Présentation de l'entreprise

| NatWest Résumé de l'examen | |

| Fondé | 1997 |

| Pays/Région Enregistré | Royaume-Uni |

| Régulation | Aucune régulation |

| Services | Banque, prêts, assurance, épargne, investissement |

| Plateforme/Application | Application de Banque Mobile NatWest |

| Support Client | Chat en ligne |

Informations sur NatWest

NatWest, fondé en 1997 et basé au Royaume-Uni, n'est pas réglementé par la FCA ou d'autres grandes agences financières mondiales. Il propose une large gamme de services financiers personnels tels que des comptes courants, des prêts, des assurances, des produits d'épargne et d'investissement, mais aucune capacité de trading avancée ou d'alternatives de compte d'échantillon.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Offre une large gamme de services bancaires de détail | Aucune régulation |

| Pas de frais mensuels sur les comptes de base | |

| Support de chat en direct |

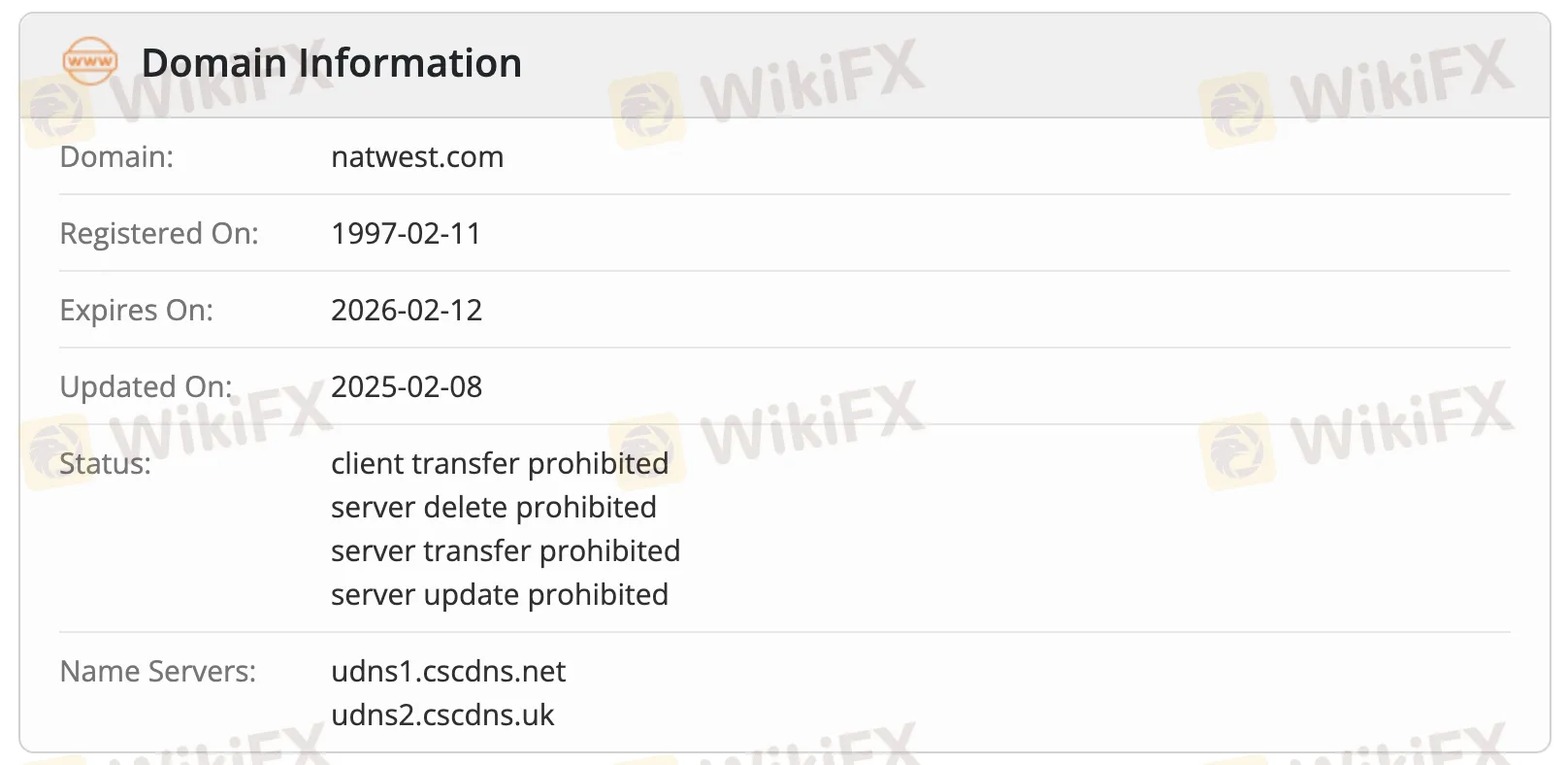

NatWest est-il légitime ?

L'Autorité de Conduite Financière (FCA) du Royaume-Uni et d'autres organismes de réglementation mondiaux clés tels que l'ASIC (Australie) et la NFA (États-Unis) ne supervisent pas NatWest, même s'il est enregistré au Royaume-Uni. Veuillez être conscient du risque !

