Buod ng kumpanya

| China Galaxy Buod ng Pagsusuri | |

| Itinatag | 2011 |

| Rehistradong Bansa/Rehiyon | Hong Kong |

| Regulasyon | Regulated |

| Mga Instrumento sa Merkado | SecuritiesFutures and OptionsBondsMutual FundsStructured Products |

| Demo Account | ❌ |

| Leverage | / |

| Spread | / |

| Plataforma ng Pagkalakalan | SPTrader ProGalaxy Global Trading TerminalsSoft TokenAAStocks |

| Min Deposit | / |

| Customer Support | Phone: (852) 3698 6750 / 400 866 8833 |

| Email: cs@chinastock.com.hk | |

| Social Media: Wechat | |

| Physical Address:20 / F, Wing On Centre, 111 Connaught Road Central, Sheung Wan, Hong KongUnit 1, 36 / F, Cosco Building, Queen's Road, Hong Kong8 / F, Mei Mei Building, 683-685 Nathan Road, Kowloon, Hong Kong | |

China Galaxy Impormasyon

Itinatag ito sa Hong Kong noong 2011. Ito ay regulado ng SFC at nagbibigay ng kumpletong hanay ng mga serbisyong pinansyal, kasama ang brokerage at sales, investment banking, investment research, asset management at financing. Bukod dito, mayroong 5 uri ng account at 4 na mga plataporma ng pagkalakalan na maaaring piliin ng mga mangangalakal.

Mga Kalamangan Mga Disadvantages Maayos na regulado Hindi sinusuportahan ang MT4/5 5 uri ng mga account Walang mga detalye ng account 4 na mga plataporma ng pagkalakalan Tunay ba ang China Galaxy?

| Rehistradong Bansa/Rehiyon |  |

| Otoridad ng Regulasyon | SFC |

| Reguladong Entidad | China Galaxy International Futures (Hong Kong)Co., Limited |

| Uri ng Lisensya | Pagsasangkot sa mga kontrata ng hinaharap |

| Numero ng Lisensya | AYH772 |

| Kasalukuyang Katayuan | Regulated |

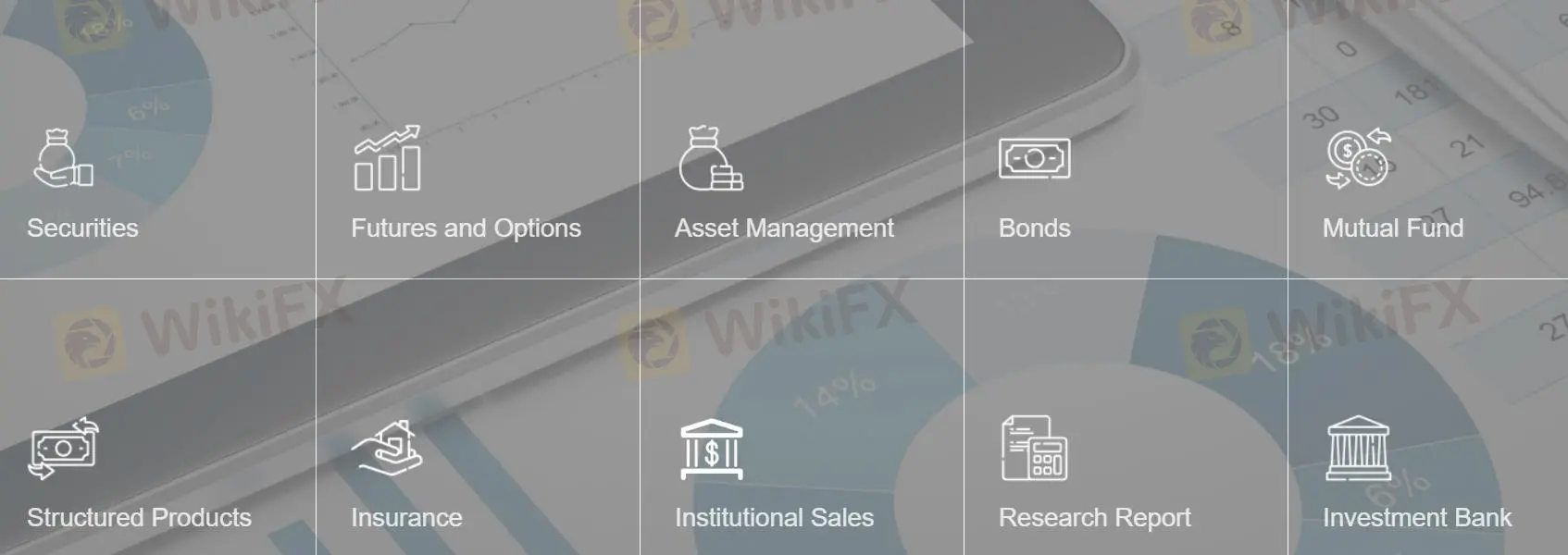

Ano ang Maaari Kong Ikalakal sa China Galaxy?

Ang mga trader ay maaaring mag-trade ng mga securities, 140+ futures at options, mga bond, mga mutual fund kasama ang mga equity fund, money market fund, bond fund, balanced fund, multi-asset fund, industry fund, at iba pa, mga structured product sa China Galaxy.

| Mga Tradable na Instrumento | Supported |

| Securities | ✔ |

| Futures at Options | ✔ |

| Bonds | ✔ |

| Mutual Funds | ✔ |

| Mga Structured Product | ✔ |

| Forex | ❌ |

| Mga Pambihirang Metal at Mga Kalakal | ❌ |

| Mga Indeks | ❌ |

| Mga Stock | ❌ |

| ETF | ❌ |

Uri ng Account

Sinabi ng China Galaxy na nag-aalok ito ng mga securities cash account, mga securities margin account, future account, at stock options account. Bukod dito, maaaring pumili ang mga customer na magbukas ng electronic trading account. Kabuuan ng 5, walang kinakailangang unang deposito.

