Buod ng kumpanya

| Review Summary Review | |

| Itinatag | 1997 |

| Nakarehistrong Bansa/Rehiyon | Pransiya |

| Regulasyon | SFC |

| Mga Produkto | Real estate equity, private debt & alternative credit, private equity & infrastructure; Equities, Fixed Income, Multi Asset investments; Private equity, infrastructure equity, private debt, hedge funds |

| Suporta sa Customer | Tel: +33144457000 |

| Email: webmaster-COM@axa-im.com | |

| Tanggapan: Tour Majunga La Défense, 6 Place de la Pyramide, 92800 Puteaux | |

| Link para sa address ng iba pang branch companies: https://www.axa-im.com/contact-us | |

Impormasyon ng AXA

Ang AXA Investment Managers (AXA IM) ay isang global asset management company na may mga branch offices sa buong mundo. Pangunahin itong naglilingkod sa mga serbisyong pinansiyal na may mga produkto tulad ng real estate equity, private debt & alternative credit, private equity & infrastructure, Equities, Fixed Income, Multi Asset investments, Private equity, infrastructure equity, private debt, hedge funds, at iba pa.

Ang magandang bagay ay ang kumpanya ay regulado ng SFC, na nangangahulugang ang mga aktibidad nito sa pinansya ay mahigpit na binabantayan ng mga awtoridad, sa ilang aspeto ay nagbibigay ng tiyak na antas ng proteksyon sa customer.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| SFC regulated | Limitadong impormasyon na inilabas para sa mga kondisyon ng kalakalan sa kanilang website |

| Global presence | |

| Iba't ibang mga produkto sa kalakalan |

Tunay ba ang AXA?

Ang AXA ay kasalukuyang maayos na regulado ng Securities and Futures Commission of Hong Kong (SFC)na may lisensiyang AAP809.

| Regulated Country | Regulator | Kasalukuyang Kalagayan | Regulated Entity | Uri ng Lisensya | Numero ng Lisensya |

| SFC | Regulado | AXA Investment Managers Asia Limited | Naglalakad sa mga kontrata sa hinaharap & Leveraged foreign exchange trading | AAP809 |

Mga Produkto at Serbisyo

Core Investments

- Mga Uri ng Asset: Equities, Fixed Income, Multi-Asset

- Fokus: Tradisyonal na mga estratehiya na may napatunayang rekord sa iba't ibang kondisyon ng merkado.

ESG & Sustainable Strategies

- Pamamaraan: Pinagsasama ang mga salik sa kapaligiran, panlipunan, at pamamahala (ESG) upang isalugar ang mga layunin sa pinansyal sa tunay na epekto sa mundo.

- Filosopiya: Pragmatiko at nakatuon sa kliyente, na nagbibigay-diin sa pangmatagalang likas-kayang kita.

Alternative Investments

- Mga Haligi:

- Real Estate Equity

- Private Debt & Alternative Credit

- Private Equity & Infrastructure

Private Markets & Hedge Funds

- Mga Kasangkapan: Primaries, secondaries, co-investments, NAV financing, GP* minority stakes.

- Saklaw: Private equity, infrastructure equity, private debt, hedge funds.

Piliin (Multi-Manager & Advisory Services)

- Mga Serbisyo: Unit-linked at mga solusyon sa pamamahala ng kayamanan.

- Mga Rehiyon: Europa at Asya, na naayon sa mga pangangailangan sa pamumuhunan ng partikular na kliyente.

