Resumo da empresa

| China GalaxyResumo da Revisão | |

| Fundado | 2011 |

| País/Região Registrado | Hong Kong |

| Regulação | Regulado |

| Instrumentos de Mercado | AçõesFuturos e OpçõesTítulosFundos MútuosProdutos Estruturados |

| Conta Demonstração | ❌ |

| Alavancagem | / |

| Spread | / |

| Plataforma de Negociação | SPTrader ProGalaxy Global Trading TerminalsSoft TokenAAStocks |

| Depósito Mínimo | / |

| Suporte ao Cliente | Telefone: (852) 3698 6750 / 400 866 8833 |

| Email: cs@chinastock.com.hk | |

| Mídias Sociais: Wechat | |

| Endereço Físico:20 / F, Wing On Centre, 111 Connaught Road Central, Sheung Wan, Hong KongUnit 1, 36 / F, Cosco Building, Queen's Road, Hong Kong8 / F, Mei Mei Building, 683-685 Nathan Road, Kowloon, Hong Kong | |

China Galaxy Informação

Foi fundada em Hong Kong em 2011. É regulamentada pela SFC e oferece uma ampla gama de serviços financeiros, incluindo corretagem e vendas, banco de investimento, pesquisa de investimento, gestão de ativos e financiamento. Além disso, existem 5 tipos de contas e 4 plataformas de negociação para os traders escolherem.

Prós e Contras

| Prós | Contras |

| Bem regulamentado | MT4/5 não é suportado |

| 5 tipos de contas | Sem detalhes da conta |

| 4 plataformas de negociação |

China Galaxy é Legítimo?

| País/Região Regulamentado |  |

| Autoridade Regulamentada | SFC |

| Entidade Regulamentada | China Galaxy International Futures (Hong Kong)Co., Limited |

| Tipo de Licença | Negociação de contratos futuros |

| Número de Licença | AYH772 |

| Status Atual | Regulado |

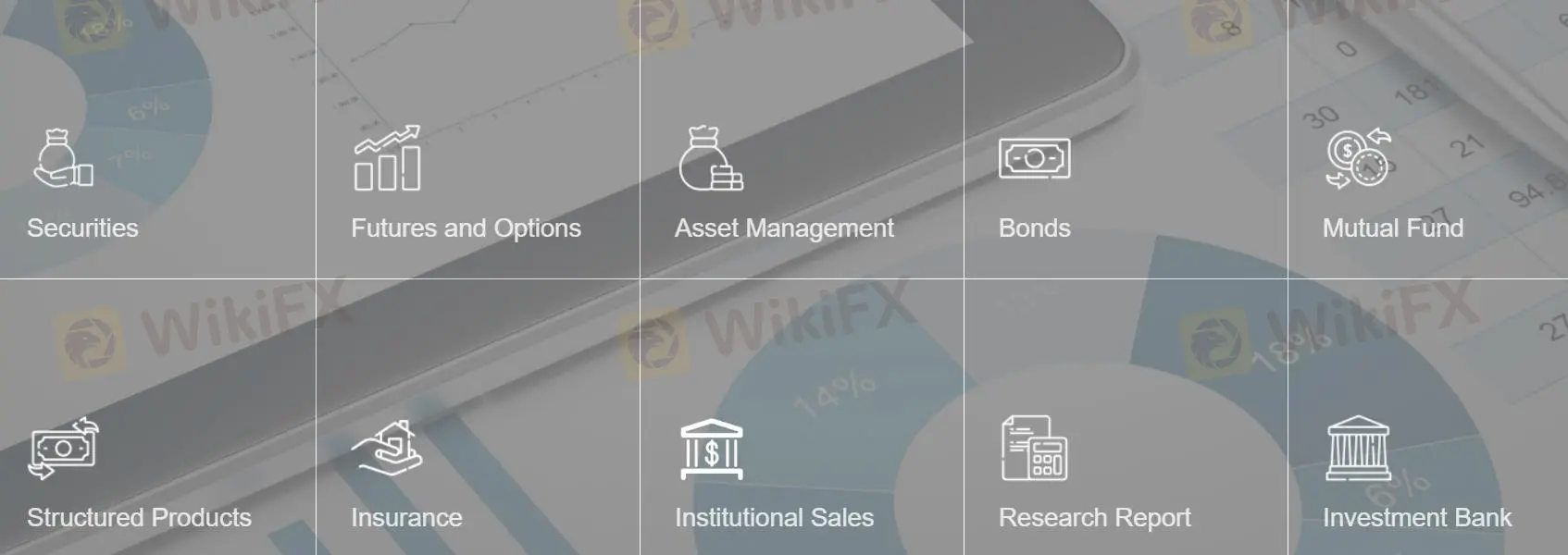

O que posso negociar na China Galaxy?

Os traders podem negociar títulos, mais de 140 futuros e opções, títulos, fundos mútuos, incluindo fundos de ações, fundos de mercado monetário, fundos de títulos, fundos balanceados, fundos multiativos, fundos setoriais, etc., produtos estruturados na China Galaxy.

