Company Summary

| SpartanForex Review Summary | |

| Founded | 2014 |

| Registered Country/Region | Costa Rica |

| Regulation | Not regulated |

| Market Instruments | Forex, Metals, Cryptocurrencies, CFDs, Indices, Stocks |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| Spread | 0.4 pips for EUR/USD pair |

| Trading Platform | Spartan Oracle |

| Min Deposit | $500 |

| Customer Support | info@spartanforex.com |

| +506-7206-7179 | |

SpartanForex Information

SpartanForex is an offshore forex and CFD broker offering trading in multiple asset classes including forex, metals, indices, stocks, and cryptocurrencies. It provides its own proprietary web-based platform, Spartan Oracle, with leverage up to 1:500 and access to over 100 instruments. However, it is not regulated by any recognized financial authority.

Pros and Cons

| Pros | Cons |

| Offers a wide range of tradable instruments | Not regulated |

| Demo accounts available | Minimum deposit of $500 is relatively high for new traders |

| Proprietary web-based platform with no installation needed | Islamic accounts not clearly offered or standardized |

Is SpartanForex Legit?

SpartanForex is not a legitimate broker. It is registered in Costa Rica but has no valid regulatory license from any recognized authority. Major global regulators like the FCA (UK), ASIC (Australia), and NFA (USA) also do not license it.

The domain spartanforex.com was registered on May 27, 2014, and will expire on May 27, 2026. It is currently in a locked status that prevents transfer and updates.

What Can I Trade on SpartanForex?

The broker offers a wide range of tradable products including forex pairs, indices, cryptocurrencies, metals, energy products, and stocks.

| Tradable Instruments | Supported |

| Forex | ✅ |

| Commodities | ✅ |

| Crypto | ✅ |

| CFD | ✅ |

| Indexes | ✅ |

| Stock | ✅ |

| ETF | ❌ |

Account Types

SpartanForex offers one standard live trading account and free demo accounts but does not offer Islamic (swap-free) accounts. The live account suits both beginners and experienced traders seeking low spreads and high leverage, while the demo account is ideal for practicing strategies without financial risk.

| Account Type | Available | Description | Suitable For |

| Live Account | ✅ | One main type, funding required within 30 days. | Best for beginners and regular traders. |

| Demo Account | ✅ | Free, unlimited usage for practice and training. | Great for testing strategies risk-free. |

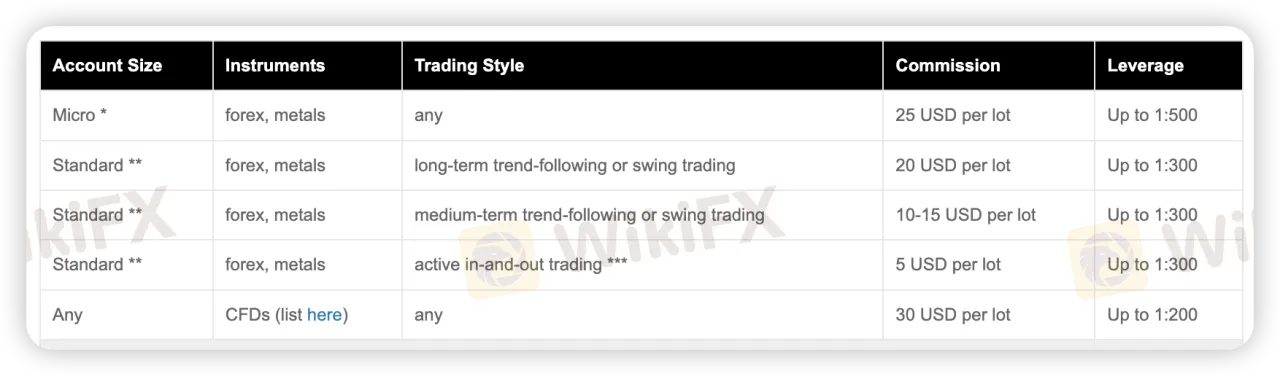

Leverage

SpartanForex offers leverage up to 1:500, depending on the account type. For example, Micro accounts can access the full 1:500 leverage, while Standard accounts are capped at 1:300, and CFD accounts go up to 1:200.

