Şirket özeti

| İnceleme Özeti İnceleme | |

| Kuruluş | 1997 |

| Kayıtlı Ülke/Bölge | Fransa |

| Düzenleme | SFC |

| Ürünler | Gayrimenkul sermayesi, özel borç ve alternatif kredi, özel sermaye ve altyapı; Hisse senetleri, Sabit Gelir, Çoklu Varlık yatırımları; Özel sermaye, altyapı sermayesi, özel borç, hedge fonlar |

| Müşteri Desteği | Tel: +33144457000 |

| E-posta: webmaster-COM@axa-im.com | |

| Merkez: Tour Majunga La Défense, 6 Place de la Pyramide, 92800 Puteaux | |

| Diğer şube şirketlerinin adresi için bağlantı: https://www.axa-im.com/contact-us | |

AXA Bilgileri

AXA Yatırım Yöneticileri (AXA IM), dünya çapında şubeleri bulunan küresel bir varlık yönetimi şirketidir. Genellikle gayrimenkul sermayesi, özel borç ve alternatif kredi, özel sermaye ve altyapı, Hisse senetleri, Sabit Gelir, Çoklu Varlık yatırımları, Özel sermaye, altyapı sermayesi, özel borç, hedge fonlar gibi ürünlerle finansal hizmetler sunmaktadır.

Şirketin iyi tarafı, SFC tarafından düzenleniyor olması, bu da finansal faaliyetlerinin bu otoriteler tarafından sıkı bir şekilde izlendiği anlamına gelir ve belirli bir müşteri koruma seviyesini garanti eder.

Artılar ve Eksiler

| Artılar | Eksiler |

| SFC düzenlemesi | Web sitesinde işlem koşullarına ilişkin sınırlı bilgi açıklanmış |

| Küresel varlık | |

| Çeşitli işlem ürünleri |

AXA Güvenilir mi?

AXA şu anda Securities and Futures Commission of Hong Kong (SFC) tarafından iyi bir şekilde düzenlenmektedir ve AAP809 lisans numarasına sahiptir.

| Düzenlenen Ülke | Düzenleyici | Mevcut Durum | Düzenlenen Kuruluş | Lisans Türü | Lisans No. |

| SFC | Düzenlenmiş | AXA Yatırım Yöneticileri Asia Limited | Vadeli işlem sözleşmeleri ve Kaldıraçlı döviz ticareti yapma | AAP809 |

Ürünler ve Hizmetler

Temel Yatırımlar

- Varlık Sınıfları: Hisse Senetleri, Sabit Gelir, Çoklu Varlık

- Odak: Çeşitli piyasa koşullarında kanıtlanmış geleneksel stratejiler.

ESG & Sürdürülebilir Stratejiler

- Yaklaşım: Finansal hedefleri gerçek dünya etkisiyle uyumlu hale getirmek için çevresel, sosyal ve yönetişim (ESG) faktörlerini entegre eder.

- Felsefe: Pragmatik ve müşteri odaklı, uzun vadeli sürdürülebilir getirilere vurgu yapar.

Alternatif Yatırımlar

- Pillarlar:

- Gayrimenkul Sermayesi

- Özel Borç ve Alternatif Kredi

- Özel Sermaye ve Altyapı

Özel Piyasalar ve Hedge Fonları

- Enstrümanlar: Birincil, ikincil, ortak yatırımlar, NAV finansmanı, GP* azınlık hisseleri.

- Kapsam: Özel sermaye, altyapı sermayesi, özel borç, hedge fonları.

Seç (Çoklu Yönetici ve Danışmanlık Hizmetleri)

- Hizmetler: Birim bağlantılı ve varlık yönetimi çözümleri.

- Bölgeler: Avrupa ve Asya, müşteriye özel yatırım ihtiyaçlarına uygun olarak uyarlanmıştır.

