Buod ng kumpanya

| NatWest Buod ng Pagsusuri | |

| Itinatag | 1997 |

| Rehistradong Bansa/Rehiyon | United Kingdom |

| Regulasyon | Walang regulasyon |

| Mga Serbisyo | Banking, loans, insurance, savings, investing |

| Platform/APP | NatWest Mobile Banking App |

| Suporta sa Customer | Online chat |

Impormasyon Tungkol sa NatWest

Ang NatWest, itinatag noong 1997 at may punong tanggapan sa United Kingdom, ay hindi regulado ng FCA o iba pang pangunahing pandaigdigang ahensya sa pinansya. Nag-aalok ito ng malawak na hanay ng mga serbisyong pinansyal tulad ng mga kasalukuyang account, mga pautang, seguro, pag-iimpok, at mga kalakal sa pamumuhunan, ngunit walang advanced na kakayahan sa kalakalan o mga sample na mga alternatibong account.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Nag-aalok ng malawak na hanay ng mga serbisyong pang-retail banking | Walang regulasyon |

| Walang buwanang bayad sa mga basic na account | |

| Suporta sa live chat |

Totoo ba ang NatWest?

Ang Financial Conduct Authority (FCA) ng UK at iba pang pangunahing pandaigdigang ahensya sa regulasyon tulad ng ASIC (Australia) at NFA (U.S.) ay hindi sumusubaybay sa NatWest, bagaman ito'y rehistrado sa UK. Mangyaring maging maingat sa panganib!

