회사 소개

| NatWest 리뷰 요약 | |

| 설립 연도 | 1997 |

| 등록 국가/지역 | 영국 |

| 규제 | 규제 없음 |

| 서비스 | 은행, 대출, 보험, 저축, 투자 |

| 플랫폼/앱 | NatWest 모바일 뱅킹 앱 |

| 고객 지원 | 온라인 채팅 |

NatWest 정보

NatWest은 1997년에 설립되어 영국에 본사를 두고 있으며 FCA나 기타 주요 글로벌 금융 기관에 의해 규제되지 않습니다. 현재 계좌, 대출, 보험, 저축 및 투자 상품과 같은 다양한 개인 금융 서비스를 제공하지만 고급 거래 기능이나 데모 계정 대안은 제공하지 않습니다.

장단점

| 장점 | 단점 |

| 다양한 소매 뱅킹 서비스 제공 | 규제 없음 |

| 기본 계좌에 월간 수수료 없음 | |

| 실시간 채팅 지원 |

NatWest의 신뢰성

영국의 금융행정청(FCA) 및 ASIC(호주), NFA(미국)와 같은 주요 세계 규제 기관은 영국에 등록되어 있음에도 NatWest를 감독하지 않습니다. 리스크에 유의하시기 바랍니다!

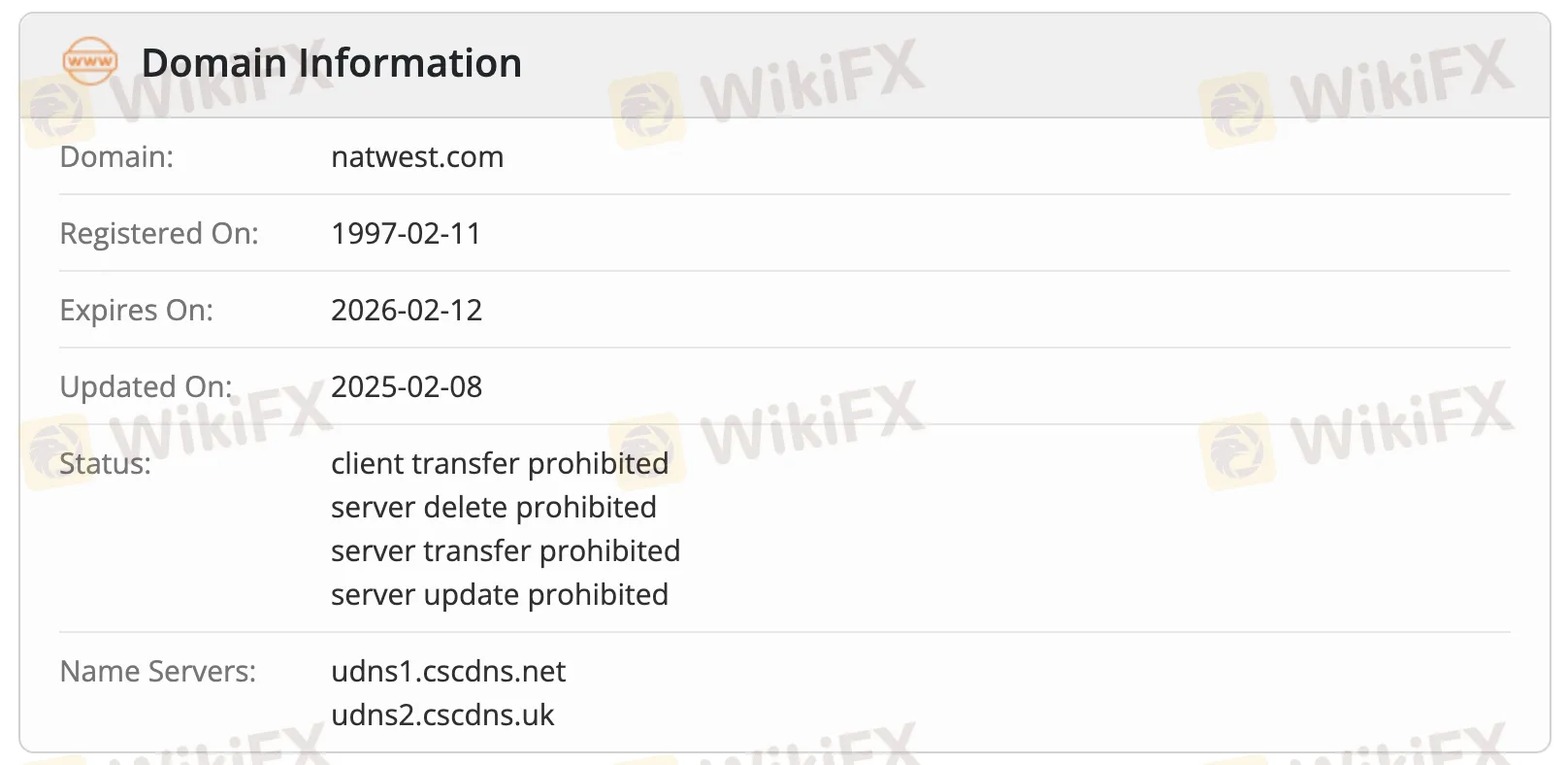

WHOIS 데이터에 따르면 natwest.com은 1997년 2월 11일에 등록되었으며 2025년 2월 8일에 마지막으로 업데이트되었으며 현재 활성 상태입니다. 2026년 2월 12일에 만료될 예정이며 다양한 레지스트리 잠금(클라이언트 및 서버 제한)이 있어 안전하게 유지되고 있으며 공식 도메인으로 많은 보호를 받고 있으며 활발히 유지되고 있습니다.