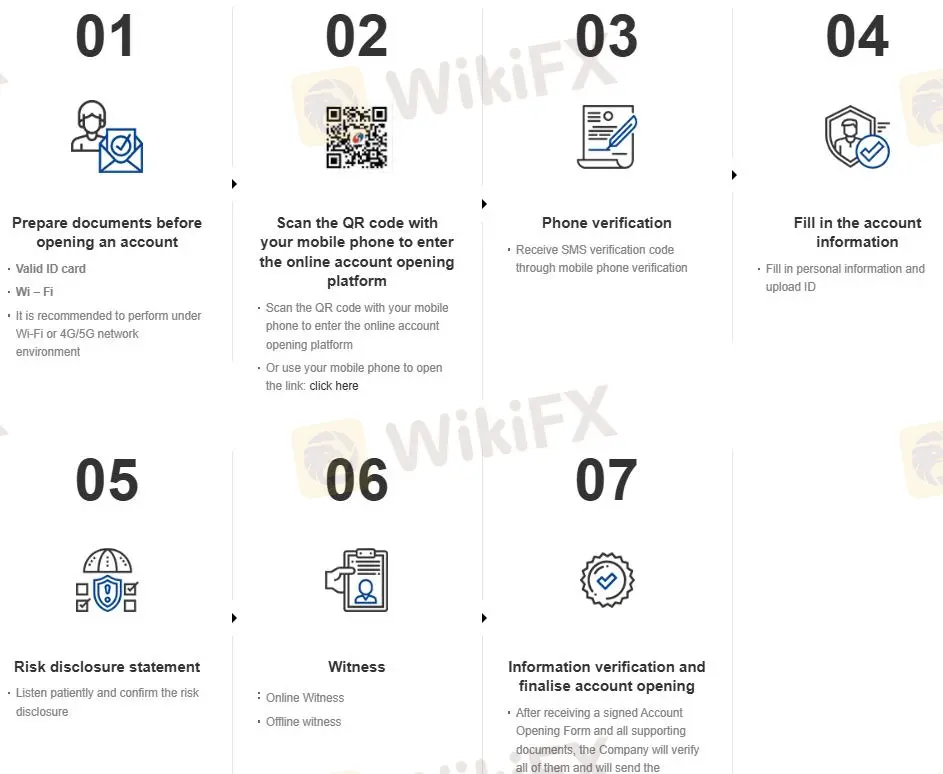

Mayroong 2 mga opsyon para magbukas ng account: online at mobile. Maaaring tingnan ang partikular na proseso dito: https://en.chinastock.com.hk/customer/process/

Platform ng Pag-trade

Ang SPTrader Pro, Galaxy Global Trading Terminals, Soft Token at AAStocks ay mga platform ng pag-trade ng China Galaxy International, na maaaring gamitin sa mobile o desktop.

| Platform ng Pag-trade | Supported | Available Devices | Suitable for |

| SPTrader Pro | ✔ | Mobile | Lahat ng mga trader |

| Galaxy Global Trading Terminals | ✔ | Desktop | Lahat ng mga trader |

| Soft Token | ✔ | Mobile | Lahat ng mga trader |

| AAStocks | ✔ | Desktop | Lahat ng mga trader |

| MT4 | ❌ | ||

| MT5 | ❌ |

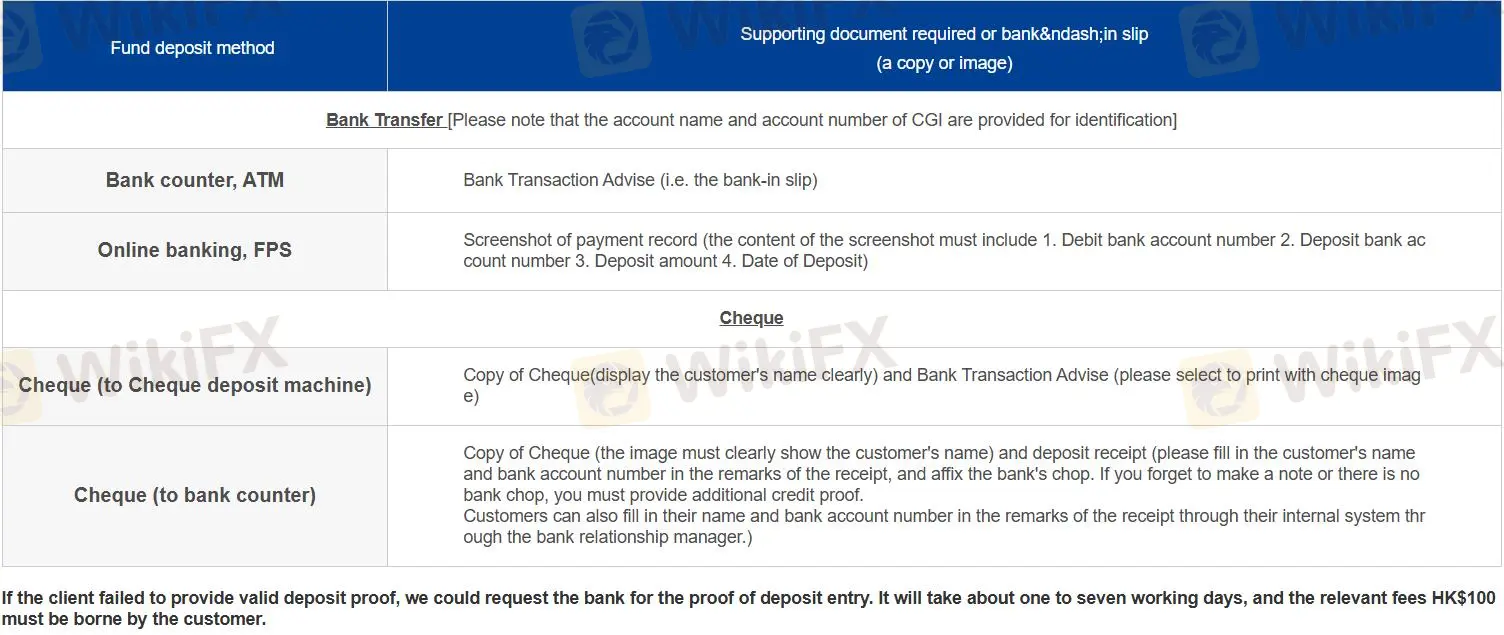

Pag-iimbak at Pag-wiwithdraw

Mayroong 4 uri ng pag-iimbak sa 2 kategorya:

Bank counter, ATM

Online banking, FPS

Tseke (para sa check deposit machine)

Tseke (para sa bank counter)

Para sa mga pag-withdraw, mga trader na may rehistradong bank account, makipag-ugnayan sa AE o punan ang withdrawal form para sa mga tagubilin. Kung hindi, kinakailangan ang withdrawal form para sa mga tagubilin.

