Informasi Dasar

Siprus

SiprusSkor

Siprus

|

Lebih dari 20 tahun

|

Siprus

|

Lebih dari 20 tahun

| http://www.rencap.com/

Website

Peringkat indeks

Pengaruh

C

Indeks pengaruh NO.1

Nigeria 3.21

Nigeria 3.21 Lisensi

LisensiLembaga berlisensi:Renaissance Securities (Cyprus) Ltd

Nomor lisensi pengaturan:053/04

Inti tunggal

1G

40G

1M*ADSL

Siprus

Siprus rencap.com

rencap.com Belanda

Belanda

ΜΑΡΙΟΣ ΧΑΤΖΗΓΙΑΝΝΑΚΗΣ

Direktur

Mulai tanggal

Status

Bekerja

RENAISSANCE SECURITIES (CYPRUS) LIMITED(Cyprus)

ΑΘΩΣ ΔΗΜΗΤΡΙΟΥ

Direktur

Mulai tanggal

Status

Bekerja

RENAISSANCE SECURITIES (CYPRUS) LIMITED(Cyprus)

A.T.S. SERVICES LIMITED

Sekretaris

Mulai tanggal

Status

Bekerja

RENAISSANCE SECURITIES (CYPRUS) LIMITED(Cyprus)

| Renaissance Capital Ringkasan Ulasan | |

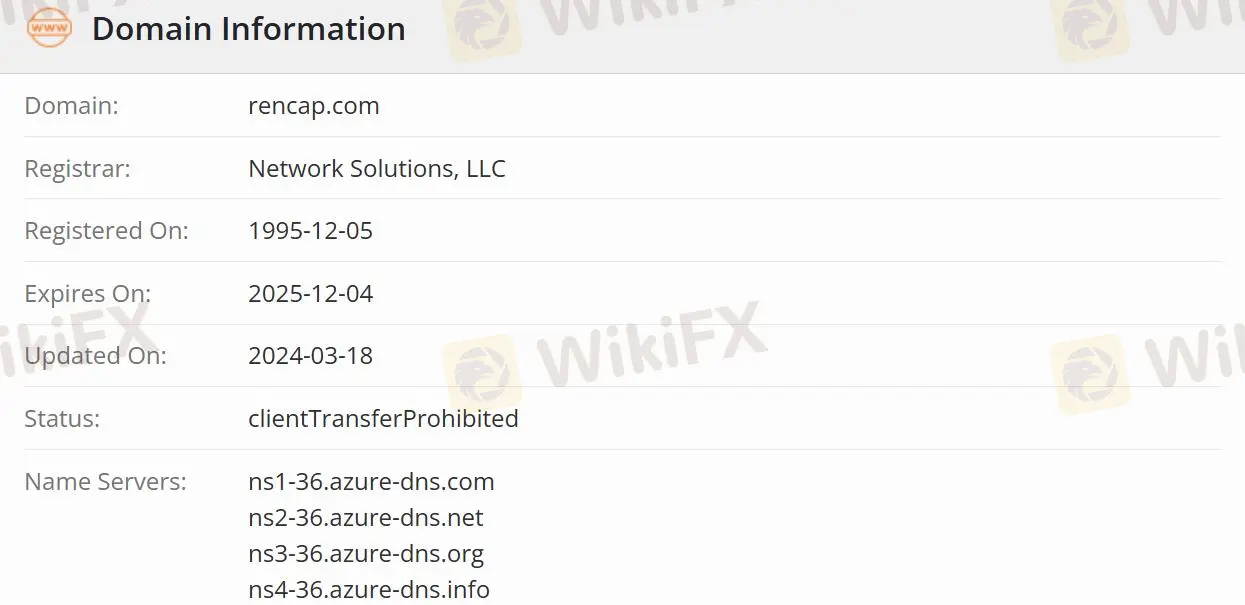

| Dibentuk | 1995-12-05 |

| Negara/Daerah Terdaftar | Siprus |

| Regulasi | Teregulasi |

| Bisnis | Investment Banking, Global Markets/Top Brokerage. |

| Dukungan Pelanggan | Telepon: + 357(22)505 800 |

| Fax: + 357(22)676 755 | |

| E-mail: info@rencap.eu | |

Renaissance Capital adalah bank investasi yang berlisensi CYSEC. Itu dinobatkan sebagai "Bank Investasi Pasar Emerging Eropa Tahun Ini" dan "Bank Investasi Independen Keberlanjutan Tahun Ini" dalam "2020 Investment Bank Awards" majalah The Banker. Perusahaan ini memiliki tiga area bisnis inti seperti investment banking, global markets, dan top brokerage.

