Company Summary

| China GalaxyReview Summary | |

| Founded | 2011 |

| Registered Country/Region | Hong Kong |

| Regulation | Regulated |

| Market Instruments | SecuritiesFutures and OptionsBondsMutual FundsStructured Products |

| Demo Account | ❌ |

| Leverage | / |

| Spread | / |

| Trading Platform | SPTrader ProGalaxy Global Trading TerminalsSoft TokenAAStocks |

| Min Deposit | / |

| Customer Support | Phone: (852) 3698 6750 / 400 866 8833 |

| Email: cs@chinastock.com.hk | |

| Social Media: Wechat | |

| Physical Address:20 / F, Wing On Centre, 111 Connaught Road Central, Sheung Wan, Hong KongUnit 1, 36 / F, Cosco Building, Queen's Road, Hong Kong8 / F, Mei Mei Building, 683-685 Nathan Road, Kowloon, Hong Kong | |

China Galaxy Information

It was incorporated in Hong Kong in 2011. It is regulated by the SFC and provides a full range of financial services, including brokerage and sales, investment banking, investment research, asset management and financing. In addition, there are 5 account types and 4 trading platforms for traders to choose from.

Pros and Cons

| Pros | Cons |

| Well regulated | MT4/5 is not supported |

| 5 kinds of accounts | No account details |

| 4 trading platforms |

Is China Galaxy Legit?

| Regulated Country/Region |  |

| Regulated Authority | SFC |

| Regulated Entity | China Galaxy International Futures (Hong Kong)Co., Limited |

| License Type | Dealing in futures contracts |

| License Number | AYH772 |

| Current Status | Regulated |

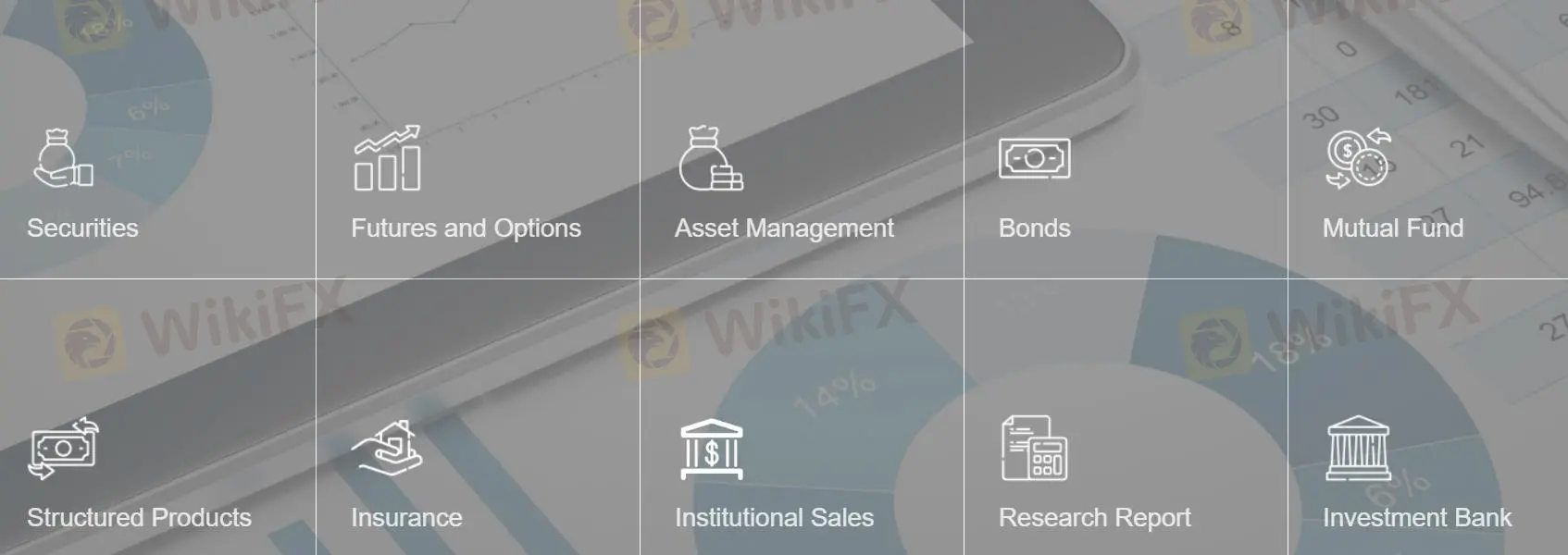

What Can I Trade on China Galaxy?

Traders can trade securities, 140+ futures and options, bonds, mutual funds including equity funds, money market funds, bond funds, balanced funds, multi-asset funds, industry funds, etc., structured products on China Galaxy.

| Tradable Instruments | Supported |

| Securities | ✔ |

| Futures and Options | ✔ |

| Bonds | ✔ |

| Mutual Funds | ✔ |

| Structured Products | ✔ |

| Forex | ❌ |

| Precious metals & Commodities | ❌ |

| Indices | ❌ |

| Stocks | ❌ |

| ETF | ❌ |

Account Types

China Galaxy said it offers securities cash accounts, securities margin accounts, future accounts and stock options accounts. In addition, customers can choose to open an electronic trading account. 5 in total, no initial deposit required.

