회사 소개

| United Securities Co. 리뷰 요약 | |

| 설립 연도 | 1996 |

| 등록 국가/지역 | 팔레스타인 |

| 규제 | 규제 없음 |

| 서비스 | 자체 거래, 대리 거래, 발행 관리, 포트폴리오 관리, 수탁 서비스, 외국 시장 거래, 거래 응용 프로그램, 전자 거래 |

| 데모 계정 | ❌ |

| 레버리지 | 최대 1:300 |

| 스프레드 | 0포인트부터 |

| 거래 플랫폼 | United Securities Co., MT5 |

| 최소 입금액 | $100 |

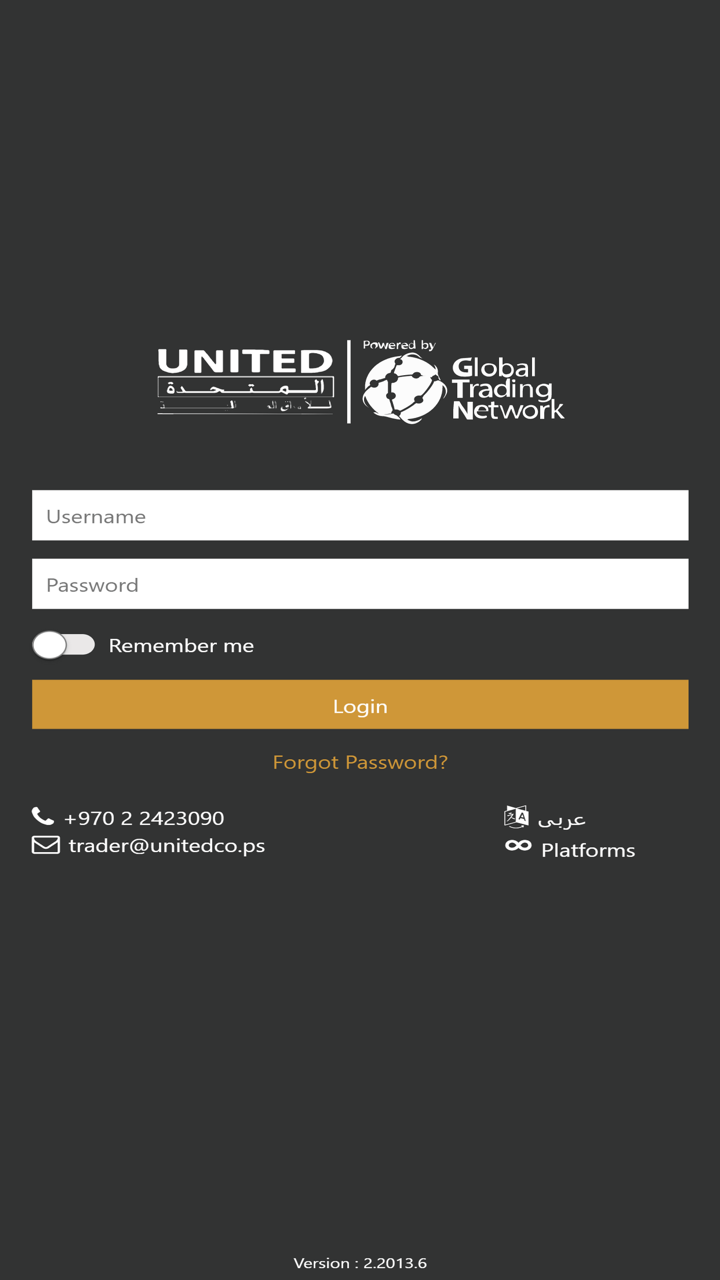

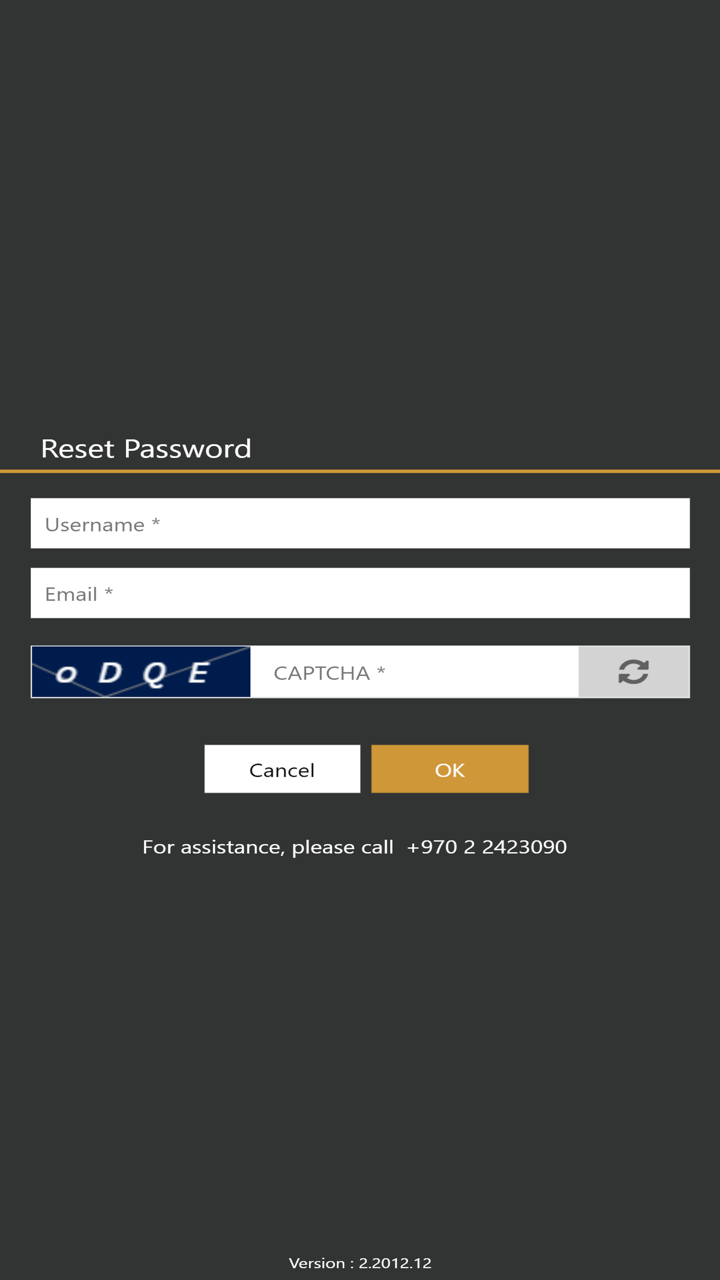

| 고객 지원 | 실시간 채팅, 연락 양식 |

| 전화: 02-2423090 | |

| 이메일: info@unitedco.ps | |

| 주소: Rawabi City Q Center, 사무실 건물, 1층 | |

| 소셜 미디어: Facebook, Whatsapp, Instagram, LinkedIn | |

United Securities Co. 정보

United Securities Co.은 1996년에 팔레스타인에서 설립된 규제되지 않은 프리미어 중개 및 금융 서비스 제공업체입니다. 자체 거래, 대리 거래, 발행 관리, 포트폴리오 관리, 수탁 서비스, 외국 시장 거래, 거래 응용 프로그램 및 전자 거래 서비스를 제공합니다.

장단점

| 장점 | 단점 |

| 운영 시간이 길다 | 규제 부족 |

| 다양한 연락 수단 | 데모 계정 없음 |

| 다양한 거래 상품 | MT4 플랫폼 없음 |

| MT5 플랫폼 | 수수료 부과 |

| 계정 선택이 제한됨 |

United Securities Co. 합법적인가요?

No. United Securities Co. 현재 유효한 규정이 없습니다. 리스크를 인식해주십시오!

