Şirket özeti

| Renaissance Capital İnceleme Özeti | |

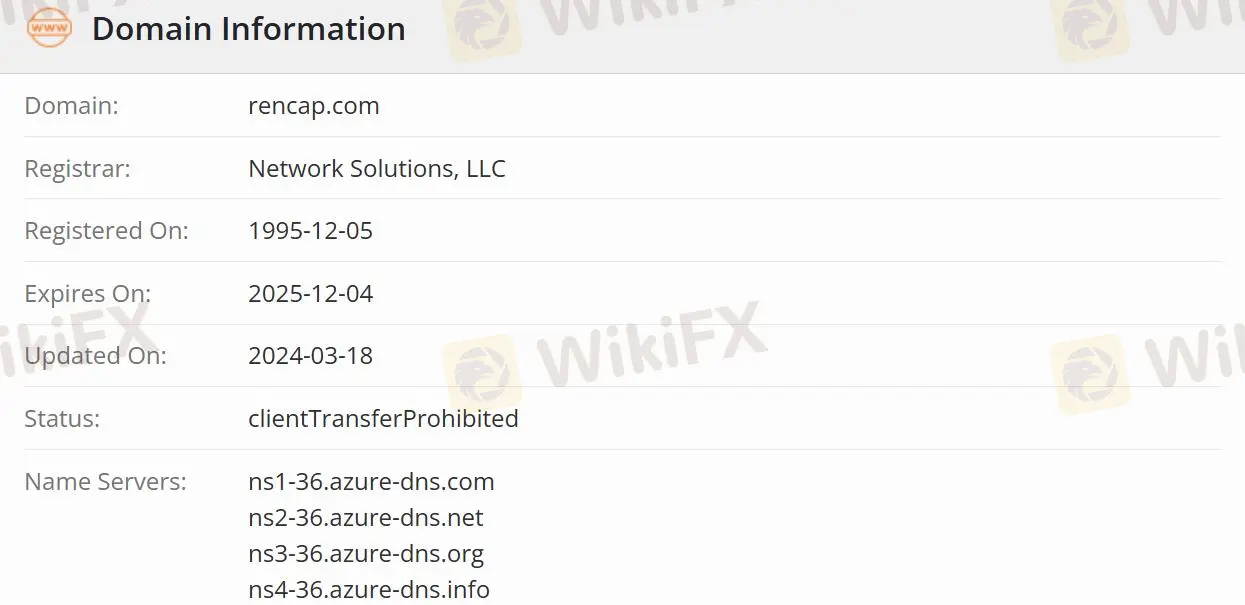

| Kuruluş Tarihi | 1995-12-05 |

| Kayıtlı Ülke/Bölge | Kıbrıs |

| Regülasyon | Düzenlenmiş |

| İş | Yatırım Bankacılığı, Küresel Piyasalar/En İyi Aracılık. |

| Müşteri Desteği | Telefon: + 357(22)505 800 |

| Faks: + 357(22)676 755 | |

| E-posta: info@rencap.eu | |

Renaissance Capital Bilgileri

Renaissance Capital, CYSEC lisanslı bir yatırım bankasıdır. The Banker dergisinin yıllık "2020 Yatırım Bankası Ödülleri"nde "Avrupa Yükselen Piyasalar Yatırım Bankası" ve "Sürdürülebilirlik Bağımsız Yatırım Bankası" olarak adlandırılmıştır. Şirket, yatırım bankacılığı, küresel piyasalar ve en iyi aracılık gibi üç temel iş alanına sahiptir.

Renaissance Capital Güvenilir mi?

Kıbrıs Menkul Kıymetler ve Borsa Komisyonu (CYSEC), Renaissance Capital'yi 053/04 lisans numarası ve Piyasa Yapıcılığı (MM) Lisans Türü altında düzenlemektedir, bu da düzenlenmemiş olanlardan daha güvenlidir.

