Perfil de la compañía

| Resumen de la revisión | |

| Establecido | 1997 |

| País/Región Registrada | Francia |

| Regulación | SFC |

| Productos | Participaciones inmobiliarias, deuda privada y crédito alternativo, capital privado e infraestructura; Acciones, renta fija, inversiones multiactivos; Capital privado, capital de infraestructura, deuda privada, fondos de cobertura |

| Soporte al Cliente | Tel: +33144457000 |

| Email: webmaster-COM@axa-im.com | |

| Sede: Tour Majunga La Défense, 6 Place de la Pyramide, 92800 Puteaux | |

| Enlace para la dirección de otras sucursales: https://www.axa-im.com/contact-us | |

Información de AXA

AXA Investment Managers (AXA IM) es una empresa global de gestión de activos que tiene sucursales en todo el mundo. Principalmente se dedica a servicios financieros con productos que incluyen participaciones inmobiliarias, deuda privada y crédito alternativo, capital privado e infraestructura, acciones, renta fija, inversiones multiactivos, capital privado, capital de infraestructura, deuda privada, fondos de cobertura, etc.

Lo bueno es que la empresa está regulada por SFC, lo que significa que sus actividades financieras son estrictamente supervisadas por estas autoridades, lo que garantiza en cierta medida un cierto nivel de protección al cliente.

Pros y Contras

| Pros | Contras |

| Regulado por SFC | Información limitada revelada sobre las condiciones de negociación en su sitio web |

| Presencia global | |

| Varios productos de negociación |

¿Es AXA Legítimo?

AXA actualmente está siendo bien regulado por Comisión de Valores y Futuros de Hong Kong (SFC)con licencia no. AAP809.

| País Regulado | Regulador | Estado Actual | Entidad Regulada | Tipo de Licencia | Número de Licencia |

| SFC | Regulado | AXA Investment Managers Asia Limited | Operaciones en contratos de futuros y negociación de divisas apalancada | AAP809 |

Productos y Servicios

Inversiones Principales

- Clases de Activos: Acciones, Renta Fija, Multi-Activos

- Enfoque: Estrategias tradicionales con un historial comprobado en diversas condiciones del mercado.

ESG & Estrategias Sostenibles

- Enfoque: Integra factores ambientales, sociales y de gobernanza (ESG) para alinear objetivos financieros con impacto en el mundo real.

- Filosofía: Pragmática y centrada en el cliente, enfatizando retornos sostenibles a largo plazo.

Inversiones Alternativas

- Pilares:

- Equidad en Bienes Raíces

- Deuda Privada y Crédito Alternativo

- Capital Privado e Infraestructura

Mercados Privados y Fondos de Cobertura

- Instrumentos: Primarios, secundarios, coinversiones, financiamiento NAV, participaciones minoritarias de GP*.

- Cobertura: Capital privado, capital de infraestructura, deuda privada, fondos de cobertura.

Seleccionar (Servicios de Multi-Gestor y Asesoramiento)

- Servicios: Soluciones de gestión patrimonial y vinculadas a unidades.

- Regiones: Europa y Asia, adaptadas a las necesidades de inversión específicas del cliente.

山27387

Hong Kong

AXA congelar mi cuenta y no puedo retirar. El servicio al cliente está fuera de contacto. El sitio web se puede abrir.

Exposición

FX1236648509

Taiwán

El servicio de atención al cliente se negó a pagarme el retiro.

