Perfil de la compañía

| HUNGSING Resumen de la revisión | |

| Fundada | 1999 |

| País/Región Registrada | Hong Kong |

| Regulación | SFC (excedida, revocada) |

| Servicios | Financiamiento de Deuda, Productos de Inversión, Gestión de Activos, Suscripción a IPO, etc. |

| Cuenta Demo | ❌ |

| Plataforma de Trading | Hongsheng Securities (versión web y móvil) |

| Depósito Mínimo | / |

| Soporte al Cliente | Formulario de contacto |

| Teléfono: (852) 3589 1623 | |

| Email: settlement@hungsing.org | |

| Horario de Oficina: Lunes a Viernes de 9:00 a.m. a 6:00 p.m.Cerrado los Sábados, Domingos y días festivos | |

| Sala 2505, Piso 25, Torre Oeste, Centro Shun Tak, 200 Connaught Road Central, Sheung Wan, Hong KongDirección: | |

HUNGSING es una firma financiera fundada en 1999 y registrada en Hong Kong. Ofrece varios servicios: financiamiento de deuda, productos de inversión, gestión de activos y suscripción a IPO. La firma proporciona la plataforma de Hongsheng Securities, disponible en versiones web y móvil. Sin embargo, su licencia para operar en valores ha sido excedida, y su licencia para operar en contratos de futuros ha sido revocada por la Comisión de Valores y Futuros (SFC).

Pros y Contras

| Pros | Contras |

| Servicios diversos | Licencias excedidas y revocadas |

| Múltiples canales de soporte al cliente | Información limitada sobre cuentas |

| Información limitada sobre tarifas de trading | |

| Sin cuenta demo |

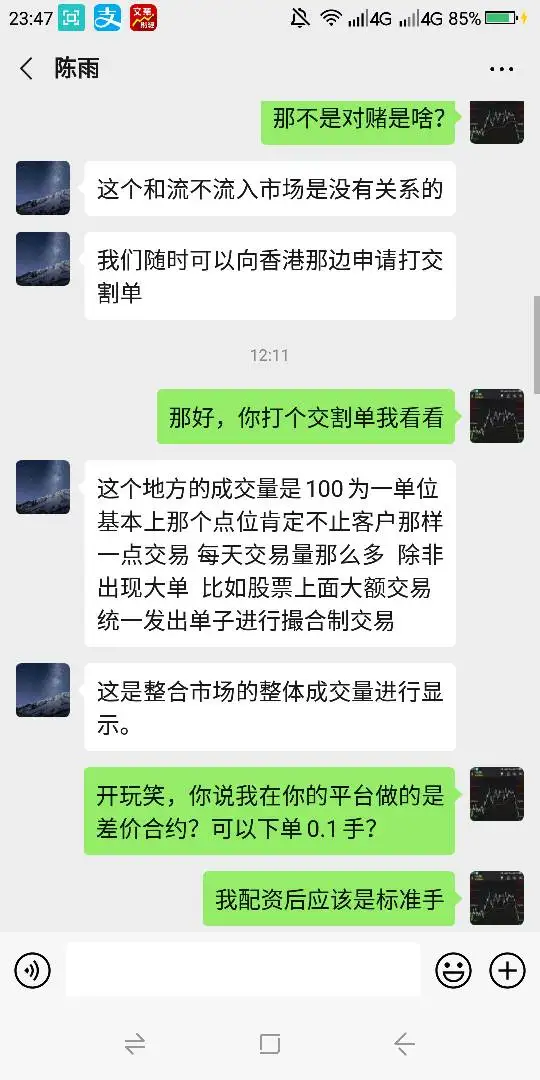

¿Es HUNGSING Legítimo?

Actualmente, HUNGSING solo posee una licencia excedida para operar en contratos de futuros de la Comisión de Valores y Futuros (SFC). Su licencia de negociación de valores ha sido revocada. Le recomendamos buscar servicios de otras empresas reguladas.

| País Regulado | Autoridad Reguladora | Entidad Regulada | Estado Actual | Tipo de Licencia | Número de Licencia |

| La Comisión de Valores y Futuros (SFC) | Hung Sing Futures Limited | Revocada | Operación en contratos de futuros | AFC168 |

| La Comisión de Valores y Futuros (SFC) | Hung Sing Securities Limited | Excedida | Operación en valores | ABS697 |

HUNGSING ofrece a los clientes diversos servicios financieros como Financiamiento de Deudas, Productos de Inversión, Gestión de Activos, Suscripción a OPI, etc.

