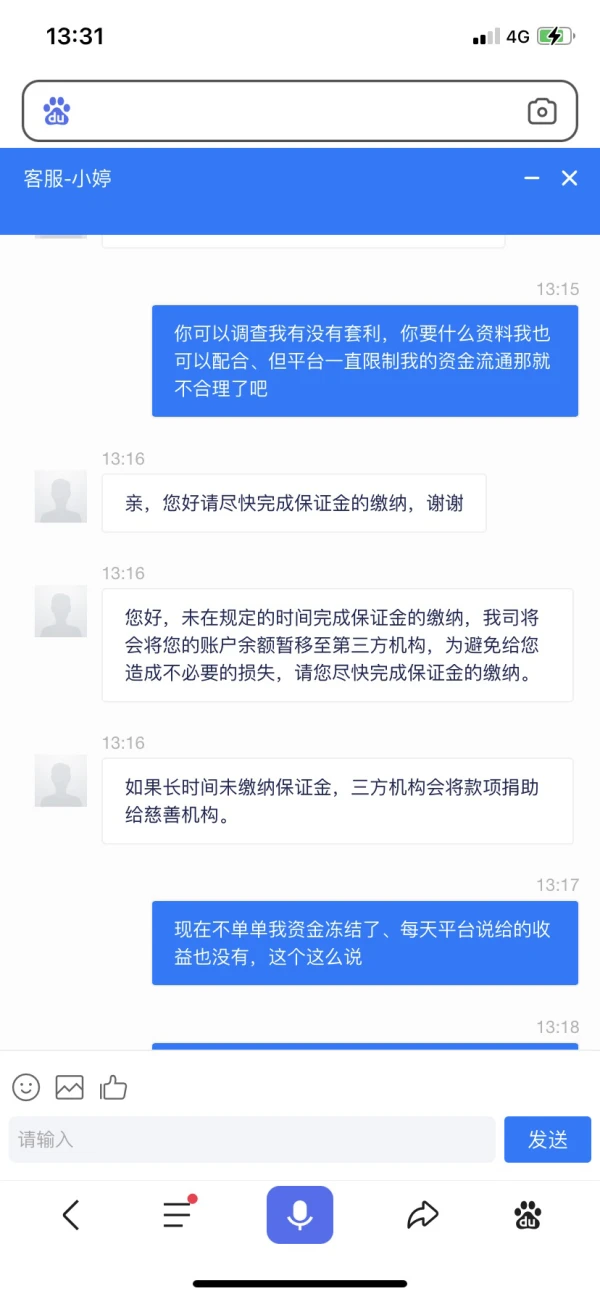

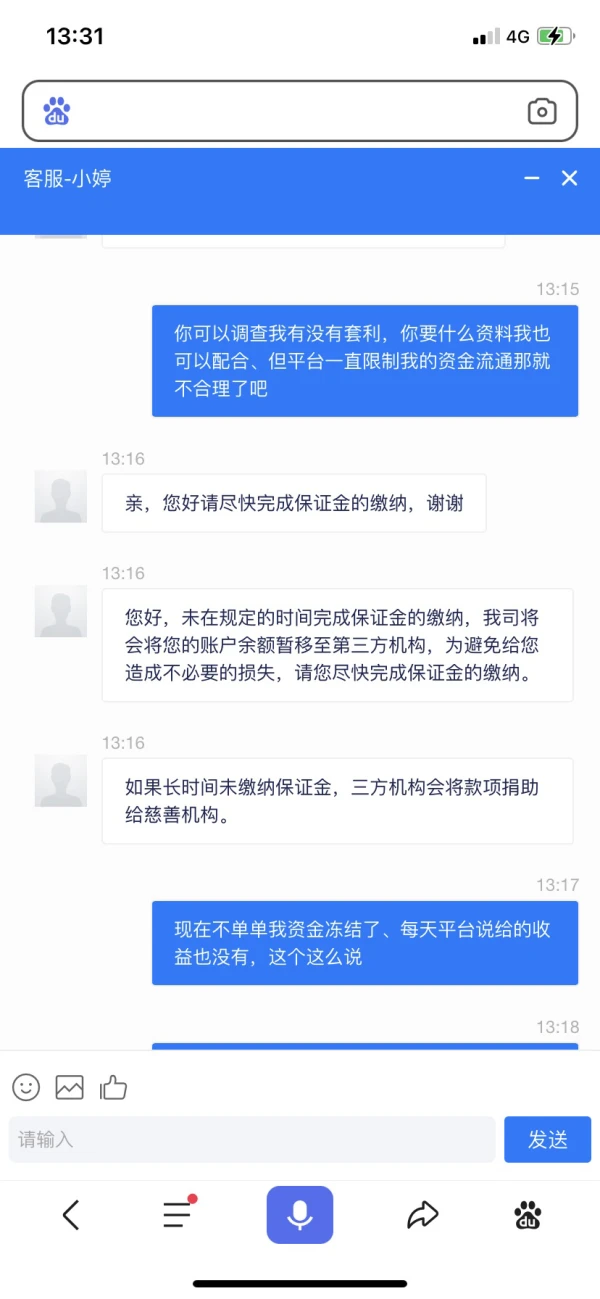

