Resumo da empresa

| CurrencyFair Resumo da Revisão | |

| Fundado | 2008 |

| País/Região Registrado | Austrália |

| Regulação | ASIC |

| Serviço | Transferência de dinheiro |

| Plataforma | Aplicativo móvel |

| Suporte ao Cliente | Formulário de contato |

| Irlanda: Colm House, 91 Pembroke Road, Ballsbridge, Dublin 4; +353 (0) 1 526 8411 (9h - 17h horário de Dublin/Londres de segunda a sexta-feira) | |

| Reino Unido: No. 1 Poultry, London ECR2 8EJ; +44 (0) 203 3089353 (9h - 17h de segunda a sexta-feira) | |

| Singapura: 15 Beach Road, 2º andar, Singapura 189677; +65 (0) 3165 0282 (17h - 1h de segunda a sábado) | |

| Hong Kong: Escritório 12100, 12/F, YF Tower, 33 Lockhart Road, Wan Chai, Hong Kong; +852 5803 2611 (17h - 1h de segunda a sábado) | |

| Austrália: Suite 26-109, 161 Castlereagh Street Sydney, NSW, 2000; +61 (0) 282 798 642 (20h - 4h de segunda a sábado) | |

CurrencyFair foi registrado em 2008 na Austrália. Em sua plataforma, os clientes podem enviar dinheiro para o exterior. Além disso, esta empresa tem um longo tempo de operação e é regulamentada na Austrália.

Prós e Contras

| Prós | Contras |

| Longo tempo de operação | Sem suporte de chat ao vivo |

| Regulamentado adequadamente | |

| Estrutura de taxas transparente |

É CurrencyFair Legítimo?

Sim, CurrencyFair é regulamentado pela Comissão de Valores Mobiliários e Investimentos da Austrália (ASIC).

| País Regulamentado | Autoridade Regulamentada | Status Atual | País Regulamentado | Tipo de Licença | Número da Licença |

| Comissão de Valores Mobiliários e Investimentos da Austrália (ASIC) | Regulamentado | Austrália | Market Making (MM) | 402709 |

