Présentation de l'entreprise

| CurrencyFair Résumé de l'examen | |

| Fondé | 2008 |

| Pays/Région enregistré(e) | Australie |

| Réglementation | ASIC |

| Service | Transfert d'argent |

| Plateforme | Application mobile |

| Assistance clientèle | Formulaire de contact |

| Irlande: Colm House, 91 Pembroke Road, Ballsbridge, Dublin 4; +353 (0) 1 526 8411 (9h - 17h heure de Dublin/Londres du lundi au vendredi) | |

| Royaume-Uni: No. 1 Poultry, London ECR2 8EJ; +44 (0) 203 3089353 (9h - 17h du lundi au vendredi) | |

| Singapour: 15 Beach Road, 2nd Floor, Singapore 189677; +65 (0) 3165 0282 (17h - 1h du matin du lundi au samedi) | |

| Hong Kong: Office 12100, 12/F, YF Tower, 33 Lockhart Road, Wan Chai, Hong Kong; +852 5803 2611 (17h - 1h du matin du lundi au samedi) | |

| Australie: Suite 26-109, 161 Castlereagh Street Sydney, NSW, 2000; +61 (0) 282 798 642 (20h - 4h du matin du lundi au samedi) | |

CurrencyFair a été enregistré en 2008 en Australie. Sur sa plateforme, les clients peuvent envoyer de l'argent à l'étranger. De plus, cette entreprise a une longue durée d'exploitation et est réglementée en Australie.

Avantages et inconvénients

| Avantages | Inconvénients |

| Longue durée d'exploitation | Pas de support de chat en direct |

| Bien réglementé | |

| Structure de frais transparente |

CurrencyFair est-il légitime?

Oui, CurrencyFair est réglementé par la Commission australienne des valeurs mobilières et des investissements (ASIC).

| Pays réglementé | Autorité réglementée | Statut actuel | Pays réglementé | Type de licence | Numéro de licence |

| Commission australienne des valeurs mobilières et des investissements (ASIC) | Réglementé | Australie | Market Making (MM) | 402709 |

