公司簡介

| M&G 評論摘要 | |

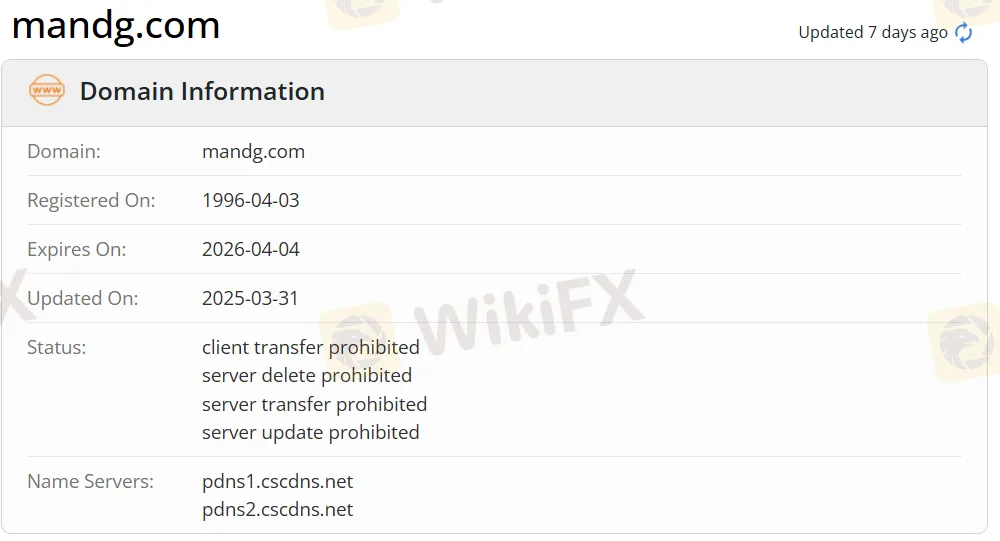

| 成立年份 | 1996 |

| 註冊國家/地區 | 愛爾蘭 |

| 監管 | FCA(已超出) |

| 服務 | 資產管理、投資和長期儲蓄 |

| 交易平台 | myM&G web |

| 最低存款 | £1 |

| 客戶支援 | 電話:+44 (0)207 626 4588 |

| 電郵:info@mandg.co.uk | |

| 地址:10 Fenchurch Avenue LondonEC3M 5AG 英國 | |

| Instagram、LinkedIn | |

| 區域限制 | 資產管理規模低於£50m的市場,以及英國海外領土、皇家屬地和歐洲微型國家(除了馬耳他)均被排除 |

M&G 資訊

M&G 是一家提供優質經紀和金融服務的服務提供商,於1996年在愛爾蘭成立。它提供資產管理、投資和長期儲蓄的產品和服務。此外,資產管理規模低於£50m的市場,以及英國海外領土、皇家屬地和歐洲微型國家(除了馬耳他)均不被允許。此外,值得注意的是,M&G 的FCA牌照已超出,這意味著可能存在潛在風險。

優缺點

| 優點 | 缺點 |

| 營運時間長 | 超出FCA牌照 |

| 多元聯絡途徑 | 區域限制 |

| 低最低存款 | 收取佣金費用 |

| 多元支付選項 |

M&G 是否合法?

M&G持有金融行為監管局的牌照,但目前狀態已超出。其牌照號碼為119328。金融行為監管局(FCA)是英國的金融監管機構,但獨立於英國政府運作,並通過向金融服務業成員收取費用來籌措資金。