Les données WHOIS montrent que natwest.com a été enregistré le 11 février 1997, mis à jour pour la dernière fois le 8 février 2025 et est toujours actif. Il expirera le 12 février 2026. Il dispose de divers verrous d'enregistrement (interdictions client et serveur) pour le maintenir en sécurité, ce qui signifie qu'il s'agit d'un domaine officiel avec beaucoup de protection et est activement maintenu.

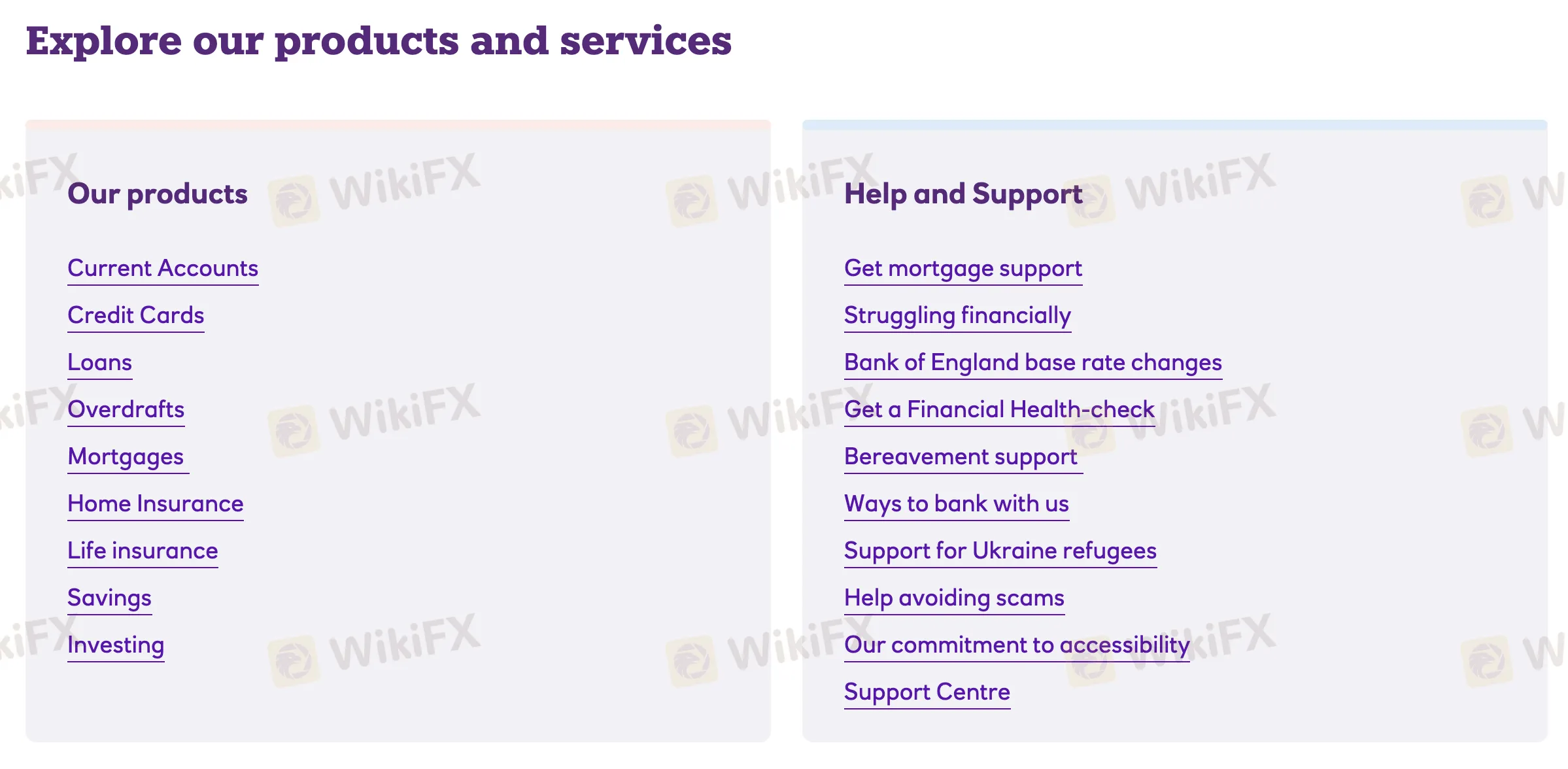

Produits et Services

NatWest propose de nombreux produits financiers personnels, tels que des services bancaires, de prêt, d'assurance et d'investissement pour les particuliers et les familles.

| Produits & Services | Pris en charge |

| Comptes Courants | ✔ |

| Cartes de Crédit | ✔ |

| Prêts | ✔ |

| Découverts | ✔ |

| Hypothèques | ✔ |

| Assurance Habitation | ✔ |

| Assurance Vie | ✔ |

| Épargne | ✔ |

| Investissement | ✔ |

Type de Compte

NatWest propose quatre catégories de comptes courants : Personnel, Premier (pour les clients fortunés), Étudiant & Jeunesse (pour les 3-25 ans) et Entreprise & Corporate (pour les startups et les grandes organisations).