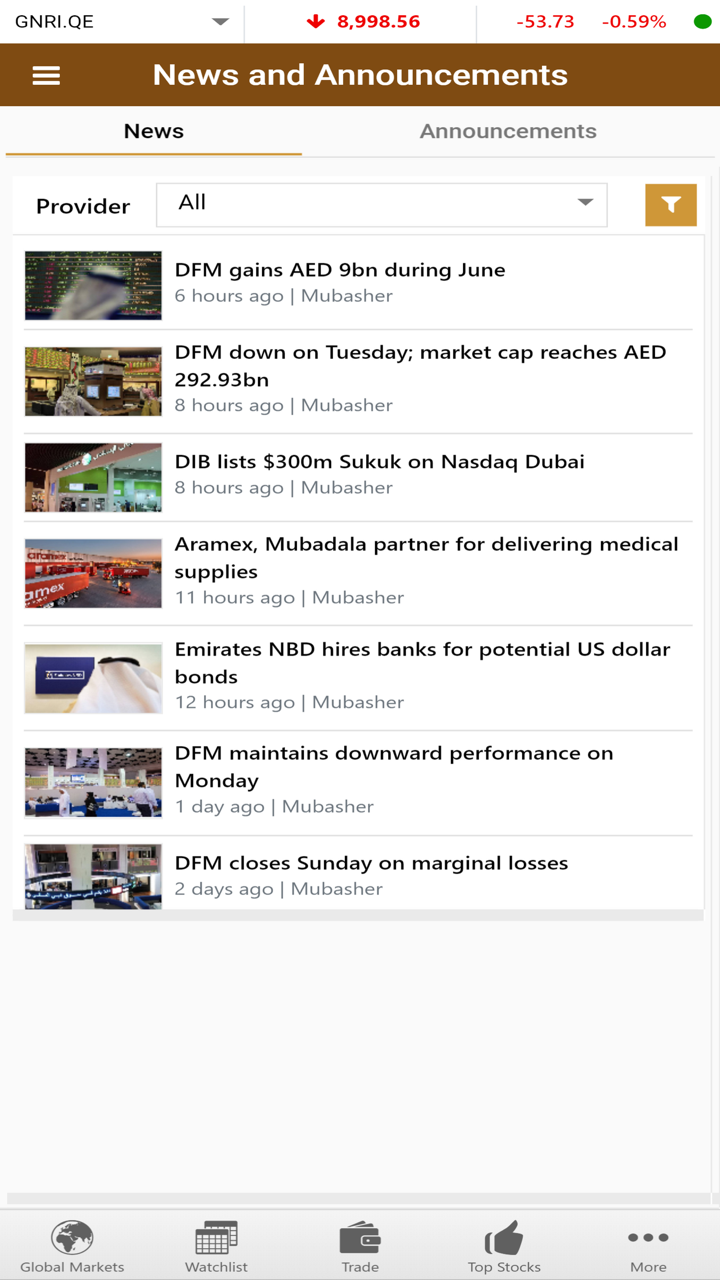

United Securities Co. 서비스

| 서비스 | 지원 |

| 자체 거래 | ✔ |

| 대리 거래 | ✔ |