山27387

Hong Kong

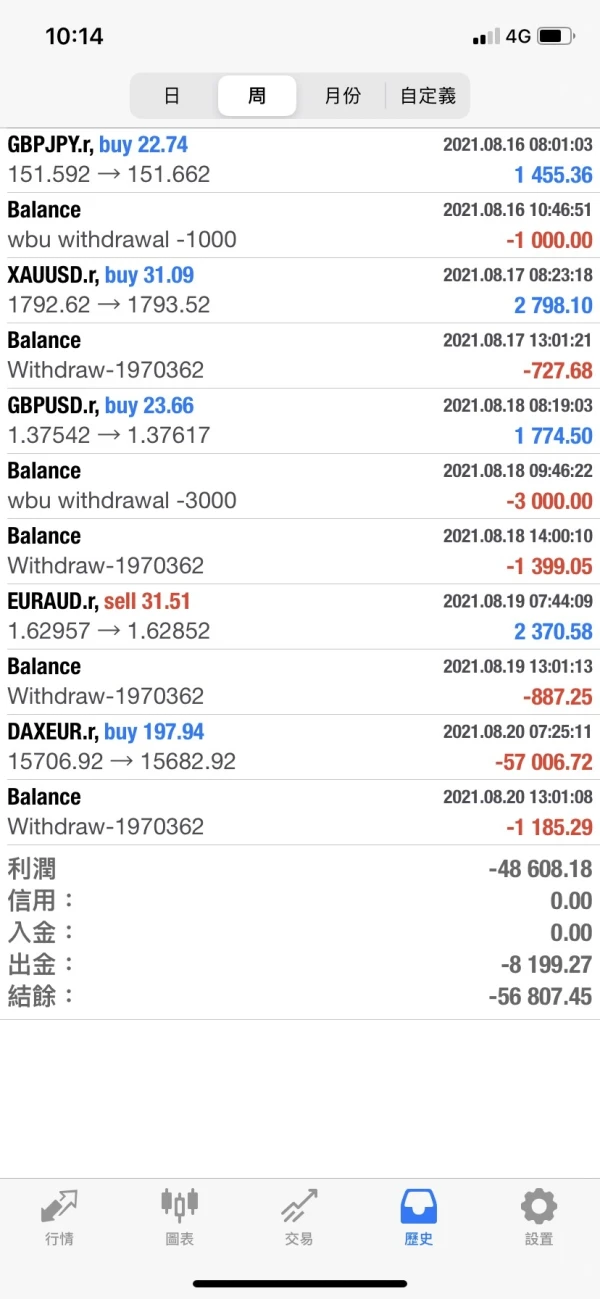

AXA i-freeze ang aking account at hindi ako maaaring mag-withdraw. Ang serbisyo sa customer ay wala nang contact. Maaaring buksan ang website.

