Şirket özeti

| IndiaNivesh İnceleme Özeti | |

| Kuruluş | 2006 |

| Kayıtlı Ülke/Bölge | Hindistan |

| Düzenleme | Düzenleme yok |

| Piyasa Araçları | Hisse senetleri, yatırım fonları, türevler, IPO, para birimleri, sigorta, emtialar |

| Demo Hesabı | ❌ |

| İşlem Platformu | IndiaNivesh UYG |

| Müşteri Desteği | Tel: 022 – 62406240 |

| Sosyal medya: Facebook, X, Instagram, LinkedIn, YouTube | |

| E-posta: customersupport@indianivesh.in | |

IndiaNivesh Bilgileri

IndiaNivesh, Hindistan Borsası'nda öncü komisyonculuk ve finansal hizmetler sağlayıcısı olup düzenlenmemiş bir hizmet sağlayıcısıdır. Hisse senetleri, yatırım fonları, türevler, IPO/OFS, para birimleri, sigorta, emtialar, LAS&MTF, özelleştirilmiş çözümler, portföy yönetimi hizmetleri, özel sermaye, stratejik yatırımlar, araştırma, satış ve ticaret, sermaye artırımı (özkaynak ve borç), Hindistan'a giriş, Hindistan şirketlerinin küreselleşmesi, birleşme ve satın almalar konularında ürün ve hizmetler sunmaktadır.

Artıları ve Eksileri

| Artıları | Eksileri |

| Uzun işlem süresi | Düzenleme eksikliği |

| Çeşitli iletişim kanalları | Demo hesapları yok |

| Çeşitli ürünler ve hizmetler |

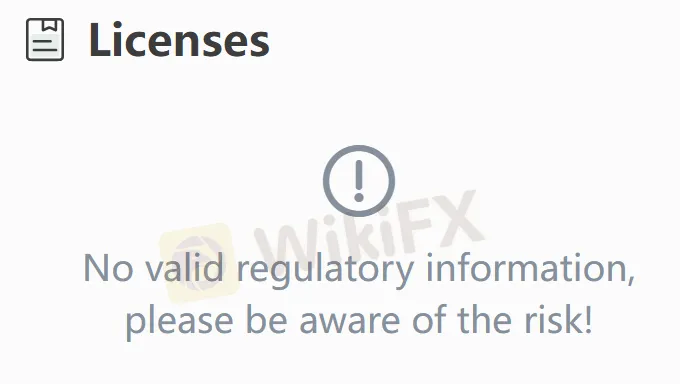

IndiaNivesh Güvenilir mi?

Hayır. Şu anda geçerli düzenlemeleri bulunmamaktadır. Lütfen riskin farkında olun!

IndiaNivesh Üzerinde Ne Alım Satım Yapabilirim?

| Alım Satım Varlıkları | Desteklenen |

| Hisse Senetleri | ✔ |

| Fonlar | ✔ |

| Türevler | ✔ |

| İlk Halka Arz (IPO) | ✔ |

| Paralar | ✔ |

| Sigortalar | ✔ |

| Emtialar | ✔ |

| Endeksler | ❌ |

| Kripto Paralar | ❌ |

| Bono | ❌ |

| Opsiyonlar | ❌ |

| ETF'ler | ❌ |

Alım Satım Platformu

| Alım Satım Platformu | Desteklenen | Mevcut Cihazlar | Uygun |

| IndiaNivesh UYGULAMASI | ✔ | Mobil | / |