Company Summary

| NatWest Review Summary | |

| Founded | 1997 |

| Registered Country/Region | United Kingdom |

| Regulation | No regulation |

| Services | Banking, loans, insurance, savings, investing |

| Platform/APP | NatWest Mobile Banking App |

| Customer Support | Online chat |

NatWest Information

NatWest, founded in 1997 and headquartered in the United Kingdom, is not regulated by the FCA or other major global financial agencies. It offers a wide range of personal finance services such as current accounts, loans, insurance, savings, and investment goods, but no advanced trading capability or sample account alternatives.

Pros and Cons

| Pros | Cons |

| Offers a wide range of retail banking services | No regulation |

| No monthly fee on basic accounts | |

| Live chat support |

Is NatWest Legit?

The UK's Financial Conduct Authority (FCA) and other key worldwide regulatory bodies like ASIC (Australia) and the NFA (U.S.) do not oversee NatWest, even though it is registered in the UK. Please be aware of the risk!

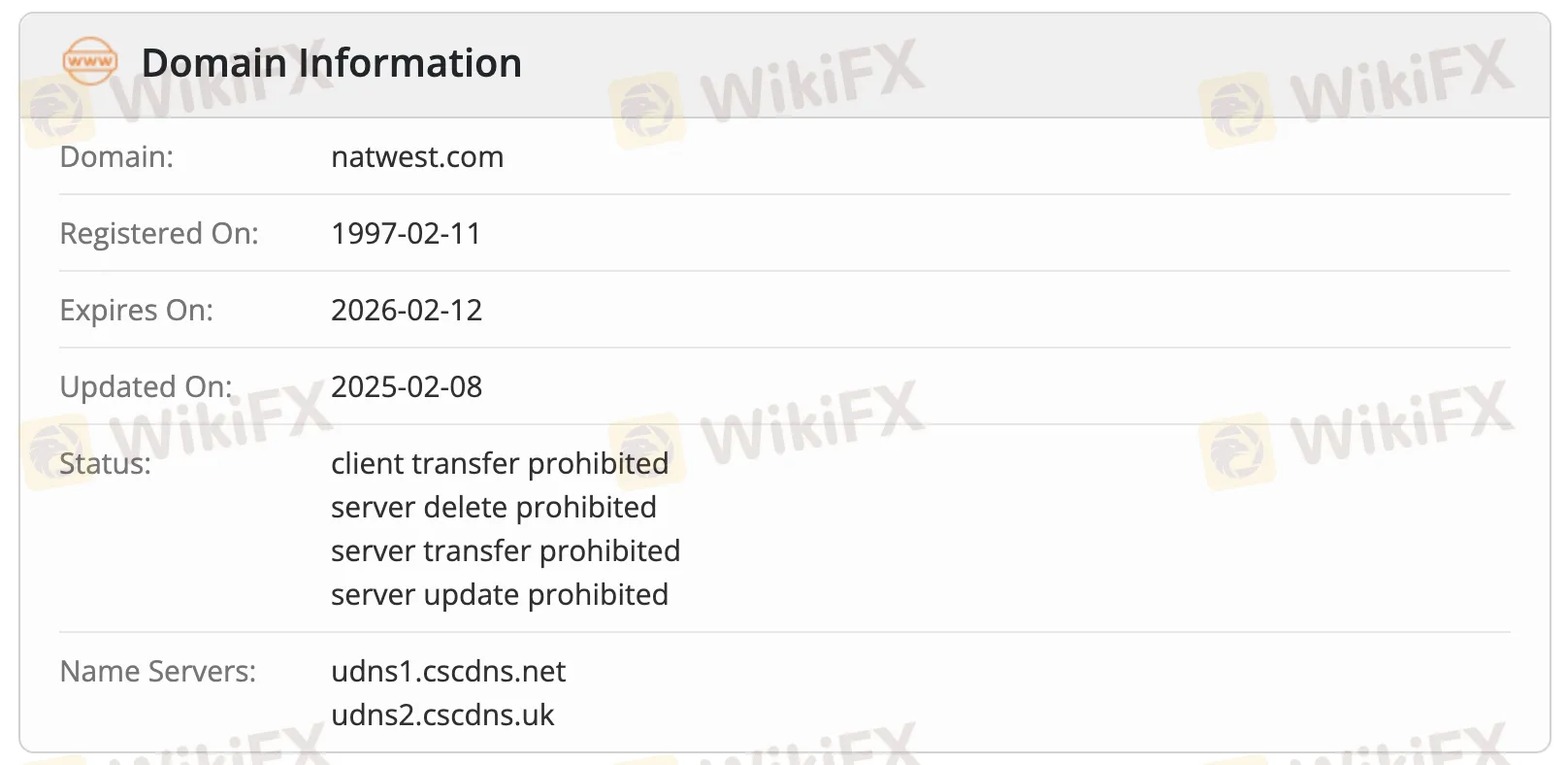

WHOIS data show thatnatwest.com was registered on February 11, 1997, last updated on February 8, 2025, and is still active. It will expire on February 12, 2026. It has various registry locks (client and server prohibitions) to keep it safe, which means it is an official domain with a lot of protection and is actively maintained.

