Company Summary

| Renaissance Capital Review Summary | |

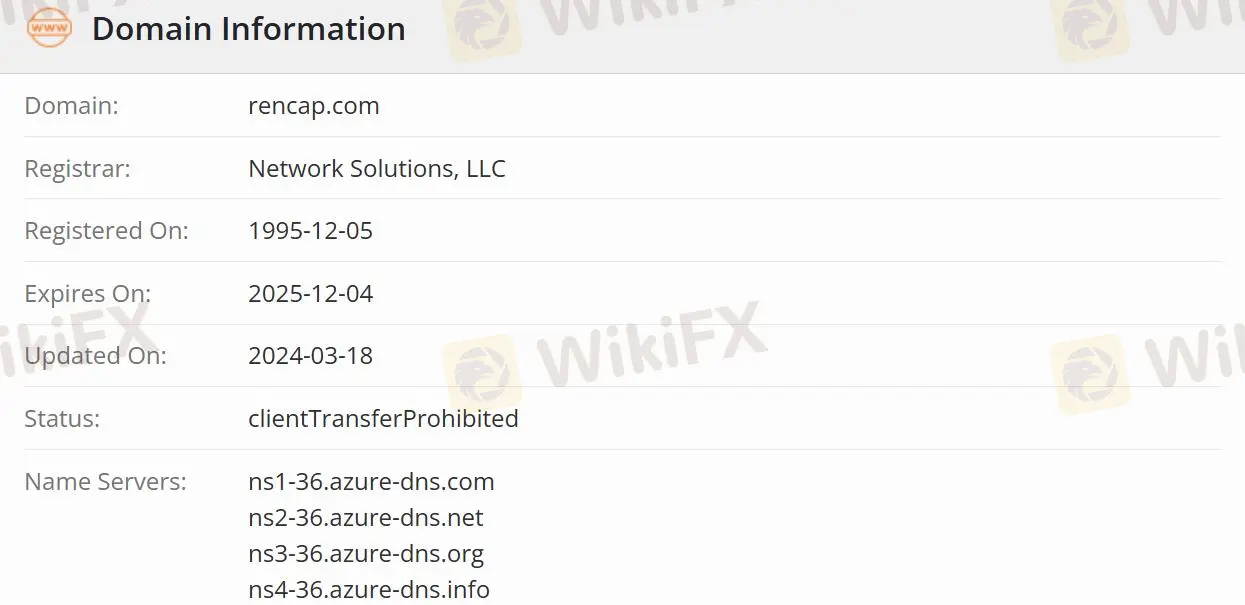

| Founded | 1995-12-05 |

| Registered Country/Region | Cyprus |

| Regulation | Regulated |

| BUsiness | Investment Banking, Global Markets/Top Brokerage. |

| Customer Support | Phone: + 357(22)505 800 |

| Fax: + 357(22)676 755 | |

| E-mail: info@rencap.eu | |

Renaissance Capital Information

Renaissance Capital is a CYSEC-licensed investment bank. It was named “European Emerging Markets Investment Bank of the Year” and “Sustainability Independent Investment Bank of the Year” in The Banker magazine's annual “2020 Investment Bank Awards”. The company has three core business areas such as investment banking, global markets, and top brokerage.

Is Renaissance Capital Legit?

Cyprus Securities and Exchange Commission(CYSEC) regulates Renaissance Capital under license No.053/04 and License Type Market Making(MM), which is safer than unregulated.

What does Renaissance Capital do?

The Investment Banking division offers unique solutions for clients by combining international and local expertise in mergers and acquisitions, equity capital markets, debt capital markets, and custom financings.

Equity capital markets offer major equity and equity-linked products, monetization, and structuring solutions.

Debt capital markets focus on local and international bonds, providing advice and debt restructuring solutions for liability management, financing, and hedging, and also include liability management and credit rating advisory services for corporate and sovereign clients.

Mergers and Acquisitions specialize in advising corporates, financial investors, and shareholders on large and complex transactions, mergers, acquisitions, restructurings, divestitures, going private transactions, management buyouts, leveraged buyouts, and other situations.

The Global Markets area serves legal entities, financial institutions, and high-net-worth individuals and provides customized services to clients.

The premier brokerage area allows clients to use the firm's global market capabilities as well as additional benefits exclusively for clients who open a brokerage account with Renaissance Capital.

