Resumo da empresa

| Barclays Resumo da Revisão | |

| Fundação | 1997 |

| País/Região Registrada | Bulgária |

| Regulação | Sem regulação |

| Serviços Financeiros | Soluções de mercados de capitais, banca de investimento, câmbio, negociação de derivativos, gestão de fundos |

| Suporte ao Cliente | Barclays Securities Co., Ltd.31º andar, Roppongi Hills Mori Tower, 6-10-1 Roppongi, Minato-ku, Tóquio 106-6131 Tel: 03-4530-1100 |

| Barclays Banco, Filial de Tóquio, 31º andar, Roppongi Hills Mori Tower, 6-10-1 Roppongi, Minato-ku, Tóquio 106-6131Tel: 03-4530-5100 | |

| Barclays Investment Management Co., Ltd.31º andar, Roppongi Hills Mori Tower, 6-10-1 Roppongi, Minato-ku, Tóquio 106-6131 Tel: 03-4530-2400 | |

| Barclays Serviços Japão Limitada31º andar, Roppongi Hills Mori Tower, 6-10-1 Roppongi, Minato-ku, Tóquio 106-6131 Tel: 03-4530-1190 | |

Informações sobre Barclays

Barclays opera no Japão como parte fundamental de sua rede global, oferecendo serviços financeiros através de Barclays Securities Co., Ltd., Barclays Banco Filial de Tóquio e Barclays Investment Management Co., Ltd para clientes no Japão, incluindo empresas comerciais, instituições financeiras, investidores institucionais e instituições públicas.

Após sua expansão global, especialmente após adquirir as operações norte-americanas da Lehman Brothers em 2008, Barclays se estabeleceu como um dos principais bancos de investimento do Japão.

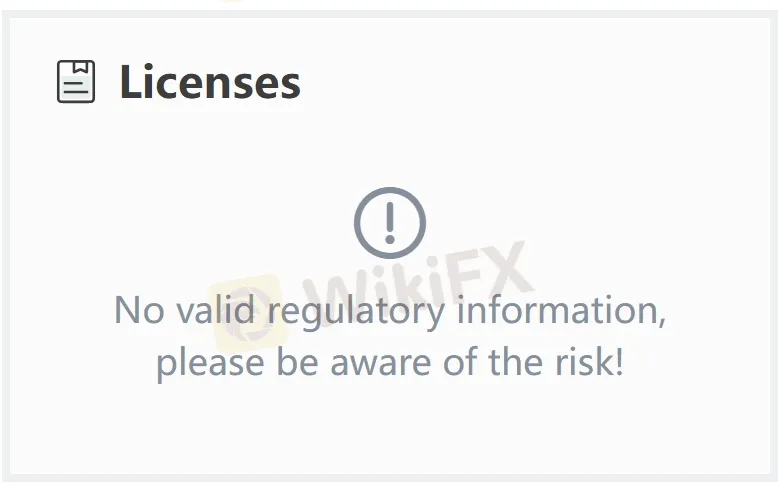

No entanto, Barclays não está sendo regulamentado por autoridades oficiais no Japão, o que deve chamar sua atenção devido à possível menor credibilidade e confiabilidade.

Prós e Contras

| Prós | Contras |

| Presença global | Sem regulação no Japão |

| Empresa mãe respeitável | |

| Diversos serviços financeiros oferecidos |

Barclays é Legítimo?

