Описание компании

| CurrencyFair Обзор | |

| Основан | 2008 |

| Страна/регион регистрации | Австралия |

| Регулирование | ASIC |

| Услуга | Перевод денег |

| Платформа | Мобильное приложение |

| Поддержка клиентов | Форма обратной связи |

| Ирландия: Colm House, 91 Pembroke Road, Ballsbridge, Dublin 4; +353 (0) 1 526 8411 (9am - 5pm Dublin/London time Monday - Friday) | |

| Великобритания: No. 1 Poultry, London ECR2 8EJ; +44 (0) 203 3089353 (9 AM-5 PM Monday-Friday) | |

| Сингапур: 15 Beach Road, 2nd Floor, Singapore 189677; +65 (0) 3165 0282 (5 PM - 1 AM Monday–Saturday) | |

| Гонконг: Office 12100, 12/F, YF Tower, 33 Lockhart Road, Wan Chai, Hong Kong; +852 5803 2611 (5pm - 1am Monday - Saturday) | |

| Австралия: Suite 26-109, 161 Castlereagh Street Sydney, NSW, 2000; +61 (0) 282 798 642 (8 PM - 4 AM Monday-Saturday) | |

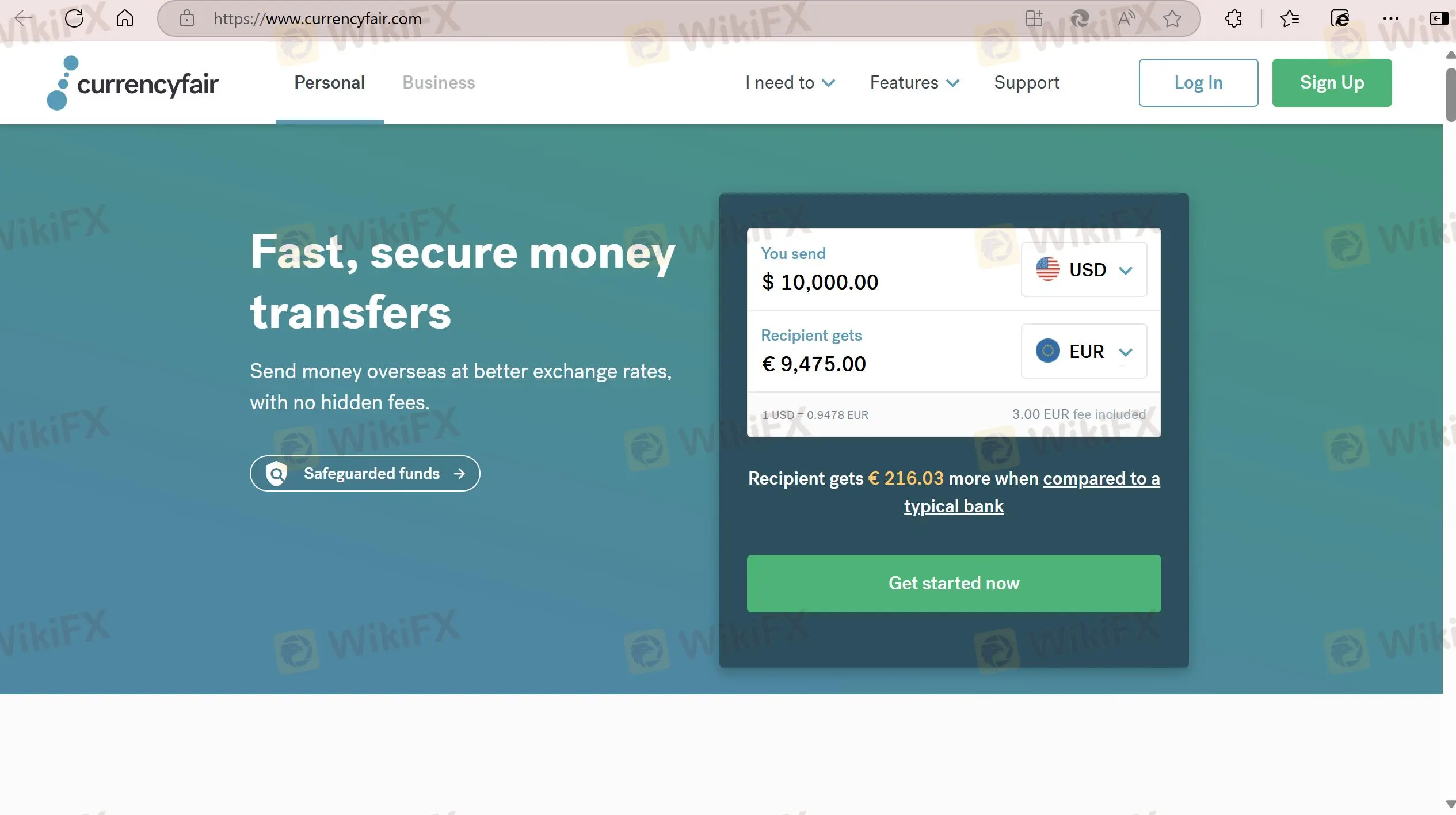

CurrencyFair была зарегистрирована в 2008 году в Австралии. На ее платформе клиенты могут отправлять деньги за границу. Кроме того, у этой компании длительное время работы и она регулируется в Австралии.

Плюсы и минусы

| Плюсы | Минусы |

| Длительное время работы | Отсутствие онлайн-чата в поддержке |

| Хорошо регулируется | |

| Прозрачная структура комиссий |

Является ли CurrencyFair законным?

Да, CurrencyFair регулируется Комиссией по ценным бумагам и инвестициям Австралии (ASIC).

| Страна регулирования | Регулирующий орган | Текущий статус | Страна регулирования | Тип лицензии | Номер лицензии |

| Комиссия по ценным бумагам и инвестициям Австралии (ASIC) | Регулируется | Австралия | Рыночное образование (MM) | 402709 |