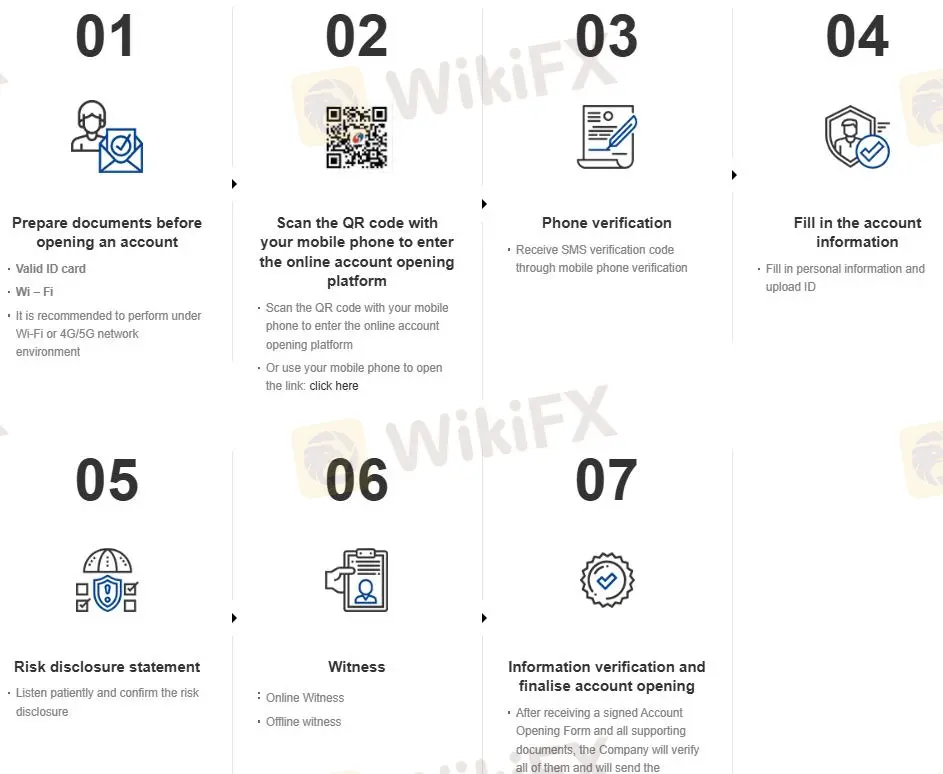

There are 2 options to open an account: online and mobile. The specific process you can refer to: https://en.chinastock.com.hk/customer/process/

Trading Platform

SPTrader Pro, Galaxy Global Trading Terminals, Soft Token and AAStocks are China Galaxy International's trading platform, which can be used on mobile or desktop.

| Trading Platform | Supported | Available Devices | Suitable for |

| SPTrader Pro | ✔ | Mobile | All traders |

| Galaxy Global Trading Terminals | ✔ | Desktop | All traders |

| Soft Token | ✔ | Mobile | All traders |

| AAStocks | ✔ | Desktop | All traders |

| MT4 | ❌ | ||

| MT5 | ❌ |

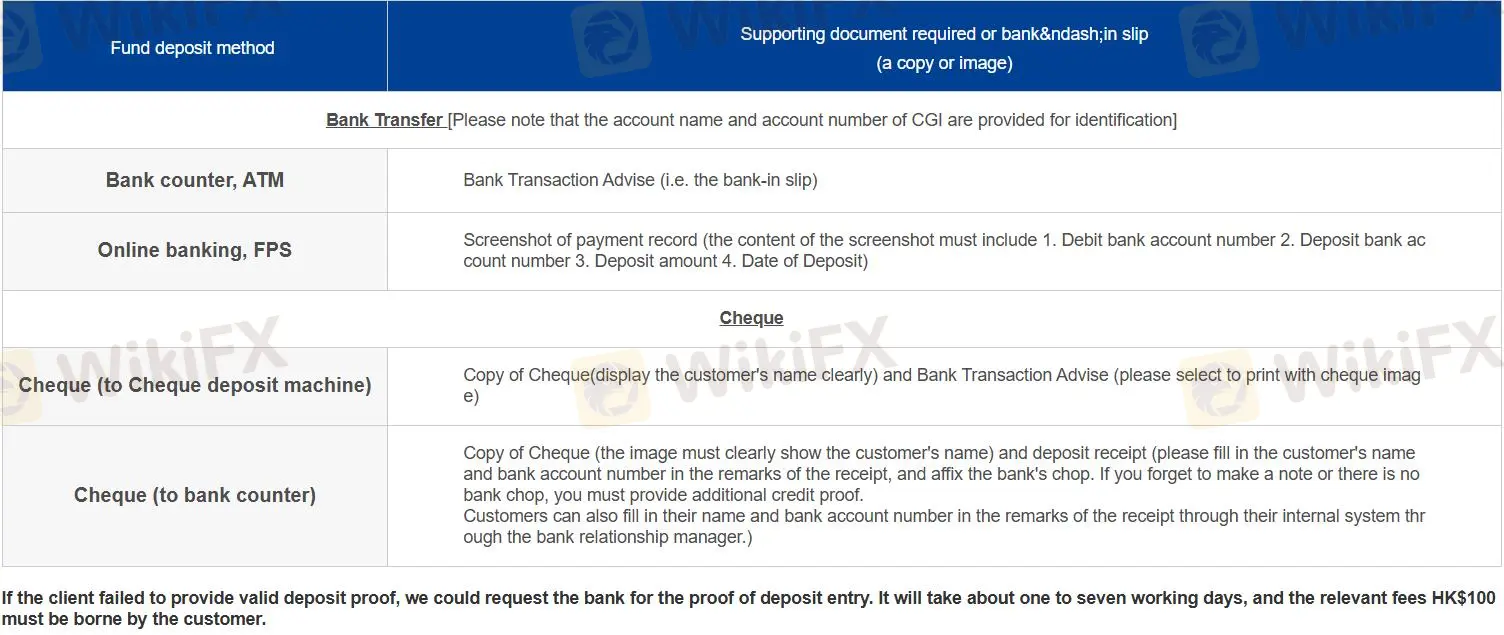

Deposit and Withdrawal

There are 4 types of deposits in 2 categories:

Bank counter, ATM

Online banking, FPS

Check (to check deposit machine)

Check (to bank counter)

For withdrawals, traders with registered bank accounts, contact AE or fill out the withdrawal form for instructions. Otherwise, a withdrawal form is required for instructions.