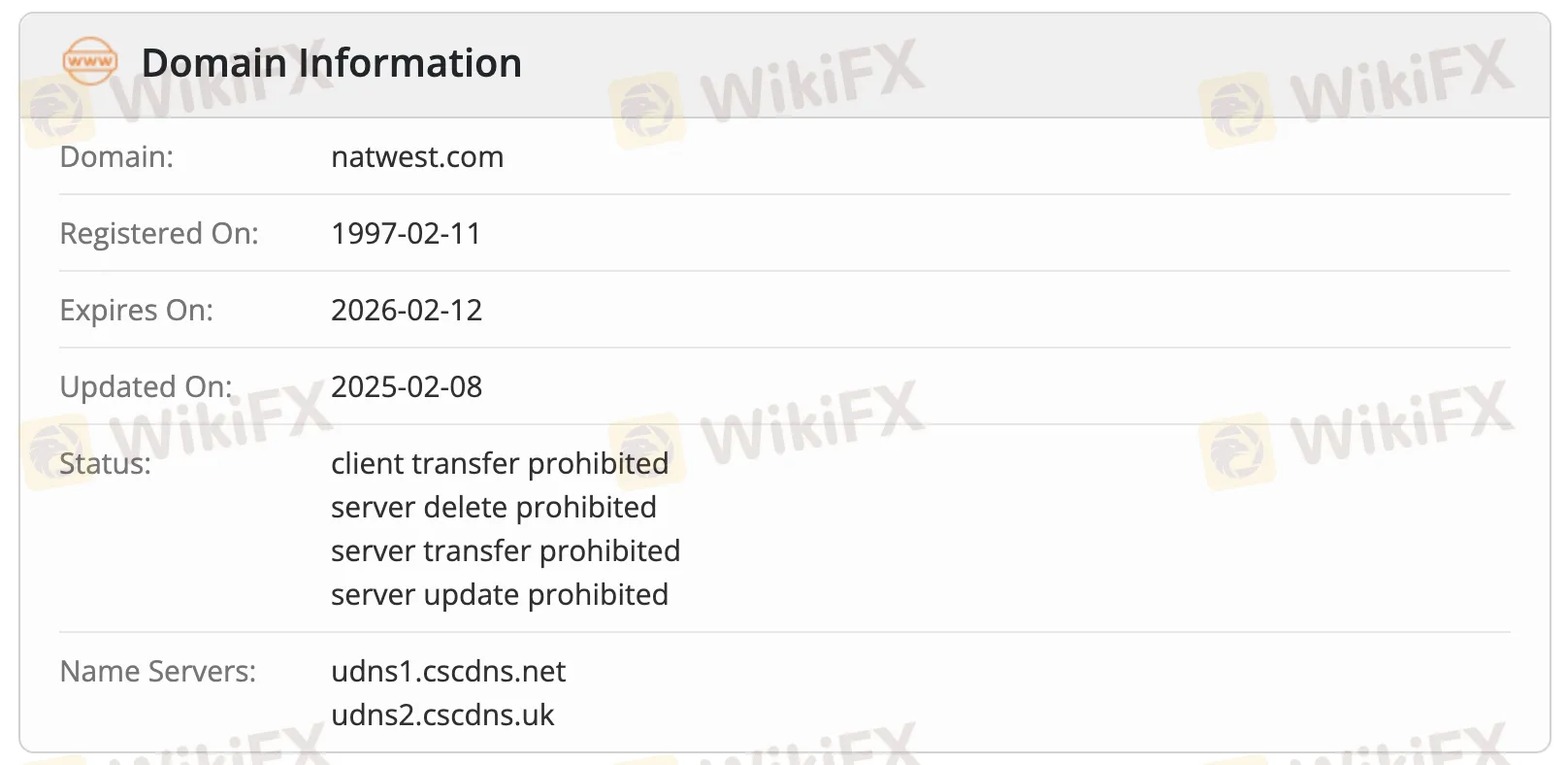

Ipakita ng data ng WHOIS na ang natwest.com ay nirehistro noong Pebrero 11, 1997, huling na-update noong Pebrero 8, 2025, at patuloy na aktibo. Mag-e-expire ito sa Pebrero 12, 2026. May iba't ibang mga registry locks (mga pagbabawal ng kliyente at server) upang panatilihing ligtas ito, na nangangahulugang ito ay isang opisyal na domain na may maraming proteksyon at aktibong inaalagaan.