1g h jv f f f

Hong Kong

Itim na plataporma

Paglalahad

建雷

Hong Kong

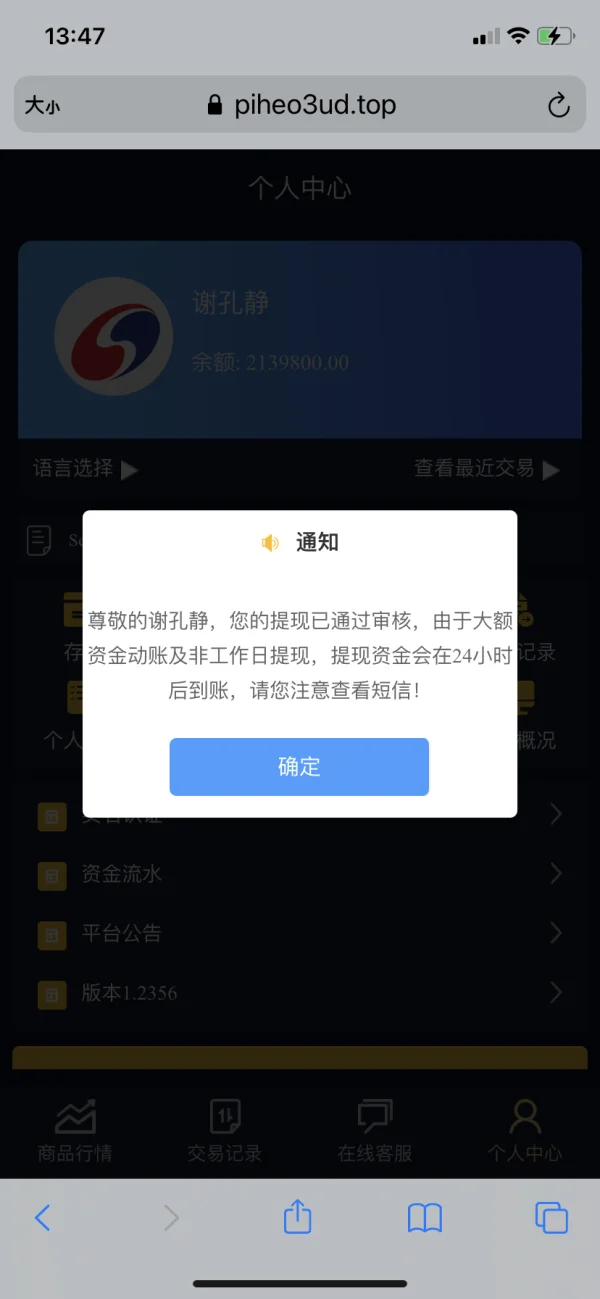

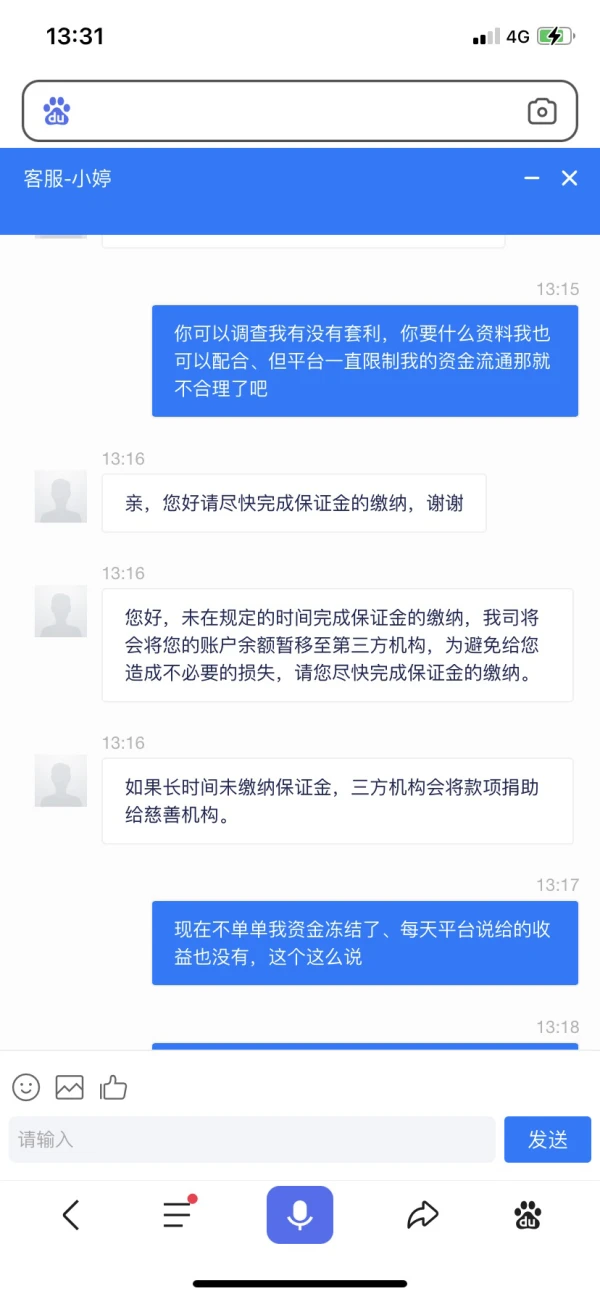