| Instrumentos Negociáveis | Suportado |

| Títulos | ✔ |

| Futuros e Opções | ✔ |

| Títulos | ✔ |

| Fundos Mútuos | ✔ |

| Produtos Estruturados | ✔ |

| Forex | ❌ |

| Metais Preciosos e Commodities | ❌ |

| Índices | ❌ |

| Ações | ❌ |

| ETF | ❌ |

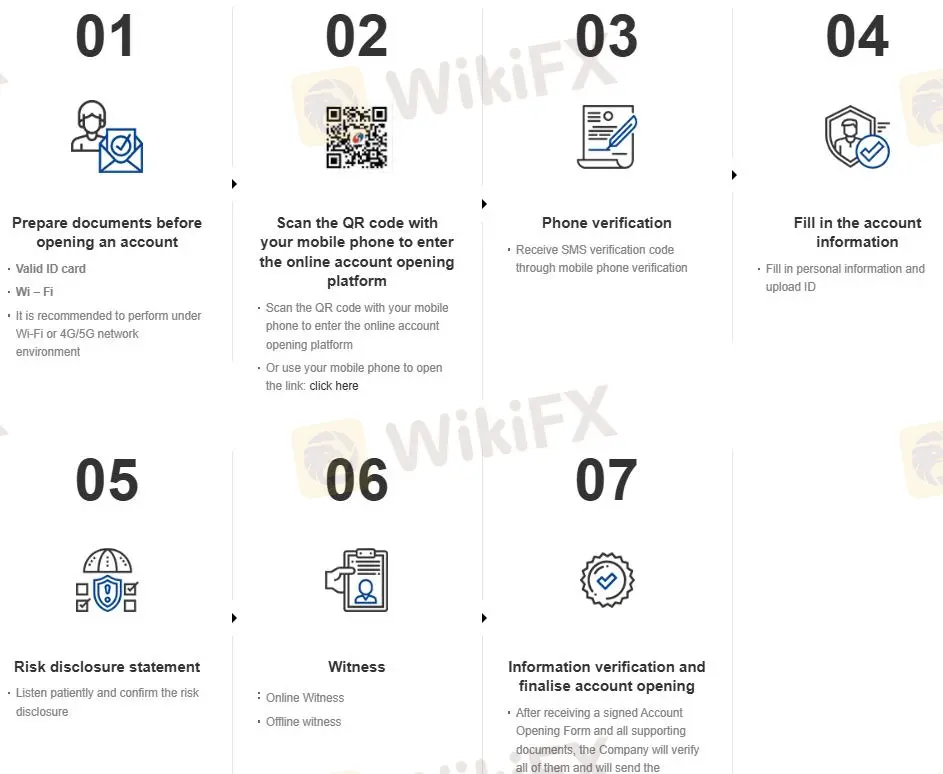

Tipos de Conta

China Galaxy disse que oferece contas de dinheiro em títulos, contas de margem em títulos, contas de futuros e contas de opções de ações. Além disso, os clientes podem optar por abrir uma conta de negociação eletrônica. No total, são 5, sem depósito inicial necessário.

Existem 2 opções para abrir uma conta: online e móvel. O processo específico pode ser consultado em: https://en.chinastock.com.hk/customer/process/

Plataforma de Negociação

SPTrader Pro, Galaxy Global Trading Terminals, Soft Token e AAStocks são as plataformas de negociação da China Galaxy International, que podem ser usadas em dispositivos móveis ou desktop.

| Plataforma de Negociação | Suportado | Dispositivos Disponíveis | Adequado para |

| SPTrader Pro | ✔ | Móvel | Todos os traders |

| Galaxy Global Trading Terminals | ✔ | Desktop | Todos os traders |

| Soft Token | ✔ | Móvel | Todos os traders |

| AAStocks | ✔ | Desktop | Todos os traders |

| MT4 | ❌ | ||

| MT5 | ❌ |

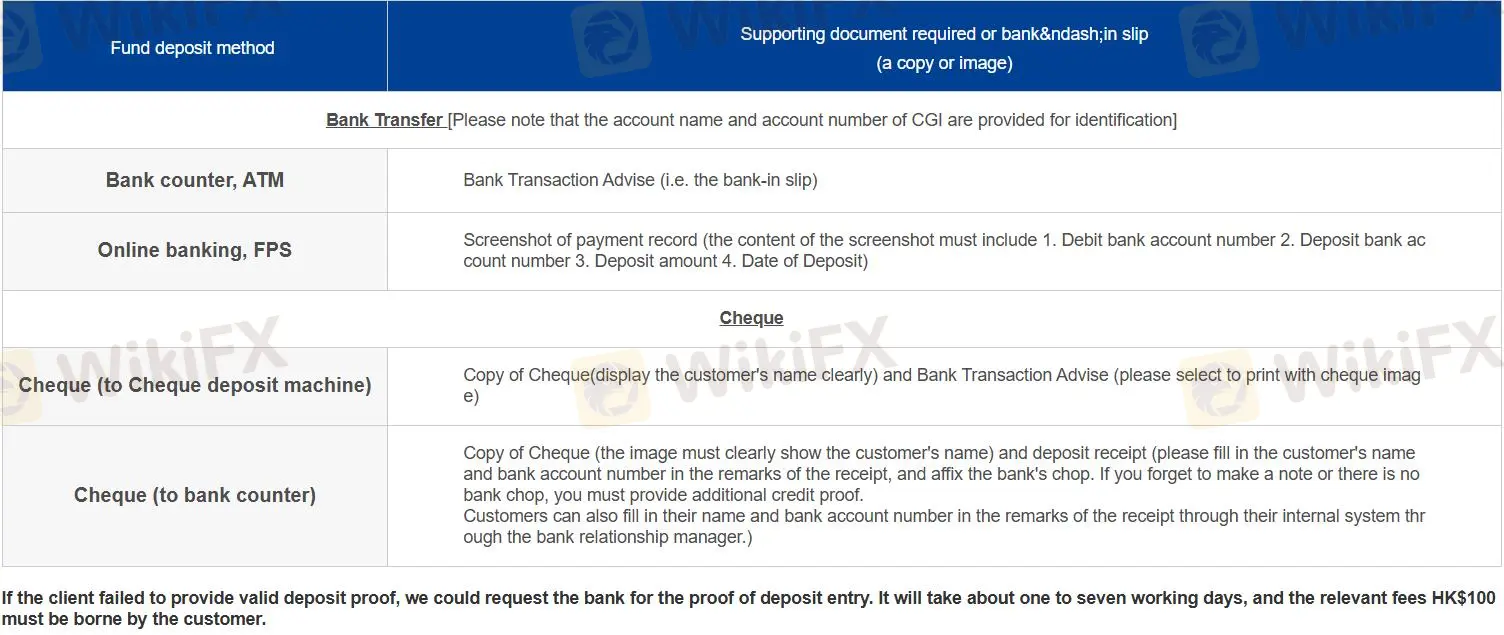

Depósito e Retirada

Existem 4 tipos de depósitos em 2 categorias:

Caixa do banco, ATM

Internet banking, FPS

Verificação (para máquina de depósito de cheques)

Verificação (para caixa do banco)

Para saques, traders com contas bancárias registradas, entrem em contato com AE ou preencham o formulário de saque para obter instruções. Caso contrário, é necessário preencher um formulário de saque para obter instruções.

