مقدمة عن الشركة

| Fineco ملخص المراجعة | |

| تأسست | ٢٠٠٢ |

| البلد/المنطقة المسجلة | إيطاليا |

| التنظيم | لا يوجد تنظيم |

| منتجات التداول | CFDs، ETF، ETC & ETNs، سندات، عقود مستقبلية، خيارات |

| الفارق بين اليورو والدولار الأمريكي | من ١ نقطة |

| منصة التداول | FinecoX |

| الحد الأدنى للإيداع | / |

| دعم العملاء | وسائل التواصل الاجتماعي: فيسبوك، تويتر، لينكد إن، إنستغرام، سبوتيفاي، ريديت |

| العنوان: ٢٠١٣١ ميلان - بيازا دورانتي، ١١ | |

معلومات Fineco

تأسست Fineco في عام ٢٠٠٢ ومسجلة في إيطاليا. تقدم مجموعة واسعة من منتجات التداول، بما في ذلك CFDs، ETF، ETC & ETNs، سندات، عقود مستقبلية، وخيارات من خلال منصتها الخاصة FinecoX.

الإيجابيات والسلبيات

| الإيجابيات | السلبيات |

| منتجات تداول متنوعة | لا يوجد تنظيم |

| لا توجد عمولات على تداول CFDs | طرق دفع محدودة |

| لا يوجد قناة اتصال مباشرة |

هل Fineco شرعية؟

Fineco غير منظمة حاليًا، لذا يجب على التجار أخذ الحيطة عند التداول.

ما الذي يمكنني التداول به على Fineco؟

Fineco تقدم مجموعة واسعة من المنتجات التي يمكن التداول بها، بما في ذلك CFDs، ETF، ETC & ETNs، سندات، عقود مستقبلية، وخيارات.

| منتجات التداول | متاح |

| CFD للأسهم | ✔ |

| CFD للمؤشرات | ✔ |

| CFD للسلع | ✔ |

| CFD للعملات الأجنبية | ✔ |

| CFD للعملات الرقمية | ✔ |

| ETF، ETC & ETN | ✔ |

| سندات | ✔ |

| عقود مستقبلية | ✔ |

| خيارات | ✔ |

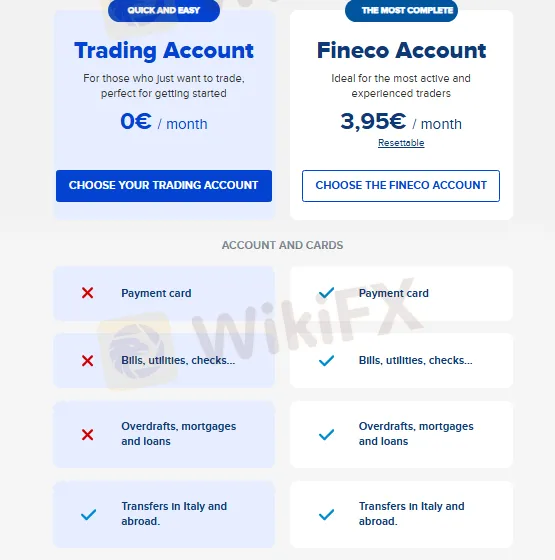

نوع الحساب

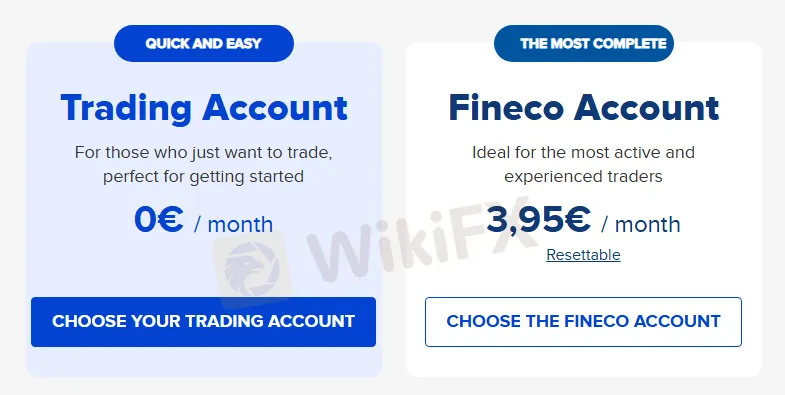

Fineco تقدم نوعين من الحسابات: حساب التداول وحساب Fineco. الفروق بين الحسابين على النحو التالي:

| نوع الحساب | رسوم شهرية | عمولة | خدمة العملات المتعددة | دعم العملاء |

| حساب التداول | €0 | 0.19% من قيمة الطلب (الحد الأدنى €2.95 - الحد الأقصى €19) | لا | البريد فقط |

| حساب Fineco | €3.95/شهريًا | ثابت من €19 إلى €2.95 لكل عملية أو أصل (يمكن إعادة تعيينه بعد شهرين) | نعم | عن طريق البريد الإلكتروني والهاتف |

