Buod ng kumpanya

| Renaissance Capital Buod ng Pagsusuri | |

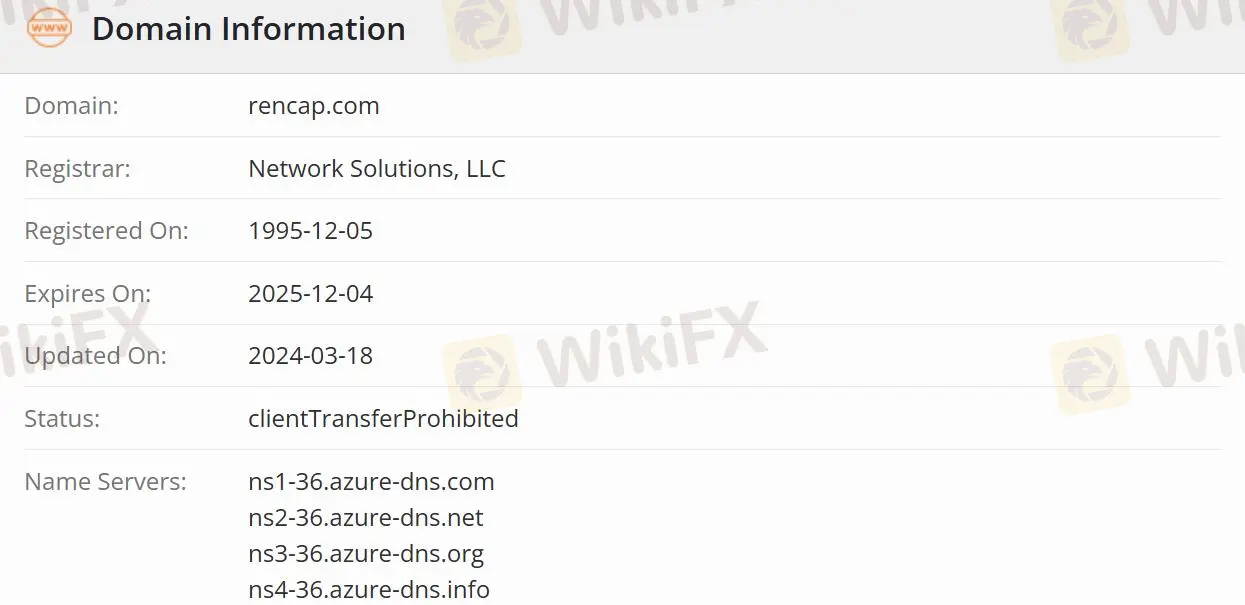

| Itinatag | 1995-12-05 |

| Rehistradong Bansa/Rehiyon | Cyprus |

| Regulasyon | Regulated |

| Negosyo | Investment Banking, Global Markets/Top Brokerage. |

| Suporta sa Customer | Telepono: + 357(22)505 800 |

| Fax: + 357(22)676 755 | |

| E-mail: info@rencap.eu | |

Renaissance Capital Impormasyon

Renaissance Capital ay isang CYSEC-licensed investment bank. Ito ay pinangalanan bilang "European Emerging Markets Investment Bank of the Year" at "Sustainability Independent Investment Bank of the Year" sa taunang "2020 Investment Bank Awards" ng The Banker magazine. Ang kumpanya ay may tatlong pangunahing larangan ng negosyo tulad ng investment banking, global markets, at top brokerage.

Totoo ba ang Renaissance Capital?

Ang Cyprus Securities and Exchange Commission (CYSEC) ay nagreregula sa Renaissance Capital sa ilalim ng lisensya No.053/04 at License Type Market Making (MM), na mas ligtas kaysa sa hindi regulado.

Ano ang ginagawa ng Renaissance Capital?

Ang Investment Banking division ay nag-aalok ng mga natatanging solusyon para sa mga kliyente sa pamamagitan ng pagpagsama ng internasyonal at lokal na kaalaman sa mga merger at acquisitions, equity capital markets, debt capital markets, at custom financings.