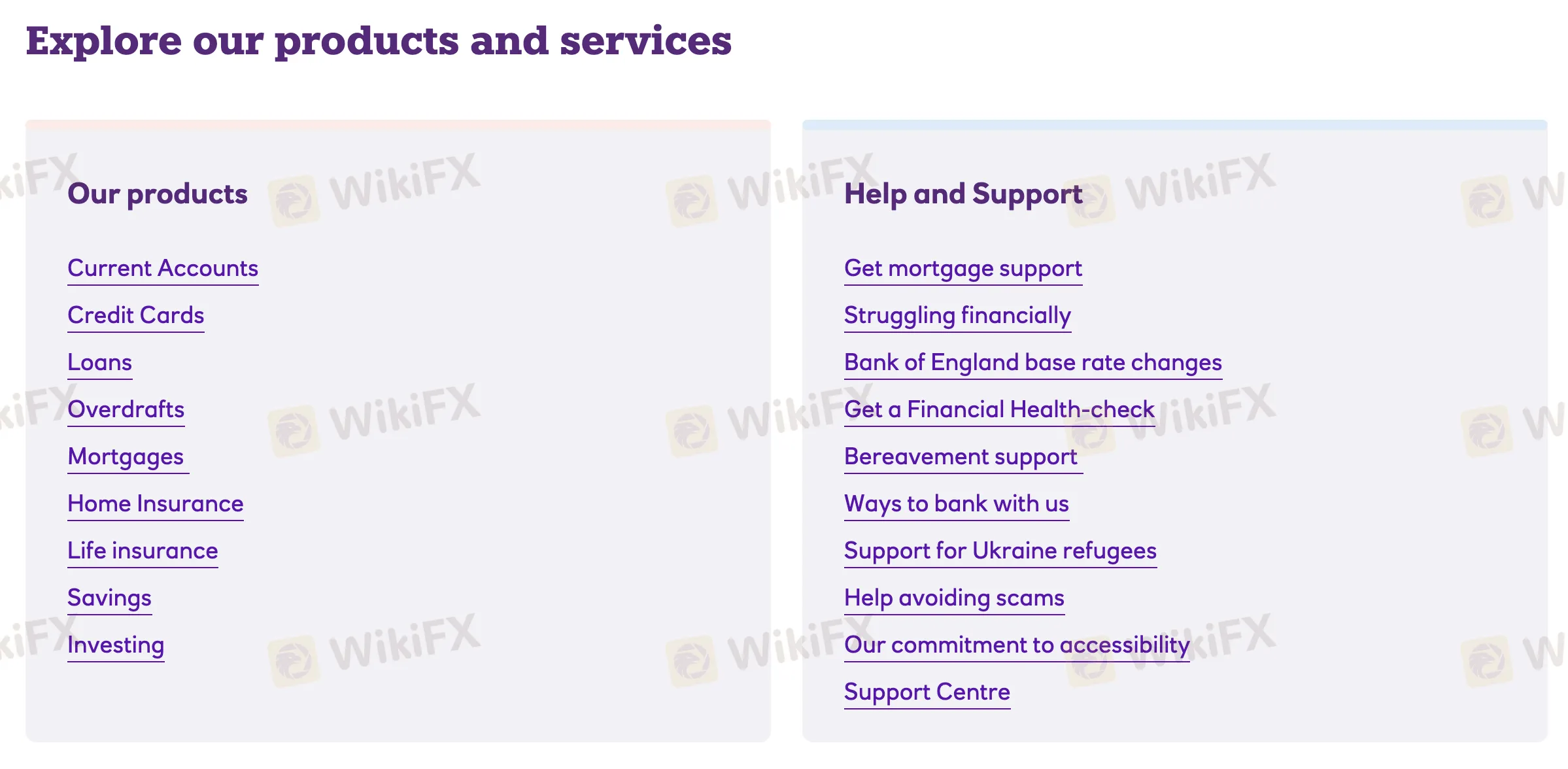

제품 및 서비스

NatWest은 은행, 대출, 보험 및 투자 서비스와 같은 다양한 개인 금융 제품을 제공합니다.

| 제품 및 서비스 | 지원 |

| 당좌 계좌 | ✔ |

| 신용 카드 | ✔ |

| 대출 | ✔ |

| 오버드래프트 | ✔ |

| 모기지 | ✔ |

| 주택 보험 | ✔ |

| 생명 보험 | ✔ |

| 저축 | ✔ |

| 투자 | ✔ |

계정 유형

NatWest은 현재 계좌에 대해 네 가지 범주를 가지고 있습니다: 개인, 프리미어 (고순자산 고객용), 학생 및 청소년 (3-25세 대상), 그리고 비즈니스 및 기업 (창업부터 대규모 조직까지).

수수료

NatWest은 일반 은행 서비스에 대해 일반적으로 낮거나 전혀 월간 수수료를 부과하며 프리미엄 계정 수준을 통해 추가 혜택을 제공합니다. 많은 계정, 예를 들어 Select 및 학생 계정은 수수료가 면제되어 있으며, 반면에 리워드 및 번들 계정은 현금 환급이나 보험 혜택을 위해 월간 수수료를 부과합니다.

| 계정 유형 | 월간 수수료 | 참고 사항 |