| 受監管國家 | 監管機構 | 當前狀態 | 受監管實體 | 牌照類型 | 牌照號碼 |

| 金融行為監管局(FCA) | 超出 | M&G投資管理有限公司 | 投資諮詢牌照 | 119328 |

M&G 服務

| 服務 | 支援 |

| 資產管理 | ✔ |

| 投資 | ✔ |

| 長期儲蓄 | ✔ |

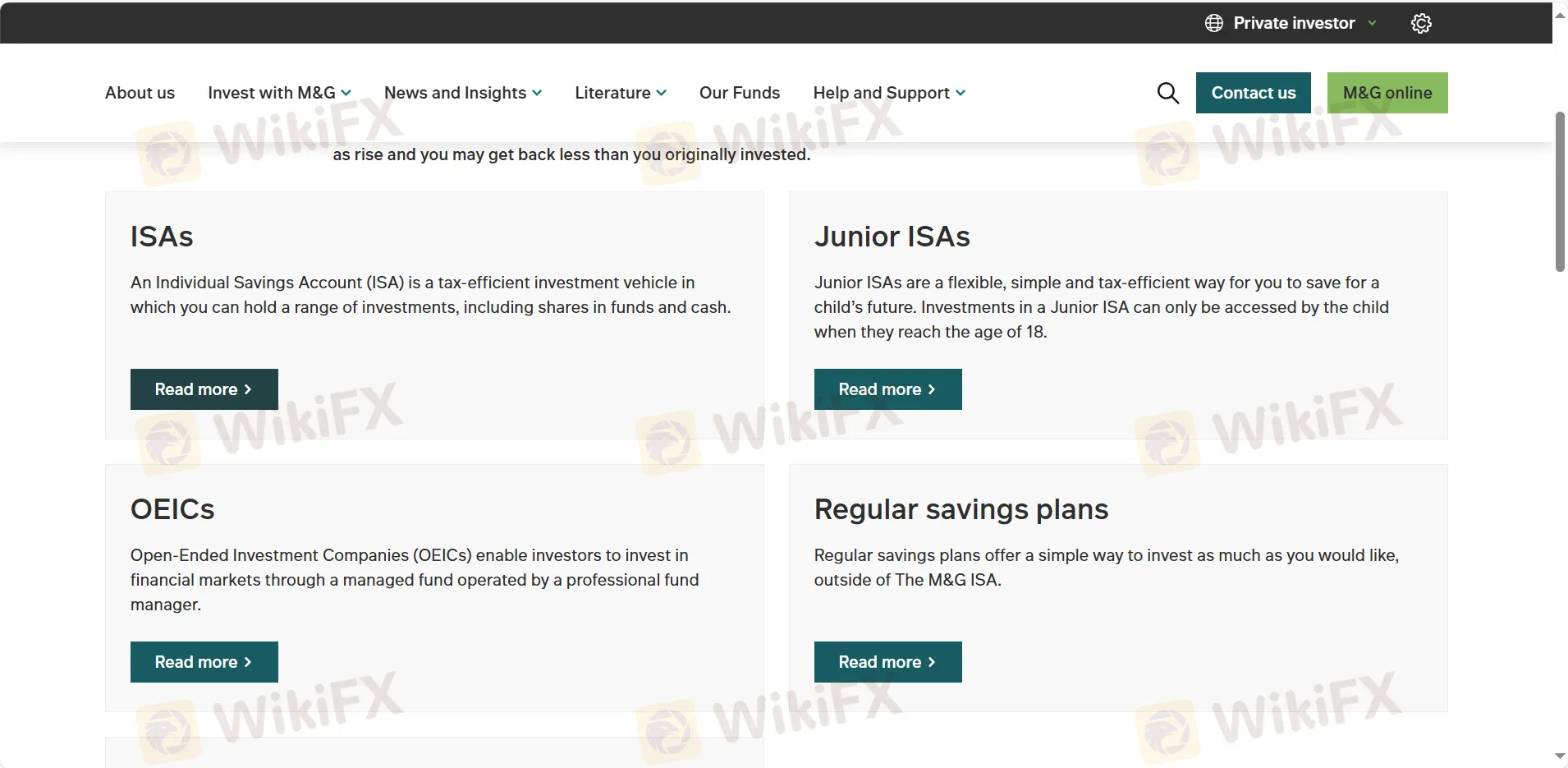

帳戶類型

| 帳戶類型 | 最低存款 |

| ISA | £1 |

| Junior ISA | £1 |

| OEIC | £1 |

M&G 費用

費用與投資價值有關,因此將取決於基金表現。費用按年計算,每日扣除。詳細資料未提及。

交易平台

| 交易平台 | 支援 | 可用設備 | 適用對象 |

| myM&G web | ✔ | PC、筆記本電腦、平板電腦 | / |

存款和提款

經紀商接受透過Maestro、MasterCard Debit、Visa Debit及Visa Delta借記卡進行付款。最低存款為£1。未設定最低提款金額,亦未指明任何費用或收費。