Ang equity capital markets ay nag-aalok ng mga pangunahing produkto sa equity at equity-linked, monetization, at mga solusyon sa pagtatayo ng istraktura.

Ang debt capital markets ay nakatuon sa lokal at internasyonal na mga bond, nagbibigay ng payo at mga solusyon sa pagbabago ng utang para sa pangangasiwa ng responsibilidad, pagsasagawa ng pondo, at hedging, at kasama rin ang pangangasiwa ng responsibilidad at serbisyong pang-rating ng credit para sa mga korporasyon at sovereign na mga kliyente.

Ang Mergers and Acquisitions ay nagspecialisa sa pagbibigay payo sa mga korporasyon, mga financial investor, at mga shareholder sa malalaking at kumplikadong transaksyon, merger, acquisition, restructuring, divestiture, going private transactions, management buyouts, leveraged buyouts, at iba pang sitwasyon.

Ang Global Markets area ay naglilingkod sa mga legal na entidad, mga institusyong pinansyal, at mga indibidwal na may mataas na net worth at nagbibigay ng mga pasadyang serbisyo sa mga kliyente.

Ang premier brokerage area ay nagbibigay-daan sa mga kliyente na gamitin ang global market capabilities ng kumpanya pati na rin ang karagdagang benepisyo na eksklusibo para sa mga kliyenteng nagbukas ng brokerage account sa Renaissance Capital.

Negatibong mga Pagsusuri sa Renaissance Capital sa WikiFX

Sa WikiFX, ang "Exposure" ay ipinapaskil bilang salita ng bibig na natanggap mula sa mga gumagamit.

Dapat suriin ng mga kliyente ang impormasyon at suriin ang mga panganib bago mag-trade sa mga hindi reguladong plataporma. Mangyaring kumunsulta sa aming plataporma para sa kaugnay na mga detalye. Iulat ang mga mapanlinlang na mga broker sa aming seksyon ng Exposure at gagawin ng aming koponan ang lahat ng makakaya upang malutas ang anumang mga isyu na inyong matagpuan.