Exposición

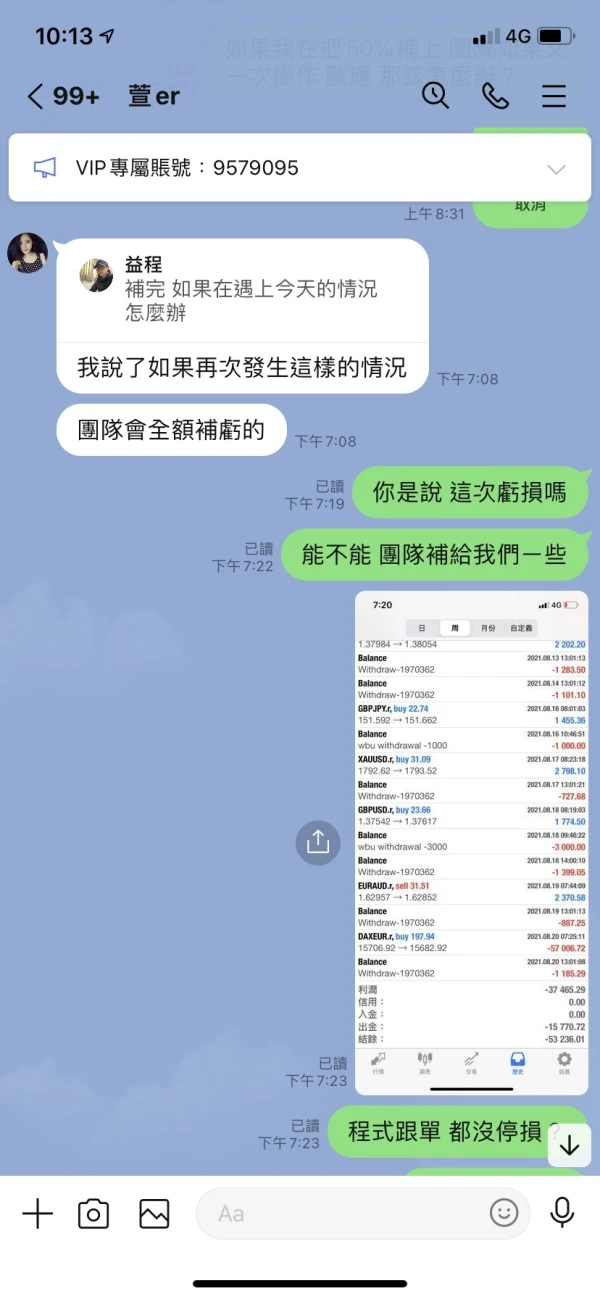

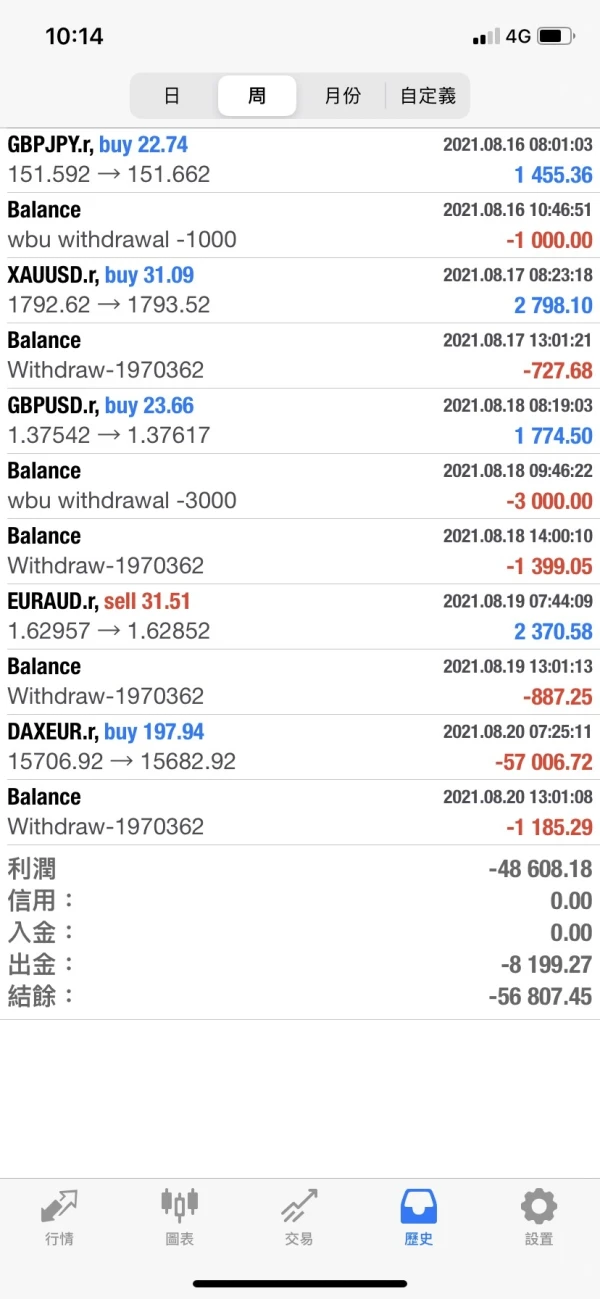

詹孟玟

Taiwán

El servicio de atención al cliente lo dijo y no estaba seguro de su realidad. ¿Puedo recuperar mi dinero?