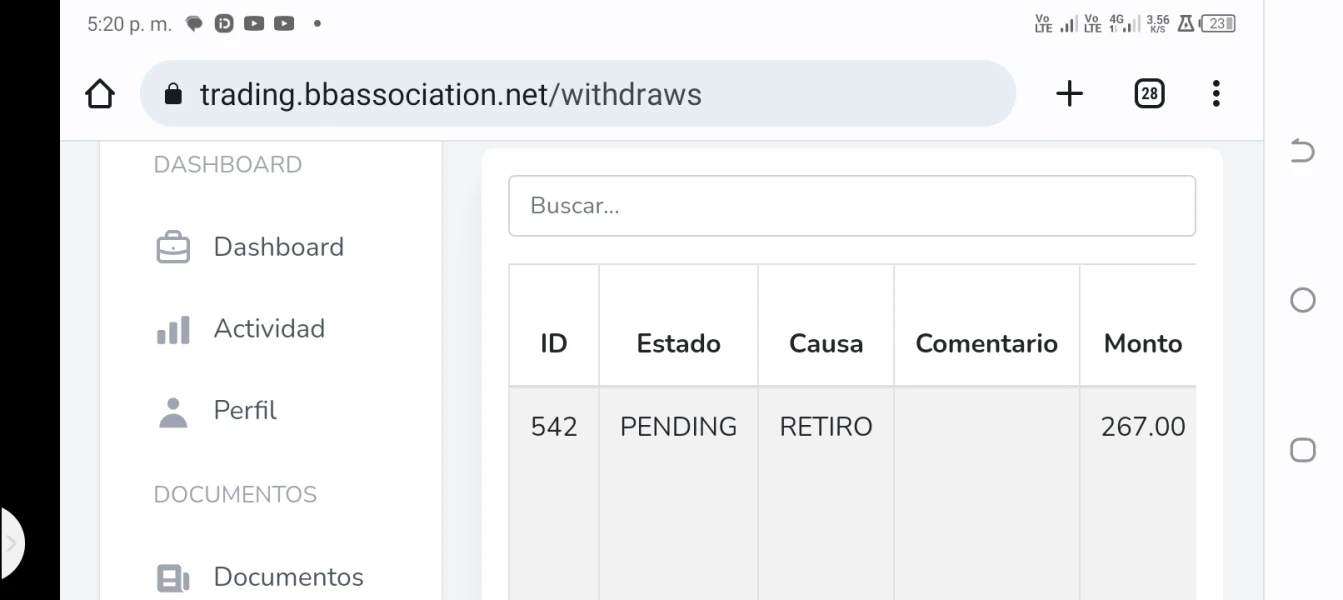

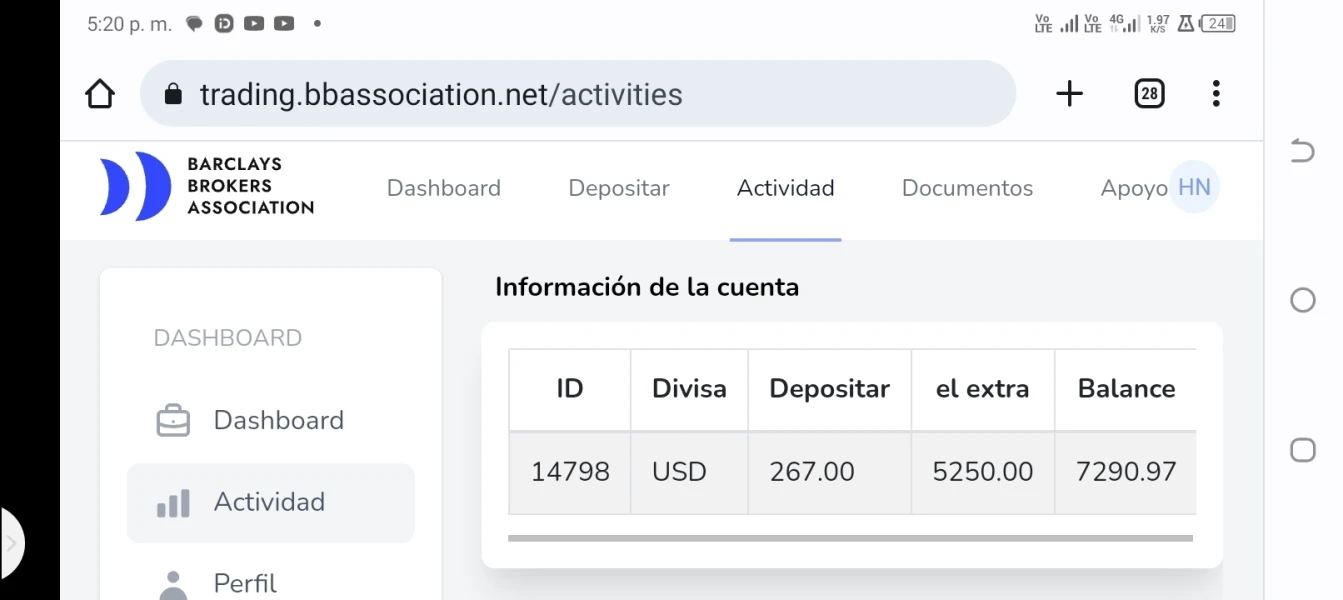

O fator mais importante na medição da segurança de uma plataforma de corretagem é se ela é formalmente regulamentada. Barclays é uma corretora não regulamentada, o que significa que a segurança dos fundos dos usuários e das atividades de negociação não são efetivamente protegidas. Investidores devem escolher Barclays com cautela.

Serviços de Barclays

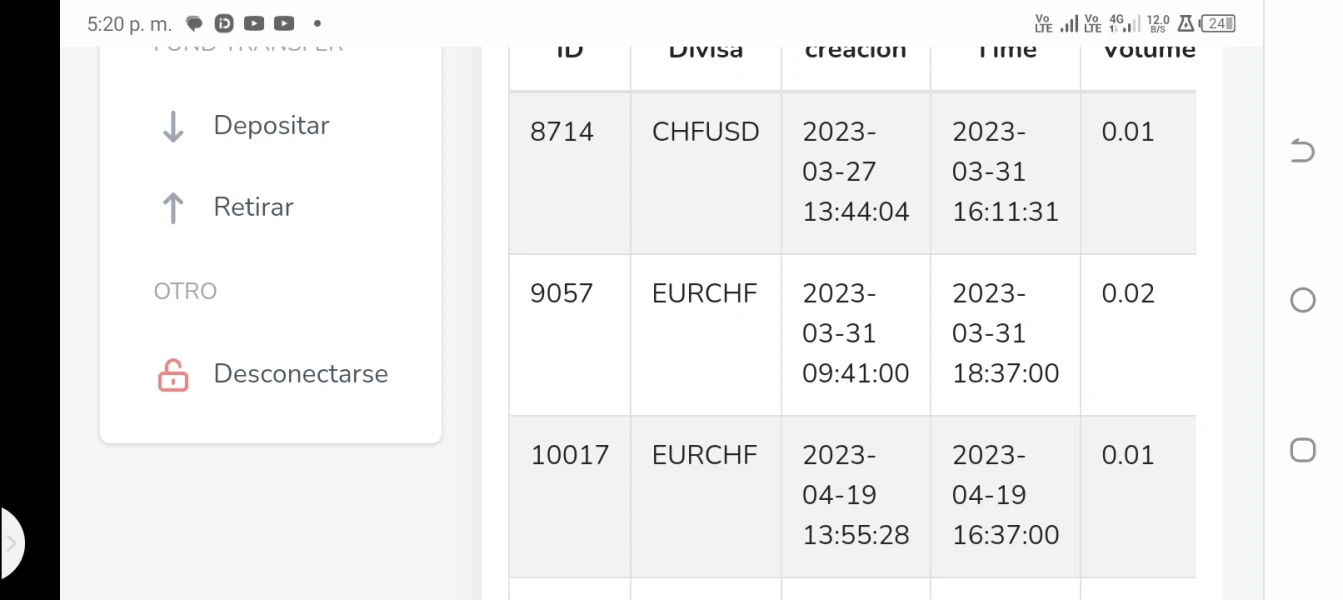

Barclays Japão oferece uma ampla gama de serviços financeiros, incluindo soluções de mercados de capitais, banca de investimento, câmbio, negociação de derivativos e gestão de fundos.

Barclays Securities foca em financiamento, gestão de ativos e serviços de consultoria;

A Filial de Tóquio facilita o acesso ao mercado de atacado, especialmente em FX e derivativos;

Enquanto a Barclays Investment Management gerencia fundos mútuos em diversas classes de ativos para atender às necessidades de investidores institucionais.