Unternehmensprofil

| CurrencyFair Überprüfungszusammenfassung | |

| Gegründet | 2008 |

| Registriertes Land/Region | Australien |

| Regulierung | ASIC |

| Service | Geldüberweisung |

| Plattform | Mobile APP |

| Kundensupport | Kontaktformular |

| Irland: Colm House, 91 Pembroke Road, Ballsbridge, Dublin 4; +353 (0) 1 526 8411 (9am - 5pm Dublin/London Zeit Montag - Freitag) | |

| UK: No. 1 Poultry, London ECR2 8EJ; +44 (0) 203 3089353 (9 AM-5 PM Montag-Freitag) | |

| Singapur: 15 Beach Road, 2nd Floor, Singapur 189677; +65 (0) 3165 0282 (5 PM - 1 AM Montag–Samstag) | |

| Hongkong: Office 12100, 12/F, YF Tower, 33 Lockhart Road, Wan Chai, Hongkong; +852 5803 2611 (5pm - 1am Montag - Samstag) | |

| Australien: Suite 26-109, 161 Castlereagh Street Sydney, NSW, 2000; +61 (0) 282 798 642 (8 PM - 4 AM Montag-Samstag) | |

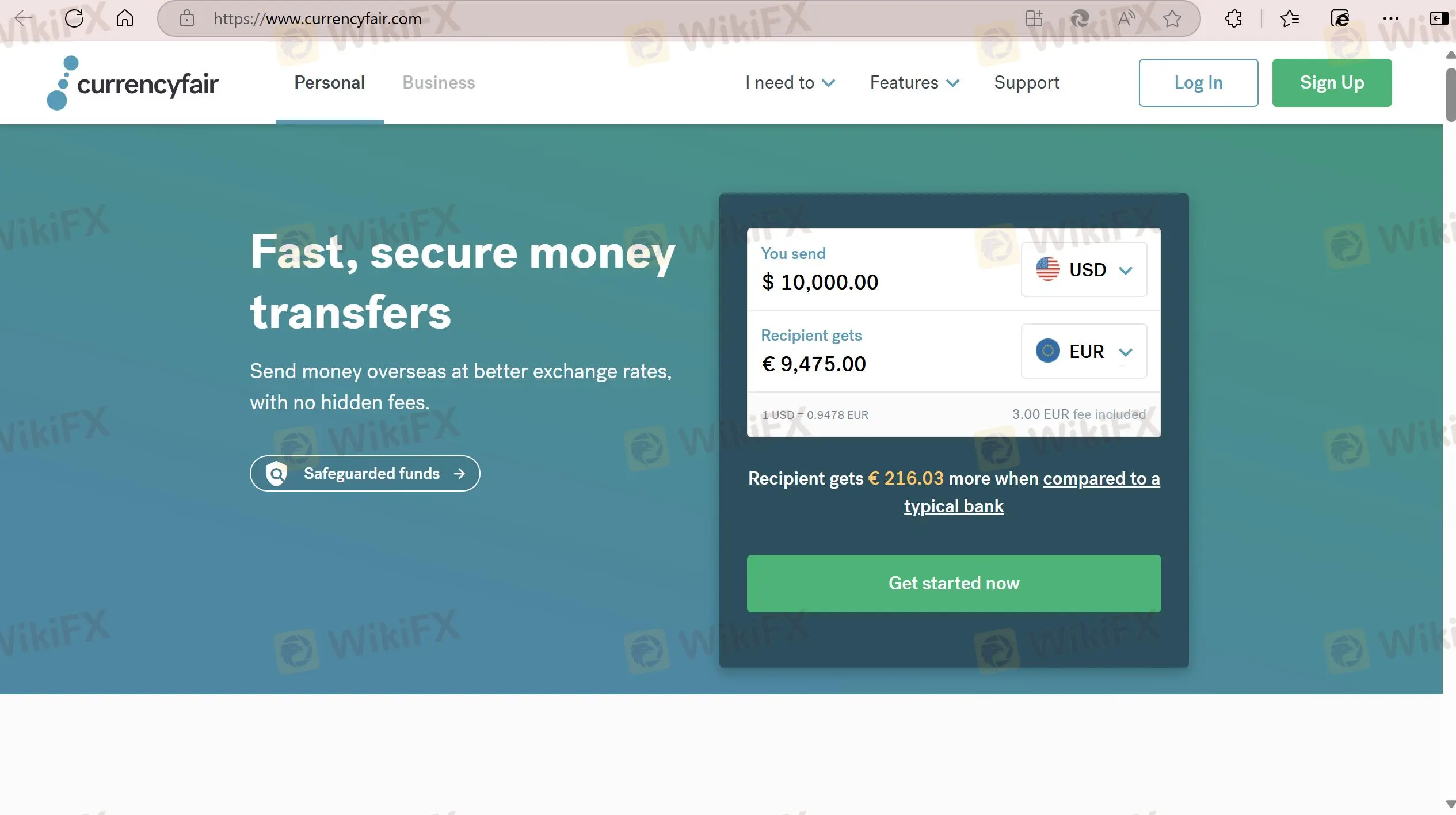

CurrencyFair wurde 2008 in Australien registriert. Auf ihrer Plattform können Kunden Geld ins Ausland senden. Darüber hinaus hat dieses Unternehmen eine lange Betriebszeit und ist in Australien reguliert.

Vor- und Nachteile

| Vorteile | Nachteile |

| Lange Betriebszeit | Kein Live-Chat-Support |

| Gut reguliert | |

| Transparente Gebührenstruktur |

Ist CurrencyFair legitim?

Ja, CurrencyFair wird von der Australian Securities and Investment Commission (ASIC) reguliert.

| Reguliertes Land | Regulierungsbehörde | Aktueller Status | Reguliertes Land | Lizenztyp | Lizenznummer |

| Australian Securities and Investment Commission (ASIC) | Reguliert | Australien | Market Making (MM) | 402709 |

