Buod ng kumpanya

| INVASTBuod ng Pagsusuri | |

| Itinatag | 2004 |

| Rehistradong Bansa/Rehiyon | Hapon |

| Regulasyon | FSA |

| Mga Kasangkapan sa Merkado | Forex, ETFs |

| Demo Account | / |

| Levage | Hanggang sa 1:25 |

| Spread | Iba't iba |

| Plataforma ng Paggagalaw | Click 365 |

| Minimum na Deposito | / |

| Suporta sa Kustomer | Telepono: 0120-659-274 |

| Form ng Pakikipag-ugnayan | |

Impormasyon Tungkol sa INVAST

Ang Invast, na may punong-tanggapan sa Tokyo, Hapon, ay isang kilalang kumpanya ng mga serbisyong pinansiyal na nagspecialize sa online trading. Ang kumpanya ay nag-aalok ng iba't ibang mga serbisyo, kabilang ang margin FX, CFDs, at mga automated trading solution. Ang INVAST ay kasalukuyang nasa ilalim ng Financial Services Agency (FSA).

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Regulado ng FSA | Limitadong mga instrumento sa merkado |

| Walang available na demo account | |

| Limitadong impormasyon sa mga kondisyon ng trading |

Tunay ba ang INVAST?

Ang INVAST ay nireregula ng Financial Services Agency (FSA), na may hawak na Retail Forex License (No.26).

| Regulated na Bansa | Regulated Authority | Regulatory Status | Regulated Entity | Uri ng Lisensya | Numero ng Lisensya |

| Financial Services Agency (FSA) | Regulated | Retail Forex License | 関東財務局長(金商)第26号 |

Ano ang Maaari Kong I-trade sa INVAST?

INVAST nag-aalok ng mga produkto na maaaring i-trade kabilang ang forex at ETFs.

| Trading Asset | Available |

| forex | ✔ |

| ETFs | ✔ |

| commodities | ❌ |

| indices | ❌ |

| stocks | ❌ |

| cryptocurrencies | ❌ |

| bonds | ❌ |

| options | ❌ |

| funds | ❌ |

Uri ng Account

INVAST nag-aalok ng mga personal account at corporate account.