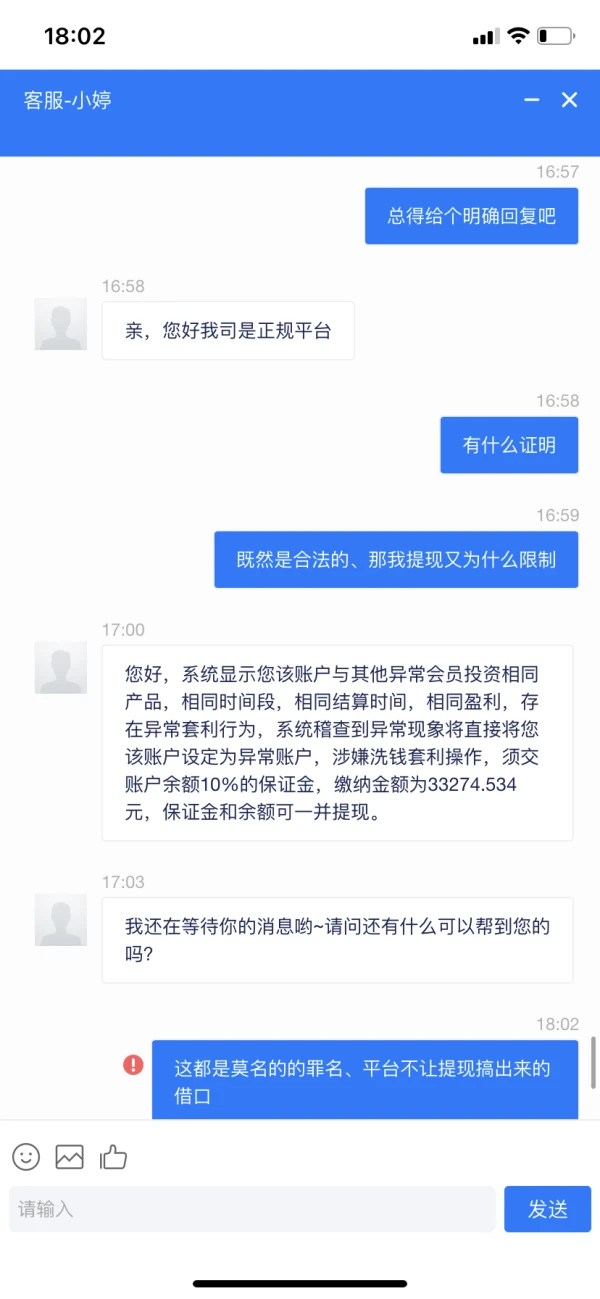

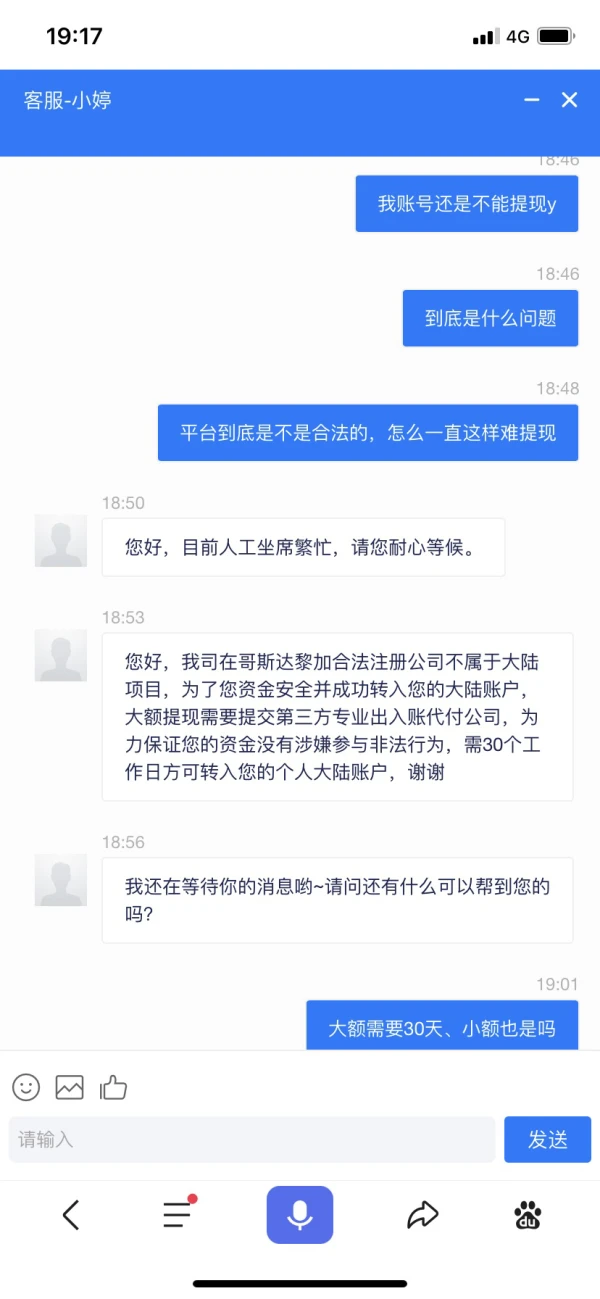

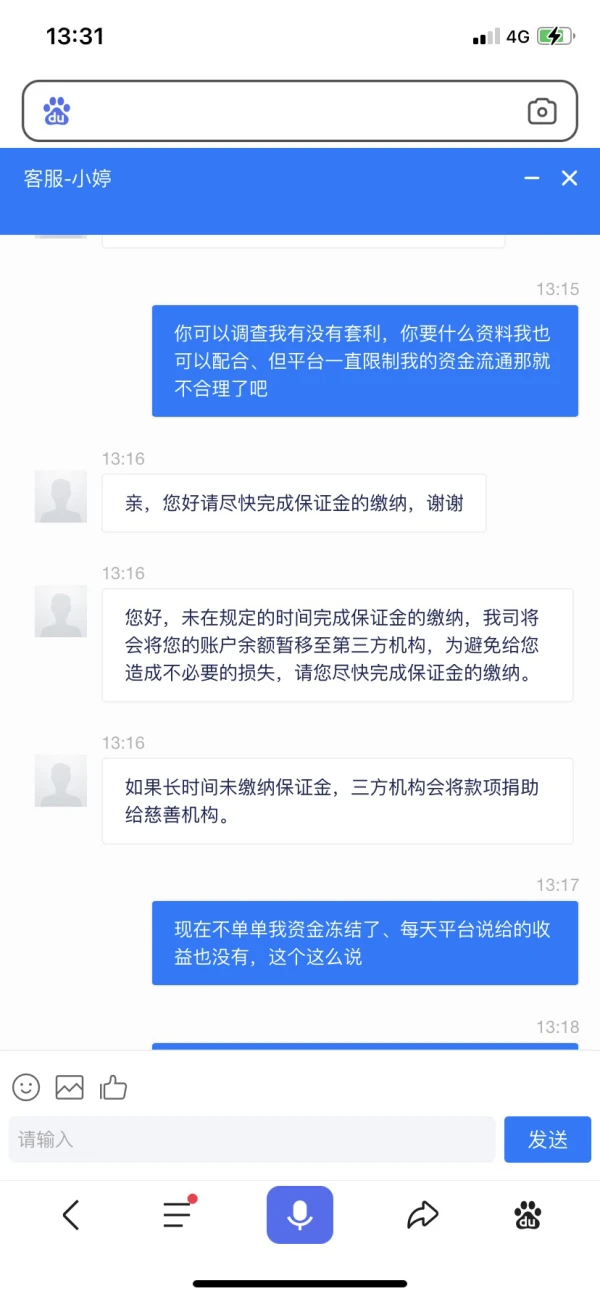