Cyprus Securities and Exchange Commission (CYSEC) mengatur Renaissance Capital dengan lisensi No.053/04 dan Tipe Lisensi Market Making (MM), yang lebih aman daripada yang tidak diatur.

Divisi Investment Banking menawarkan solusi unik bagi klien dengan menggabungkan keahlian internasional dan lokal dalam merger dan akuisisi, pasar modal ekuitas, pasar modal utang, dan pembiayaan kustom.

Pasar modal ekuitas menawarkan produk ekuitas utama dan terkait ekuitas, monetisasi, dan solusi struktural.

Pasar modal utang berfokus pada obligasi lokal dan internasional, memberikan nasihat dan solusi restrukturisasi utang untuk manajemen kewajiban, pembiayaan, lindung nilai, dan juga mencakup layanan manajemen kewajiban dan penilaian kredit untuk klien korporat dan pemerintah.

Mergers and Acquisitions mengkhususkan diri dalam memberikan nasihat kepada perusahaan, investor keuangan, dan pemegang saham tentang transaksi besar dan kompleks, merger, akuisisi, restrukturisasi, pelepasan aset, transaksi swasta, buyout manajemen, buyout berleverage, dan situasi lainnya.

Area Global Markets melayani entitas hukum, lembaga keuangan, dan individu berkekayaan bersih tinggi serta menyediakan layanan yang disesuaikan untuk klien.

Area brokerage premier memungkinkan klien menggunakan kemampuan pasar global perusahaan serta manfaat tambahan secara eksklusif bagi klien yang membuka rekening brokerage dengan Renaissance Capital.