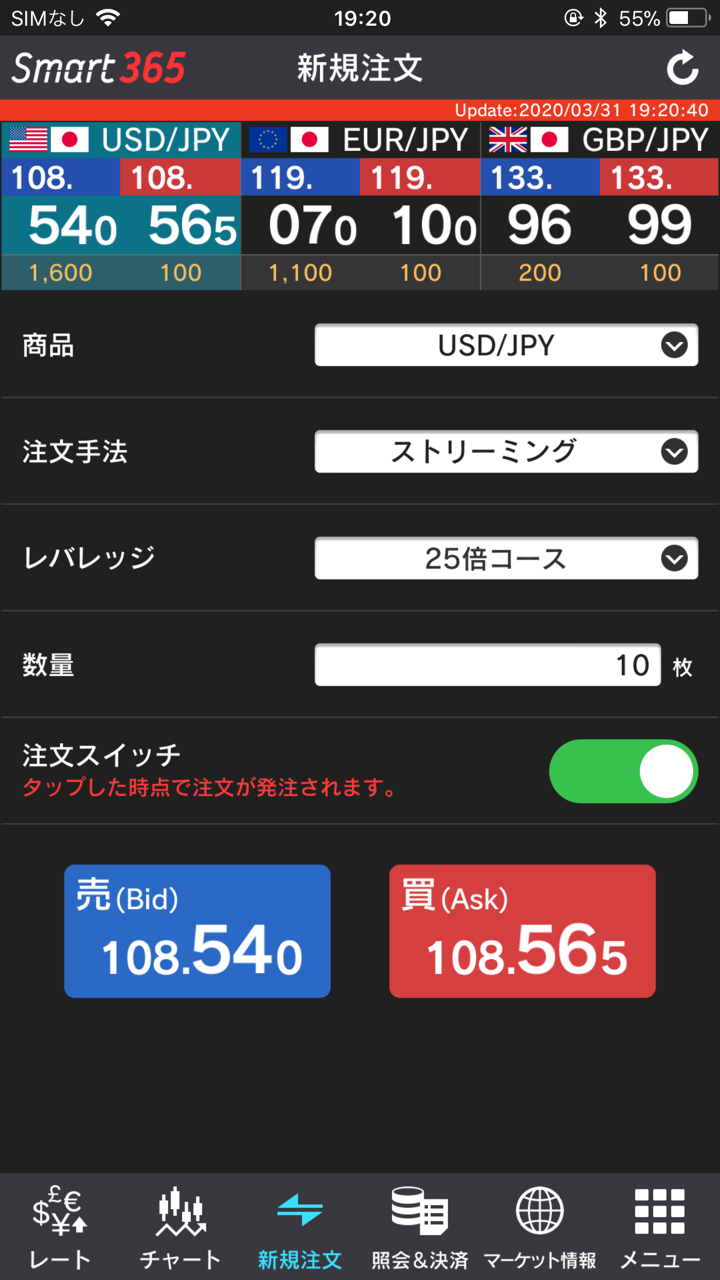

Leverage

INVAST nag-aalok ng iba't ibang leverage rates.

Personal account leverage: 25x course, 10x course, 5x course, at 1x course.

Mayroon lamang isang corporate account: leverage course.

Mga Bayad

Ang mga spreads ay itinakda ng Tokyo Financial Exchange.

Para sa mga detalye, mangyaring bisitahin ang website ng Tokyo Financial Exchange.

Karaniwang JPY 330 ang trading fees. Ngunit may mga exemptions:

- Higit sa 1,000 sheets: May ibinabang bayad na JPY 88 kung higit sa 1,000 sheets ang na-trade sa isang buwan.

- Higit sa 3,000 sheets: Mas mababang bayad (o walang bayad) ang naaaply kung higit sa 3,000 sheets ang na-trade sa isang buwan.

| 1 sheet (kasama ang buwis) | karaniwan | Diskwento sa Damdamin (Buwanang Transaksyon Meter) | |||

| Higit sa 1,000 sheets | Higit sa 3,000 sheets | ||||

| Karaniwang one-way fee | JPY 330 | JPY 88 | JPY 0 | ||

Bukod pa rito, ang accumulated fee ay ibabawas mula sa halaga ng margin deposit sa katapusan ng trading sa unang araw.