Renaissance Capital Ne Yapar?

Yatırım Bankacılığı bölümü, uluslararası ve yerel uzmanlığı birleştirerek müşteriler için benzersiz çözümler sunar, bunlar arasında birleşme ve satın almalar, özsermaye piyasaları, borç sermaye piyasaları ve özel finansmanlar bulunur.

Özsermaye piyasaları, büyük ölçekli özsermaye ve özsermaye bağlantılı ürünler, paraya çevirme ve yapılandırma çözümleri sunar.

Borç sermaye piyasaları, yerel ve uluslararası tahvillere odaklanır, kurumsal ve egemen müşteriler için borç yönetimi, finansman ve riskten korunma çözümleri için danışmanlık ve borç yeniden yapılandırma hizmetleri sunar.

Birleşme ve Satın Almalar, büyük ve karmaşık işlemler, birleşmeler, satın almalar, yeniden yapılandırmalar, varlık satışları, özel şirketlere geçiş işlemleri, yönetim tarafından satın alma, kaldıraçlı satın almalar ve diğer durumlar konusunda şirketlere, finansal yatırımcılara ve hissedarlara danışmanlık yapmaya odaklanır.

Küresel Piyasalar alanı, yasal kuruluşlara, finansal kurumlara ve yüksek net değerli bireylere özel hizmetler sunar.

En iyi aracılık alanı, müşterilere şirketin küresel piyasa yeteneklerini ve sadece Renaissance Capital ile bir aracılık hesabı açan müşteriler için ek faydaları kullanma imkanı sağlar.

WikiFX'te Renaissance Capital Hakkında Olumsuz Yorumlar

WikiFX'te "Maruz Kalma", kullanıcılardan gelen bir sözlüktür.

Müşteriler, düzenlenmemiş platformlarda işlem yapmadan önce bilgileri gözden geçirmeli ve riskleri değerlendirmelidir. İlgili ayrıntılar için platformumuza danışın. Dolandırıcı aracıları Maruz Kalma bölümümüzde bildirin ve ekibimiz karşılaştığınız herhangi bir sorunu çözmek için çalışacaktır.