1g h jv f f f

Hong Kong

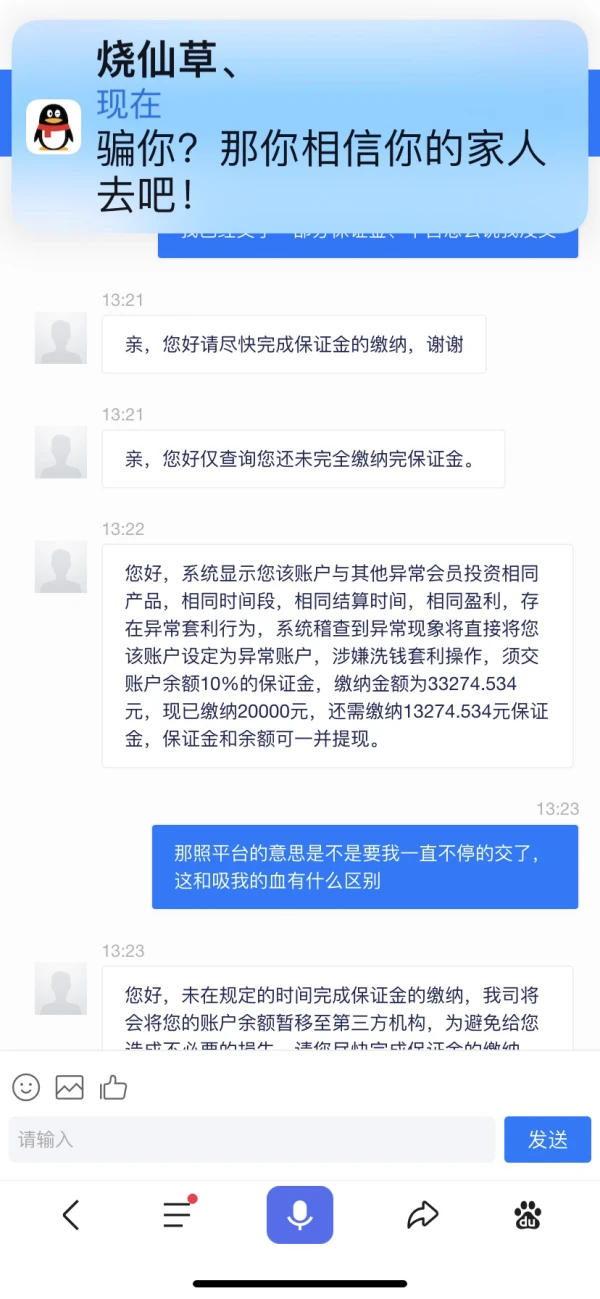

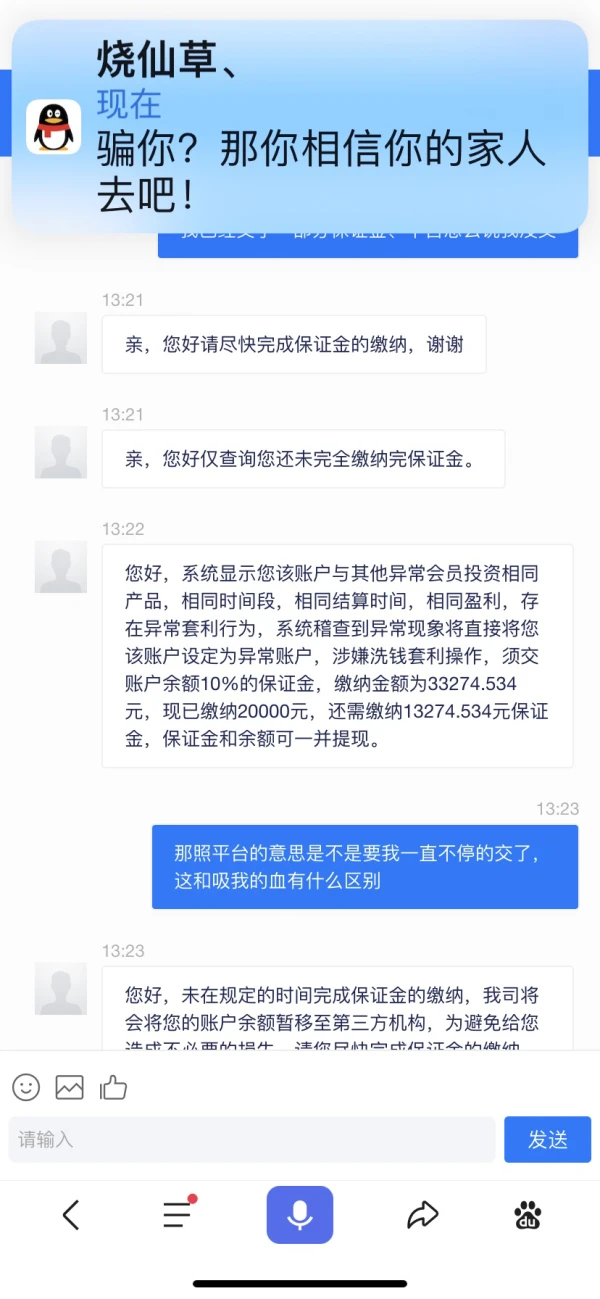

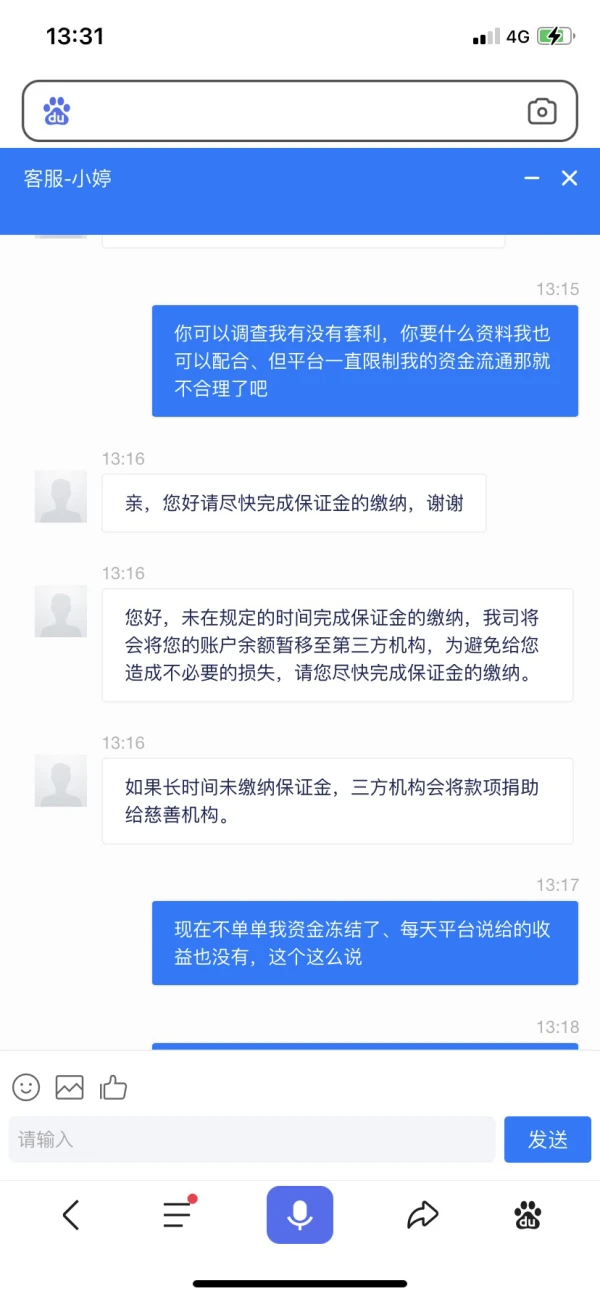

Black platform

Exposure

建雷

