Buod ng kumpanya

| Barclays Buod ng Pagsusuri | |

| Itinatag | 1997 |

| Nakarehistrong Bansa/Rehiyon | Bulgaria |

| Regulasyon | Walang regulasyon |

| Mga Serbisyong Pinansiyal | Mga solusyon sa pamilihan ng kapital, investment banking, foreign exchange, derivatives trading, pamamahala ng pondo |

| Suporta sa Customer | Barclays Securities Co., Ltd.31st floor, Roppongi Hills Mori Tower, 6-10-1 Roppongi, Minato-ku, Tokyo 106-6131 Tel: 03-4530-1100 |

| Barclays Bank, Tokyo Branch, 31st floor, Roppongi Hills Mori Tower, 6-10-1 Roppongi, Minato-ku, Tokyo 106-6131Tel: 03-4530-5100 | |

| Barclays Investment Management Co., Ltd.31st floor,Roppongi Hills Mori Tower, 6-10-1 Roppongi, Minato-ku, Tokyo 106-6131 Tel: 03-4530-2400 | |

| Barclays Services Japan Limited31st floor, Roppongi Hills Mori Tower, 6-10-1 Roppongi, Minato-ku, Tokyo 106-6131 Tel: 03-4530-1190 | |

Impormasyon Tungkol sa Barclays

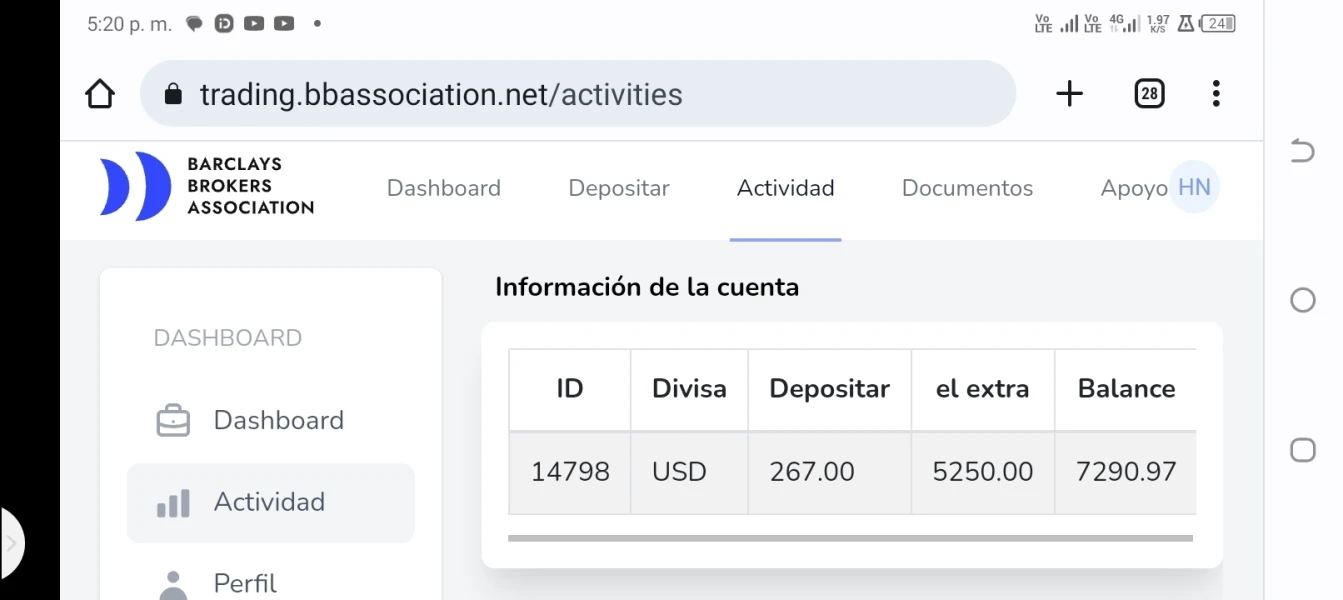

Ang Barclays ay nag-ooperate sa Hapon bilang isang mahalagang bahagi ng kanilang pandaigdigang network, nag-aalok ng mga serbisyong pinansiyal sa pamamagitan ng Barclays Securities Co., Ltd., Barclays Bank Tokyo Branch, at Barclays Investment Management Co., Ltd sa mga kliyente sa Hapon, kabilang ang mga korporasyong pangnegosyo, institusyong pinansyal, institusyonal na mga mamumuhunan, at mga pampublikong institusyon.