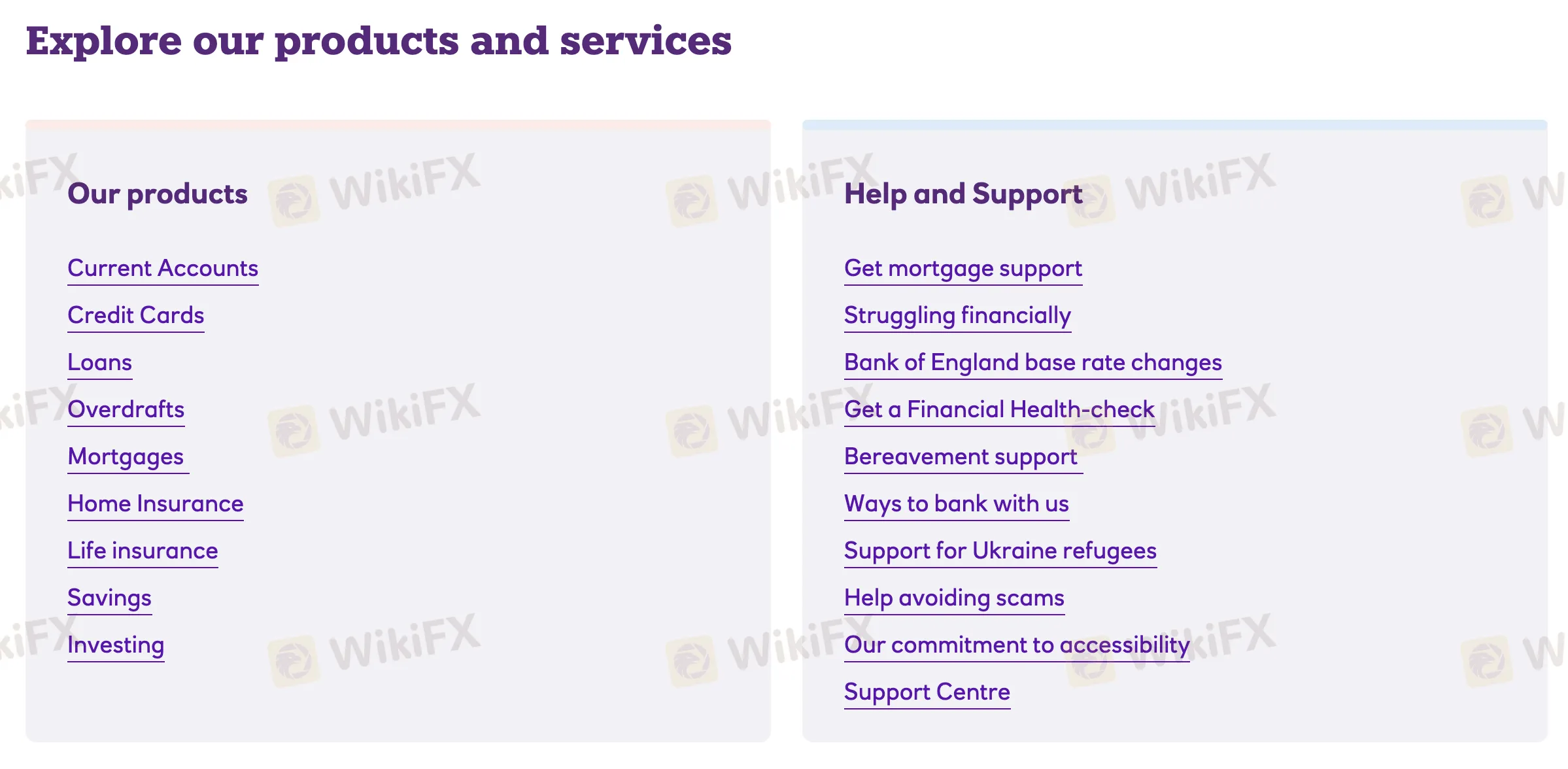

Mga Produkto at Serbisyo

Mayroong maraming personal na mga produkto sa pinansya ang NatWest, tulad ng mga serbisyong pang-bangko, pautang, seguro, at mga serbisyong pang-invest para sa mga tao at pamilya.

| Mga Produkto at Serbisyo | Supported |

| Kasalukuyang Accounts | ✔ |

| Credit Cards | ✔ |

| Pautang | ✔ |

| Overdrafts | ✔ |

| Mortgages | ✔ |

| Home Insurance | ✔ |

| Life Insurance | ✔ |

| Pag-iimpok | ✔ |

| Pamumuhunan | ✔ |

Uri ng Account

Ang NatWest ay may apat na kategorya ng kasalukuyang mga account: Personal, Premier (para sa mga client na may mataas na net worth), Student & Youth (para sa mga edad 3-25), at Business & Corporate (para sa mga startups hanggang sa malalaking organisasyon).

Mga Bayad

Karaniwan nang mababa o walang buwanang bayad ang singilin ng NatWest para sa mga pangunahing serbisyong bangko, na may karagdagang benepisyo na inaalok sa pamamagitan ng mga premium na antas ng account. Maraming account, tulad ng Select at Student accounts, ay walang bayad, samantalang ang Reward at bundled accounts ay nagpapataw ng buwanang bayad kapalit ng cashback o insurance benefits.

| Uri ng Account | Buwanang Bayad | Mga Tala |

| Basic Account | £0 | Walang buwanang bayad; kasama ang mga tool sa budget at mga savings feature |

| Reward Account | £2 | Cashback mula sa Direct Debits at paggamit ng app |

| Student Account | £0 | Kasama ang interest-free overdraft (may limitasyon) |

| Adapt Account (11–17) | Kumikita ng 2.25% interes; sumusuporta sa Apple/Google Pay | |

| Rooster Money (3–17) | Libre (mga gumagamit ng NatWest) | Walang bayad para sa mga customer ng NatWest; kung hindi, £1.99/buwan |

| Reward Silver | £10 | Kasama ang travel/mobile insurance, fee-free foreign spending |

| Reward Platinum | £22 | Nagdaragdag ng worldwide insurance at UK car breakdown cover |

| Premier | Nag-iiba | Nagsisimula mula sa £0, ang bayad ay depende sa pagpili ng produkto |

| Business Account | Mga bayad at mga feature ay batay sa uri ng negosyo at mga serbisyong pinili |