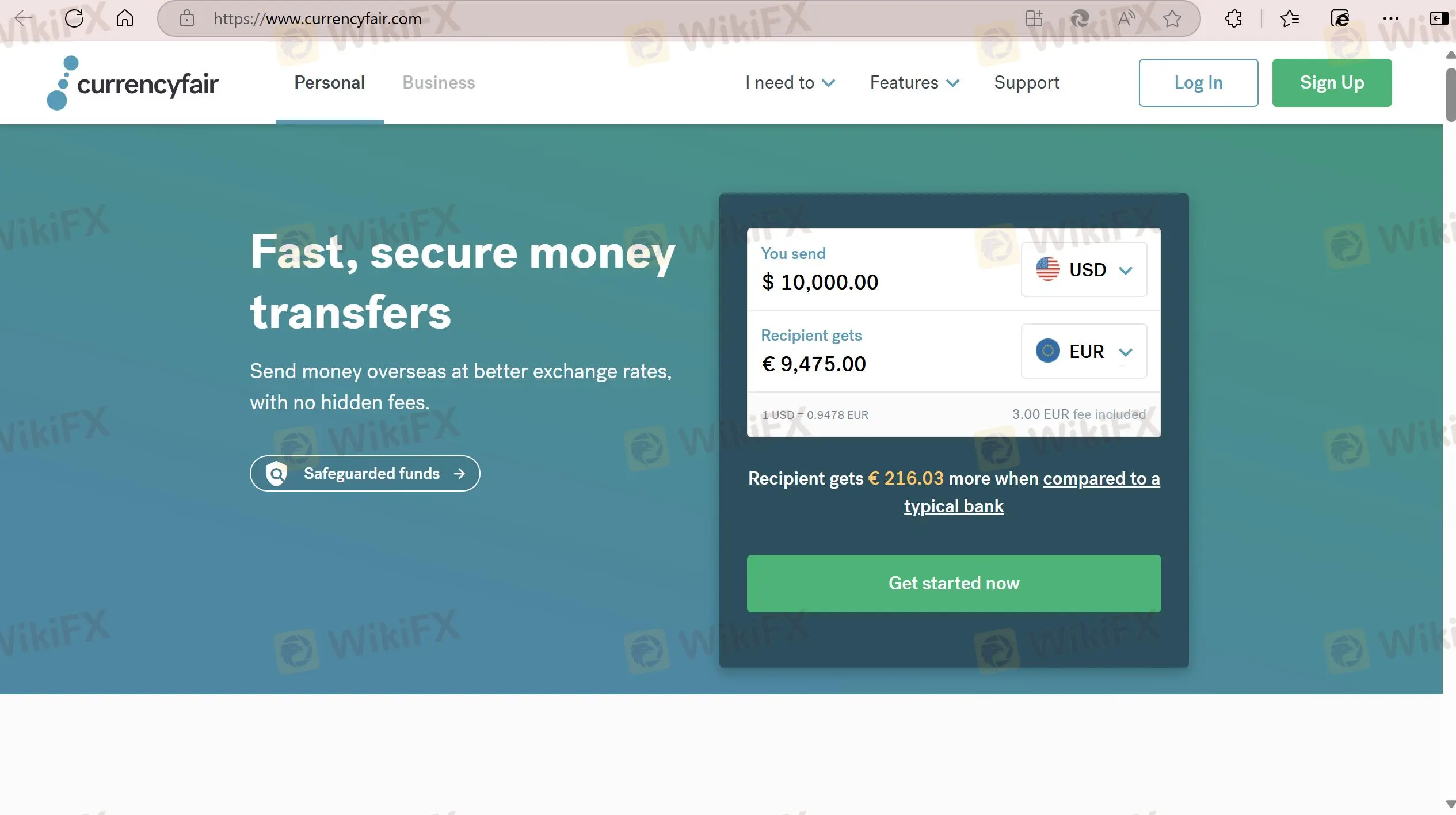

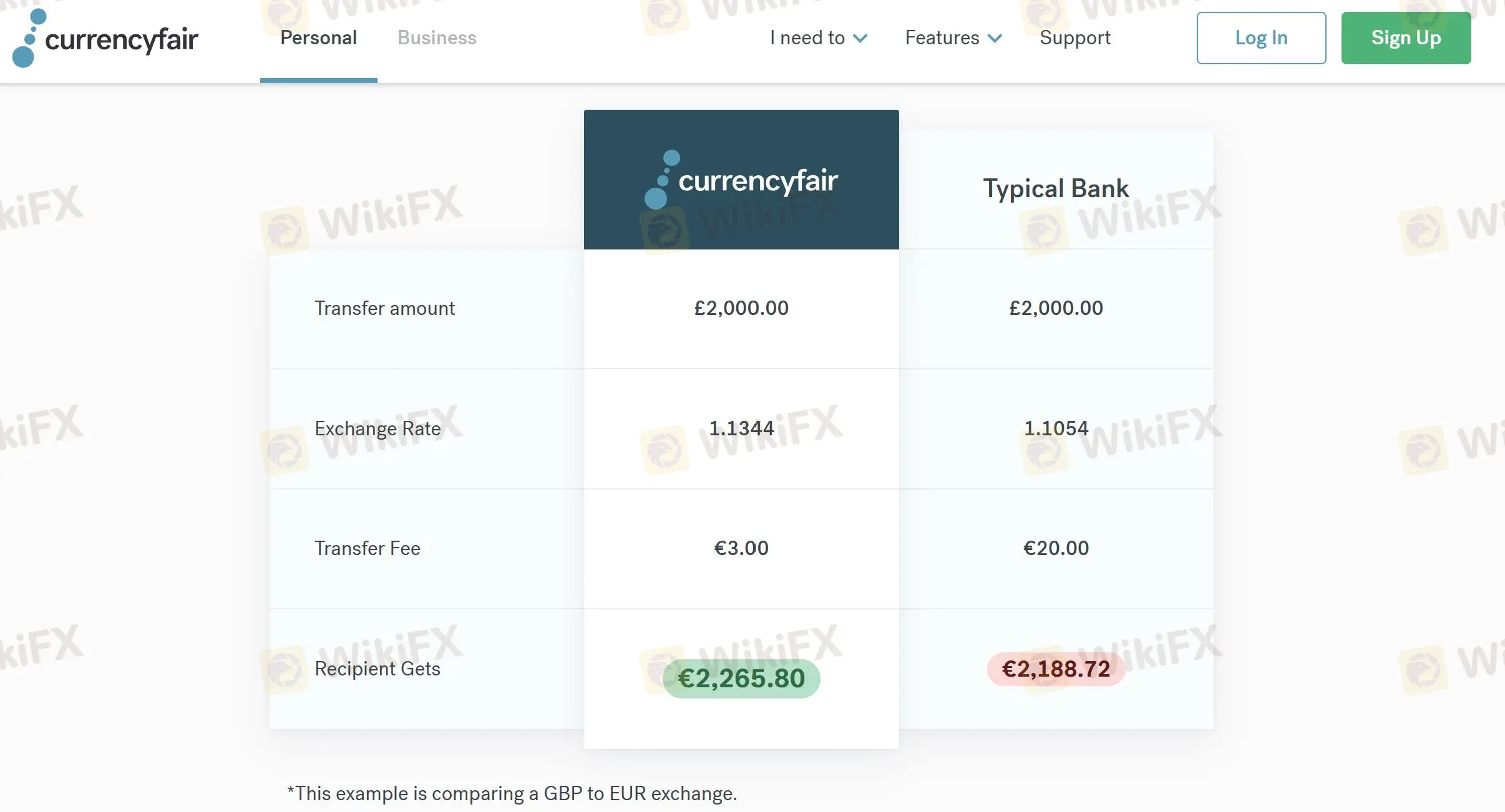

Frais CurrencyFair

| Montant du transfert | Taux de change | Frais de transfert | Bénéficiaire reçoit |