山27387

Hong Kong

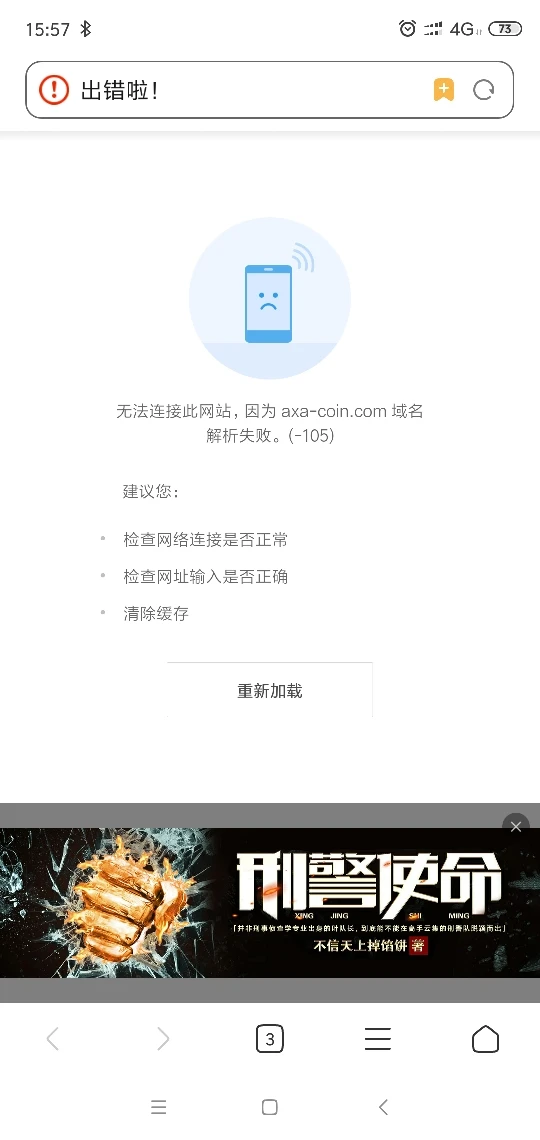

安盛基金冻结账户,无法出金,客服失联,客服网站已无法打开

Teşhir

FX1236648509

Tayvan

錢提領不出來當初看ios商店評分那麼高想說五顆星一定安全誰知道現在什麼都沒了

Teşhir

詹孟玟

Tayvan