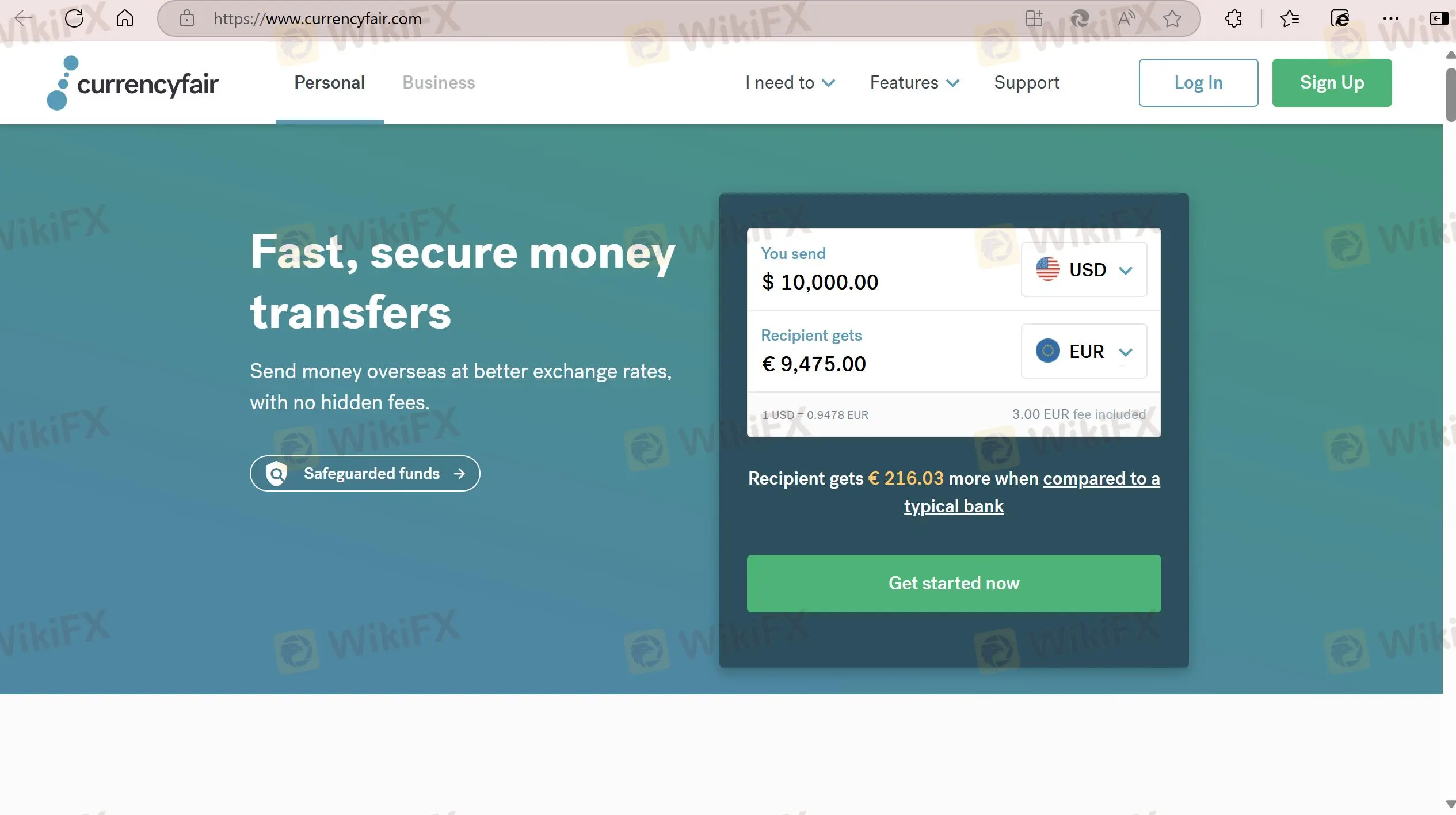

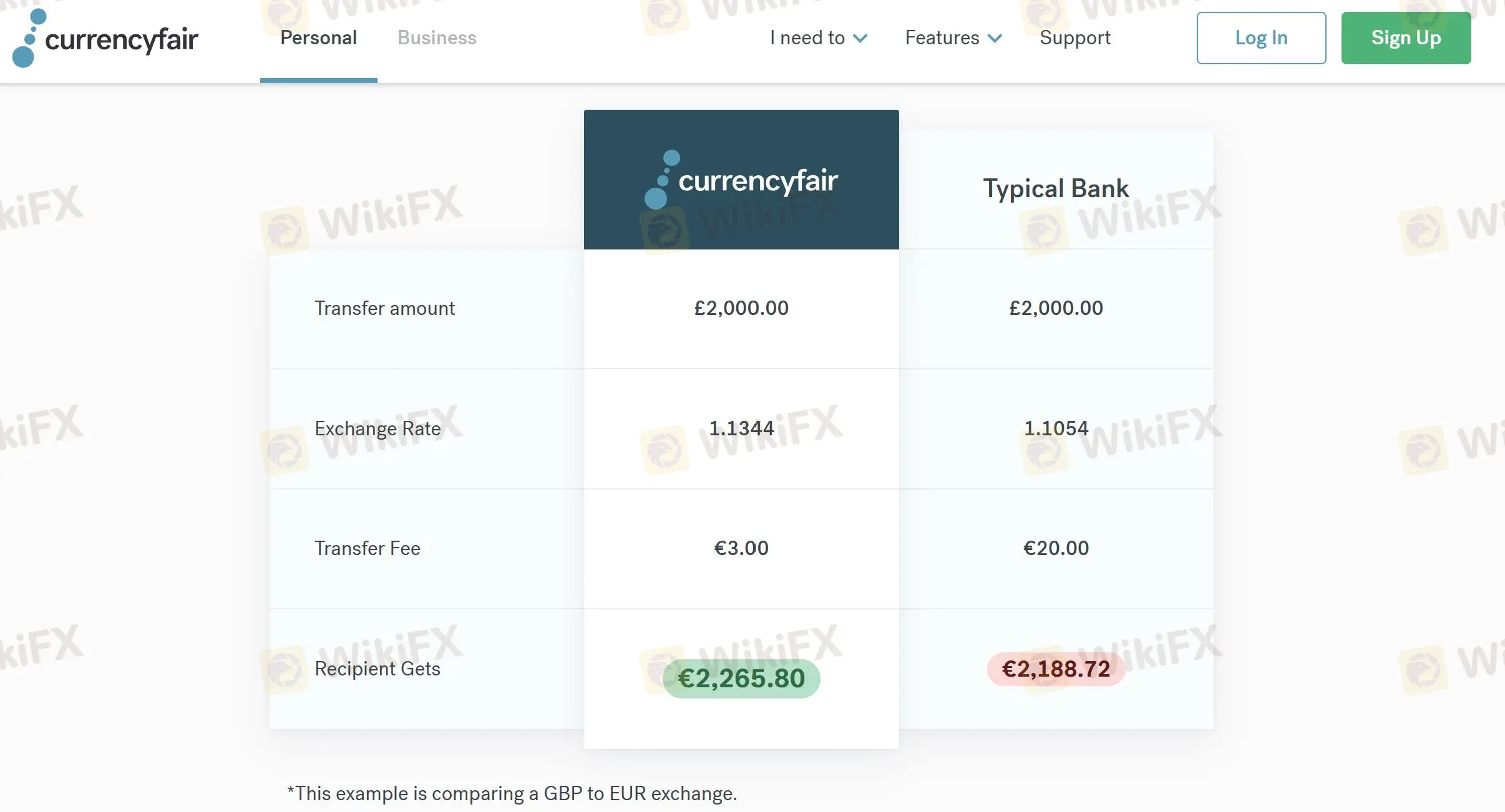

Taxas CurrencyFair

| Valor da Transferência | Taxa de Câmbio | Taxa de Transferência | Valor Recebido |

