Resumo da empresa

| Resumo da Revisão | |

| Fundação | 1997 |

| País/Região Registrada | França |

| Regulação | SFC |

| Produtos | Patrimônio imobiliário, dívida privada e crédito alternativo, private equity e infraestrutura; Ações, Renda Fixa, Investimentos Multiativos; Private equity, infraestrutura de capital, dívida privada, fundos de hedge |

| Suporte ao Cliente | Tel: +33144457000 |

| Email: webmaster-COM@axa-im.com | |

| Sede: Tour Majunga La Défense, 6 Place de la Pyramide, 92800 Puteaux | |

| Link para endereço de outras empresas filiais: https://www.axa-im.com/contact-us | |

Informações sobre AXA

AXA Investment Managers (AXA IM) é uma empresa global de gestão de ativos que possui filiais em todo o mundo. Ela lida principalmente com serviços financeiros, com produtos que incluem patrimônio imobiliário, dívida privada e crédito alternativo, private equity e infraestrutura, Ações, Renda Fixa, Investimentos Multiativos, Private equity, infraestrutura de capital, dívida privada, fundos de hedge, etc.

O bom é que a empresa é regulada pela SFC, o que significa que suas atividades financeiras são estritamente monitoradas por essas autoridades, garantindo em certa medida um certo nível de proteção ao cliente.

Prós e Contras

| Prós | Contras |

| Regulamentado pela SFC | Informações limitadas divulgadas sobre condições de negociação em seu site |

| Presença global | |

| Diversos produtos de negociação |

AXA é Legítimo?

AXA está atualmente sendo bem regulado pela Comissão de Valores Mobiliários e Futuros de Hong Kong (SFC)com a licença nº AAP809.

| País Regulamentado | Regulador | Status Atual | Entidade Regulamentada | Tipo de Licença | Nº de Licença |

| SFC | Regulamentado | AXA Investment Managers Asia Limited | Negociação de contratos futuros e negociação alavancada de câmbio estrangeiro | AAP809 |

Produtos e Serviços

Investimentos Principais

- Classes de Ativos: Ações, Renda Fixa, Multiativos

- Foco: Estratégias tradicionais com um histórico comprovado em várias condições de mercado.

ESG & Estratégias Sustentáveis

- Abordagem: Integra fatores ambientais, sociais e de governança (ESG) para alinhar objetivos financeiros com impacto no mundo real.

- Filosofia: Pragmática e focada no cliente, enfatizando retornos sustentáveis a longo prazo.

Investimentos Alternativos

- Pilares:

- Equidade Imobiliária

- Dívida Privada e Crédito Alternativo

- Private Equity e Infraestrutura

Mercados Privados e Fundos de Cobertura

- Instrumentos: Primários, secundários, co-investimentos, financiamento NAV, participações minoritárias de GP*.

- Cobertura: Private equity, infraestrutura de capital, dívida privada, fundos de cobertura.

Selecionar (Multi-Gestor e Serviços de Consultoria)

- Serviços: Soluções de gestão de patrimônio e vinculadas a unidades.

- Regiões: Europa e Ásia, adaptadas às necessidades de investimento específicas do cliente.

