회사 소개

| Barclays 리뷰 요약 | |

| 설립 연도 | 1997 |

| 등록 국가/지역 | 불가리아 |

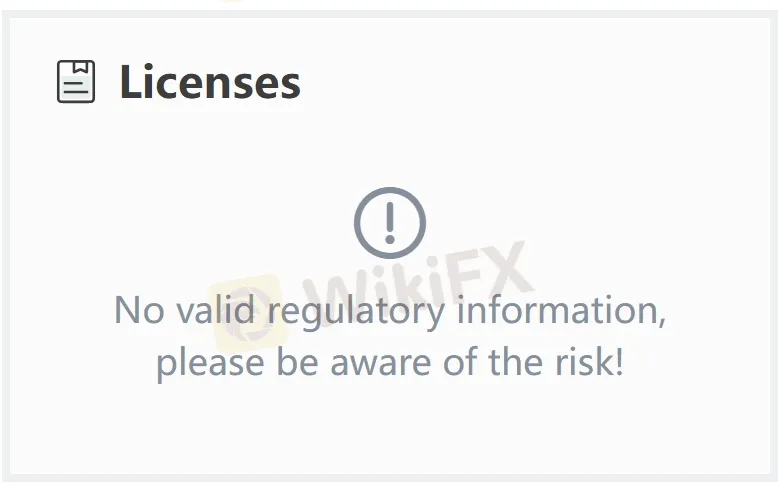

| 규제 | 규제 없음 |

| 금융 서비스 | 자본 시장 솔루션, 투자 은행, 외환, 파생상품 거래, 자금 관리 |

| 고객 지원 | Barclays Securities Co., Ltd.도쿄도 미나토구 롯폰기 6-10-1 롯폰기 힐즈 모리 타워 31층 106-6131 전화: 03-4530-1100 |

| Barclays 은행 도쿄 지점, 도쿄도 미나토구 롯폰기 6-10-1 롯폰기 힐즈 모리 타워 31층 106-6131 전화: 03-4530-5100 | |

| Barclays 투자 관리 주식회사도쿄도 미나토구 롯폰기 6-10-1 롯폰기 힐즈 모리 타워 31층 106-6131 전화: 03-4530-2400 | |

| Barclays 서비스 일본 주식회사도쿄도 미나토구 롯폰기 6-10-1 롯폰기 힐즈 모리 타워 31층 106-6131 전화: 03-4530-1190 | |

Barclays 정보

Barclays은 글로벌 네트워크의 중요한 부분으로서 일본에서 Barclays Securities Co., Ltd., Barclays 은행 도쿄 지점, Barclays 투자 관리 주식회사를 통해 비즈니스 기업, 금융 기관, 기관 투자가 및 공공 기관을 대상으로 금융 서비스를 제공합니다.

2008년 리먼 브라더스의 북미 사업을 인수한 후 특히 글로벌 확장을 거듭한 Barclays은 일본의 주요 투자 은행 중 하나로 자리매김했습니다.

그러나 Barclays은 일본의 공식 당국에 의해 규제를 받지 않고 있습니다, 이는 신뢰성과 신뢰성이 떨어질 수 있음을 고려해야 합니다.

장단점

| 장점 | 단점 |

| 글로벌 존재감 | 일본에서의 규제 없음 |

| 신뢰할 수 있는 모회사 | |

| 다양한 금융 서비스 제공 |

Barclays 합법성

중개 플랫폼의 안전성을 측정하는 가장 중요한 요소는 공식적으로 규제를 받는지 여부입니다. Barclays은 규제를 받지 않는 중개업체로, 사용자의 자금 안전 및 거래 활동이 효과적으로 보호되지 않습니다. 투자자는 Barclays을 신중히 선택해야 합니다.

Barclays 서비스

Barclays 일본은 자본 시장 솔루션, 투자 은행, 외환, 파생상품 거래, 및 자금 관리를 포함한 포괄적인 금융 서비스를 제공합니다.

Barclays 증권은 자금 조달, 자산 관리, 및 자문 서비스에 중점을 두고 있습니다;

도쿄 지점은 FX 및 파생상품을 중점으로 한 도매 시장 접근을 용이하게 합니다;

Barclays 투자 관리는 다양한 자산 클래스를 대상으로 상호 펀드를 관리하여 기관 투자자의 요구를 충족시킵니다.