| 발행 관리 | ✔ |

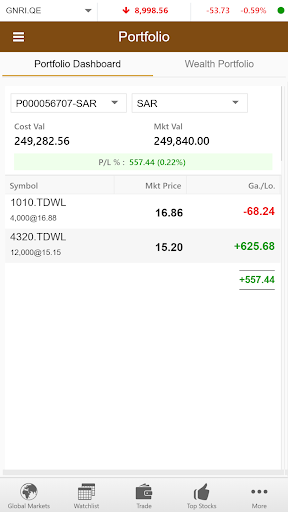

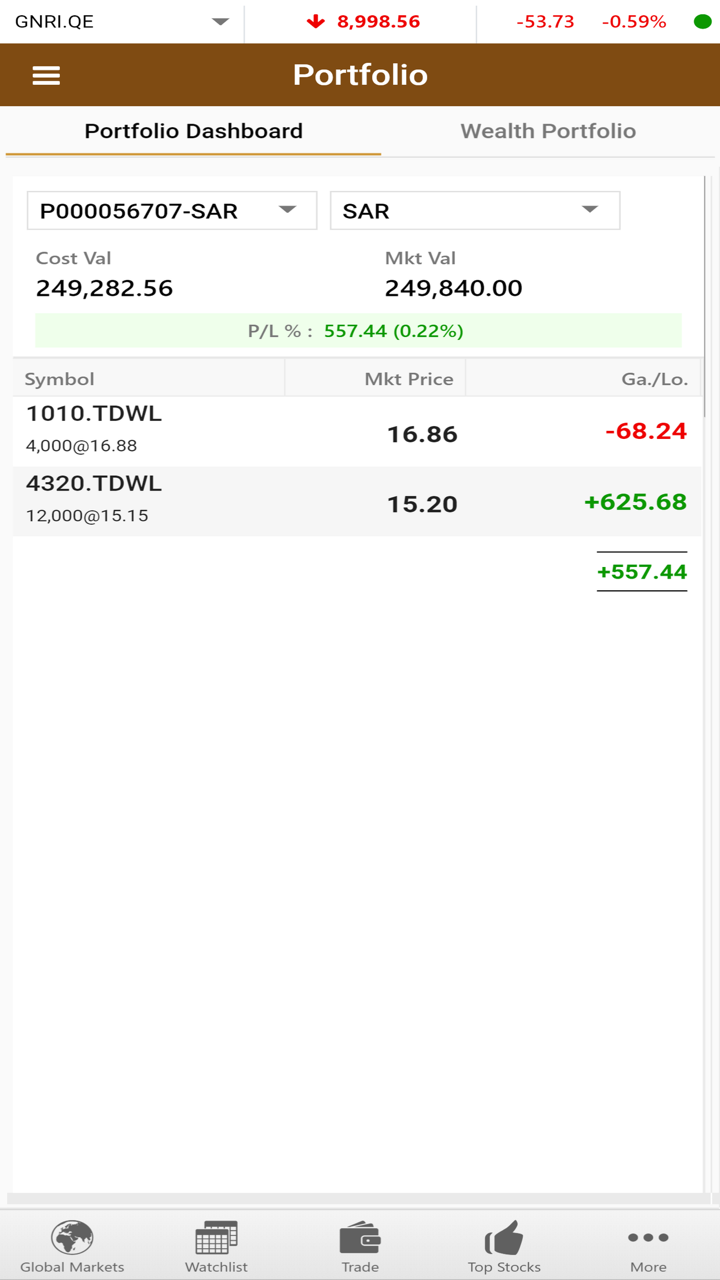