1g h jv f f f

Hong Kong

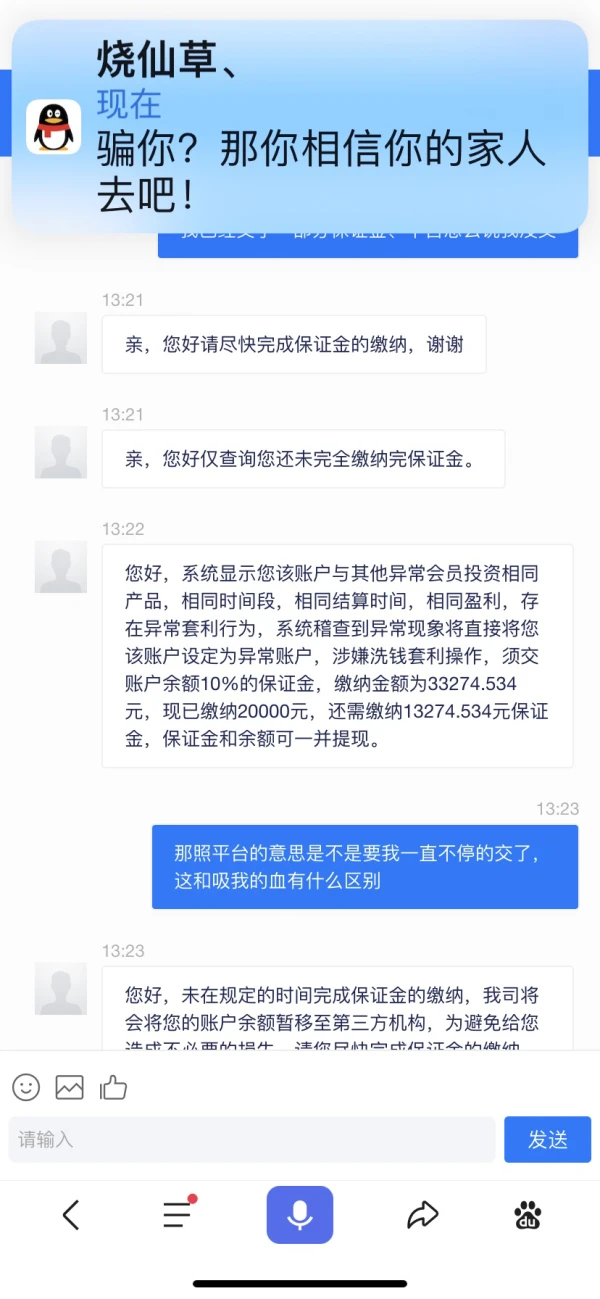

Plataforma preta

Exposição

建雷

Hong Kong

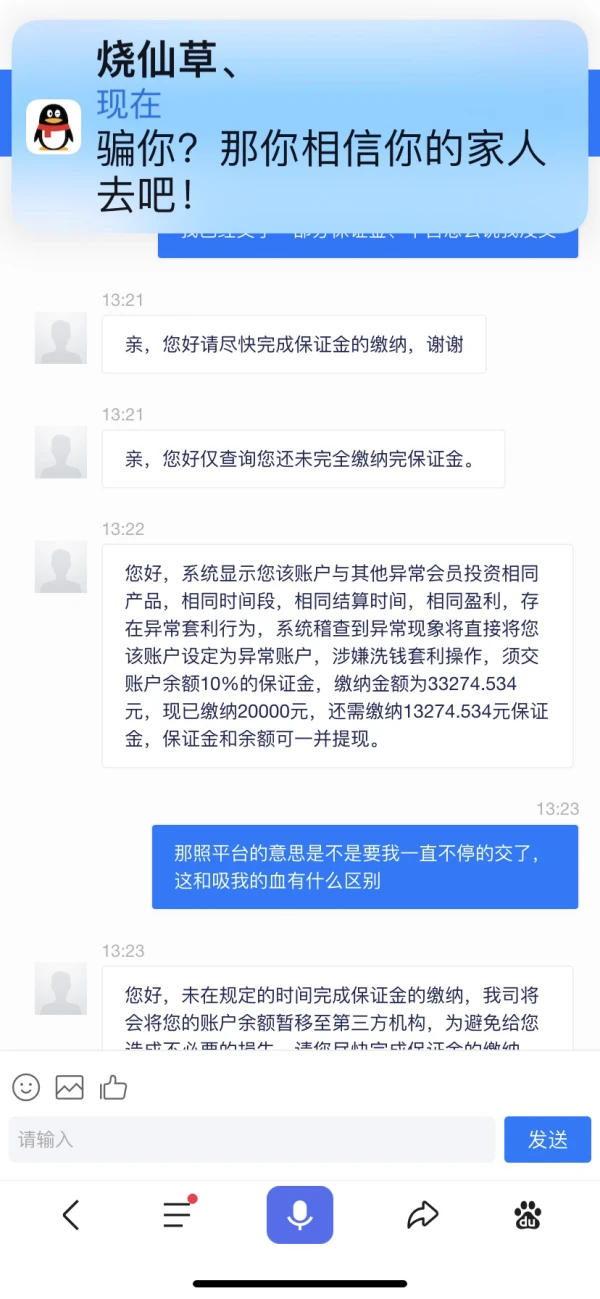