Hong Kong

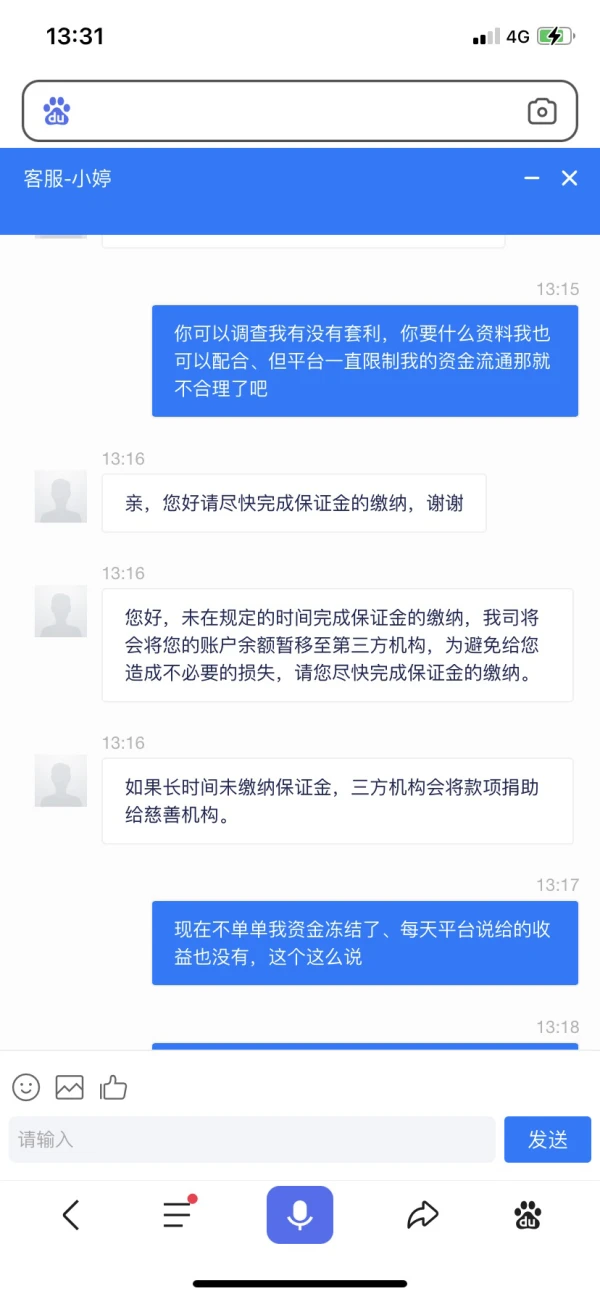

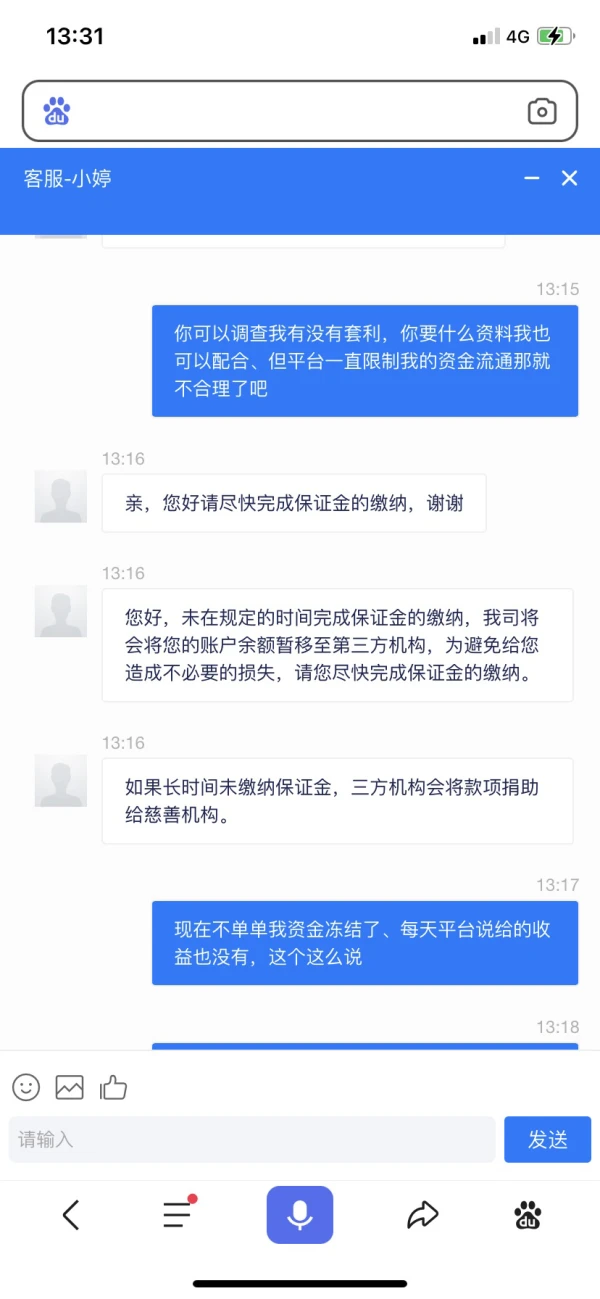

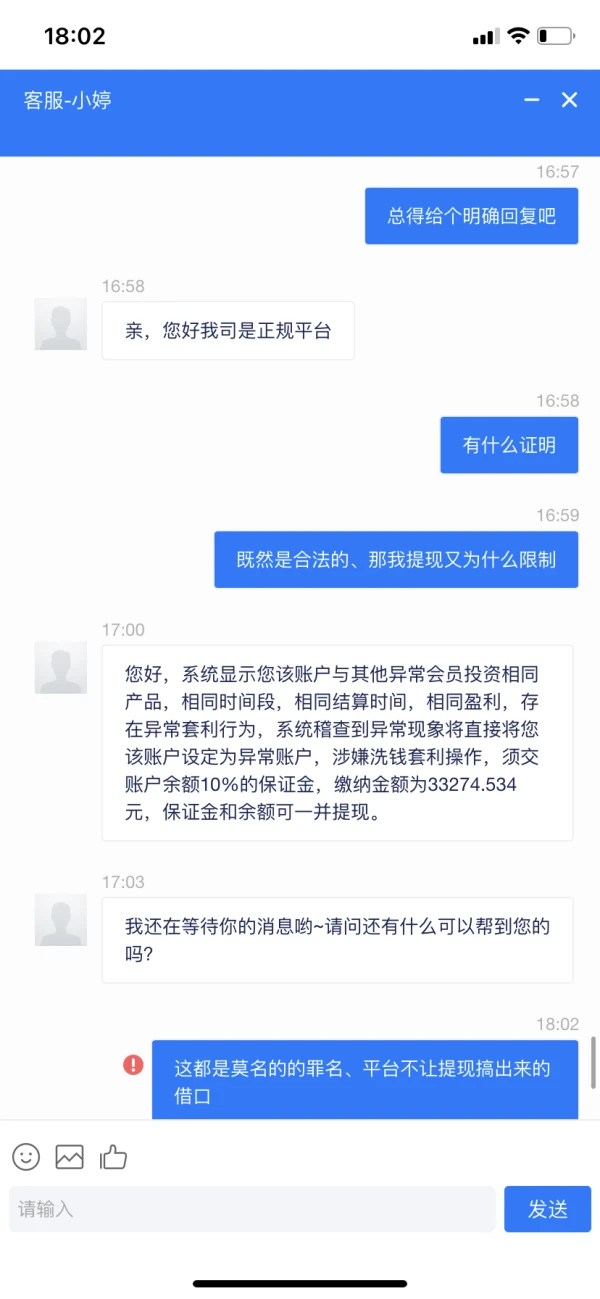

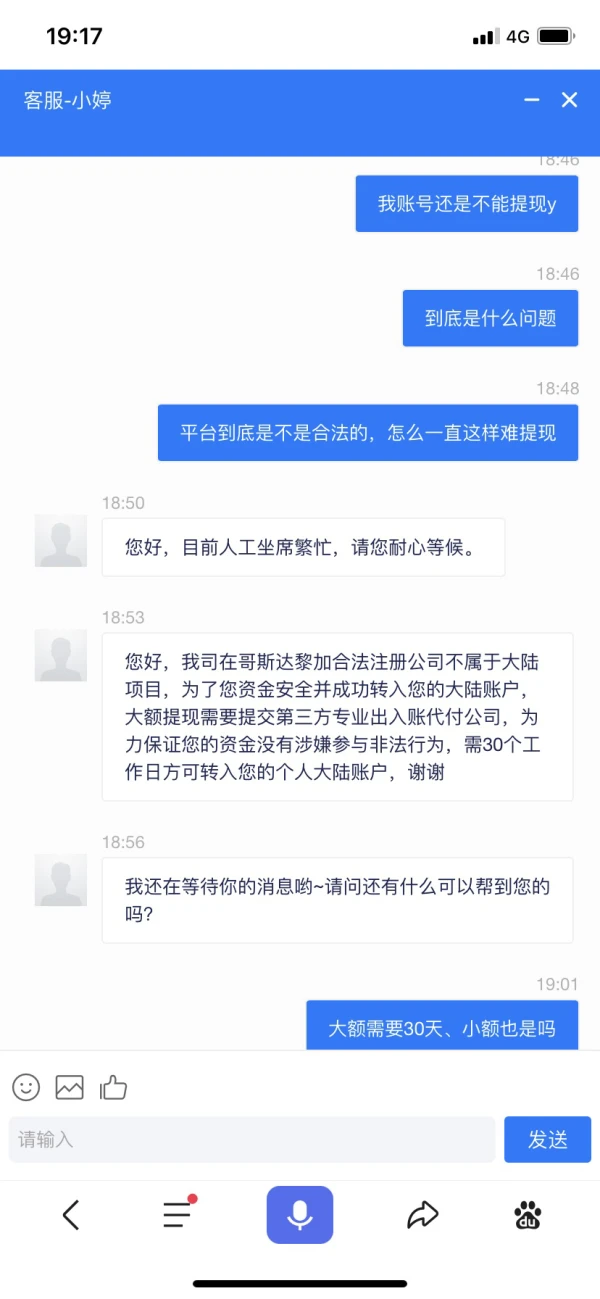