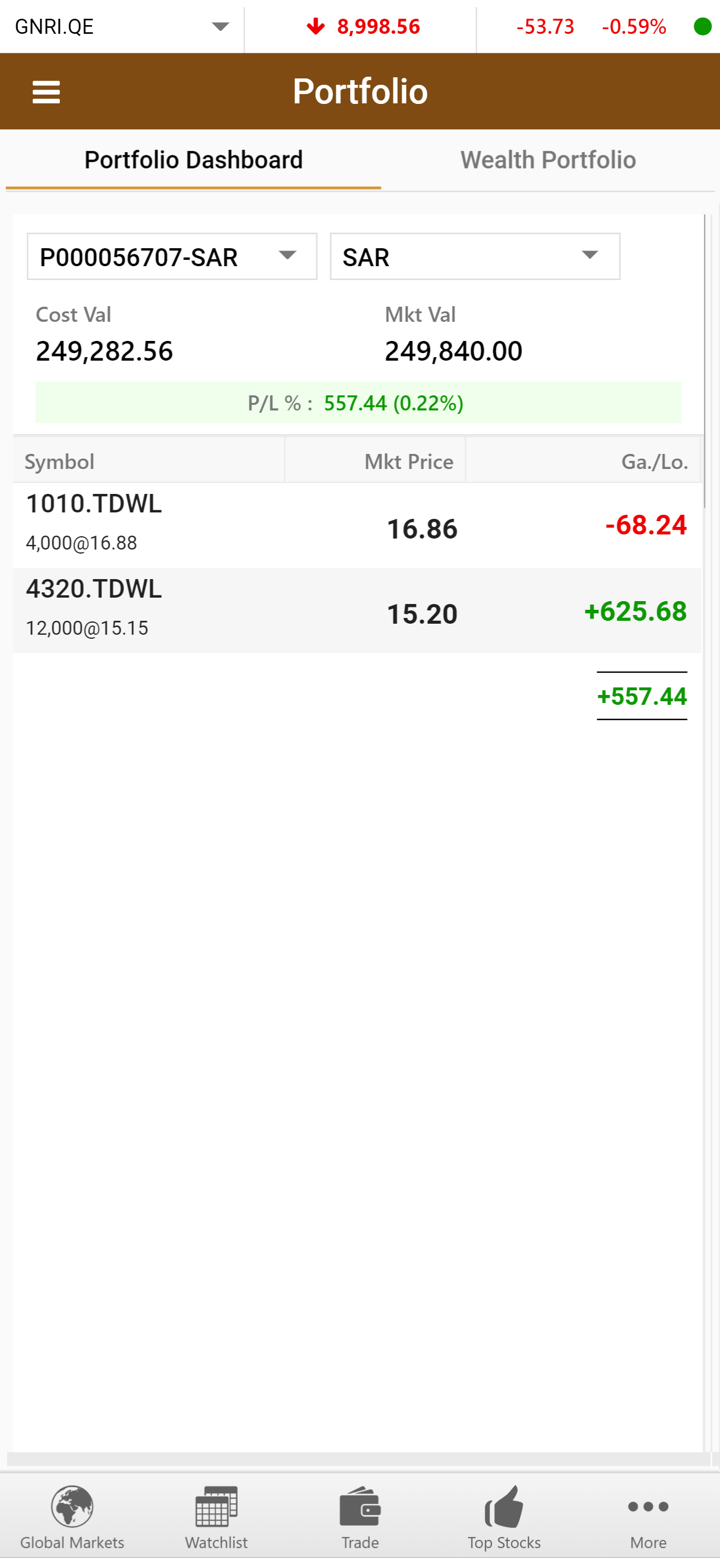

| 포트폴리오 관리 | ✔ |

| 보관 서비스 | ✔ |

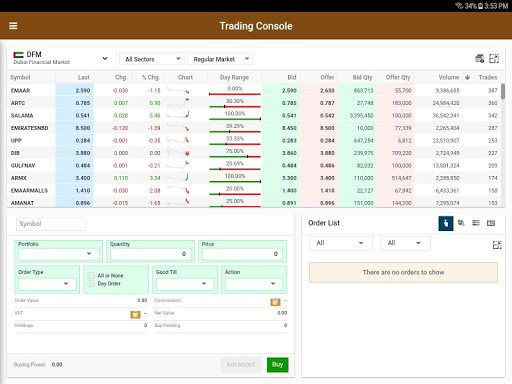

