Perfil de la compañía

| CurrencyFair Resumen de la reseña | |

| Fundado | 2008 |

| País/Región registrado | Australia |

| Regulación | ASIC |

| Servicio | Transferencia de dinero |

| Plataforma | Aplicación móvil |

| Soporte al cliente | Formulario de contacto |

| Irlanda: Colm House, 91 Pembroke Road, Ballsbridge, Dublin 4; +353 (0) 1 526 8411 (9am - 5pm Dublin/London time Monday - Friday) | |

| Reino Unido: No. 1 Poultry, London ECR2 8EJ; +44 (0) 203 3089353 (9 AM-5 PM Monday-Friday) | |

| Singapur: 15 Beach Road, 2nd Floor, Singapore 189677; +65 (0) 3165 0282 (5 PM - 1 AM Monday–Saturday) | |

| Hong Kong: Office 12100, 12/F, YF Tower, 33 Lockhart Road, Wan Chai, Hong Kong; +852 5803 2611 (5pm - 1am Monday - Saturday) | |

| Australia: Suite 26-109, 161 Castlereagh Street Sydney, NSW, 2000; +61 (0) 282 798 642 (8 PM - 4 AM Monday-Saturday) | |

CurrencyFair se registró en 2008 en Australia. En su plataforma, los clientes pueden enviar dinero al extranjero. Además, esta empresa tiene un largo tiempo de operación y está regulada en Australia.

Pros y contras

| Pros | Contras |

| Largo tiempo de operación | No hay soporte de chat en vivo |

| Regulado adecuadamente | |

| Estructura de tarifas transparente |

¿Es CurrencyFair legítimo?

Sí, CurrencyFair está regulado por la Comisión de Valores e Inversiones de Australia (ASIC).

| País Regulado | Autoridad Reguladora | Estado Actual | País Regulado | Tipo de Licencia | Número de Licencia |

| Comisión de Valores e Inversiones de Australia (ASIC) | Regulado | Australia | Market Making (MM) | 402709 |

