Profil perusahaan

| CurrencyFair Ringkasan Ulasan | |

| Didirikan | 2008 |

| Negara/Daerah Terdaftar | Australia |

| Regulasi | ASIC |

| Layanan | Transfer uang |

| Platform | Aplikasi Mobile |

| Dukungan Pelanggan | Formulir kontak |

| Irlandia: Colm House, 91 Pembroke Road, Ballsbridge, Dublin 4; +353 (0) 1 526 8411 (9 pagi - 5 sore waktu Dublin/London Senin - Jumat) | |

| Inggris: No. 1 Poultry, London ECR2 8EJ; +44 (0) 203 3089353 (9 AM-5 PM Senin-Jumat) | |

| Singapura: 15 Beach Road, Lantai 2, Singapura 189677; +65 (0) 3165 0282 (5 PM - 1 AM Senin–Sabtu) | |

| Hong Kong: Office 12100, Lantai 12, YF Tower, 33 Lockhart Road, Wan Chai, Hong Kong; +852 5803 2611 (5 sore - 1 pagi Senin - Sabtu) | |

| Australia: Suite 26-109, 161 Castlereagh Street Sydney, NSW, 2000; +61 (0) 282 798 642 (8 malam - 4 pagi Senin-Sabtu) | |

CurrencyFair terdaftar pada tahun 2008 di Australia. Di platformnya, pelanggan dapat mengirim uang ke luar negeri. Selain itu, perusahaan ini memiliki waktu operasi yang lama dan diatur di Australia.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Waktu operasi yang lama | Tidak ada dukungan obrolan langsung |

| Diatur dengan baik | |

| Struktur biaya yang transparan |

Apakah CurrencyFair Legal?

Ya, CurrencyFair diatur oleh Australia Securities and Investment Commission (ASIC).

| Negara yang Diatur | Otoritas yang Diatur | Status Saat Ini | Negara yang Diatur | Tipe Lisensi | Nomor Lisensi |

| Australia Securities and Investment Commission (ASIC) | Diatur | Australia | Market Making (MM) | 402709 |