| 2,000.00 GBP | 1.1344 | 3.00 EUR | 2,265.80 EUR |

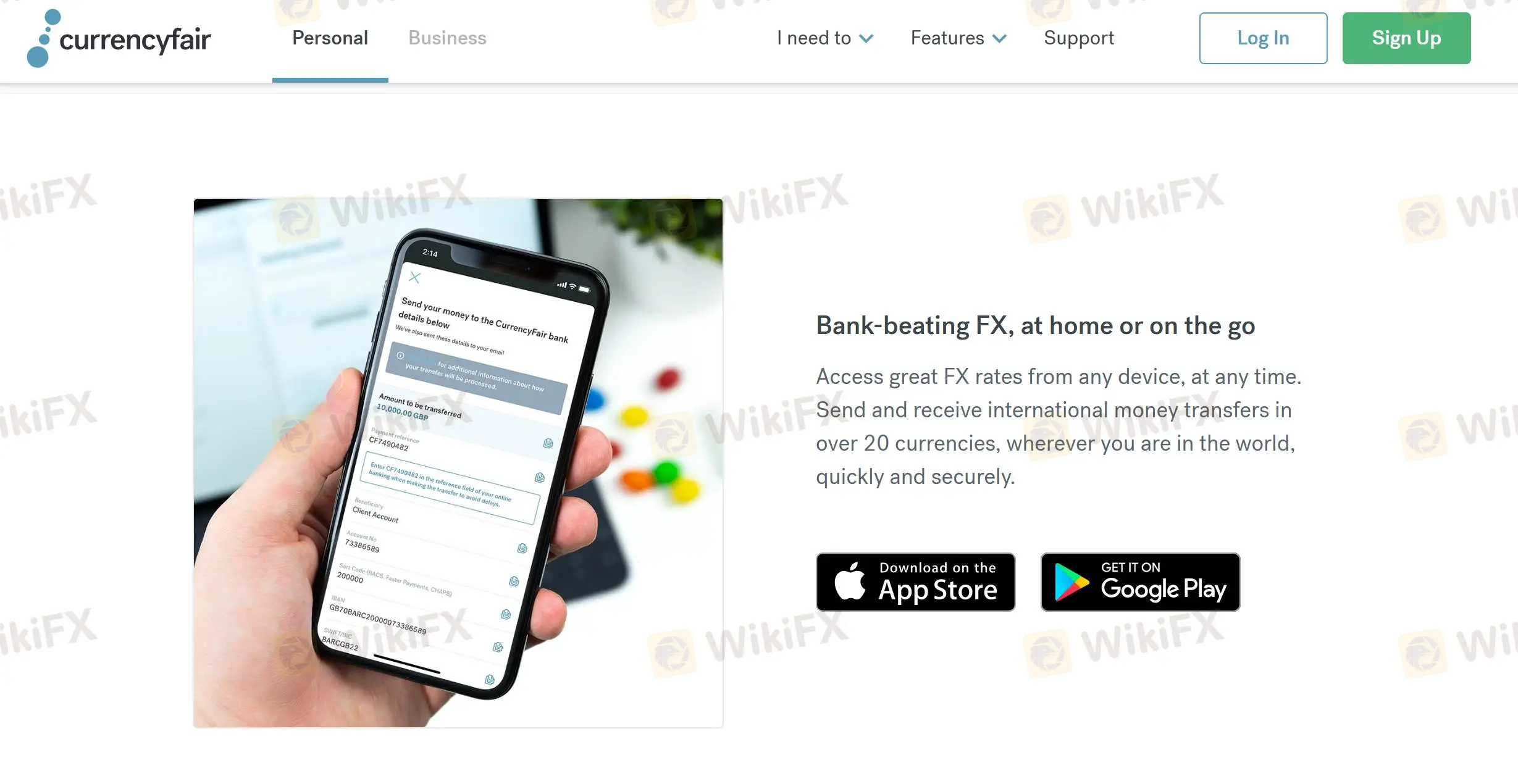

Plateforme

| Plateforme | Pris en charge | Appareils disponibles |

| Application mobile | ✔ | iOS, Android |

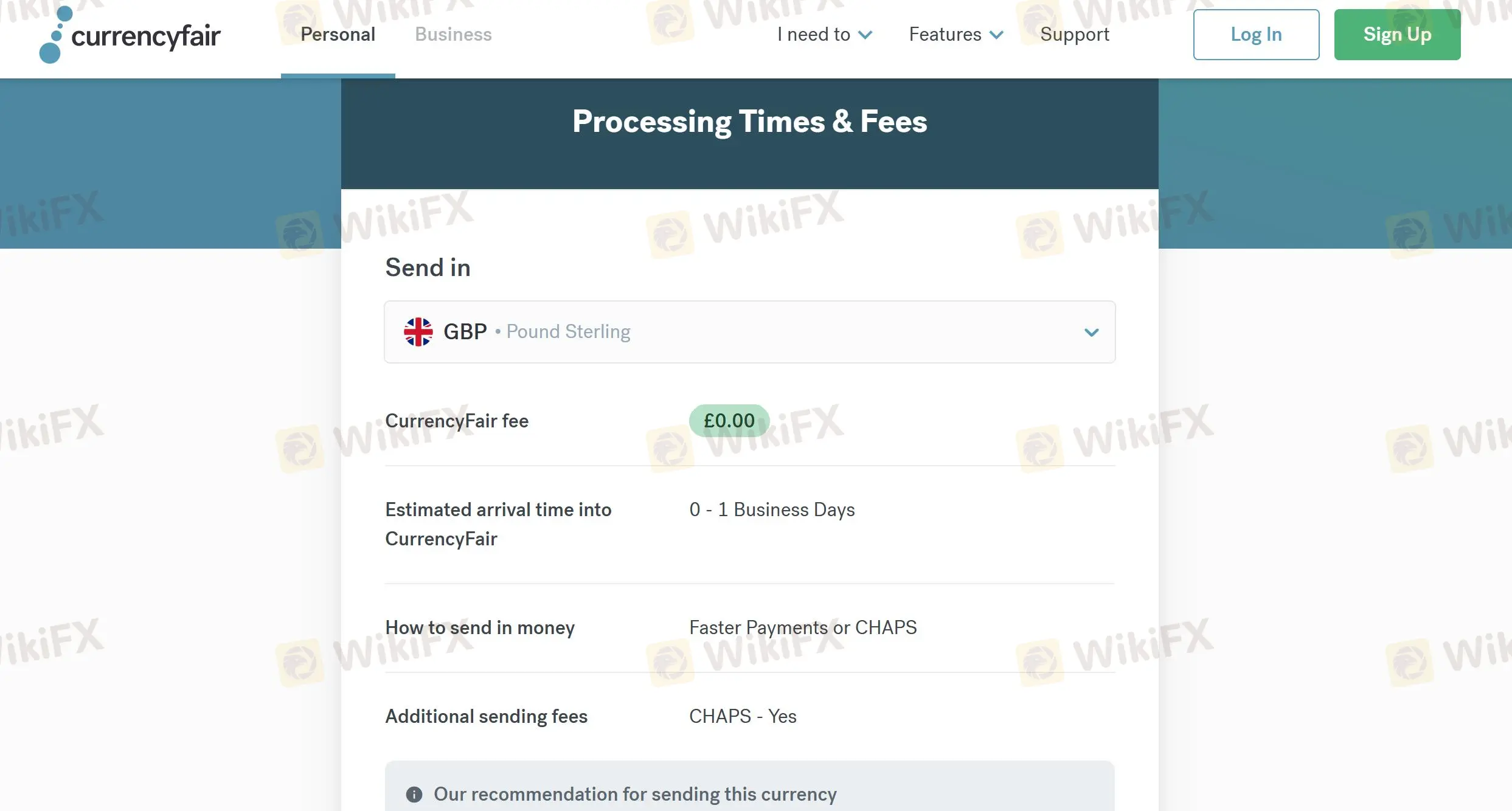

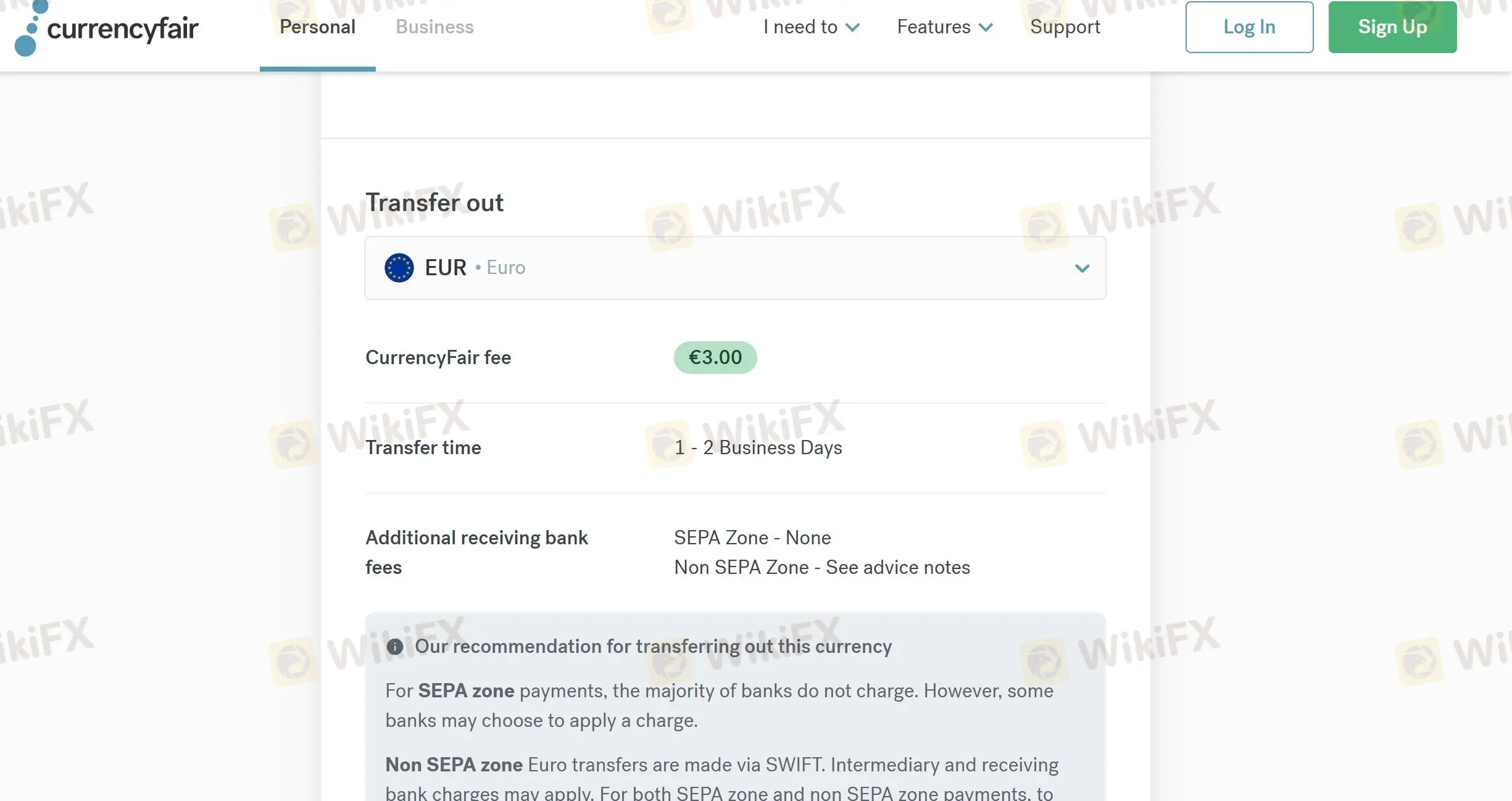

Temps de traitement et frais

| Envoyer | Frais | Options | Temps |

| GBP | ❌ | Paiements plus rapides ou CHAPS | 0 à 1 jour ouvrable |

| EUR | ❌ | Virement SEPA | 1 à 2 jours ouvrables |

| USD | ❌ | Virement bancaire | 1 à 2 jours ouvrables |

| Transfert sortant | Frais | Temps |

| EUR | 3.00 EUR | 1 à 2 jours ouvrables |

| GBP | 2.5 GBP | 0 à 1 jour ouvrable |