山27387

Hong Kong

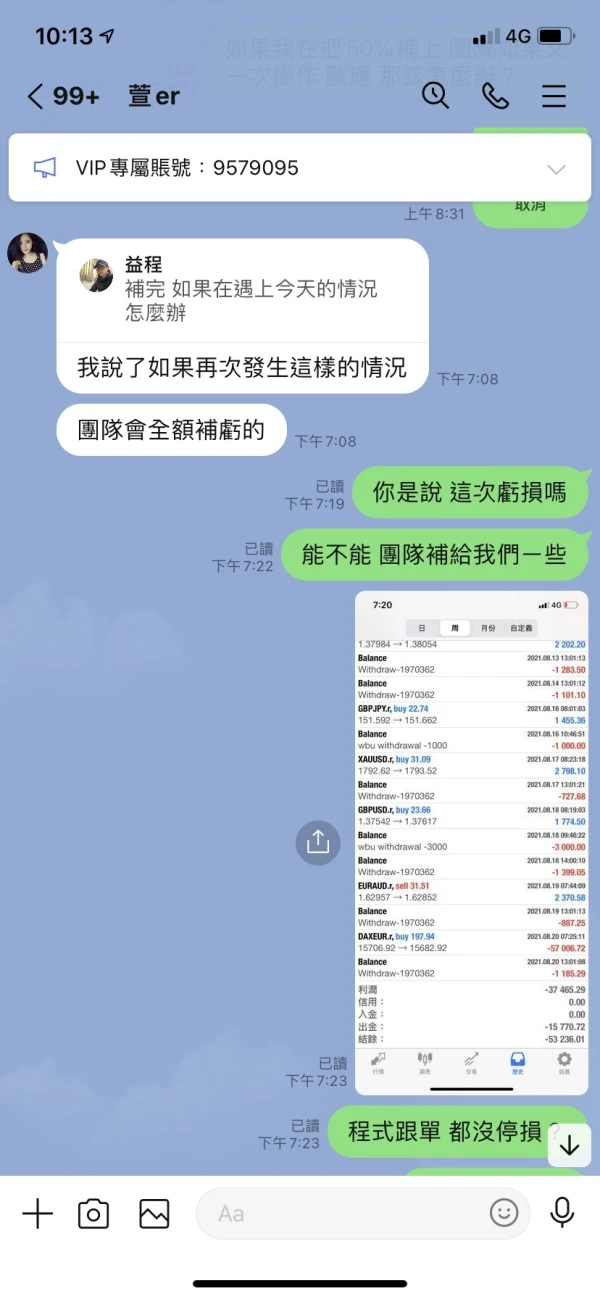

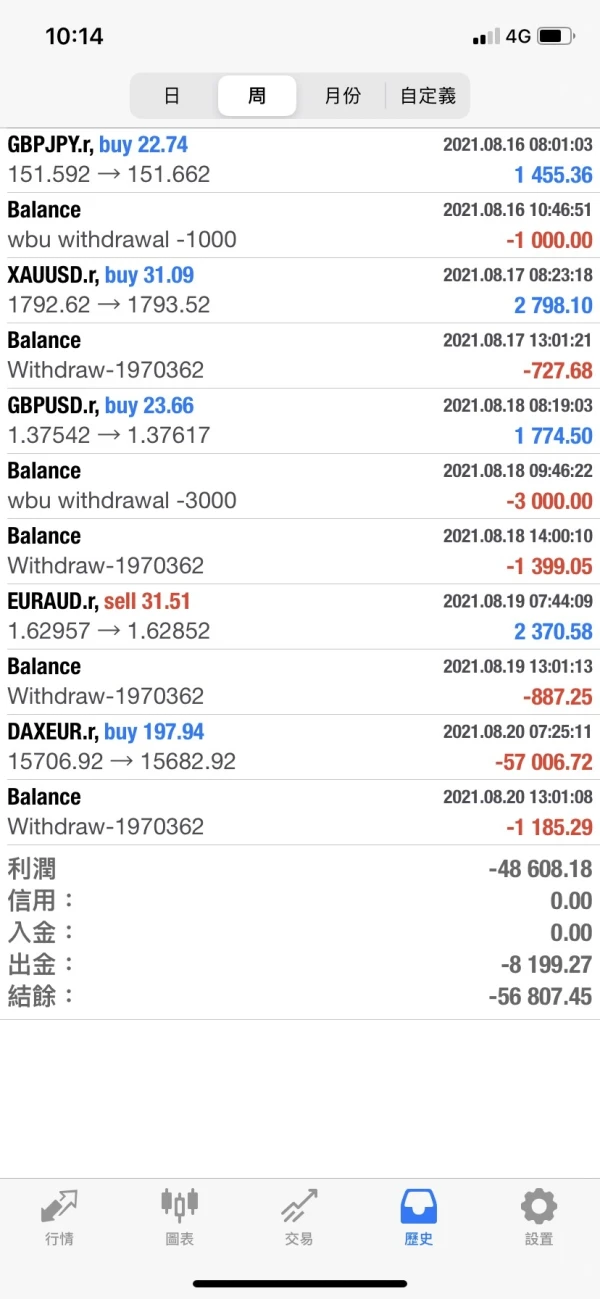

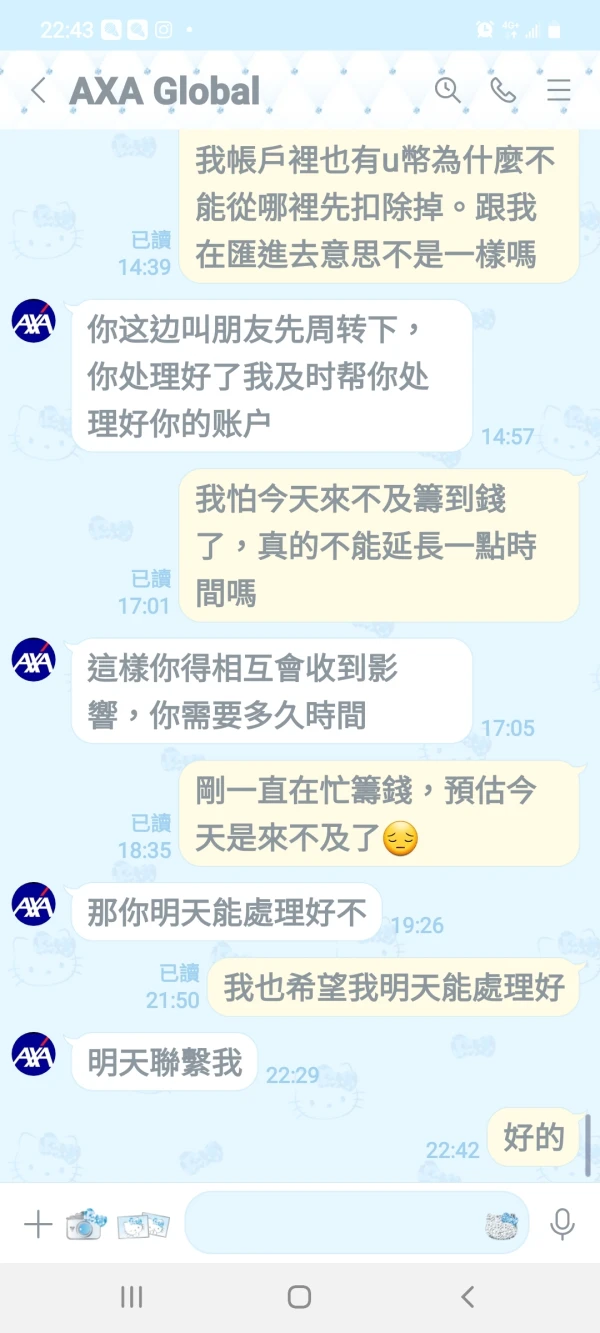

