Perfil de la compañía

| ZHONGYANG Resumen de la revisión | |

| Fundado | 2019 |

| País/Región Registrado | Hong Kong |

| Regulación | SFC (Excedido, Clon sospechoso) |

| Instrumentos de Mercado | Valores y futuros |

| Cuenta Demo | ❌ |

| Plataforma de Trading | Sistema Yisheng Polestar 9.5.7 |

| Depósito Mínimo | / |

| Soporte al Cliente | Consulta en línea |

| Teléfono: +852 31070731 | |

| Fax: (852) 2836 3825 | |

| Email: CS@zyzq.com.hk | |

| Dirección: Room 1101, 118 Connaught Road West, Hong Kong | |

ZHONGYANG ofrece servicios de corretaje de valores y futuros, ofreciendo opciones de trading en varios mercados, incluyendo la Bolsa de Valores de Hong Kong (HKEX), las bolsas de valores estadounidenses (NYSE, NASDAQ), y el Shanghai y Shenzhen Stock Connect.

Ofrecen una variedad de productos financieros, incluyendo contratos de valores y futuros, cada uno con sus respectivas comisiones de trading.

Sin embargo, sus licencias regulatorias de SFC están excedidas y son sospechosas de ser clones.

Pros y Contras

| Pros | Contras |

| Acceso a valores y futuros globales | Licencias de SFC excedidas y sospechosas de ser clones |

| Consulta en línea disponible | Métodos de financiamiento limitados |

| No hay información sobre el depósito mínimo |

¿Es ZHONGYANG Legítimo?

ZHONGYANG tiene dos tipos de licencia de SFC: Asesoramiento en valores y Negociación de contratos de futuros. Sin embargo, estas dos licencias se informan como excedidas o clones sospechosos.