| USD | 4.00 USD | 1 jour ouvrable |

FX1240839140

Nouvelle Zélande

Lorsque vous envoyez de l'argent à l'étranger, les frais bancaires sont très élevés ! Heureusement, j'ai currencyfair, ce qui me permet d'effectuer des virements rapidement et d'économiser de l'argent. Je sais que la sécurité sera la préoccupation de beaucoup, mais currencyfair est sûr !

Positifs

程安 -陶

L'Argentine

Jusqu'à présent, je pense que currencyfair est une excellente entreprise, ce qui facilite grandement mon travail, car je dois souvent effectuer des virements transfrontaliers !

Positifs

ONE I LOVE

Hong Kong

Leur support client est excellent et cette plateforme est facile à utiliser. J'utilise ces services depuis plus d'un an et je n'ai rencontré aucun problème ni problème. Je recommande cette entreprise si vous avez besoin de ce genre de services.

Neutre

你好99363

Hong Kong

CurrencyFair offre des taux compétitifs meilleurs que les banques. Je me souviens qu'une fois j'ai utilisé cette société pour envoyer mon argent d'Amérique en Australie, mais quelque chose de terrible s'est produit, et il s'est avéré que c'était la banque intermédiaire de CurrencyFair qui avait fait une erreur. Bien que cette société affirme que la plupart de ses transferts internationaux sont effectués dans les 24 heures, alors que cela dépend de votre chance, vous voyez ?

Neutre