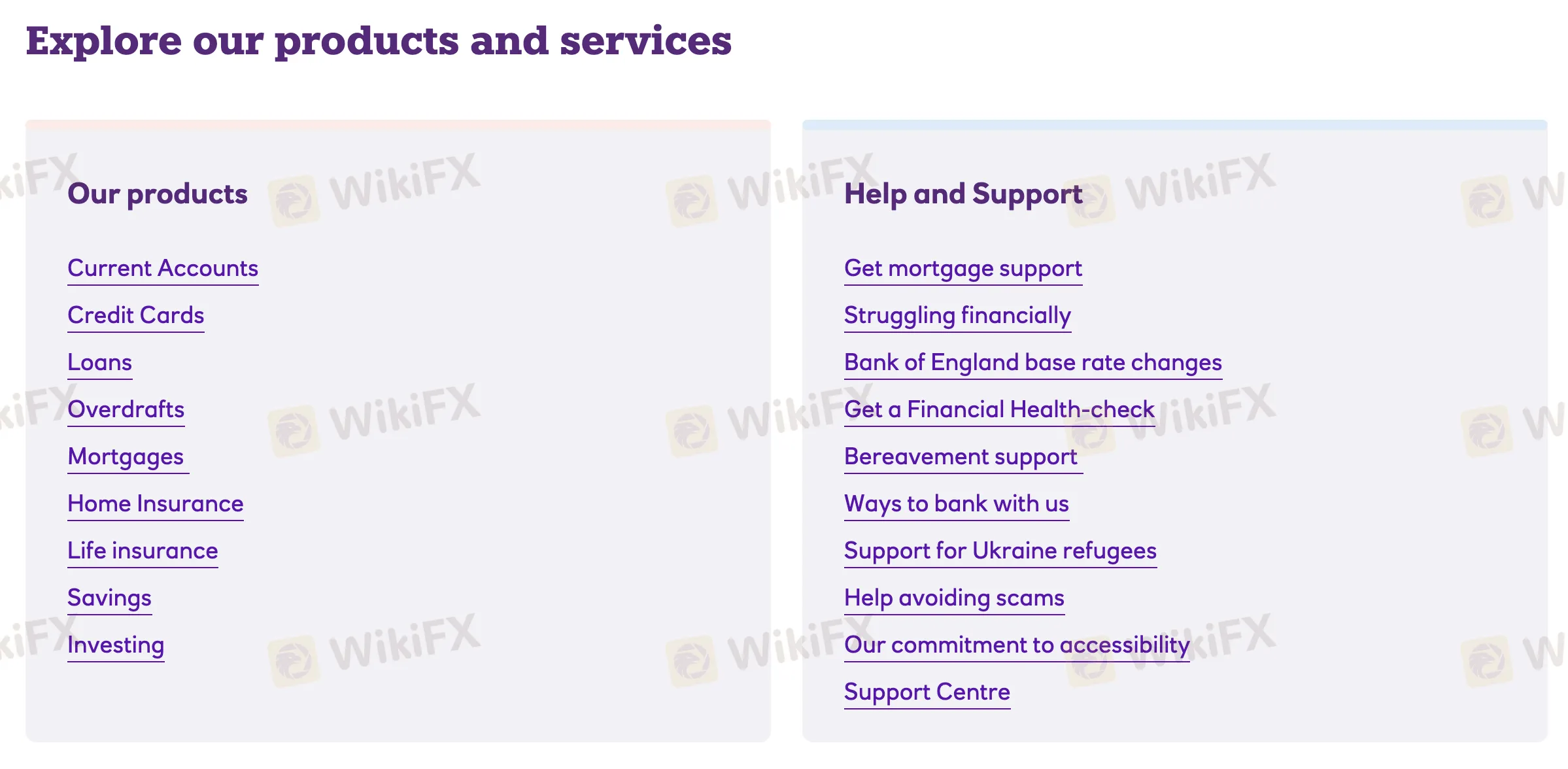

Products and Services

NatWest has a lot of personal finance products, such as banking, lending, insurance, and investment services for people and families.

| Products & Services | Supported |

| Current Accounts | ✔ |

| Credit Cards | ✔ |

| Loans | ✔ |

| Overdrafts | ✔ |

| Mortgages | ✔ |

| Home Insurance | ✔ |

| Life Insurance | ✔ |

| Savings | ✔ |

| Investing | ✔ |

Account Type

NatWest has four categories of current accounts: Personal, Premier (for high-net-worth clients), Student & Youth (for ages 3-25), and Business & Corporate (for startups to large organizations).