Exposición

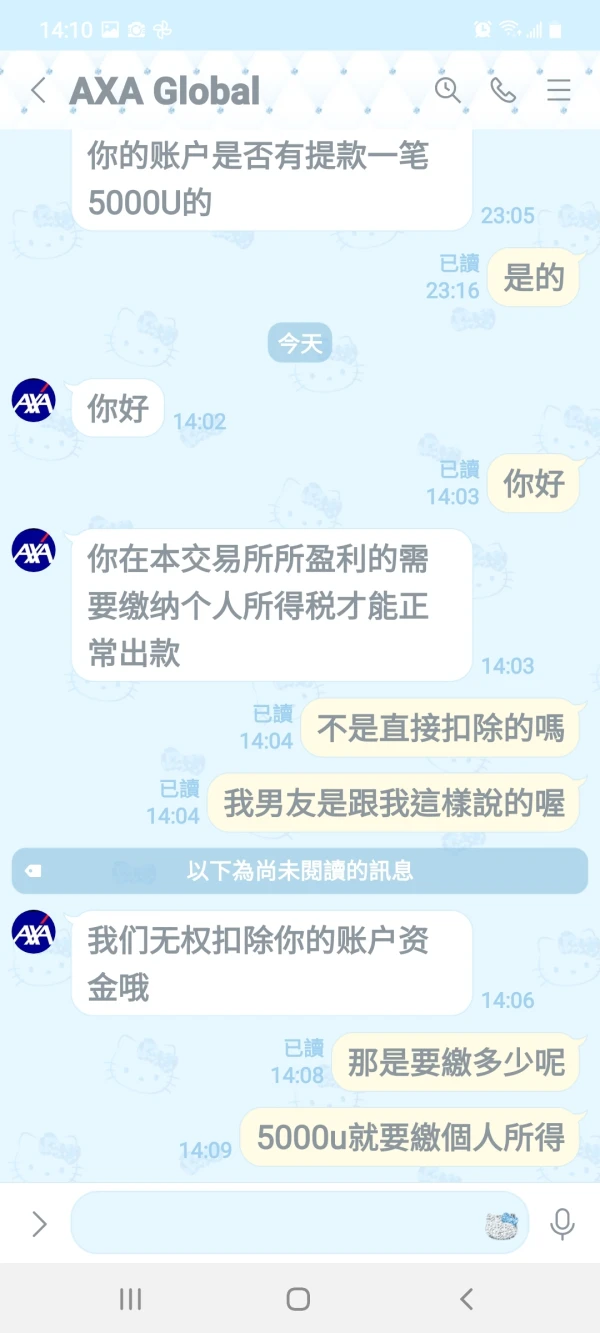

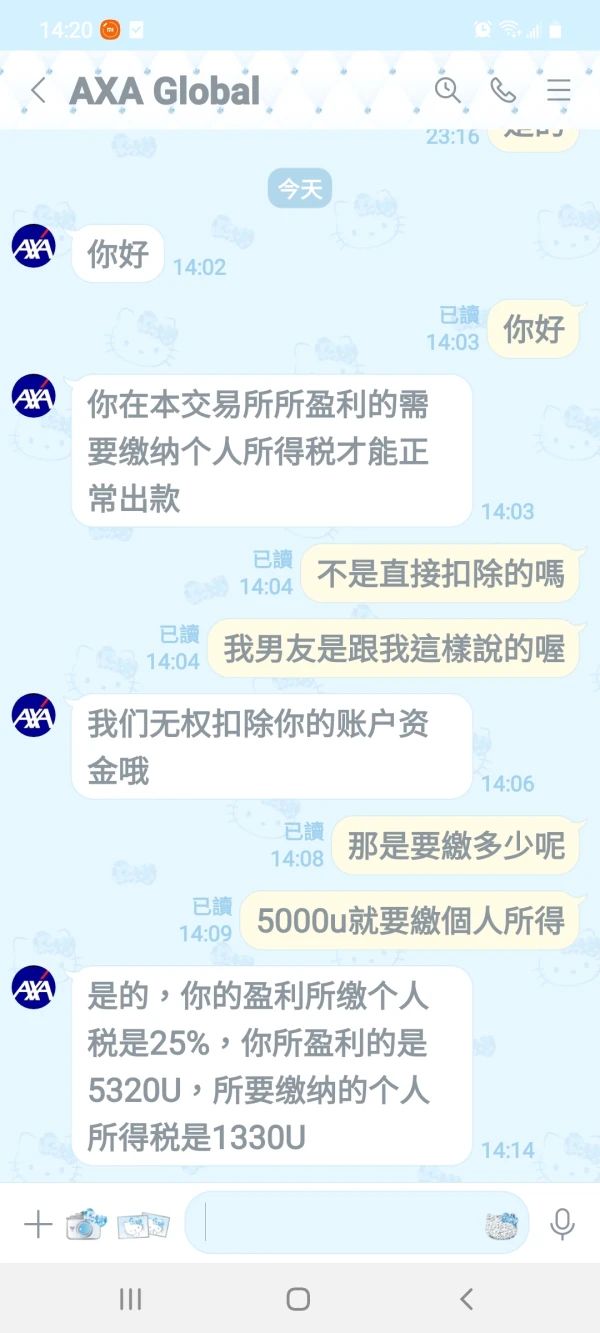

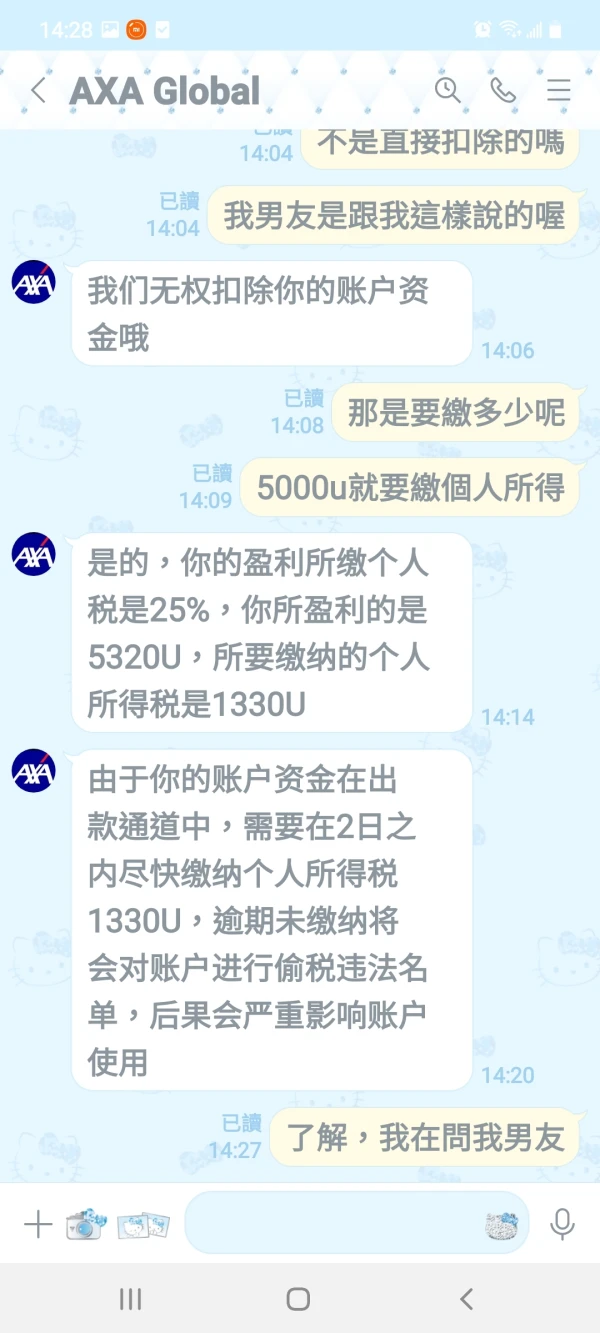

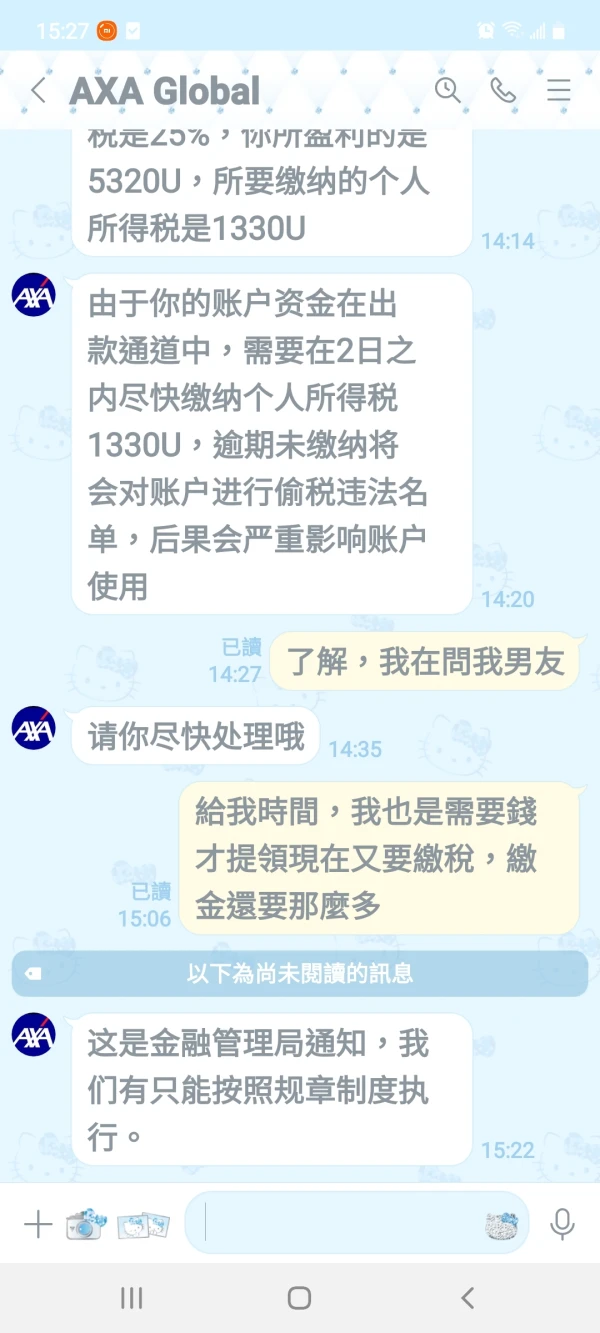

