Profil perusahaan

| Ringkasan Ulasan | |

| Didirikan | 1997 |

| Negara/Daerah Terdaftar | Prancis |

| Regulasi | SFC |

| Produk | Ekuitas real estat, utang swasta & kredit alternatif, ekuitas swasta & infrastruktur; Ekuitas, Pendapatan Tetap, Investasi Multi Aset; Ekuitas swasta, ekuitas infrastruktur, utang swasta, dana lindung nilai |

| Dukungan Pelanggan | Tel: +33144457000 |

| Email: webmaster-COM@axa-im.com | |

| Kantor Pusat: Tour Majunga La Défense, 6 Place de la Pyramide, 92800 Puteaux | |

| Tautan untuk alamat perusahaan cabang lain: https://www.axa-im.com/contact-us | |

Informasi AXA

AXA Investment Managers (AXA IM) adalah perusahaan manajemen aset global yang memiliki kantor cabang di seluruh dunia. Perusahaan ini terutama bergerak di bidang layanan keuangan dengan produk-produk termasuk ekuitas real estat, utang swasta & kredit alternatif, ekuitas swasta & infrastruktur, Ekuitas, Pendapatan Tetap, Investasi Multi Aset, Ekuitas swasta, ekuitas infrastruktur, utang swasta, dana lindung nilai, dll.

Hal baiknya adalah perusahaan ini diatur oleh SFC, yang berarti aktivitas keuangannya secara ketat dipantau oleh otoritas tersebut, hingga batas tertentu menjamin tingkat perlindungan pelanggan tertentu.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Diatur oleh SFC | Informasi terbatas yang diungkapkan untuk kondisi perdagangan di situs webnya |

| Kehadiran global | |

| Berbagai produk perdagangan |

Apakah AXA Legal?

AXA saat ini diatur dengan baik oleh Komisi Sekuritas dan Berjangka Hong Kong (SFC)dengan nomor lisensi AAP809.

| Negara yang Diatur | Regulator | Status Saat Ini | Entitas yang Diatur | Tipe Lisensi | Nomor Lisensi |

| SFC | Diatur | AXA Investment Managers Asia Limited | Bertransaksi dalam kontrak berjangka & perdagangan valuta asing berleverage | AAP809 |

Produk dan Layanan

Investasi Inti

- Kelas Aset: Ekuitas, Pendapatan Tetap, Multi-Aset

- Fokus: Strategi tradisional dengan catatan kinerja terbukti di berbagai kondisi pasar.

ESG & Strategi Berkelanjutan

- Pendekatan: Mengintegrasikan faktor lingkungan, sosial, dan tata kelola (ESG) untuk menyelaraskan tujuan keuangan dengan dampak dunia nyata.

- Filosofi: Pragmatis dan berorientasi pada klien, menekankan pengembalian jangka panjang yang berkelanjutan.

Investasi Alternatif

- Pilar:

- Ekuitas Real Estat

- Hutang Swasta & Kredit Alternatif

- Ekuitas Swasta & Infrastruktur

Pasar Swasta & Dana Lindung Nilai

- Instrumen: Primer, sekunder, co-investments, pembiayaan NAV, saham minoritas GP*.

- Cakupan: Ekuitas swasta, ekuitas infrastruktur, hutang swasta, dana lindung nilai.

Pilih (Multi-Manager & Layanan Penasihat)

- Layanan: Solusi terkait unit dan manajemen kekayaan.

- Wilayah: Eropa dan Asia, disesuaikan dengan kebutuhan investasi khusus klien.