Paglalahad

FX1236648509

Taiwan

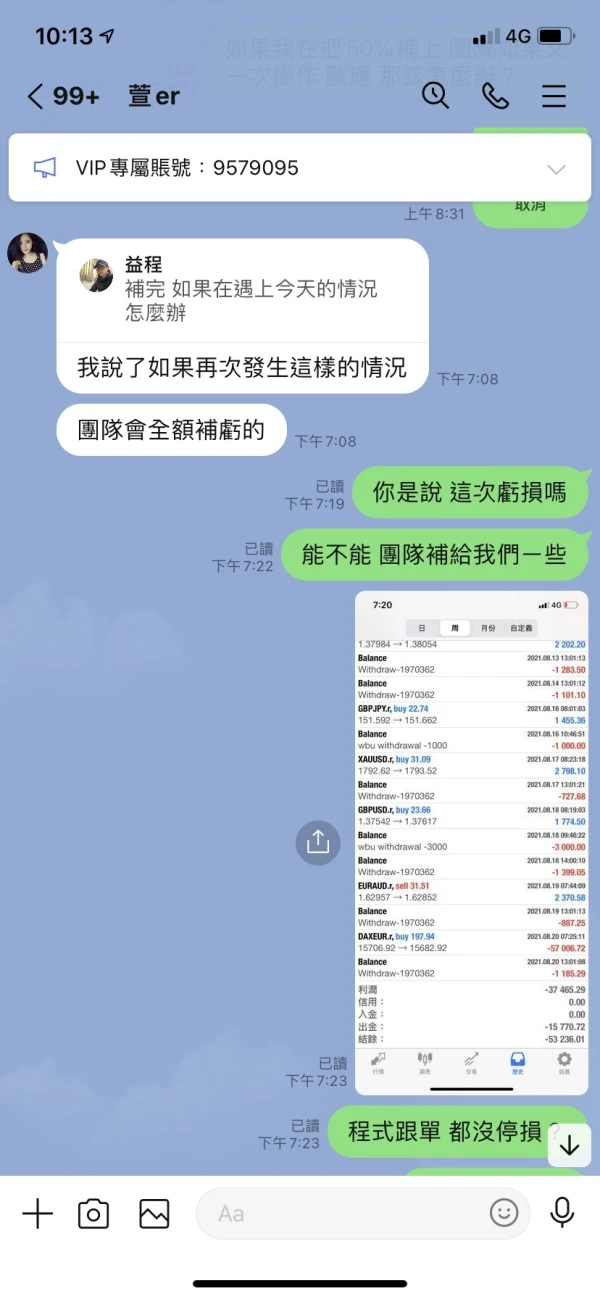

Tumanggi ang serbisyo sa customer na bayaran ako ng pag-atras.

Paglalahad

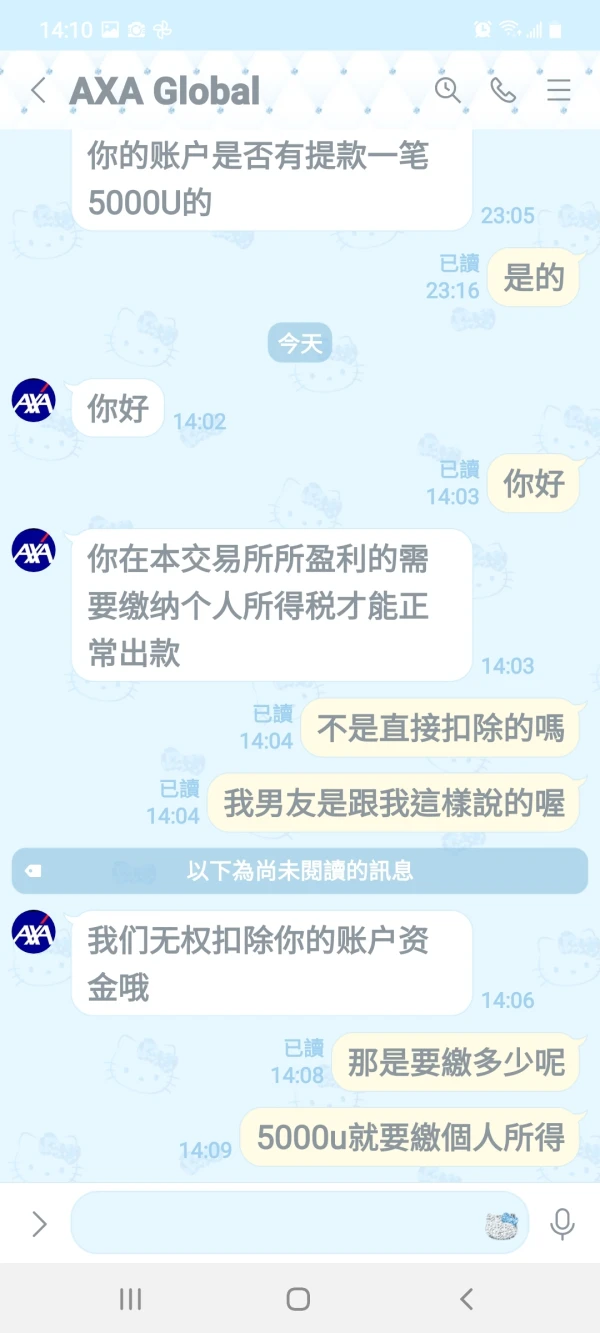

詹孟玟

Taiwan

Sinabi ito ng serbisyo sa customer at hindi ako sigurado tungkol sa realidad nito. Maaari ko bang ibalik ang aking pera?