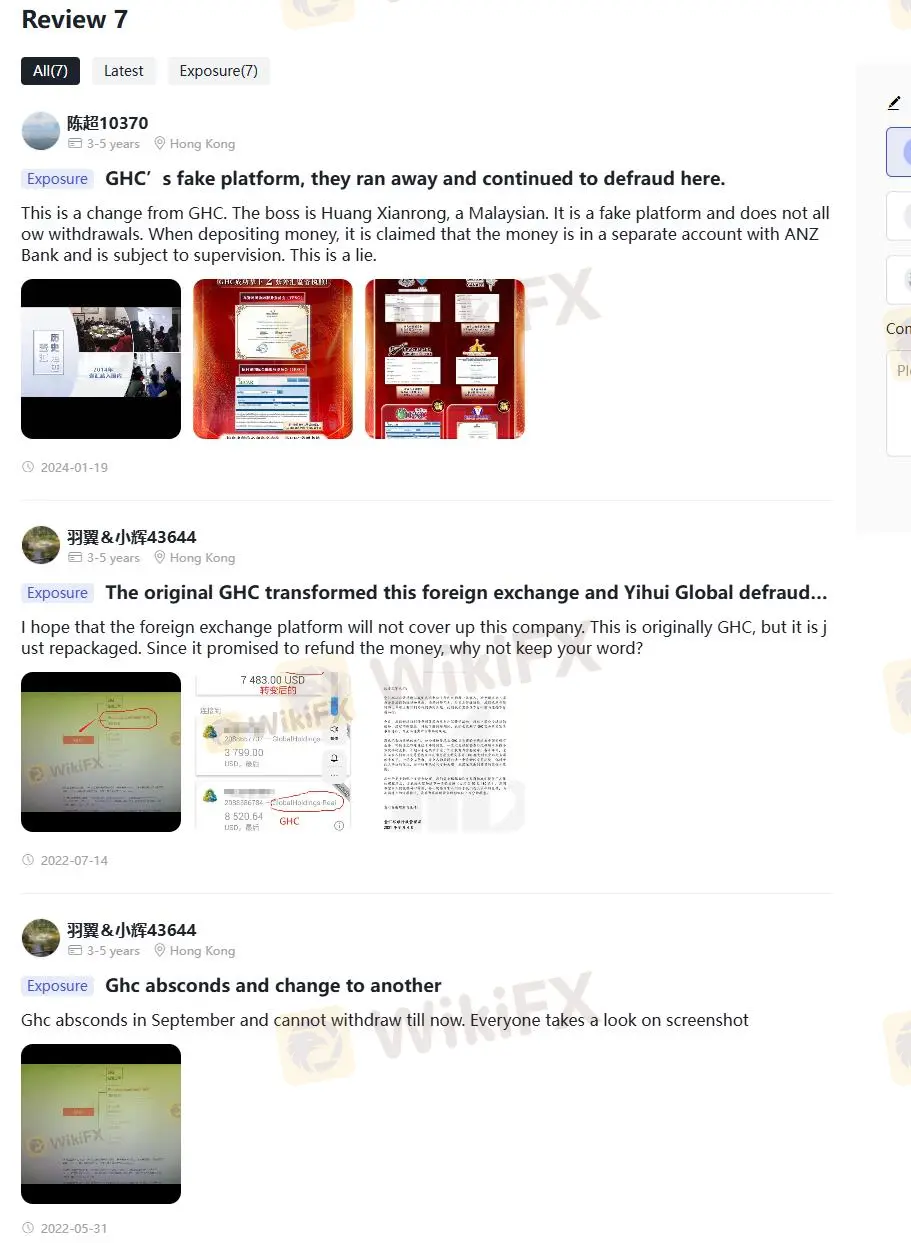

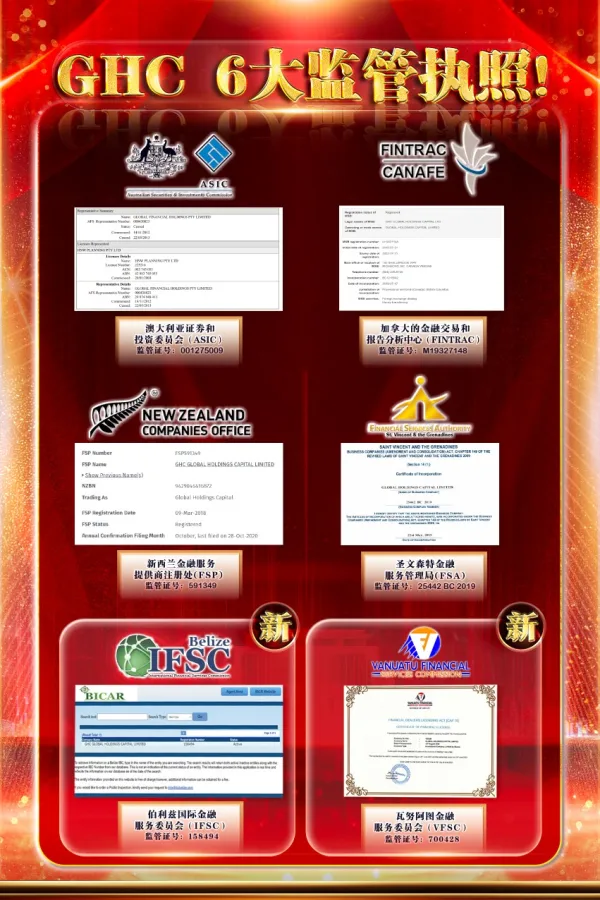

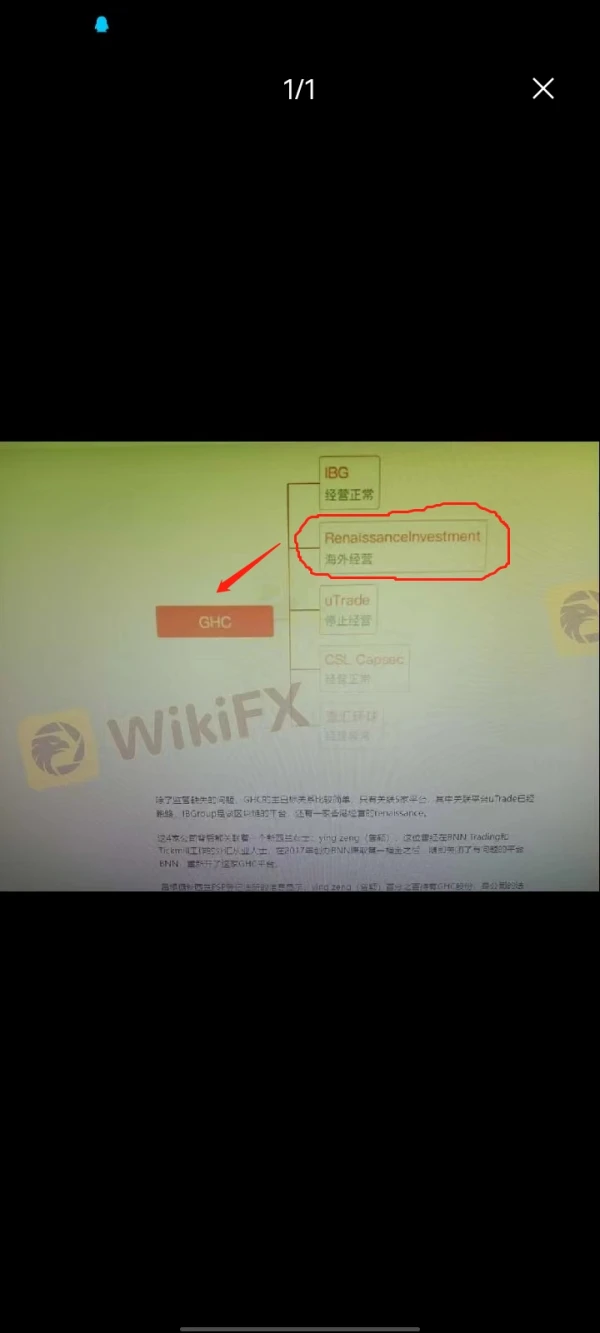

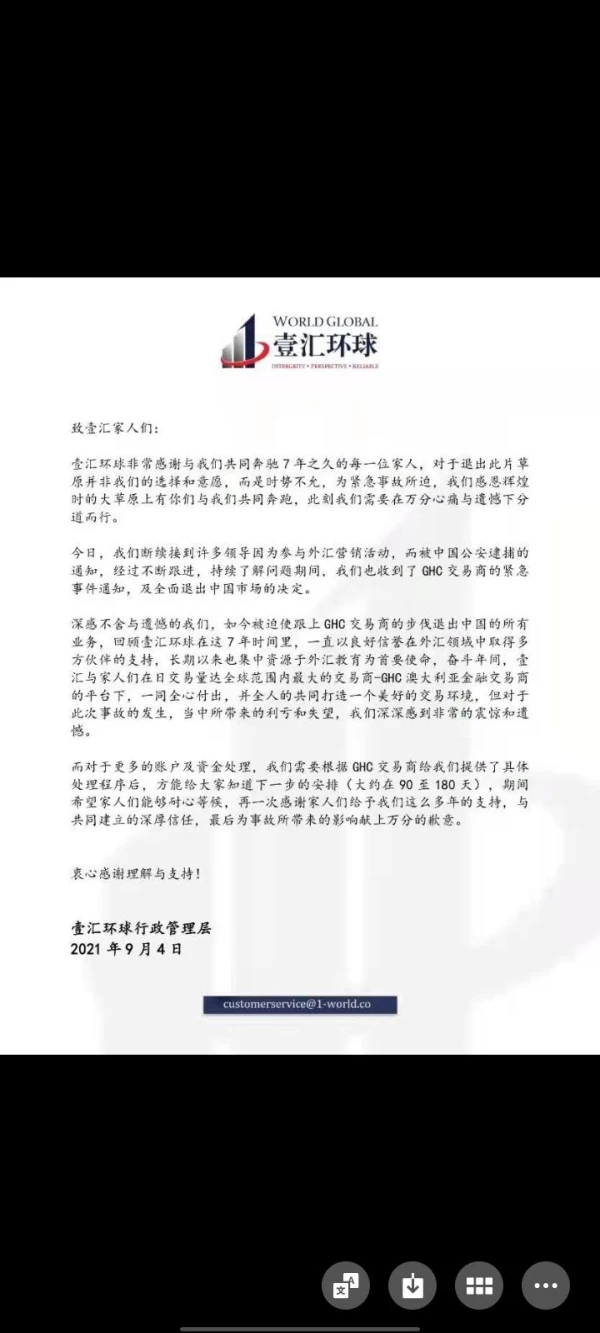

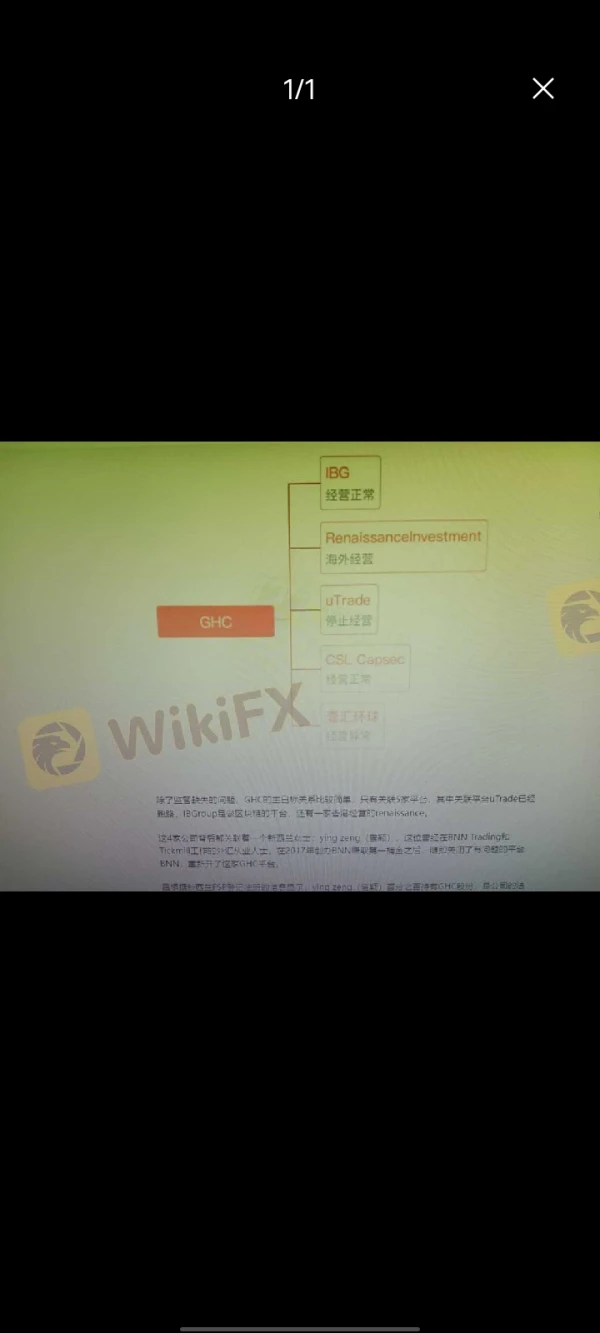

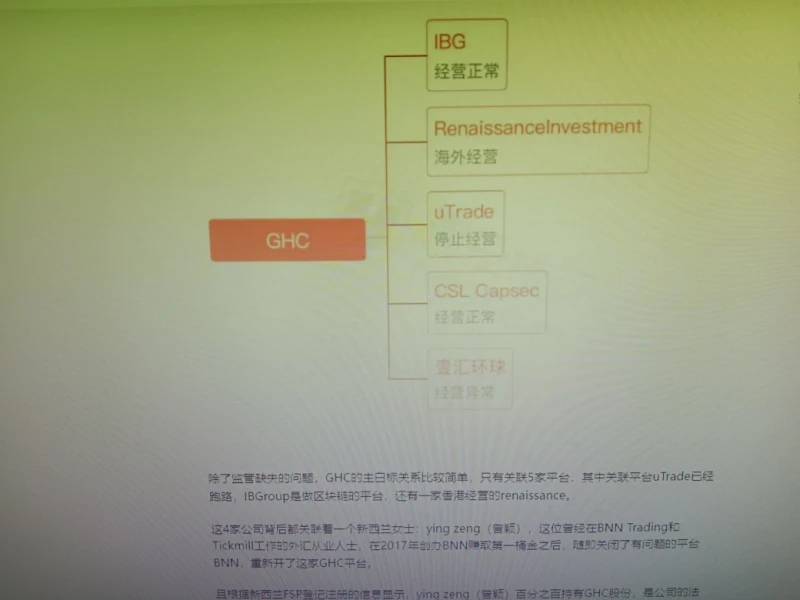

Birden fazla kullanıcı, bu şirketin ve GHC'nin aynı sahibe sahip olduğunu söyledi. GHC onları dolandırdı ve para çekemedi. Bu bazı güvenlik endişelerine neden olacaktır. Ziyaret edebilirsiniz: https://www.wikifx.com/en/comments/detail/202401199212973915.html https://www.wikifx.com/en/comments/detail/202207146672596195.html https://www.wikifx.com/en/comments/detail/202205315752526357.html.

陈超10370

Hong Kong

Bu, GHC'den bir değişikliktir. Patronu Malezyalı olan Huang Xianrong'dur. Bu sahte bir platformdur ve para çekmeye izin vermez. Para yatırırken, paranın ANZ Bankası'nda ayrı bir hesapta olduğu ve denetime tabi olduğu iddia edilir. Bu bir yalandır.

Teşhir

壞丫头

Hong Kong

换了马甲的骗子。。就是之前的GHC。。

Teşhir

A天蓝蓝(牙医)