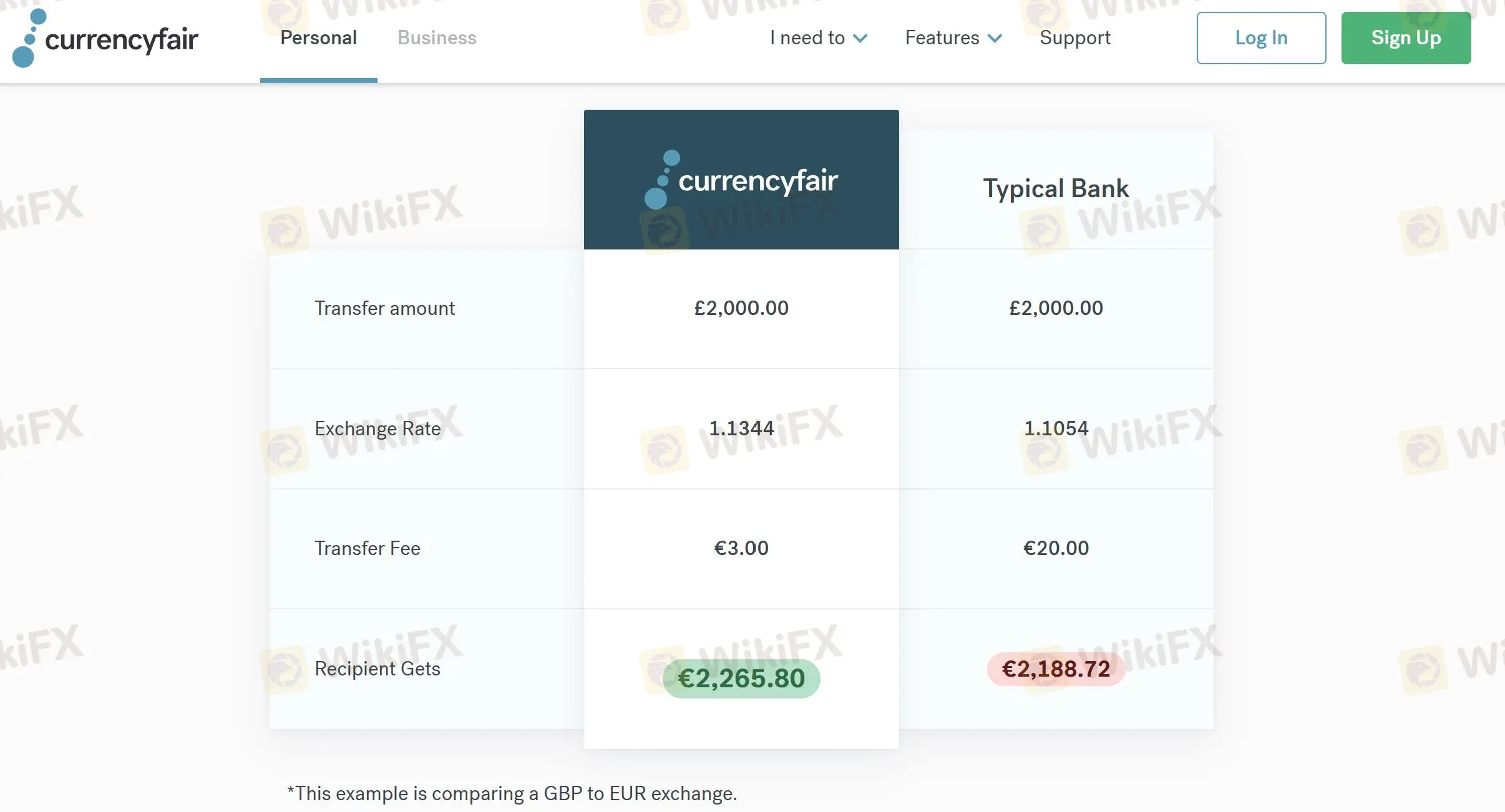

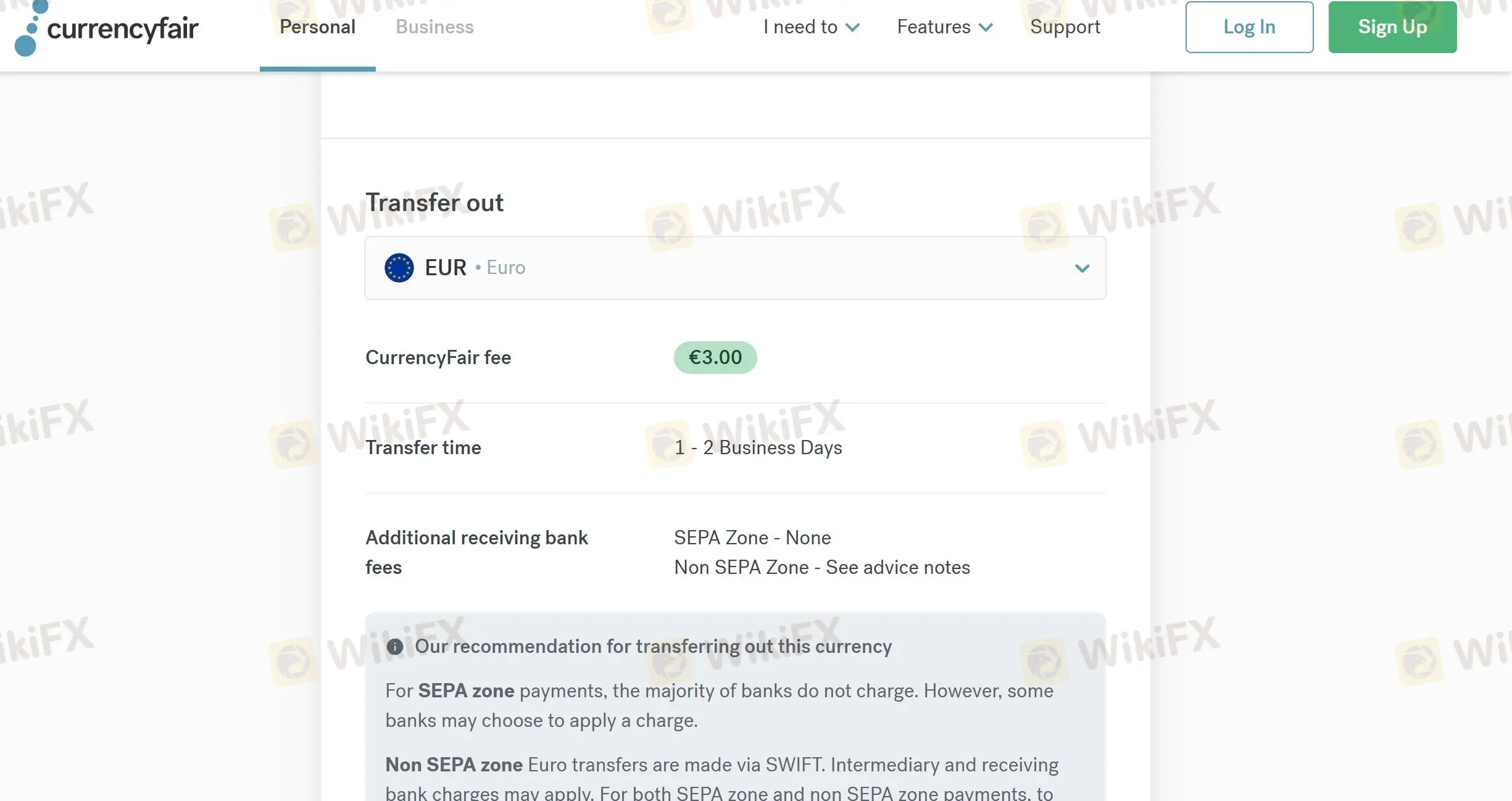

CurrencyFair Gebühren

| Überweisungsbetrag | Wechselkurs | Überweisungsgebühr | Empfänger erhält |

| 2.000,00 GBP | 1,1344 | 3,00 EUR | 2.265,80 EUR |

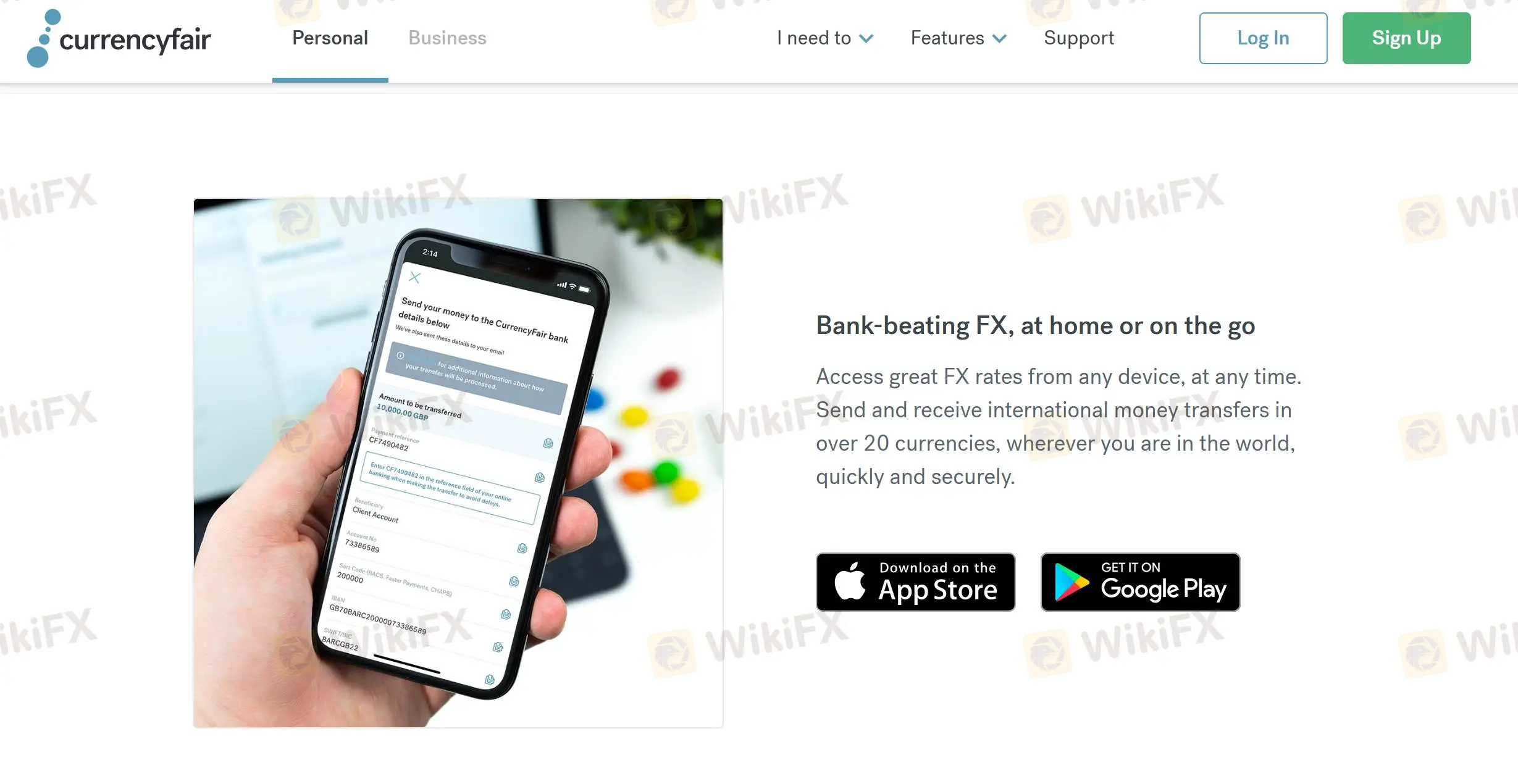

Plattform

| Plattform | Unterstützt | Verfügbare Geräte |

| Mobile APP | ✔ | iOS, Android |

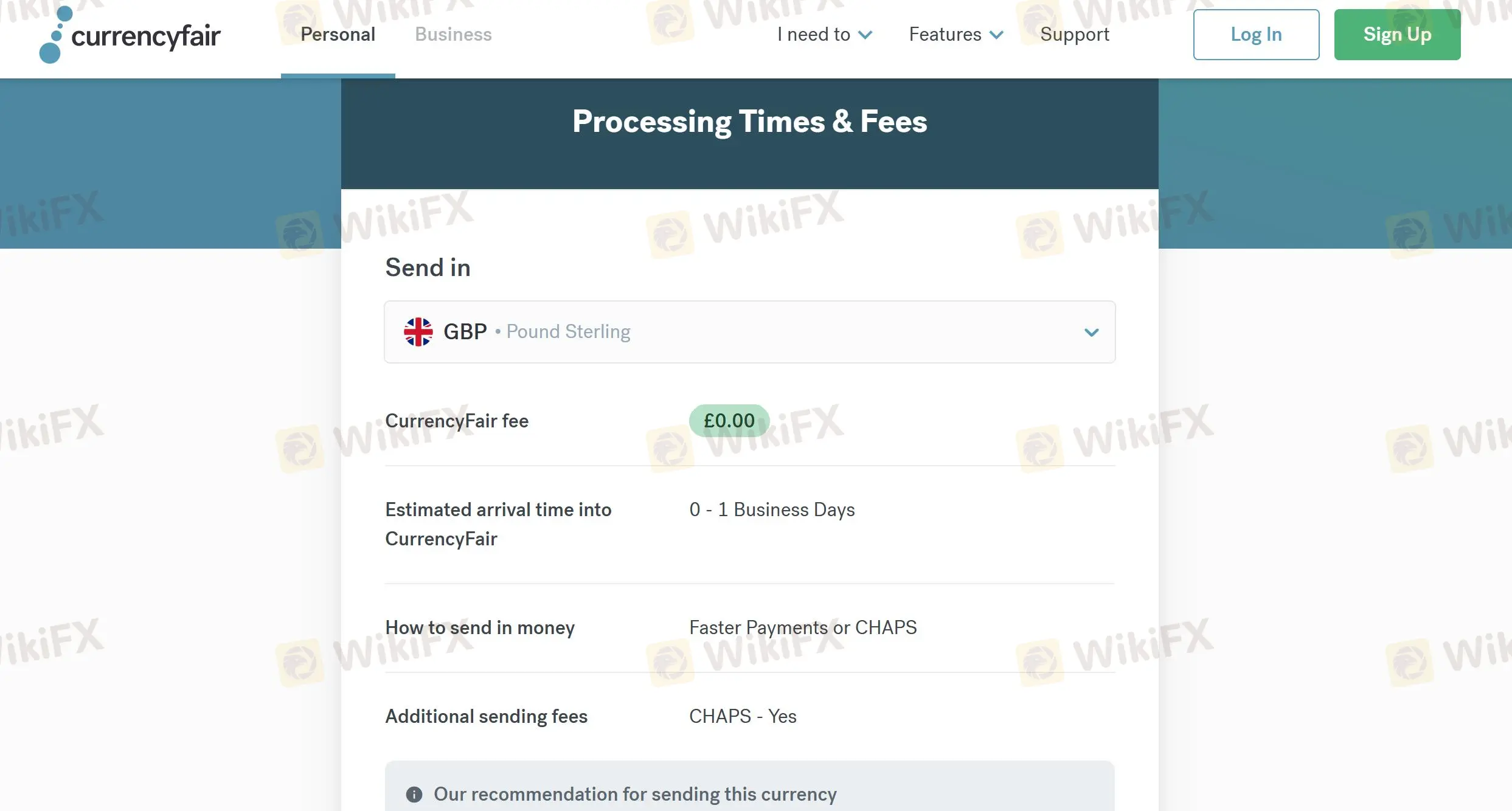