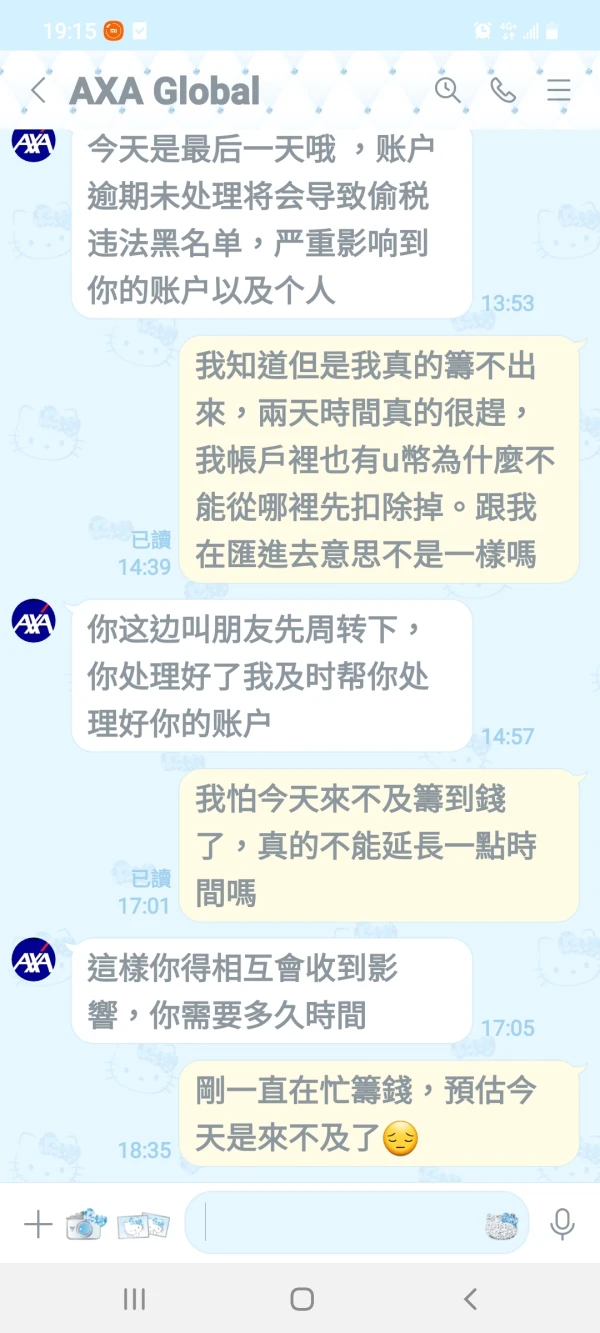

AXA congela minha conta e não consigo sacar. O atendimento ao cliente está fora de contato. O site pode ser aberto.