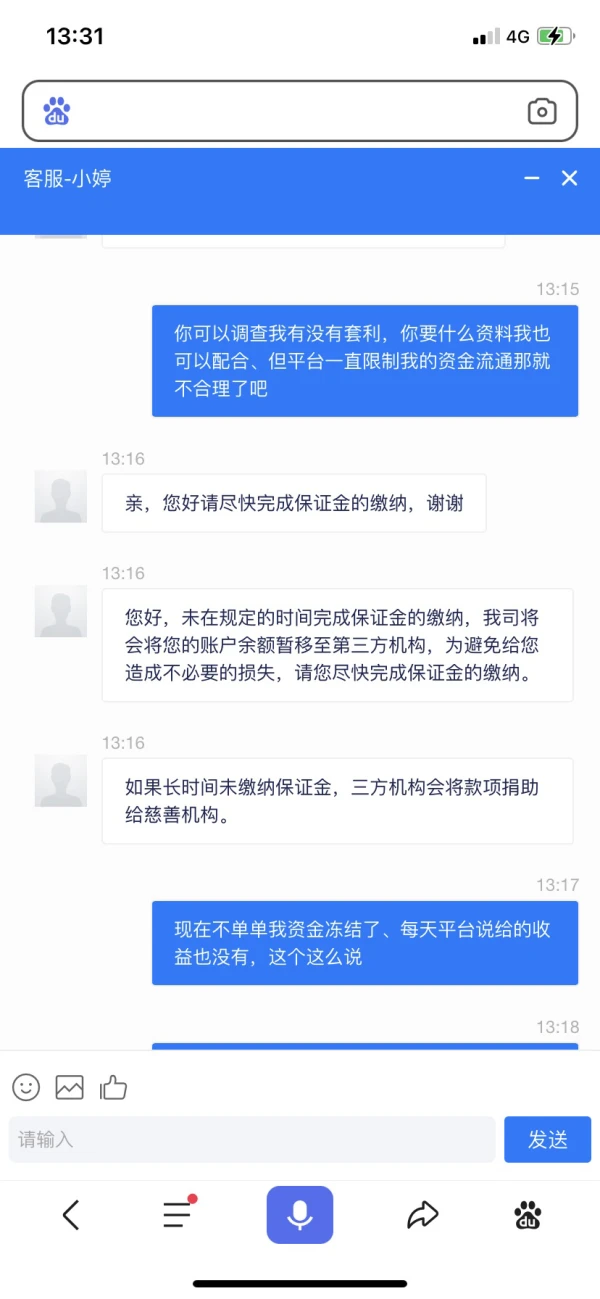

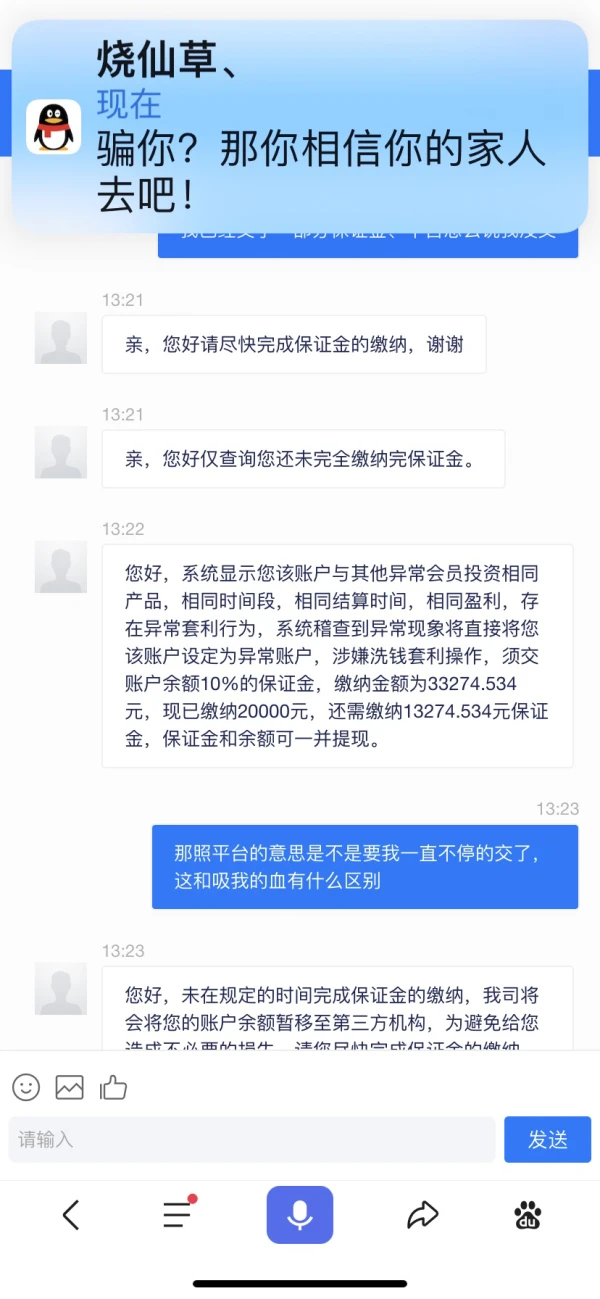

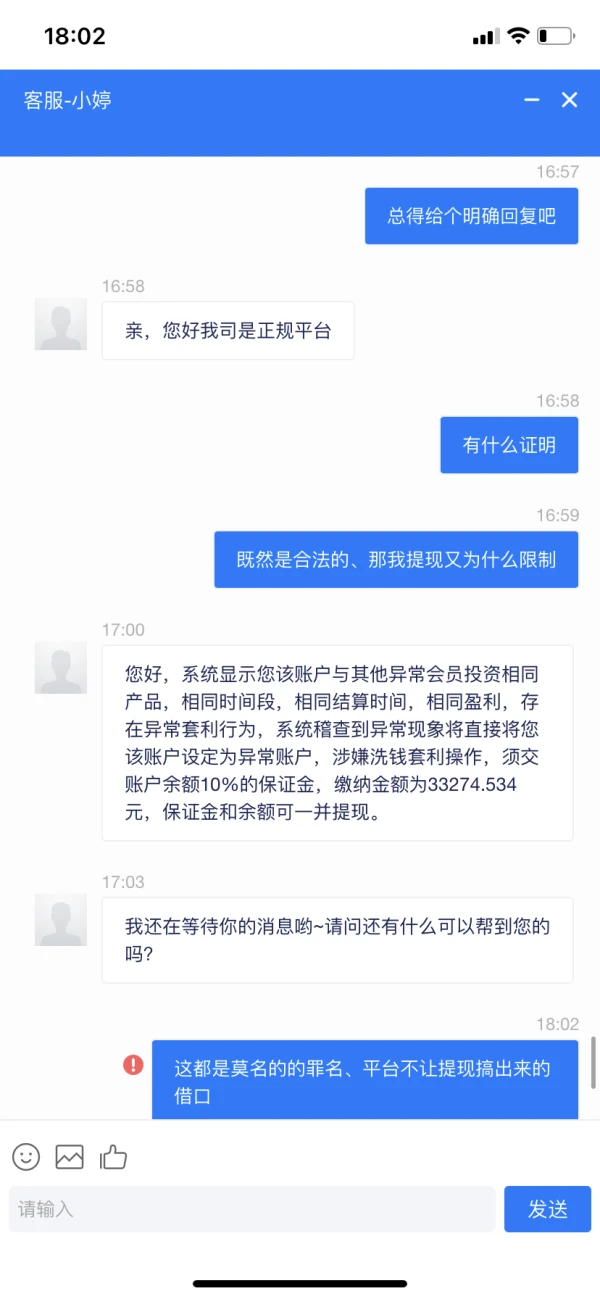

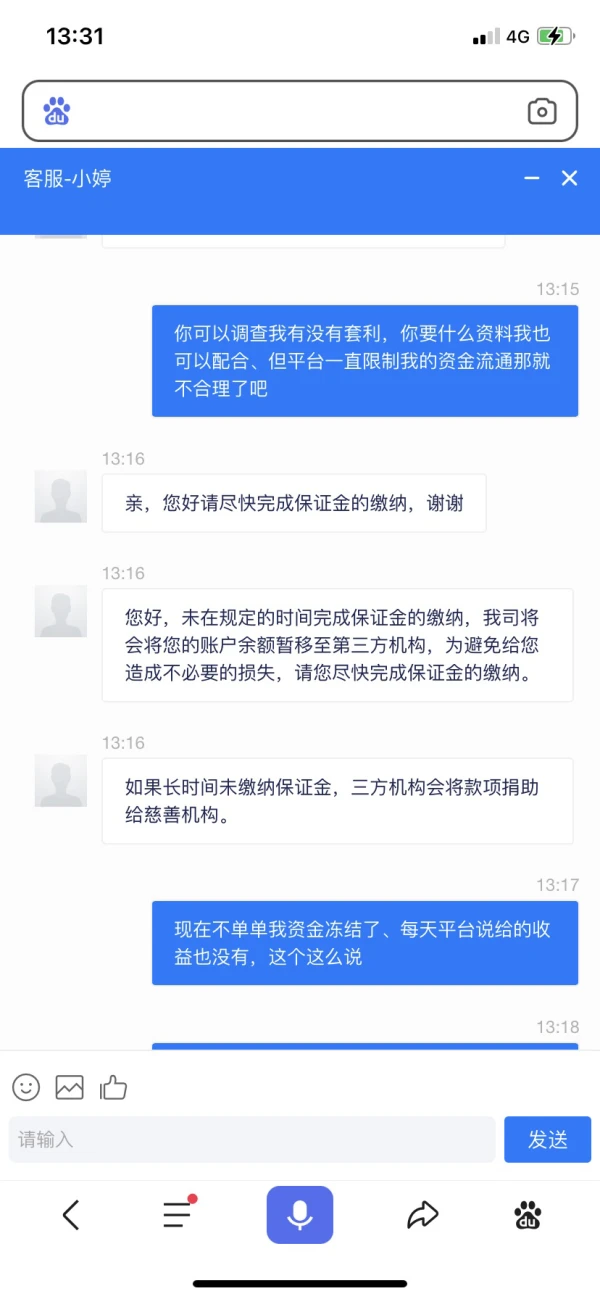

