Perfil de la compañía

| NatWest Resumen de la revisión | |

| Establecido | 1997 |

| País/Región Registrada | Reino Unido |

| Regulación | Sin regulación |

| Servicios | Banca, préstamos, seguros, ahorros, inversión |

| Plataforma/APP | Aplicación de Banca Móvil NatWest |

| Soporte al Cliente | Chat en línea |

Información de NatWest

NatWest, fundado en 1997 y con sede en el Reino Unido, no está regulado por la FCA u otras agencias financieras globales importantes. Ofrece una amplia gama de servicios financieros personales como cuentas corrientes, préstamos, seguros, ahorros y productos de inversión, pero no tiene capacidades avanzadas de trading ni alternativas de cuentas de muestra.

Pros y Contras

| Pros | Contras |

| Ofrece una amplia gama de servicios bancarios minoristas | Sin regulación |

| Sin tarifa mensual en cuentas básicas | |

| Soporte de chat en vivo |

¿Es NatWest Legítimo?

La Financial Conduct Authority (FCA) del Reino Unido y otros organismos reguladores clave a nivel mundial como ASIC (Australia) y la NFA (EE. UU.) no supervisan a NatWest, a pesar de estar registrada en el Reino Unido. ¡Por favor, tenga en cuenta el riesgo!

