Présentation de l'entreprise

| Résumé de l'examen | |

| Fondé | 1997 |

| Pays/Région d'enregistrement | France |

| Régulation | SFC |

| Produits | Actions immobilières, dette privée et crédit alternatif, capital-investissement et infrastructure ; Actions, Revenu fixe, Investissements multi-actifs ; Capital-investissement, capital-investissement en infrastructure, dette privée, fonds spéculatifs |

| Support Client | Tél : +33144457000 |

| Email : webmaster-COM@axa-im.com | |

| Siège social : Tour Majunga La Défense, 6 Place de la Pyramide, 92800 Puteaux | |

| Lien pour l'adresse des autres sociétés de la branche : https://www.axa-im.com/contact-us | |

Informations sur AXA

AXA Investment Managers (AXA IM) est une société mondiale de gestion d'actifs qui possède des bureaux dans le monde entier. Elle traite principalement des services financiers avec des produits incluant des actions immobilières, de la dette privée et du crédit alternatif, du capital-investissement et de l'infrastructure, des actions, des revenus fixes, des investissements multi-actifs, du capital-investissement, du capital-investissement en infrastructure, de la dette privée, des fonds spéculatifs, etc.

Le bon point est que la société est réglementée par la SFC, ce qui signifie que ses activités financières sont strictement surveillées par ces autorités, garantissant dans une certaine mesure un certain niveau de protection des clients.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Réglementé par la SFC | Informations limitées divulguées sur les conditions de trading sur son site web |

| Présence mondiale | |

| Divers produits de trading |

AXA est-il légitime ?

AXA est actuellement bien réglementé par la Securities and Futures Commission de Hong Kong (SFC)avec le numéro de licence AAP809.

| Pays Réglementé | Régulateur | Statut Actuel | Entité Réglementée | Type de Licence | Numéro de Licence |

| SFC | Réglementé | AXA Investment Managers Asia Limited | Opérations sur contrats à terme & Trading de change sur marge | AAP809 |

Produits et Services

Investissements Principaux

- Classes d'actifs : Actions, Revenu fixe, Multi-actifs

- Focus : Stratégies traditionnelles avec un historique éprouvé dans diverses conditions de marché.

ESG & Stratégies Durables

- Approche : Intègre les facteurs environnementaux, sociaux et de gouvernance (ESG) pour aligner les objectifs financiers avec l'impact réel sur le monde.

- Philosophie : Pragmatique et axée sur le client, mettant l'accent sur des rendements durables à long terme.

Investissements Alternatifs

- Piliers :

- Actions Immobilières

- Dette Privée & Crédit Alternatif

- Capital Investissement & Infrastructure

Marchés Privés & Fonds de Couverture

- Instruments : Primaires, secondaires, co-investissements, financement de la valeur liquidative (NAV), participations minoritaires de GP*.

- Couverture : Capital-investissement privé, actions d'infrastructure, dette privée, fonds de couverture.

Sélection (Multi-Gestionnaire & Services de Conseil)

- Services : Solutions de gestion liées à des unités et de gestion de patrimoine.

- Régions : Europe et Asie, adaptées aux besoins d'investissement spécifiques des clients.

山27387

Hong Kong

AXA gèle mon compte et je ne peux pas retirer. Le service client est hors de contact. Le site Web peut être ouvert.