Paglalahad

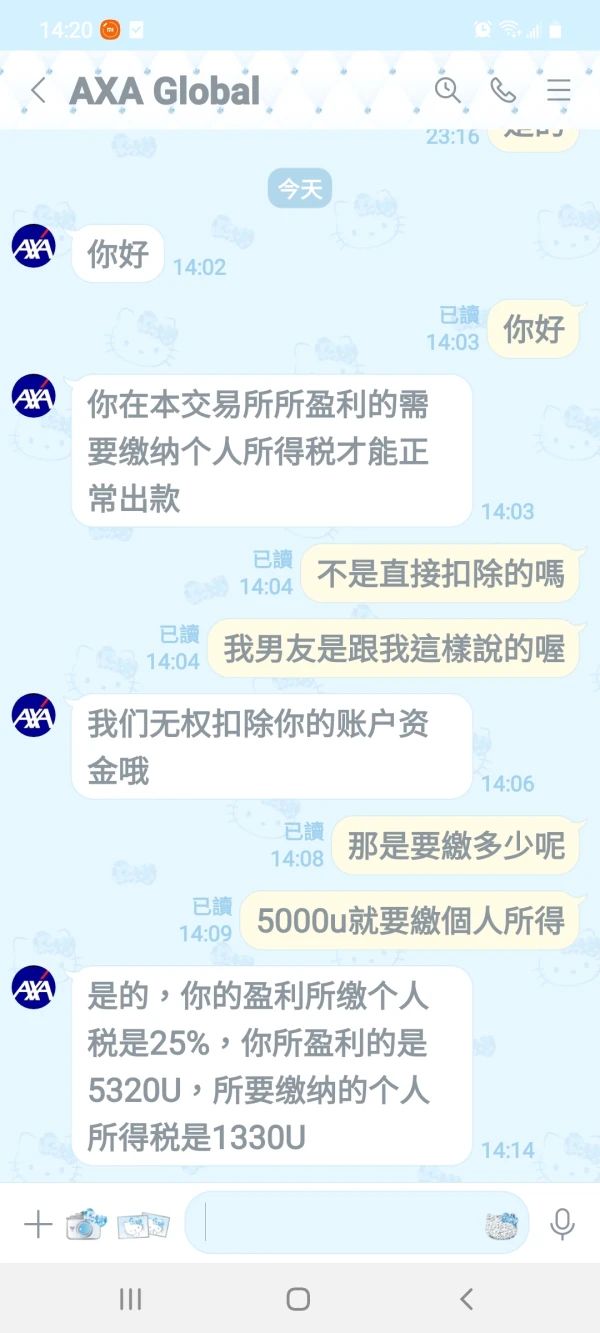

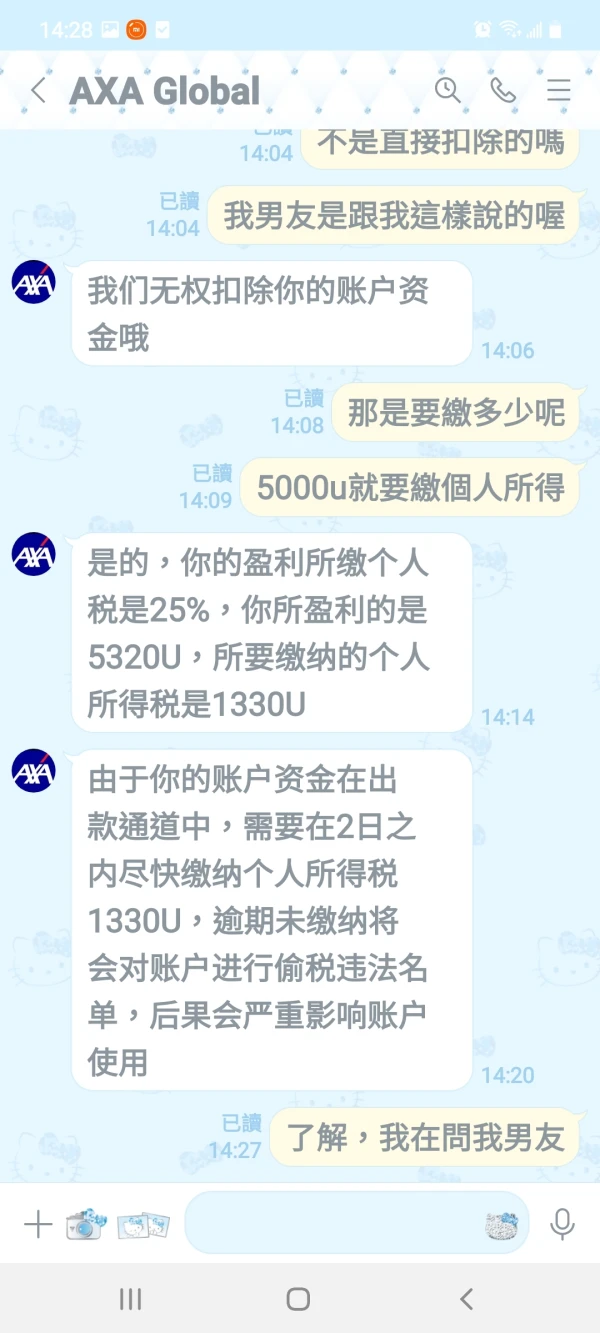

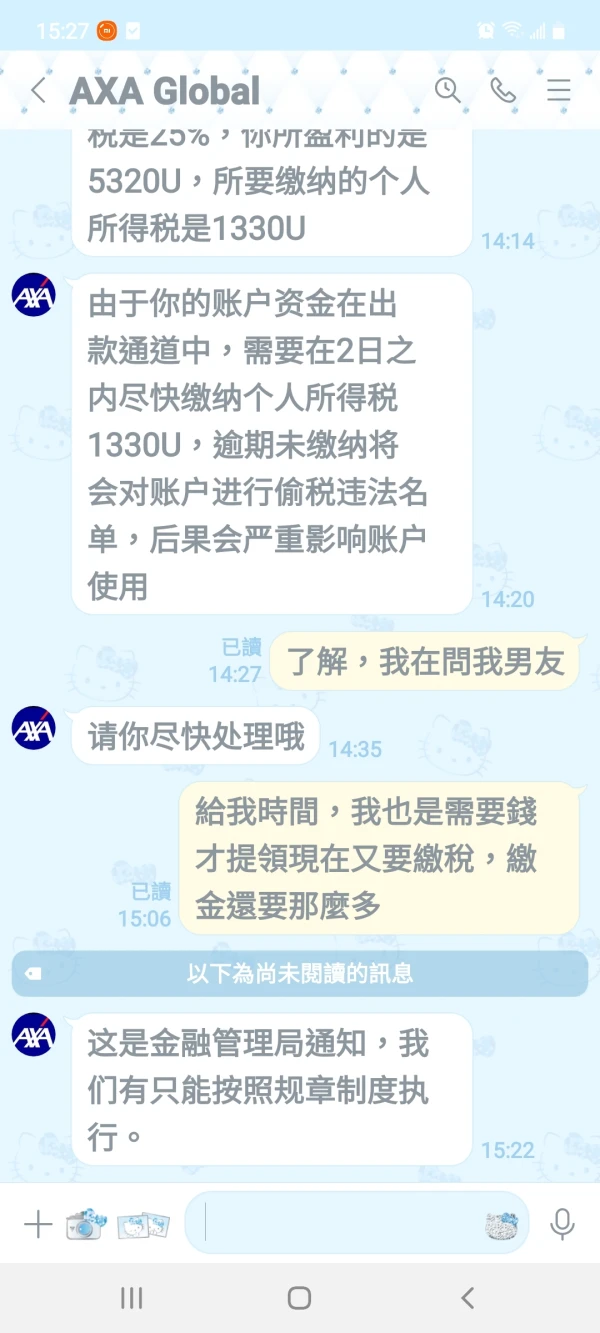

FX1566795049

Cyprus

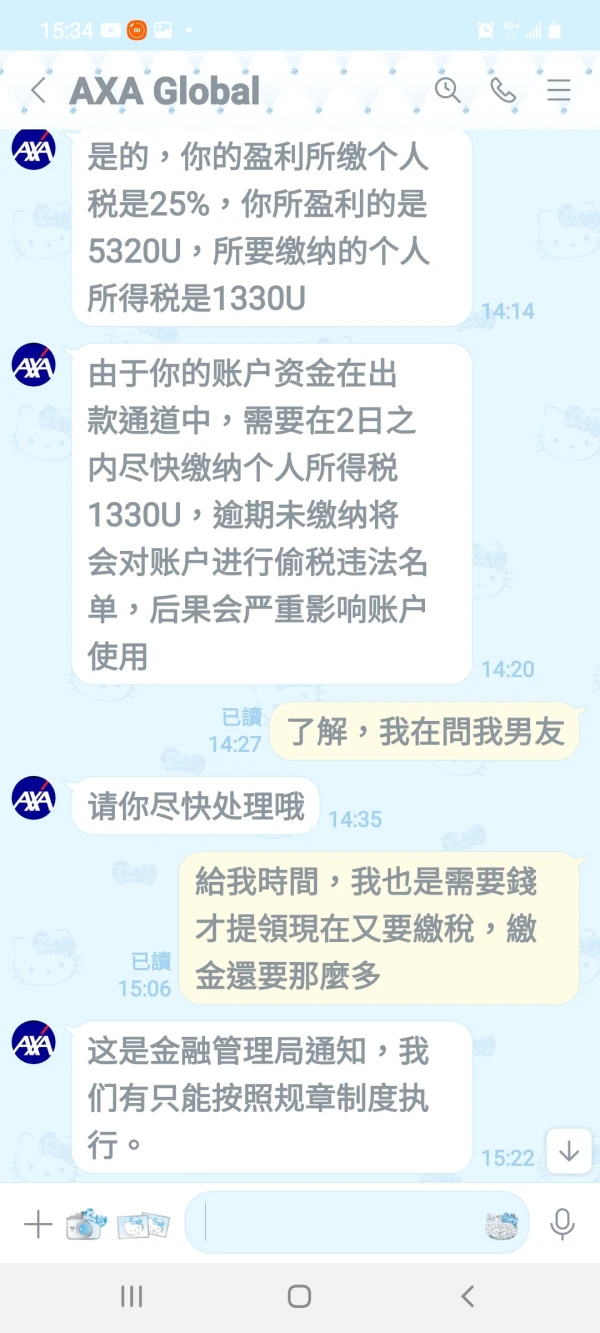

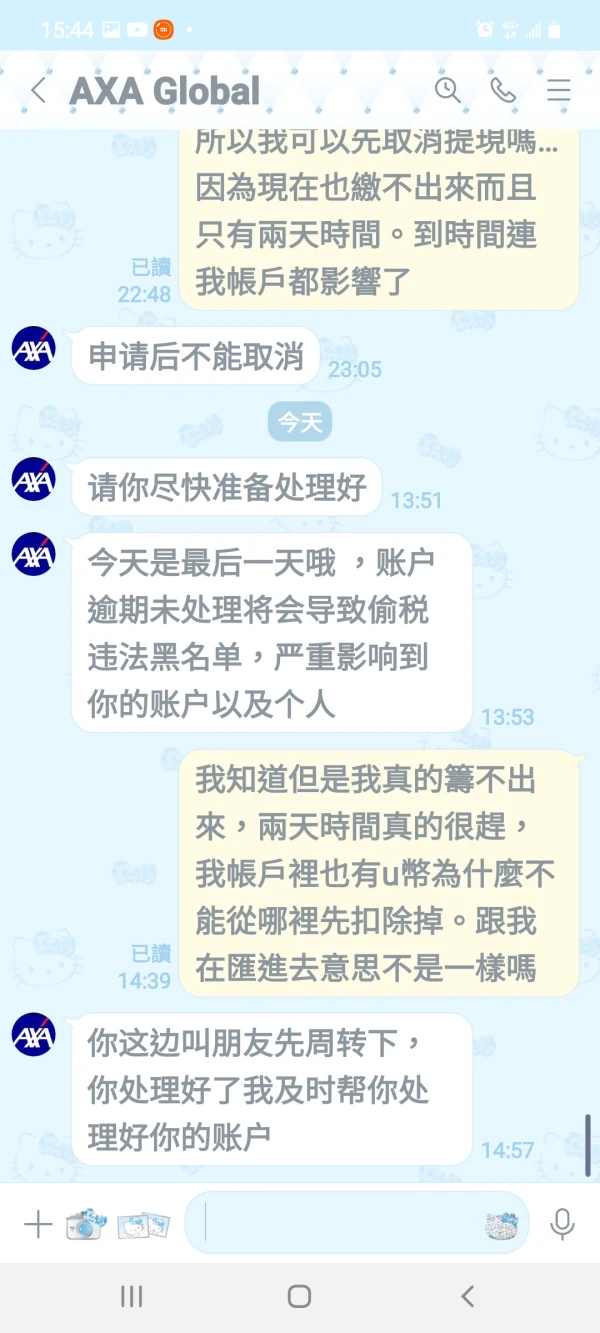