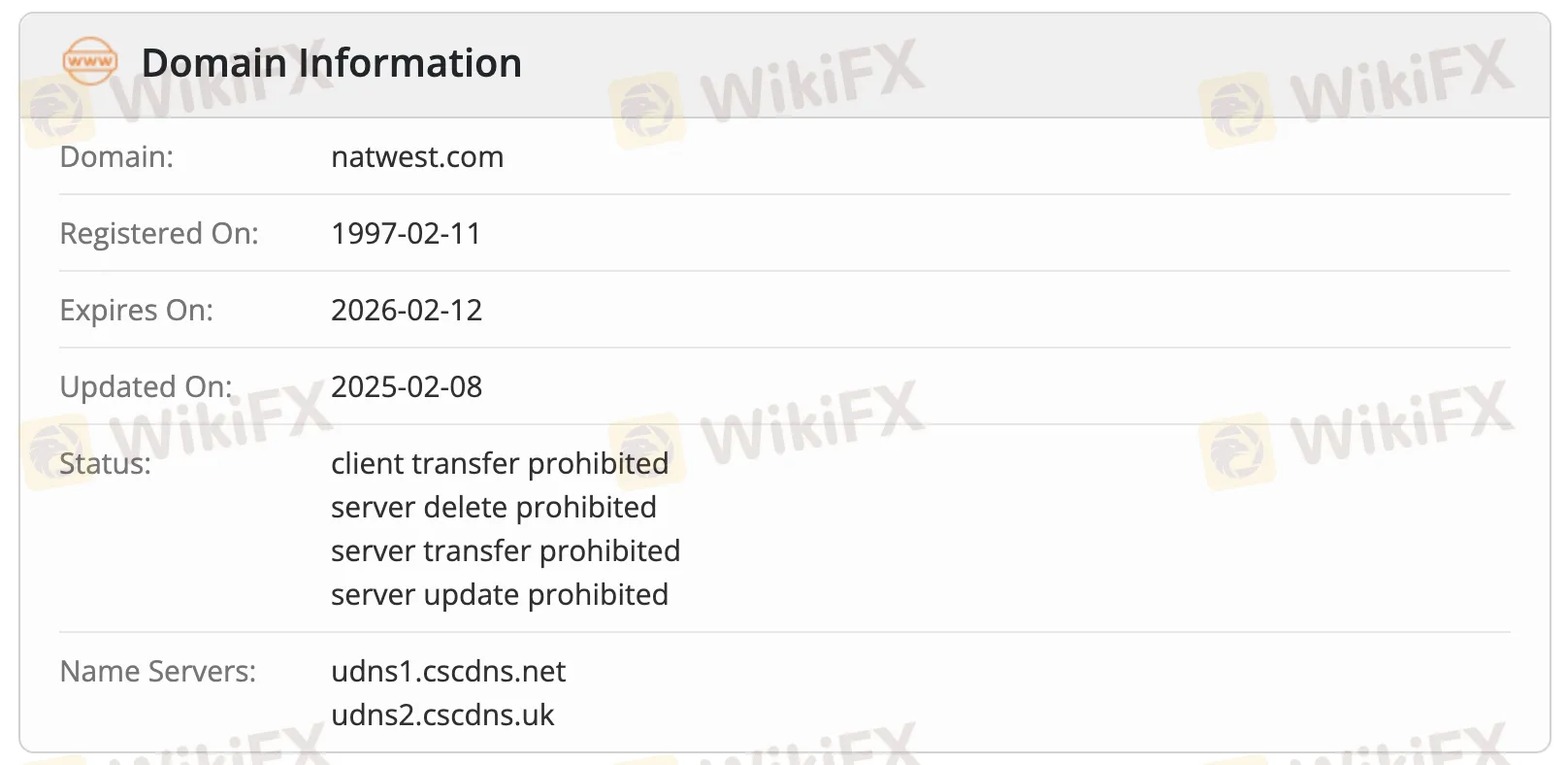

Los datos WHOIS muestran que natwest.com fue registrado el 11 de febrero de 1997, actualizado por última vez el 8 de febrero de 2025 y sigue activo. Expirará el 12 de febrero de 2026. Tiene varios bloqueos de registro (prohibiciones de cliente y servidor) para mantenerlo seguro, lo que significa que es un dominio oficial con mucha protección y se mantiene activamente.

