公司简介

| Fineco 评论摘要 | |

| 成立时间 | 2002 |

| 注册国家/地区 | 意大利 |

| 监管 | 无监管 |

| 交易产品 | 差价合约、交易所交易基金(ETF)、交易所交易产品(ETC)和交易所交易品种(ETNs)、债券、期货、期权 |

| 欧元/美元 点差 | 从1点起 |

| 交易平台 | FinecoX |

| 最低存款 | / |

| 客户支持 | 社交媒体:Facebook、Twitter、LinkedIn、Instagram、Spotify、Reddit |

| 地址:20131 Milan - P.zza Durante, 11 | |

Fineco 信息

Fineco成立于2002年,注册地为意大利。通过其自有的FinecoX平台,提供包括差价合约、交易所交易基金(ETF)、交易所交易产品(ETC)和交易所交易品种(ETNs)、债券、期货和期权在内的广泛交易产品。

优点和缺点

| 优点 | 缺点 |

| 多样的交易产品 | 无监管 |

| 差价合约交易无佣金 | 有限的支付方式 |

| 无直接联系渠道 |

Fineco 是否合法?

Fineco目前没有受到监管,因此交易者在交易时需要谨慎。

我可以在Fineco上交易什么?

Fineco提供广泛的可交易产品,包括差价合约、交易所交易基金(ETF)、交易所交易产品(ETC)和交易所交易品种(ETNs)、债券、期货和期权。

| 交易产品 | 可用 |

| 差价合约股票 | ✔ |

| 差价合约指数 | ✔ |

| 差价合约商品 | ✔ |

| 外汇差价合约 | ✔ |

| 加密货币差价合约 | ✔ |

| 交易所交易基金(ETF)、交易所交易产品(ETC)和交易所交易品种(ETNs) | ✔ |

| 债券 | ✔ |

| 期货 | ✔ |

| 期权 | ✔ |

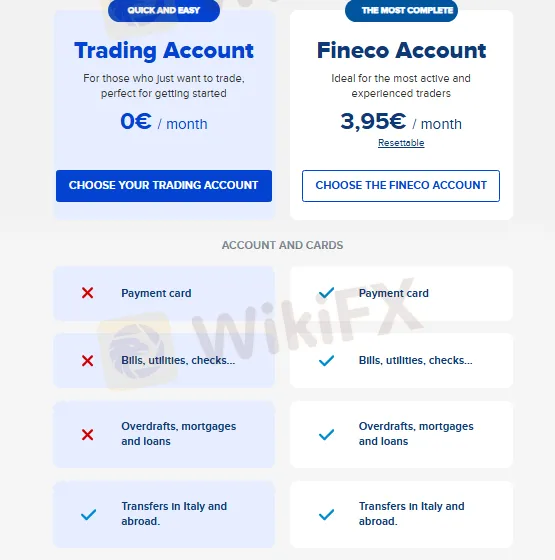

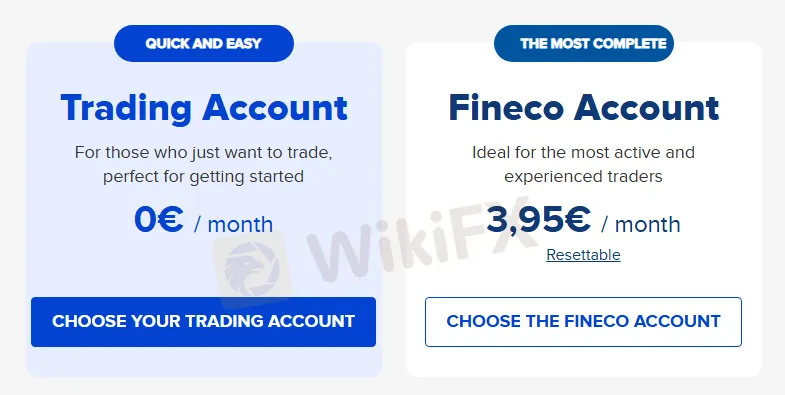

账户类型

Fineco 提供两种账户: 交易账户和Fineco账户。两者之间的区别如下:

| 账户类型 | 月费 | 佣金 | 多币种服务 | 客户支持 |

| 交易账户 | €0 | 订单价值的0.19%(最低€2.95 - 最高€19) | 否 | 仅邮件 |

| Fineco账户 | €3.95/月 | 每次操作或资产固定从€19降至€2.95(两个月后可重置) | 是 | 通过电子邮件和电话 |

费用

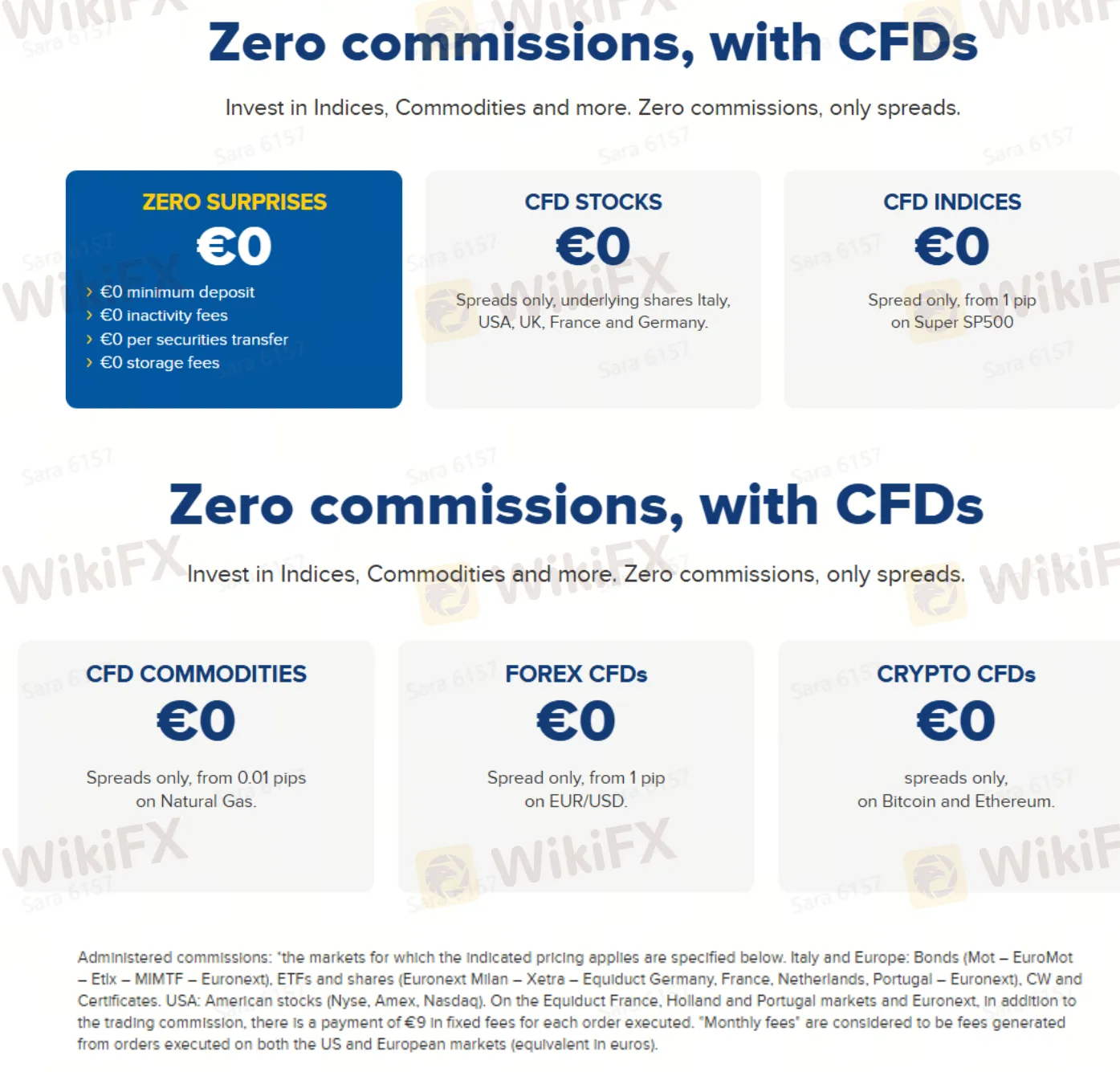

点差: CFD产品提供零佣金,仅适用点差手续费。不同资产的点差有所不同;例如,EUR/USD的点差从1点开始,超级SP500指数的点差也从1点开始。

佣金: CFD交易无佣金。

管理佣金: 在美国和欧洲市场执行的交易额外收取固定费用9欧元,另外还有交易佣金。

交易平台

Fineco 支持交易者通过其专有的 FinecoX平台 进行交易。

| 交易平台 | 支持 | 可用设备 | 适用于 |

| FinecoX | ✔ | 桌面,移动,Web | / |

| MT4 | ❌ | / | 初学者 |

| MT5 | ❌ | / | 经验丰富的交易者 |

存款和取款

Fineco的不同账户在支付方式和金融服务方面有所不同。以下是两种账户类型存取款功能的比较:

| 账户类型 | 支付卡 | 账单、公用事业、支票 | 透支、抵押和贷款 | 意大利和国际转账 |

| 交易账户 | ✗ | ✗ | ✗ | ✓ |

| Fineco账户 | ✓ | ✓ | ✓ | ✓ |