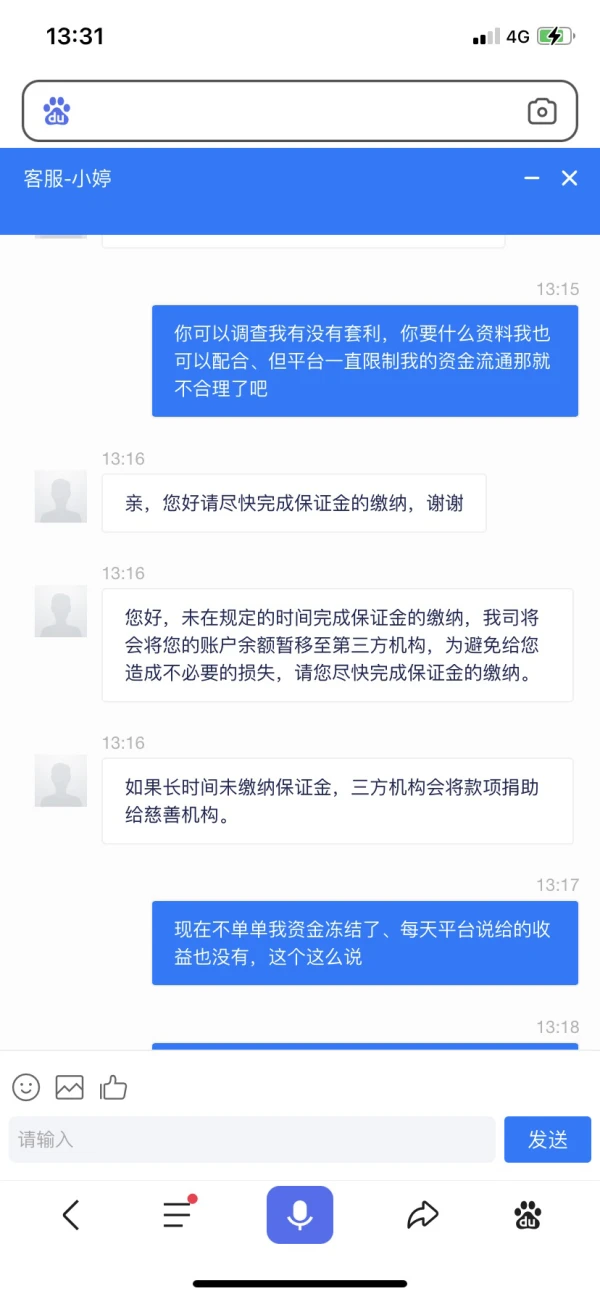

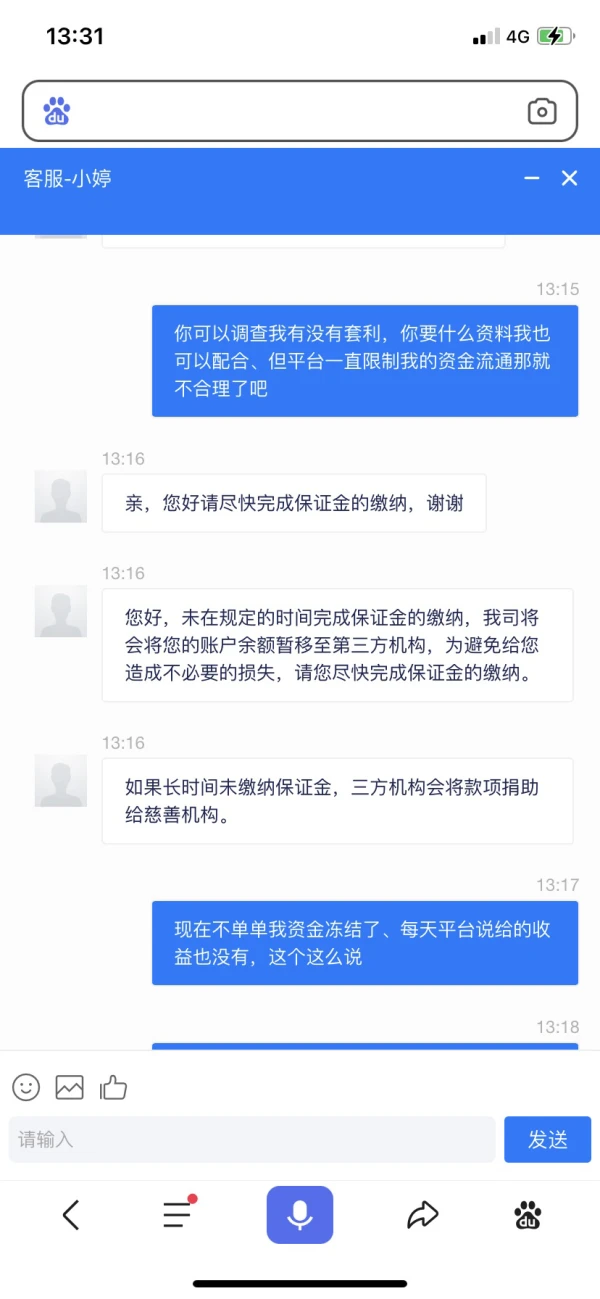

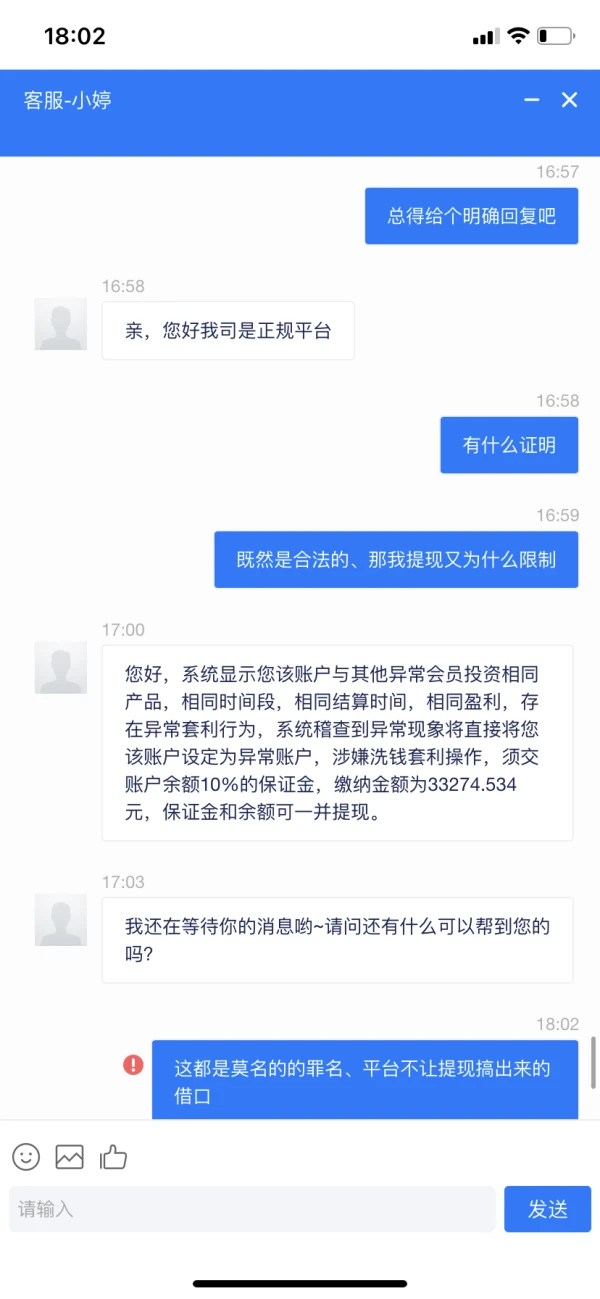

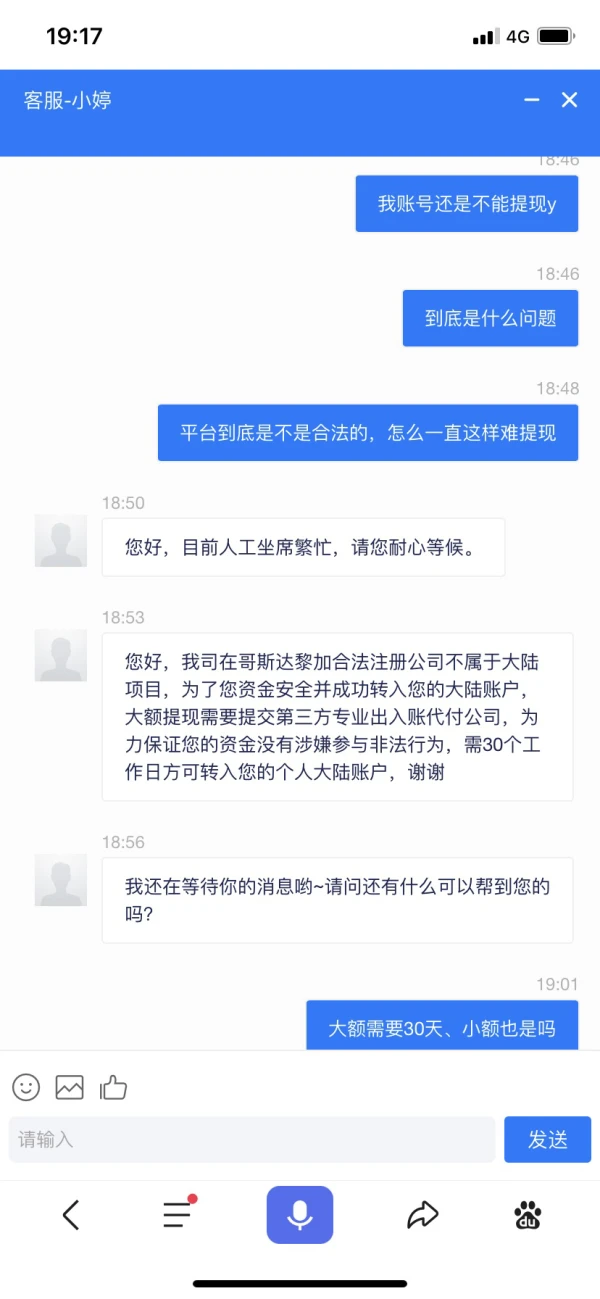