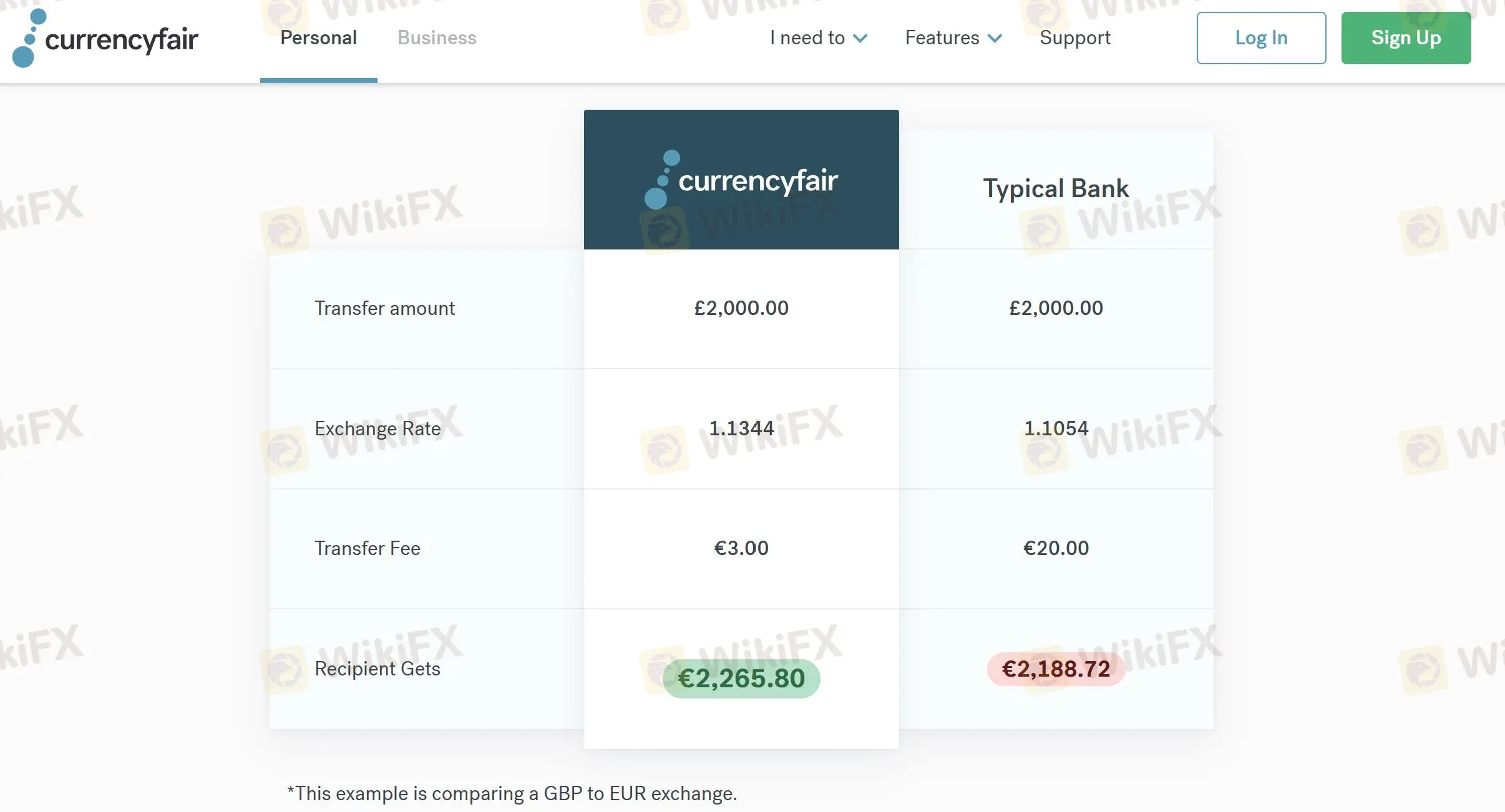

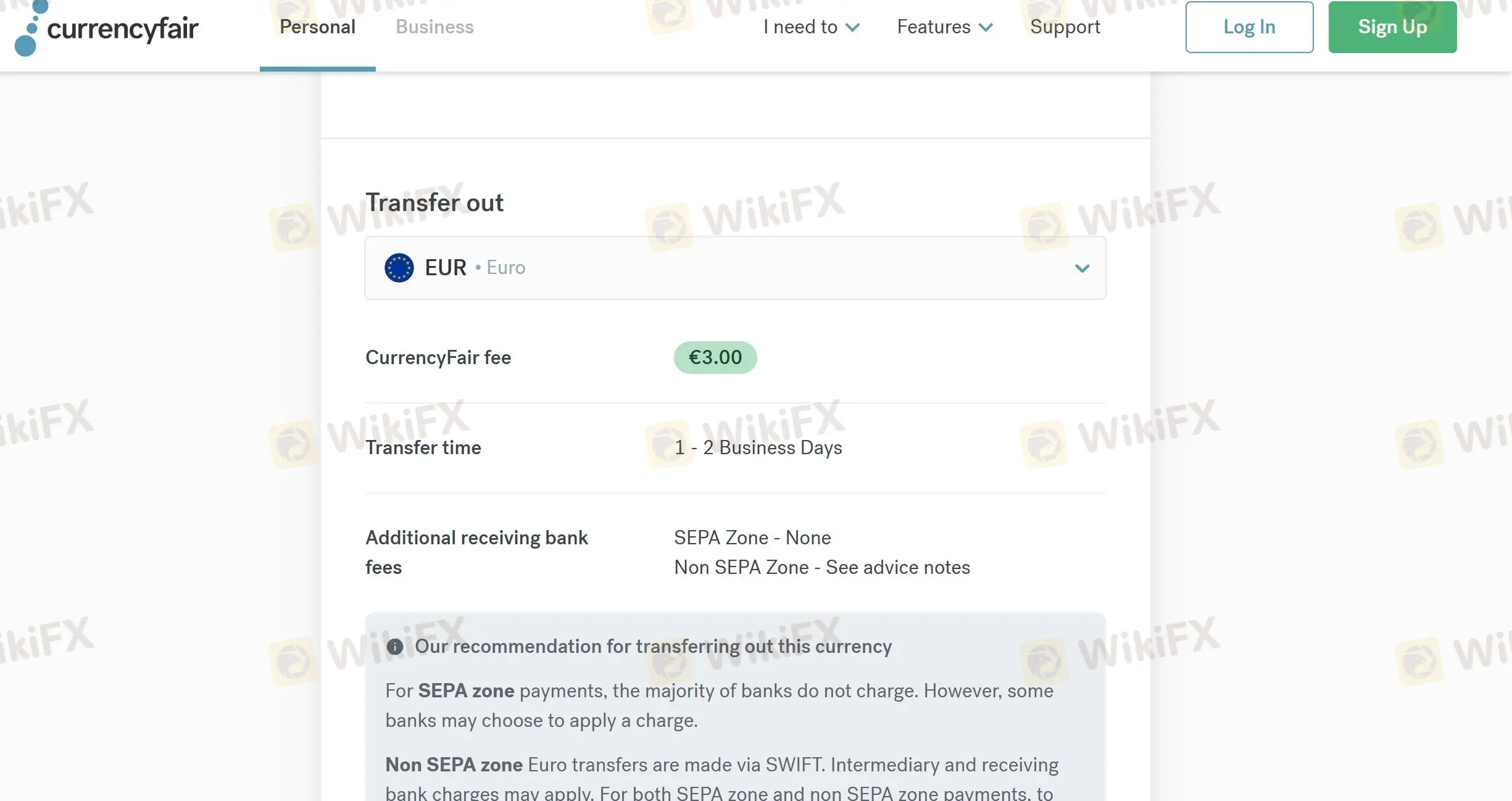

Сборы CurrencyFair

| Сумма перевода | Обменный курс | Комиссия за перевод | Получает получатель |

| 2,000.00 GBP | 1.1344 | 3.00 EUR | 2,265.80 EUR |

Платформа

| Платформа | Поддерживается | Доступные устройства |

| Мобильное приложение | ✔ | iOS, Android |

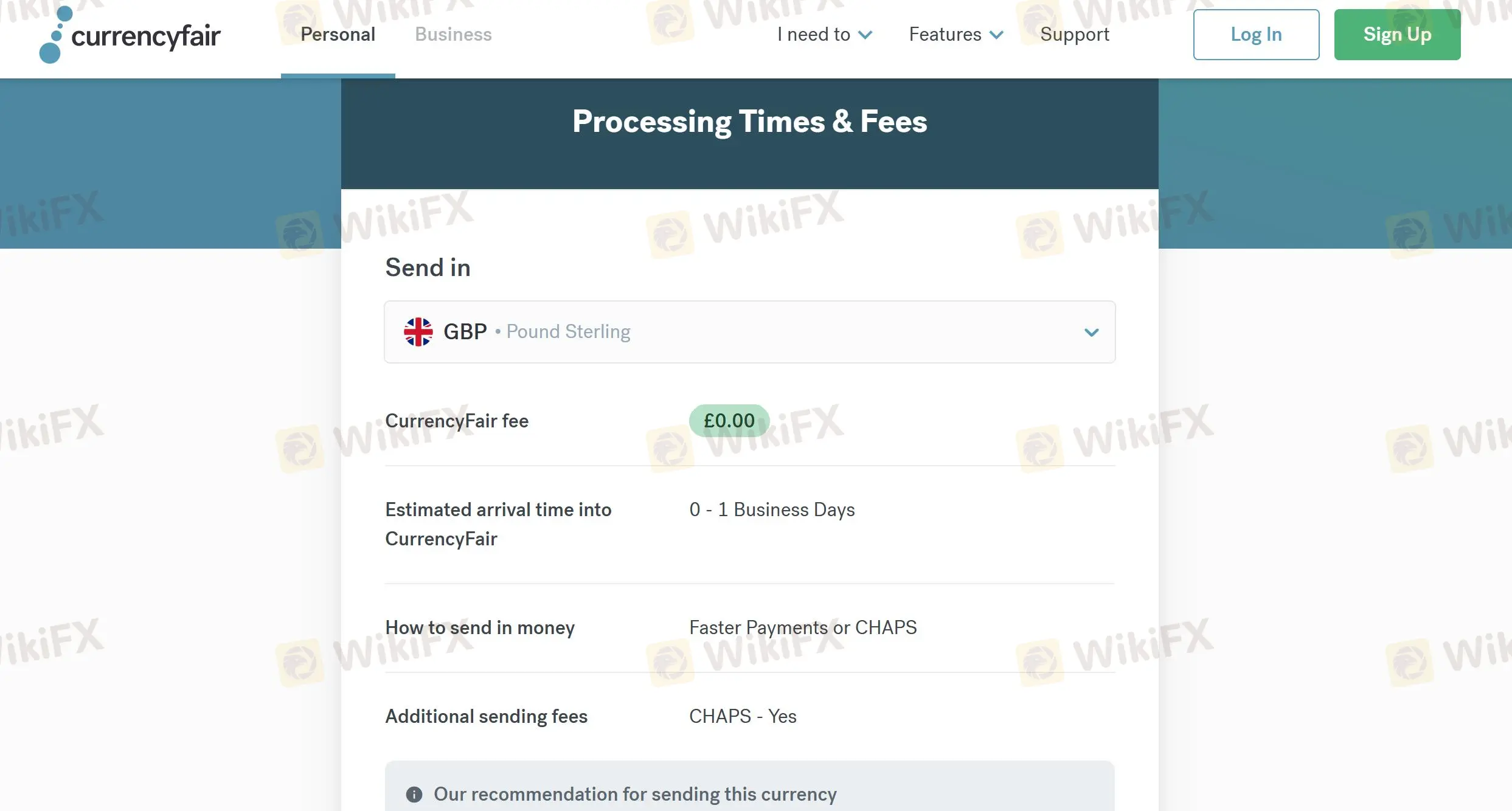

Время обработки и комиссии

| Отправить | Комиссия | Варианты | Время |

| GBP | ❌ | Быстрые платежи или CHAPS | 0-1 рабочий день |