Exposição

FX1236648509

Taiwan

O serviço de atendimento ao cliente recusou-se a me pagar o saque.

Exposição

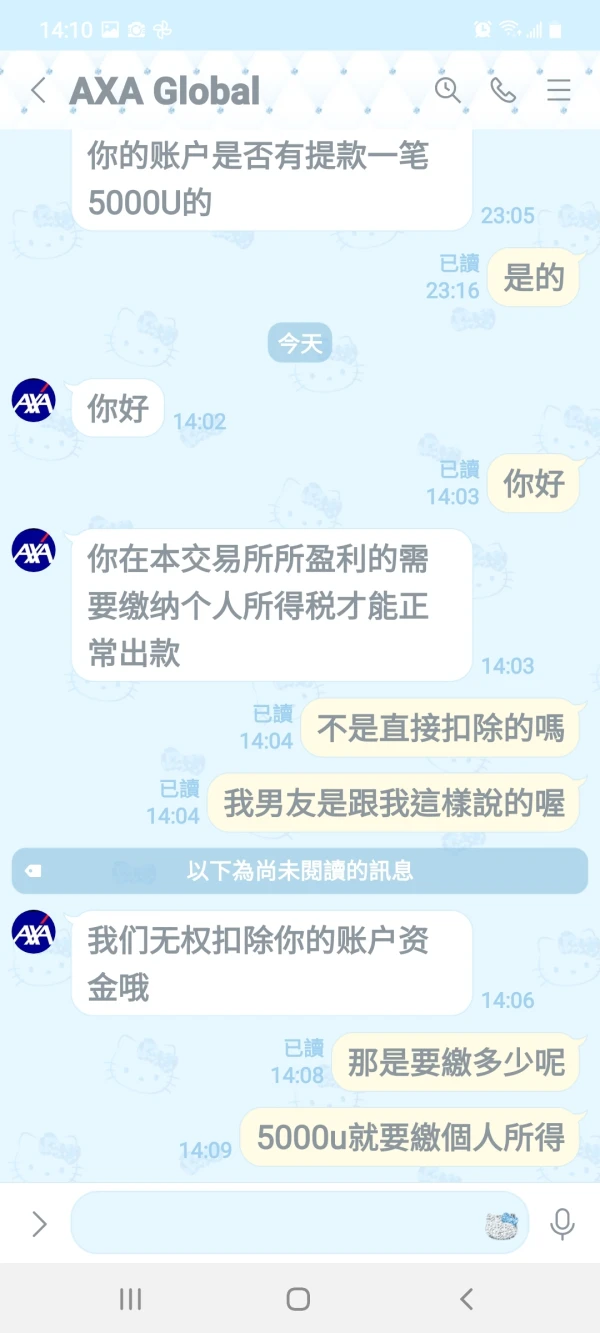