الرسوم

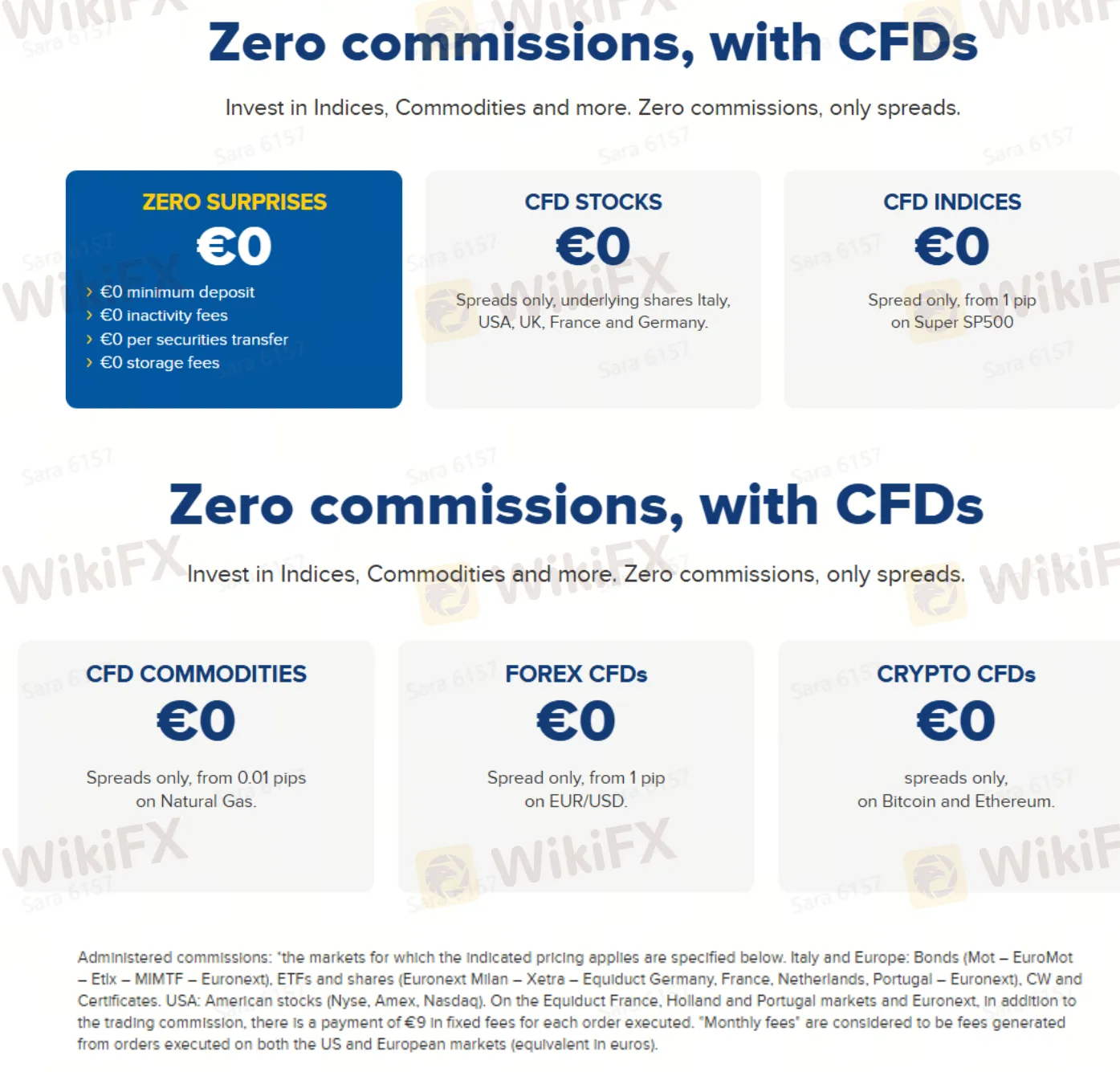

الانتشار: يتم تقديم CFDs بدون عمولة، مع تطبيق رسوم الانتشار فقط. تختلف الانتشارات حسب الأصل؛ على سبيل المثال، تبدأ الانتشارات لزوج العملات EUR/USD من 1 نقطة، وتبدأ الانتشارات لمؤشر Super SP500 أيضًا من 1 نقطة.

العمولة: لا توجد عمولة على تداول CFDs.

عمولة الإدارة: الطلبات المنفذة في الأسواق الأمريكية والأوروبية تخضع لرسم ثابت قدره 9 يورو بالإضافة إلى عمولة المعاملة.

منصة التداول

Fineco تدعم التجار في إجراء المعاملات من خلال منصتها الخاصة FinecoX.

| منصة التداول | مدعومة | الأجهزة المتاحة | مناسبة لـ |

| FinecoX | ✔ | سطح المكتب، الجوال، الويب | / |

| MT4 | ❌ | / | المبتدئين |

| MT5 | ❌ | / | التجار المتمرسين |

الإيداع والسحب

تختلف حسابات Fineco من حيث طرق الدفع والخدمات المالية. وفيما يلي مقارنة لوظائف الإيداع والسحب لنوعي الحسابين:

| نوع الحساب | بطاقة الدفع | الفواتير، المرافق، الشيكات | السحوبات الزائدة، الرهونات العقارية، والقروض | التحويلات داخل إيطاليا وخارجها |

| حساب التداول | ✗ | ✗ | ✗ | ✓ |

| حساب Fineco | ✓ | ✓ | ✓ | ✓ |