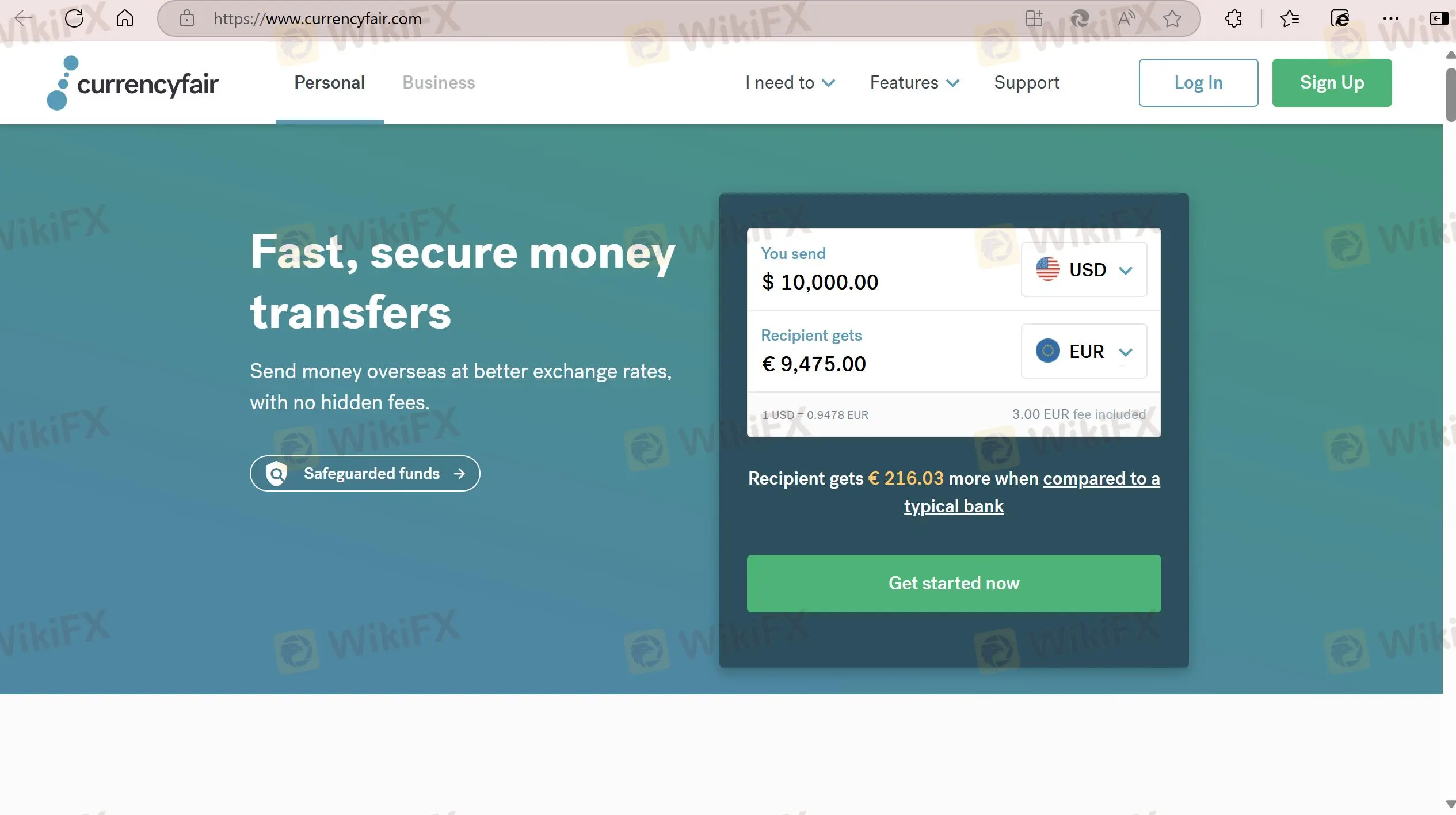

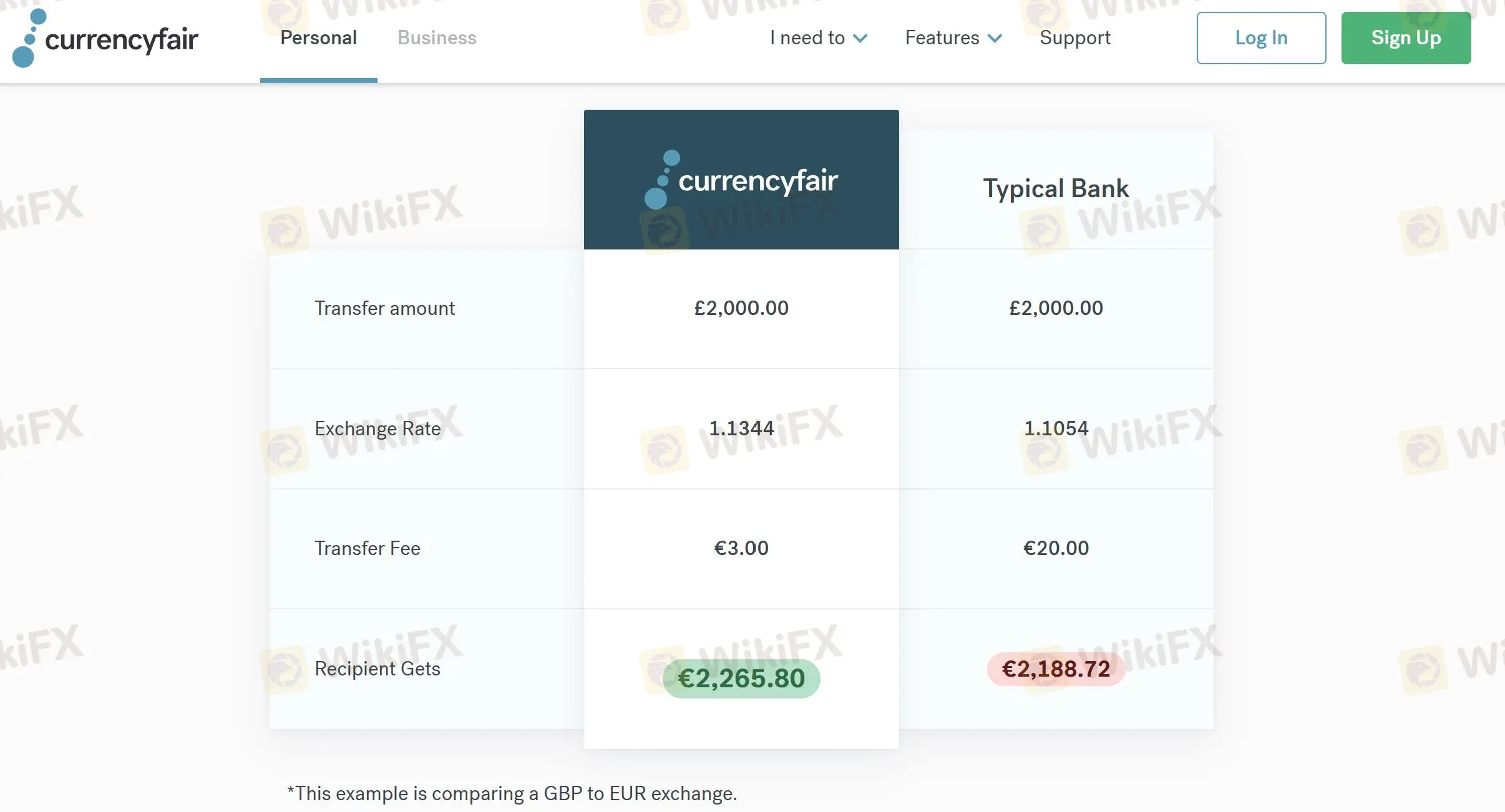

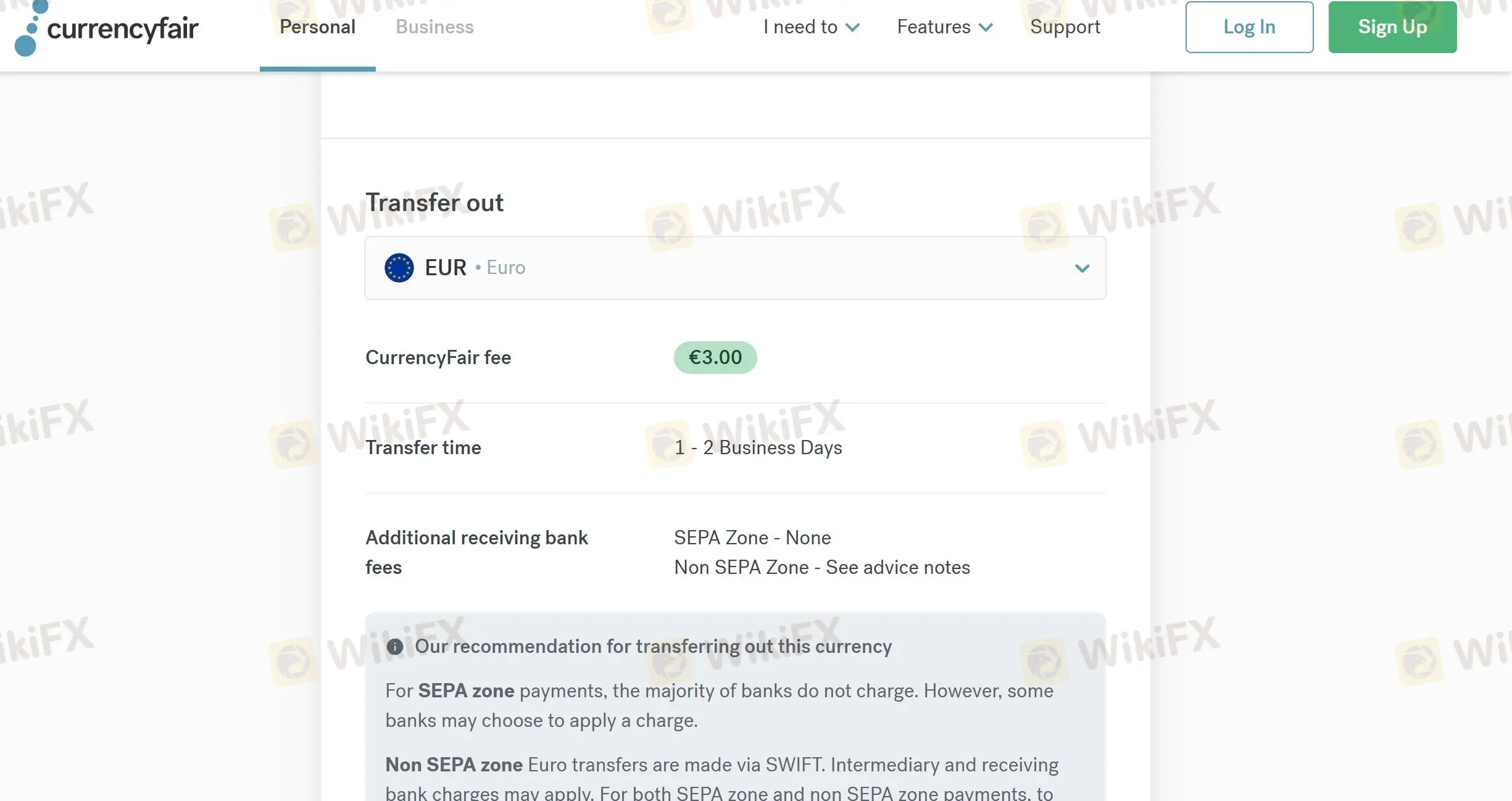

Biaya CurrencyFair

| Jumlah Transfer | Kurs | Biaya Transfer | Penerima Mendapatkan |

| 2,000.00 GBP | 1.1344 | 3.00 EUR | 2,265.80 EUR |

Platform

| Platform | Didukung | Perangkat yang Tersedia |

| Aplikasi Seluler | ✔ | iOS, Android |

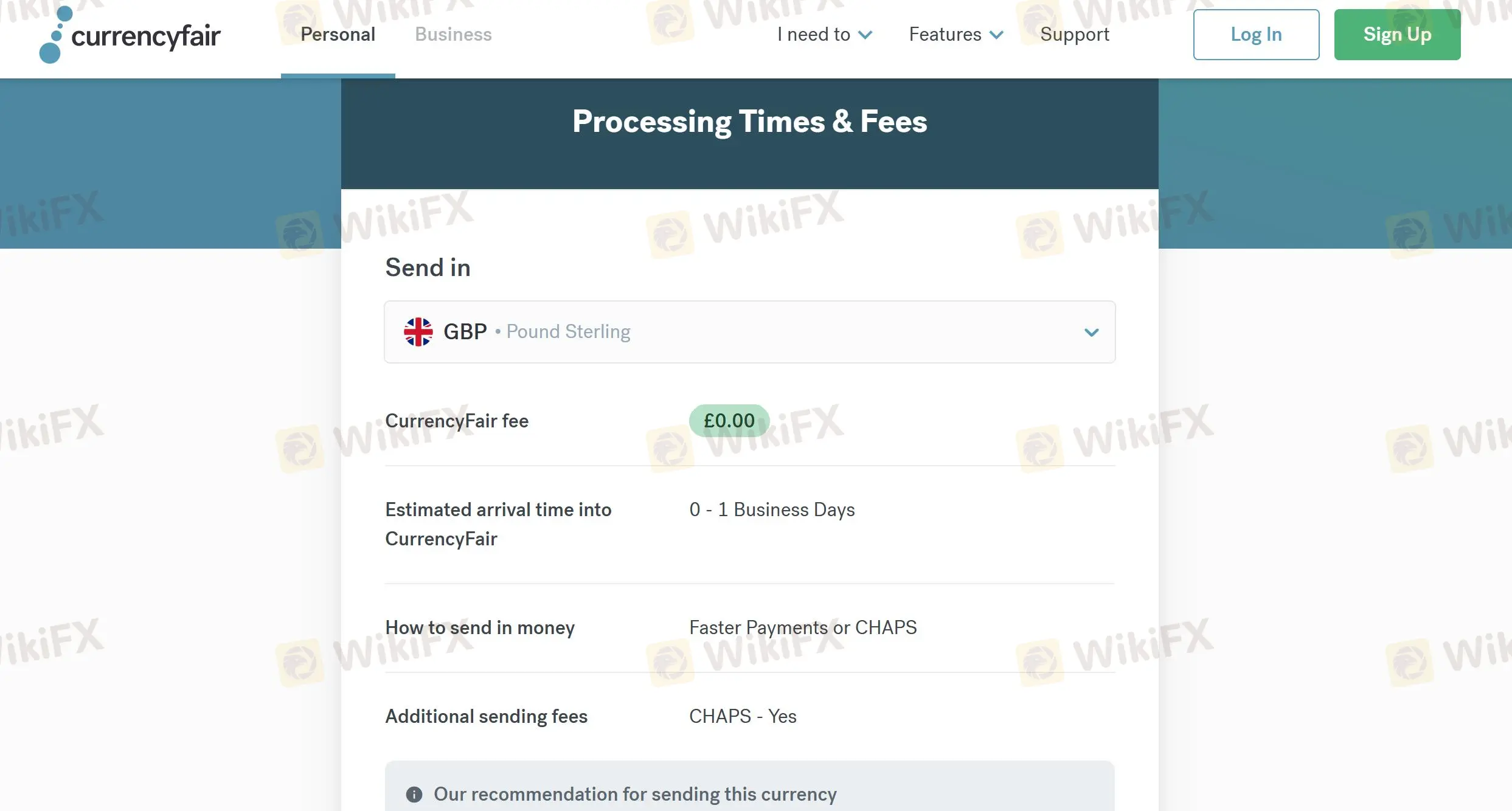

Waktu dan Biaya Pengolahan

| Kirim masuk | Biaya | Opsi | Waktu |

| GBP | ❌ | Pembayaran lebih cepat atau CHAPS | 0-1 hari kerja |