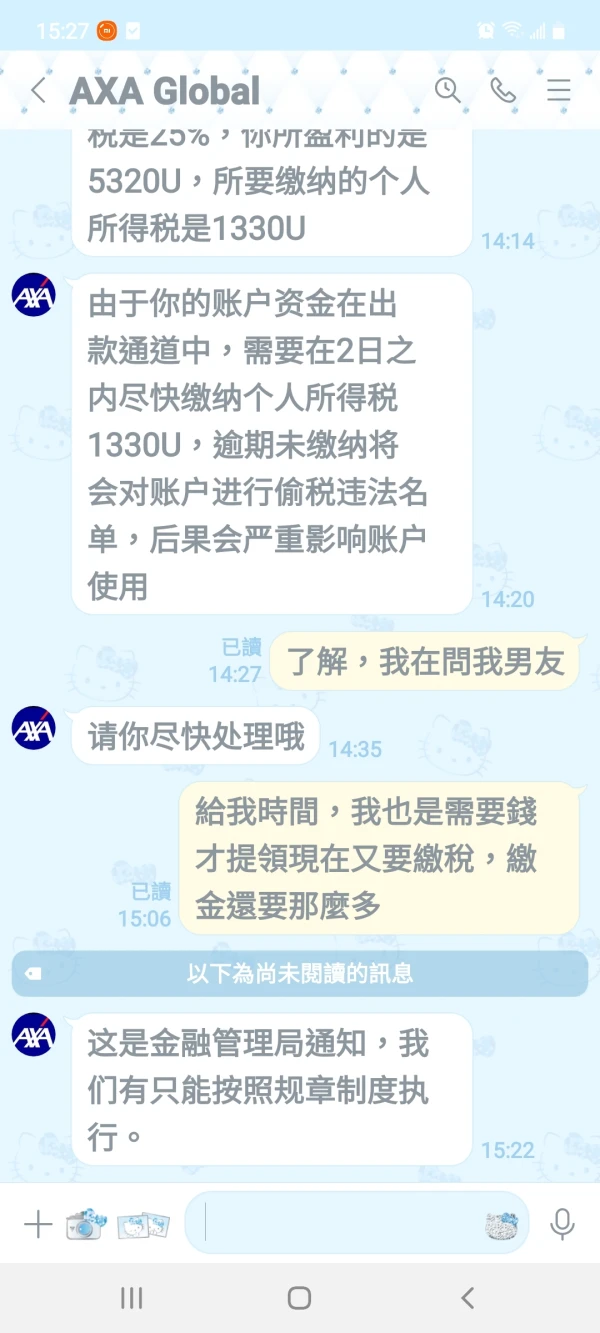

山27387

Hong Kong

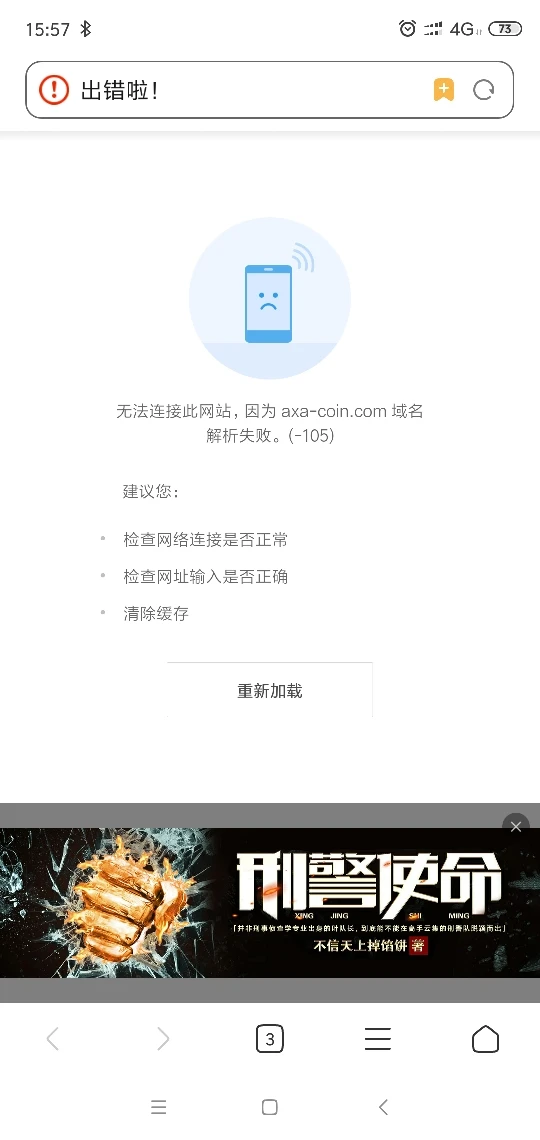

AXA membekukan akun saya dan saya tidak dapat menarik. Layanan pelanggan tidak dapat dihubungi. Situs web dapat 'dibuka.