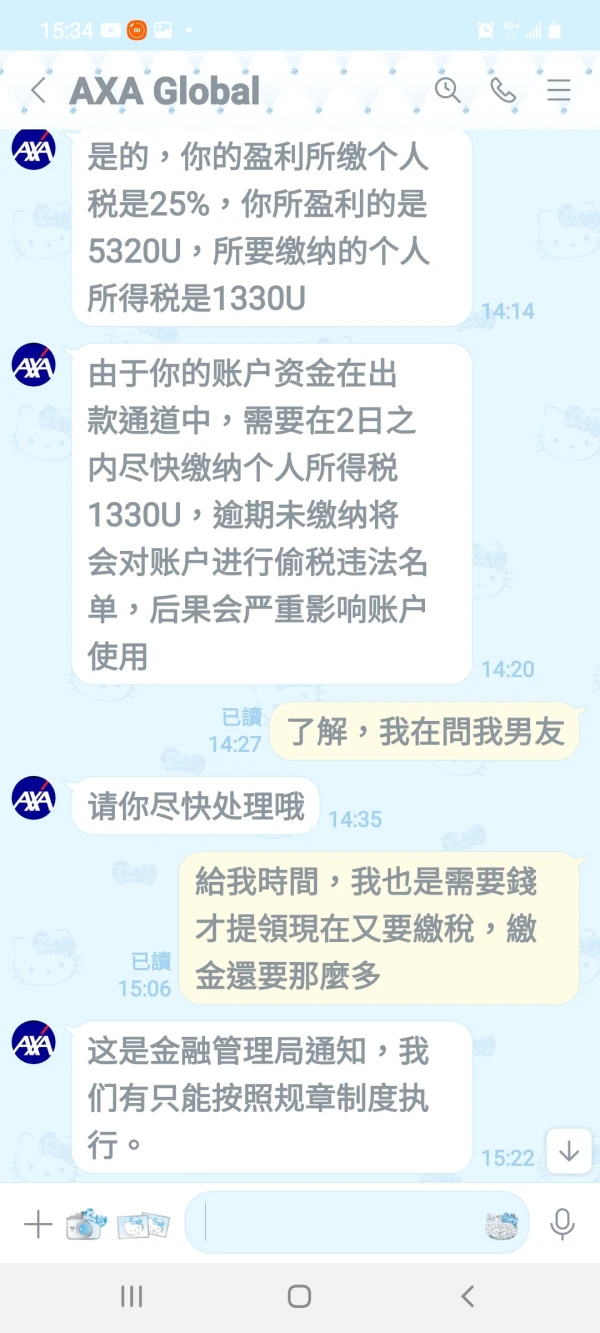

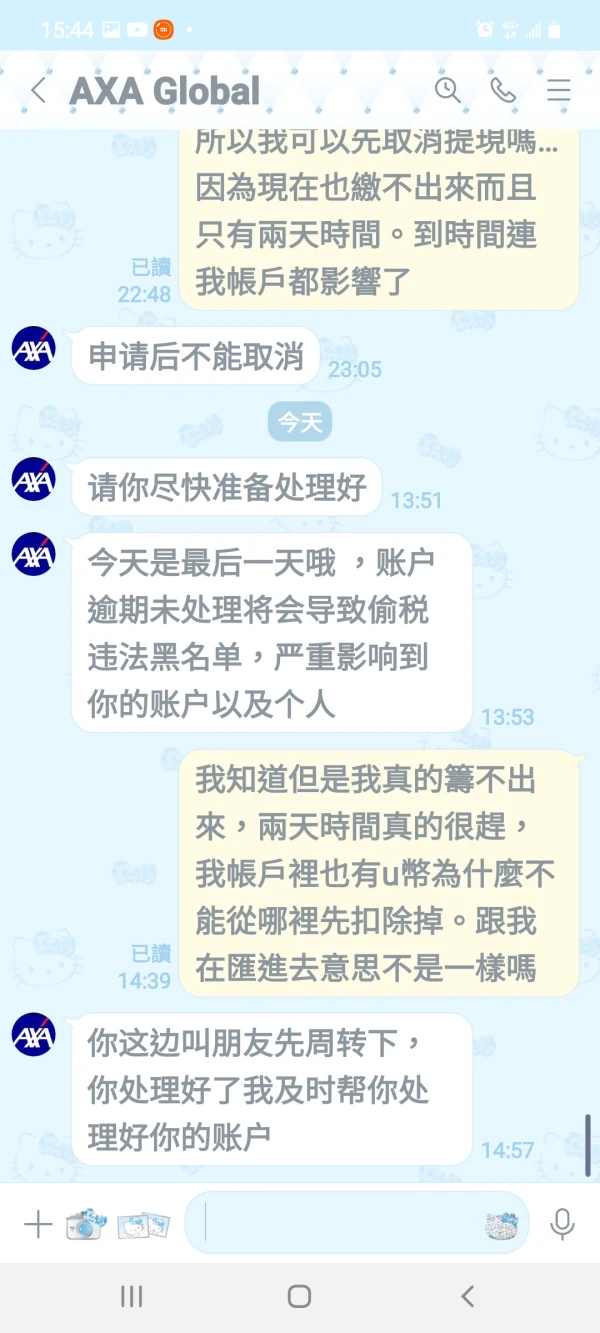

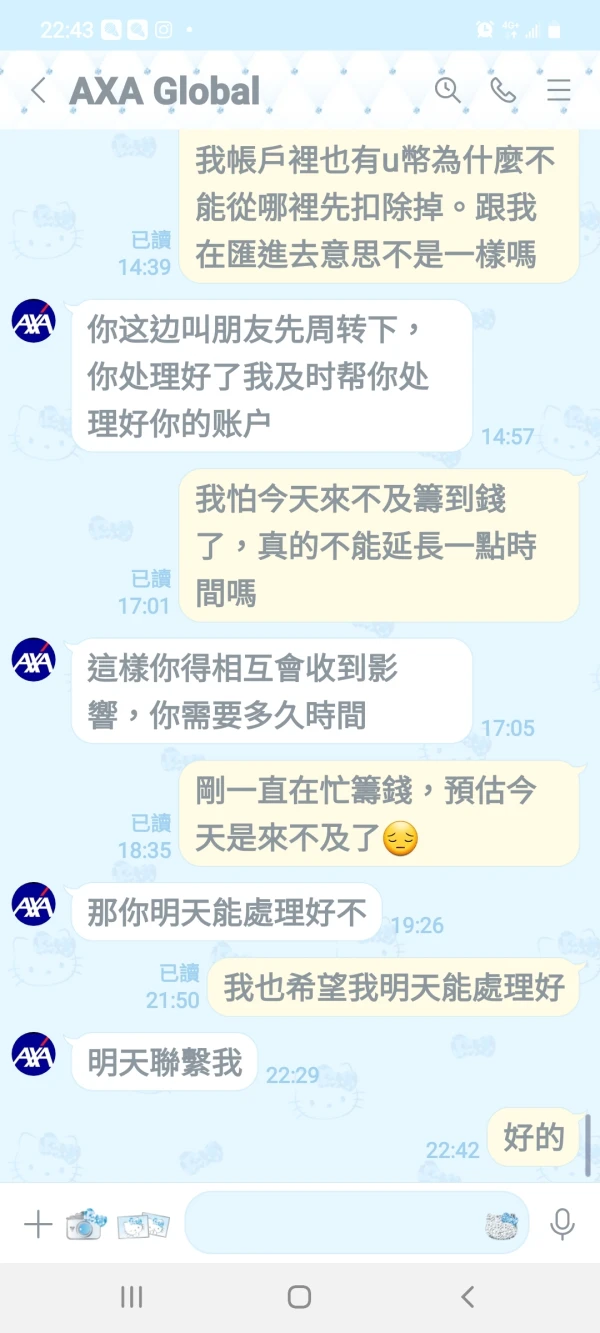

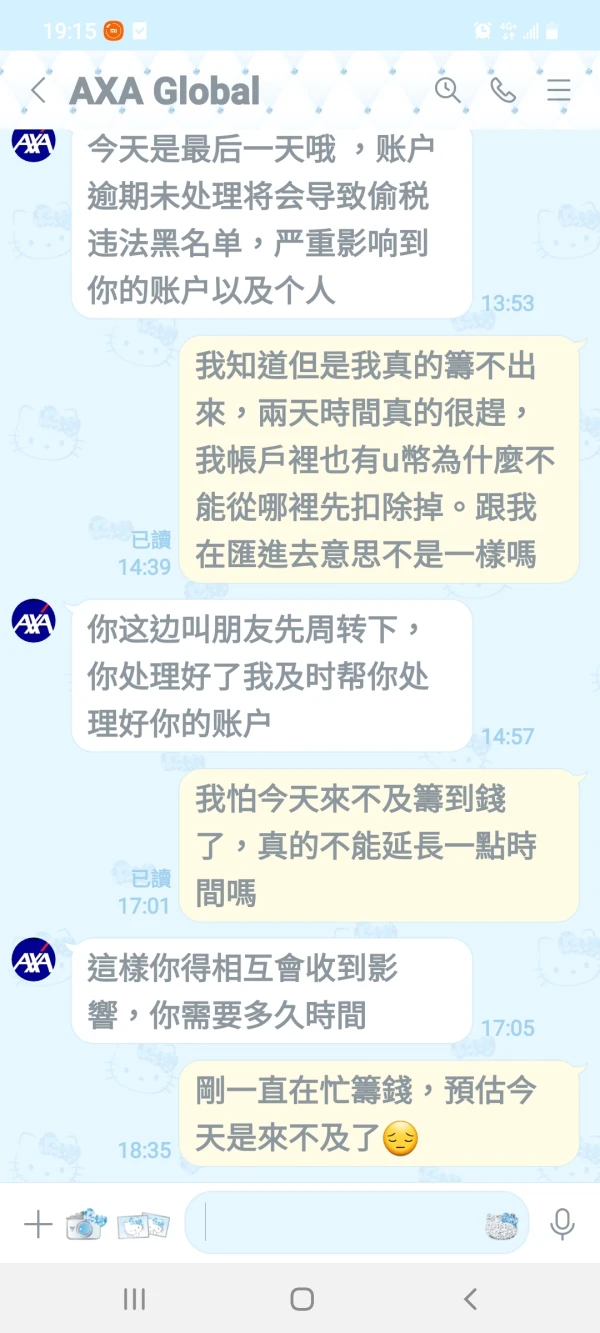

FX1566795049

Chipre

Mi conversación reciente con el servicio de atención al cliente de AXA reveló un requisito de impuesto sobre la renta personal del 25% para los retiros. No tengo claro el proceso y el posible reembolso, pero me preocupa la transparencia y confiabilidad de los servicios de AXA. La claridad sobre estos asuntos mejoraría enormemente la experiencia del usuario.

Neutral

贫僧悟道ing......

Estados Unidos

Proporciona una variedad de productos de inversión, incluidos fondos de acciones, fondos de bonos, etc. una plataforma de inversión que vale la pena considerar.

Positivo