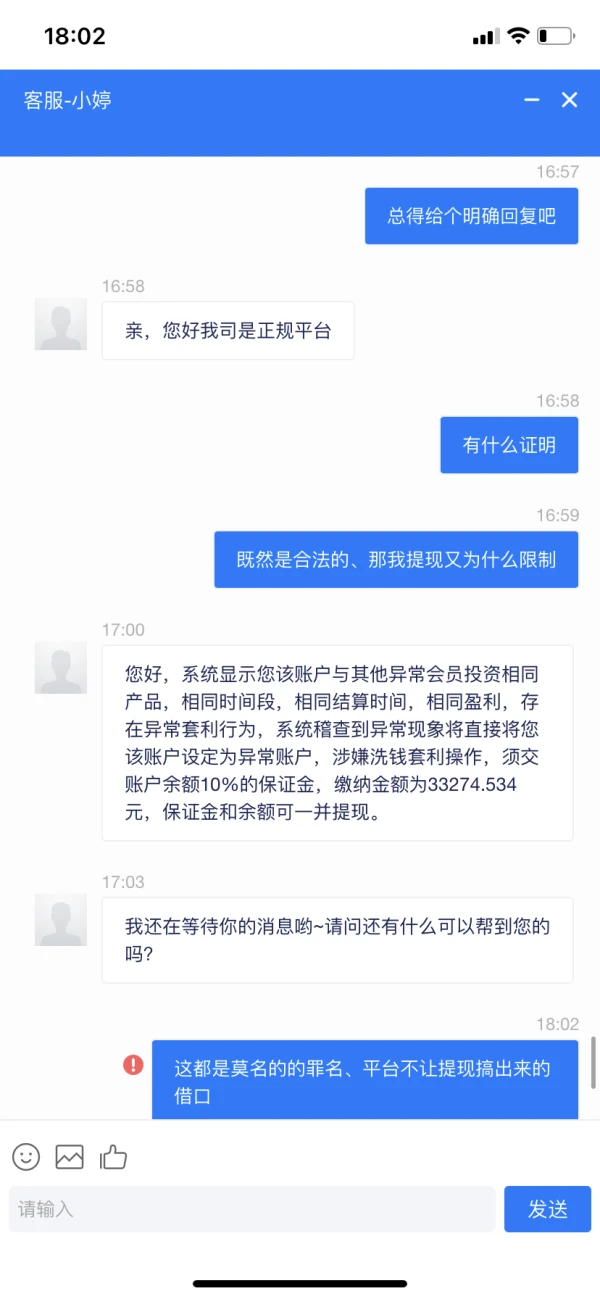

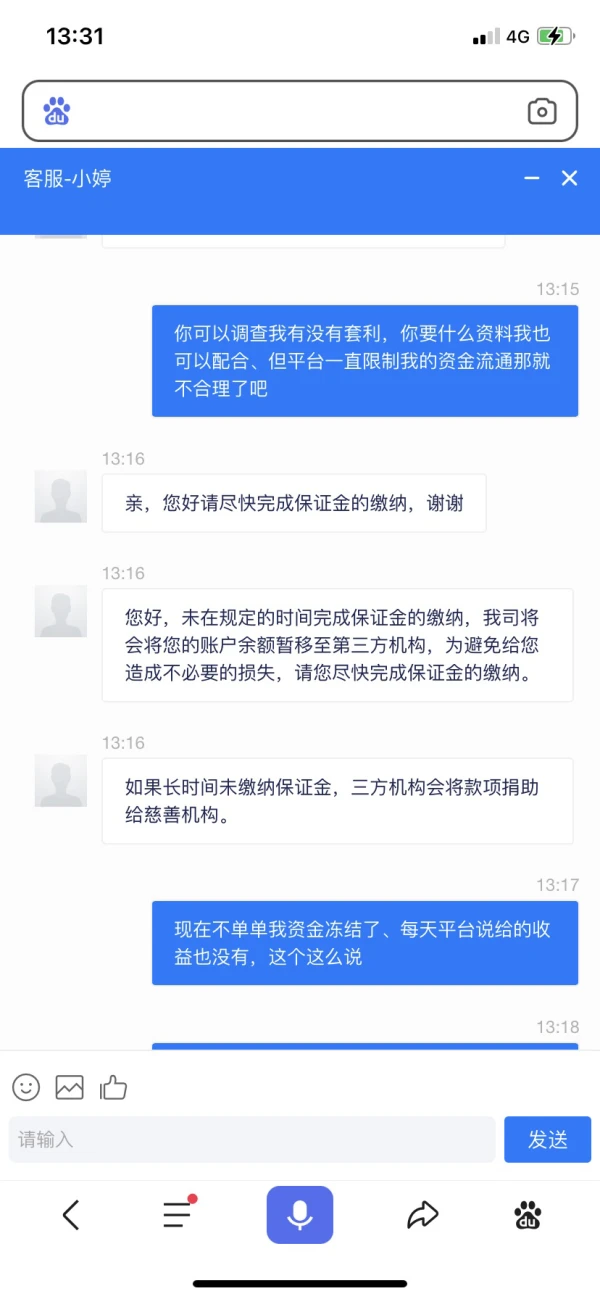

The application for witdhrawal has been refused all along with lots of reasons. Please pay attention.

Exposure

徊眸

Hong Kong

The customer service keep using different excuses for not withdrawing. I ask what is the problem, but they cannot state it. Just looking for excuses.