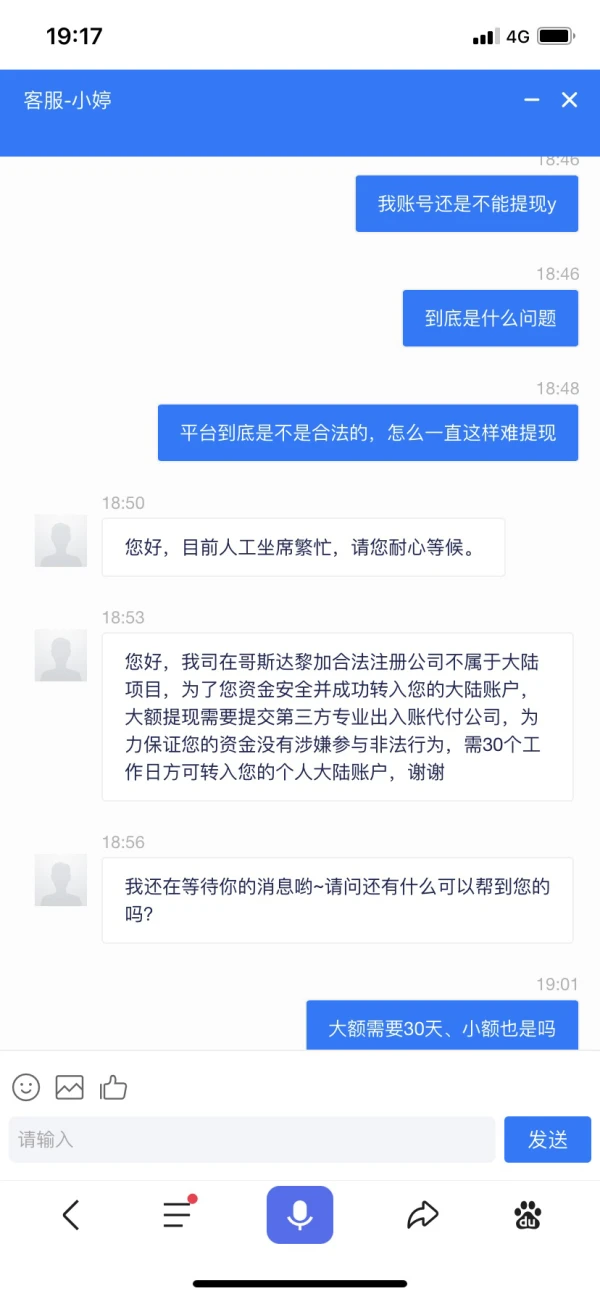

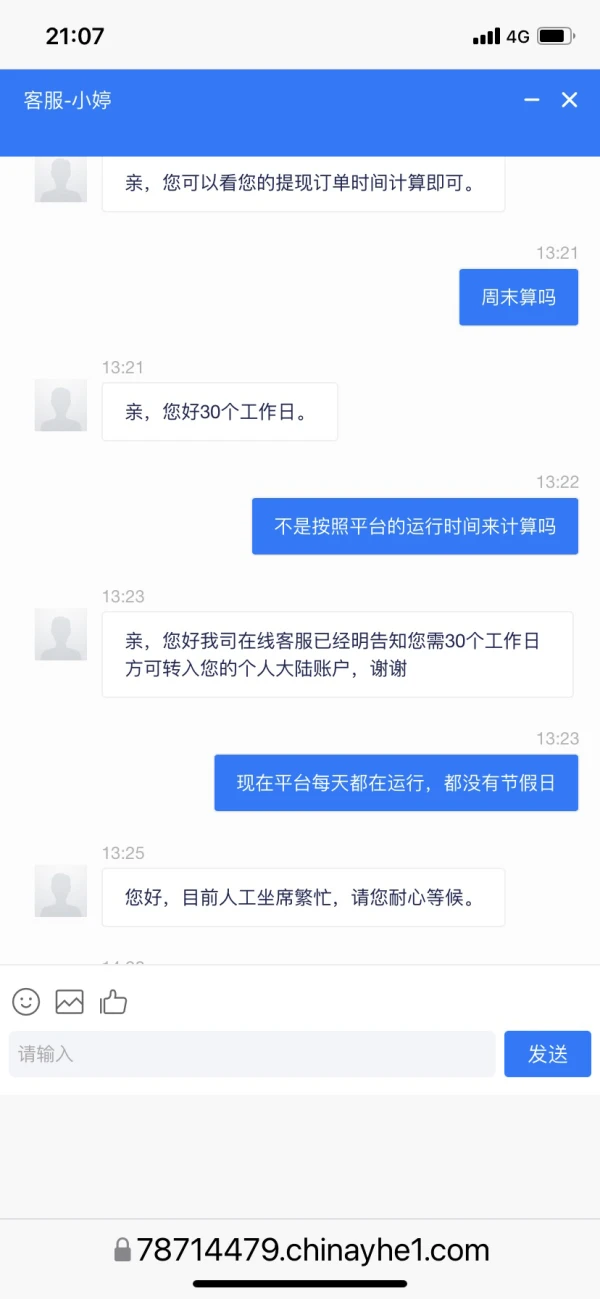

一直拒绝提现,不让提现说一大堆理由,引起大家警示