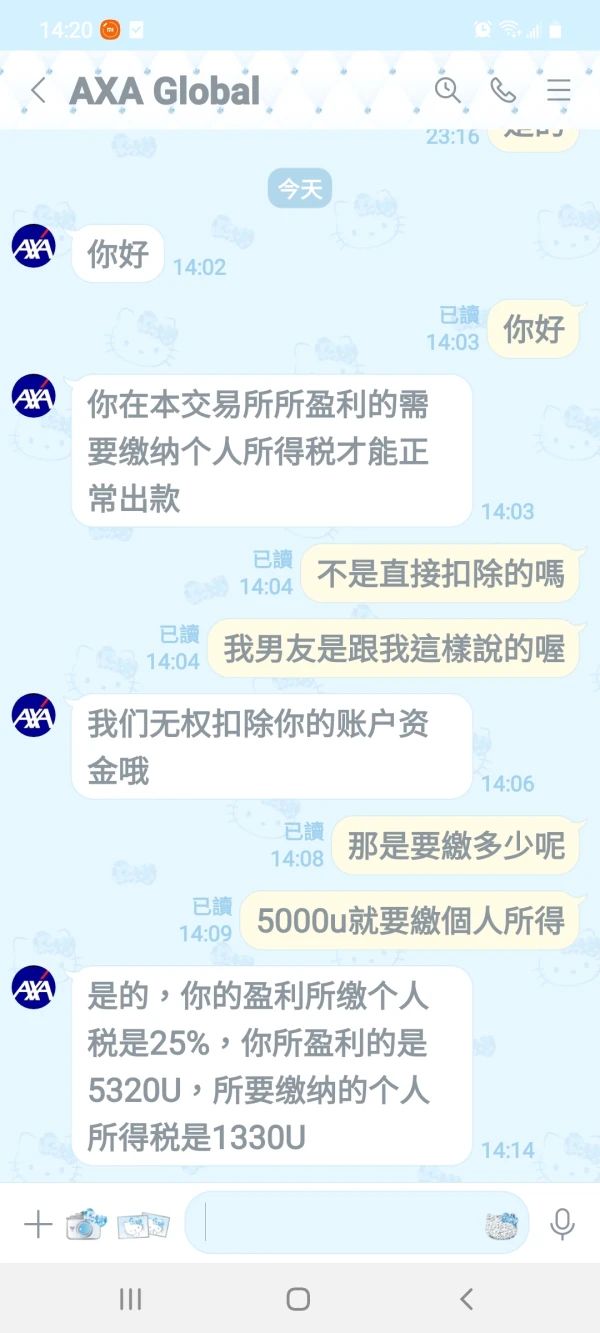

詹孟玟

Taiwan

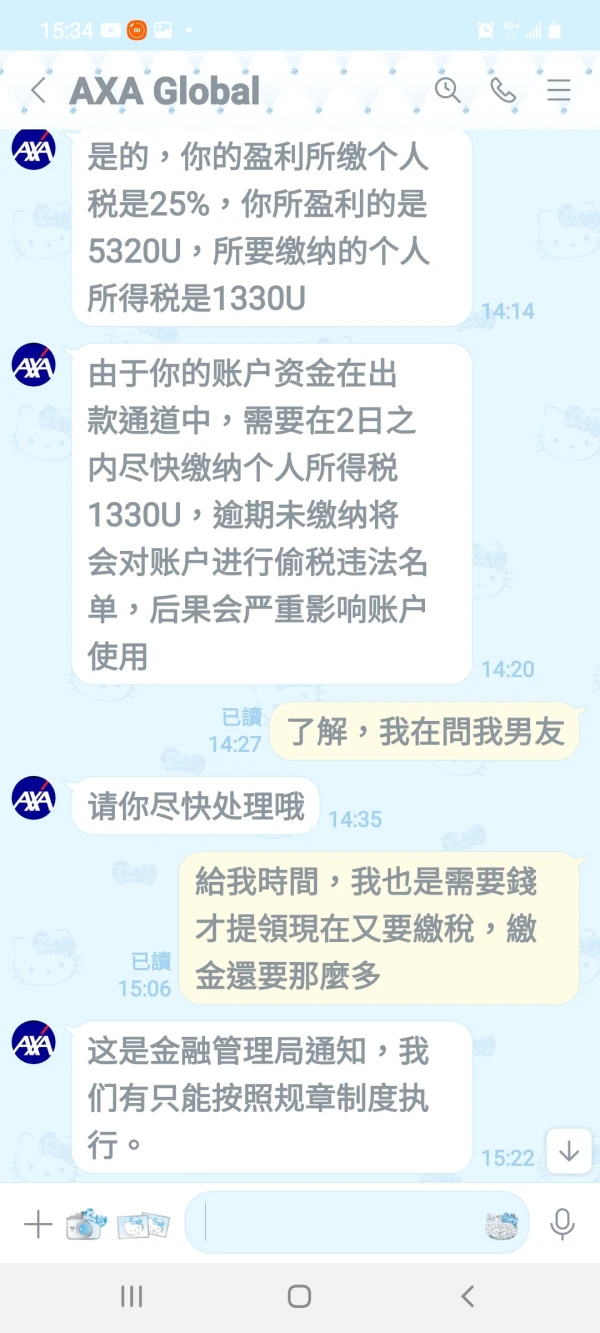

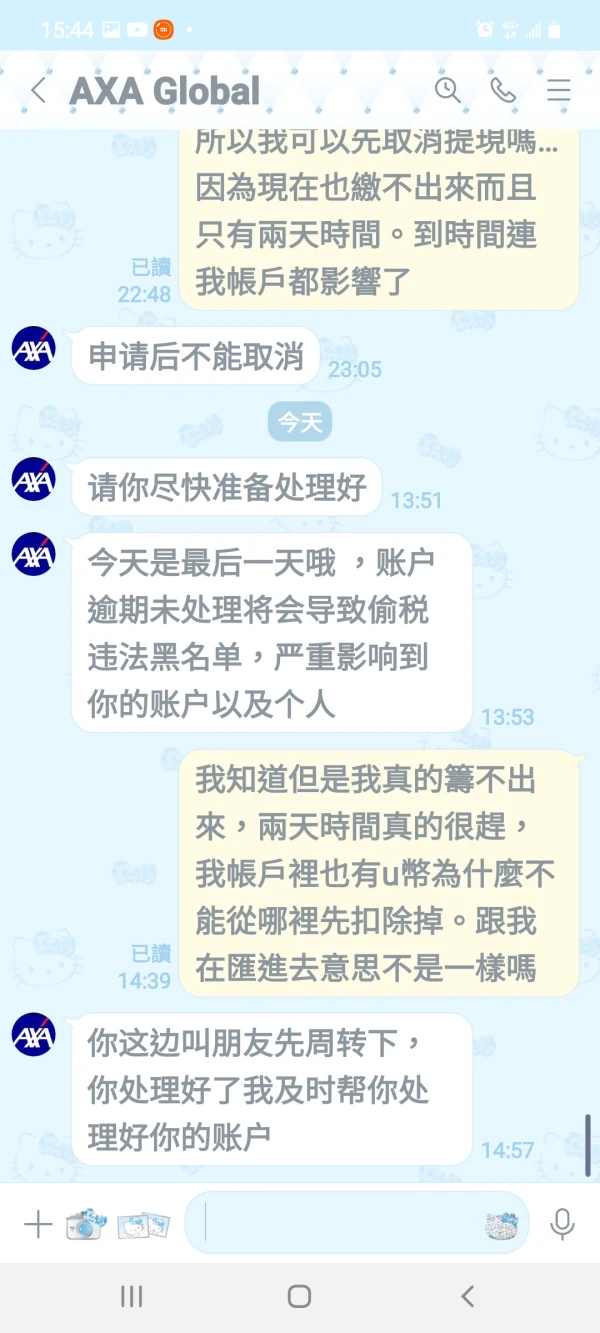

O serviço de atendimento ao cliente disse isso e eu não tinha certeza sobre sua realidade. Posso receber meu dinheiro de volta?