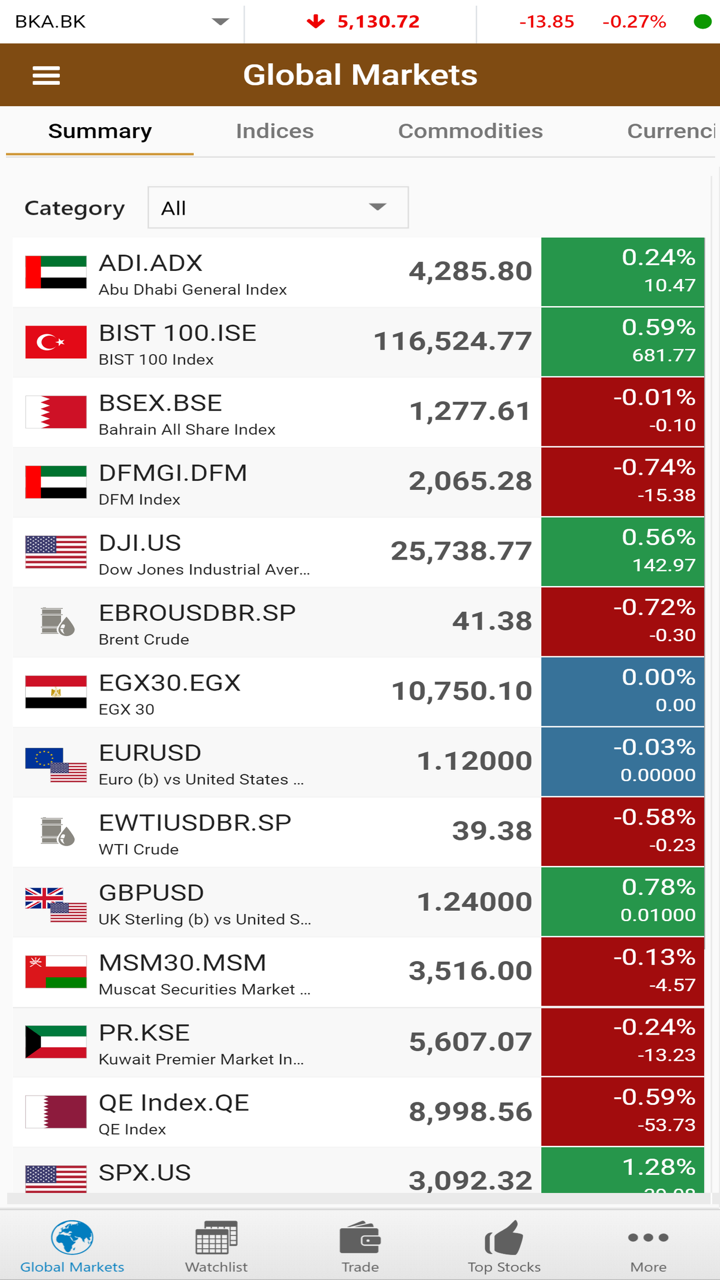

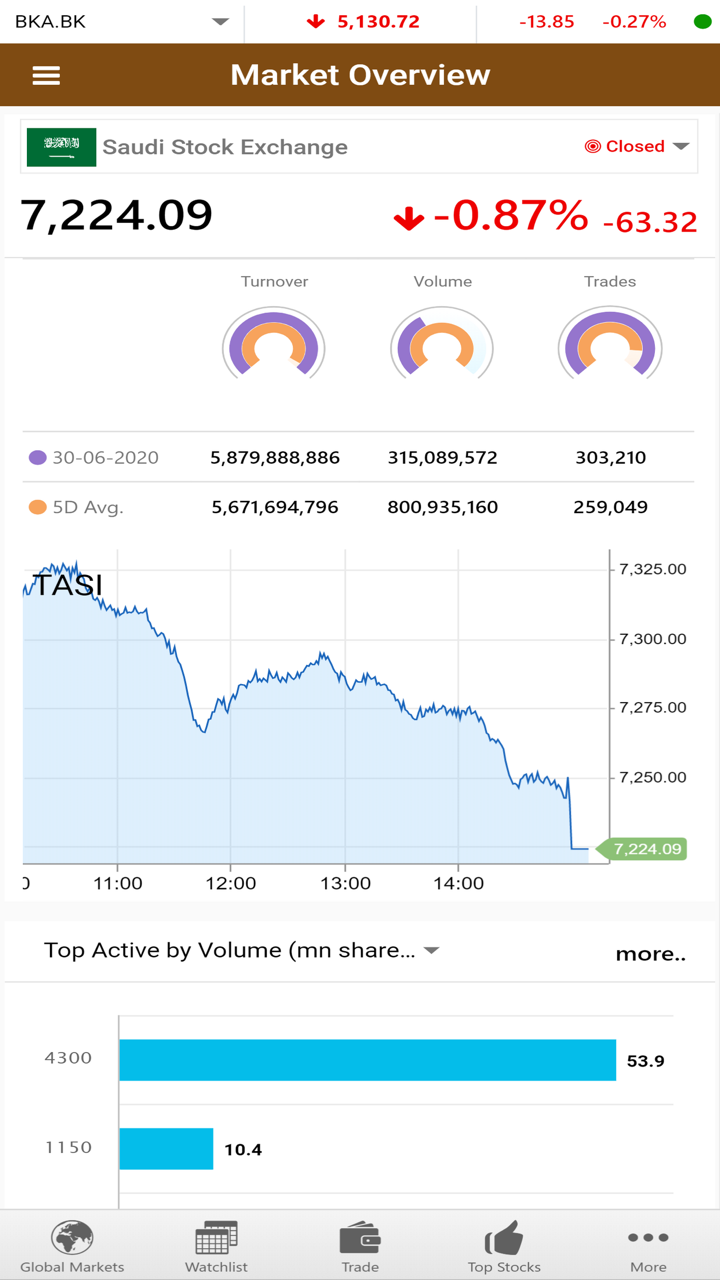

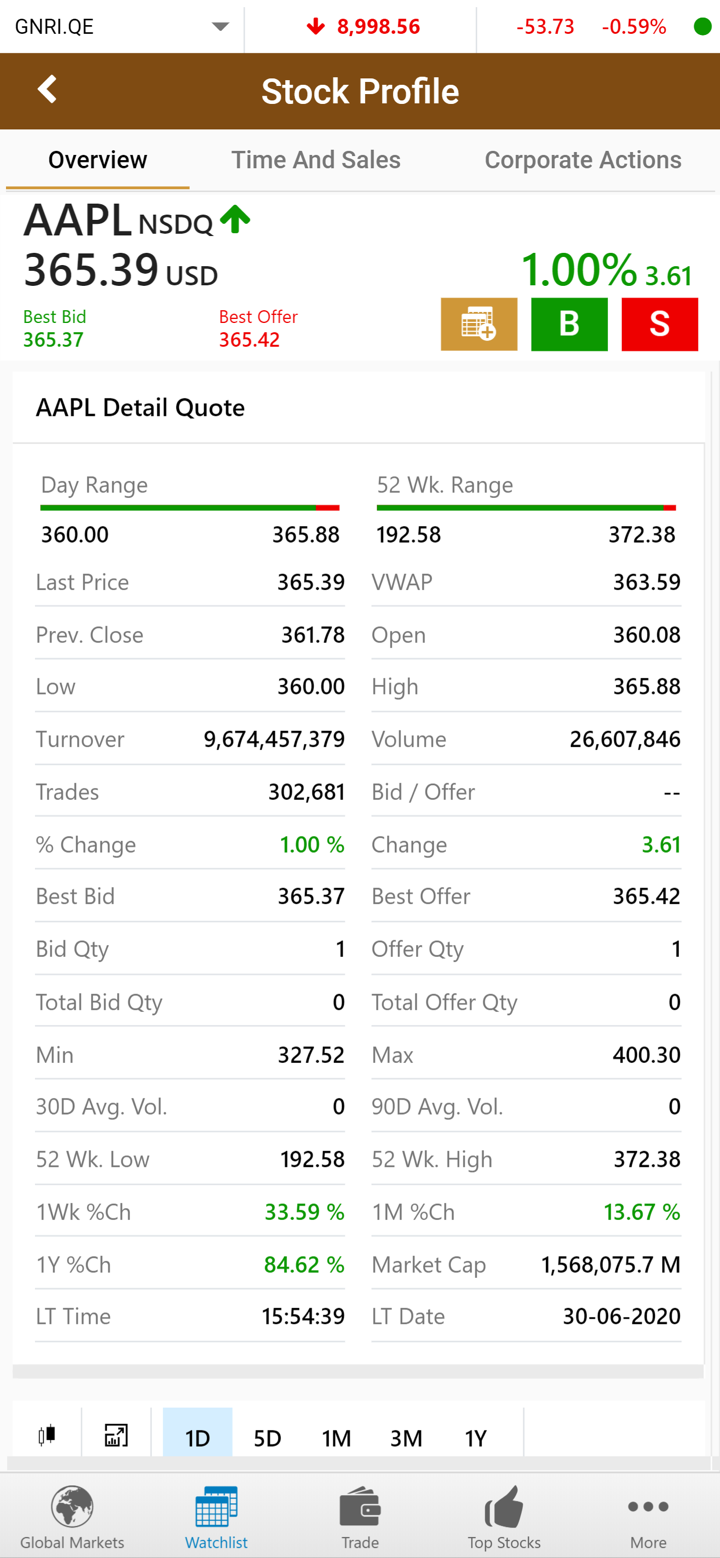