| 기본 계정 | £0 | 월간 수수료 없음; 예산 도구 및 저축 기능 포함 |

| 리워드 계정 | £2 | 직접 이체 및 앱 사용으로 현금 환급 |

| 학생 계정 | £0 | 무이자 초과 인출 포함 (한도 적용) |

| 적응 계정 (11-17세) | 2.25% 이자 획득; Apple/Google Pay 지원 | |

| Rooster Money (3-17세) | 무료 (NatWest 사용자) | NatWest 고객을 위한 구독 면제; 그렇지 않으면 월간 £1.99 |

| 리워드 실버 | £10 | 여행/모바일 보험, 수수료 면제 외화 사용 포함 |

| 리워드 플래티넘 | £22 | 전 세계 보험 및 영국 자동차 고장 보상 추가 |

| 프리미어 | 다양함 | £0부터 시작, 수수료는 제품 선택에 따라 다름 |

| 비즈니스 계정 | 비즈니스 유형 및 선택한 서비스에 따라 수수료 및 기능이 결정됨 |

플랫폼/앱

| 거래 플랫폼 | 지원 | 사용 가능한 장치 | 적합 대상 |

| NatWest 모바일 뱅킹 앱 | ✔ | iOS, Android | 개인 및 비즈니스 뱅킹, 11세 이상, 일상적 사용 |