FX7068259962

台灣

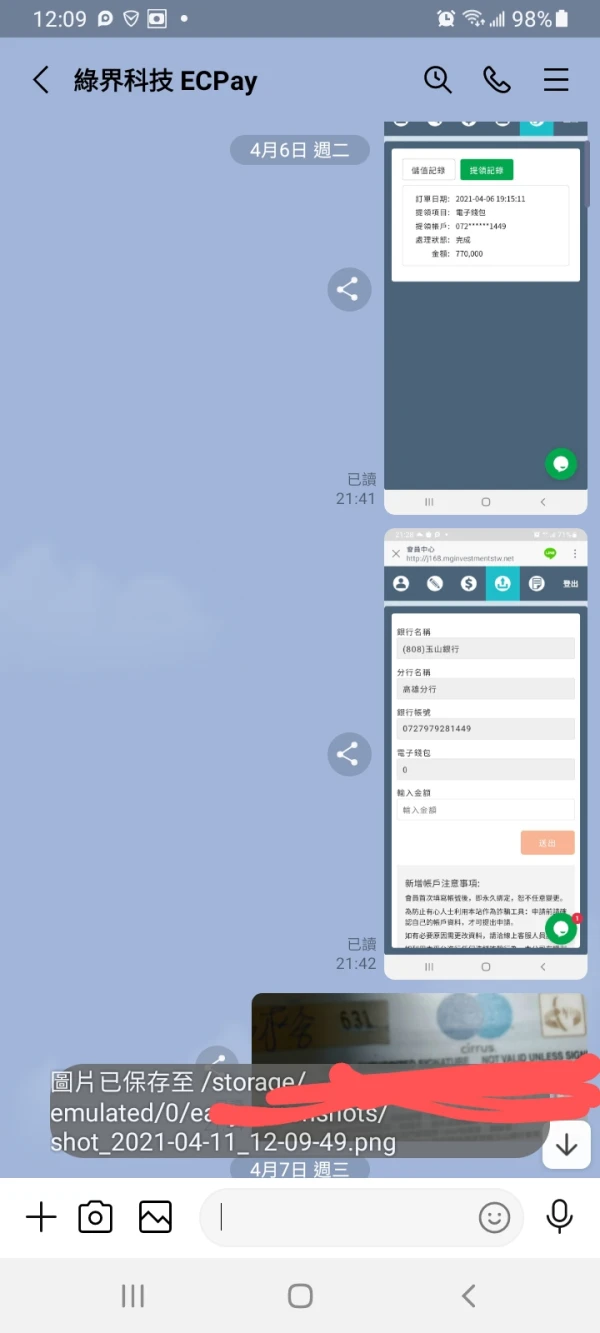

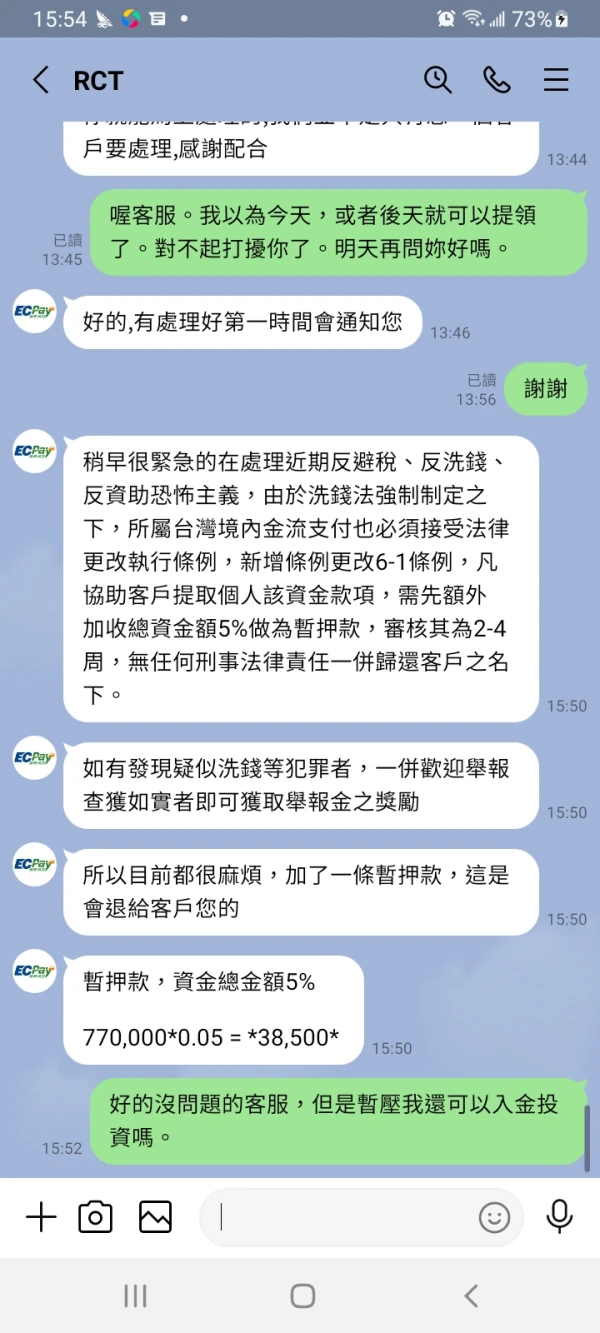

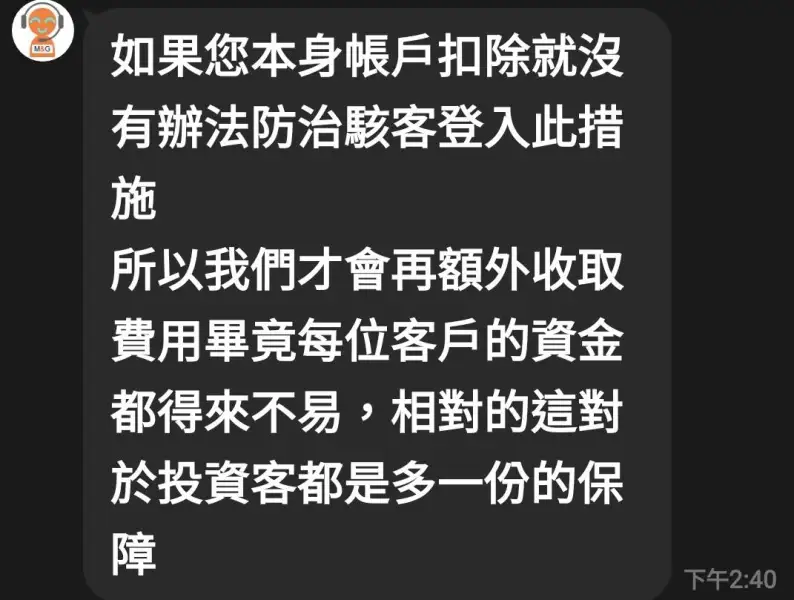

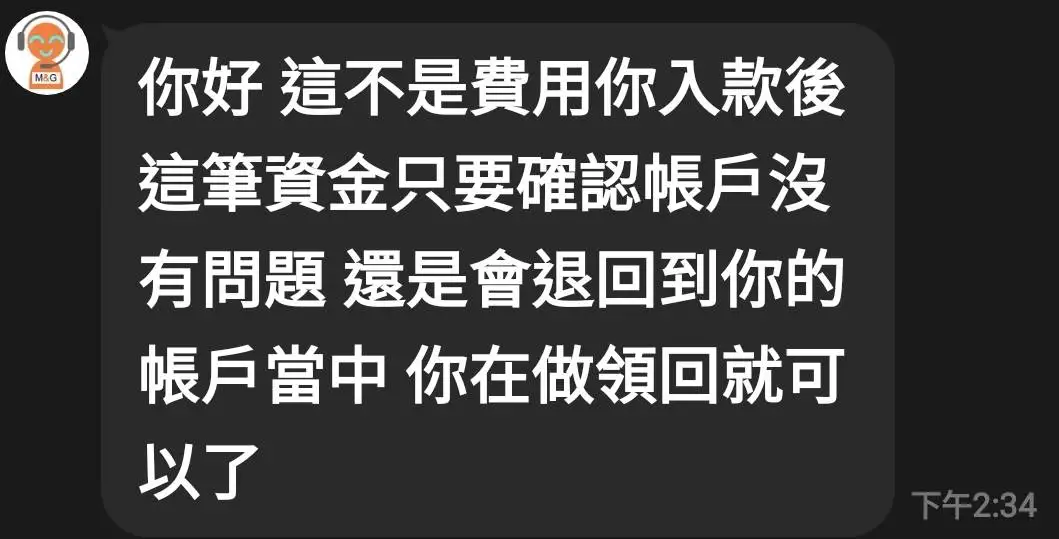

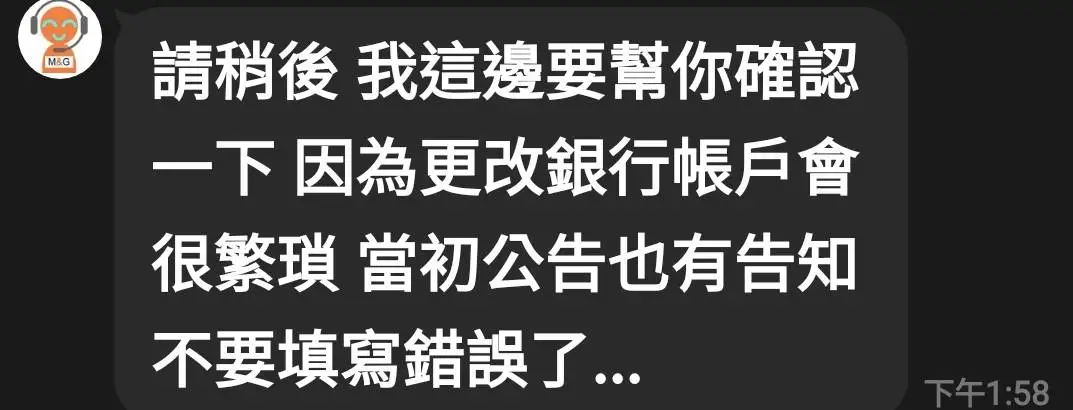