Divulgation

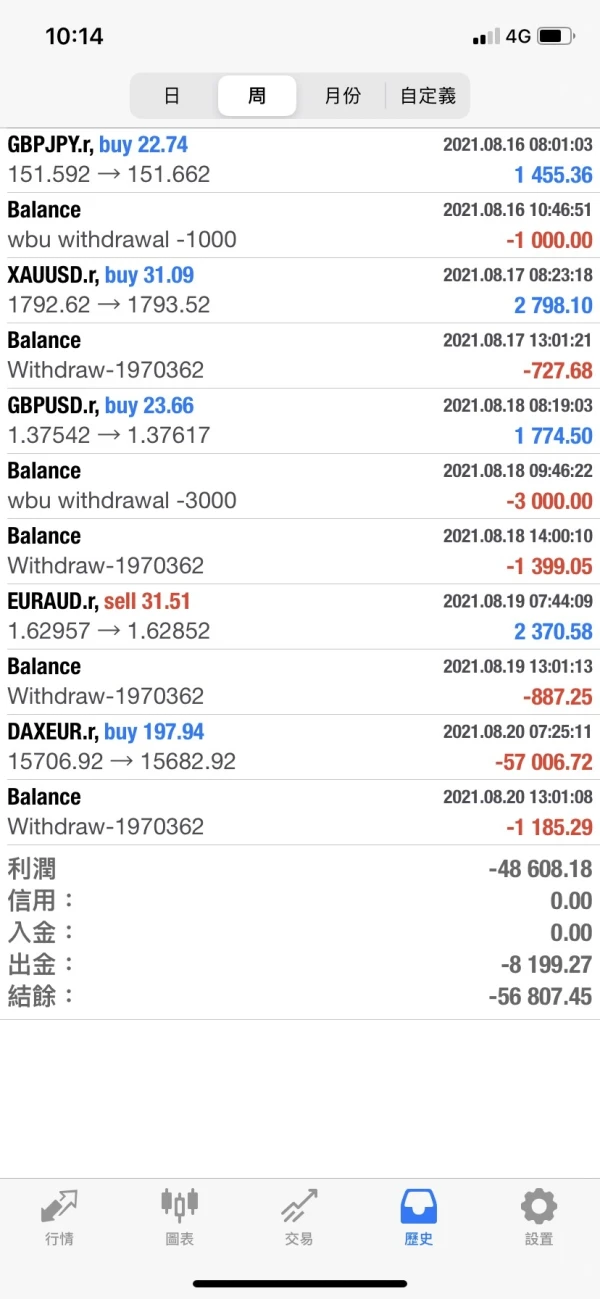

FX1236648509

Taïwan

Le service client a refusé de me payer le retrait.

Divulgation

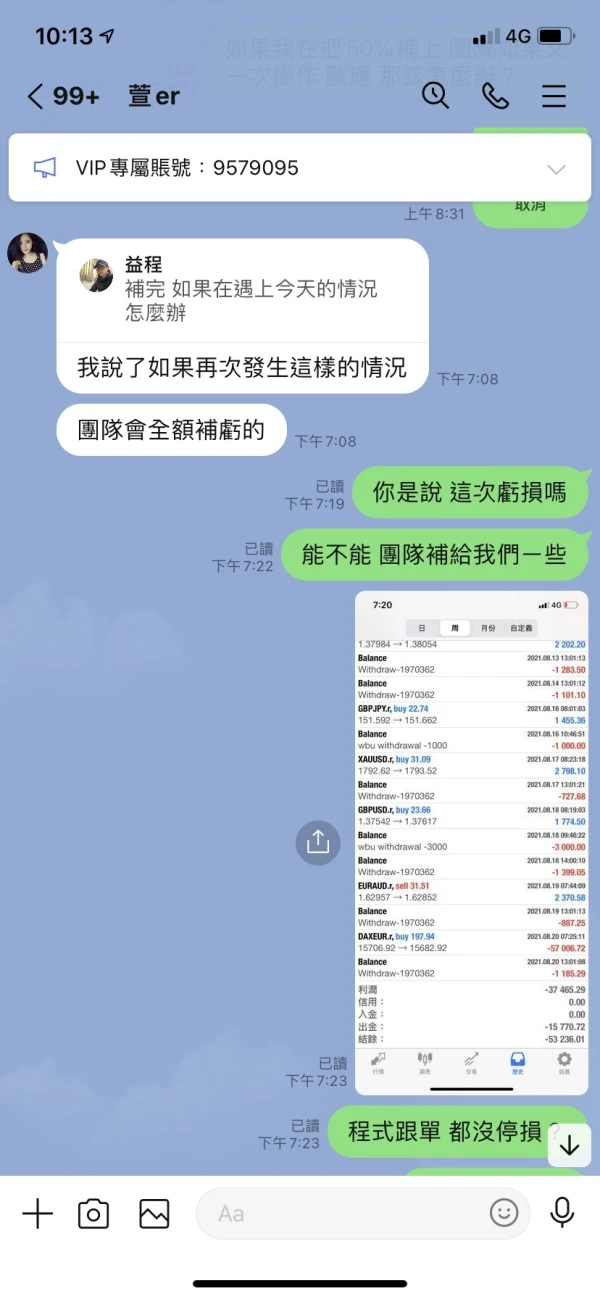

詹孟玟

Taïwan

Le service client l'a dit et je n'étais pas sûr de sa réalité. Puis-je récupérer mon argent ?