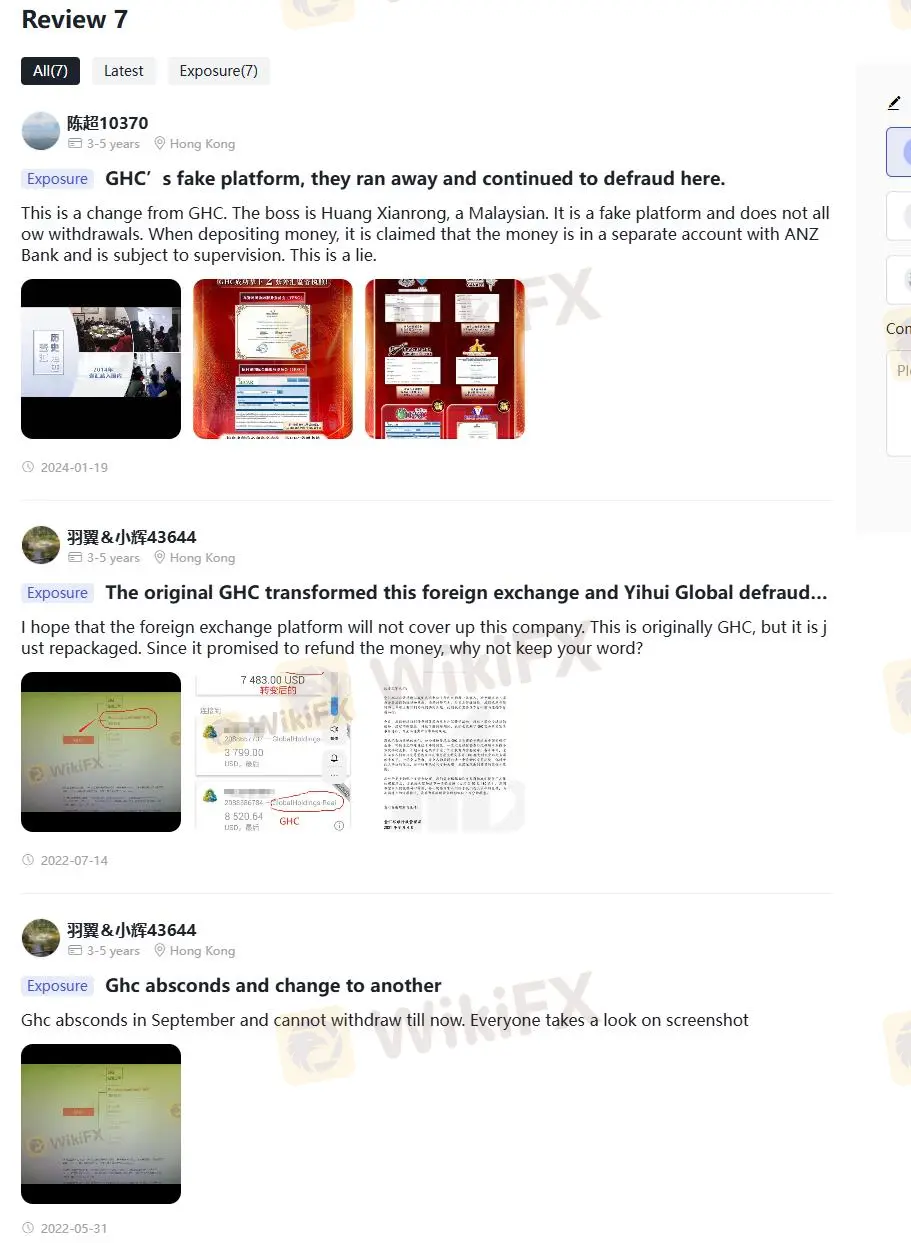

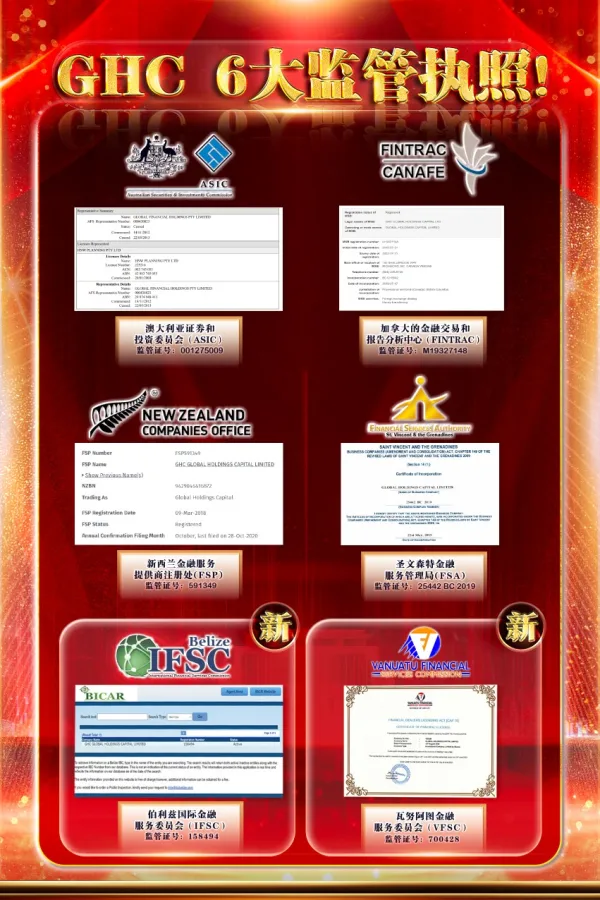

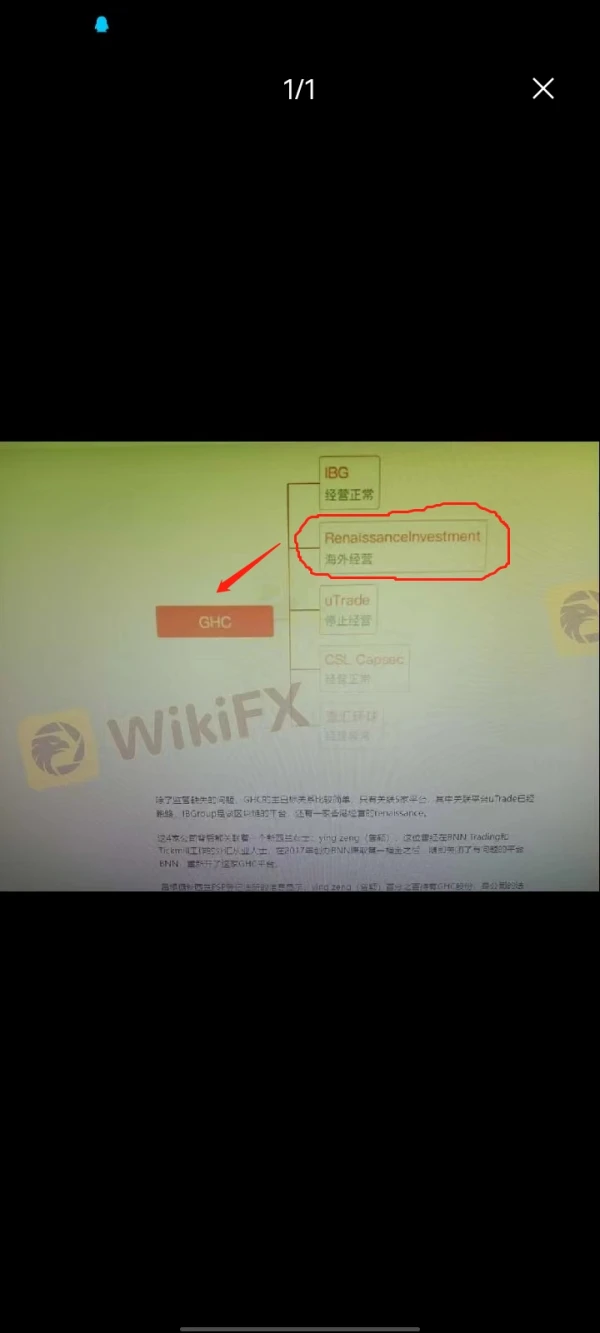

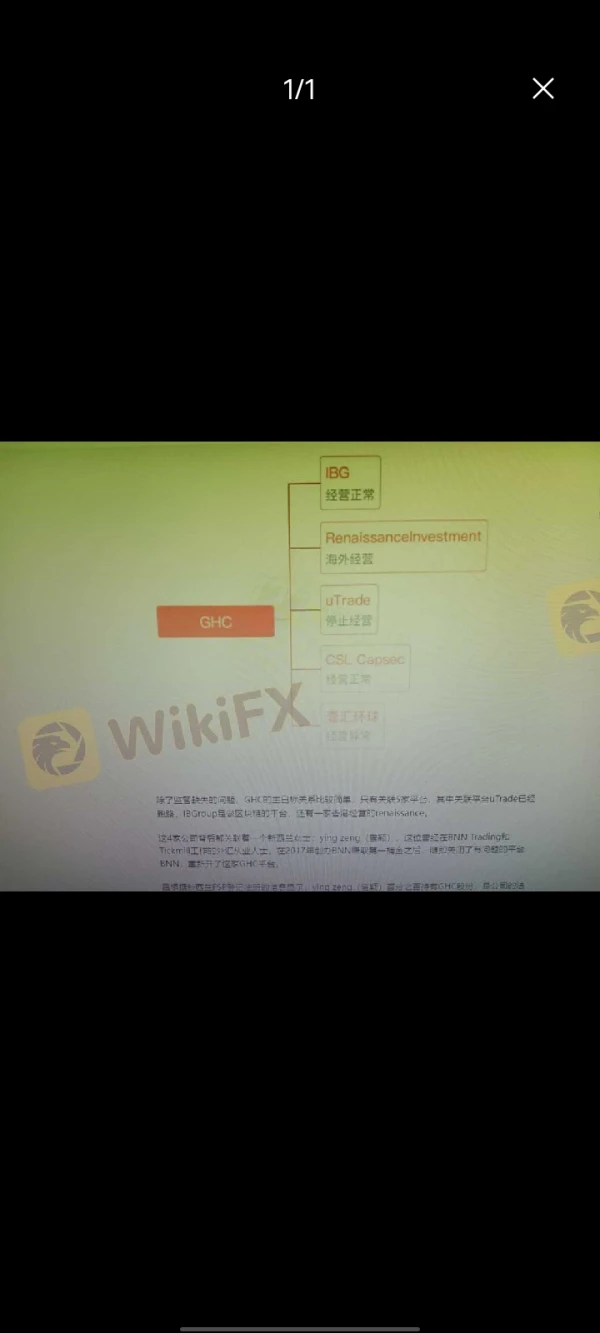

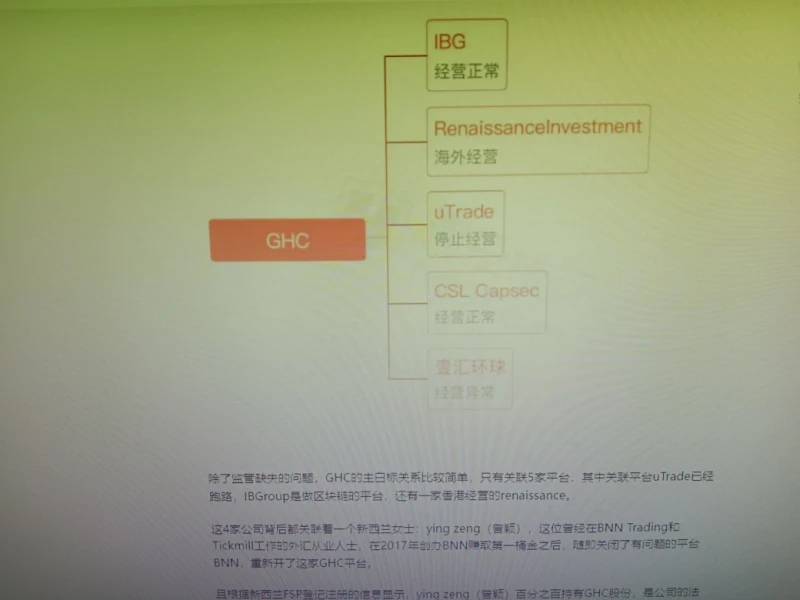

Maraming mga gumagamit ang nagsabi na ang kumpanyang ito at GHC ay may parehong may-ari. Niloko sila ng GHC at hindi nila maipapalabas ang pera. Ito ay magdudulot ng ilang mga alalahanin sa seguridad. Maaari kayong bumisita sa: https://www.wikifx.com/en/comments/detail/202401199212973915.html https://www.wikifx.com/en/comments/detail/202207146672596195.html https://www.wikifx.com/en/comments/detail/202205315752526357.html.

陈超10370

Hong Kong

Ito ay isang pagbabago mula sa GHC. Ang boss ay si Huang Xianrong, isang Malaysian. Ito ay isang pekeng plataporma at hindi pinapayagan ang mga pag-withdraw. Kapag nagdedeposito ng pera, sinasabing ang pera ay nasa hiwalay na account sa ANZ Bank at sumasailalim sa pagbabantay. Ito ay isang kasinungalingan.

Paglalahad

壞丫头

Hong Kong

Ito ay isa pang pangalan ng GHC at patuloy na gumawa ng mga scam.

Paglalahad

A天蓝蓝(牙医)

Hong Kong

Mula sa GHC muli hanggang sa mangangalakal na ito, ang mga scammer ay patuloy na nanloloko. Kaming mga Chinese investor lang ang kumukuha ng resulta.