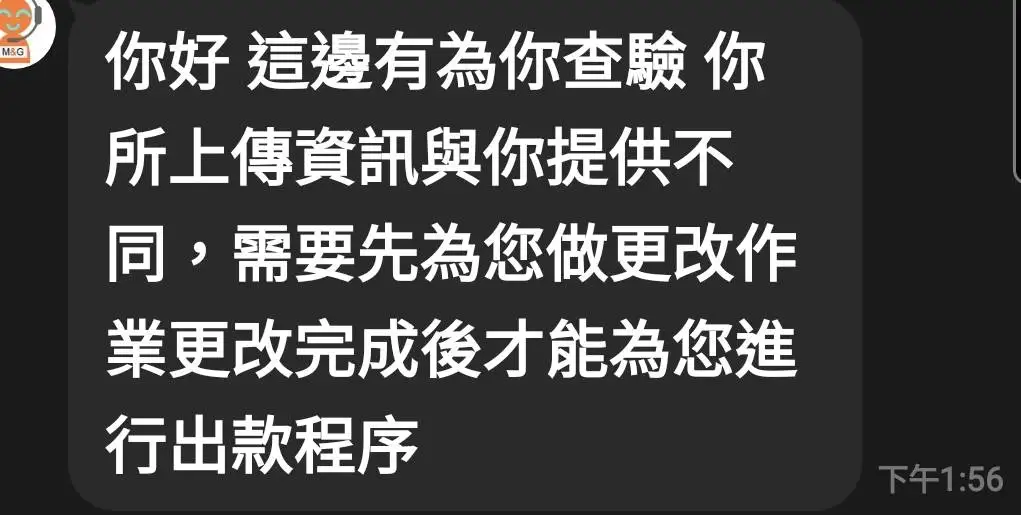

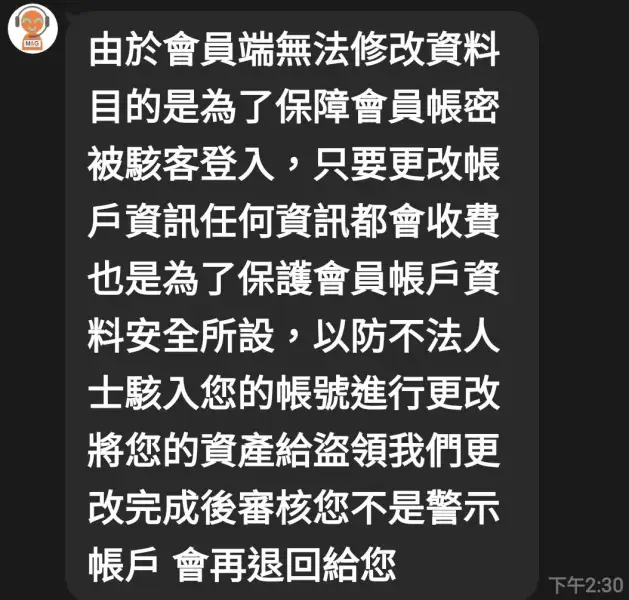

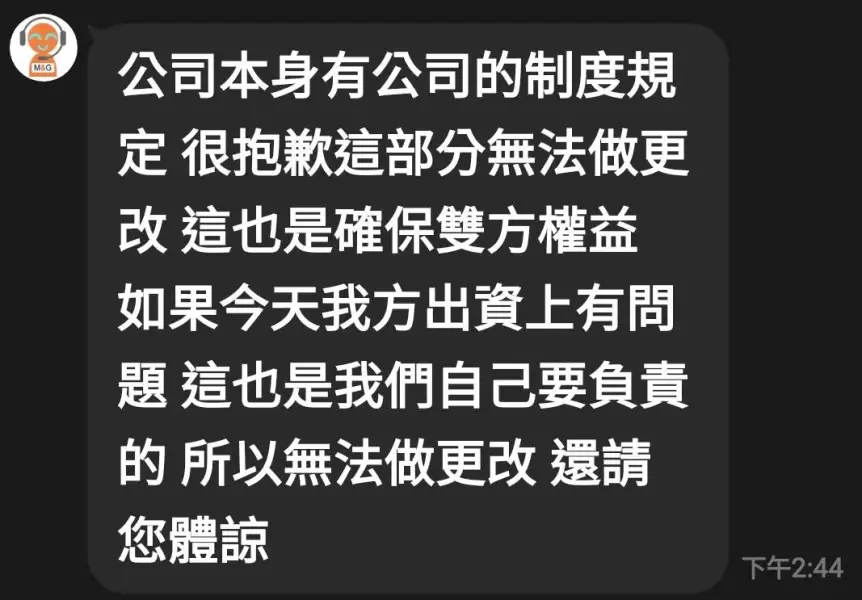

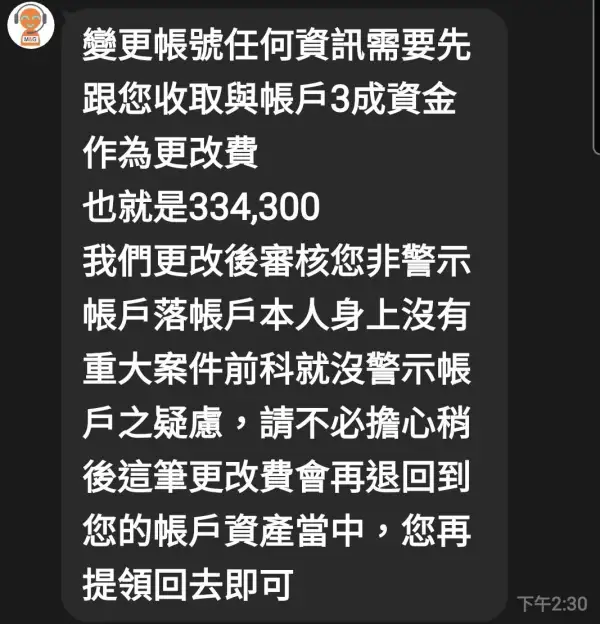

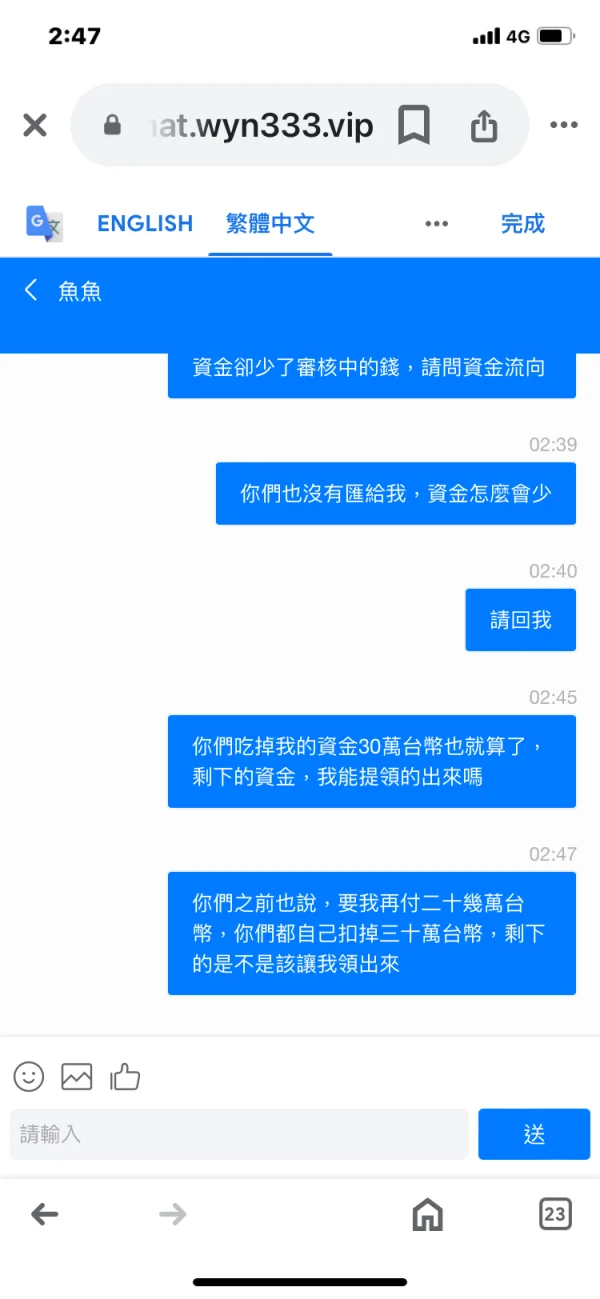