| Estado regulatorio | Excedido |

| Regulado por | Comisión de Valores y Futuros de Hong Kong (SFC) |

| Institución con licencia | Zhong Yang Capital Limited |

| Tipo de licencia | Asesoramiento en valores |

| Número de licencia | BLG119 |

| Estado regulatorio | Clon sospechoso |

| Regulado por | Comisión de Valores y Futuros de Hong Kong (SFC) |

| Institución con licencia | Zhong Yang Capital Limited |

| Tipo de licencia | Negociación de contratos de futuros |

| Número de licencia | BGT529 |

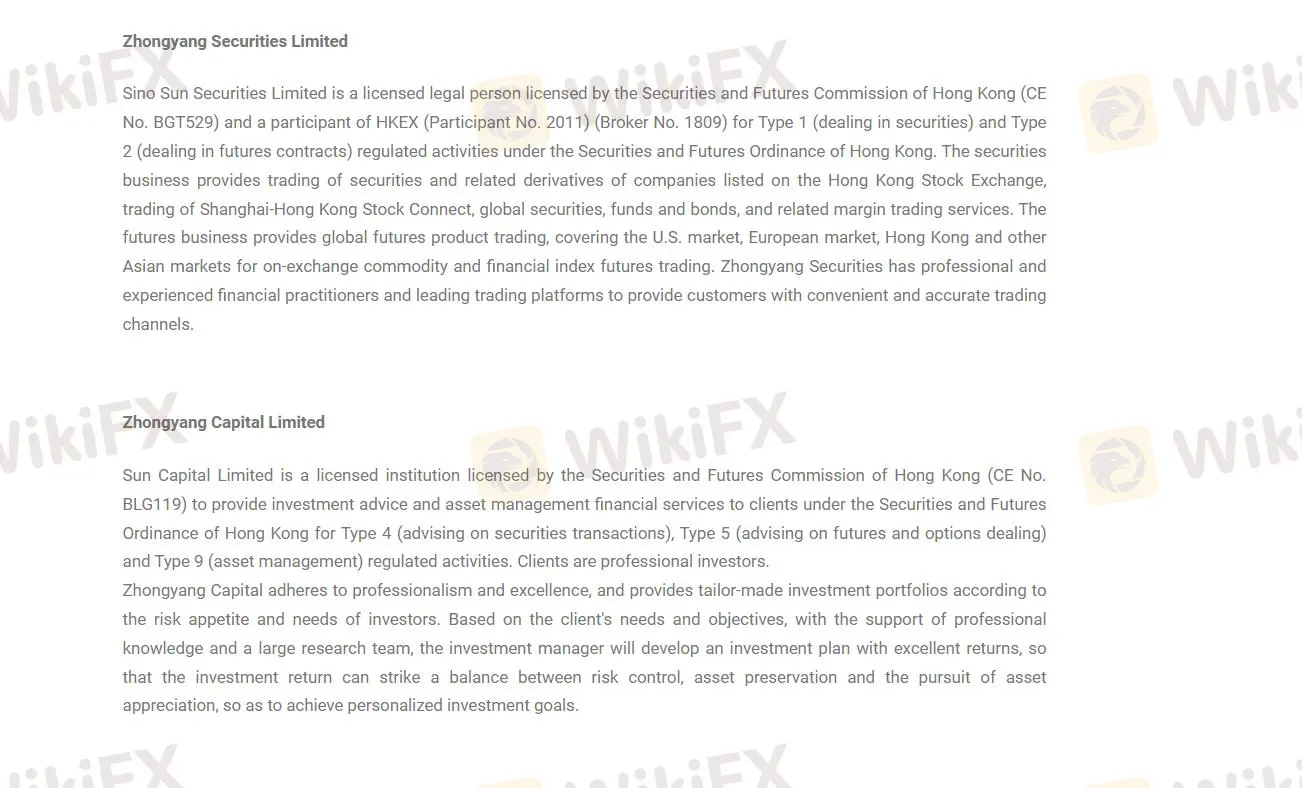

Productos y servicios

El negocio de valores de ZHONGYANG ofrece negociación de valores y derivados relacionados de empresas listadas en la Bolsa de Valores de Hong Kong, negociación de Shanghai-Hong Kong Stock Connect, valores globales, fondos y bonos, y servicios relacionados de negociación con margen.

Además, también brindan asesoramiento de inversión y servicios financieros de gestión de activos a los clientes.

Tarifas de ZHONGYANG

ZHONGYANG cobra tarifas de volumen de negocios y comisiones:

| Bolsa de Hong Kong | Shanghai/Shenzhen-Hong Kong Stock Connect | Estados Unidos | |

| Tarifa | Tarifa de volumen de negocios del 0,1% | Tarifa de operación del 0,1% | Tarifa de ejecución de $0,05/acción (tarifa de $0,01/acción para más de 2.000 acciones por día) |

| Tasa de consumo mínima | 80 dólares de Hong Kong | 100 yuanes | $1,99 |

| Tasa de interés de financiamiento | 8% anual | 8% anual | 8% anual |

Además, también cobran comisiones por diferentes productos de futuros, por ejemplo:

| Número de Raza | Nombre de Raza | Unidades de Contrato | Cambio Mínimo de Precio | Comisión (USD) | |

| COMEX | GC | Oro de EE. UU. | 100 onzas | 0.1 | 20 |

| COMEX | HG | Cobre CMX | 25000 libras | 0.0005 | |

| COMEX | SI | Plata de EE. UU. | 5000 onzas | 0.005 | |

| COMEX | MGC | Micro Futuros de Oro | 10 onzas | 1 | |

| NYMEX | CL | Petróleo Crudo de EE. UU. | 1000 barriles | 0.01 |

Se pueden obtener más detalles haciendo clic en: https://www.zyfgl.com/index.php?m=content&c=index&a=lists&catid=19