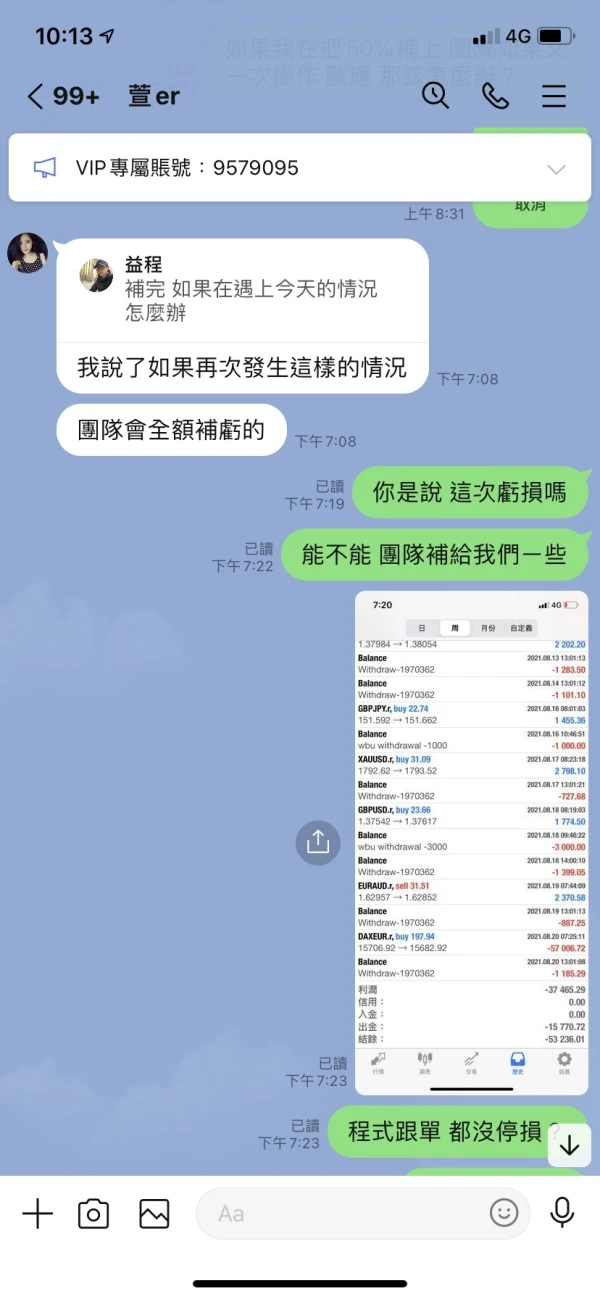

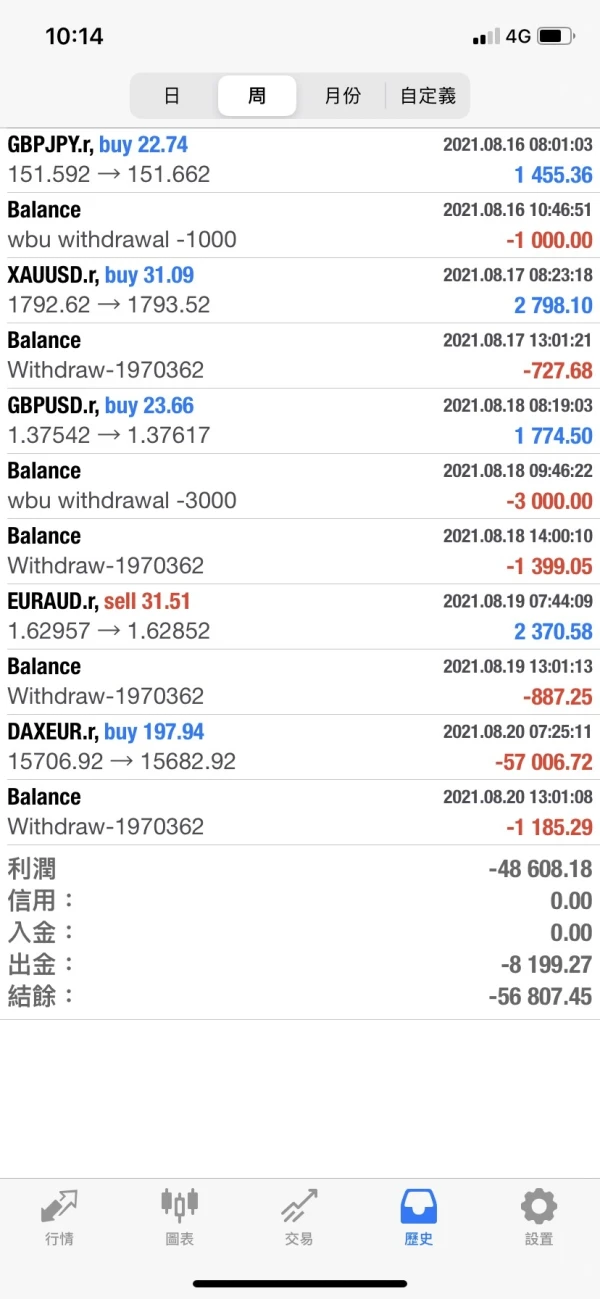

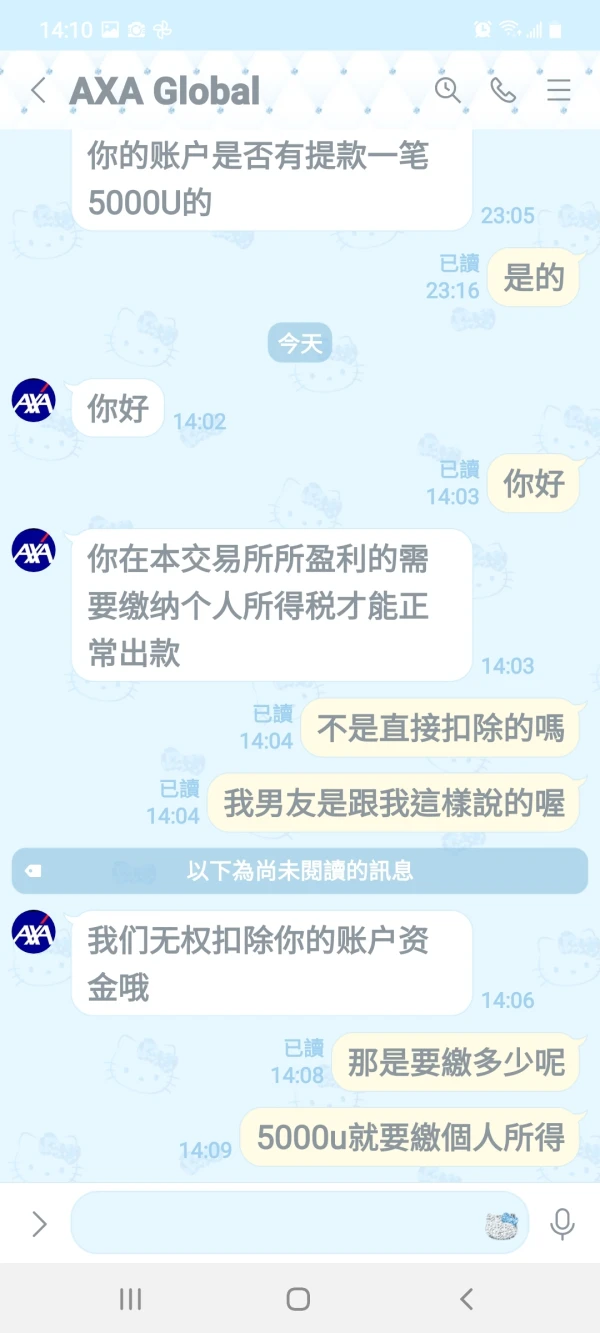

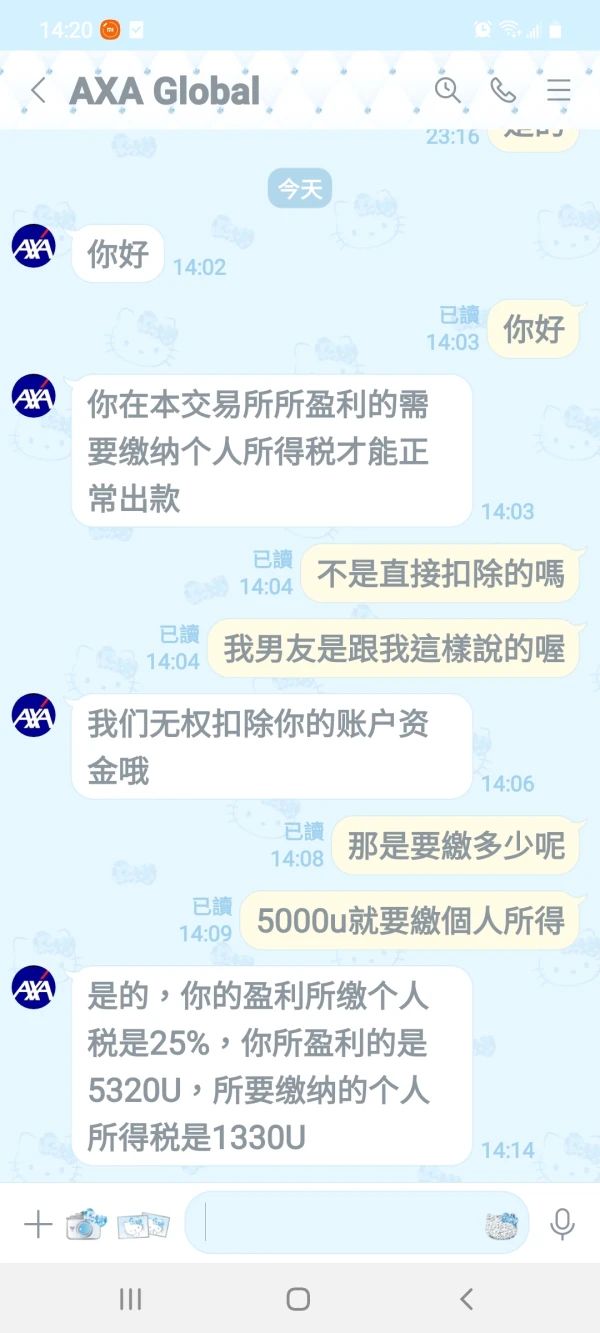

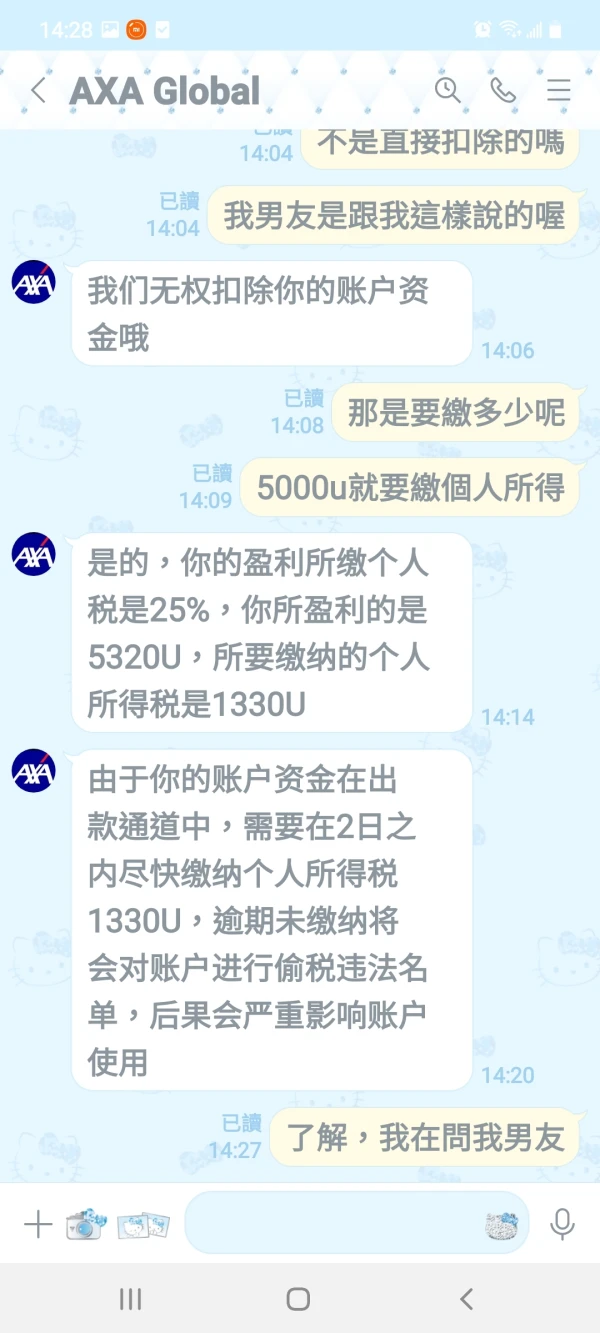