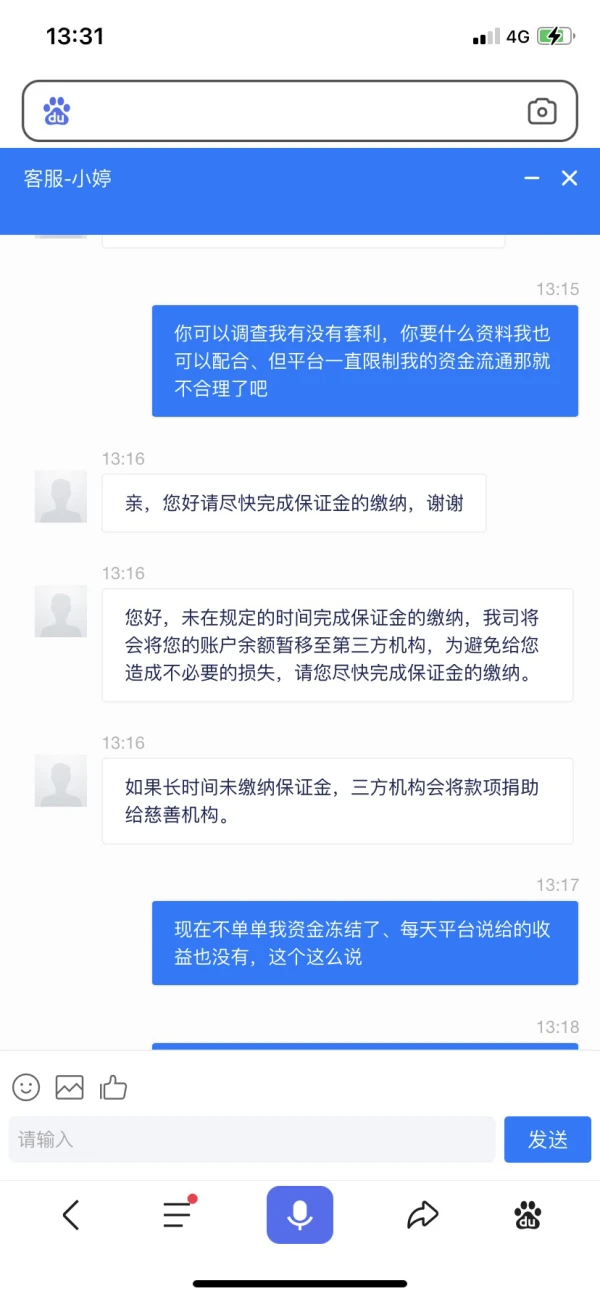

Ang aplikasyon para sa witdhrawal ay tinanggihan lahat kasama ang maraming mga kadahilanan. Mangyaring magbayad ng pansin.