Bearbeitungszeit und Gebühren

| Senden | Gebühren | Optionen | Zeit |

| GBP | ❌ | Schnellüberweisung oder CHAPS | 0-1 Werktage |

| EUR | ❌ | SEPA-Überweisung | 1-2 Werktage |

| USD | ❌ | Banküberweisung | 1-2 Werktage |

| Überweisung | Gebühren | Zeit |

| EUR | 3,00 EUR | 1 bis 2 Werktage |

| GBP | 2,5 GBP | 0 bis 1 Werktage |

| USD | 4,00 USD | 1 Werktag |

FX1240839140

Neuseeland

Beim Geldversand ins Ausland sind die Gebühren bei den Banken sehr hoch! Zum Glück habe ich CurrencyFair, was es mir ermöglicht, schnell Überweisungen zu tätigen und Geld zu sparen. Ich weiß, dass die Sicherheit viele Sorgen bereiten wird, aber Currencyfair ist sicher!

Positive

程安 -陶

Argentinien

Bisher finde ich currencyfair ein tolles Unternehmen, was meine Arbeit sehr erleichtert, da ich oft grenzüberschreitende Überweisungen tätigen muss!

Positive

ONE I LOVE

Hongkong

Ihr Kundensupport ist ausgezeichnet und diese Plattform ist einfach zu bedienen. Ich benutze diese Dienste seit mehr als einem Jahr und bin auf keine Probleme oder Probleme gestoßen. Ich empfehle dieses Unternehmen, wenn Sie diese Art von Dienstleistungen benötigen.

Neutral

你好99363

Hongkong

CurrencyFair bietet wettbewerbsfähige Preise, die besser sind als Banken. Ich erinnerte mich, dass ich diese Firma einmal benutzt hatte, um mein Geld von Amerika nach Australien zu schicken, aber etwas Schreckliches passierte, und es stellte sich heraus, dass die zwischengeschaltete Bank von CurrencyFair einen Fehler gemacht hatte. Obwohl dieses Unternehmen behauptet, dass die meisten seiner internationalen Überweisungen innerhalb von 24 Stunden abgeschlossen sind, hängt dies von Ihrem Glück ab, verstehen Sie?

Neutral