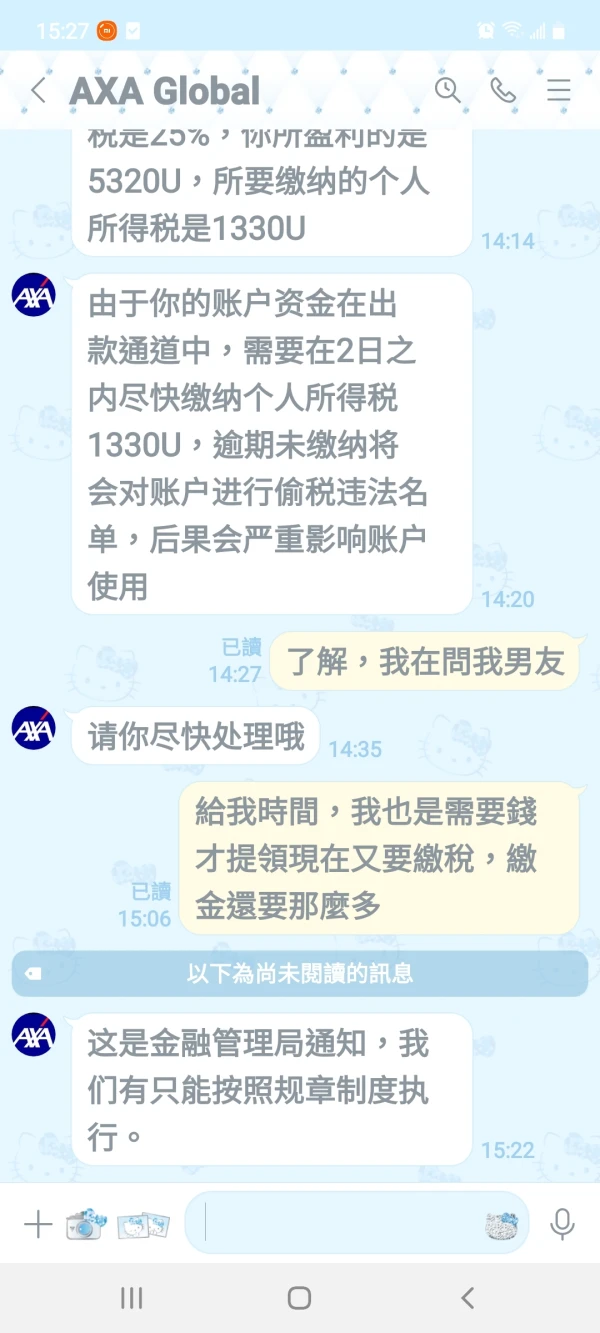

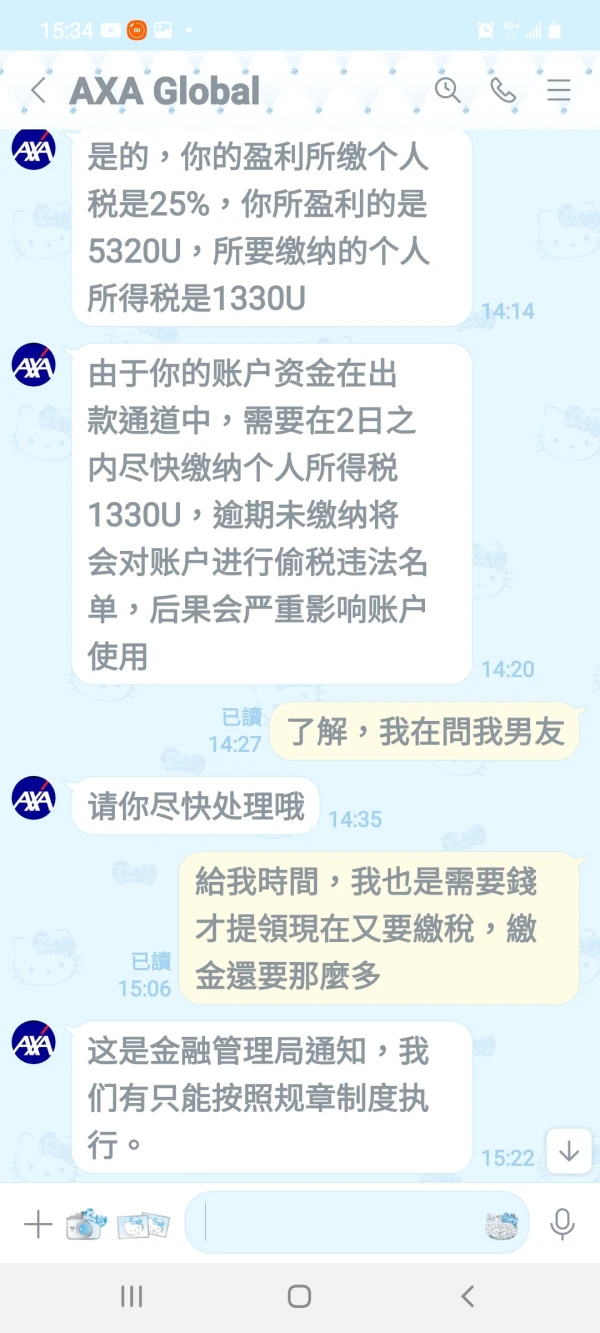

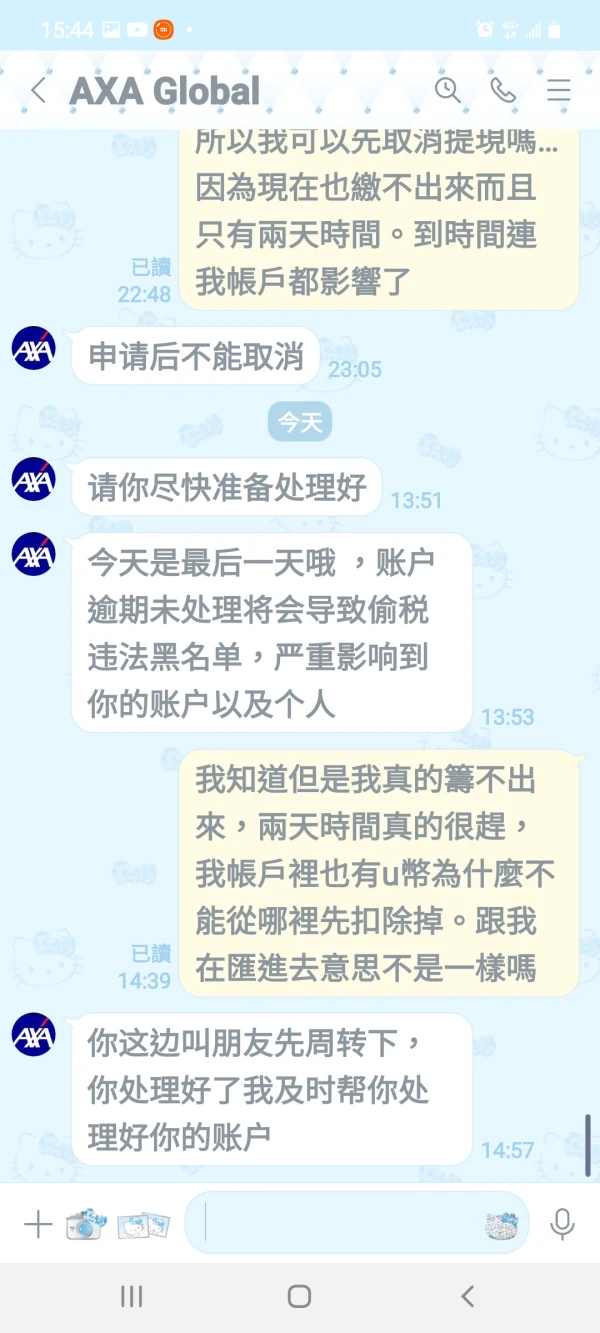

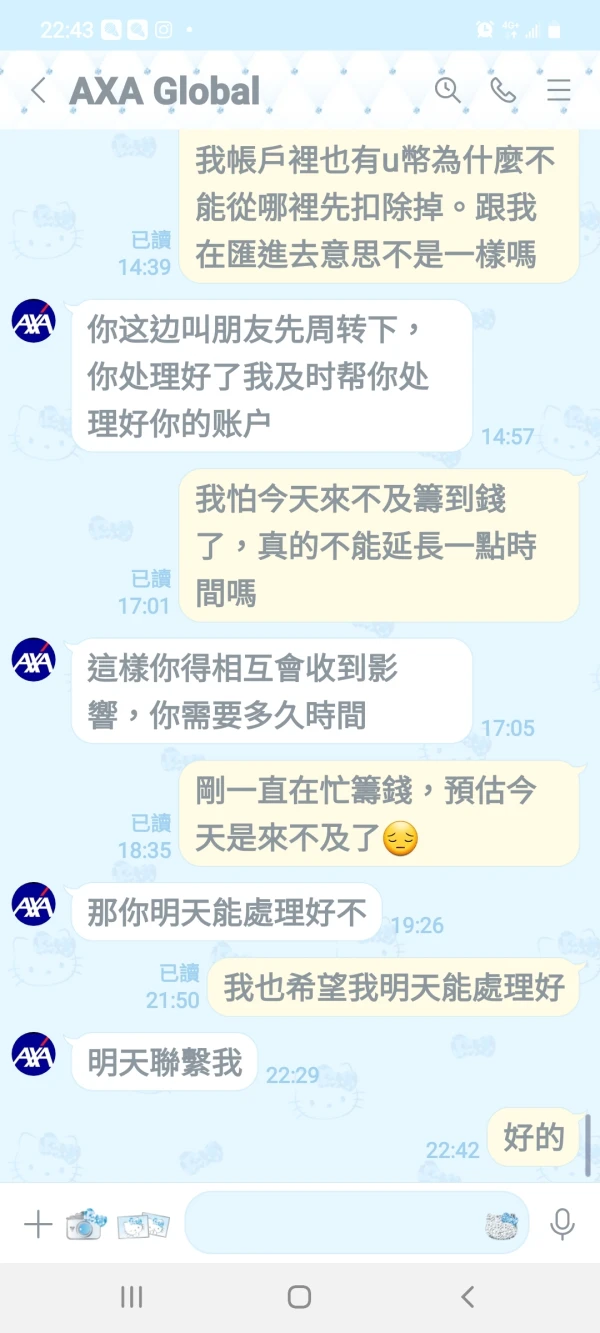