| 2,000.00 GBP | 1.1344 | 3.00 EUR | 2,265.80 EUR |

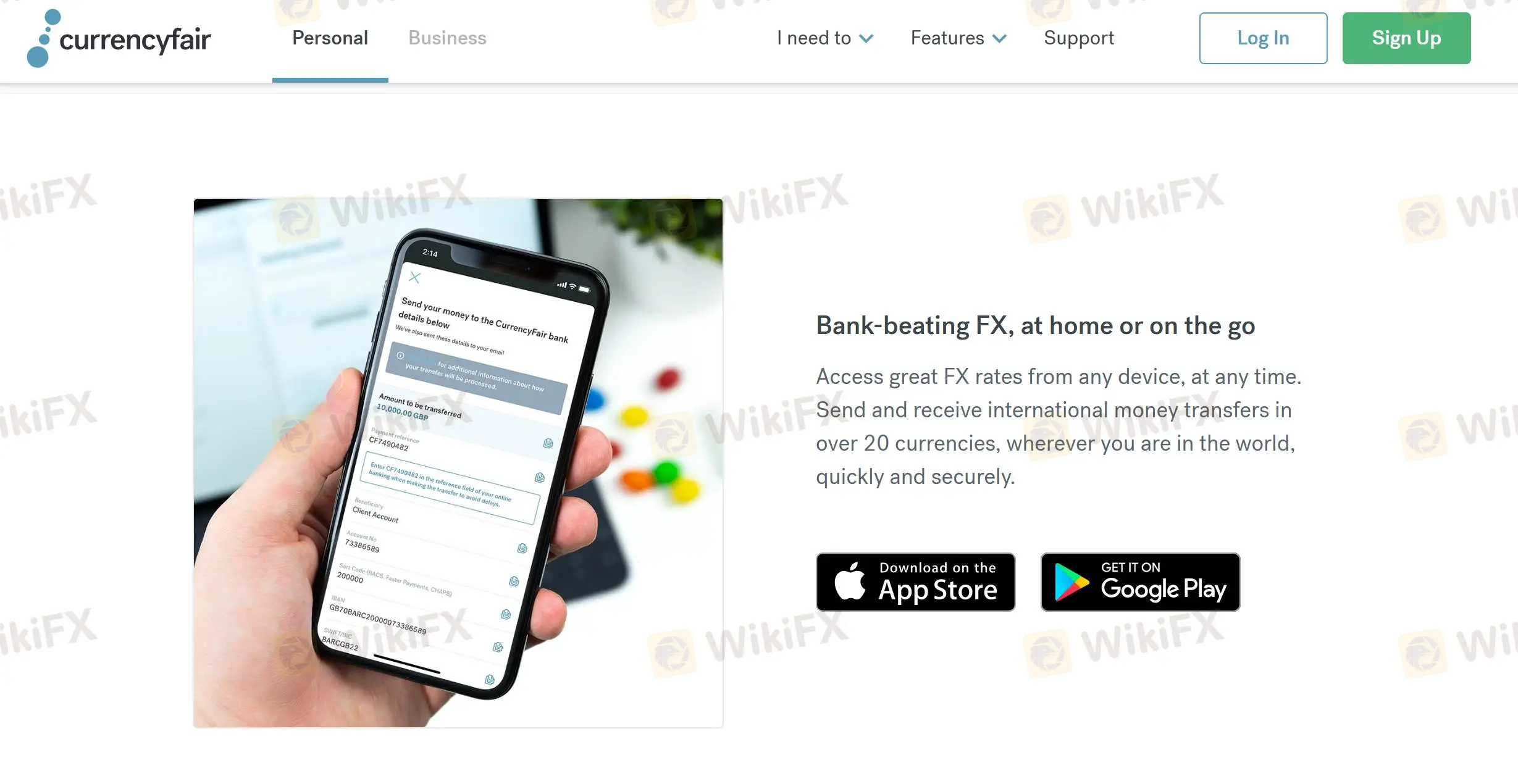

Plataforma

| Plataforma | Suportado | Dispositivos Disponíveis |

| Aplicativo Móvel | ✔ | iOS, Android |

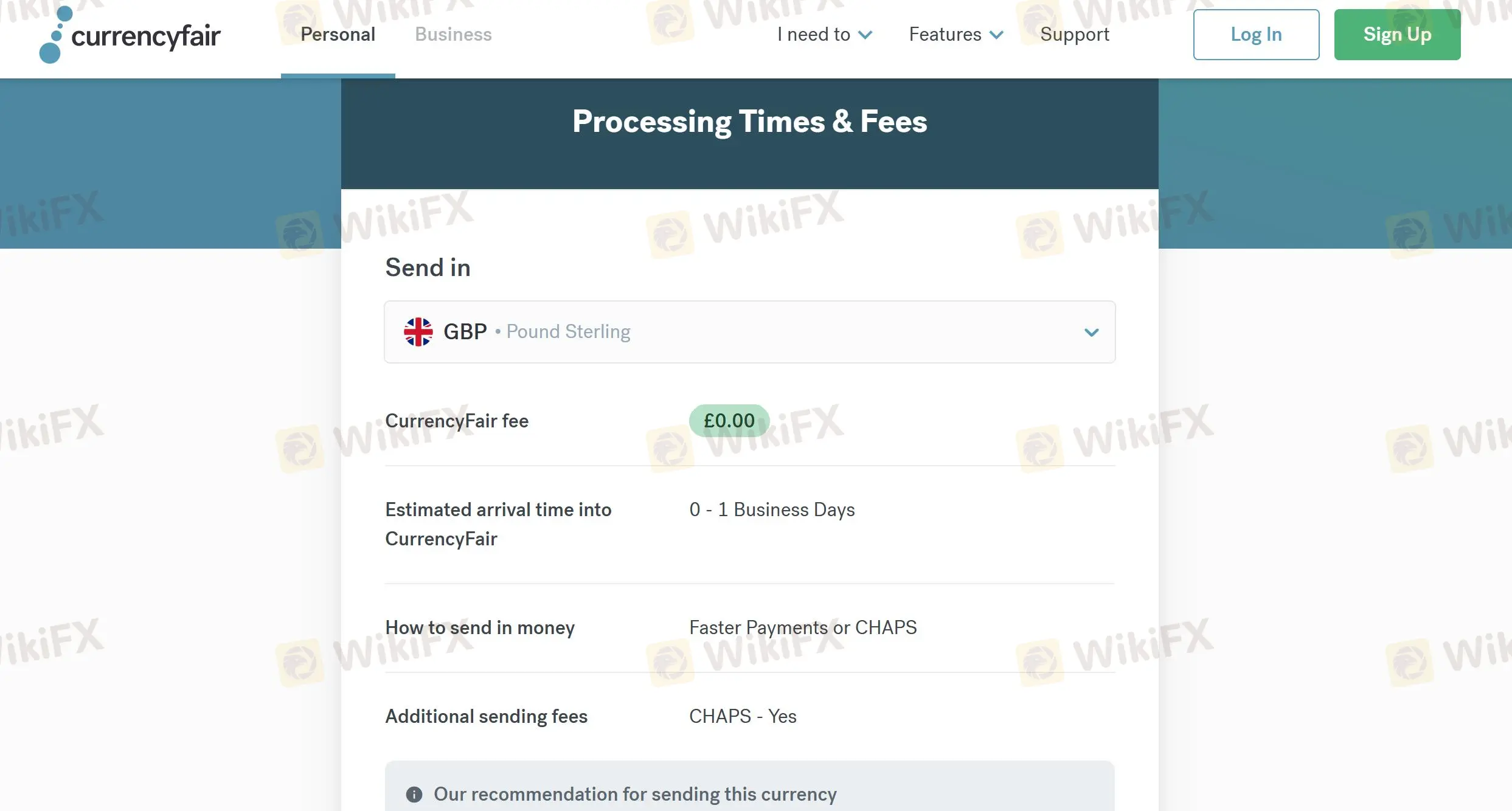

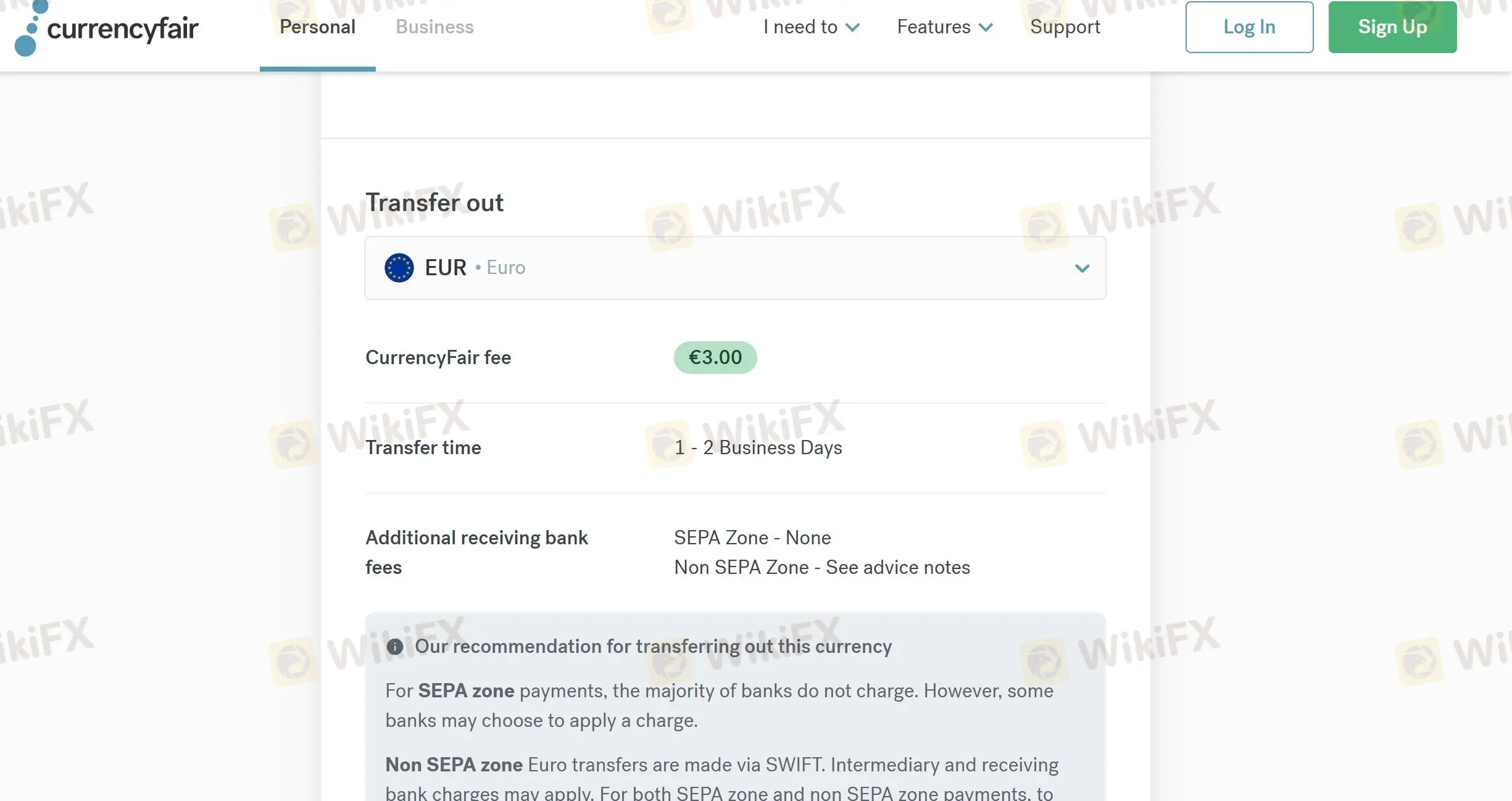

Tempo de Processamento e Taxas

| Enviar in | Taxas | Opções | Tempo |

| GBP | ❌ | Pagamentos mais rápidos ou CHAPS | 0-1 dias úteis |

| EUR | ❌ | Transferência de Crédito SEPA | 1-2 dias úteis |

| USD | ❌ | Transferência bancária | 1-2 dias úteis |

| Transfer out | Taxas | Tempo |

| EUR | 3.00 EUR | 1 a 2 dias úteis |