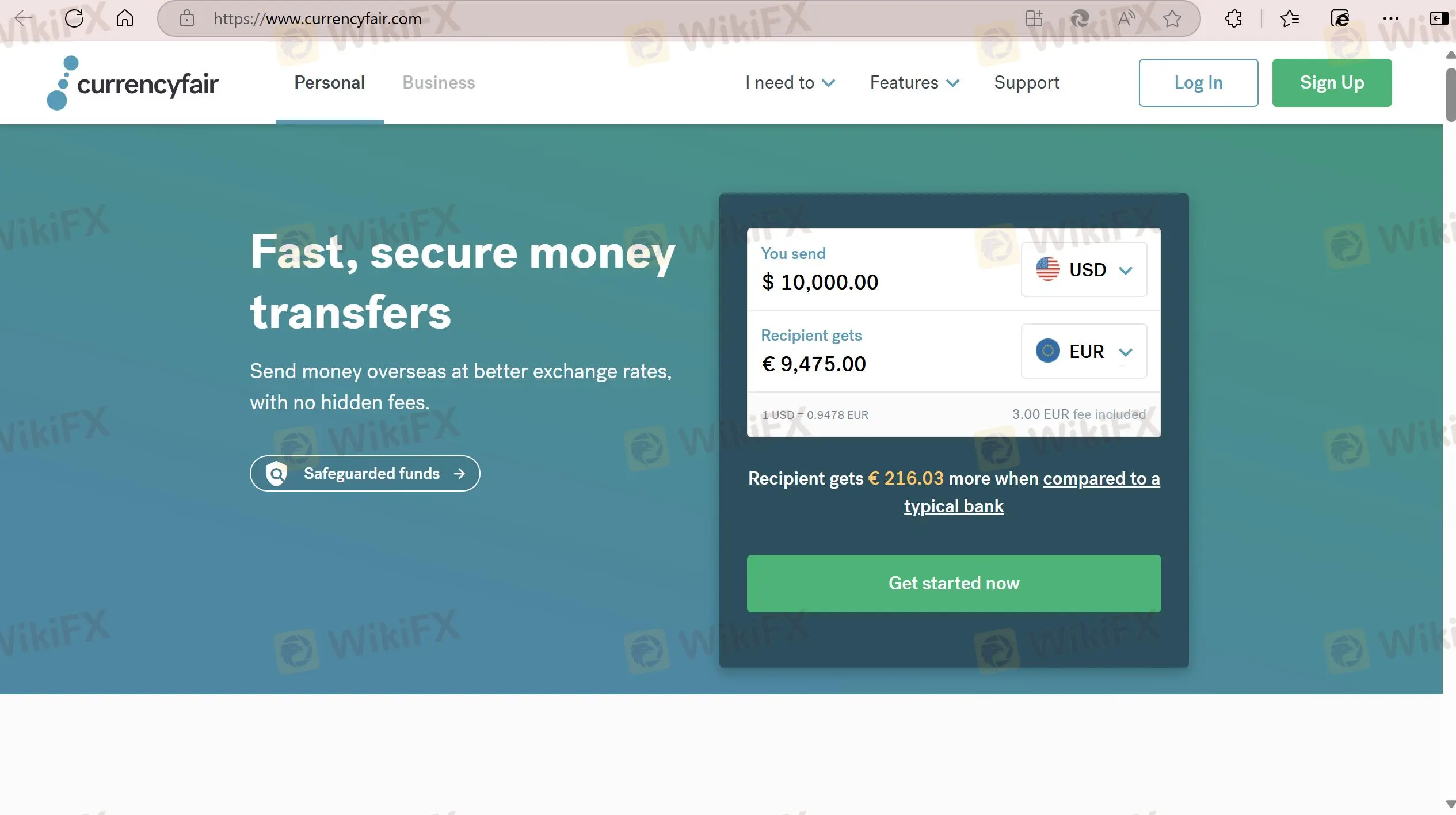

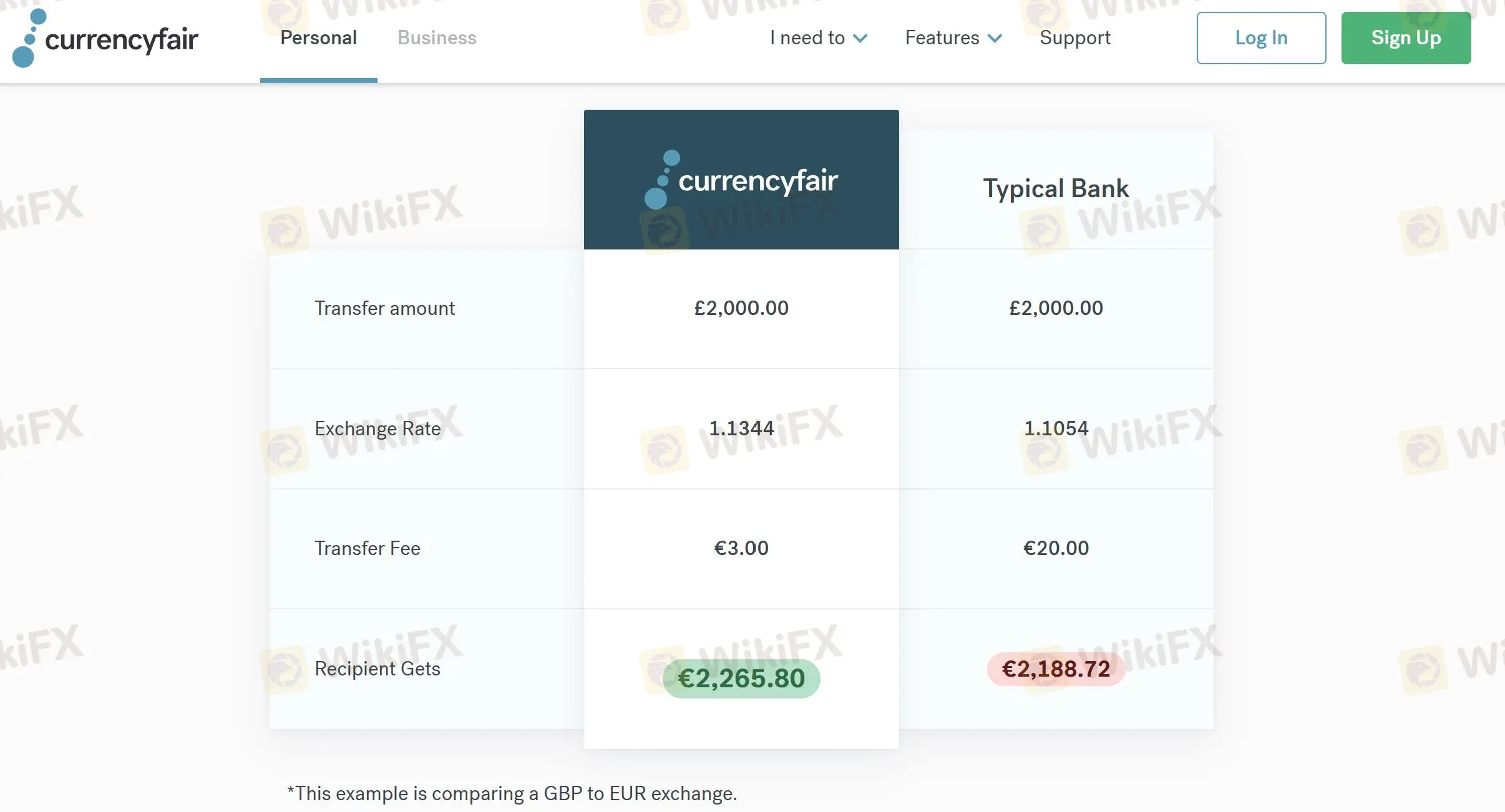

Tarifas de CurrencyFair

| Monto de Transferencia | Tipo de Cambio | Tarifa de Transferencia | Recibe el Destinatario |