Matapos ang kanilang pandaigdigang paglawak, lalo na matapos ang pag-akwir ng operasyon ng Lehman Brothers sa Hilagang Amerika noong 2008, naitatag na ng Barclays ang kanilang sarili bilang isa sa mga pangunahing investment banks sa Hapon.

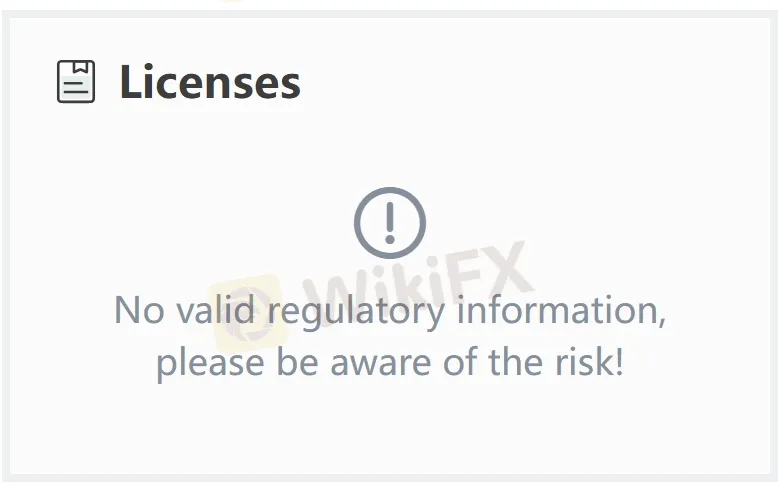

Gayunpaman, ang Barclays ay hindi isinasailalim sa anumang opisyal na awtoridad sa Hapon, kaya't dapat itong magbigay sa iyo ng babala dahil sa posibleng kakulangan sa kredibilidad at pagtitiwala.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Global na presensya | Walang regulasyon sa Hapon |

| Kapani-paniwalang kumpanya ng ina | |

| Iba't ibang mga serbisyong pinansiyal na inaalok |

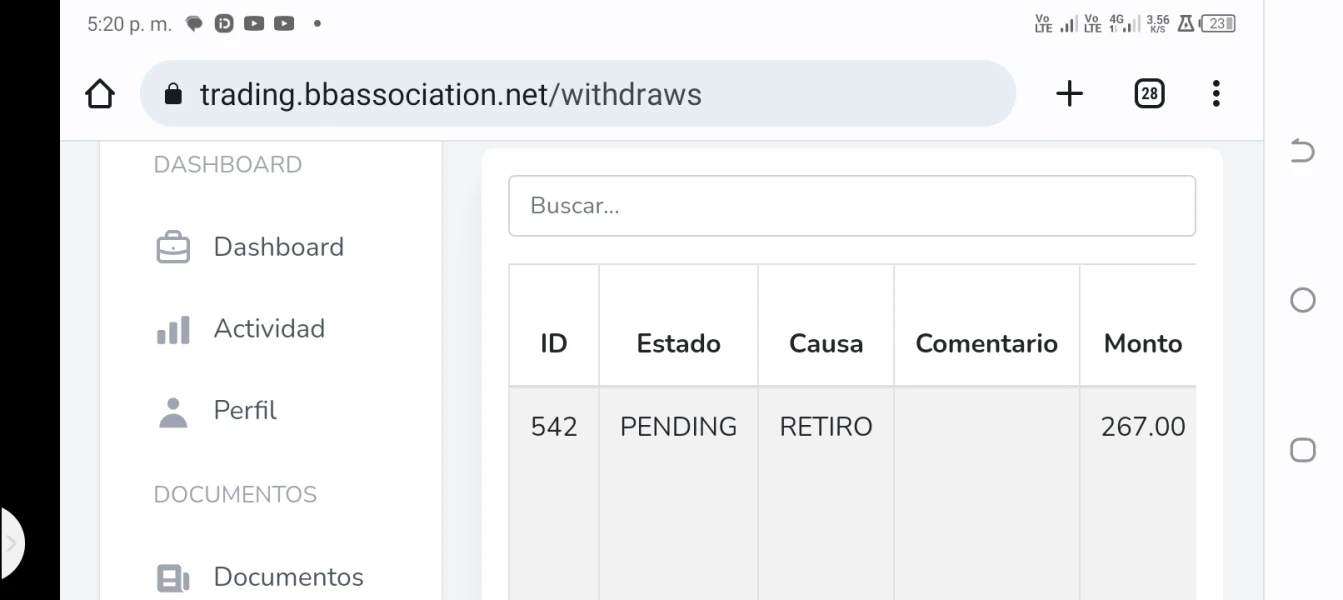

Tunay ba ang Barclays?

