Company Summary

| Fineco Review Summary | |

| Founded | 2002 |

| Registered Country/Region | Italy |

| Regulation | No Regulation |

| Trading Products | CFDs, ETF, ETC & ETNs, Bonds, Futures, Options |

| EUR/USD Spread | From 1 pip |

| Trading Platform | FinecoX |

| Minimum Deposit | / |

| Customer Support | Social Media: Facebook, Twitter, LinkedIn, Instagram, Spotify, Reddit |

| Address: 20131 Milan - P.zza Durante, 11 | |

Fineco Information

Fineco was founded in 2002 and is registered in Italy. It offers a wide range of trading products, including CFDs, ETF, ETC & ETNs, Bonds, Futures, and Options through its own FinecoX platform.

Pros and Cons

| Pros | Cons |

| Various trading products | No regulation |

| No commissions on CFD trading | Limited payment methods |

| No direct contact channel |

Is Fineco Legit?

Fineco is not regulated currently, so traders need to exercise caution when trading.

What Can I Trade on Fineco?

Fineco offers a wide range of tradable products, including CFDs, ETF, ETC & ETNs, Bonds, Futures, and Options.

| Trading Products | Available |

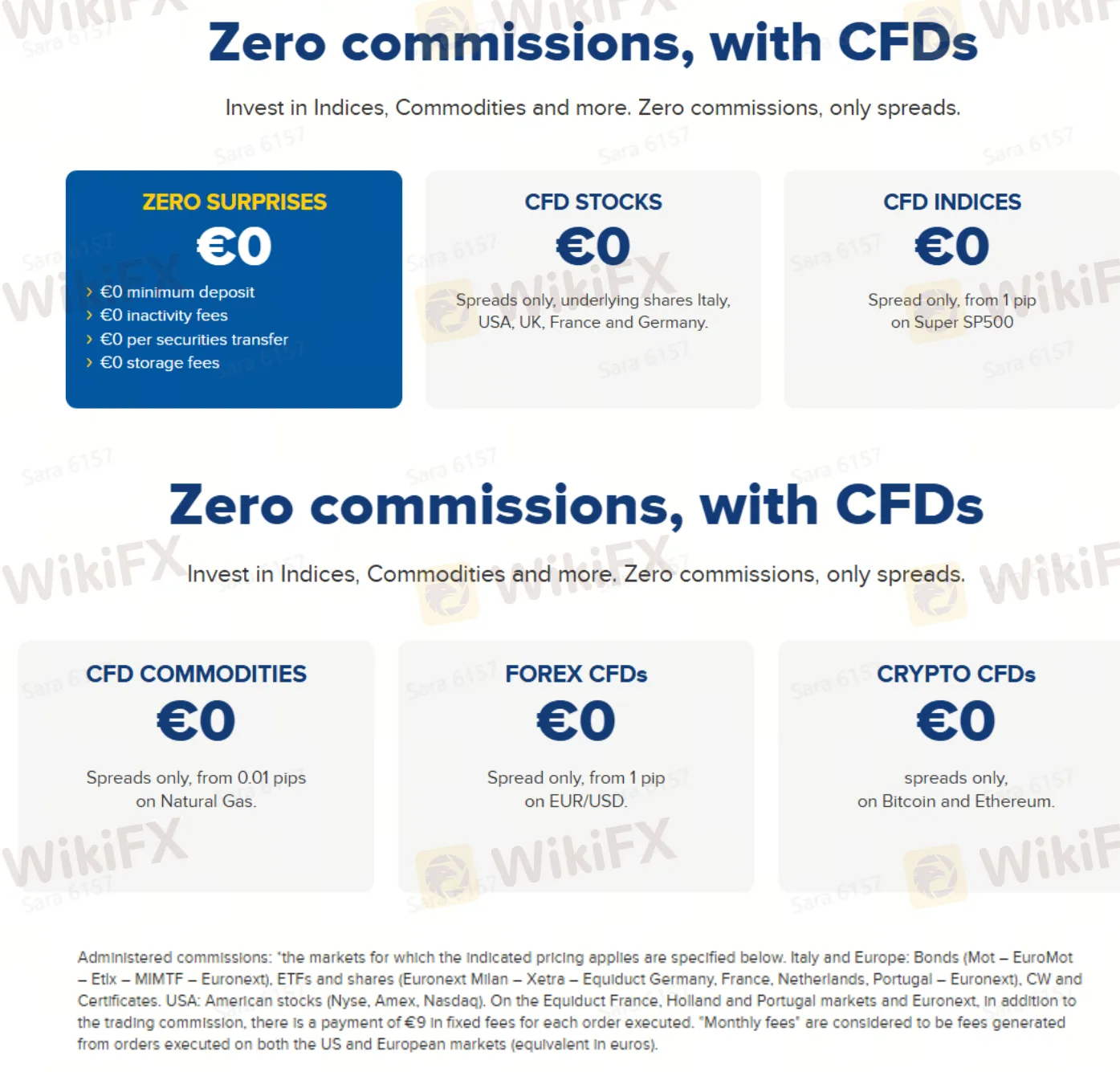

| CFD Stocks | ✔ |

| CFD Indices | ✔ |

| CFD Commodities | ✔ |

| Forex CFDs | ✔ |

| Crypto CFDs | ✔ |

| ETF, ETC & ETN | ✔ |

| Bonds | ✔ |

| Futures | ✔ |

| Options | ✔ |

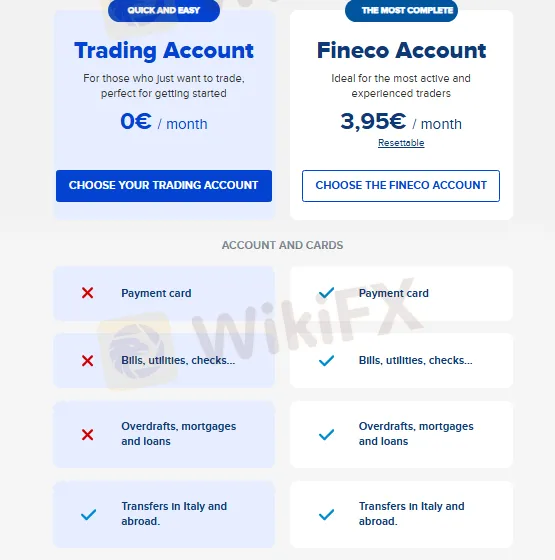

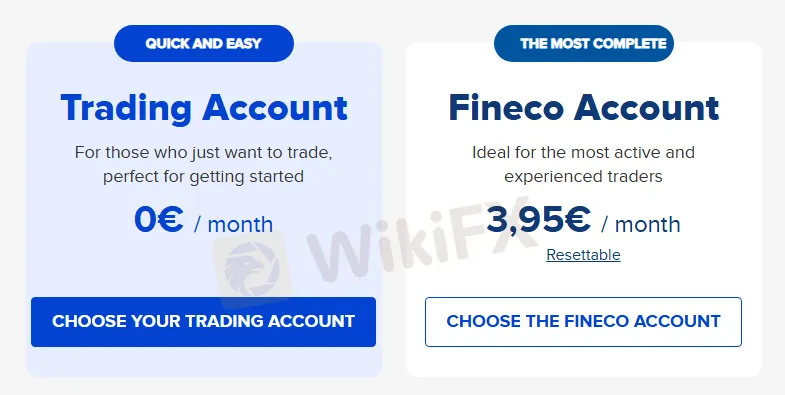

Account Type