| 2,000.00 GBP | 1.1344 | 3.00 EUR | 2,265.80 EUR |

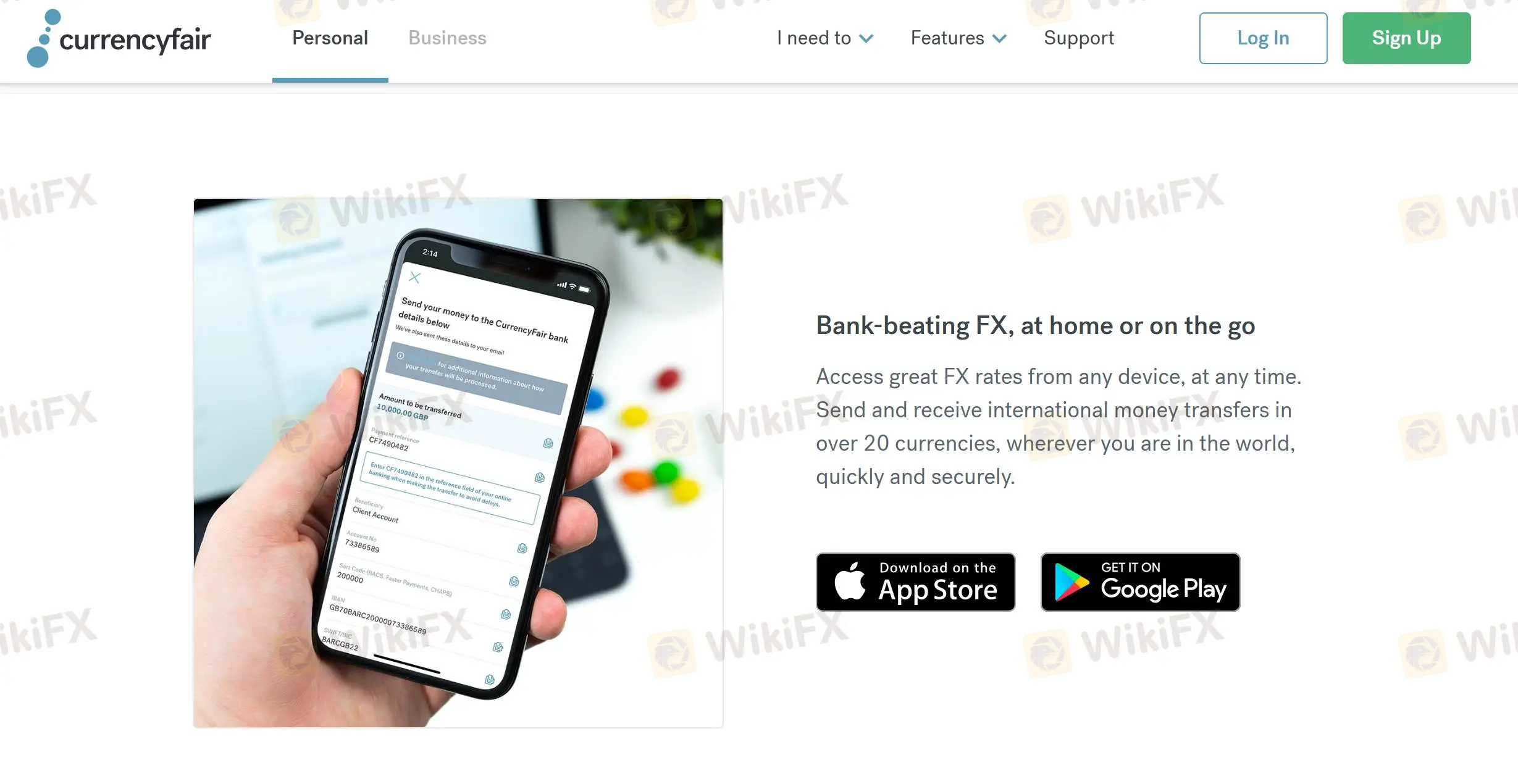

Plataforma

| Plataforma | Compatible | Dispositivos Disponibles |

| Aplicación Móvil | ✔ | iOS, Android |

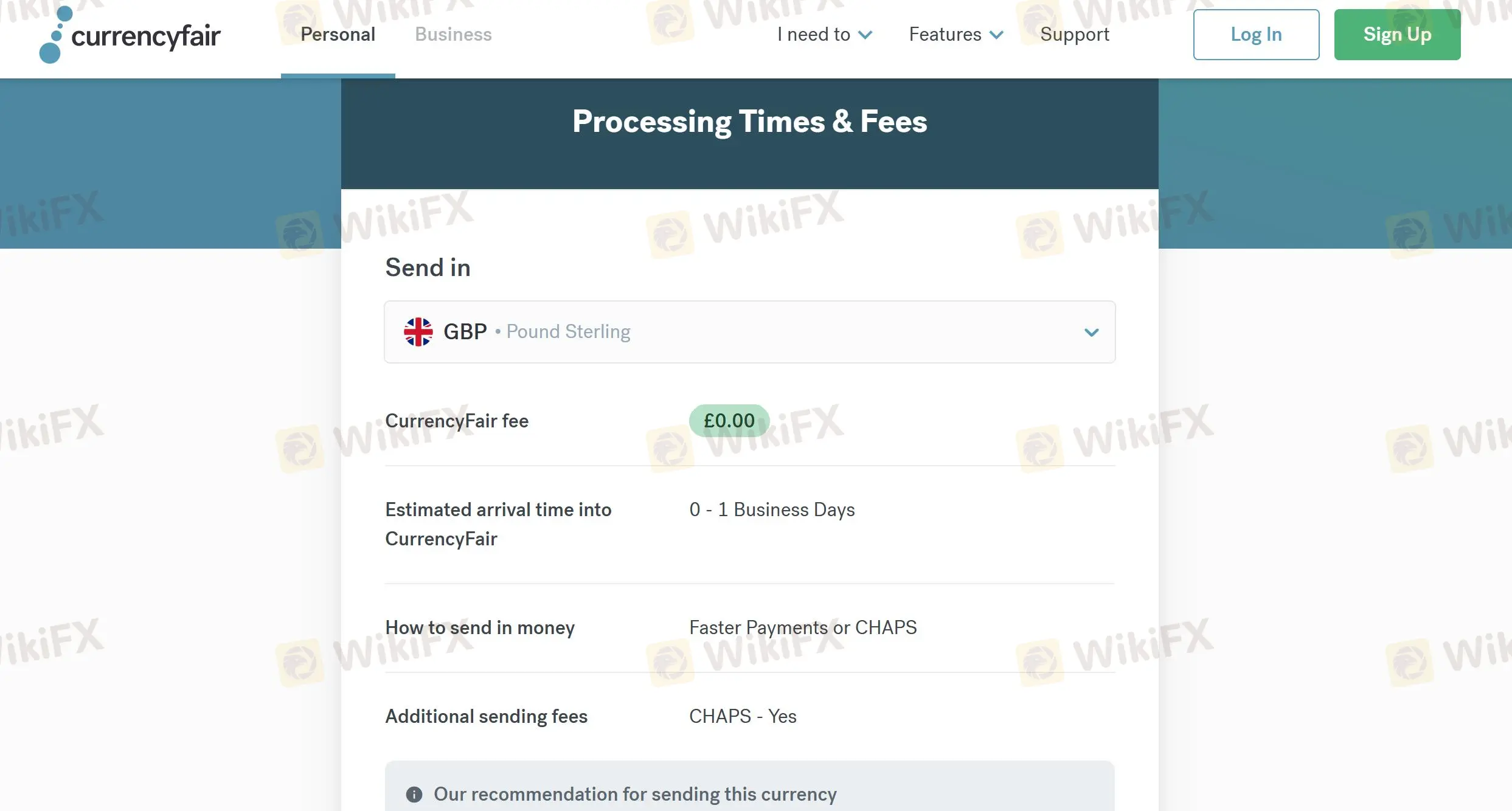

Tiempo y Tarifas de Procesamiento

| Enviar in | Tarifas | Opciones | Tiempo |

| GBP | ❌ | Pagos más rápidos o CHAPS | 0-1 días hábiles |

| EUR | ❌ | Transferencia de Crédito SEPA | 1-2 días hábiles |

| USD | ❌ | Transferencia bancaria | 1-2 días hábiles |

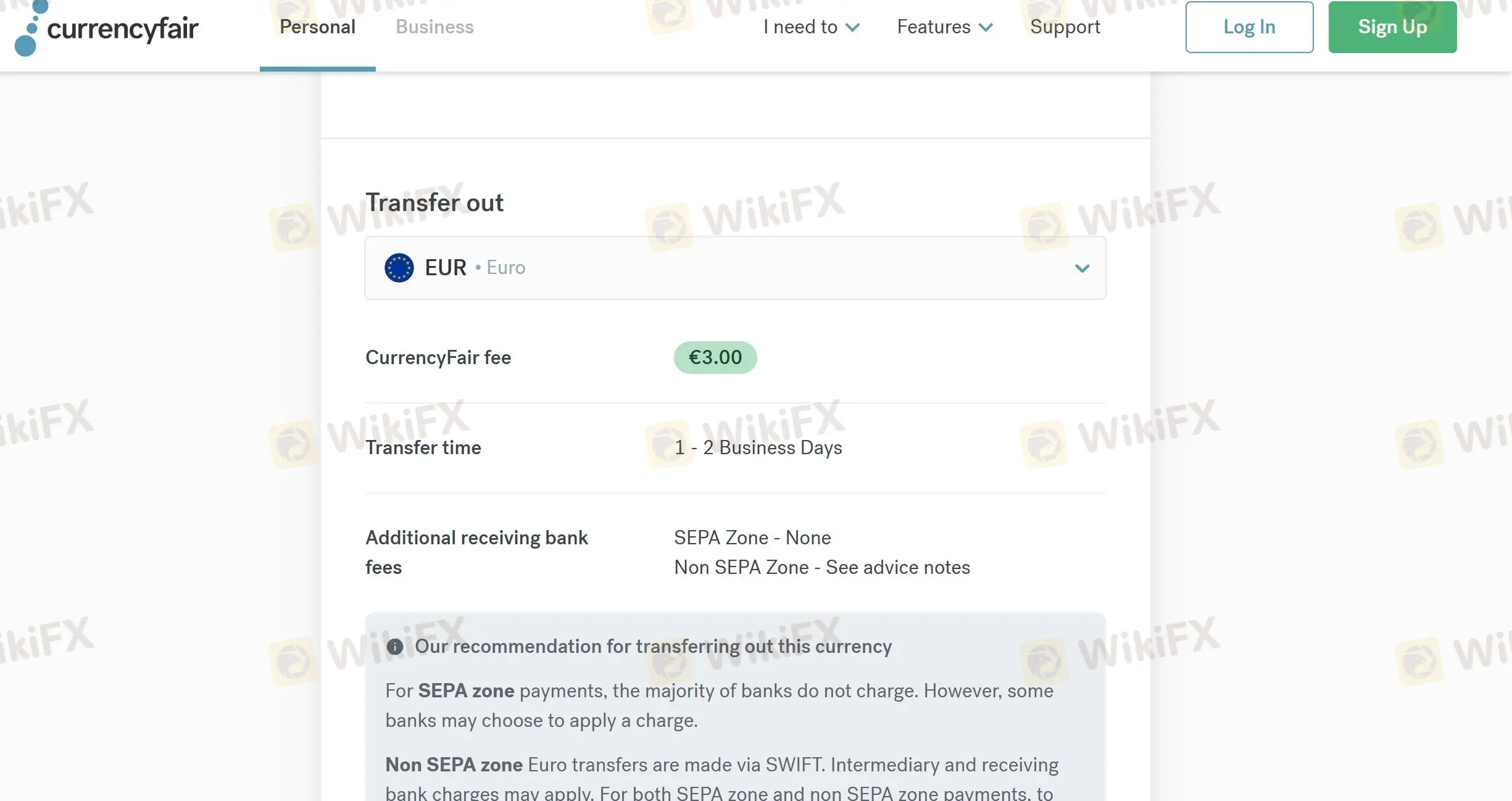

| Transferencia out | Tarifas | Tiempo |

| EUR | 3.00 EUR | 1 a 2 días hábiles |