Paparan

FX1236648509

Taiwan

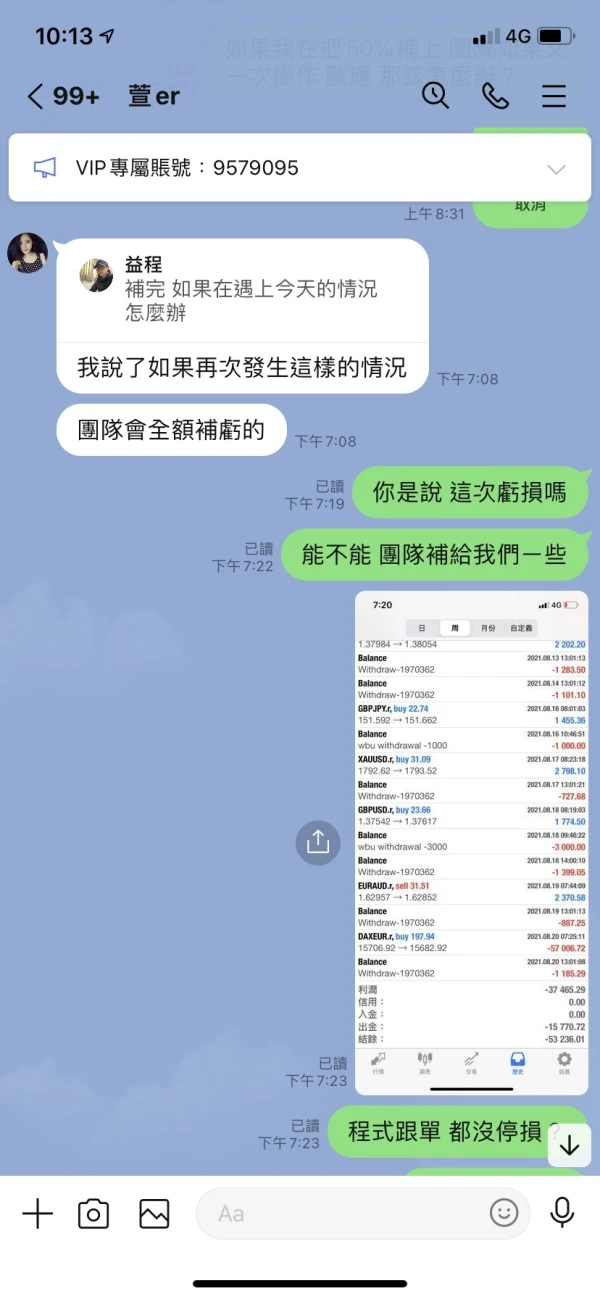

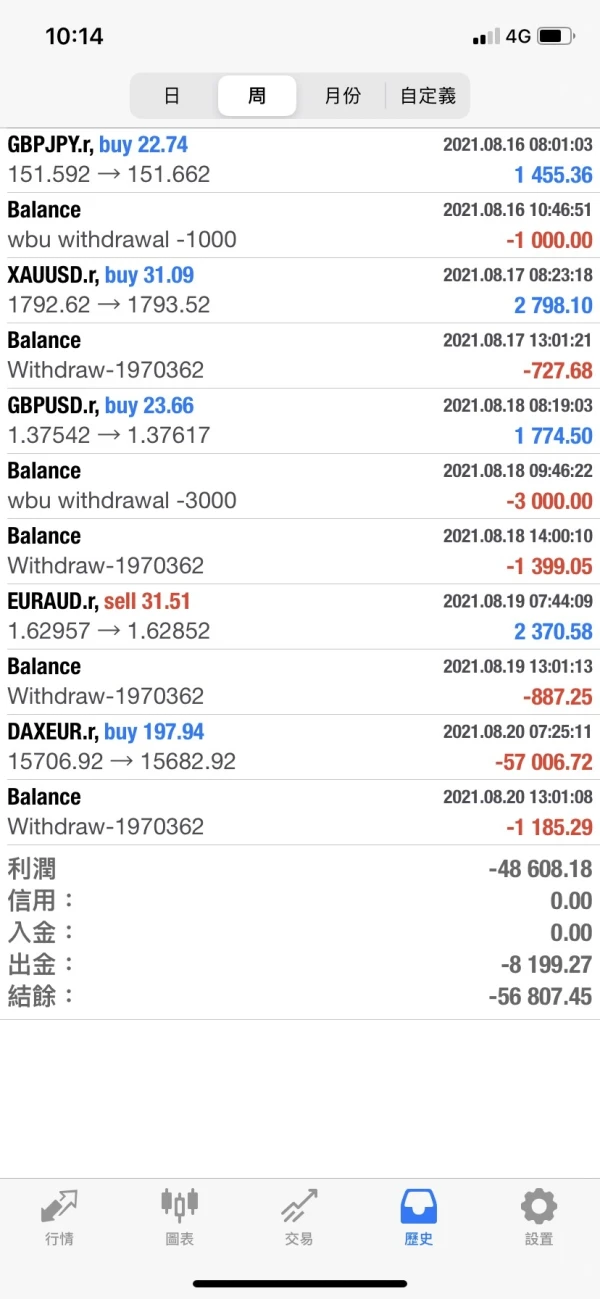

Layanan pelanggan menolak untuk membayar saya penarikan.