Exposure

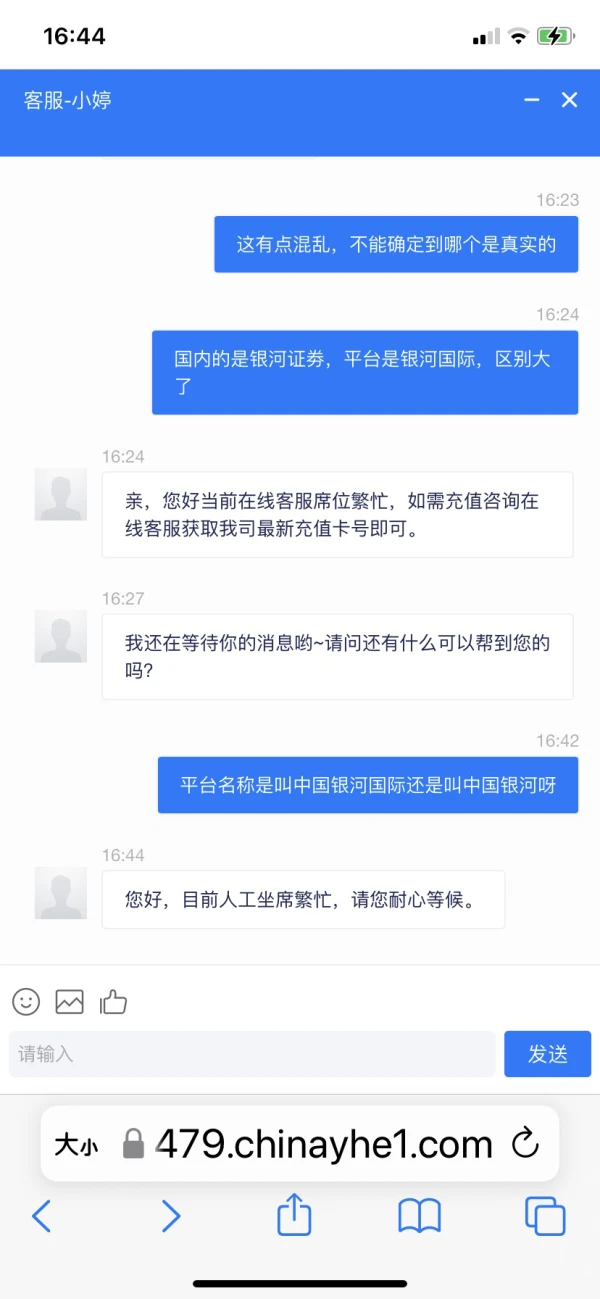

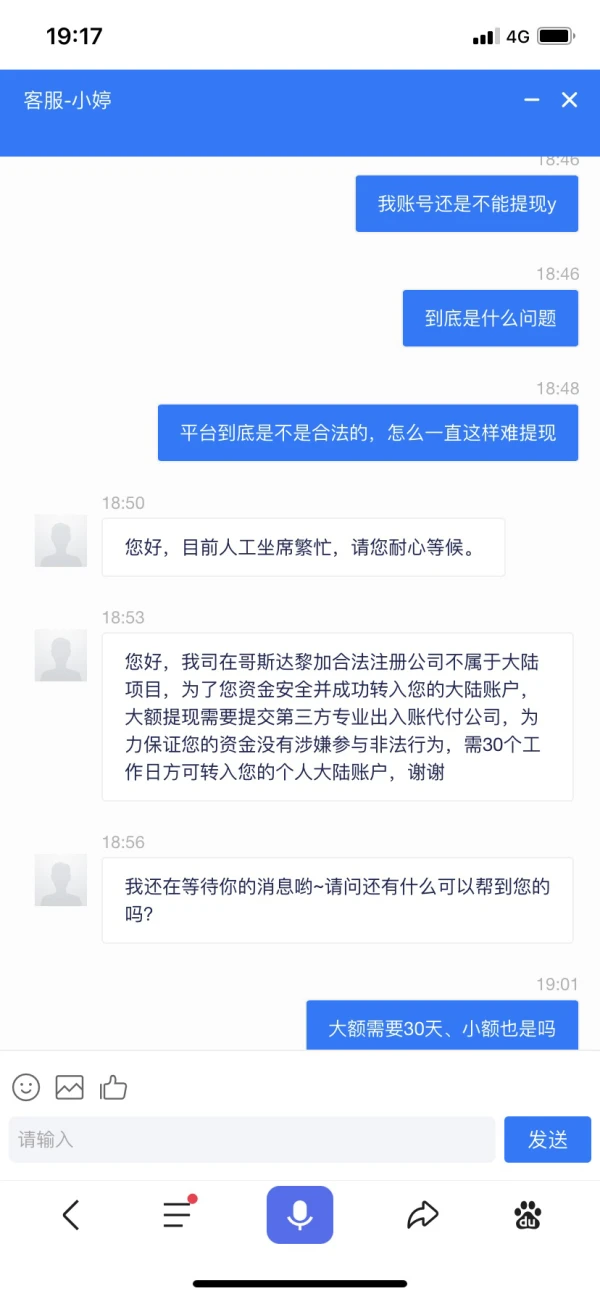

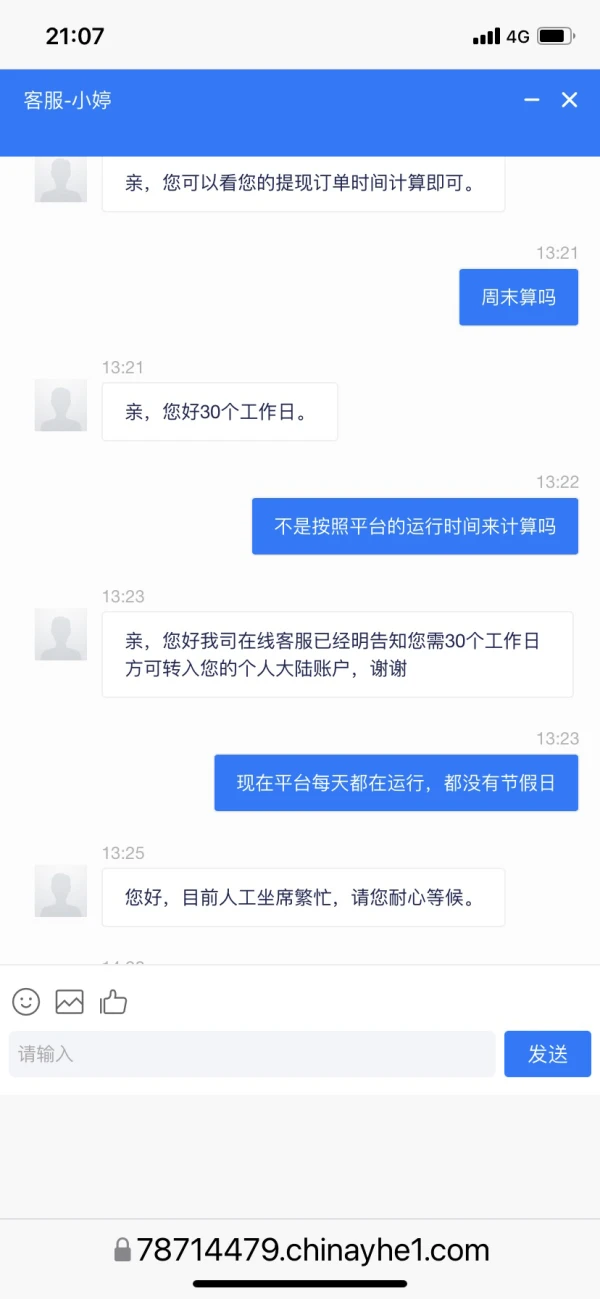

徊眸

Hong Kong

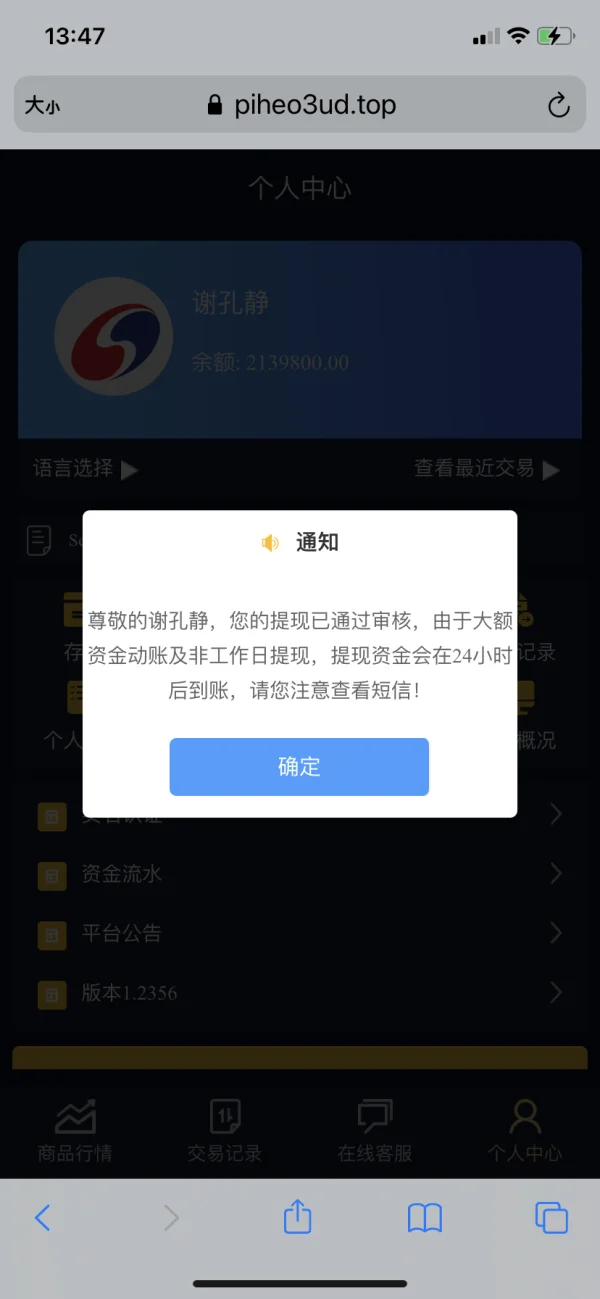

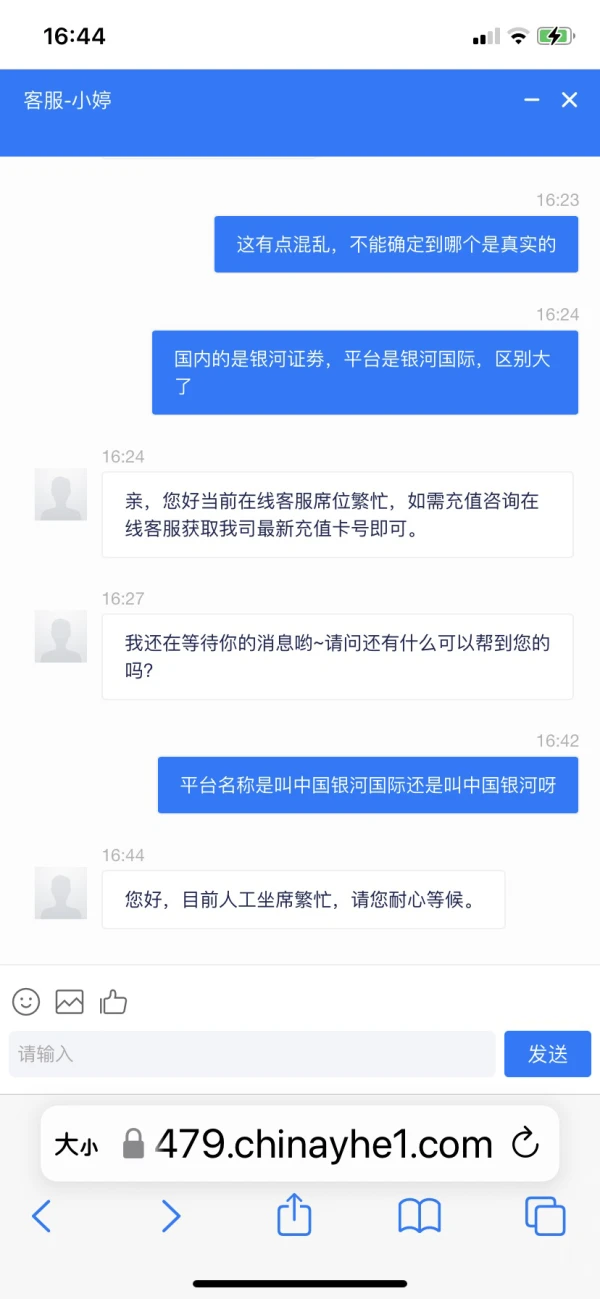

The customer service has not withdrawn by using different excuses, I do not know if it is a legit plaform or a fraud clone platform. The website is https://78714479.chinayhe1.com/index/login/login/token/d6b70b5b8eef4ceef2e2765b7f46dd9b.html

Exposure

FX1433857007

Hong Kong

I knew a person via my phone, who claim himself as a forex practitioner. After consulting a few things, I made some deals. The trading went smoothly at first, but my account started to wipe out from the sixth order with a loss of 35,000RMB. But he comforted me that the losses would be compensated. After his negotiation with his partners, he would transfer 17,500RMB into my forex account but I had to make up for the rest 175,000RMB. I agreed. Then he asked me to invest in 350,000 and told me that I couldn’t withdrawal until the next order. This time I declined. Now there are 934,000RMB in the account. But I dare not to withdraw. Besides, the man blacklisted me. Thank you!

Exposure