| GBP | 2.5 GBP | 0 a 1 día hábil |

| USD | 4.00 USD | 1 día hábil |

FX1240839140

Nueva Zelanda

Al enviar dinero al extranjero, ¡las tarifas en los bancos son realmente altas! Afortunadamente cuento con currencyfair, lo que me permite hacer transferencias rápidamente y ahorrar dinero. Sé que la seguridad será la preocupación de muchos, ¡pero la moneda justa es segura!

Positivo

程安 -陶

Argentina

Hasta ahora, creo que currencyfair es una gran empresa, lo que facilita mucho mi trabajo, ¡porque a menudo necesito hacer transferencias transfronterizas!

Positivo

ONE I LOVE

Hong Kong

Su atención al cliente es excelente y esta plataforma es fácil de usar. He estado usando estos servicios durante más de un año y no he encontrado ningún problema o problema. Recomiendo esta empresa si tiene alguna necesidad de este tipo de servicios.

Neutral

你好99363

Hong Kong

CurrencyFair ofrece tasas competitivas mejores que los bancos. Recuerdo una vez que usé esta compañía para enviar mi dinero de Estados Unidos a Australia, pero sucedió algo terrible y resultó que el banco intermediario de CurrencyFair cometió un error. Aunque esta empresa afirma que la mayoría de sus transferencias internacionales se completan en 24 horas, mientras que depende de tu suerte, ¿ves?

Neutral