| EUR | ❌ | Transfer Kredit SEPA | 1-2 hari kerja |

| USD | ❌ | Transfer bank | 1-2 hari kerja |

| Transfer keluar | Biaya | Waktu |

| EUR | 3.00 EUR | 1 hingga 2 hari kerja |

| GBP | 2.5 GBP | 0 hingga 1 hari kerja |

| USD | 4.00 USD | 1 hari kerja |

FX1240839140

Selandia Baru

Saat mengirim uang ke luar negeri, biaya di bank sangat tinggi! Untungnya saya memiliki currencyfair, yang memungkinkan saya melakukan transfer dengan cepat dan menghemat uang. Saya tahu keamanan akan menjadi perhatian banyak orang, tetapi currencyfair aman!

Baik

程安 -陶

Argentina

Sejauh ini, menurut saya currencyfair adalah perusahaan yang hebat, yang membuat pekerjaan saya jauh lebih mudah, karena saya sering harus melakukan transfer lintas batas!

Baik

ONE I LOVE

Hong Kong

Dukungan pelanggan mereka sangat baik, dan platform ini mudah digunakan. Saya telah menggunakan layanan ini selama lebih dari satu tahun, dan saya tidak mengalami masalah atau masalah apa pun. Saya merekomendasikan perusahaan ini jika Anda membutuhkan layanan semacam ini.

ulasan netral

你好99363

Hong Kong

CurrencyFair memang menawarkan tarif kompetitif lebih baik daripada bank. Saya ingat pernah menggunakan perusahaan ini untuk mengirim uang saya dari Amerika ke Australia, tetapi sesuatu yang buruk terjadi, dan ternyata bank perantara CurrencyFair melakukan kesalahan. Meskipun perusahaan ini mengklaim bahwa sebagian besar transfer internasionalnya selesai dalam 24 jam, sementara itu tergantung pada keberuntungan Anda, bukan?

ulasan netral