Paglalahad

徊眸

Hong Kong

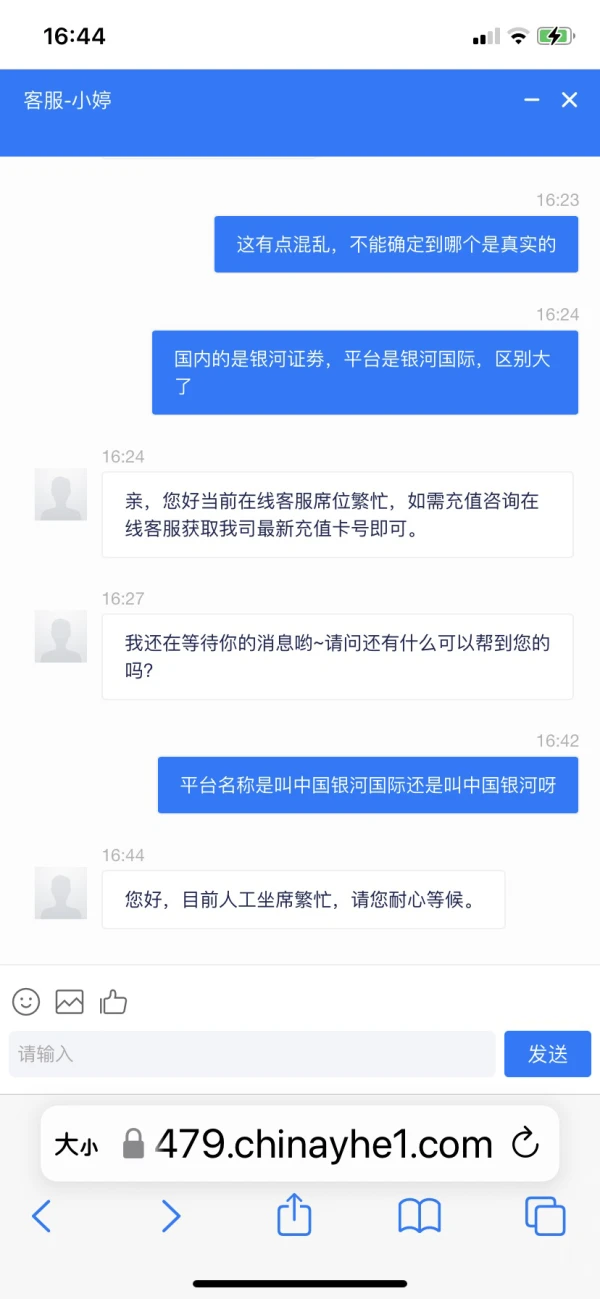

Patuloy na gumagamit ng iba't ibang dahilan ang customer service para hindi mag-withdraw. Tinatanong ko kung ano ang problema, ngunit hindi nila ito masasabi. Naghahanap lang ng excuses.