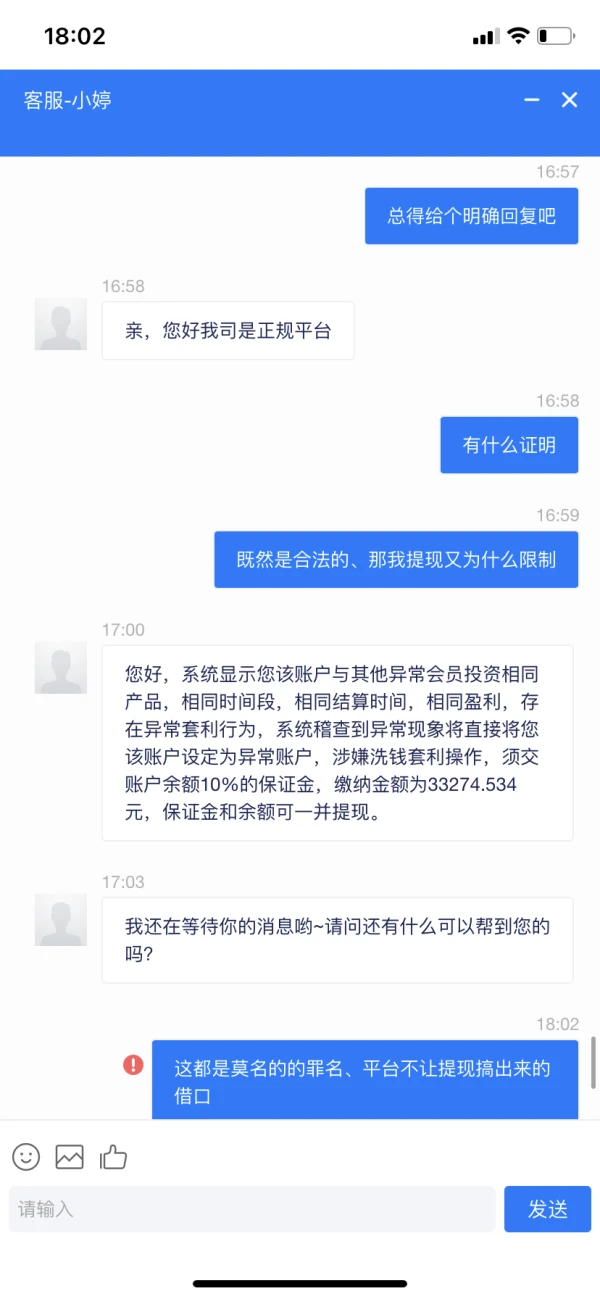

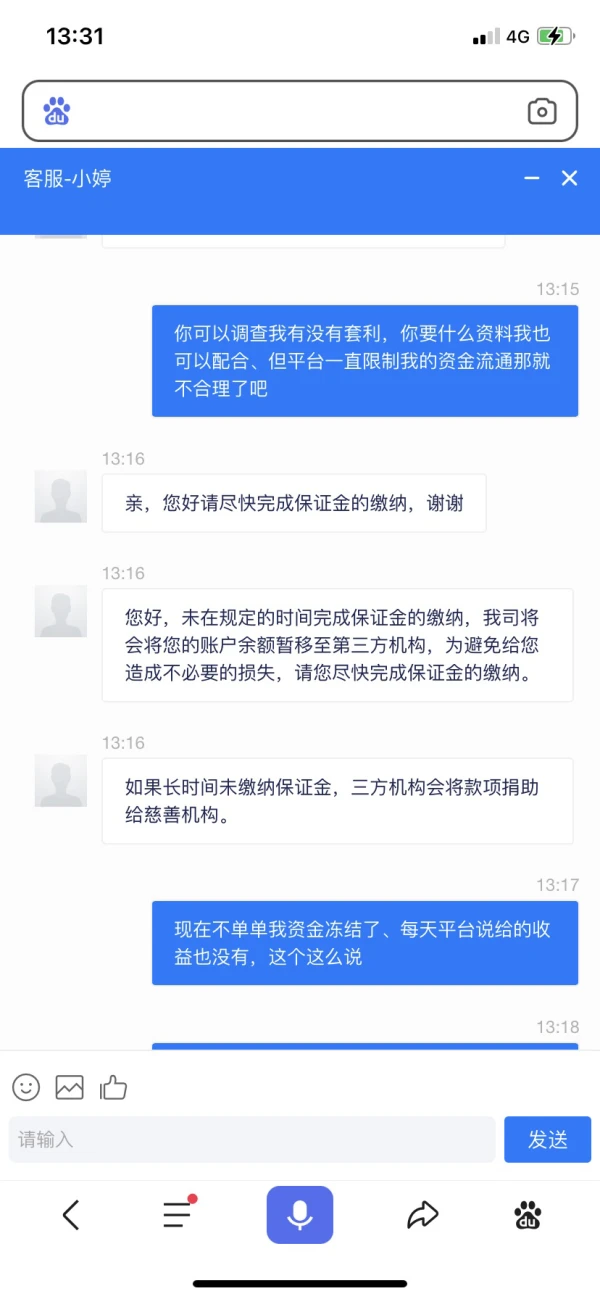

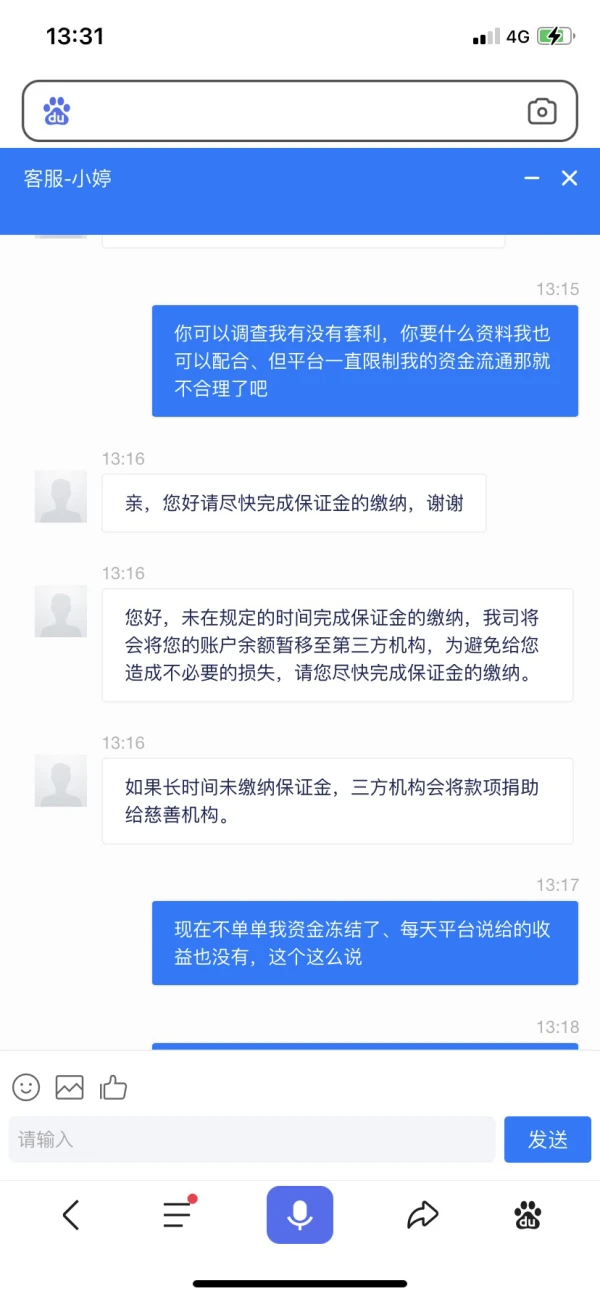

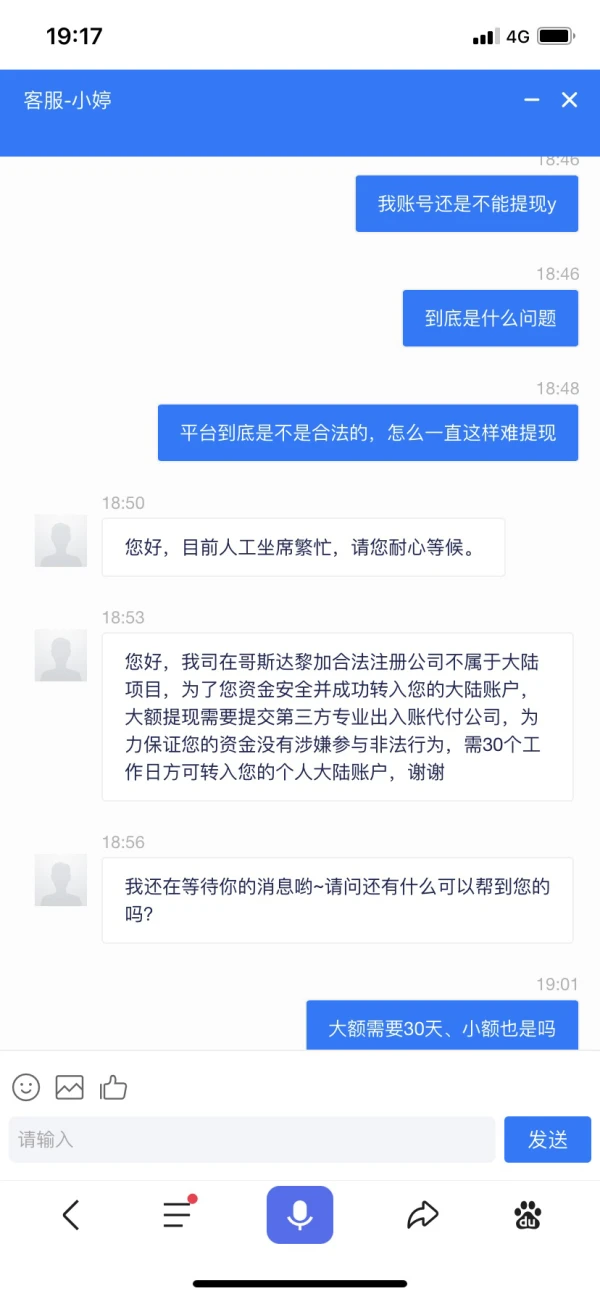

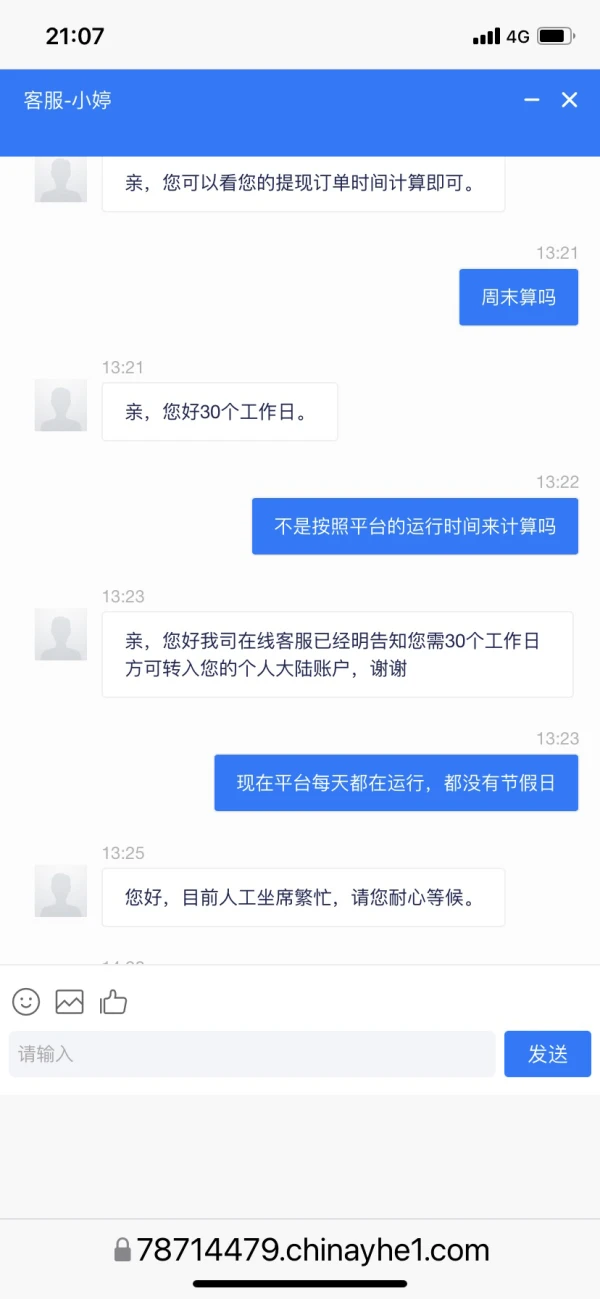