Exposição

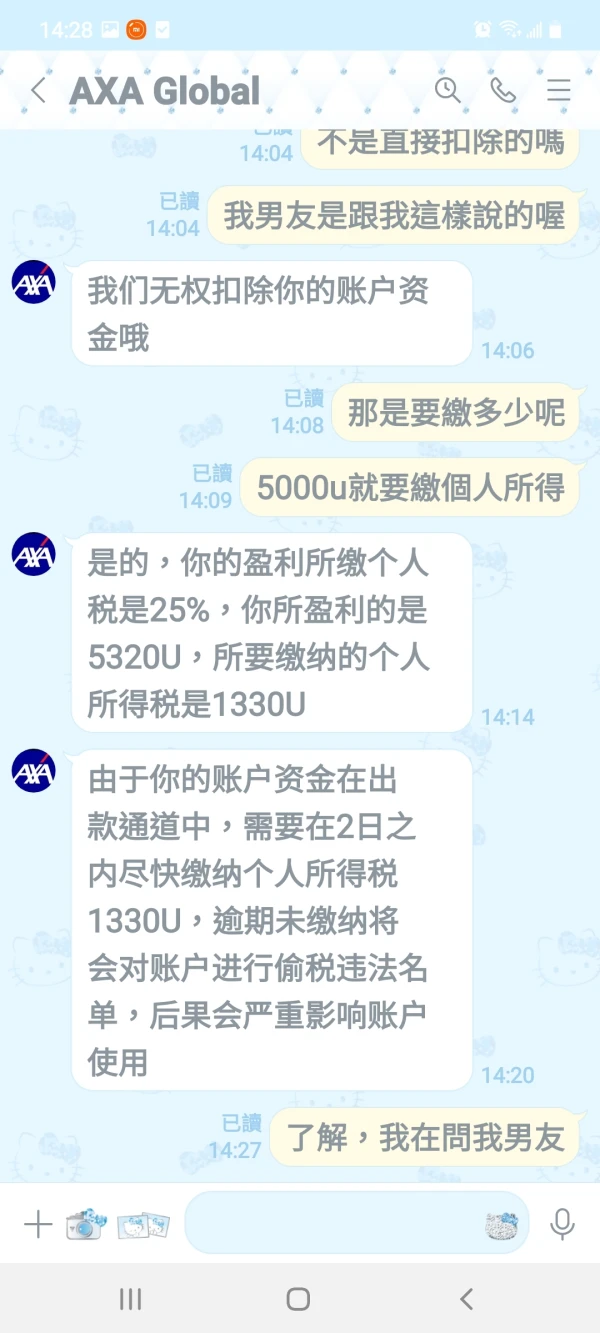

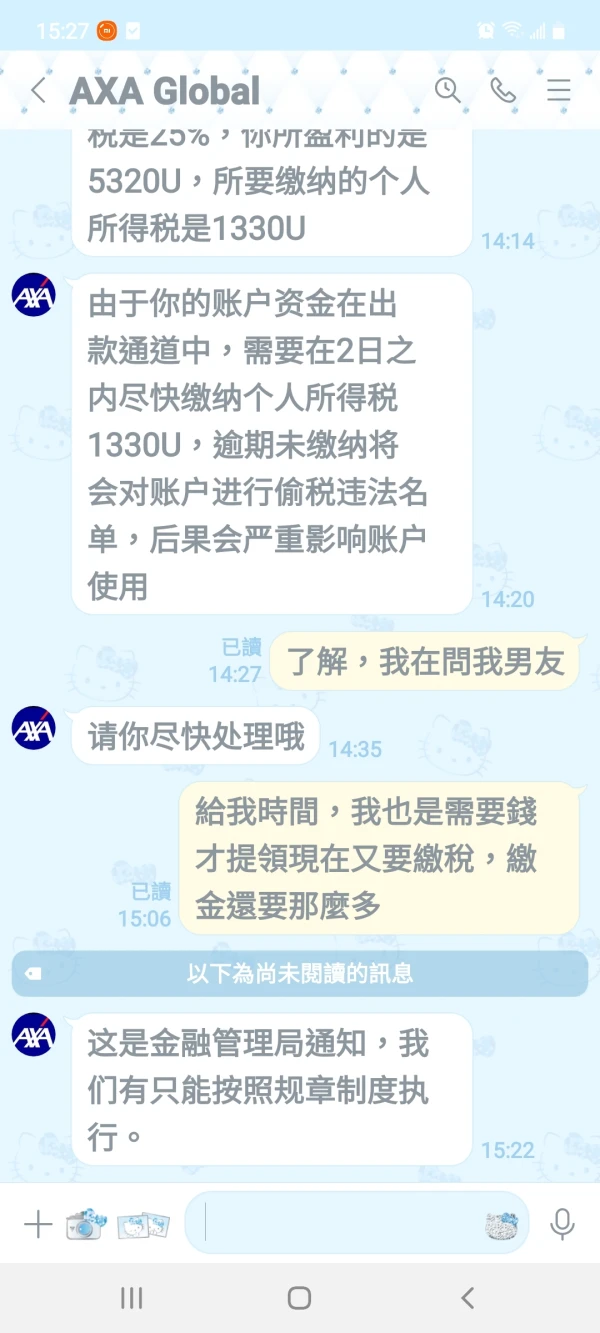

FX1566795049

Chipre

Minha conversa recente com o atendimento ao cliente da AXA revelou uma exigência de imposto de renda pessoal de 25% para saques. Não tenho certeza sobre o processo e o potencial reembolso. Estou preocupado com a transparência e a confiabilidade dos serviços da AXA. A clareza sobre esses assuntos melhoraria muito a experiência do usuário.

Neutro

贫僧悟道ing......

Estados Unidos

Ele fornece uma variedade de produtos de investimento, incluindo fundos de ações, fundos de títulos, etc., produtos de fundos também são abrangentes, fornecendo dados detalhados de fundos e análise de gráficos, a página do site é simples e fácil de entender, o processo de transação é relativamente simples, é uma plataforma de investimento que vale a pena considerar.

Positivos