Paglalahad

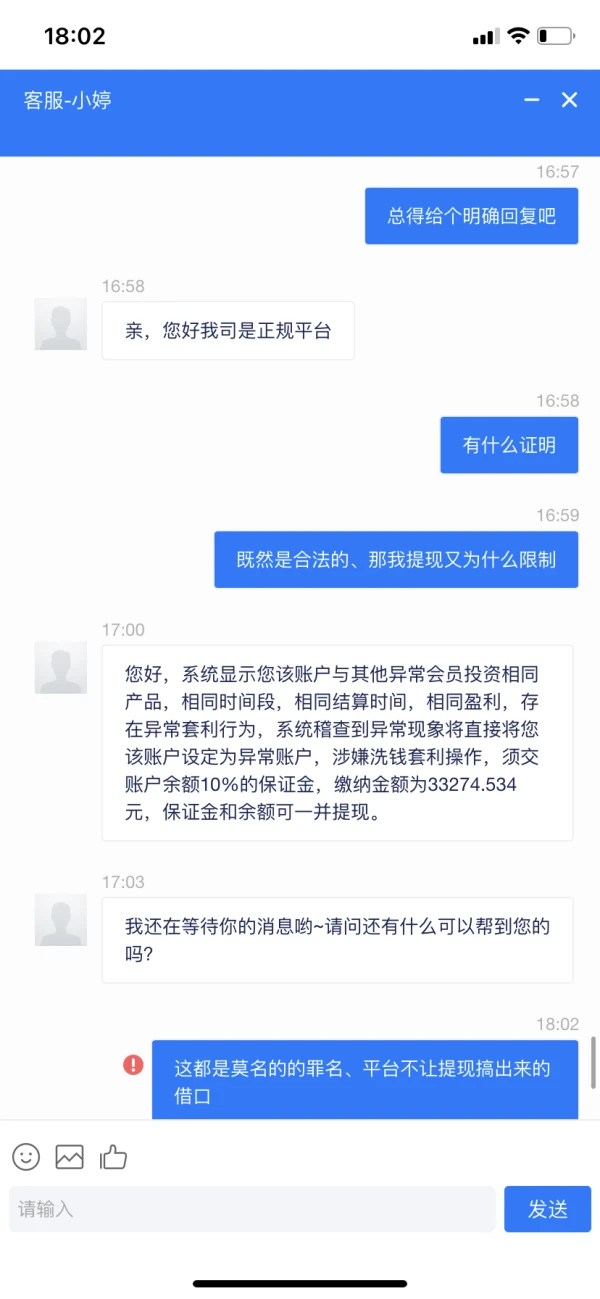

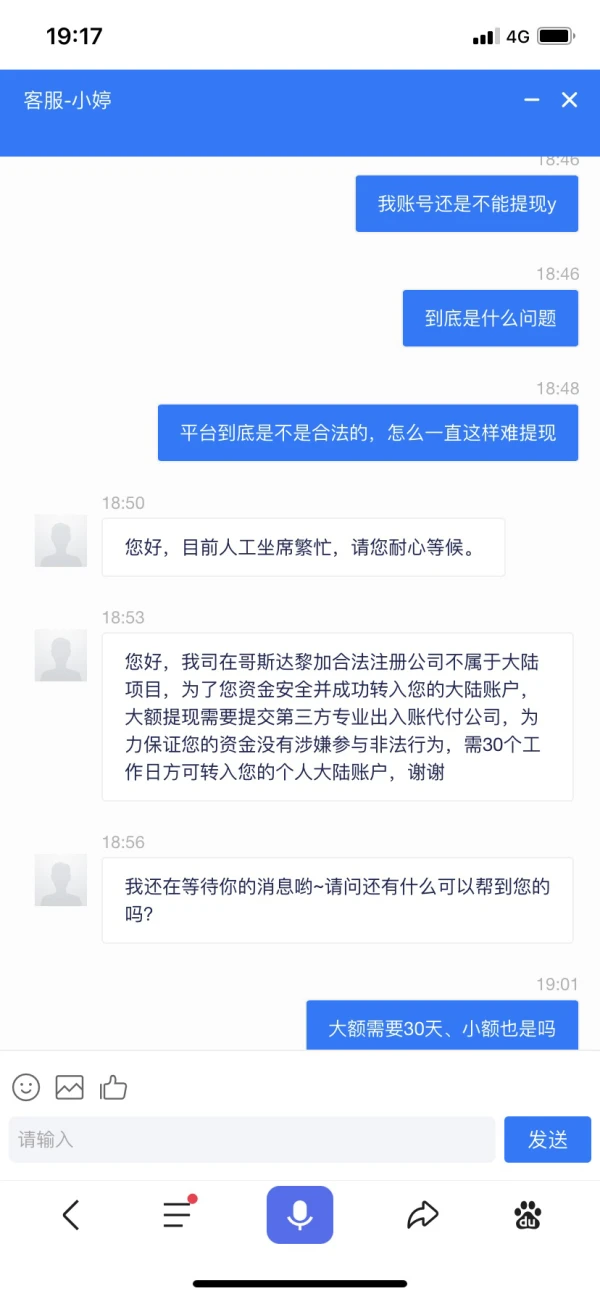

徊眸

Hong Kong

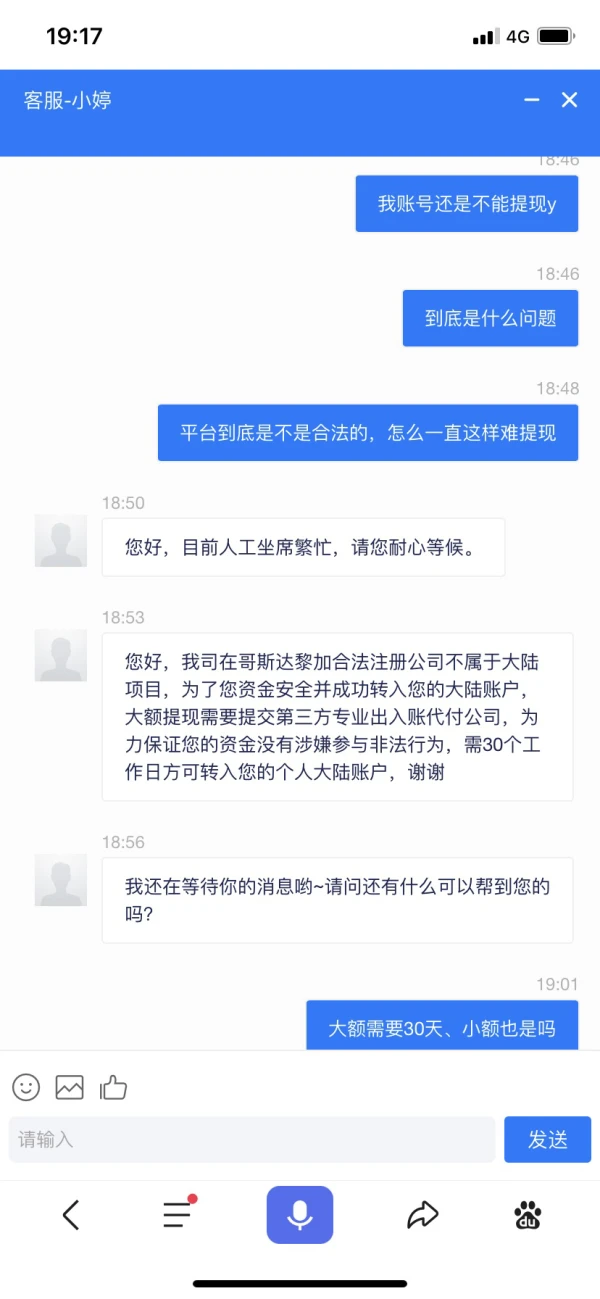

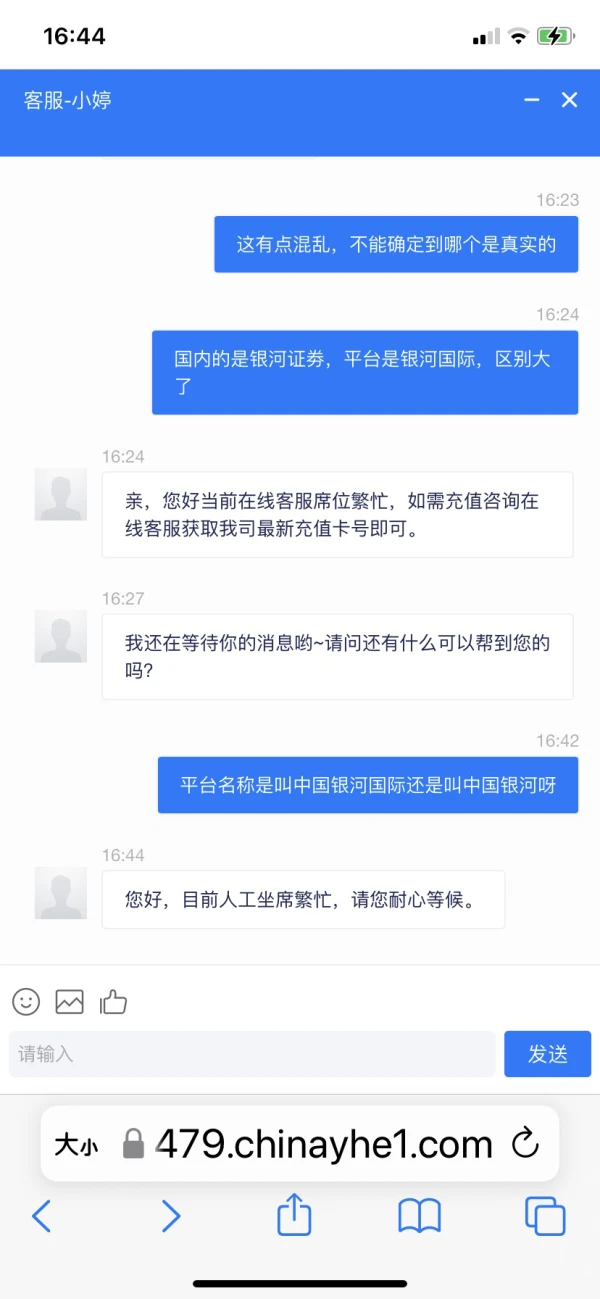

客服一直不给出金,找各种理由,不知道是不是合法平台还是套牌黑平台,网站是https://78714479.chinayhe1.com/index/login/login/token/d6b70b5b8eef4ceef2e2765b7f46dd9b.html