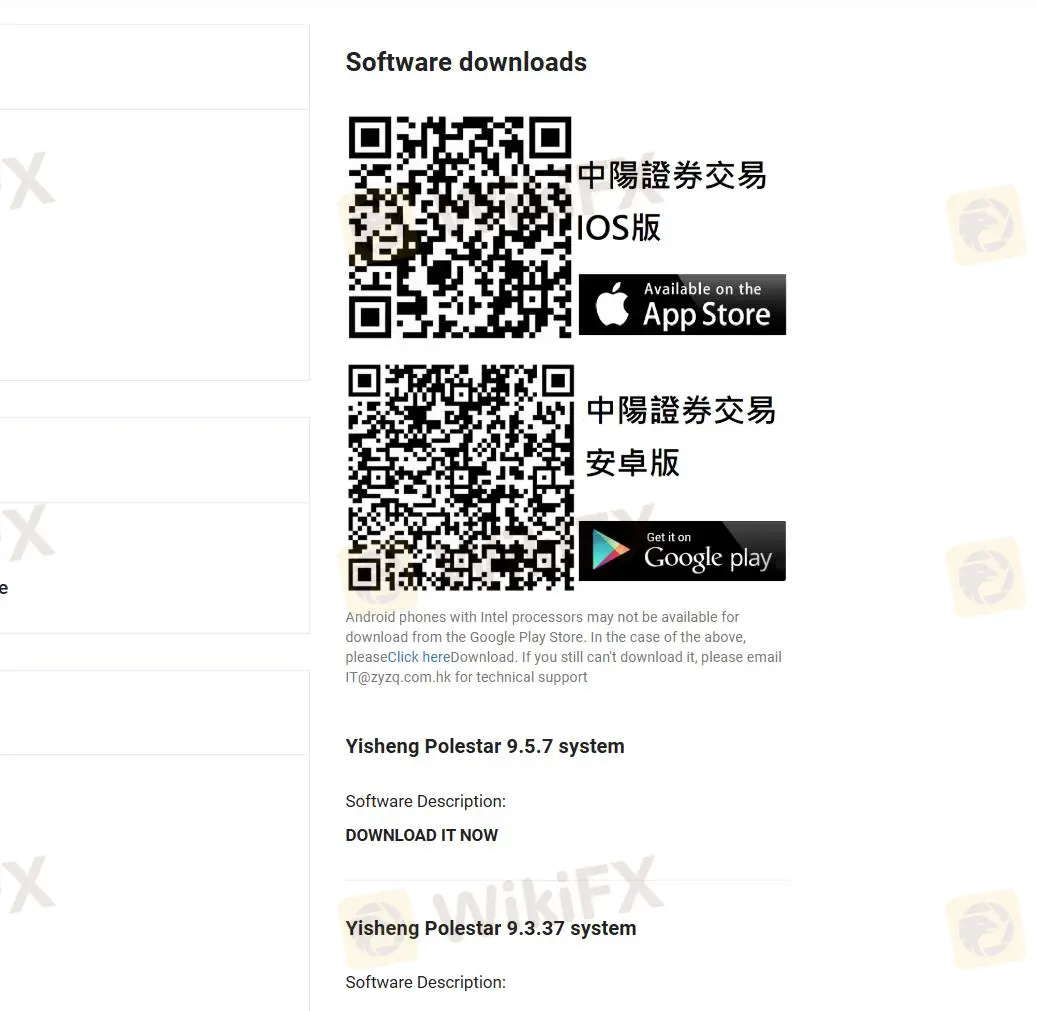

Plataforma de Trading

ZHONGYANG ofrece el sistema Yisheng Polestar 9.5.7, que se puede descargar a través de App Store y Google Play.