Hong Kong

从GHC又变成这个交易商,骗子还在继续骗,坑死了中国的投资者,

Teşhir

羽翼&小辉43644

Hong Kong

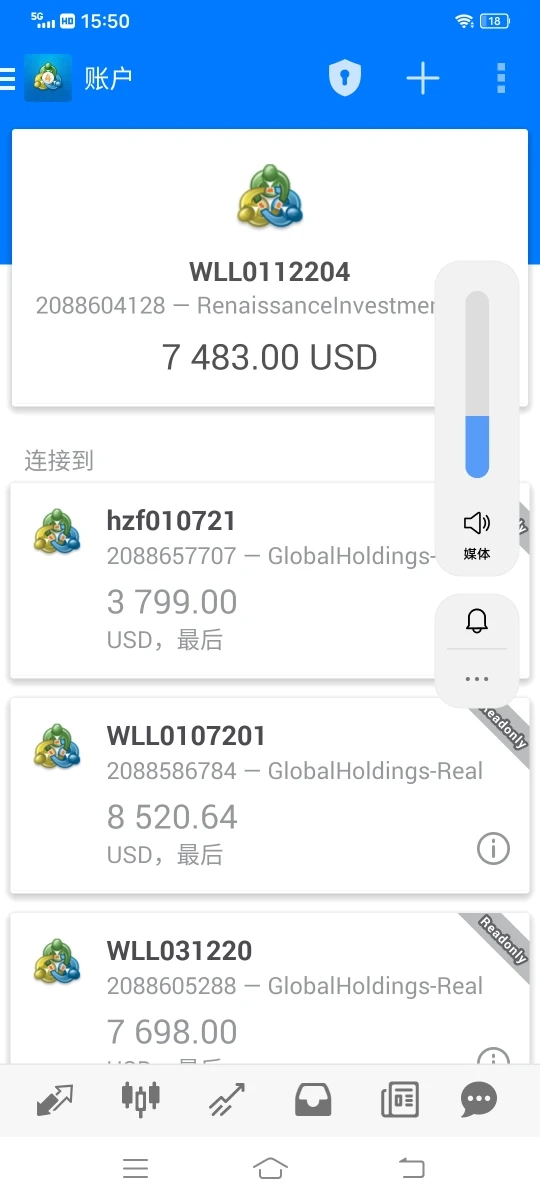

希望外汇平台不要包庇这家公司,这原本就GHC,只是从新包装一下,既然承诺退钱为什么不承诺。

Teşhir

羽翼&小辉43644

Hong Kong

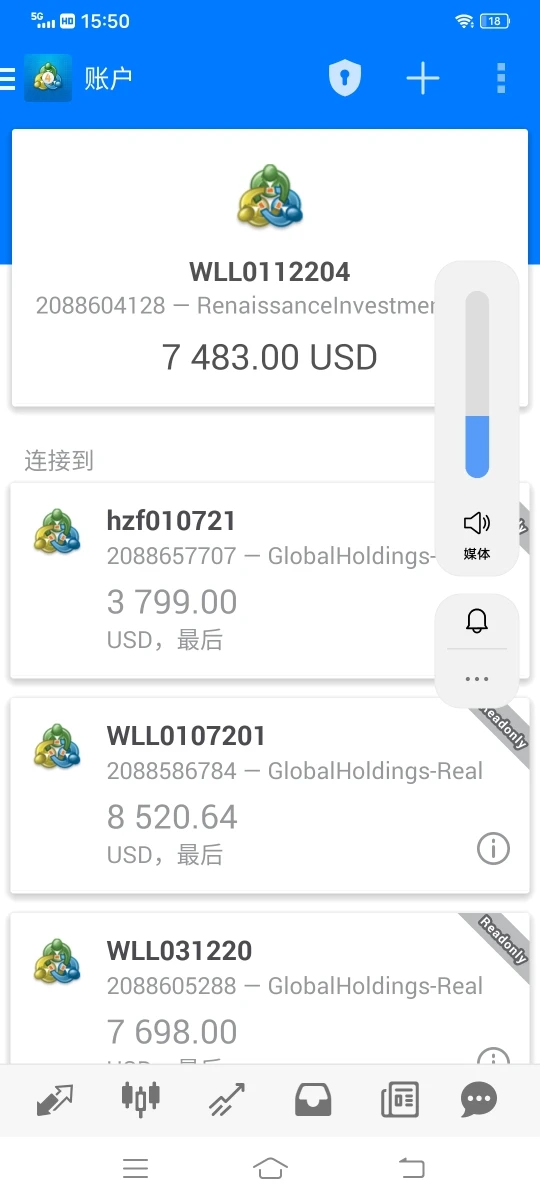

GHC去年9月跑路 到现在无法出金,大家看看截图。

Teşhir

羽翼&小辉

Hong Kong

都说你跟GHC 有关联 确实 骗了那么多人钱

Teşhir

A天蓝蓝(牙医)

Hong Kong

9月四号同时网站打不开,紧接着GHC就变成了这个交易商,骗子

Teşhir