Divulgation

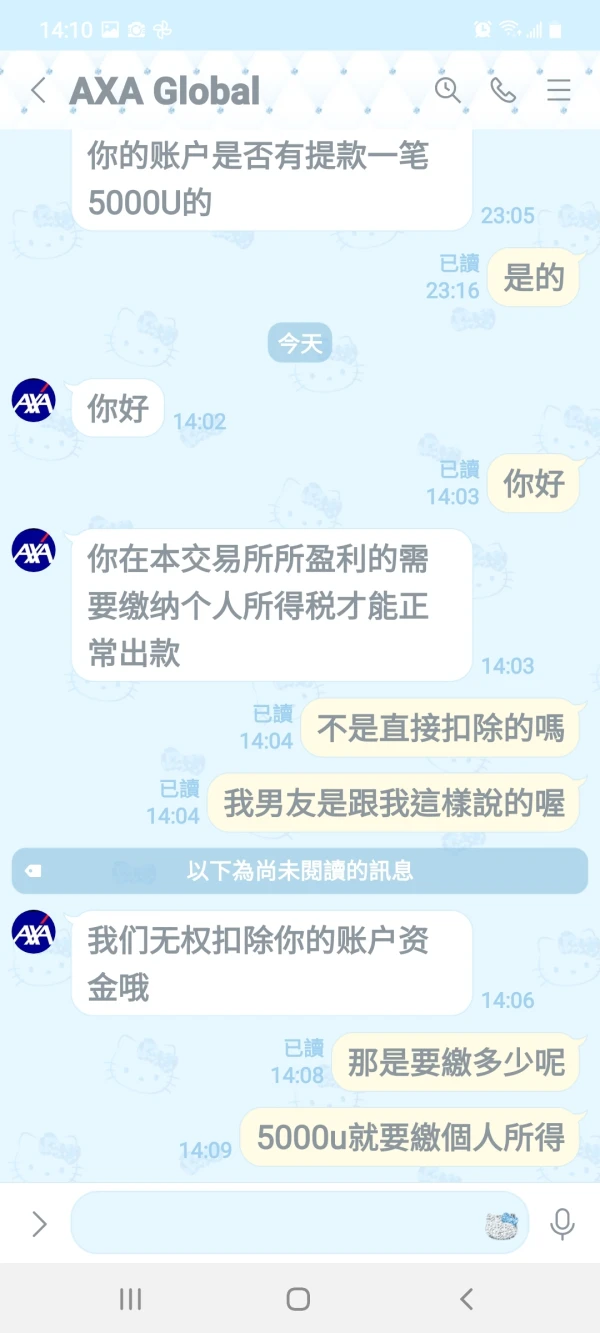

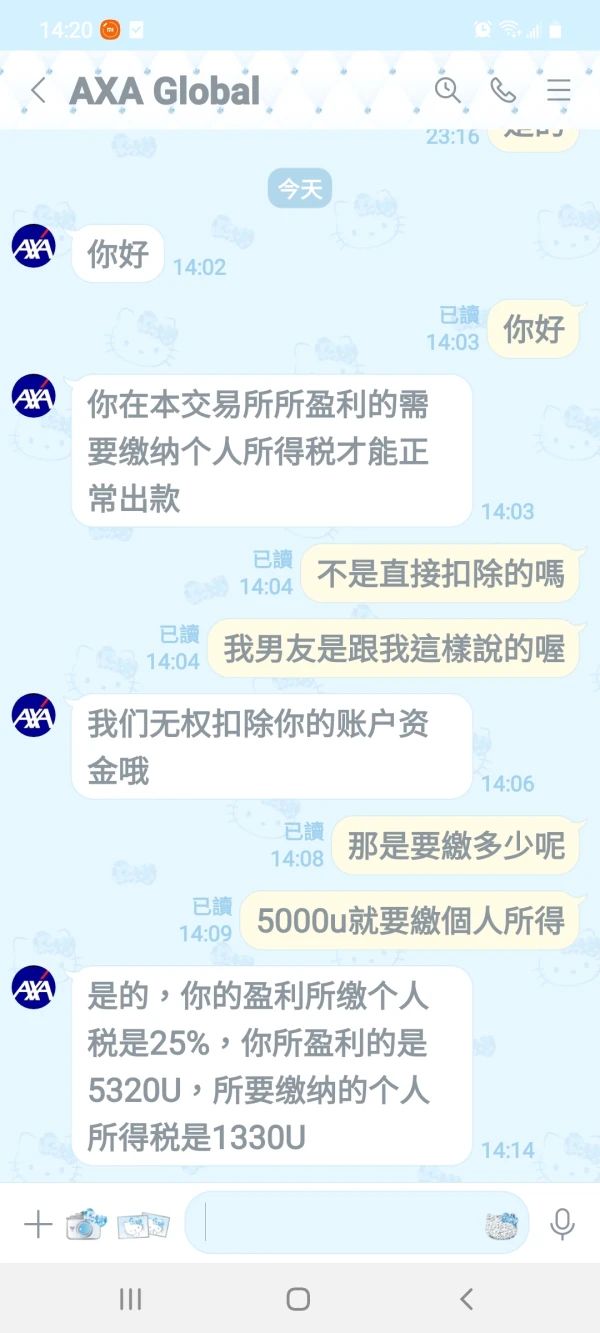

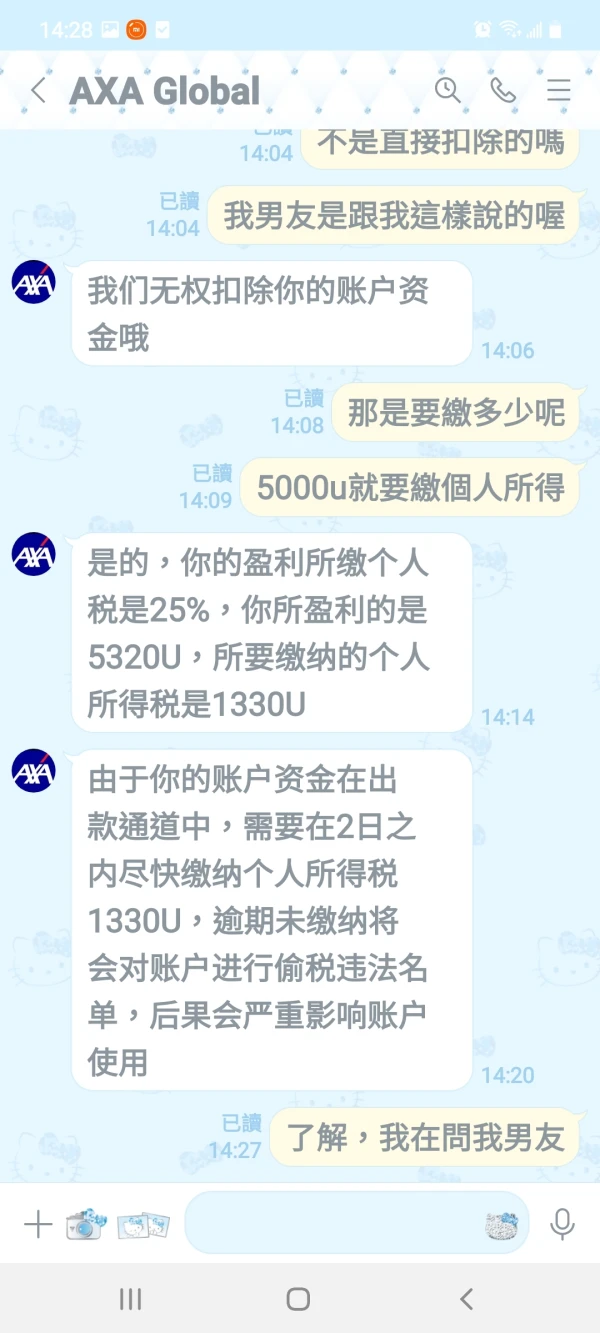

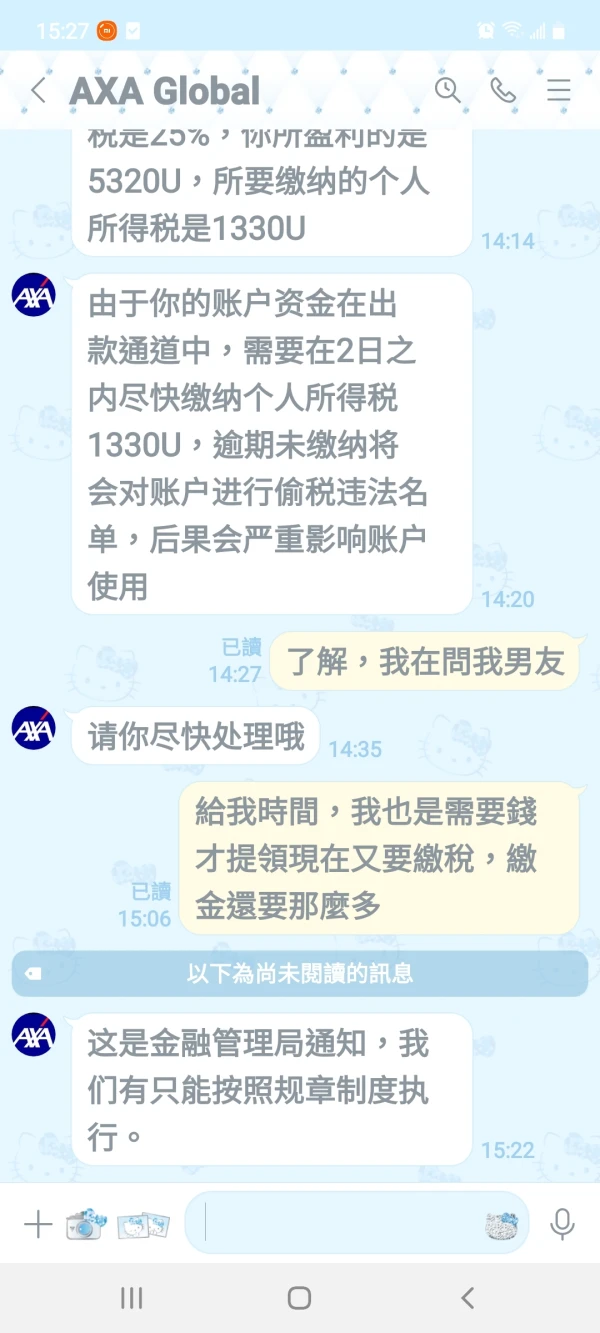

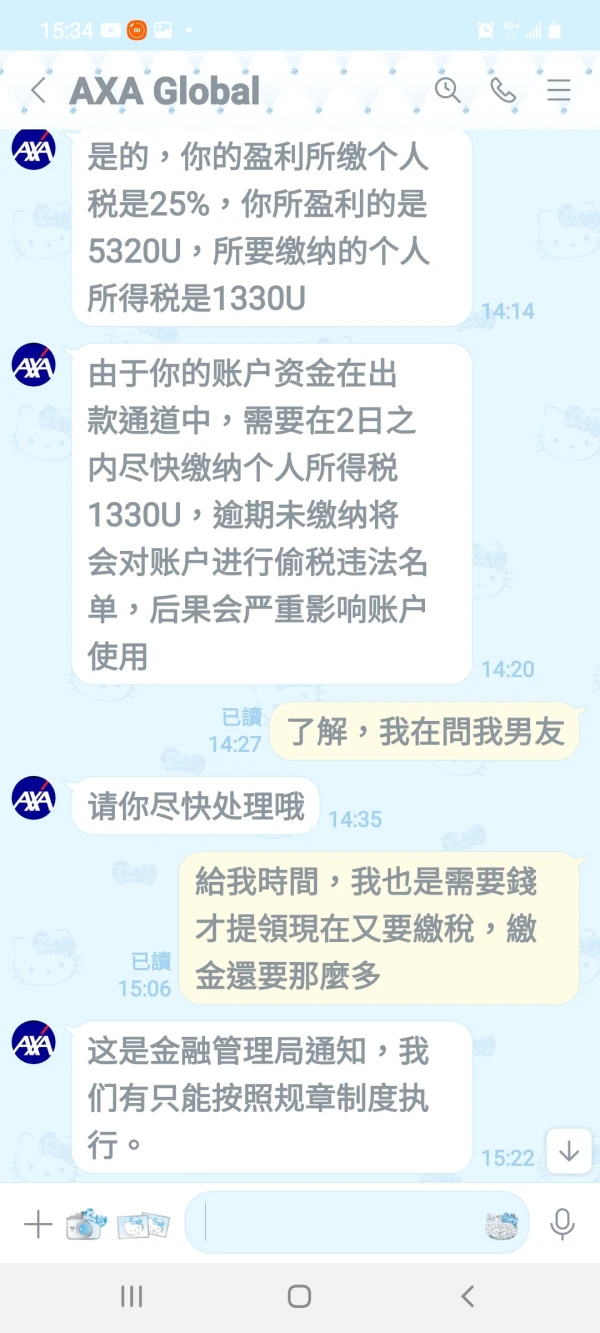