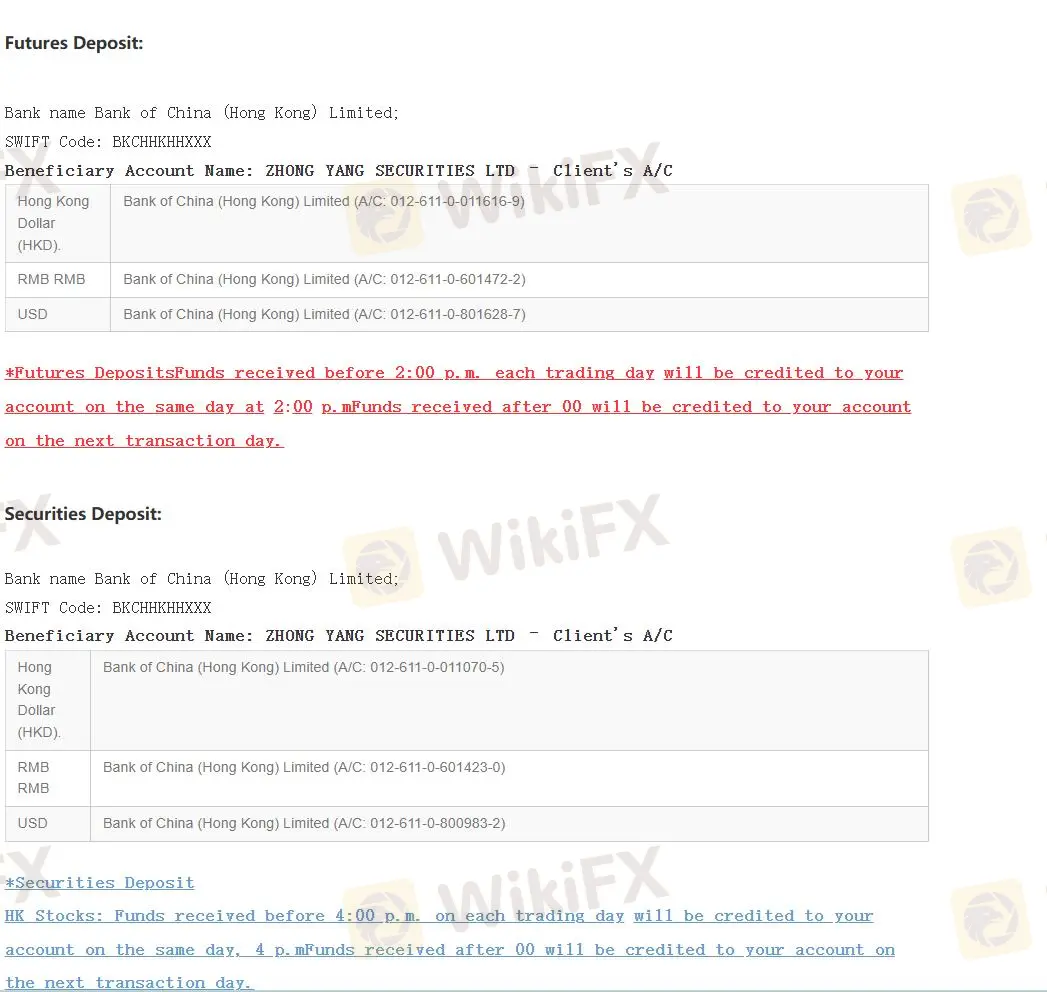

Depósito y Retiro

Depósito:

ZHONGYANG ofrece transferencia bancaria para realizar un depósito. Después de que se complete la transferencia de la cuenta, el cliente debe proporcionar a Zhong Yang Securities un certificado de depósito completo. La empresa luego llamará al cliente para verificar y confirmar la operación de depósito de fondos.

