회사 소개

| PGM 리뷰 요약 | |

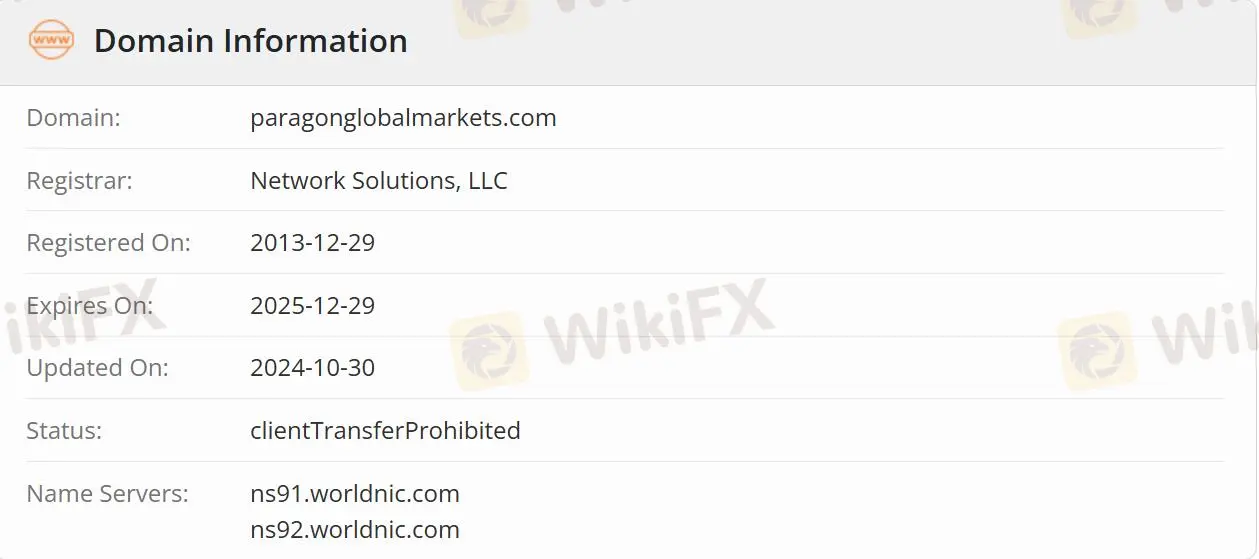

| 설립일 | 2013-12-29 |

| 등록 국가/지역 | 미국 |

| 규제 | 규제되지 않음 |

| 제품 및 서비스 | 제품/매니지드 퓨처스/고객 솔루션 |

| 거래 플랫폼 | CQG/CTS/Trading Technology/QST/Bloomberg/FFastFil/InfoReach/CME Group/Ice |

| 고객 지원 | 전화: +1 (212) 590-1900 |

| 이메일: info@paragonglobalmarkets.com | |

PGM 정보

Paragon Global Markets (PGM)은 글로벌 파생상품 시장에서 거래하는 다양한 선물, 외환, 실행 및 청산 고객을 대상으로 하는 독립 소개 브로커입니다.

PGM의 신뢰성

PGM은 규제되지 않음으로 규제된 브로커보다 안전하지 않습니다.

PGM이 제공하는 제품 및 서비스

제품 및 서비스는 세 가지 범주로 구성됩니다: 제품, 매니지드 퓨처스 및 고객 솔루션

제품: 주요 글로벌 선물 거래소를 통한 글로벌 거래 선물 및 외환 실행 서비스, 알고리즘, LME 전문 지식, 블록 주문 관리, 주문 관리 및 옵션 전략 관리를 포함한 선도적인 전자 거래 플랫폼을 고객에게 제공합니다.

매니지드 퓨처스: 주식 및 채권과 같은 전통적인 투자와 구별되는 대체 투자 세계에서의 독특한 자산 클래스입니다. 상품 거래 자문가(CTA)로 알려진 포트폴리오 매니저는 투자 전략의 일환으로 선물 계약을 사용하며 금융 상품, 통화 및 상품에 대한 롱 및/또는 숏 포지션을 취함으로써 이익을 얻습니다.

고객 솔루션: 포지션, 매수 및 매도, 현금 활동, 잔액, 마진, 거래 등을 포함합니다.

거래 플랫폼

PGM은 Trading Technology, Bloomberg, FFastFill 등 온라인 및 다운로드 가능한 다양한 거래 플랫폼에 액세스할 수 있습니다.

| 거래 플랫폼 | 지원 |

| CQG | ✔ |

| CTS | ✔ |

| Trading Technology | ✔ |

| QST | ✔ |

| Bloomberg | ✔ |

| FFastFill | ✔ |

| InfoReach | ✔ |

| CME Group | ✔ |

| Ice | ✔ |