Paglalahad

羽翼&小辉43644

Hong Kong

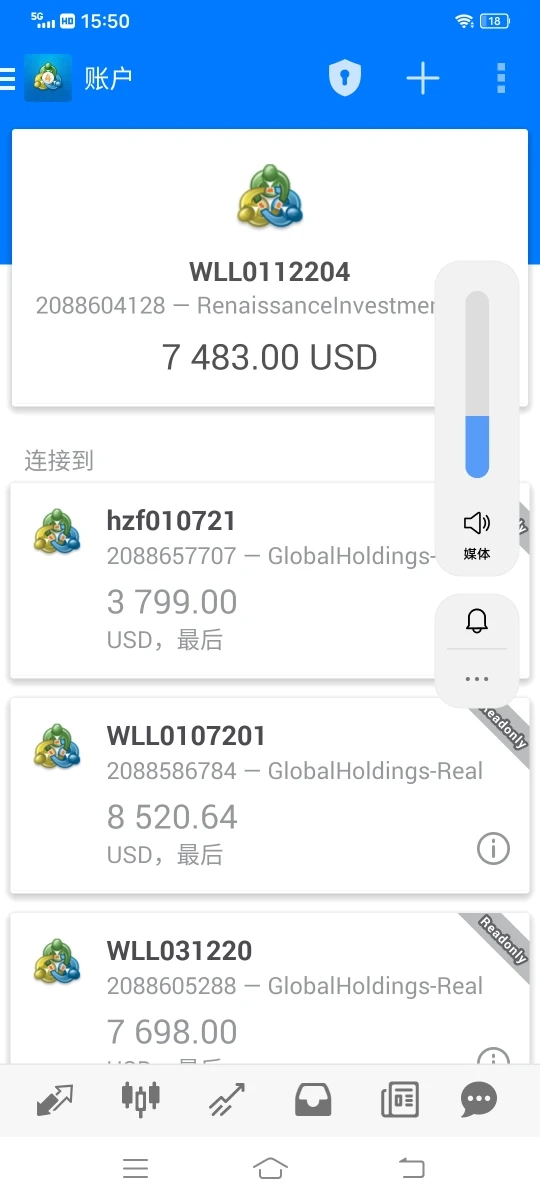

Sana ay hindi pagtakpan ng foreign exchange platform ang kumpanyang ito. Ito ay orihinal na GHC, ngunit ito ay nire-repack lang. Dahil nangako itong ibabalik ang pera, bakit hindi tuparin ang iyong salita?