SpartanForex Fees

Compared to industry standards, SpartanForexs fees are moderate to high. Spreads start from 0.4 pips across major forex pairs. Commissions vary by account type, ranging from $5 to $30 per lot.

| Account Type | Instruments | Spread (from) | Commission per Lot | Leverage |

| Micro | Forex, Metals | 0.4 pips | $25 | Up to 1:500 |

| Standard | Forex, Metals | 0.4 pips | $5–20 | Up to 1:300 |

| CFD | CFDs | Not mentioned | $30 | Up to 1:200 |

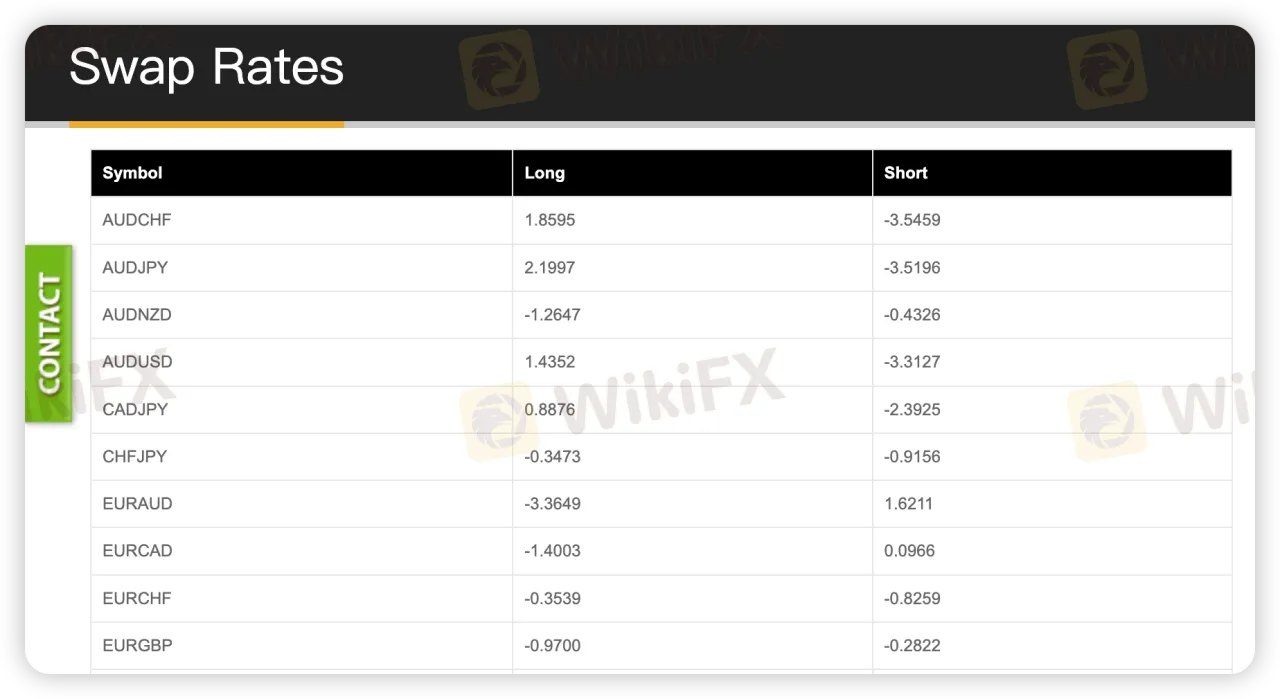

Swap Rates

SpartanForex applies overnight swap fees for holding positions past market close, with charges varying by instrument and trade direction. Although swap-free accounts are not standard, they may be available upon request with an added $5 per lot fee.