O pedido de witdhrawal foi recusado por vários motivos. Por favor preste atenção.

Exposição

徊眸

Hong Kong

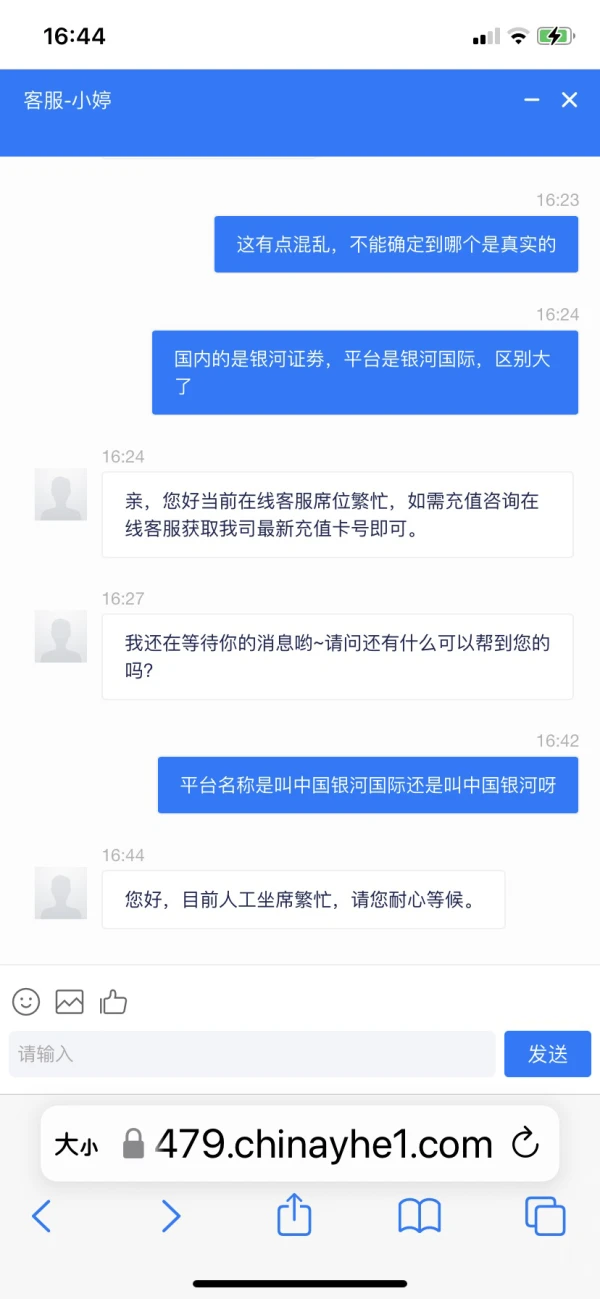

O atendimento ao cliente continua usando desculpas diferentes para não retirar. Eu pergunto qual é o problema, mas eles não podem declará-lo. Apenas procurando desculpas.