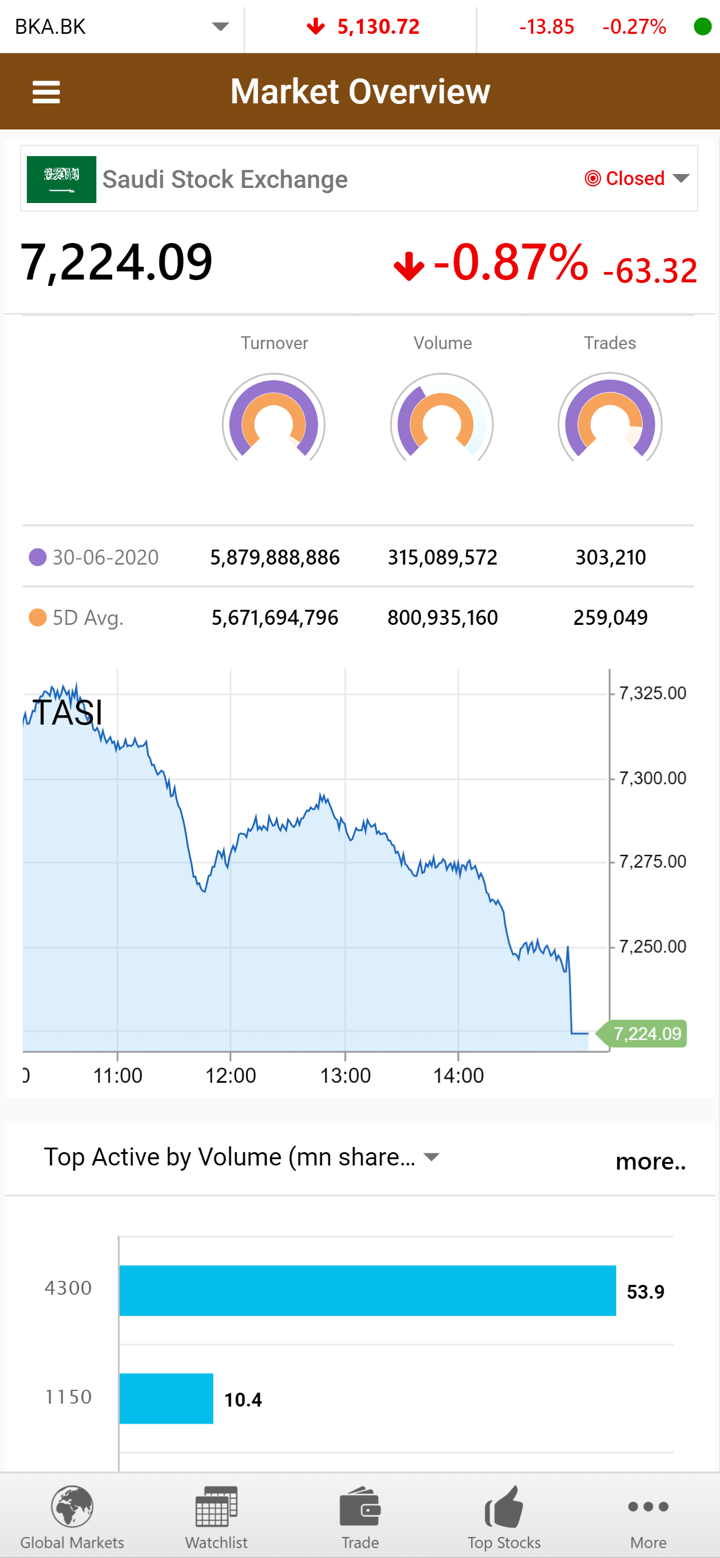

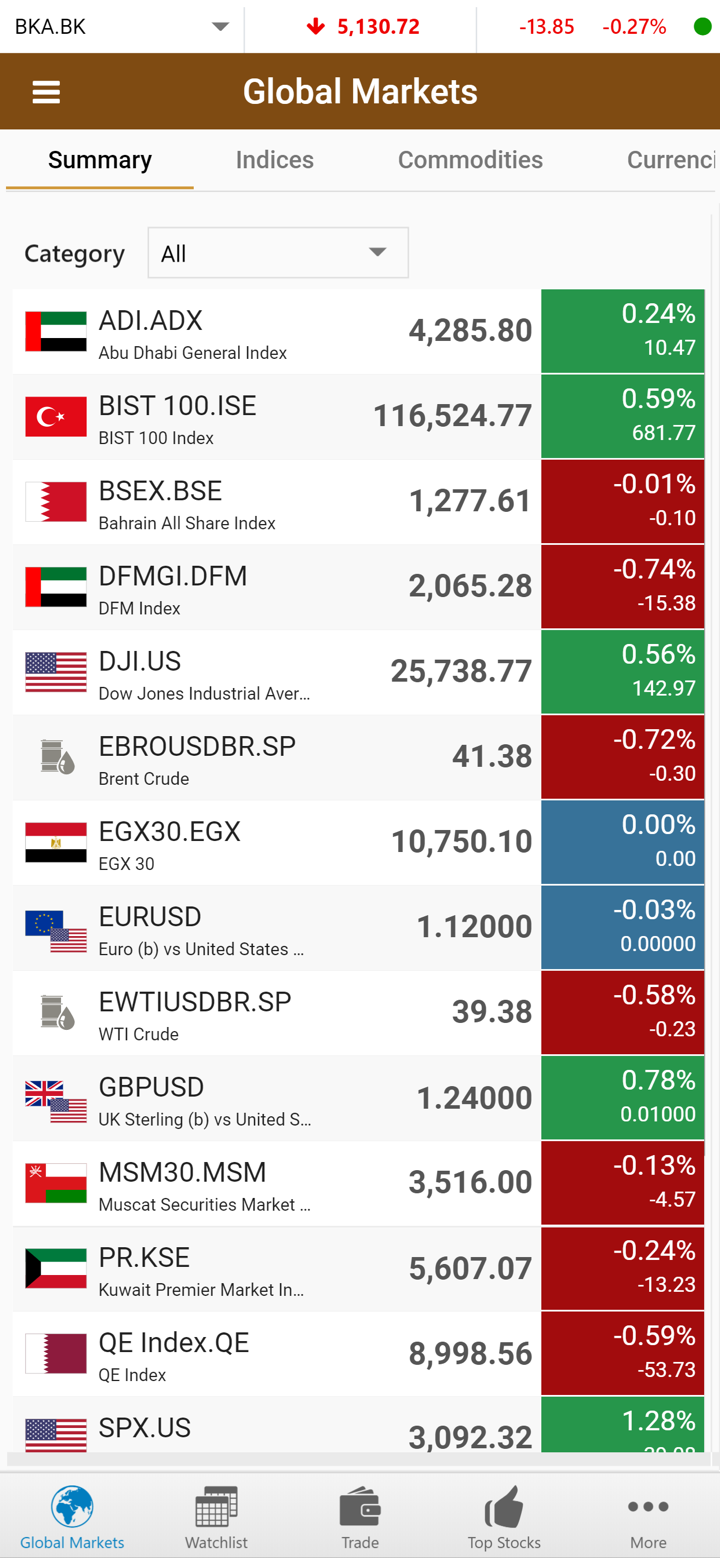

| 외국 시장 거래 | ✔ |