收了滯納金十多萬沒出金黑平台大家要小心不要被偷改帳號又要滯納金要保證金又要改帳號的錢加起多花一二十萬喔黑平台大家不要下單

爆料

Hsuan天天

台灣

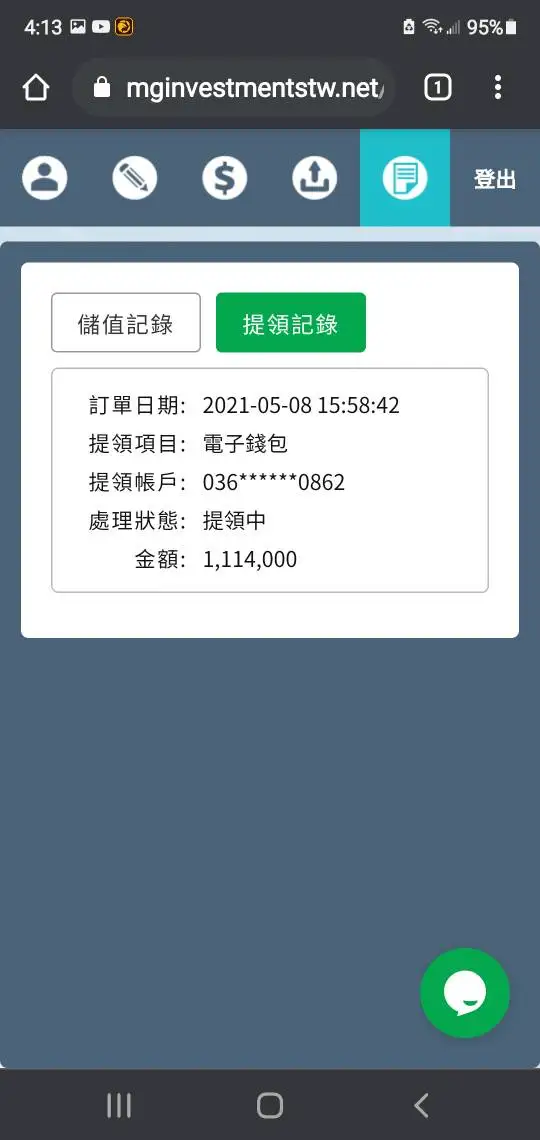

只要看到這網頁mginvestmentstw.net/ 不管前面有啥英文 他們都是一樣的網頁都是可以登入 一樣明明輸入對的銀行帳戶 但網頁顯示錯的 跟改還要是資金的3成才能更變 感覺一受騙 呼籲大家只要看到以上這網頁 基本不要去做投資 有入沒有出