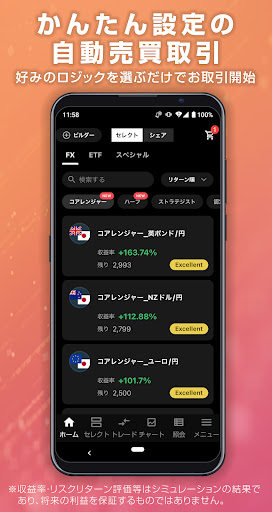

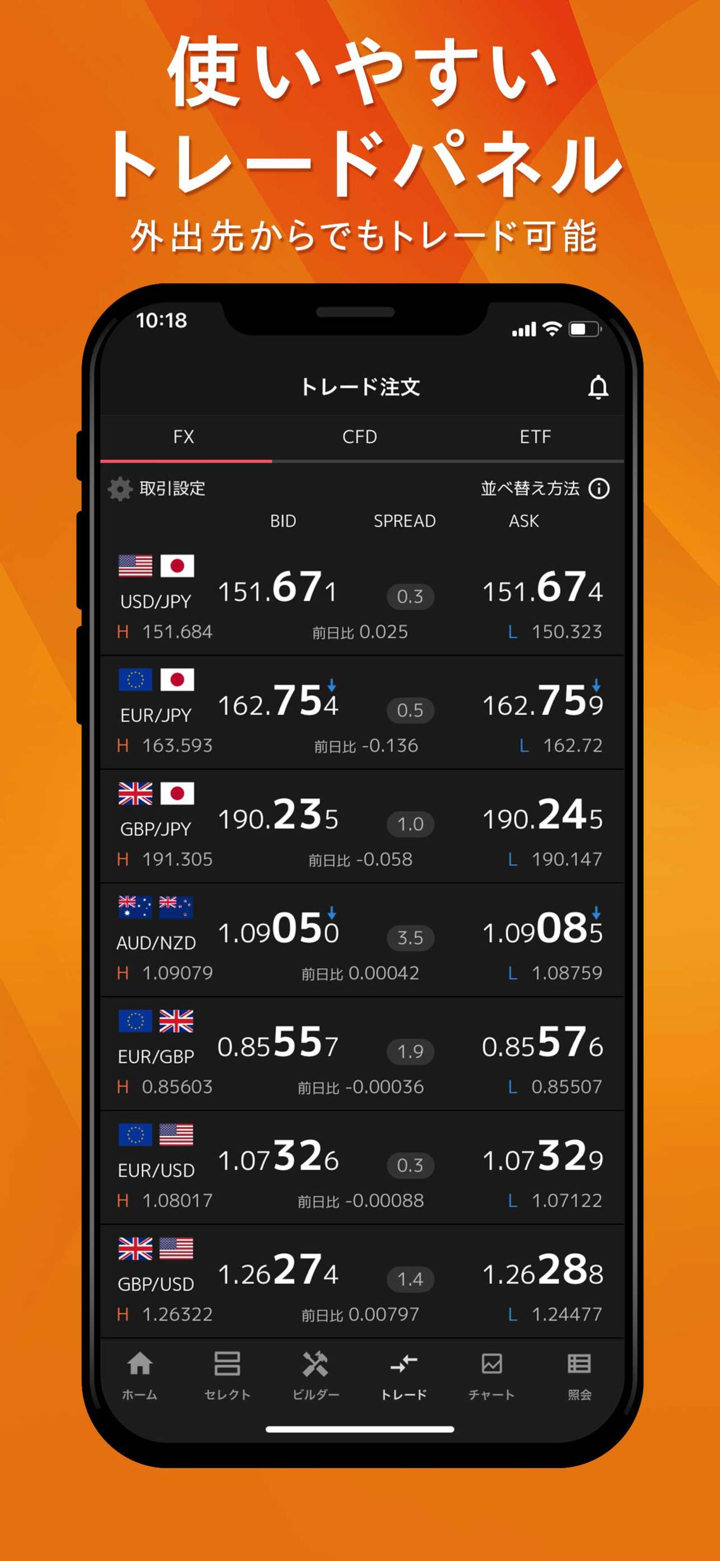

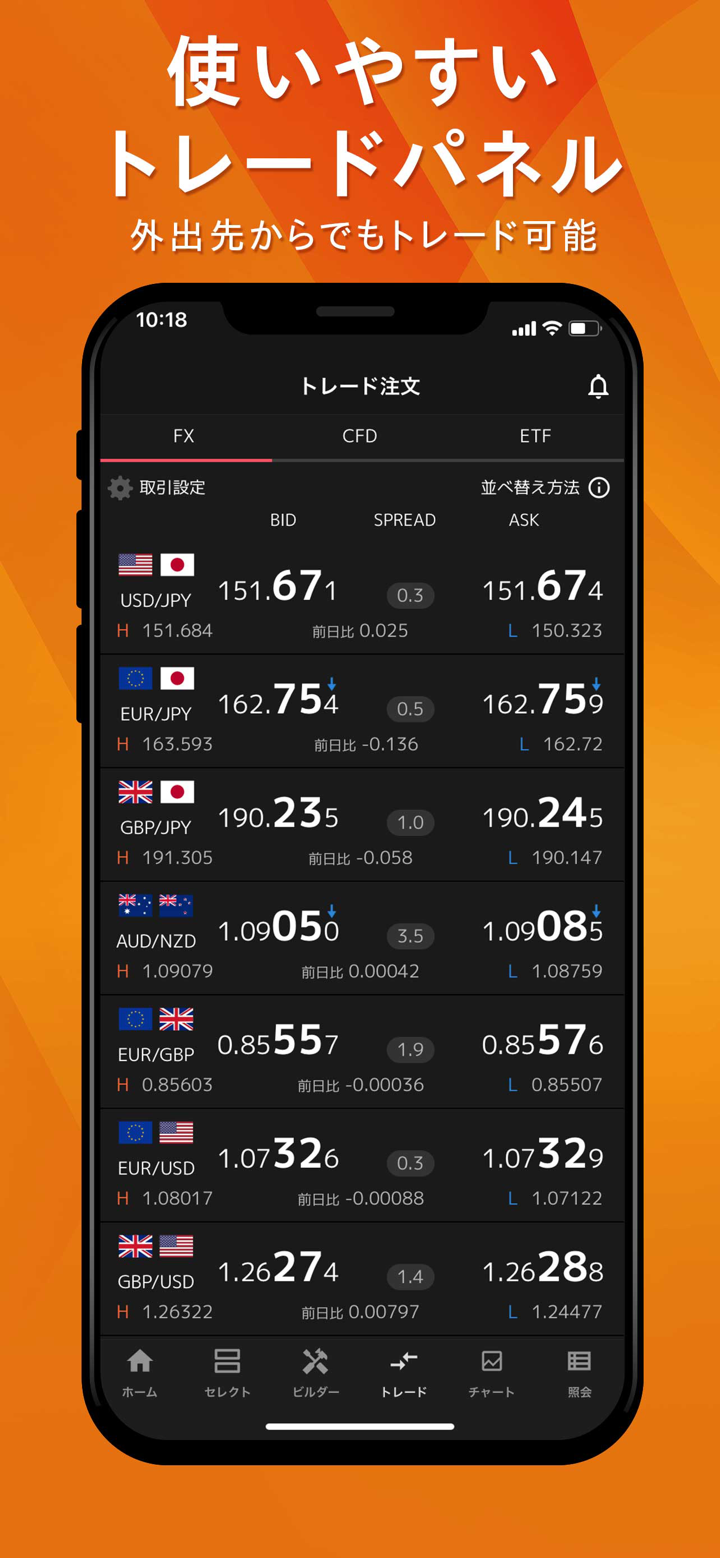

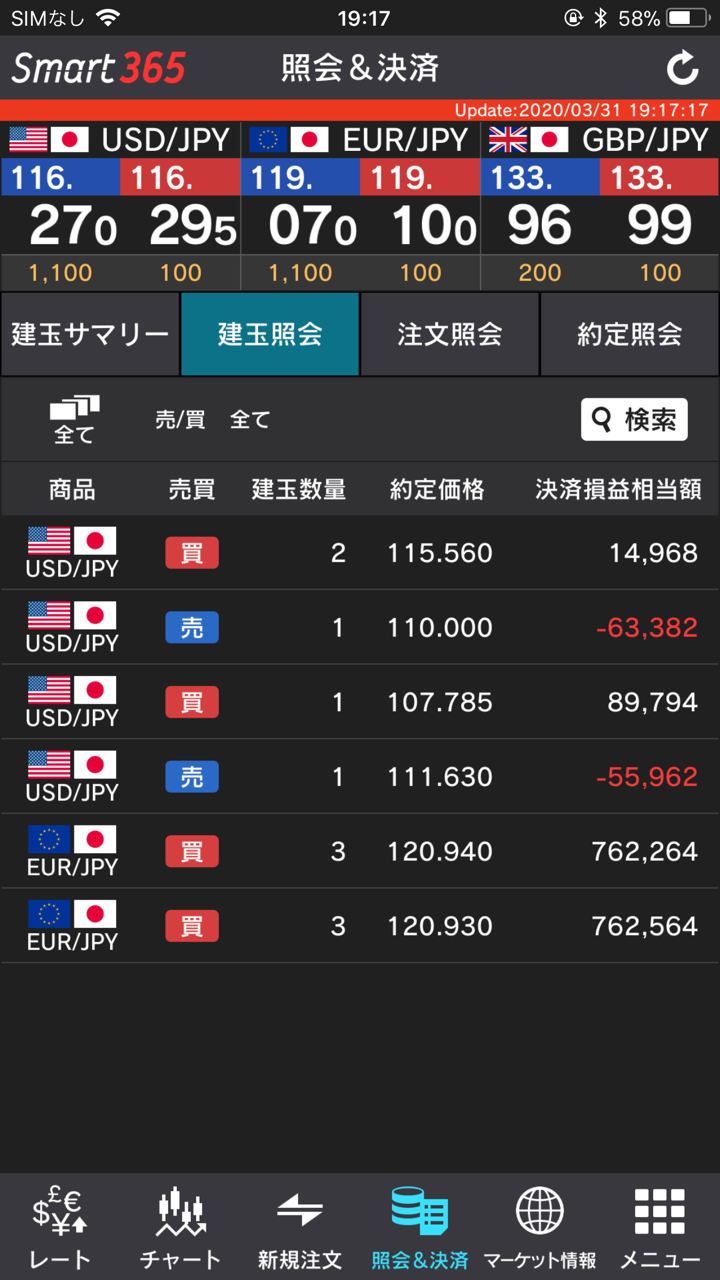

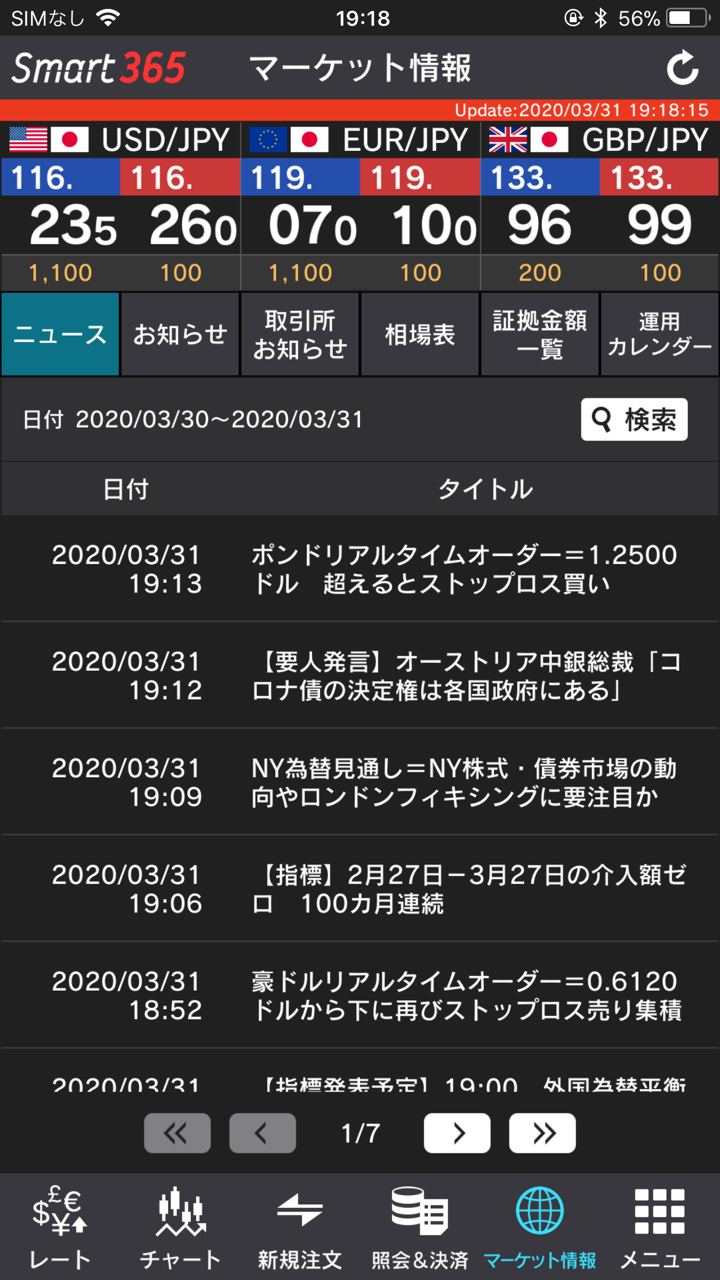

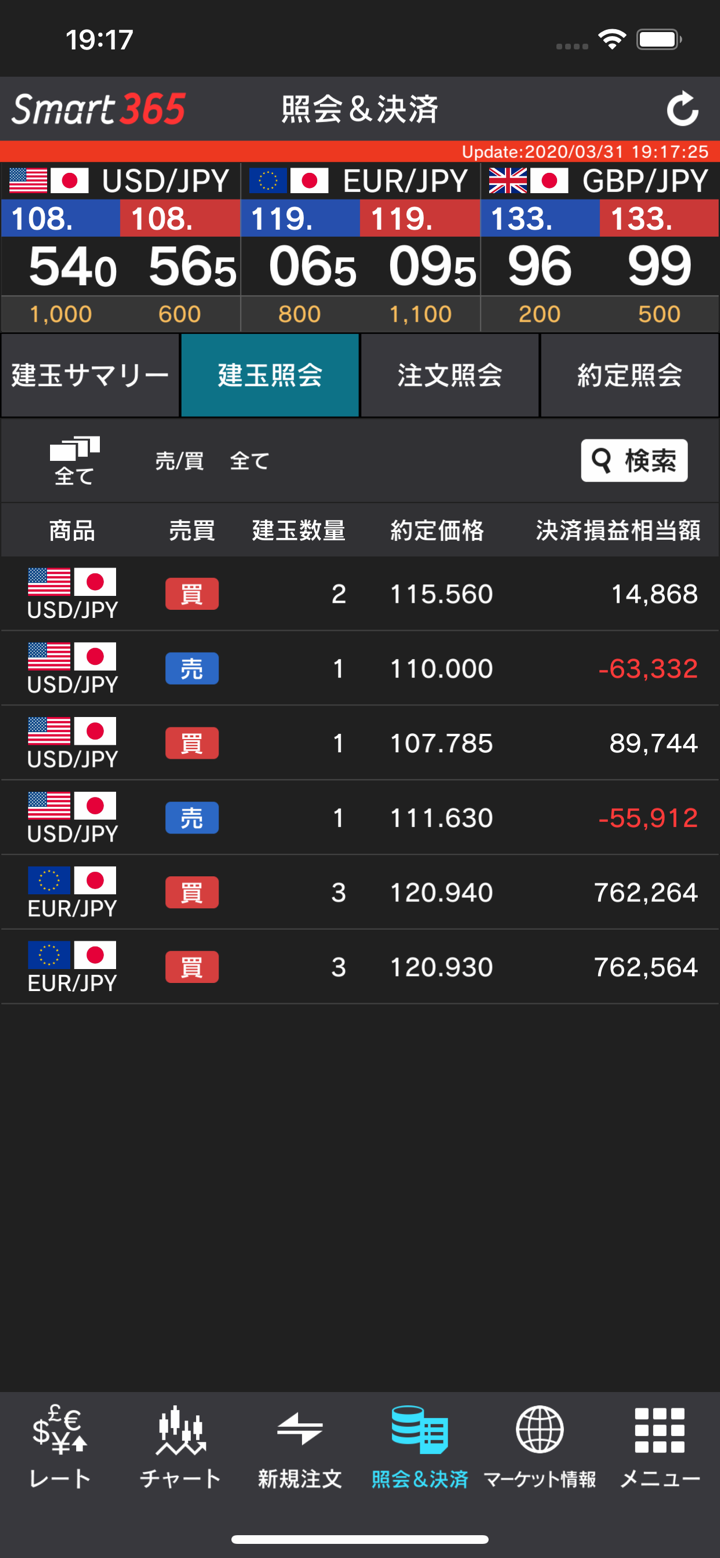

Platform ng Trading

Ang Click 365 ay ang proprietary online trading platform ng Invast Securities na idinisenyo para sa mga Japanese retail investors.

| Platform ng Trading | Supported | Available Devices | Suitable for |

| Click 365 | ✔ | Desktop, Mobile, Web | / |

| MT5 | ❌ | / | Experienced traders |

| MT4 | ❌ | / | Beginners |

Deposito at Pag-Wiwithdraw