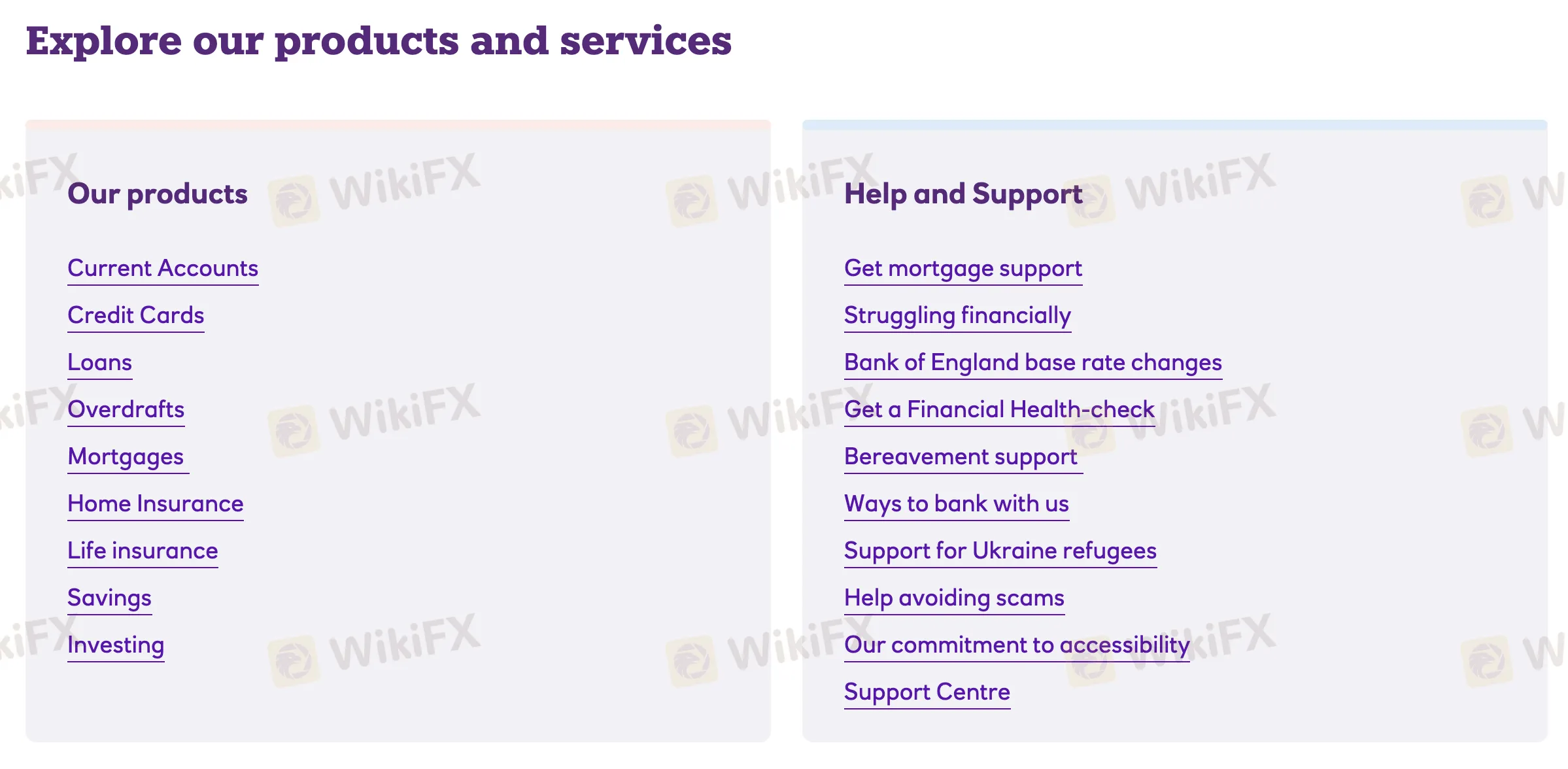

Productos y Servicios

NatWest tiene muchos productos financieros personales, como servicios bancarios, préstamos, seguros y servicios de inversión para personas y familias.

| Productos y Servicios | Soportados |

| Cuentas Corrientes | ✔ |

| Tarjetas de Crédito | ✔ |

| Préstamos | ✔ |

| Sobregiros | ✔ |

| Hipotecas | ✔ |

| Seguro de Hogar | ✔ |

| Seguro de Vida | ✔ |

| Ahorros | ✔ |

| Inversión | ✔ |

Tipo de Cuenta

NatWest tiene cuatro categorías de cuentas corrientes: Personal, Premier (para clientes de alto patrimonio neto), Estudiante y Juvenil (para edades de 3 a 25 años) y Negocios y Corporativa (para startups y grandes organizaciones).

Tarifas

NatWest normalmente cobra tarifas mensuales bajas o nulas por servicios bancarios básicos, con beneficios adicionales ofrecidos a través de niveles de cuenta premium. Muchas cuentas, como las cuentas Select y Estudiante, son gratuitas, mientras que las cuentas Reward y paquetes cobran tarifas mensuales a cambio de reembolsos en efectivo o beneficios de seguros.

| Tipo de Cuenta | Tarifa Mensual | Notas |

| Cuenta Básica | £0 | Sin tarifa mensual; incluye herramientas de presupuesto y funciones de ahorro |

| Cuenta Reward | £2 | Reembolso de domiciliaciones bancarias y uso de la aplicación |

| Cuenta Estudiante | £0 | Incluye descubierto sin intereses (se aplican límites) |

| Cuenta Adapt (11–17) | Gana un 2.25% de interés; compatible con Apple/Google Pay | |

| Rooster Money (3–17) | Gratis (usuarios de NatWest) | Suscripción exenta para clientes de NatWest; de lo contrario £1.99/mes |

| Reward Silver | £10 | Incluye seguro de viaje/móvil, gastos en el extranjero sin comisiones |

| Reward Platinum | £22 | Añade seguro mundial y cobertura de averías de coche en el Reino Unido |

| Premier | Varía | Desde £0, las tarifas dependen de la elección del producto |

| Cuenta de Negocios | Tarifas y características basadas en el tipo de negocio y servicios seleccionados |