Fineco offers two types of accounts: Trading Account and Fineco Account. The differences between the two accounts are as follows:

| Account Type | Monthly Fee | Commission | Multicurrency Service | Customer Support |

| Trading Account | €0 | 0.19% of the order value (Min. €2.95 - Max. €19) | No | Mail only |

| Fineco Account | €3.95/month | Fixed from €19 to €2.95 per operation or asset (resettable after two months) | Yes | By email and phone |

Fees

Spread: CFDs are offered with zero commission, with only spread fees applied. Spreads vary by asset; for example, EUR/USD spreads start at 1 pip, and Super SP500 index spreads also start at 1 pip.

Commission: No commission on CFD trading.

Management Commission: Orders executed in the US and European markets are subject to a fixed fee of 9 euros in addition to the transaction commission.

Trading Platform

Fineco supports traders in conducting transactions through its proprietary FinecoX platform.

| Trading Platform | Supported | Available Devices | Suitable for |

| FinecoX | ✔ | Desktop, Mobile, Web | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

Deposit and Withdrawal

Fineco's different accounts vary in terms of payment methods and financial services. The following is a comparison of the deposit and withdrawal functions of the two account types:

| Account Type | Payment Card | Bills, Utilities, Checks | Overdrafts, Mortgages, and Loans | Transfers in Italy and Abroad |

| Trading Account | ✗ | ✗ | ✗ | ✓ |

| Fineco Account | ✓ | ✓ | ✓ | ✓ |