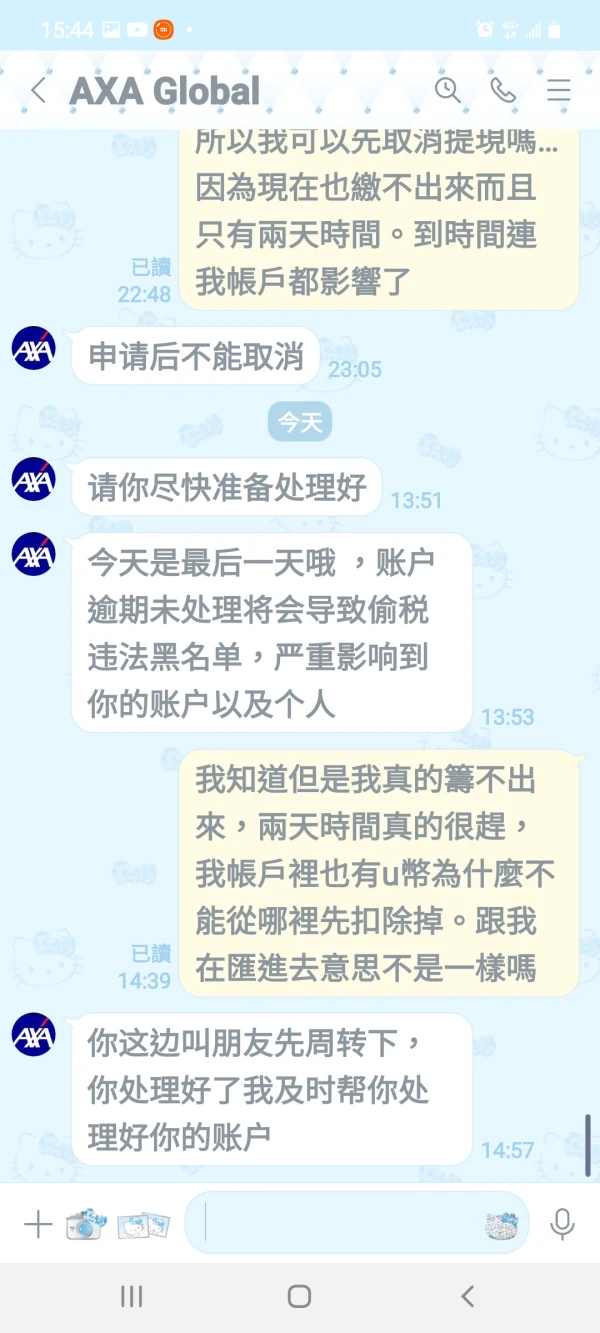

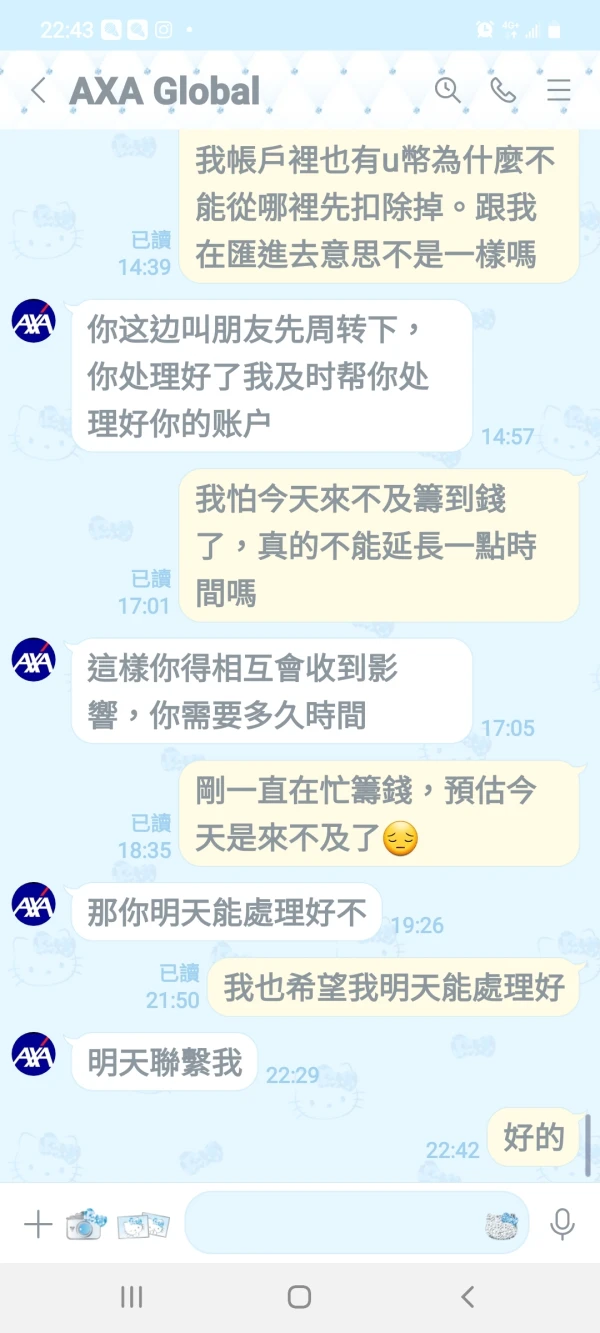

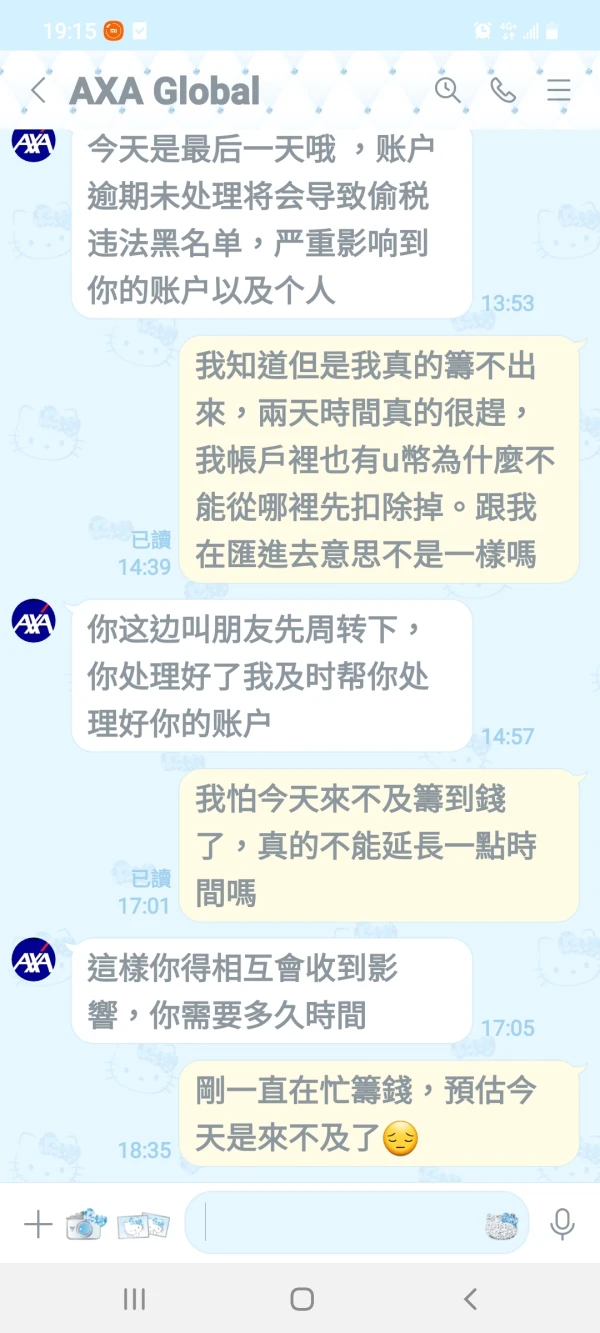

FX1566795049

Chypre

Ma récente conversation avec le service client d'AXA a révélé une exigence d'impôt sur le revenu des personnes physiques de 25 % pour les retraits. Peu clair sur le processus et le remboursement potentiel, je m'inquiète de la transparence et de la fiabilité des services d'AXA. La clarté sur ces questions améliorerait considérablement l’expérience utilisateur.

Neutre

贫僧悟道ing......

États-Unis

Il fournit une variété de produits d'investissement, y compris des fonds d'actions, des fonds d'obligations, etc., les produits de fonds sont également complets, fournissant des données détaillées sur les fonds et une analyse graphique, la page du site Web est simple et facile à comprendre, le processus de transaction est relativement simple, est une plateforme d'investissement à considérer.

Positifs