Paparan

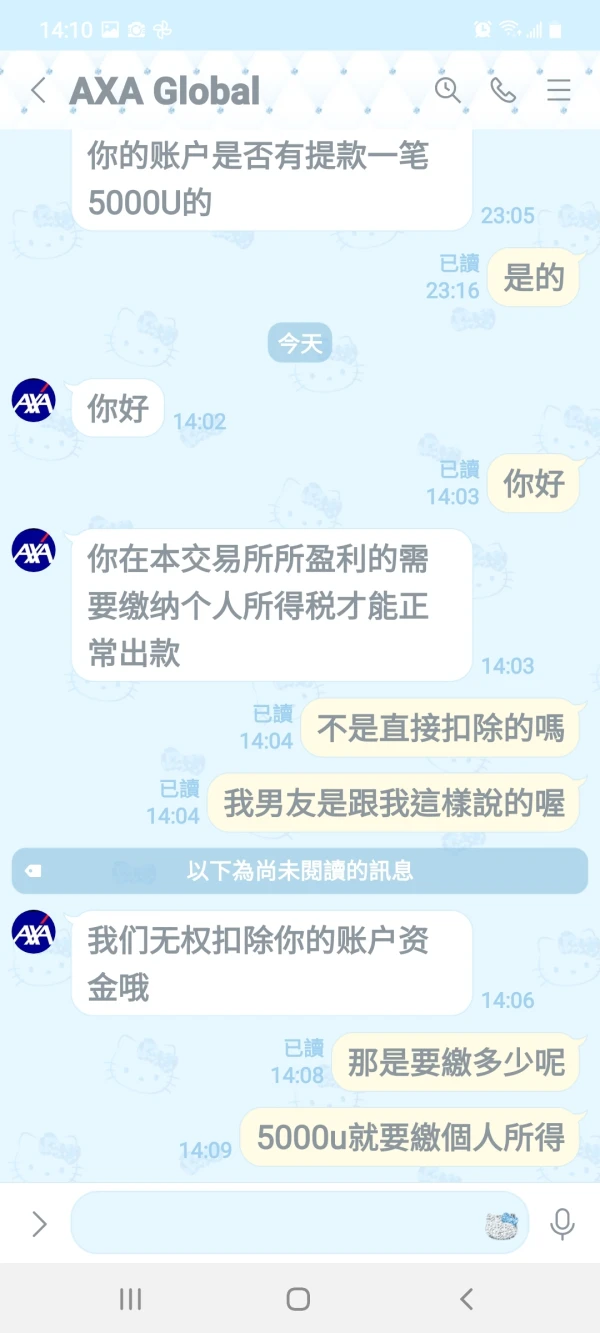

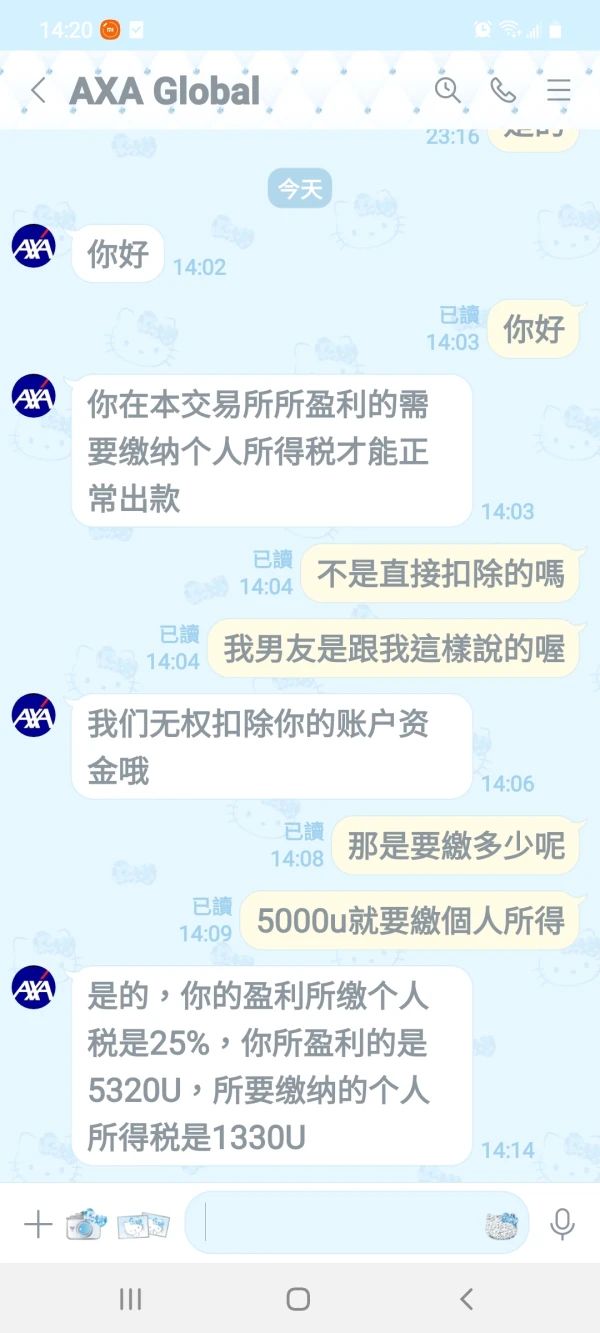

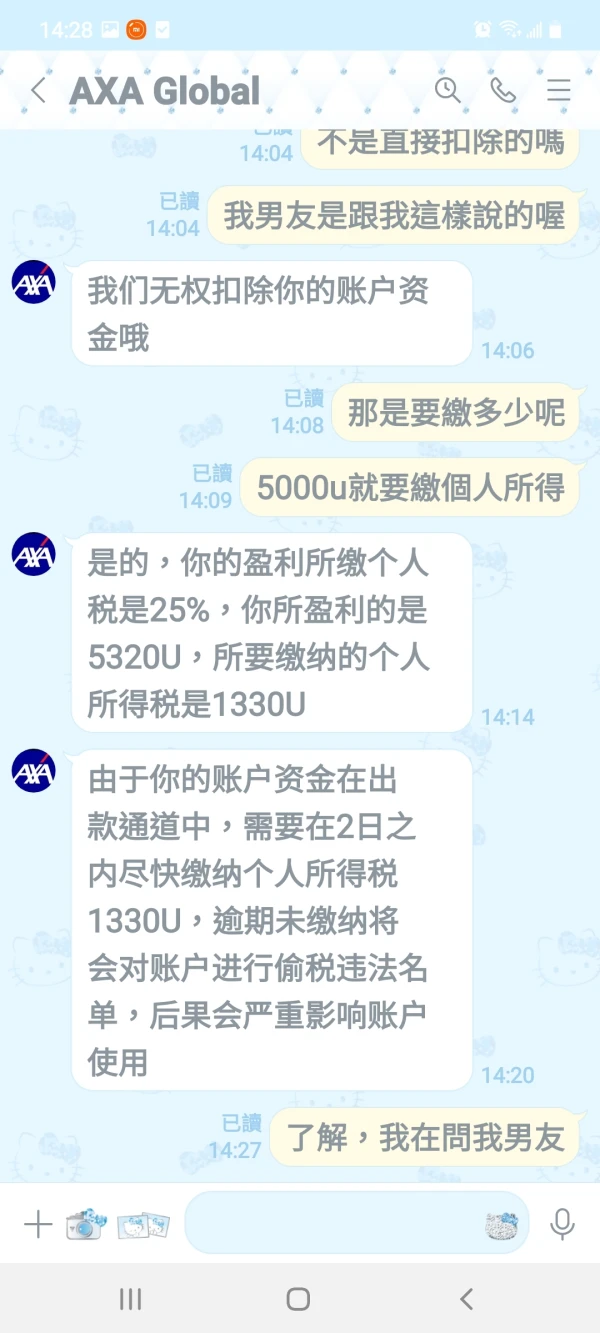

詹孟玟

Taiwan

Layanan pelanggan mengatakannya dan saya tidak yakin tentang kenyataannya. Bisakah saya mendapatkan uang saya kembali?

