Perfil de la compañía

| IndiaNivesh Resumen de la reseña | |

| Establecido | 2006 |

| País/Región Registrada | India |

| Regulación | Sin regulación |

| Instrumentos de Mercado | Acciones, fondos mutuos, derivados, OPV, divisas, seguros, materias primas |

| Cuenta Demo | ❌ |

| Plataforma de Trading | APP IndiaNivesh |

| Soporte al Cliente | Tel: 022 – 62406240 |

| Redes sociales: Facebook, X, Instagram, LinkedIn, YouTube | |

| Email: customersupport@indianivesh.in | |

Información de IndiaNivesh

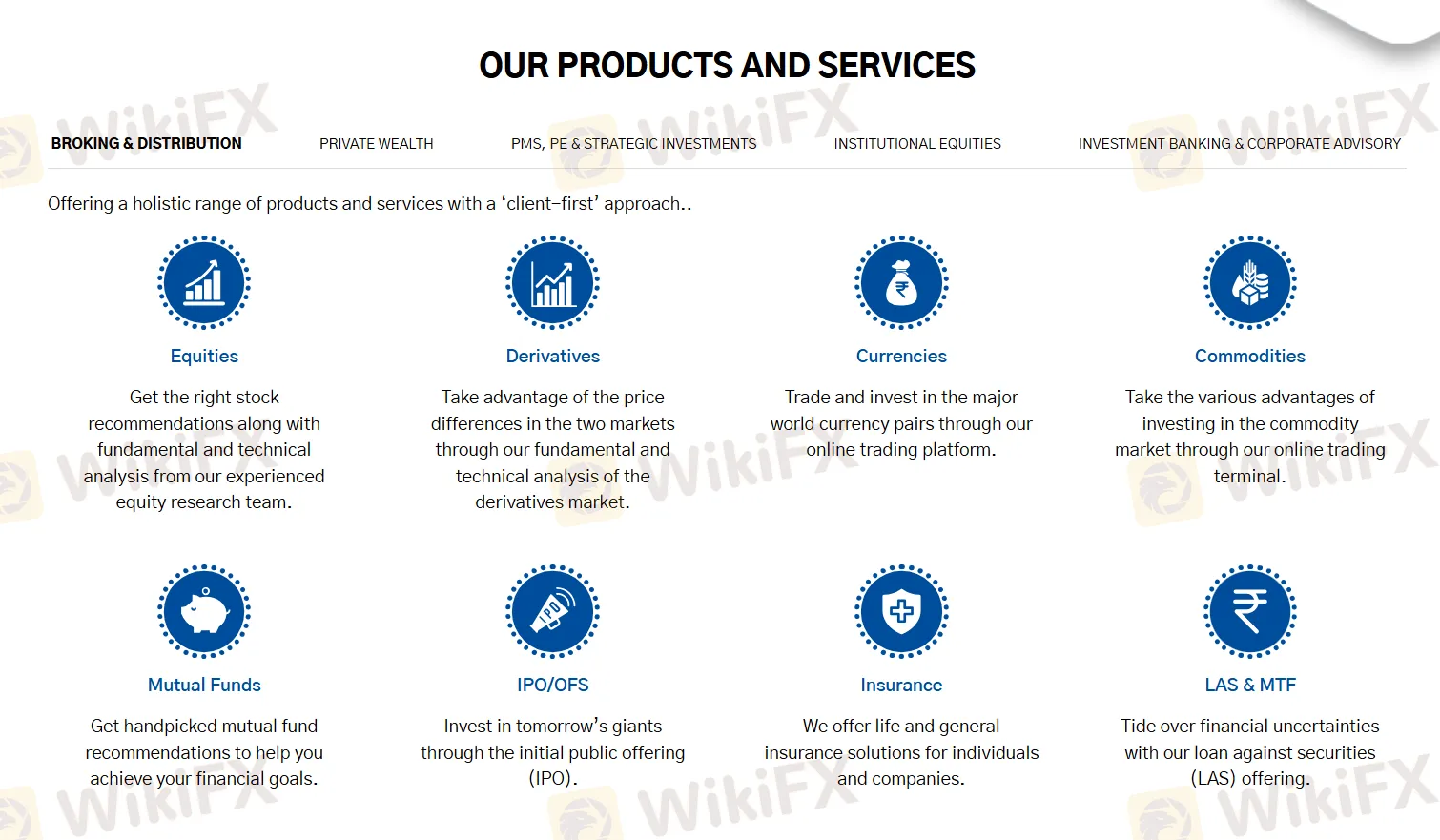

IndiaNivesh es un proveedor de servicios no regulado de corretaje y servicios financieros de primera categoría en la Bolsa de Valores de la India. Ofrece productos y servicios en acciones, fondos mutuos, derivados, OPV/OFS, divisas, seguros, materias primas, LAS y MTF, soluciones personalizadas, servicios de gestión de cartera, capital privado, inversiones estratégicas, investigación, ventas y trading, aumento de capital (acciones y deuda), entrada en India, globalización de empresas indias, fusiones y adquisiciones.

Pros y Contras

| Pros | Contras |

| Tiempo de operación prolongado | Falta de regulación |

| Varios canales de contacto | Sin cuentas demo |

| Varios productos y servicios |

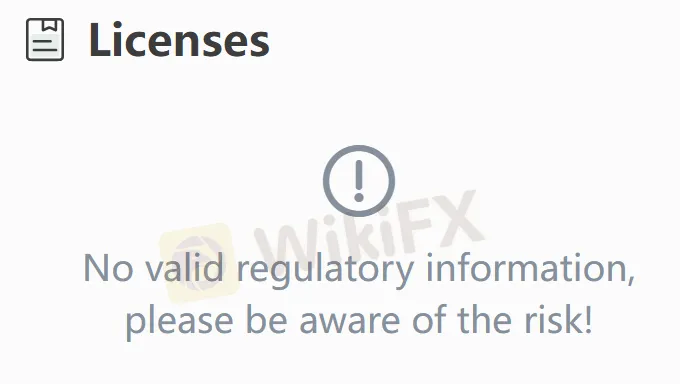

¿Es IndiaNivesh Legítimo?

No. Actualmente no tiene regulaciones válidas. ¡Por favor, tenga en cuenta el riesgo!

¿Qué puedo negociar en IndiaNivesh?

| Activos de Negociación | Soportado |

| Acciones | ✔ |

| Fondos de inversión | ✔ |

| Derivados | ✔ |

| OPI | ✔ |

| Divisas | ✔ |

| Seguros | ✔ |

| Productos básicos | ✔ |

| Índices | ❌ |

| Criptomonedas | ❌ |

| Bonos | ❌ |

| Opciones | ❌ |

| ETFs | ❌ |

Plataforma de Negociación

| Plataforma de Negociación | Soportado | Dispositivos Disponibles | Adecuado para |

| IndiaNivesh APP | ✔ | Móvil | / |