Teşhir

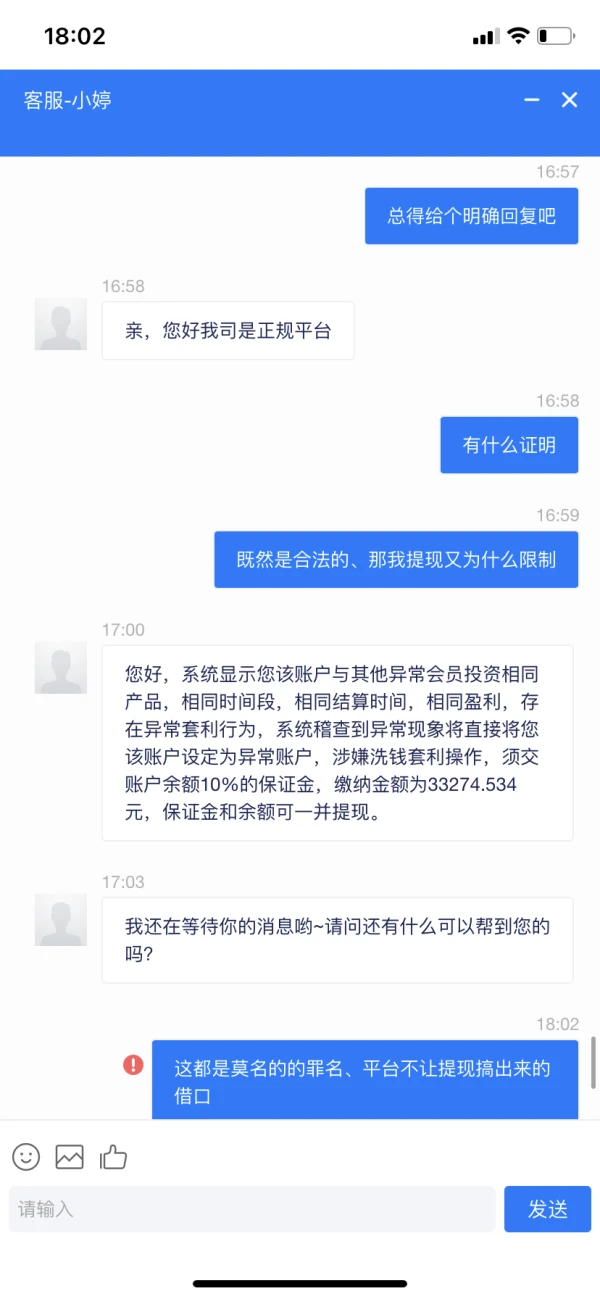

徊眸

Hong Kong

客服一直找各种借口无法出金,问其是什么问题也不说明白就是找各种理由。