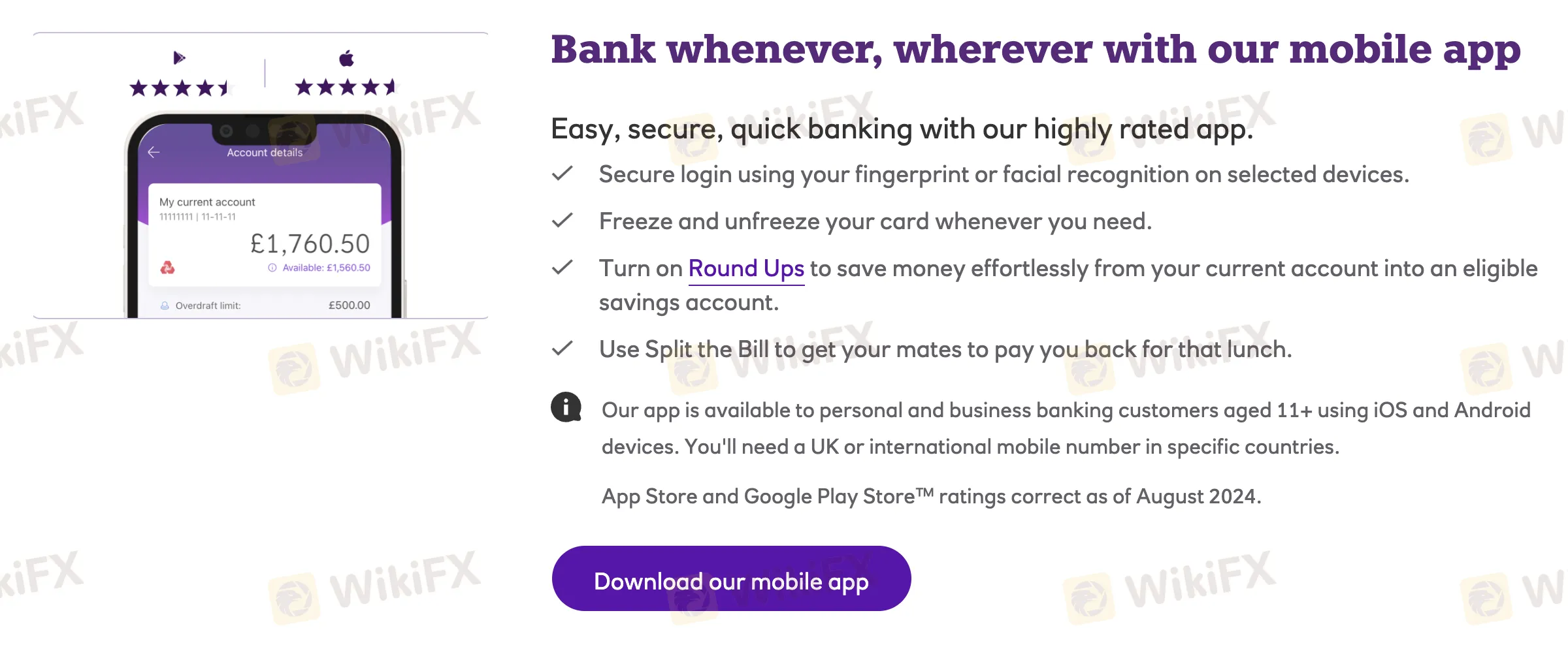

Plataforma/Aplicación

| Plataforma de Trading | Compatible | Dispositivos Disponibles | Adecuado para |

| Aplicación de Banca Móvil de NatWest | ✔ | iOS, Android | Banca personal y empresarial, mayores de 11 años, uso diario |