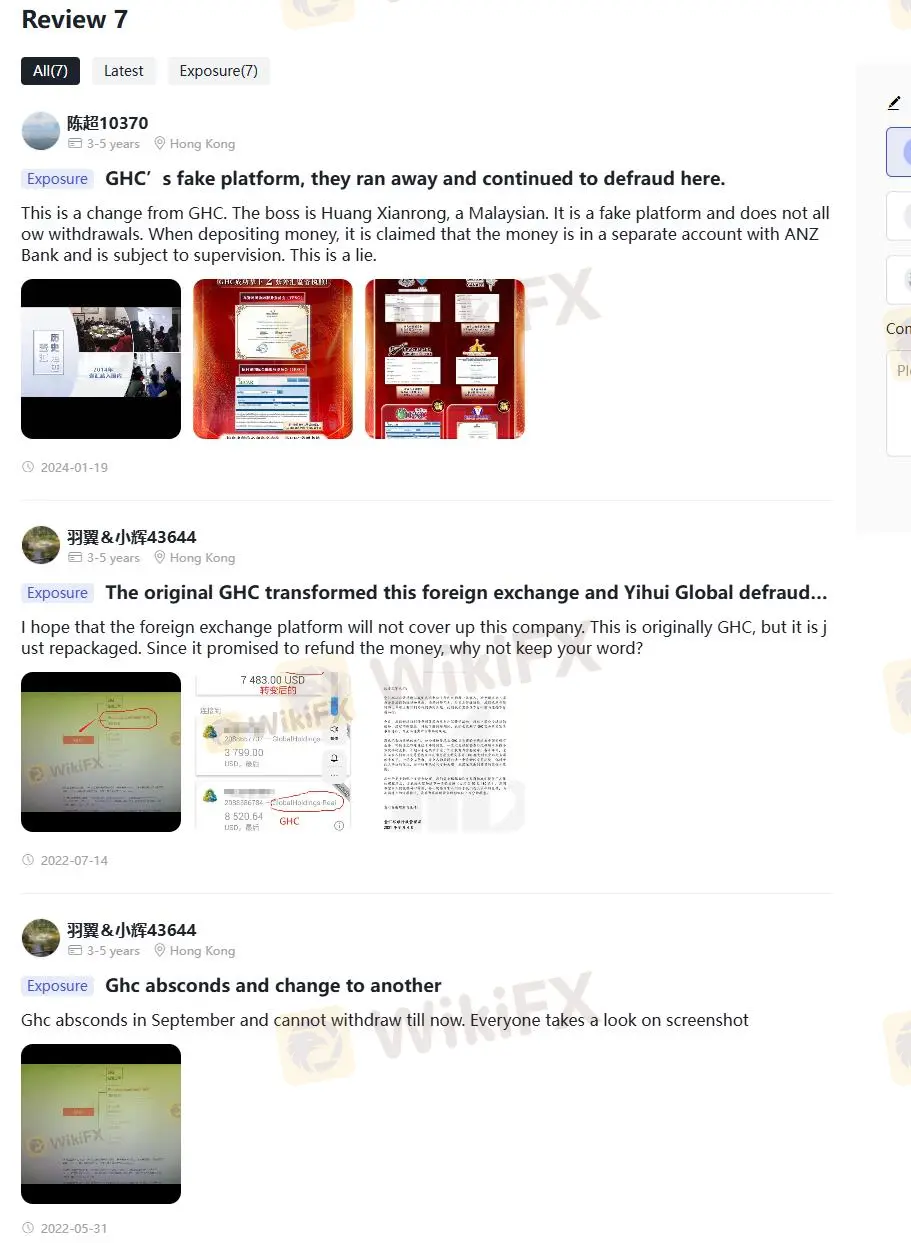

Di WikiFX, "Paparan" diposting sebagai kata dari mulut yang diterima dari pengguna.

Klien harus meninjau informasi dan menilai risiko sebelum bertransaksi di platform yang tidak diatur. Silakan konsultasikan platform kami untuk rincian terkait. Laporkan broker penipuan di bagian Paparan kami dan tim kami akan bekerja untuk menyelesaikan masalah yang Anda hadapi.

Beberapa pengguna mengatakan bahwa perusahaan ini dan GHC memiliki pemilik yang sama. GHC menipu mereka dan tidak dapat menarik uang. Hal ini akan menimbulkan beberapa kekhawatiran keamanan. Anda dapat mengunjungi: https://www.wikifx.com/en/comments/detail/202401199212973915.html https://www.wikifx.com/en/comments/detail/202207146672596195.html https://www.wikifx.com/en/comments/detail/202205315752526357.html.

In my research and direct experience with Renaissance Capital, I have not found clear evidence that a free demo account is available to individual traders, nor explicit information about any restrictions or time limits that might apply if such an option existed. Renaissance Capital positions itself primarily as an investment bank with a strong focus on investment banking, global markets, and institutional brokerage services—rather than serving traditional retail forex traders looking for standard demo environments. While the firm operates under Cyprus Securities and Exchange Commission (CYSEC) oversight and maintains a long-standing presence, I noticed the absence of retail-driven features like demo accounts advertised on their public materials. This stands out because demo accounts are a common tool for retail-focused brokers, offering potential clients a risk-free way to evaluate trading platforms and conditions. With Renaissance Capital, there is a significant emphasis on serving legal entities and high-net-worth individuals, which may explain the lack of accessible demo account information and raises questions about whether a standard demo feature is supported at all. Given the high-risk warnings and multiple user reports of previous withdrawal issues and rebranding concerns, I would urge fellow traders to exercise extra caution and obtain direct confirmation from the broker’s customer service before depositing any funds. This step ensures clarity and mitigates unnecessary risk, particularly if you are seeking a platform to practice trading through a demo environment. For my own trading needs, this lack of transparency would be a red flag and prompt me to look elsewhere if a demo account is a priority.

In my experience as a forex trader, I always take a broker’s regulatory status seriously, since this is central to protecting my capital and ensuring a fair trading environment. Renaissance Capital is regulated by the Cyprus Securities and Exchange Commission (CYSEC), which means the company must adhere to set financial standards, operational practices, and client protection policies. In theory, this sort of regulation obliges the broker to keep client funds segregated from its own working capital—an important buffer against misuse of deposits. However, as I dug deeper, I noticed some significant concerns raised by previous clients about the integrity and transparency of Renaissance Capital, including troubling allegations of withdrawal issues and links to other problematic platforms. Although CYSEC is a recognized regulator and its oversight reduces some risks compared to unregulated brokers, no regulator can absolutely eliminate the potential for misconduct. For me, this situation underscores the importance of not relying solely on the presence of regulation but also examining the broker’s reputation and reported user experiences before entrusting them with any funds. Regulation is an important layer of defense, but comprehensive due diligence is always essential for safeguarding your money.