| EUR | ❌ | SEPA Credit Transfer | 1-2 рабочих дня |

| USD | ❌ | Банковский перевод | 1-2 рабочих дня |

| Перевод | Комиссия | Время |

| EUR | 3.00 EUR | 1-2 рабочих дня |

| GBP | 2.5 GBP | 0-1 рабочий день |

| USD | 4.00 USD | 1 рабочий день |

FX1240839140

Новая Зеландия

При отправке денег за границу комиссия в банках очень высока! К счастью, у меня есть currencyfair, что позволяет мне быстро совершать переводы и экономить деньги. Я знаю, что безопасность будет заботой многих, но currencyfair безопасна!

Хорошие

程安 -陶

Аргентина

На данный момент я считаю, что currencyfair — отличная компания, которая значительно облегчает мою работу, потому что мне часто приходится совершать трансграничные переводы!

Хорошие

ONE I LOVE

Гонконг

У них отличная поддержка клиентов, и эта платформа проста в использовании. Пользуюсь этим сервисом уже не один год, и не сталкивался ни с какими проблемами или проблемами. Рекомендую эту компанию, если у вас есть потребность в такого рода услугах.

Нейтральный

你好99363

Гонконг

CurrencyFair предлагает конкурентоспособные ставки лучше, чем банки. Я вспомнил, как однажды использовал эту компанию, чтобы отправить свои деньги из Америки в Австралию, но случилось что-то ужасное, и оказалось, что это банк-посредник CurrencyFair допустил ошибку. Хотя эта компания утверждает, что большинство ее международных переводов выполняется в течение 24 часов, это зависит от вашей удачи, понимаете?

Нейтральный