Fees

NatWest normally charges low or no monthly fees for basic banking services, with additional benefits offered via premium account levels. Many accounts, like the Select and Student accounts, are fee-free, whereas the Reward and bundled accounts charge monthly fees in exchange for cashback or insurance benefits.

| Account Type | Monthly Fee | Notes |

| Basic Account | £0 | No monthly fee; includes budget tools and savings features |

| Reward Account | £2 | Cashback from Direct Debits and app usage |

| Student Account | £0 | Includes interest-free overdraft (limits apply) |

| Adapt Account (11–17) | Earns 2.25% interest; supports Apple/Google Pay | |

| Rooster Money (3–17) | Free (NatWest users) | Subscription waived for NatWest customers; otherwise £1.99/month |

| Reward Silver | £10 | Includes travel/mobile insurance, fee-free foreign spending |

| Reward Platinum | £22 | Adds worldwide insurance and UK car breakdown cover |

| Premier | Varies | Starting from £0, fees depend on product choice |

| Business Account | Fees and features based on business type and services selected |

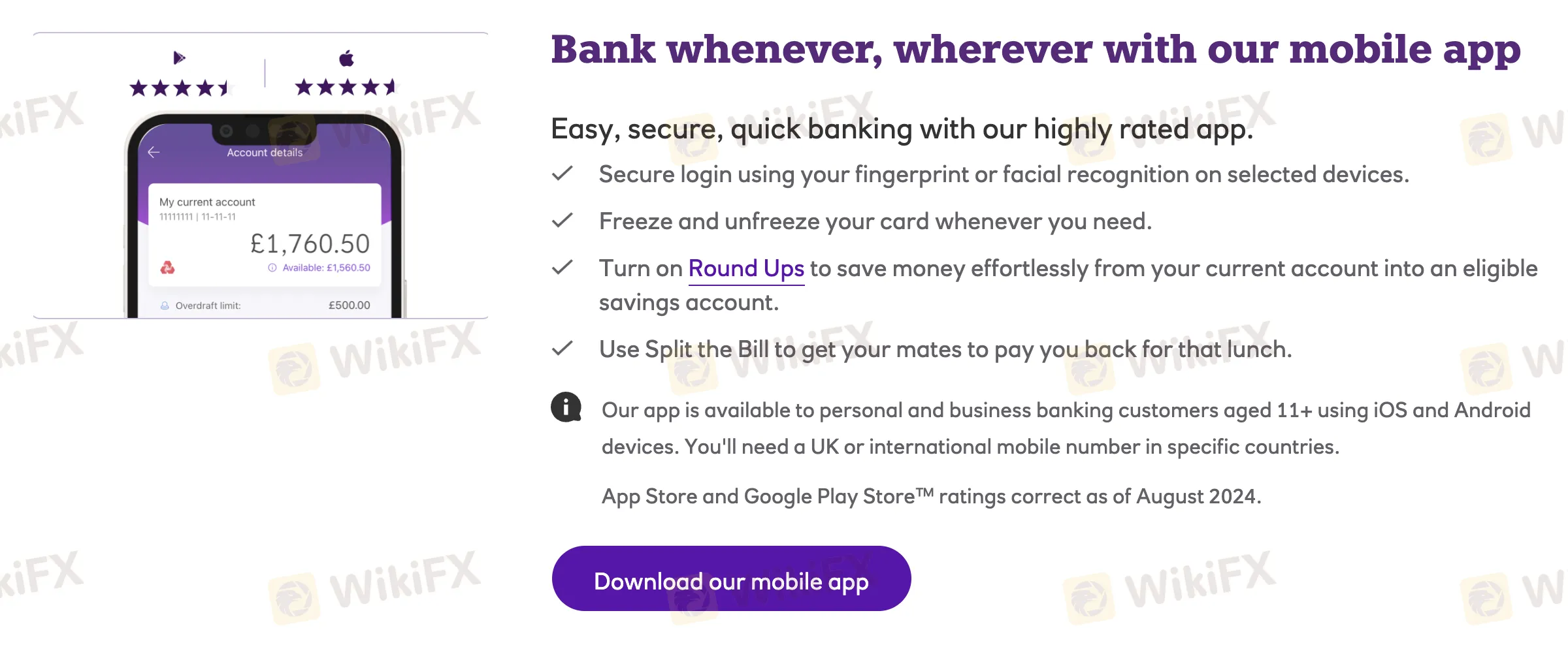

Platform/APP

| Trading Platform | Supported | Available Devices | Suitable for |

| NatWest Mobile Banking App | ✔ | iOS, Android | Personal & business banking, age 11+, everyday use |