| GBP | 2.5 GBP | 0 a 1 dia útil |

| USD | 4.00 USD | 1 dia útil |

FX1240839140

Nova Zelândia

Ao enviar dinheiro para o exterior, as taxas dos bancos são muito altas! Felizmente, eu tenho o currencyfair, o que me permite fazer transferências rapidamente e economizar dinheiro. Eu sei que a segurança será a preocupação de muitos, mas a feira de moedas é segura!

Positivos

程安 -陶

Argentina

Até agora, acho que a currencyfair é uma ótima empresa, o que facilita muito meu trabalho, porque muitas vezes preciso fazer transferências internacionais!

Positivos

ONE I LOVE

Hong Kong

Seu suporte ao cliente é excelente e esta plataforma é fácil de usar. Eu uso esses serviços há mais de um ano e não encontrei nenhum problema ou problema. Eu recomendo esta empresa se você precisar deste tipo de serviço.

Neutro

你好99363

Hong Kong

A CurrencyFair oferece taxas competitivas melhores do que os bancos. Lembrei-me de uma vez que usei essa empresa para enviar meu dinheiro da América para a Austrália, mas algo terrível aconteceu e descobri que o banco intermediário da CurrencyFair cometeu um erro. Embora esta empresa afirme que a maioria de suas transferências internacionais são concluídas em 24 horas, enquanto isso depende da sua sorte, você vê?

Neutro