爆料

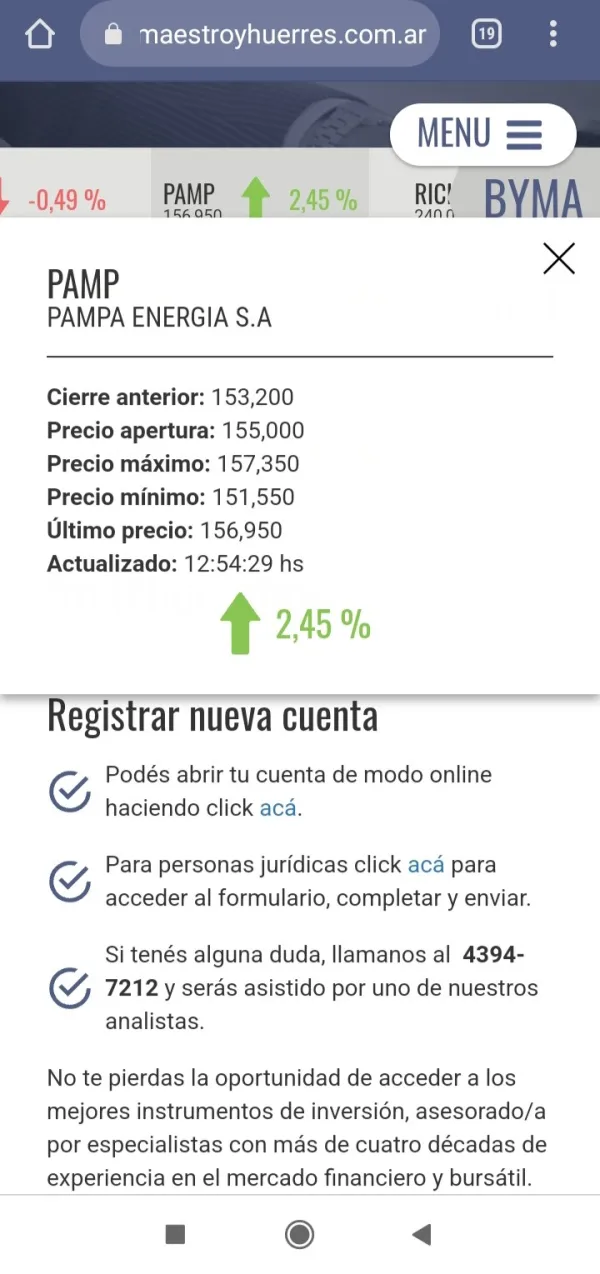

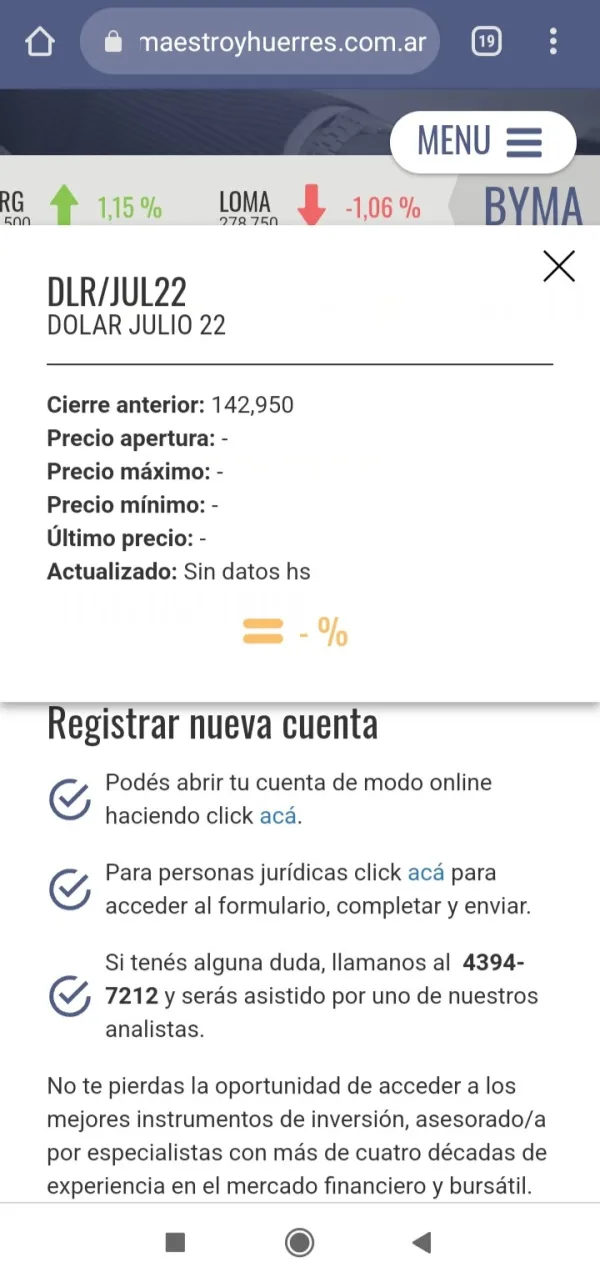

FX4102010959

阿根廷

這些人或所謂的公司,致力於不斷改變不同金融市場的圖表,從而將您的資本減少到 0 美元,我投資了 66,215 比索,一切都失去了

爆料

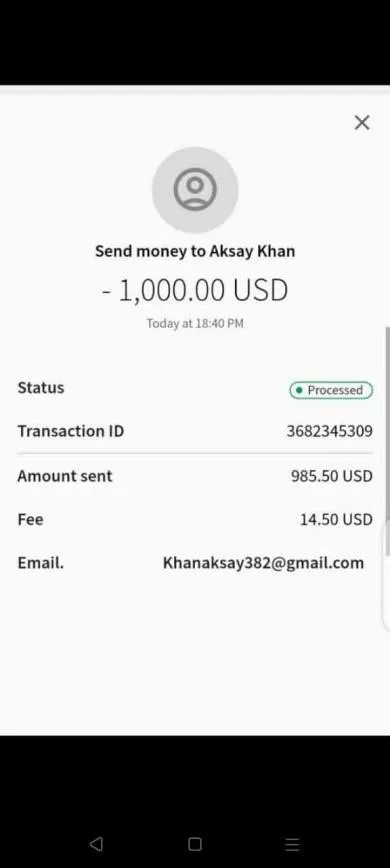

FX3308363627

台灣

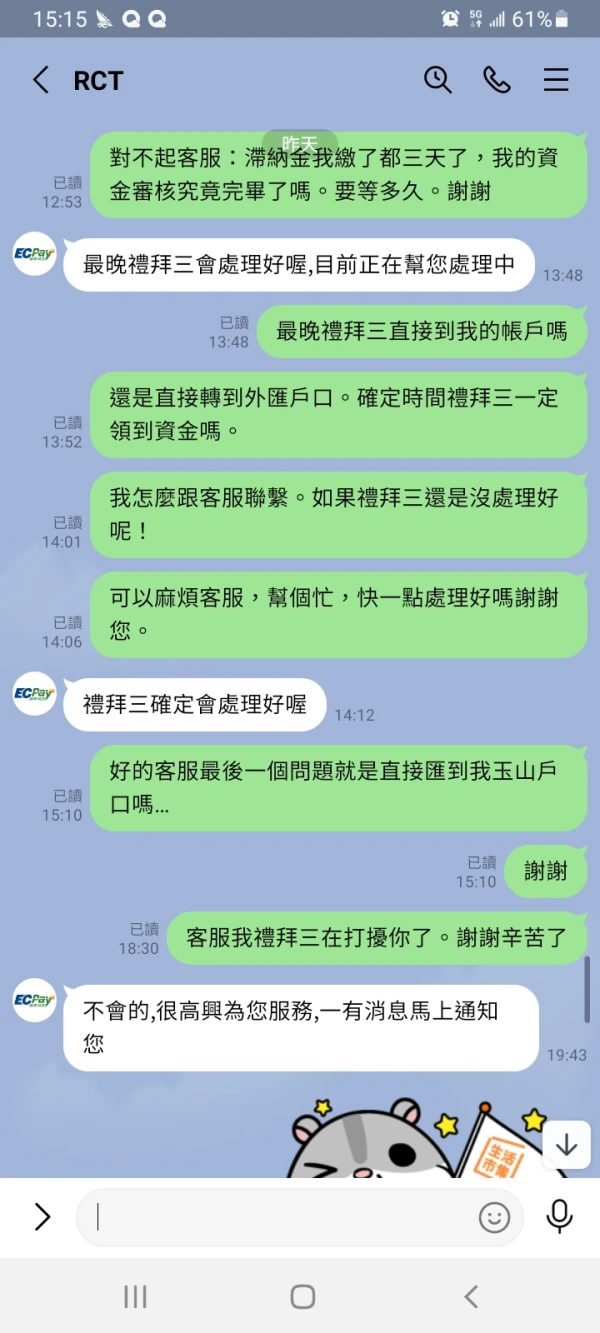

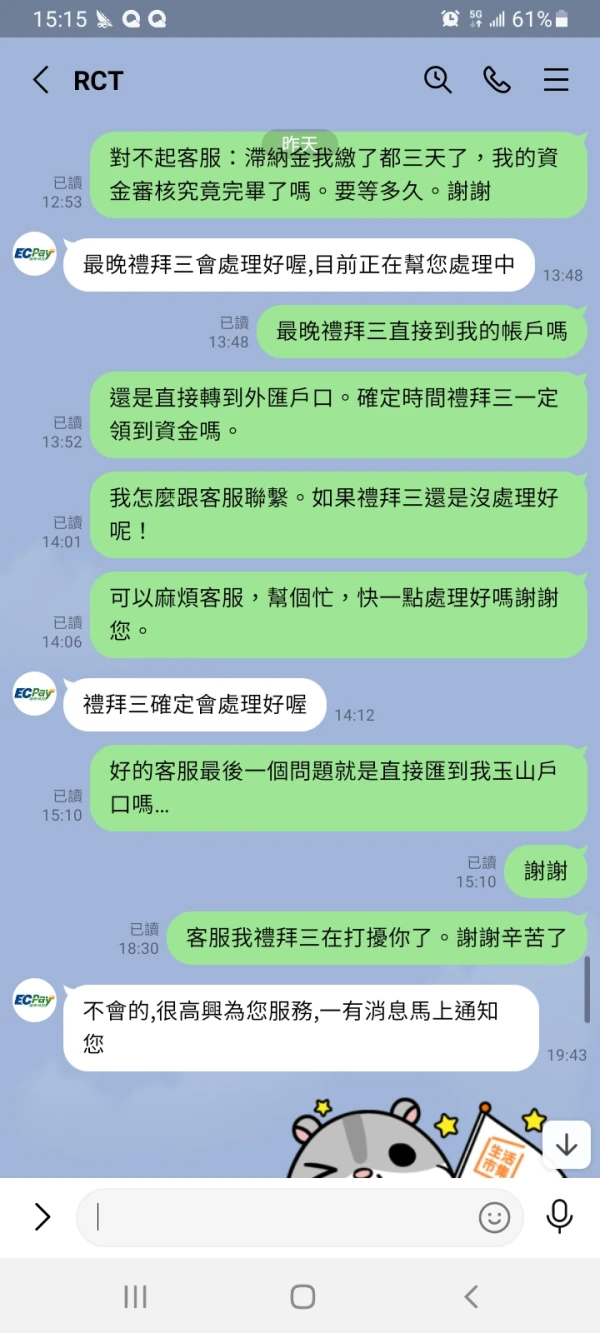