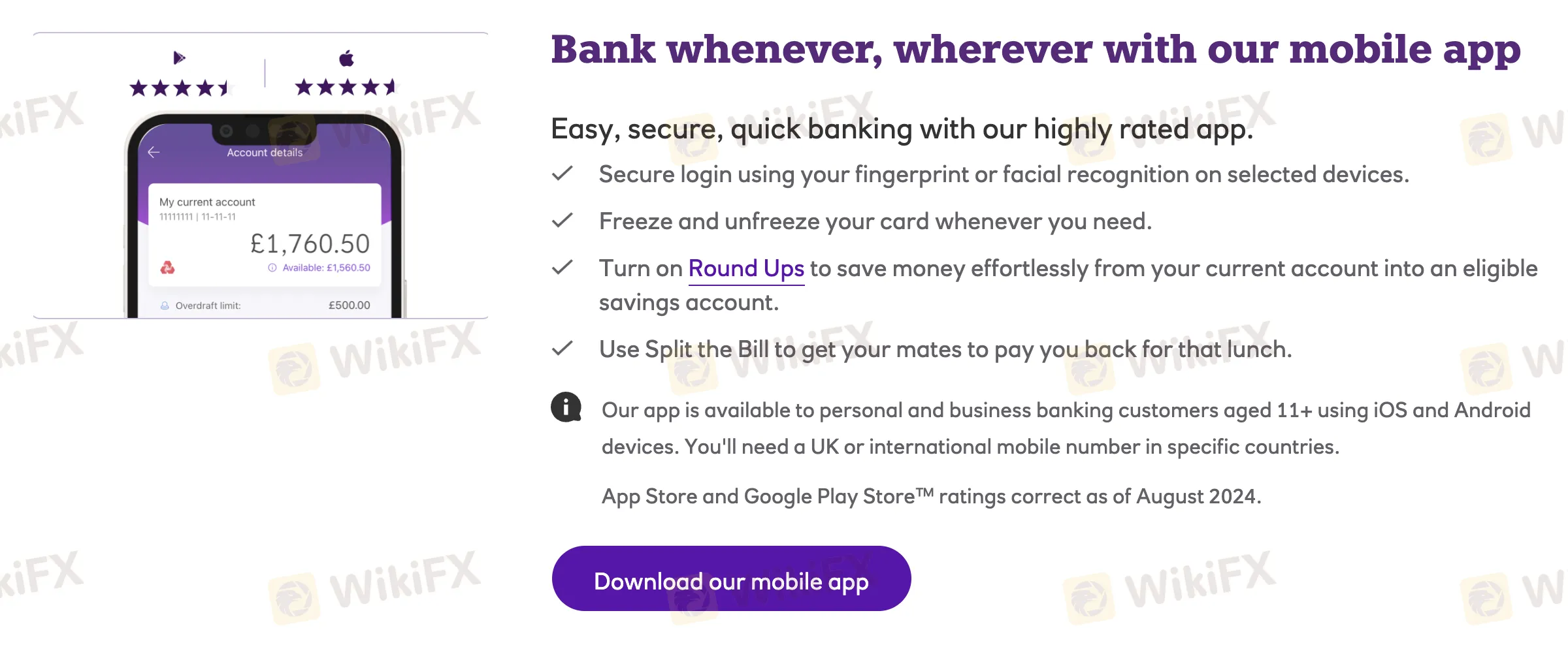

Platform/APP

| Plataforma ng Trading | Supported | Available Devices | Angkop para sa |

| NatWest Mobile Banking App | ✔ | iOS, Android | Personal & business banking, edad 11+, pang-araw-araw na paggamit |