Exposição

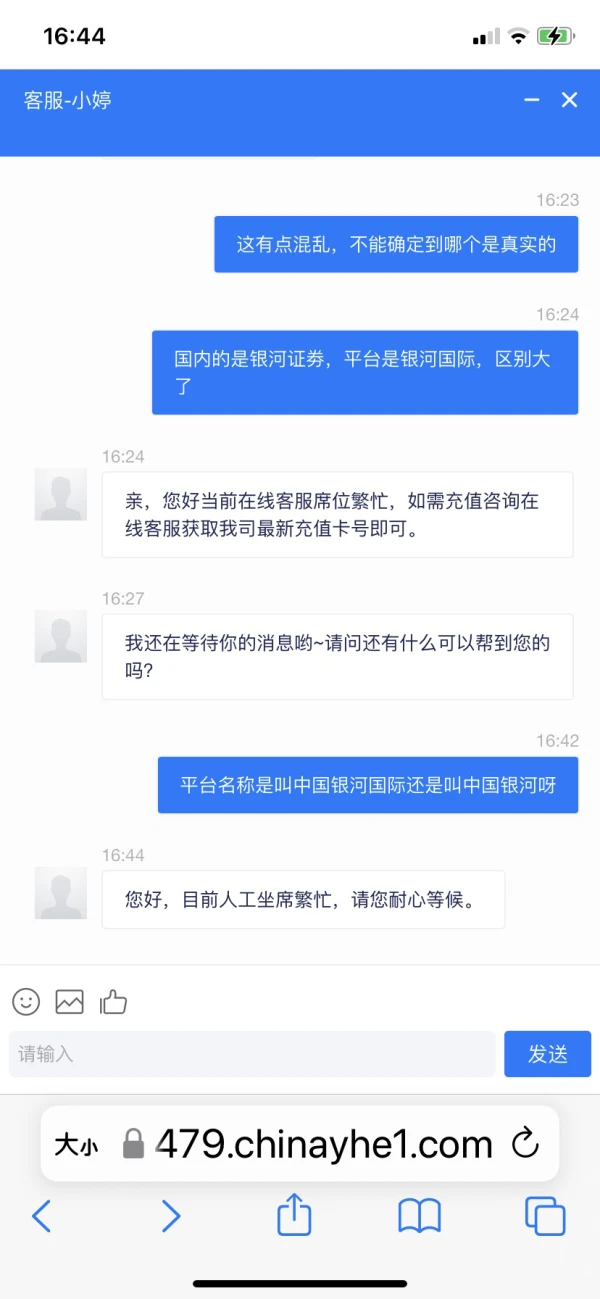

徊眸

Hong Kong

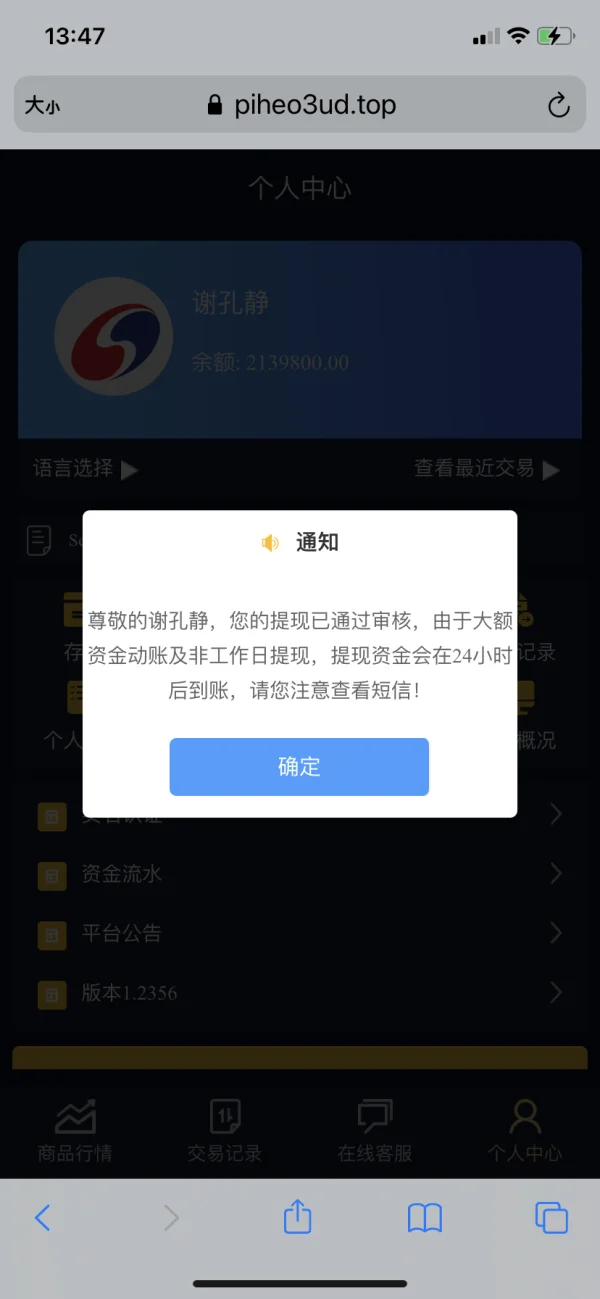

O atendimento ao cliente não desistiu usando desculpas diferentes, não sei se é uma plataforma legítima ou uma plataforma de clone de fraude. O site é https://78714479.chinayhe1.com/index/login/login/token/d6b70b5b8eef4ceef2e2765b7f46dd9b.html

Exposição

FX1433857007

Hong Kong

Há alguns dias, conheci uma pessoa de um telefone celular e disse que estava fazendo câmbio. Eu consultei algumas coisas e deixei-me fazer algumas ordens.Foi muito bom na época.Quando cheguei ao sexto single, eu tinha uma má posição de 35.000 yuan.Mais tarde, ele disse que ele não deveria se preocupar, ele iria pagar por isso. Depois que eles negociaram para me chamar de uma conta de câmbio de 17.500 yuan, deixe-me adicionar outro 17.500 yuan, após a consulta, acompanhamento, deixe o post 35.000 yuan, após a conclusão desta ordem, mas não pode retirar, dizem ser outra ordem, pode Retirar, mas não segui. Até agora, o livro ainda está em 93.400 yuan, mas não me atrevo a retirá-lo. Há pessoas que me contatam para me puxar preto. Obrigado!

Exposição