Perfil de la compañía

| Resumen de la reseña de Barclays | |

| Establecido | 1997 |

| País/Región Registrada | Bulgaria |

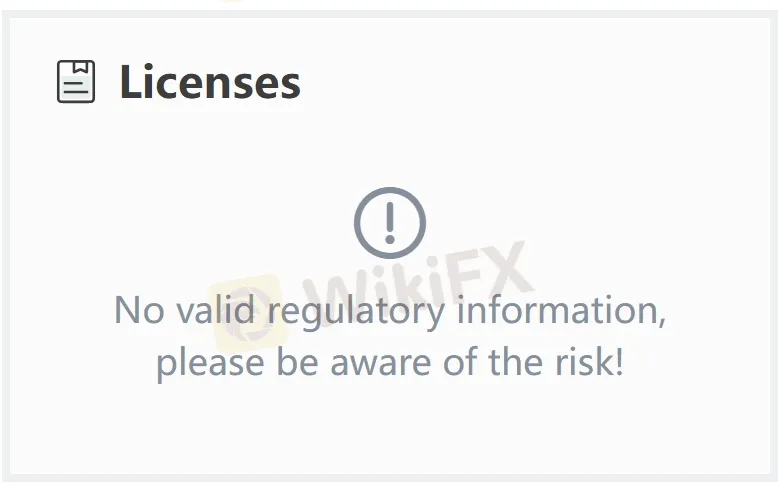

| Regulación | Sin regulación |

| Servicios Financieros | Soluciones de mercados de capitales, banca de inversión, cambio de divisas, operaciones con derivados, gestión de fondos |

| Soporte al Cliente | Barclays Securities Co., Ltd.31st floor, Roppongi Hills Mori Tower, 6-10-1 Roppongi, Minato-ku, Tokyo 106-6131 Tel: 03-4530-1100 |

| Barclays Bank, Sucursal de Tokio, 31st floor, Roppongi Hills Mori Tower, 6-10-1 Roppongi, Minato-ku, Tokyo 106-6131Tel: 03-4530-5100 | |

| Barclays Investment Management Co., Ltd.31st floor,Roppongi Hills Mori Tower, 6-10-1 Roppongi, Minato-ku, Tokyo 106-6131 Tel: 03-4530-2400 | |

| Barclays Services Japan Limited31st floor, Roppongi Hills Mori Tower, 6-10-1 Roppongi, Minato-ku, Tokyo 106-6131 Tel: 03-4530-1190 | |

Información sobre Barclays

Barclays opera en Japón como una parte clave de su red global, ofreciendo servicios financieros a través de Barclays Securities Co., Ltd., Sucursal de Tokio de Barclays Bank y Barclays Investment Management Co., Ltd a clientes en Japón, incluyendo empresas comerciales, instituciones financieras, inversores institucionales e instituciones públicas.

Tras su expansión global, especialmente después de adquirir las operaciones norteamericanas de Lehman Brothers en 2008, Barclays se ha establecido como uno de los principales bancos de inversión de Japón.

Sin embargo, Barclays no está regulado por ninguna autoridad oficial en Japón, lo que debería llamar su atención debido a una posible menor credibilidad y confiabilidad.

Pros y Contras

| Pros | Contras |

| Presencia global | Sin regulación en Japón |

| Empresa matriz de buena reputación | |

| Se ofrecen varios servicios financieros |

¿Es Barclays Legítimo?

El factor más importante para medir la seguridad de una plataforma de corretaje es si está regulada formalmente. Barclays es un corredor no regulado, lo que significa que la seguridad de los fondos de los usuarios y las actividades comerciales no están protegidas de manera efectiva. Los inversores deben elegir Barclays con precaución.

Servicios de Barclays

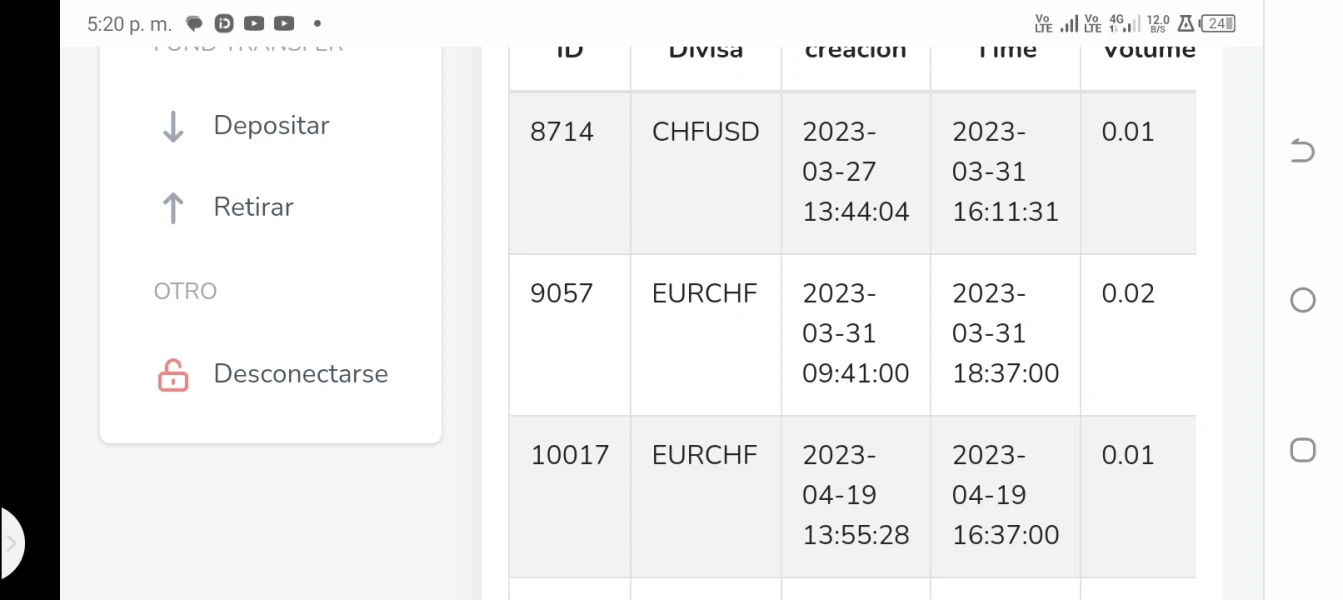

Barclays Japan ofrece una amplia gama de servicios financieros que incluyen soluciones de mercados de capitales, banca de inversión, cambio de divisas, operaciones con derivados y gestión de fondos.

Barclays Securities se enfoca en financiamiento, gestión de activos y servicios de asesoramiento;

La Sucursal de Tokio facilita el acceso al mercado mayorista, especialmente en FX y derivados;

Mientras Barclays Investment Management administra fondos mutuos en diversas clases de activos para satisfacer las necesidades de los inversores institucionales.