Profil perusahaan

| Fineco Ringkasan Ulasan | |

| Didirikan | 2002 |

| Negara/Daerah Terdaftar | Italia |

| Regulasi | Tidak Diatur |

| Produk Perdagangan | CFD, ETF, ETC & ETN, Obligasi, Futures, Opsi |

| Spread EUR/USD | Dari 1 pip |

| Platform Perdagangan | FinecoX |

| Deposit Minimum | / |

| Dukungan Pelanggan | Media Sosial: Facebook, Twitter, LinkedIn, Instagram, Spotify, Reddit |

| Alamat: 20131 Milan - P.zza Durante, 11 | |

Informasi Fineco

Fineco didirikan pada tahun 2002 dan terdaftar di Italia. Perusahaan ini menawarkan berbagai produk perdagangan, termasuk CFD, ETF, ETC & ETN, Obligasi, Futures, dan Opsi melalui platform FinecoX miliknya.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Berbagai produk perdagangan | Tidak diatur |

| Tidak ada komisi pada perdagangan CFD | Metode pembayaran terbatas |

| Tidak ada saluran kontak langsung |

Apakah Fineco Legal?

Fineco saat ini tidak diatur, sehingga para trader perlu berhati-hati saat melakukan perdagangan.

Apa yang Bisa Saya Perdagangkan di Fineco?

Fineco menawarkan berbagai produk yang dapat diperdagangkan, termasuk CFD, ETF, ETC & ETN, Obligasi, Futures, dan Opsi.

| Produk Perdagangan | Tersedia |

| Saham CFD | ✔ |

| Indeks CFD | ✔ |

| Komoditas CFD | ✔ |

| Forex CFD | ✔ |

| Kripto CFD | ✔ |

| ETF, ETC & ETN | ✔ |

| Obligasi | ✔ |

| Futures | ✔ |

| Opsi | ✔ |

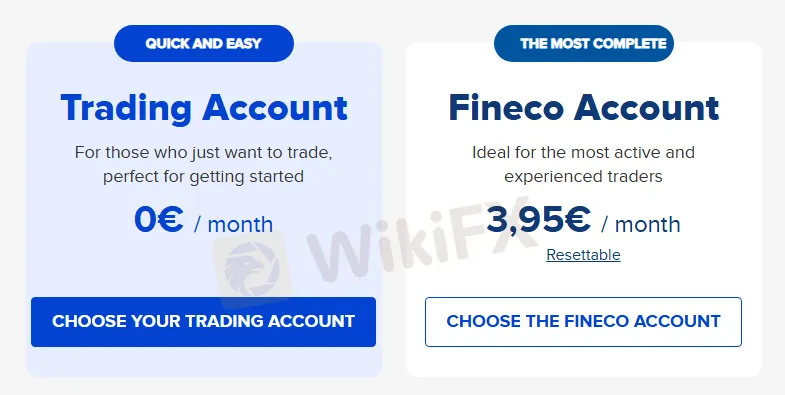

Jenis Akun

Fineco menawarkan dua jenis akun: Akun Trading dan Akun Fineco. Perbedaan antara kedua akun tersebut adalah sebagai berikut:

| Jenis Akun | Biaya Bulanan | Komisi | Layanan Multimata Uang | Dukungan Pelanggan |

| Akun Trading | €0 | 0,19% dari nilai pesanan (Min. €2,95 - Maks. €19) | Tidak | Hanya melalui surat |

| Akun Fineco | €3,95/bulan | Tetap dari €19 menjadi €2,95 per operasi atau aset (dapat diatur ulang setelah dua bulan) | Ya | Melalui email dan telepon |