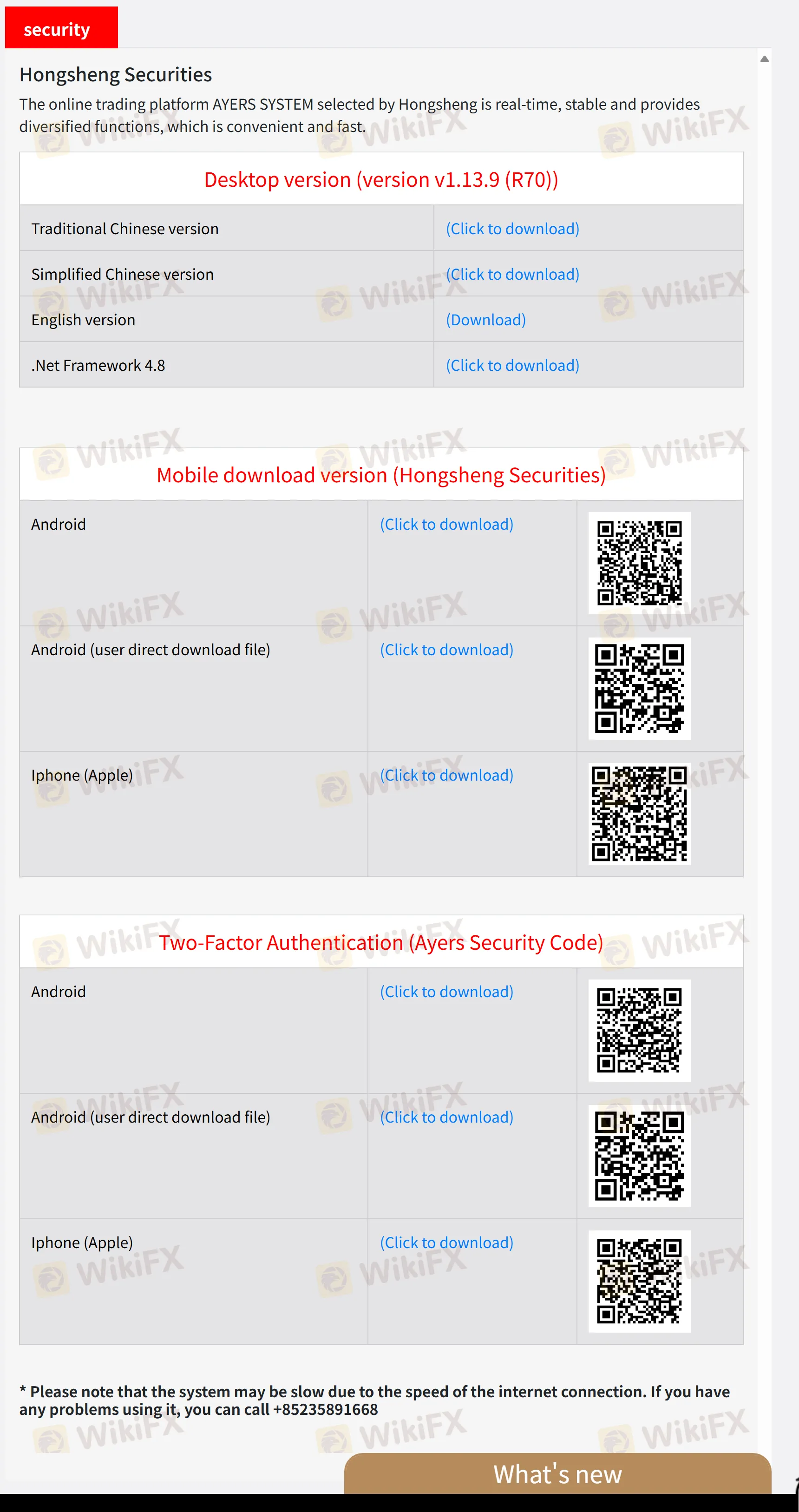

Plataforma de Trading

| Plataforma de Trading | Compatible | Dispositivos Disponibles |

| Hongsheng Securities | ✔ | Web, móvil |