Ang mga traders ay maaaring mag-deposito sa pamamagitan ng bank counter, ATM, o online banking.

- Mga Bayad para saDeposito Ang mga bayad para sa pagdedeposito ng pera sa iyong trading account ay walang bayad kung gagamitin mo ang instant deposit service.

Kung hindi mo gagamitin ang instant deposit service at gagawa ng regular transfer, ikaw ay magiging responsable sa transfer fee ng bawat financial institution.

- Mga Bayad para sa Pag-Wiwithdraw Ang mga bayad para sa pag-withdraw mula sa iyong trading account ay sagutin ng Invast Securities (libre para sa iyo).

FX3196354740

Hong Kong

Mukhang maganda, mabilis ang pag-withdraw, madali at mabilis ang pagbubukas ng account, madali rin ang pag-ooperate, ngunit medyo mabagal ang pag-update ng data, limitado ang mga uri ng produkto, dahil hindi ito isang lokal na platform, hindi gaanong madaling makipag-ugnayan sa customer service, ngunit ang customer service ay mayroong pasensya at maaasahan pa rin.

Positibo

周红玉

Hong Kong

Binibigyan ko ng 5 bituin ang lugar na ito. At inirerekomenda din ito sa lahat. Siguradong kikita ka ng malaking pera kung magsisimula ka sa pangangalakal sa lugar na ito. Walang ibang platform na tulad nito sa merkado sa kasalukuyan. Wala akong reklamo sa lugar na ito. Nakatanggap ako ng suporta sa tuwing humingi ako sa customer service crew dito.

Positibo

FX1182046228

Hong Kong

Ang spread ay sobrang makitid, at ang bilis ng deposito at pag-withdraw ay napakabilis din. Bagama't ang mga opsyon ay mas kaunti pa rin, umaasa akong panatilihin ang kasalukuyan at patuloy na mapabuti. Mas maganda pa kung kaya nitong suportahan ang electronic payment, para mas maging convenient ang transaction!

Positibo

杰出青年

Hong Kong

Ang Japanese company na ito ay mukhang okay, ngunit sa kasamaang-palad ay hindi ko maintindihan ang Japanese at pakiramdam ko ay mas mabuting makipagnegosyo sa isang lokal na kumpanya. Mayroon bang mga katulad na kumpanya sa Hong Kong? Mayroon ka bang mga kaibigang Hui na irerekomenda?

Positibo