我在網上看到這個可以賺錢的應用程式後下載了它。客戶服務還提供在線匯款。我匯款了錢。當我想要提款時,它仍在審核中。我提款了三次,每次提款10萬新台幣,但我沒有收到任何款項。我多次向客戶服務詢問,但他們沒有回應。當我再次登錄這個平台時,我發現我提款的錢不見了。原本是超過190萬,但現在只剩下150萬多。這明顯是一個詐騙騙取我的錢的行為。

爆料

วิทยา ประธานทรง

聖巴泰勒米島

你好,Witthaya Prathantrong 或 M 企業家。

好評

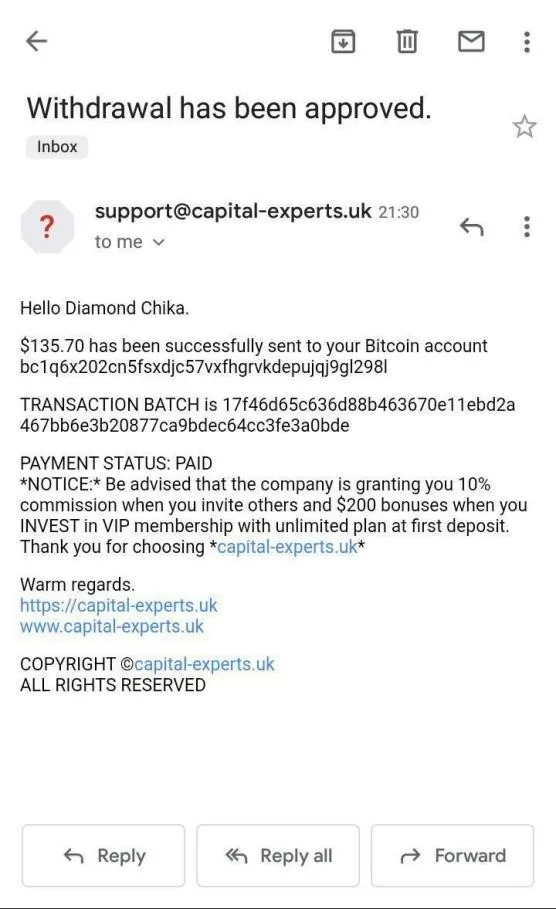

FX1828697794

墨西哥

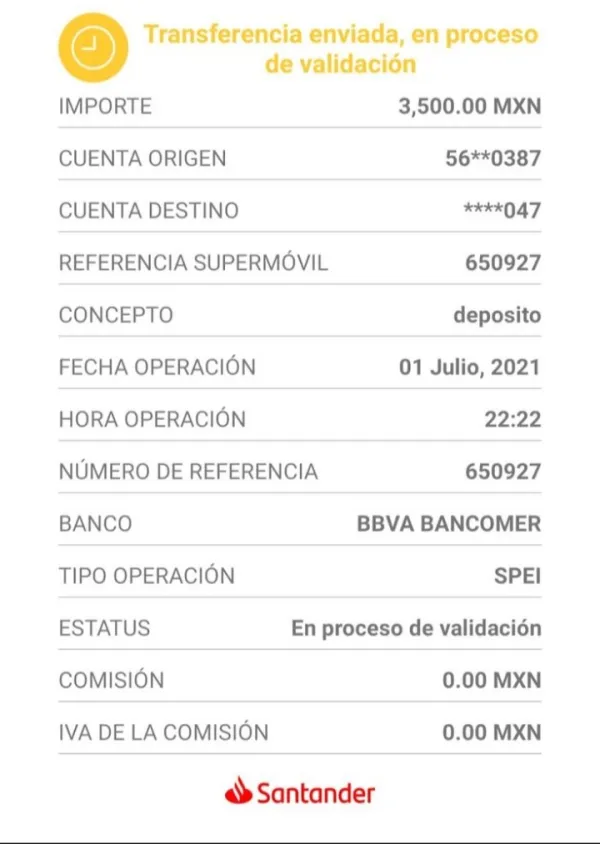

存入了 3,500 美元的比索,那天我提取了 2,300 多美元,我的董事會上出現了一張圖片,說他們錯了,這些操作很糟糕,所有的錢都不是我的,這有什麼不道德的? ,最壞的真相

爆料

FX2046354843

菲律賓

避免投資M&G,我太蠢了居然相信他們承諾的投資回報率,我借了5000英鎊的貸款。我甚至記不清他們廣告上說的投資回報率是多少了,大約是每月5%-7%(確實很可觀)剛開始兩周,表現非常積極(我從2021年8月開始與他們合作),然后就開始走下坡路。如果你制定一個我賬戶余額的圖表,圖標會看起來像一組下降的樓梯。我現在設定在2900英鎊(5000英鎊中),未平倉交易的浮動利潤為-600英鎊。因此,如果要提取剩余余額我會不得不關閉所有的未平倉交易,并且失去600英鎊。不過他們確實提供了有幫助的,大體上也響應迅速的客戶支持。他們似乎也真的很努力。

爆料