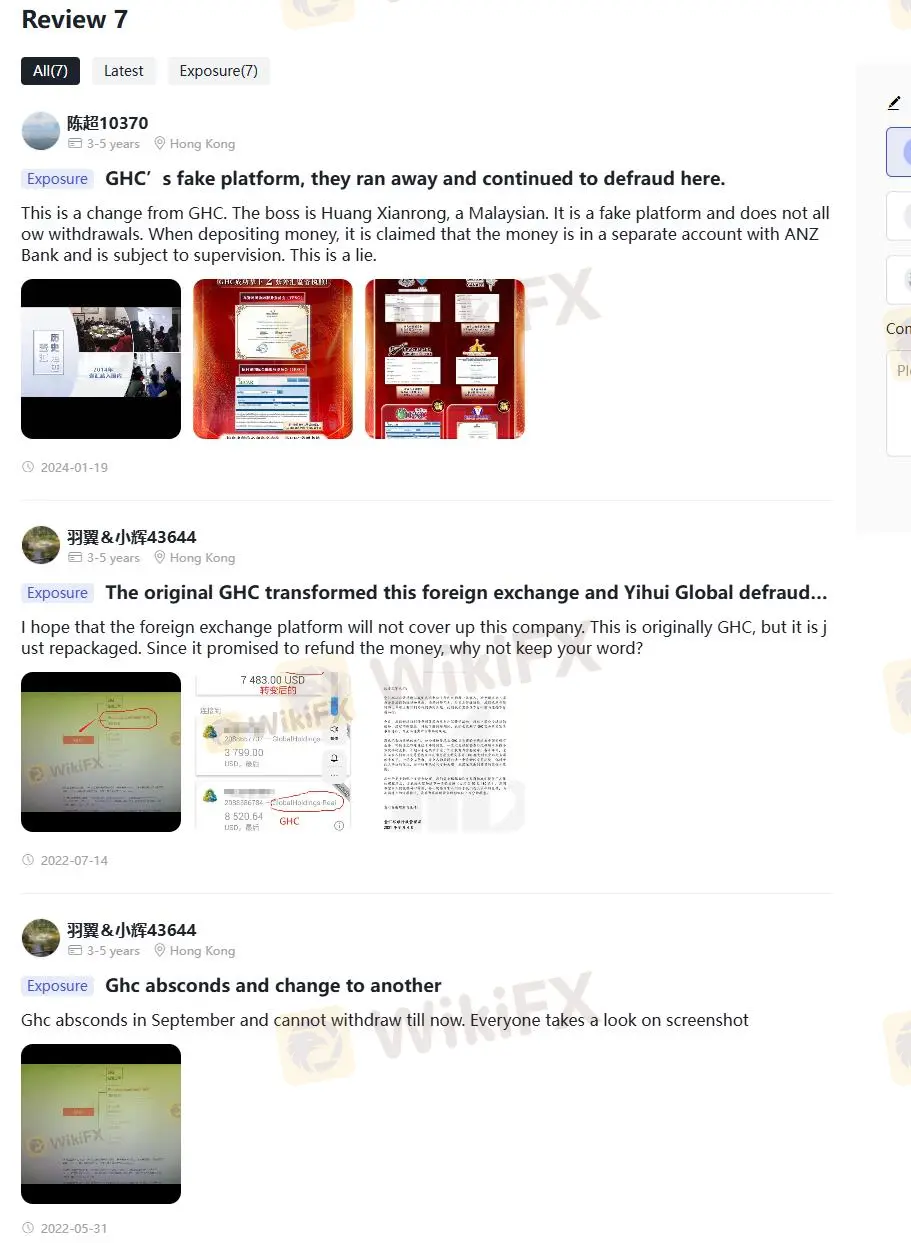

Negative Renaissance Capital Reviews on WikiFX

On WikiFX, “Exposure” is posted as a word of mouth received from users.

Clients must review the information and assess risks before trading on unregulated platforms. Please consult our platform for related details. Report fraudulent brokers in our Exposure section and our team will work to resolve any issues you encounter.