Paglalahad

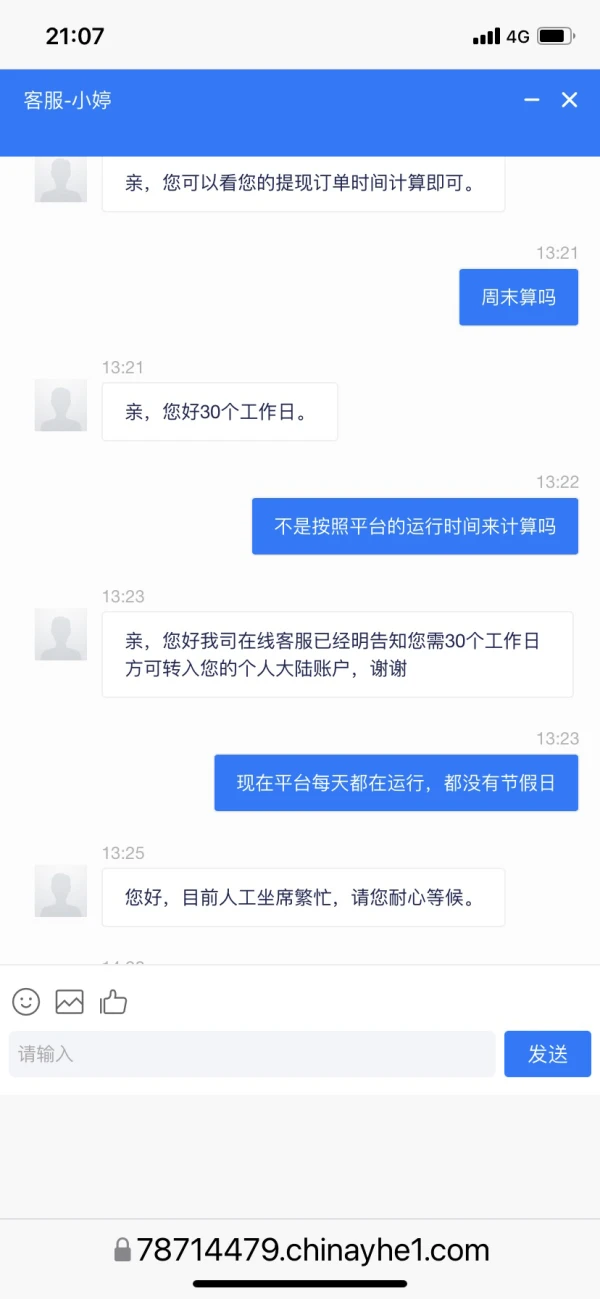

FX1433857007

Hong Kong

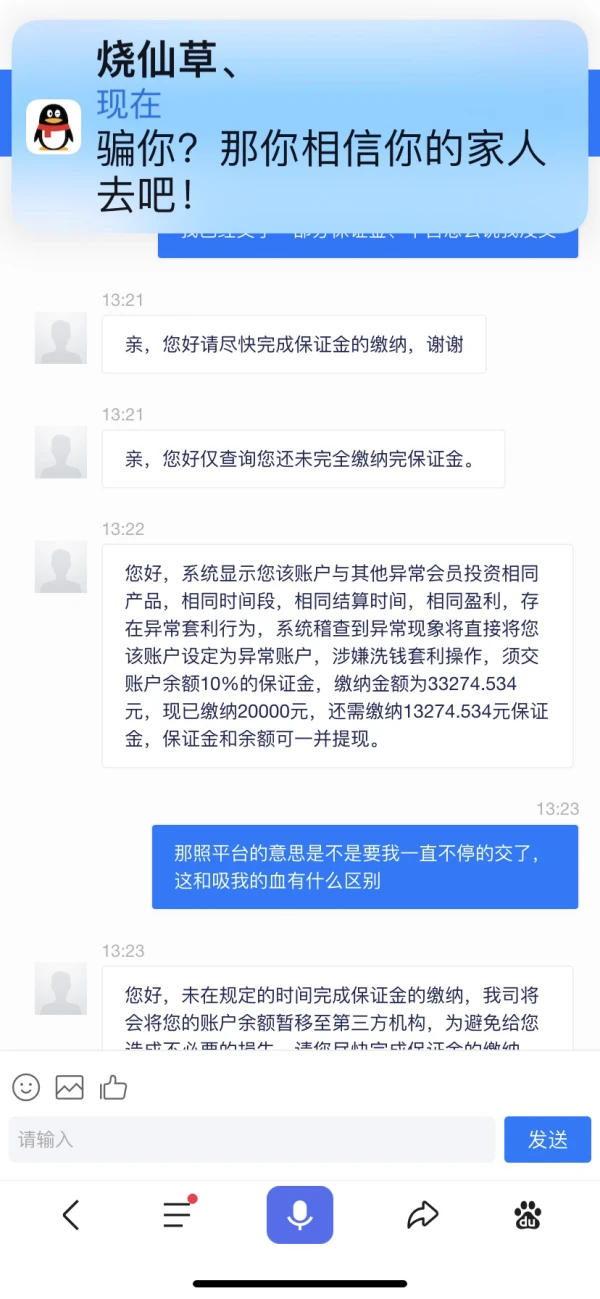

前些日子,从手机上认识了一个人,说是做外汇的。我咨询了一些事,让后做了几单,当时挺好,到了第六单就暴仓了35000元,后来他说不要急,包赔。 经过他们商量给我打到外汇帐上17500元,让我再加17500元,商量后也跟进,让后做单35000元,后这单完成,但不能提现,说要再下一单,才能提现,但我没跟。到现在帐面上还在93400元,但不敢提现。 还有跟我联系的人,以把我拉黑。谢!

Paglalahad