Biaya

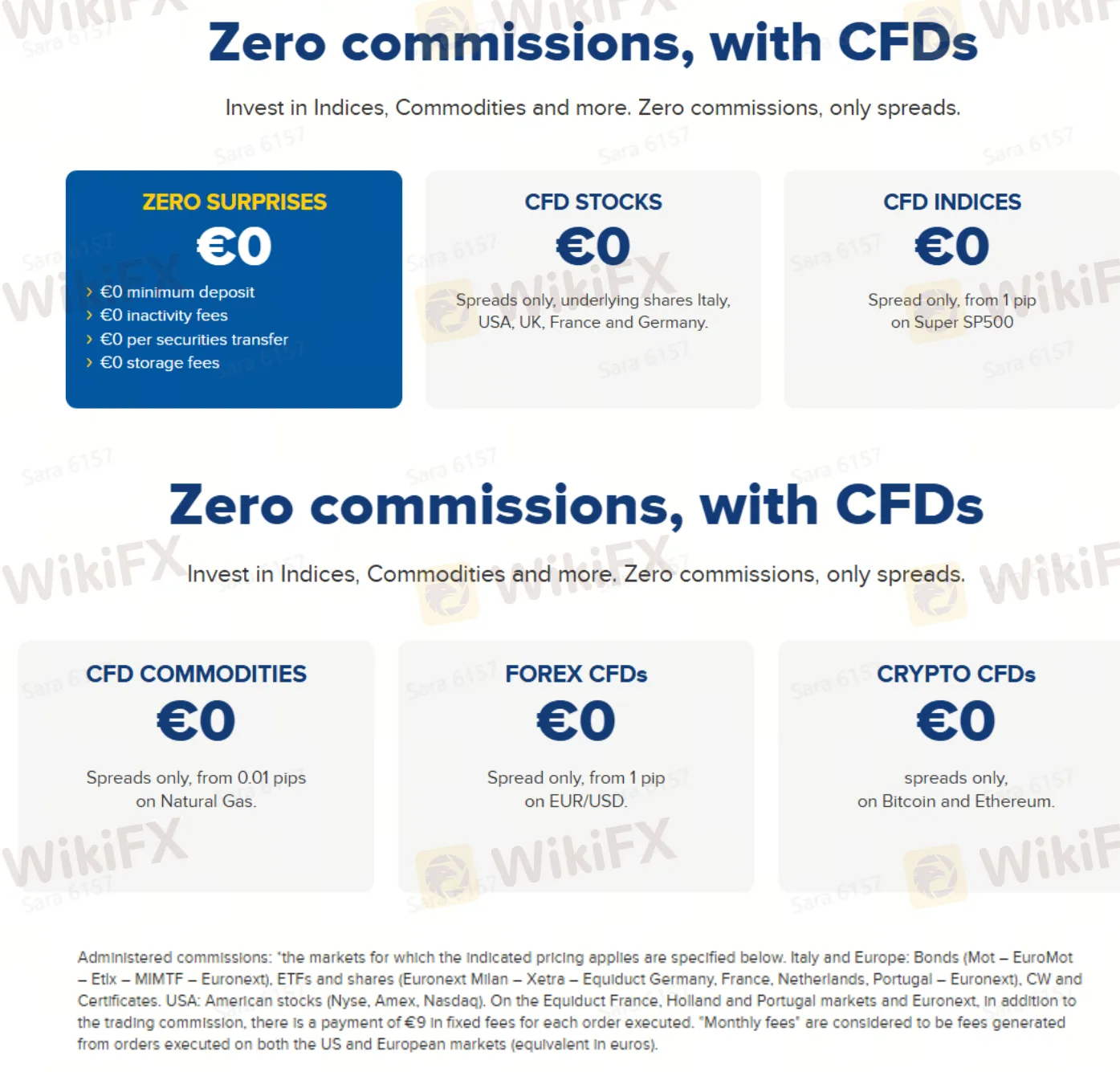

Spread: CFD ditawarkan tanpa komisi, hanya dikenakan biaya spread. Spread bervariasi berdasarkan aset; misalnya, spread EUR/USD dimulai dari 1 pip, dan spread indeks Super SP500 juga dimulai dari 1 pip.

Komisi: Tidak ada komisi pada perdagangan CFD.

Komisi Manajemen: Pesanan yang dieksekusi di pasar AS dan Eropa dikenai biaya tetap sebesar 9 euro ditambah komisi transaksi.

Platform Perdagangan

Fineco mendukung para trader dalam melakukan transaksi melalui platform FinecoX miliknya.

| Platform Perdagangan | Didukung | Perangkat Tersedia | Cocok untuk |

| FinecoX | ✔ | Desktop, Mobile, Web | / |

| MT4 | ❌ | / | Pemula |

| MT5 | ❌ | / | Trader berpengalaman |

Deposit dan Penarikan

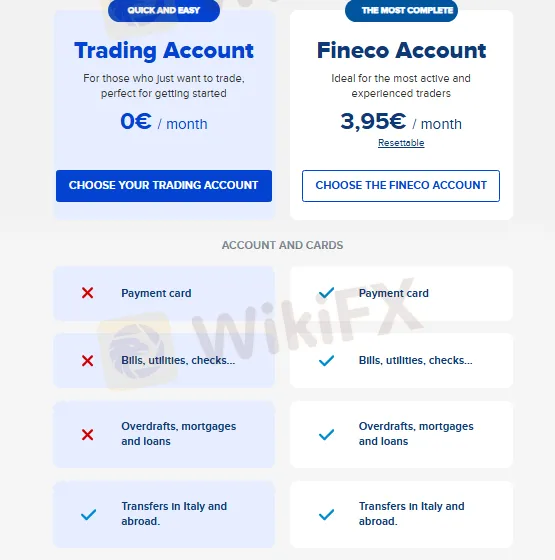

Akun Fineco bervariasi dalam hal metode pembayaran dan layanan keuangan. Berikut adalah perbandingan fungsi deposit dan penarikan dari dua jenis akun:

| Jenis Akun | Kartu Pembayaran | Tagihan, Utilitas, Cek | Overdraft, Hipotek, dan Pinjaman | Transfer di Italia dan Luar Negeri |

| Akun Trading | ✗ | ✗ | ✗ | ✓ |

| Akun Fineco | ✓ | ✓ | ✓ | ✓ |