| Symbol | Long Swap | Short Swap |

| AUDCHF | 1.8595 | -3.5459 |

| AUDJPY | 2.1997 | -3.5196 |

| AUDNZD | -1.2647 | -0.4326 |

| AUDUSD | 1.4352 | -3.3127 |

| EURAUD | -3.3649 | 1.6211 |

| EURUSD | -0.5251 | -0.4951 |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for what kind of traders |

| Spartan Oracle | ✅ | Any browser-based system (Windows, Mac, Linux, Android, iOS) | Traders wanting cross-device access with no installation needed. |

| MT4 | ✅ | Windows, Mac, Android, iOS | Experienced traders needing EA (Expert Advisors), indicators, advanced charting tools. |

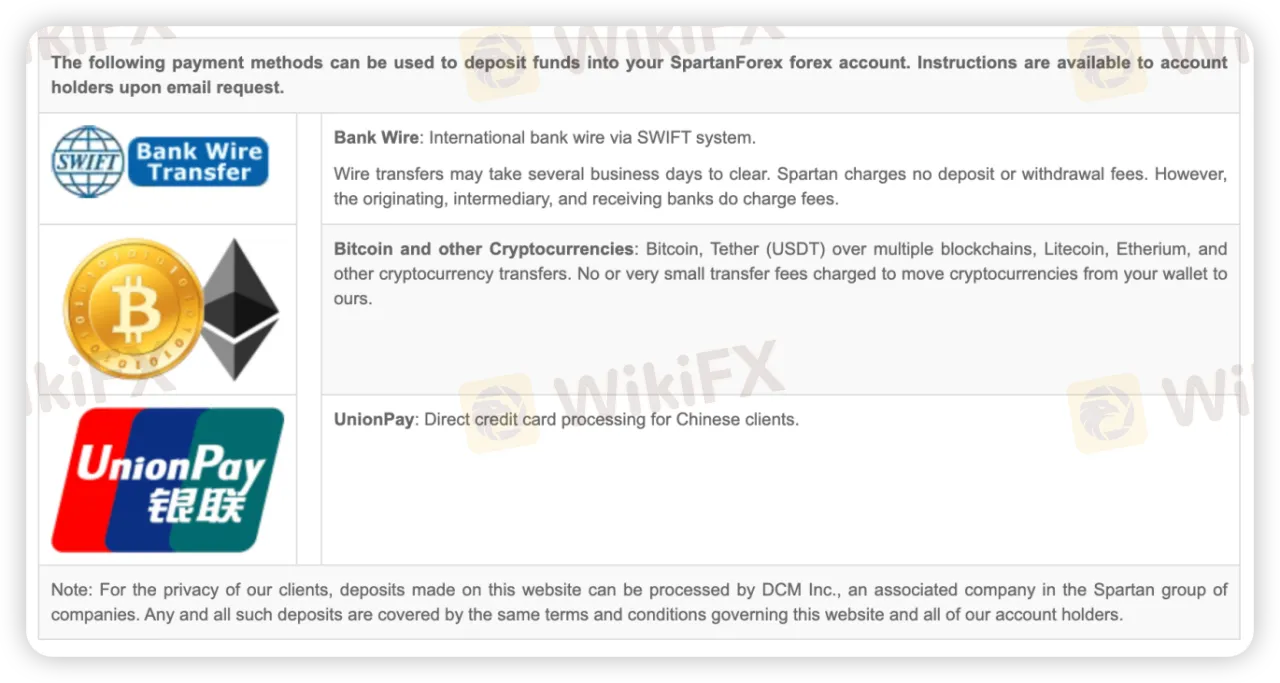

Deposit and Withdrawal

| Method | Min. Deposit | Min. Withdrawal | Fees | Processing Time |

| Bank Wire | $ 500 | Not mentioned | No fee from SpartanForex, but bank fees may apply. | Several business days. |

| Cryptocurrency (BTC, USDT, LTC, ETH) | $ 500 | Not mentioned | No or very low network fees. | Depends on network confirmation. |

| UnionPay (China only) | $ 500 | Not mentioned | Not mentioned | Not mentioned |