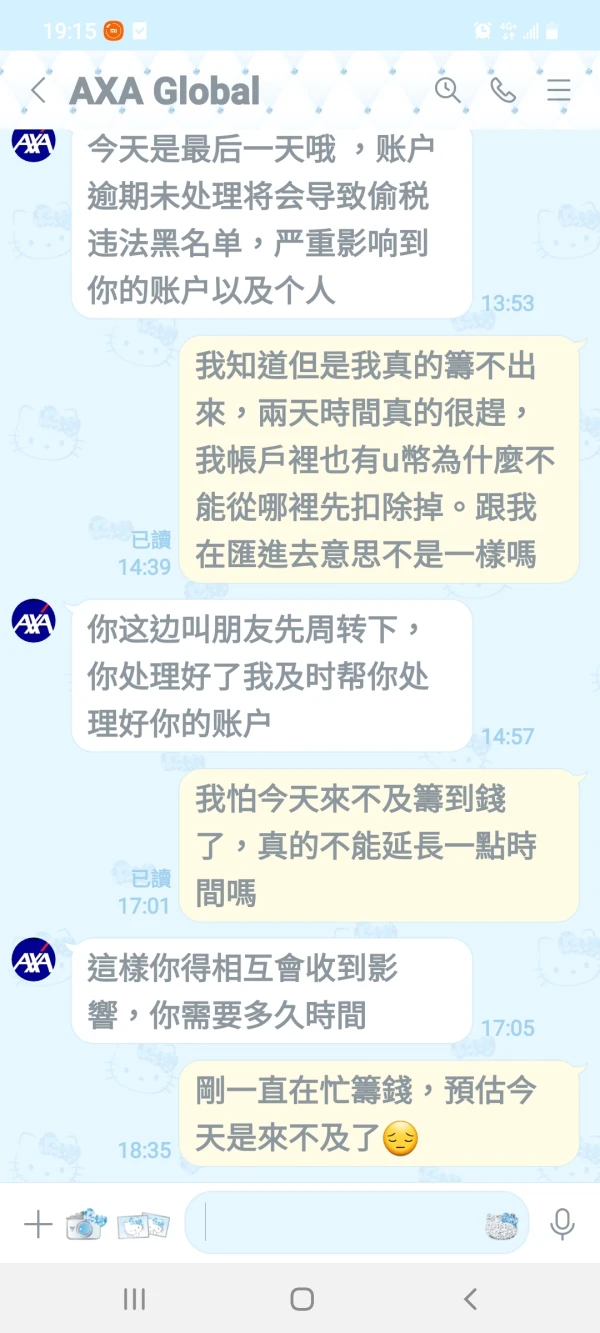

這是跟客服的對話,我不知道真實性有多高,錢繳下去錢還拿的回來嗎

Teşhir

FX1566795049

Kıbrıs

AXA müşteri hizmetleriyle yaptığım son sohbette, para çekme işlemleri için %25 kişisel gelir vergisi zorunluluğu ortaya çıktı. Süreç ve olası geri ödeme konusunda net bilgim olmadığından AXA hizmetlerinin şeffaflığı ve güvenilirliği konusunda endişelerim var. Bu konularda netlik, kullanıcı deneyimini büyük ölçüde artıracaktır.

Doğal

贫僧悟道ing......

Amerika Birleşik Devletleri

Hisse senedi fonları, tahvil fonları vb. dahil olmak üzere çeşitli yatırım ürünleri sağlar, fon ürünleri de kapsamlıdır, ayrıntılı fon verileri ve grafik analizi sağlar, web sitesi sayfası basit ve anlaşılması kolaydır, işlem süreci nispeten basittir, dikkate değer bir yatırım platformu.

Pozitif