Frais

NatWest facture normalement des frais mensuels bas ou nuls pour les services bancaires de base, avec des avantages supplémentaires offerts via les niveaux de compte premium. De nombreux comptes, comme les comptes Select et Étudiant, sont sans frais, tandis que les comptes Reward et groupés facturent des frais mensuels en échange de remises en argent ou d'avantages d'assurance.

| Type de compte | Frais mensuels | Remarques |

| Compte de base | £0 | Pas de frais mensuels ; comprend des outils de budget et des fonctionnalités d'épargne |

| Compte Reward | £2 | Remises en argent sur les prélèvements automatiques et l'utilisation de l'application |

| Compte Étudiant | £0 | Comprend un découvert sans intérêts (sous réserve de limites) |

| Compte Adapt (11–17) | Rapporte un intérêt de 2,25 % ; prend en charge Apple/Google Pay | |

| Rooster Money (3–17) | Gratuit (utilisateurs NatWest) | Abonnement offert aux clients NatWest ; sinon £1,99/mois |

| Reward Silver | £10 | Comprend une assurance voyage/mobile, dépenses à l'étranger sans frais |

| Reward Platinum | £22 | Ajoute une assurance mondiale et une couverture en cas de panne de voiture au Royaume-Uni |

| Premier | Varie | À partir de £0, les frais dépendent du choix du produit |

| Compte Entreprise | Frais et fonctionnalités basés sur le type d'entreprise et les services sélectionnés |

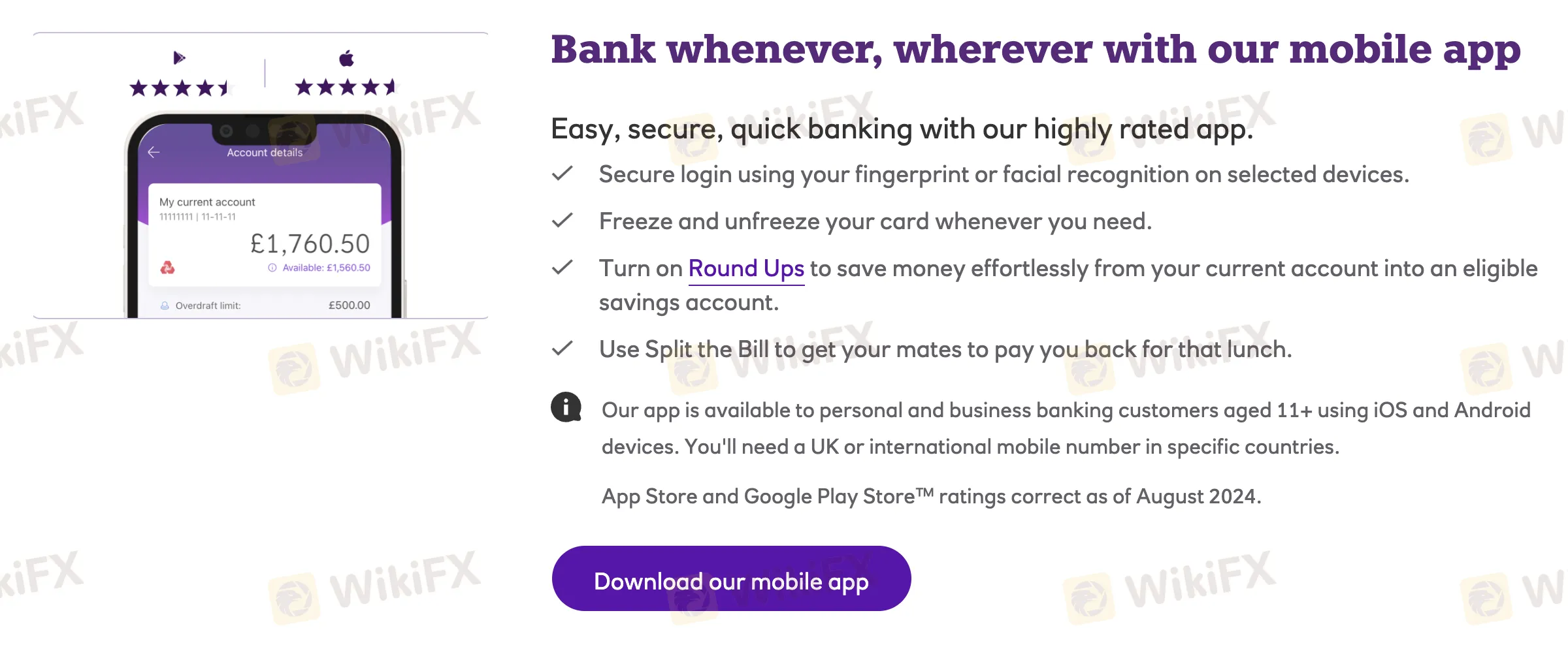

Plateforme/APPLI

| Plateforme de trading | Pris en charge | Appareils disponibles | Convient pour |

| Application de banque mobile NatWest | ✔ | iOS, Android | Banque personnelle et professionnelle, à partir de 11 ans, utilisation quotidienne |