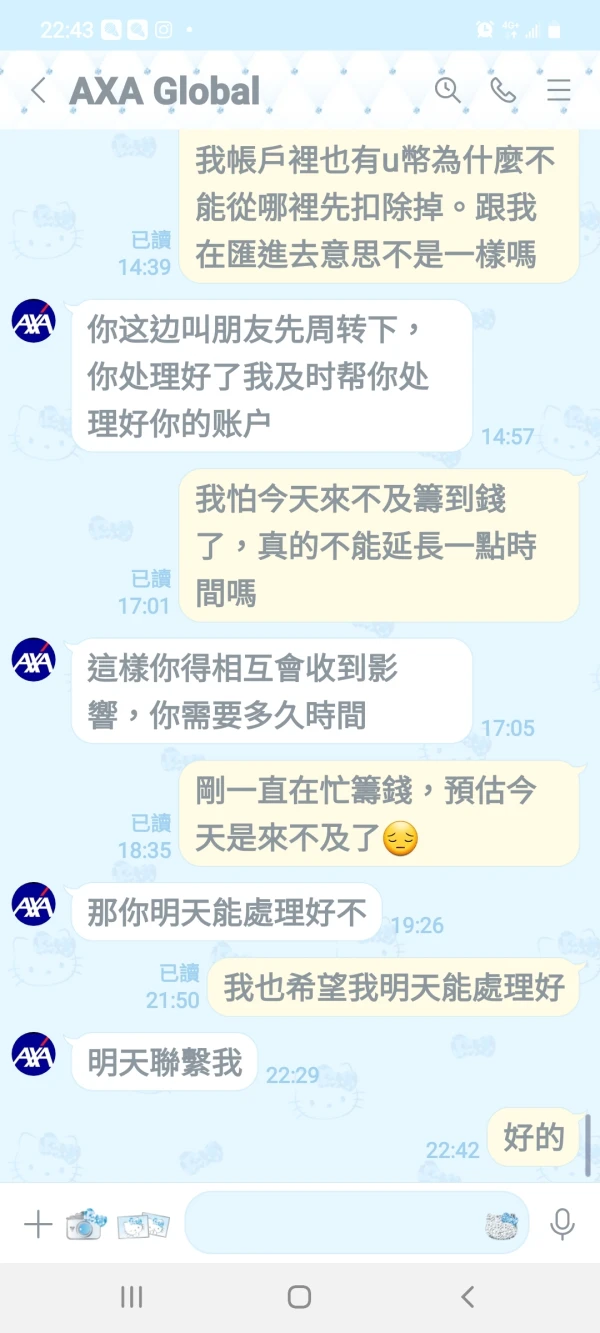

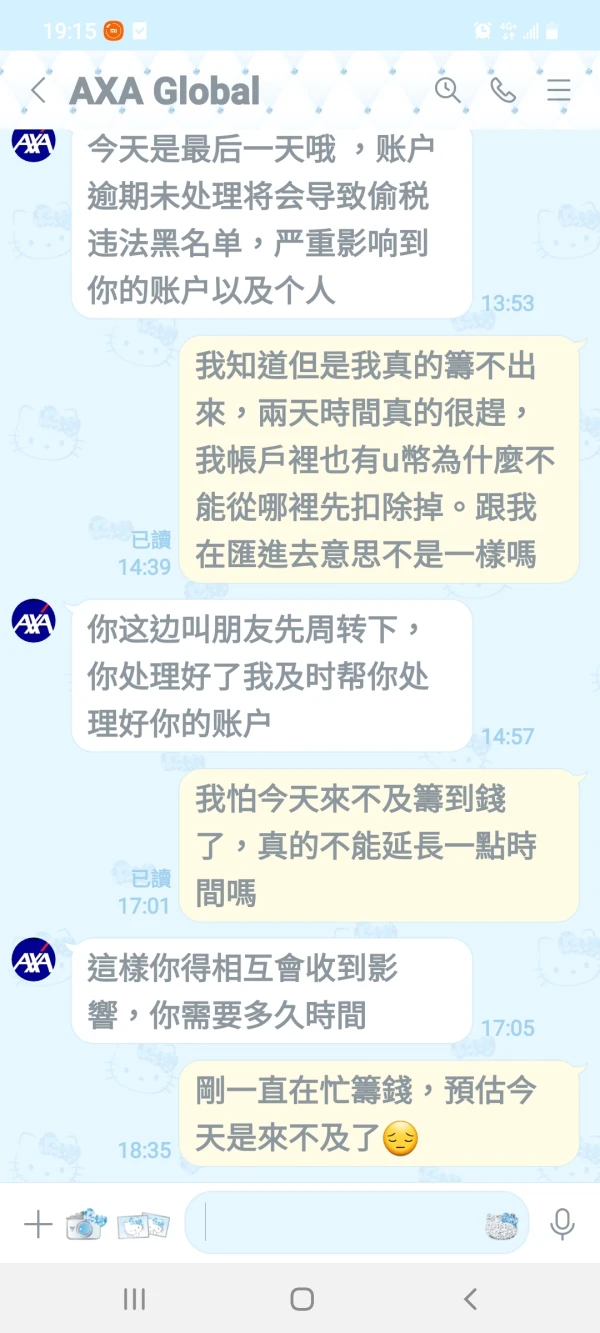

Ang aking kamakailang pakikipag-chat sa serbisyo ng customer ng AXA ay nagsiwalat ng 25% na kinakailangan sa personal na buwis sa kita para sa mga withdrawal. Hindi malinaw tungkol sa proseso at potensyal na reimbursement, nag-aalala ako tungkol sa transparency at pagiging maaasahan ng mga serbisyo ng AXA. Ang kalinawan sa mga bagay na ito ay lubos na magpapahusay sa karanasan ng user.

Katamtamang mga komento

贫僧悟道ing......

Estados Unidos

Nagbibigay ito ng iba't ibang mga produkto ng pamumuhunan, kabilang ang mga pondo ng stock, mga pondo ng bono, atbp., ang mga produkto ng pondo ay komprehensibo din, na nagbibigay ng detalyadong data ng pondo at pagsusuri ng tsart, ang pahina ng website ay simple at madaling maunawaan, ang proseso ng transaksyon ay medyo simple, ay isang investment platform na dapat isaalang-alang.

Positibo