Nombre del Banco: Bank of China (Hong Kong) Limited

Código SWIFT: BKCHHKHHXXX

Nombre de la Cuenta del Beneficiario: ZHONG YANG SECURITIES LTD – Clients A/C

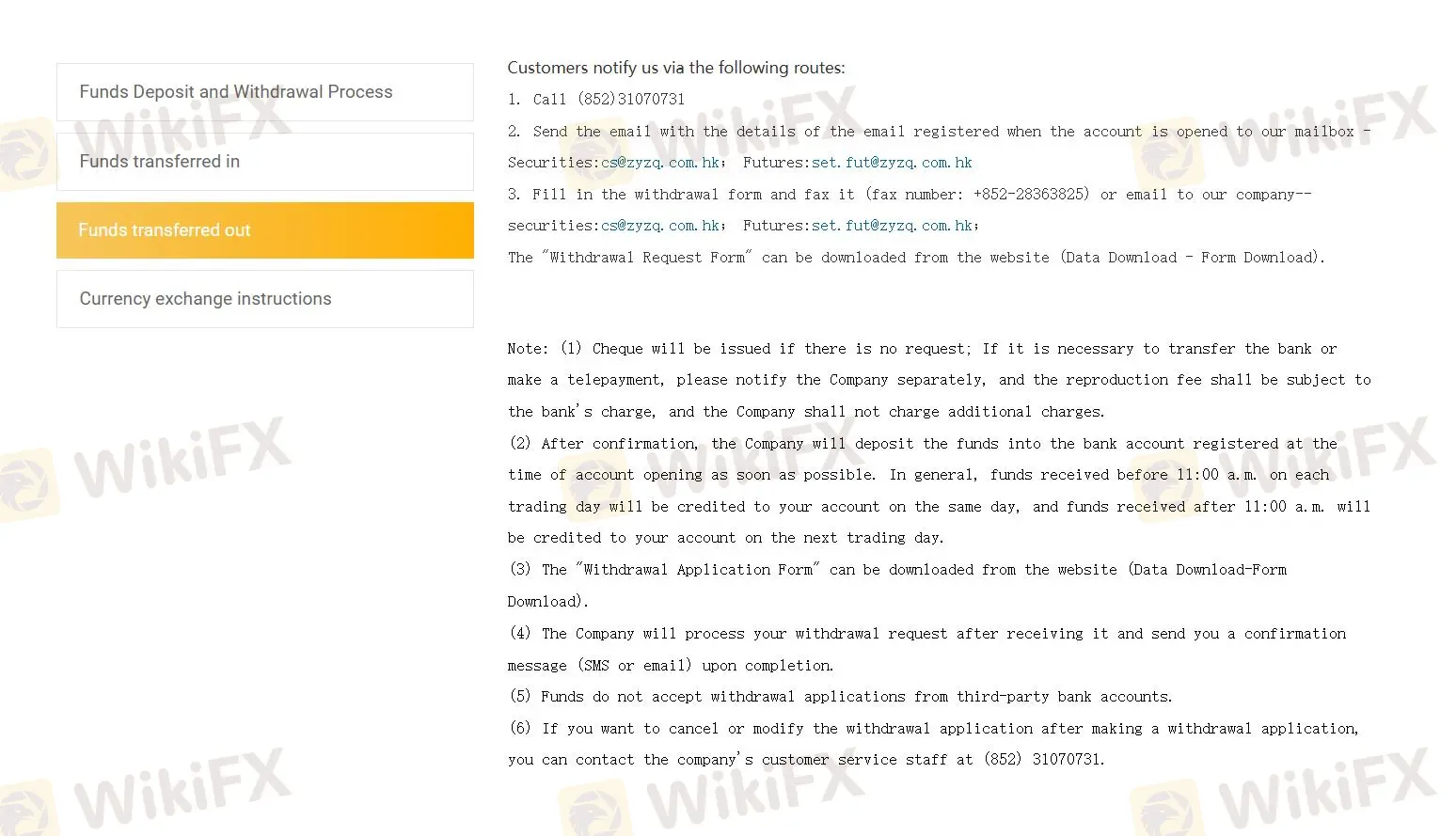

Retiro:

Los clientes pueden notificar a Zhong Yang Securities sobre los retiros a través de las siguientes vías:

Llamada: Marcar (852) 31070731

Email: Enviar un correo electrónico con los detalles a cs@zyzq.com.hk para valores y set.fut@zyzq.com.hk para futuros, utilizando el correo electrónico registrado al abrir la cuenta.

Fax o Email: Completar el formulario de retiro y enviarlo por fax al +852-28363825 o enviarlo por correo electrónico a cs@zyzq.com.hk para valores y set.fut@zyzq.com.hk para futuros.

Notas:

- Si no se realiza ninguna solicitud, se emitirá un cheque. Para transferencias bancarias o pagos telegráficos, notificar a la empresa por separado. Cualquier tarifa de manejo está sujeta a los cargos del banco.

- Los fondos recibidos antes de las 11:00 a.m. en un día hábil se acreditarán el mismo día, y los fondos recibidos después de las 11:00 a.m. se acreditarán el próximo día hábil.

- La empresa no procesa solicitudes de retiro de cuentas bancarias de terceros.