Ang pinakamahalagang salik sa pagmamatimbang ng kaligtasan ng isang plataporma ng brokerage ay kung ito ay pormal na nireregula. Ang Barclays ay isang di-reguladong broker, ibig sabihin, ang kaligtasan ng pondo ng mga gumagamit at mga aktibidad sa trading ay hindi epektibong pinoprotektahan. Dapat piliin ng mga mamumuhunan ang Barclays nang may pag-iingat.

Mga Serbisyo ng Barclays

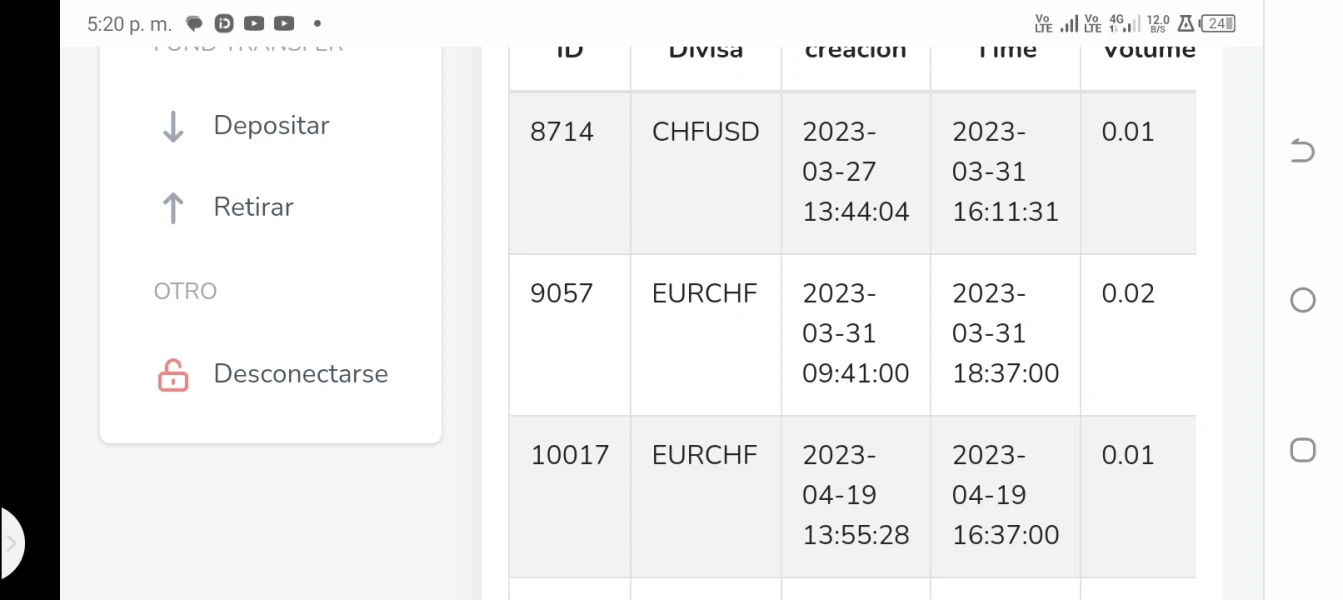

Ang Barclays sa Hapon ay nagbibigay ng kumpletong suite ng mga serbisyong pinansiyal kabilang ang mga solusyon sa pamilihan ng kapital, investment banking, foreign exchange, derivatives trading, at pamamahala ng pondo.

Nakatuon ang Barclays Securities sa pagpapautang, pamamahala ng ari-arian, at mga serbisyong pangpayo;

Ang Tokyo Branch ay nagpapadali ng access sa wholesale market, lalo na sa FX at derivatives;

Samantalang pinamamahalaan ng Barclays Investment Management ang mutual funds sa iba't ibang asset classes upang matugunan ang mga pangangailangan ng institusyonal na mga mamumuhunan.