Teşhir

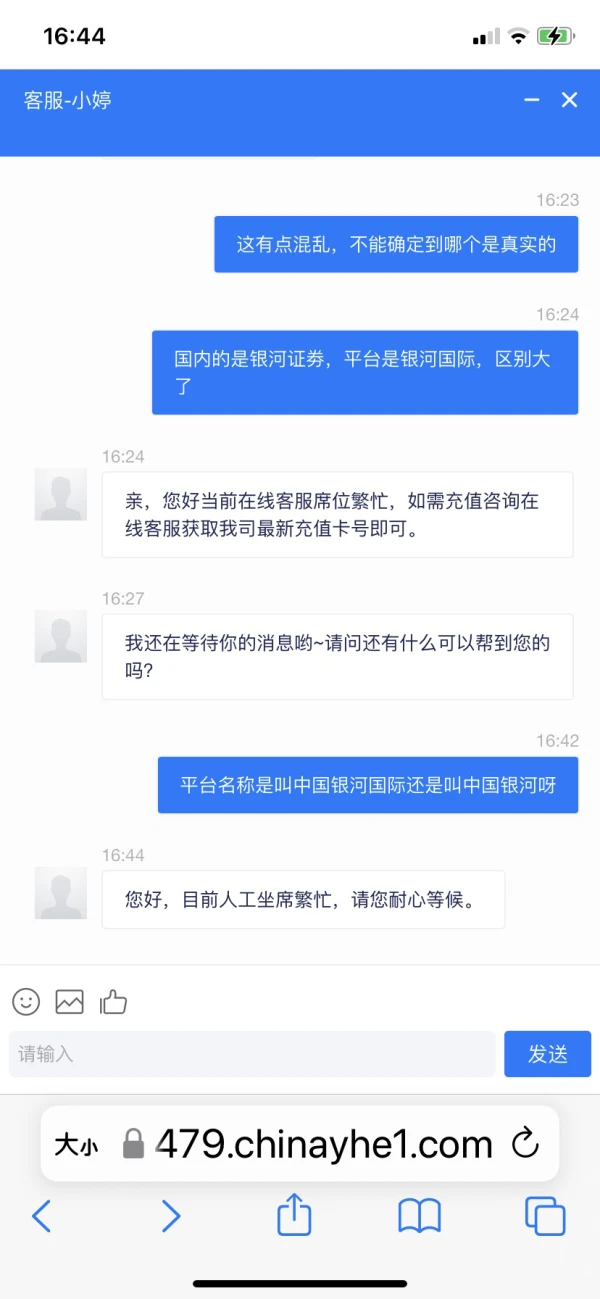

徊眸

Hong Kong

客服一直不给出金,找各种理由,不知道是不是合法平台还是套牌黑平台,网站是https://78714479.chinayhe1.com/index/login/login/token/d6b70b5b8eef4ceef2e2765b7f46dd9b.html