Paglalahad

羽翼&小辉43644

Hong Kong

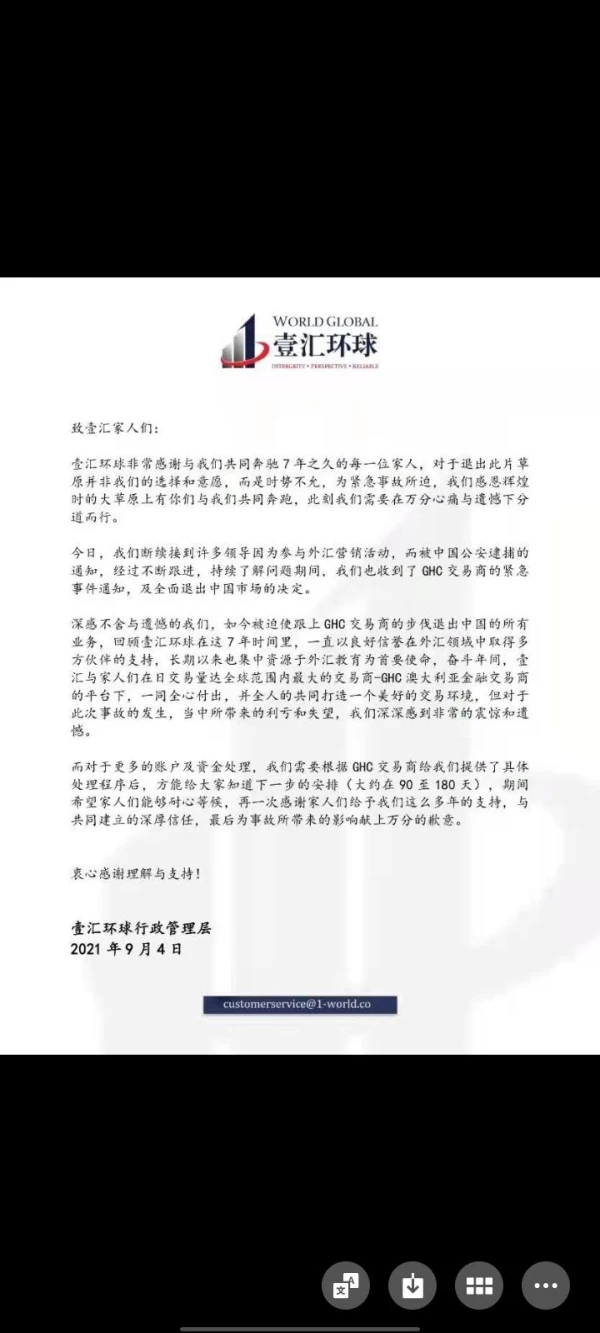

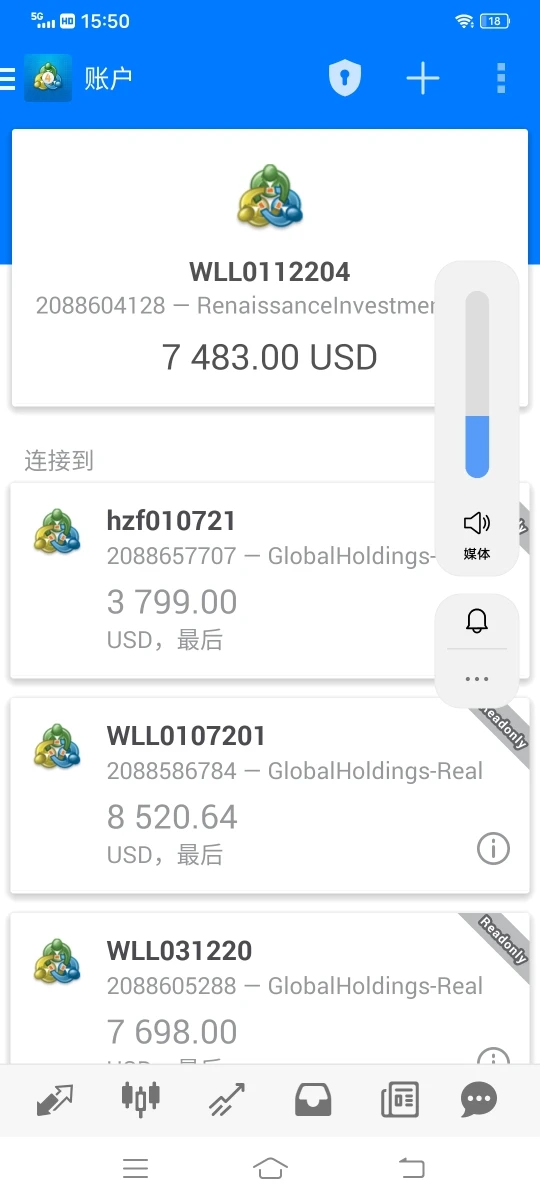

Ang Ghc ay tumakas noong Setyembre at hindi maaaring mag-withdraw hanggang ngayon. Lahat ay tumitingin sa screenshot

Paglalahad

羽翼&小辉

Hong Kong

Sinasabi na may koneksyon ka sa GHC. Napakaraming tao ang niloko mo.

Paglalahad

A天蓝蓝(牙医)

Hong Kong

Noong ika-4 ng Setyembre, ang website ay hindi mabuksan nang sabay-sabay, at pagkatapos ay ang GHC ay naging dealer na ito, scammer.

Paglalahad