As an experienced forex trader, I approach every broker with a healthy degree of skepticism and a careful risk assessment. In evaluating Renaissance Capital, several factors weigh heavily on my decision-making process. While the company holds a Cyprus Securities and Exchange Commission (CYSEC) license and has been operating for more than 20 years, I find it crucial to dig deeper than regulatory status alone, especially when user reports suggest significant issues. My primary concern stems from repeated negative reviews, particularly allegations that Renaissance Capital is connected to GHC—a platform that, according to users, has a history of non-processed withdrawals and rebranding after alleged scams. In trading, the inability to withdraw funds or clear evidence of past misconduct is a serious red flag, regardless of any awards or apparent regulatory oversight. Personally, the potential for overlap with a previously exposed platform raises notable questions about transparency and operational integrity. Furthermore, reports of a "suspicious scope of business" and "high potential risk," combined with first-hand accounts of unresolved problems and transformation from other entities, mean that I would adopt a highly cautious stance. Even though regulatory status can provide a safety net, it is not always sufficient protection against operational malpractice. My professional judgement compels me to avoid platforms where there is ongoing uncertainty about the legitimacy and safety of client funds. For me, trustworthiness hinges not just on formal regulation, but also on a consistent track record of treating clients fairly—and this is where Renaissance Capital currently falls short in my evaluation.

Based on my careful review of the available details regarding Renaissance Capital, I see that information about specific trading accounts—such as ECN or raw spread accounts—and the commission structure per lot is not directly provided. The broker is identified as a market maker and holds a CYSEC license in Cyprus, which does offer a measure of regulatory oversight. However, clear and transparent fee schedules, especially regarding commissions per lot for ECN or raw spread accounts, are notably absent. For me as a trader, this lack of transparency is a significant concern. In my experience, reputable brokers typically disclose their commission structures upfront, particularly if they offer ECN or raw account types, where commissions are usually charged per lot to make up for tighter spreads. The fact that none of this essential information is readily available, coupled with substantial negative feedback from users claiming prior issues with account withdrawals and platform transitions, increases my caution. Ultimately, without explicit confirmation of the commission per lot for ECN or raw accounts, I cannot verify Renaissance Capital's fee arrangement with confidence. This would lead me to be extremely cautious before considering any trading activity, especially given the potential risks highlighted by former users and the importance of fee transparency in trading decisions.

Silakan masukan...

TOP

TOP

Chrome

Plugin Chrome

Pertanyaan Regulasi Pialang Forex Global

Jelajahi situs web broker forex dan kenali broker resmi dan penipu secara akurat

Pasang sekarang

陈超10370

China

Ini adalah perubahan dari GHC. Bosnya adalah Huang Xianrong, seorang Malaysia. Ini adalah platform palsu dan tidak mengizinkan penarikan. Saat melakukan deposit, diklaim bahwa uang berada di rekening terpisah dengan ANZ Bank dan tunduk pada pengawasan. Ini adalah kebohongan.

Paparan

壞丫头

China

Ini adalah nama lain dari GHC dan terus melakukan penipuan.

Paparan

A天蓝蓝(牙医)

China

Dari GHC lagi ke pedagang ini, scammers terus menipu. Hanya kami investor China yang mengambil hasilnya.

Paparan

羽翼&小辉43644

China

Saya berharap platform valuta asing tidak akan menutupi perusahaan ini. Ini awalnya GHC, tetapi hanya dikemas ulang. Karena itu berjanji untuk mengembalikan uang, mengapa tidak menepati janji Anda?

Paparan

羽翼&小辉43644

China

Ghc melarikan diri pada bulan September dan tidak dapat mundur sampai sekarang. Semua orang melihat pada tangkapan layar

Paparan

羽翼&小辉

China

Sudah dikatakan bahwa Anda memiliki koneksi dengan GHC. Anda telah menipu begitu banyak orang.

Paparan

A天蓝蓝(牙医)

China

Pada tanggal 4 September, situs web tidak dapat dibuka secara bersamaan, dan kemudian GHC menjadi dealer ini, scammer.

Paparan