Teşhir

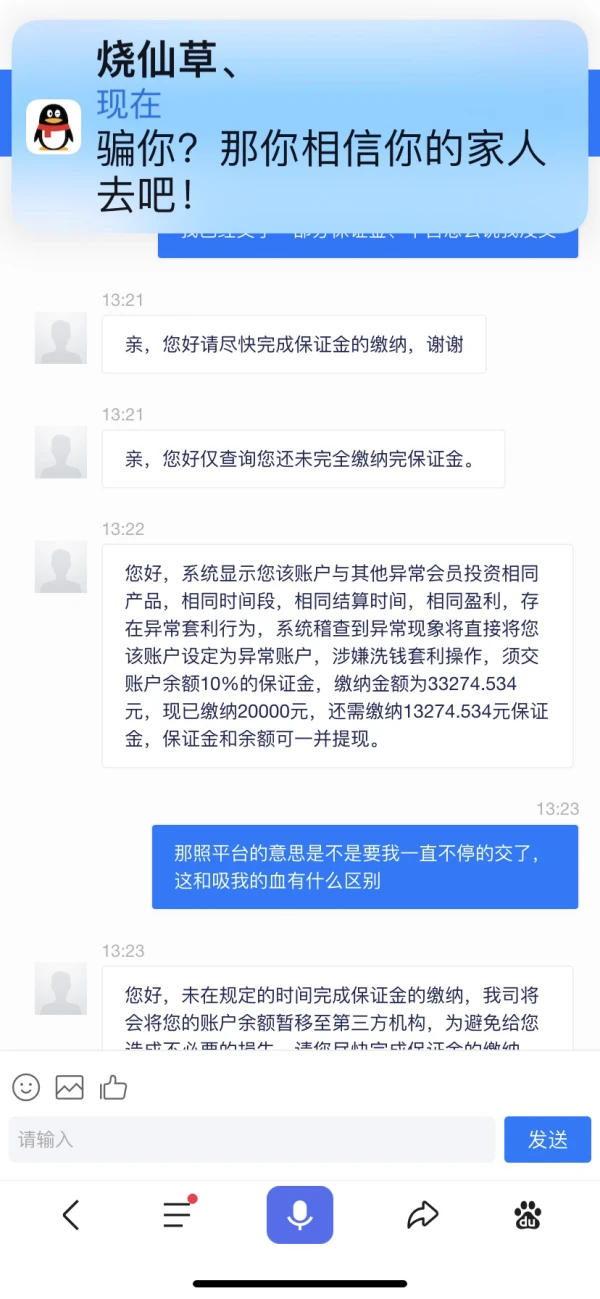

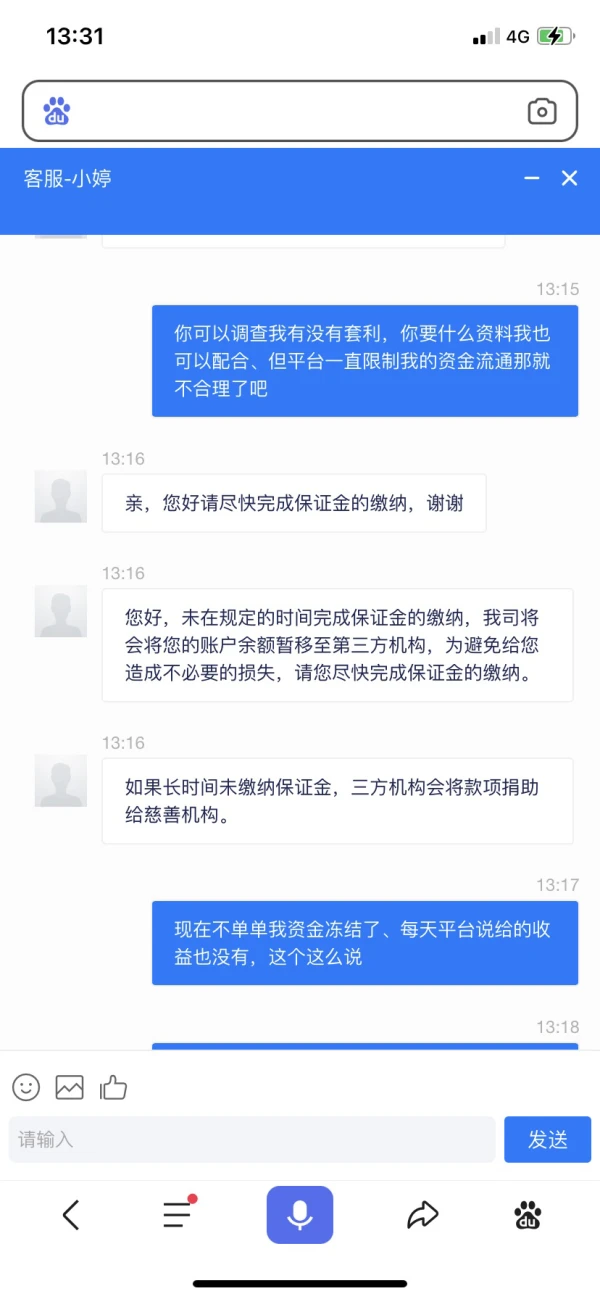

FX1433857007

Hong Kong

前些日子,从手机上认识了一个人,说是做外汇的。我咨询了一些事,让后做了几单,当时挺好,到了第六单就暴仓了35000元,后来他说不要急,包赔。 经过他们商量给我打到外汇帐上17500元,让我再加17500元,商量后也跟进,让后做单35000元,后这单完成,但不能提现,说要再下一单,才能提现,但我没跟。到现在帐面上还在93400元,但不敢提现。 还有跟我联系的人,以把我拉黑。谢!

Teşhir