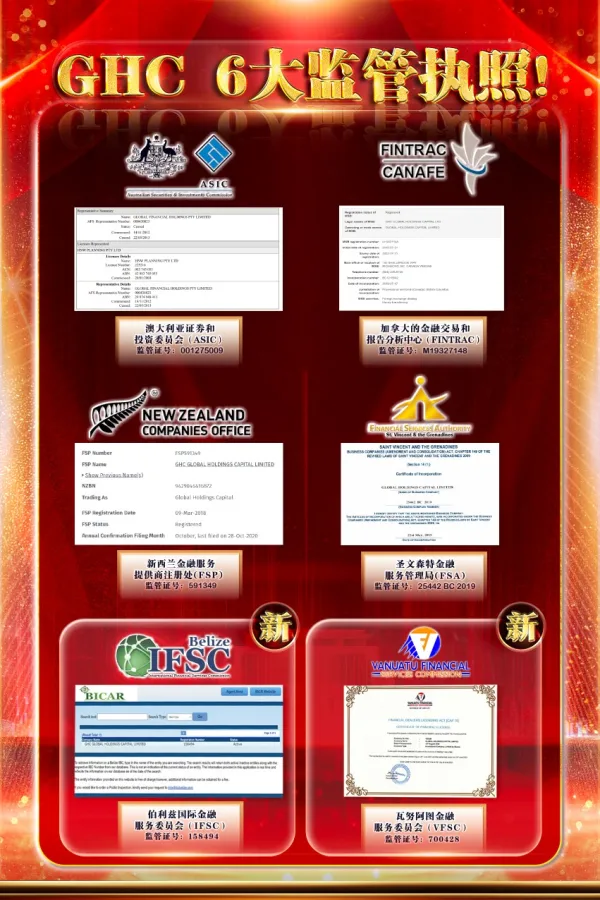

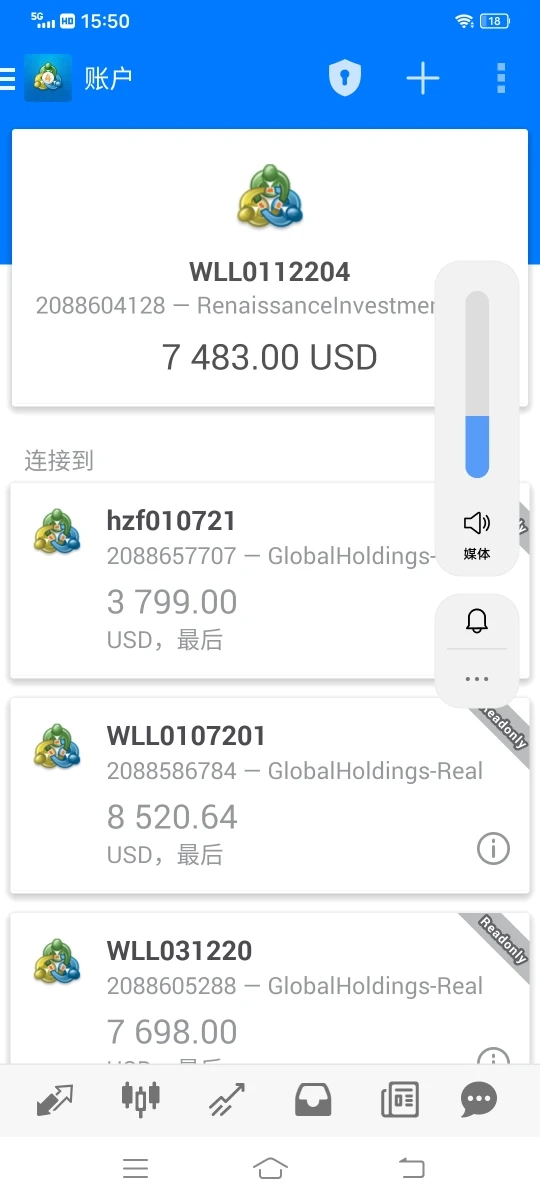

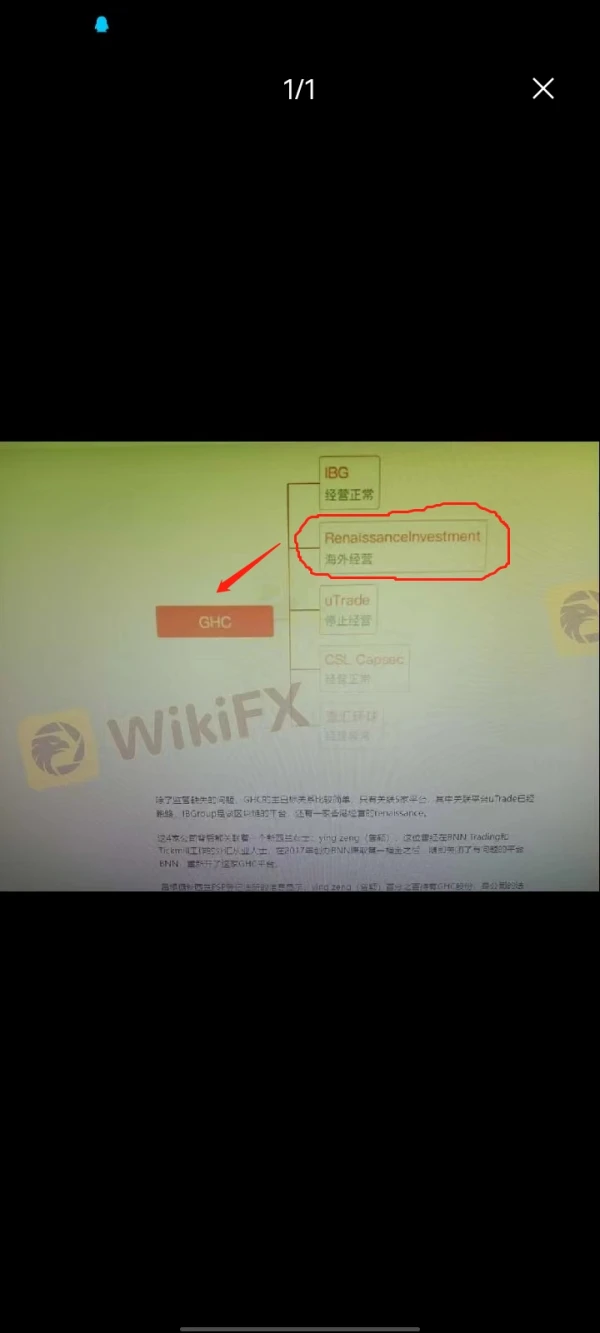

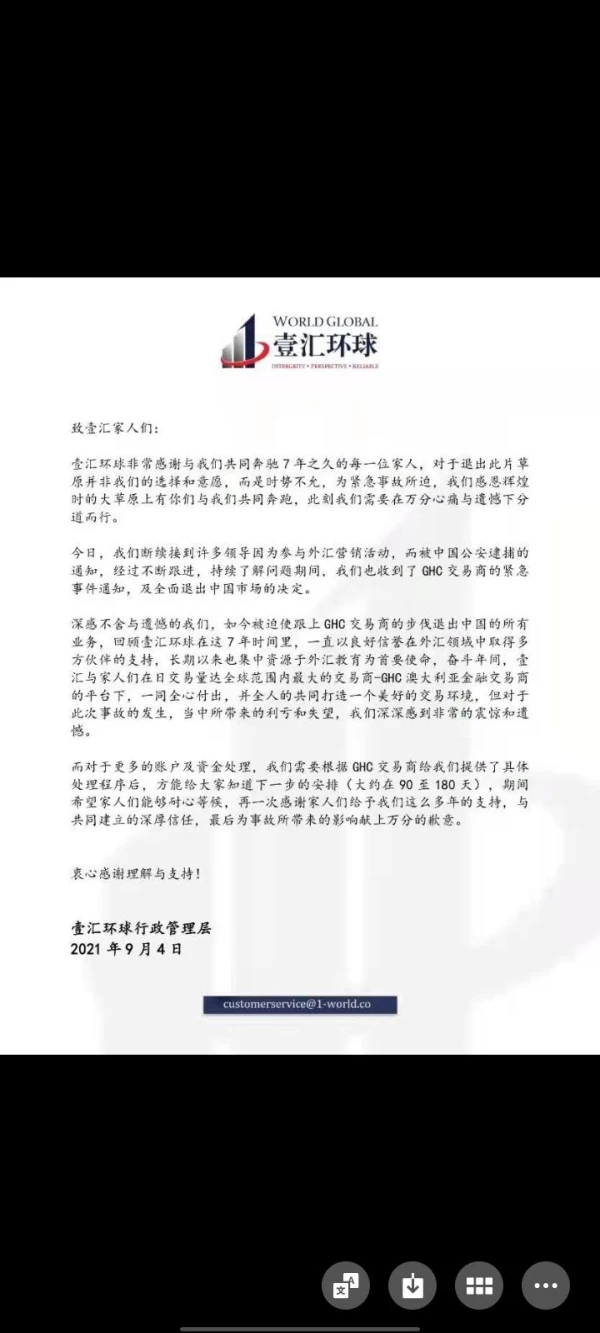

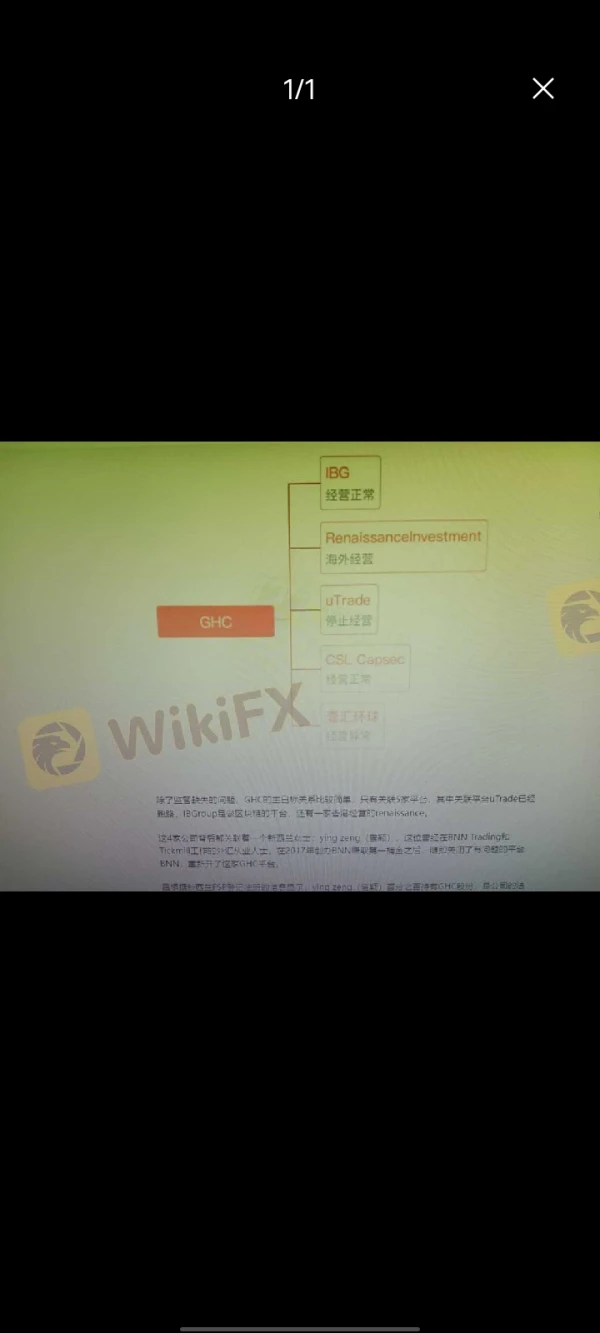

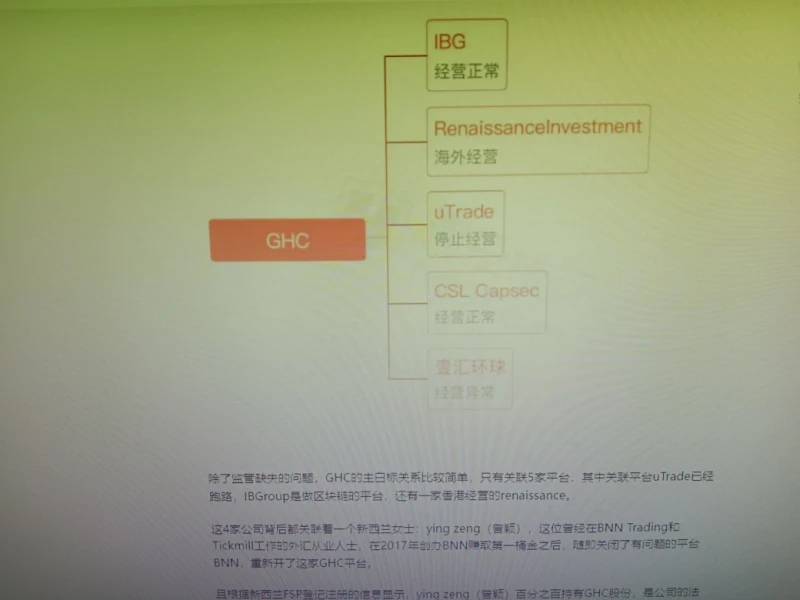

Multiple users said that this company and GHC have the same owner. GHC scammed them and could not withdraw money. This will cause some security concerns. You may visit: https://www.wikifx.com/en/comments/detail/202401199212973915.html https://www.wikifx.com/en/comments/detail/202207146672596195.html https://www.wikifx.com/en/comments/detail/202205315752526357.html.

陈超10370

Hong Kong

This is a change from GHC. The boss is Huang Xianrong, a Malaysian. It is a fake platform and does not allow withdrawals. When depositing money, it is claimed that the money is in a separate account with ANZ Bank and is subject to supervision. This is a lie.

Exposure

壞丫头

Hong Kong

This was another name of GHC and continue to did scams.

Exposure

A天蓝蓝(牙医)

Hong Kong

From GHC again to this trader, the scammers continue to cheat. Only we Chinese investors take the result.

Exposure

羽翼&小辉43644

Hong Kong

I hope that the foreign exchange platform will not cover up this company. This is originally GHC, but it is just repackaged. Since it promised to refund the money, why not keep your word?

Exposure

羽翼&小辉43644

Hong Kong

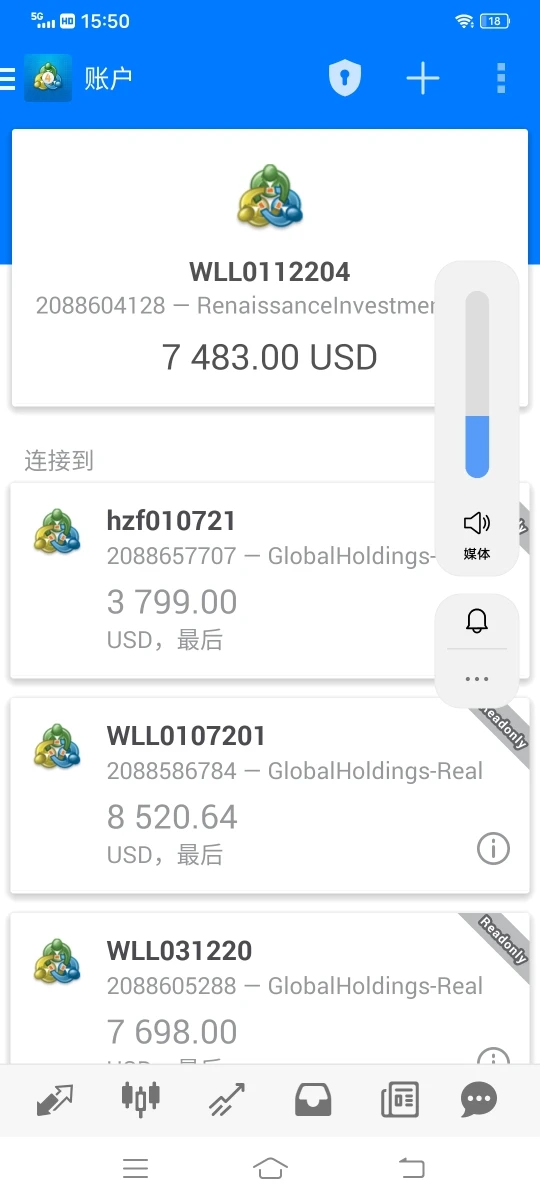

Ghc absconds in September and cannot withdraw till now. Everyone takes a look on screenshot

Exposure

羽翼&小辉

Hong Kong

It is already said that you have connection with GHC. You had scammed so many people.

Exposure

A天蓝蓝(牙医)

Hong Kong

On September 4th, the website could not be opened at the same time, and then GHC became this dealer, scammer.

Exposure