Paparan

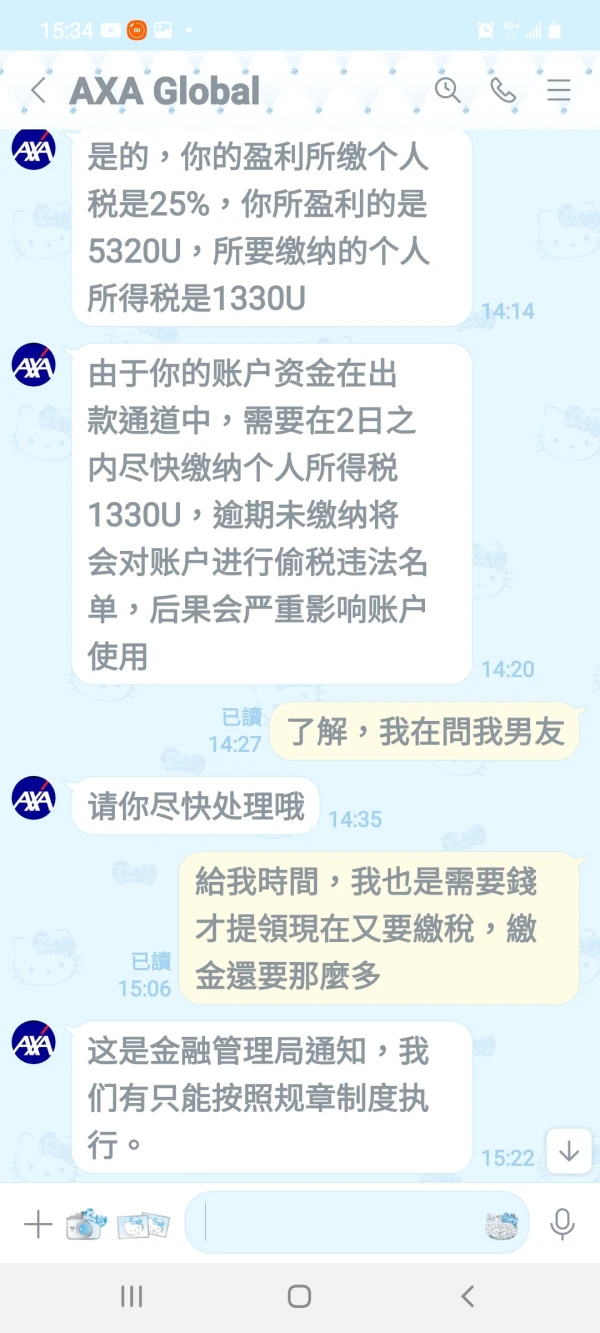

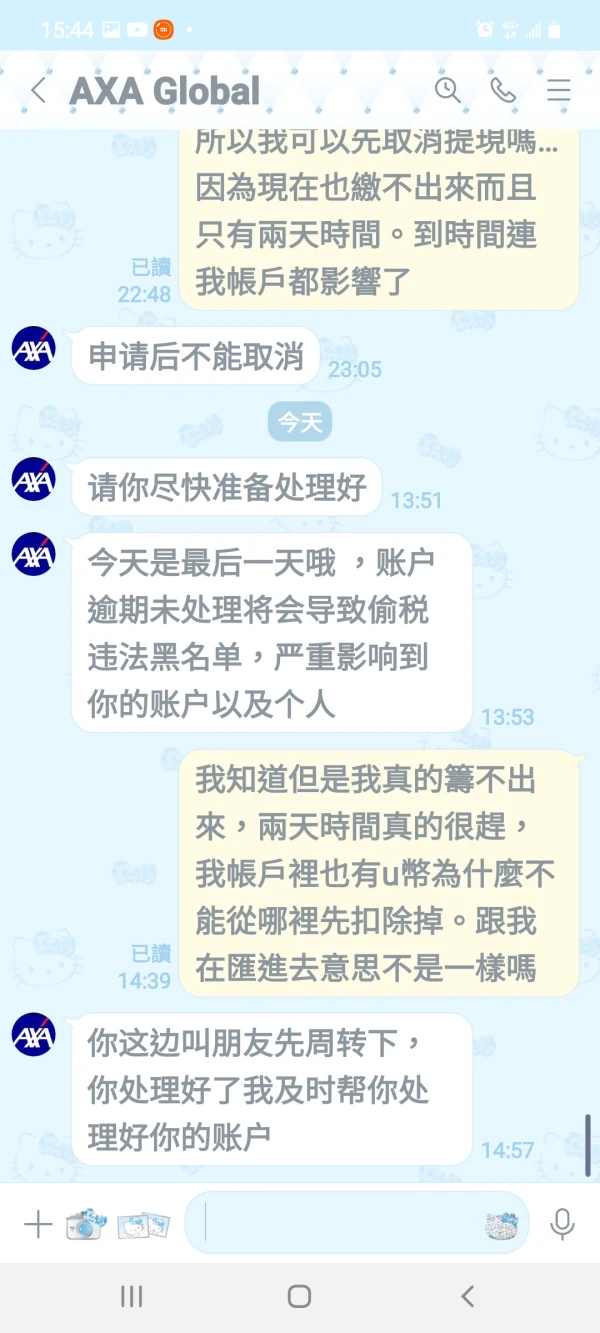

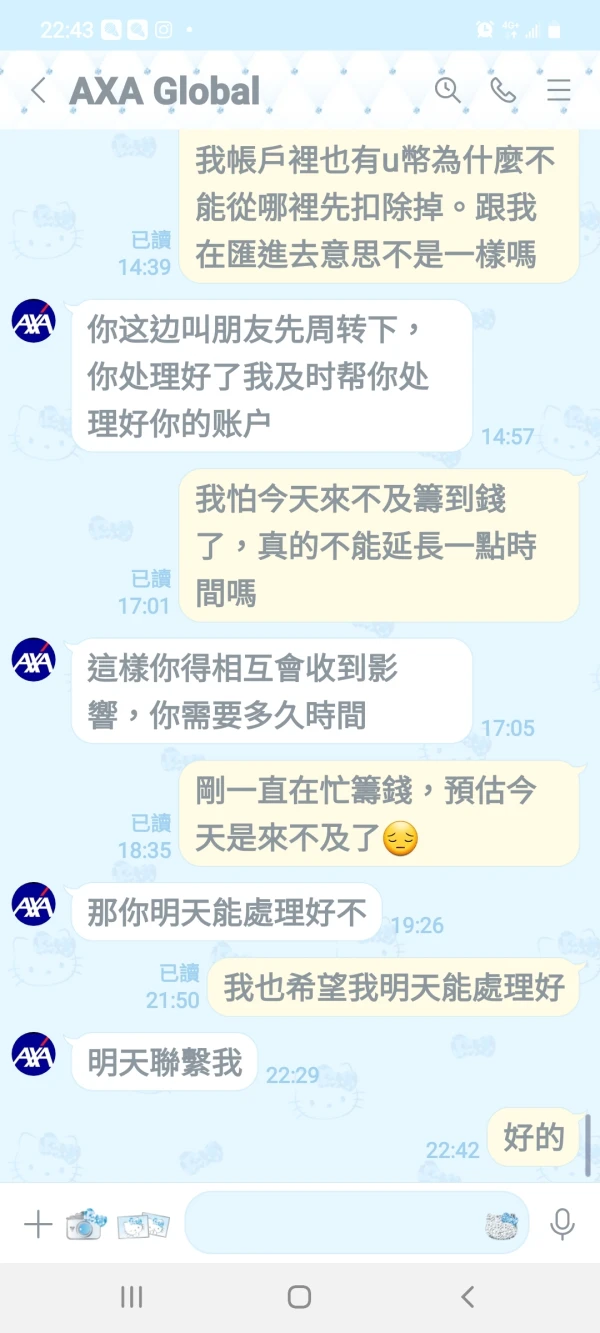

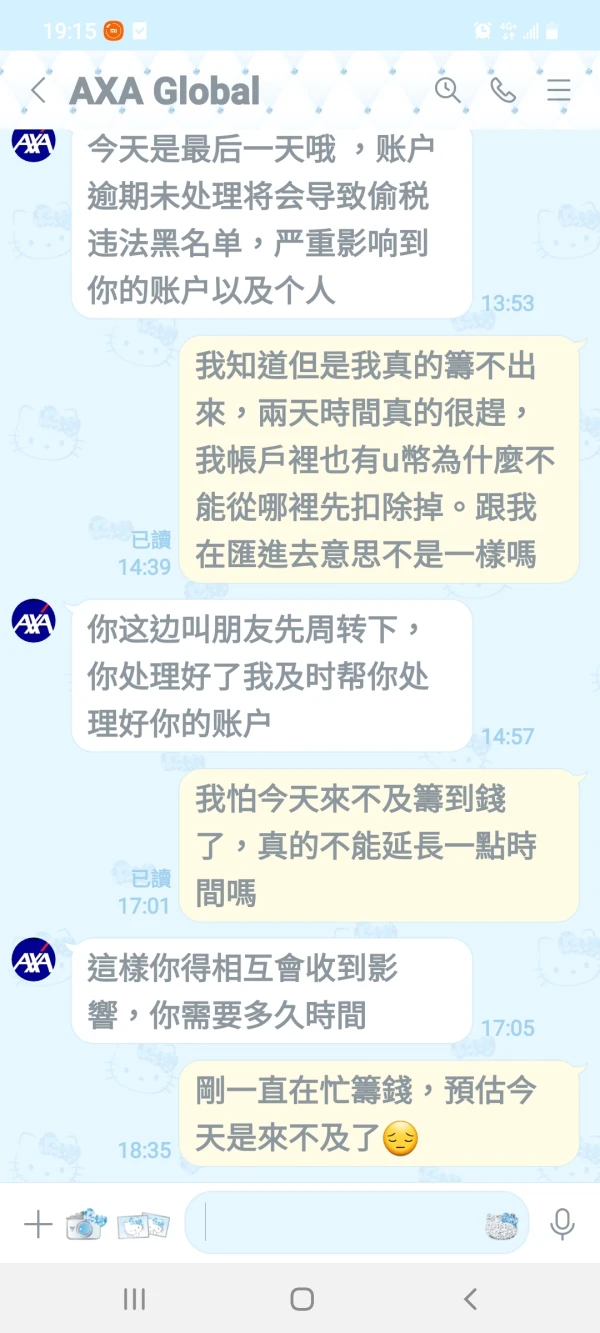

FX1566795049

Siprus

Obrolan saya baru-baru ini dengan layanan pelanggan AXA mengungkapkan persyaratan pajak penghasilan pribadi sebesar 25% untuk penarikan. Tidak jelas mengenai proses dan potensi penggantian biaya, saya mengkhawatirkan transparansi dan keandalan layanan AXA. Kejelasan mengenai hal ini akan sangat meningkatkan pengalaman pengguna.

ulasan netral

贫僧悟道ing......

Amerika Serikat

Menyediakan berbagai produk investasi antara lain reksa dana saham, reksa dana obligasi, dll, produk reksa dana juga lengkap, menyediakan data reksa dana dan analisis chart secara detail, halaman website sederhana dan mudah dipahami, proses transaksi relatif sederhana, adalah platform investasi yang layak dipertimbangkan.

Baik