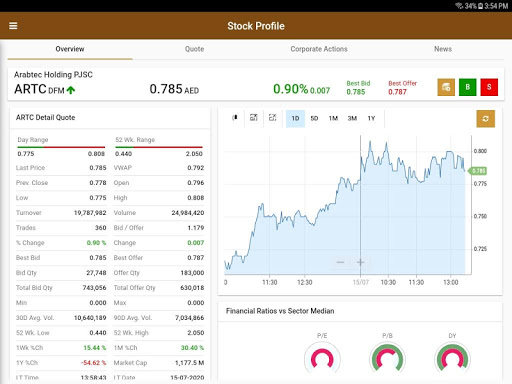

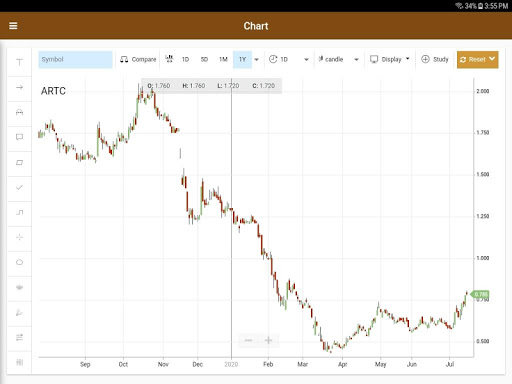

| 거래 응용 프로그램 | ✔ |

| E-Trade | ✔ |

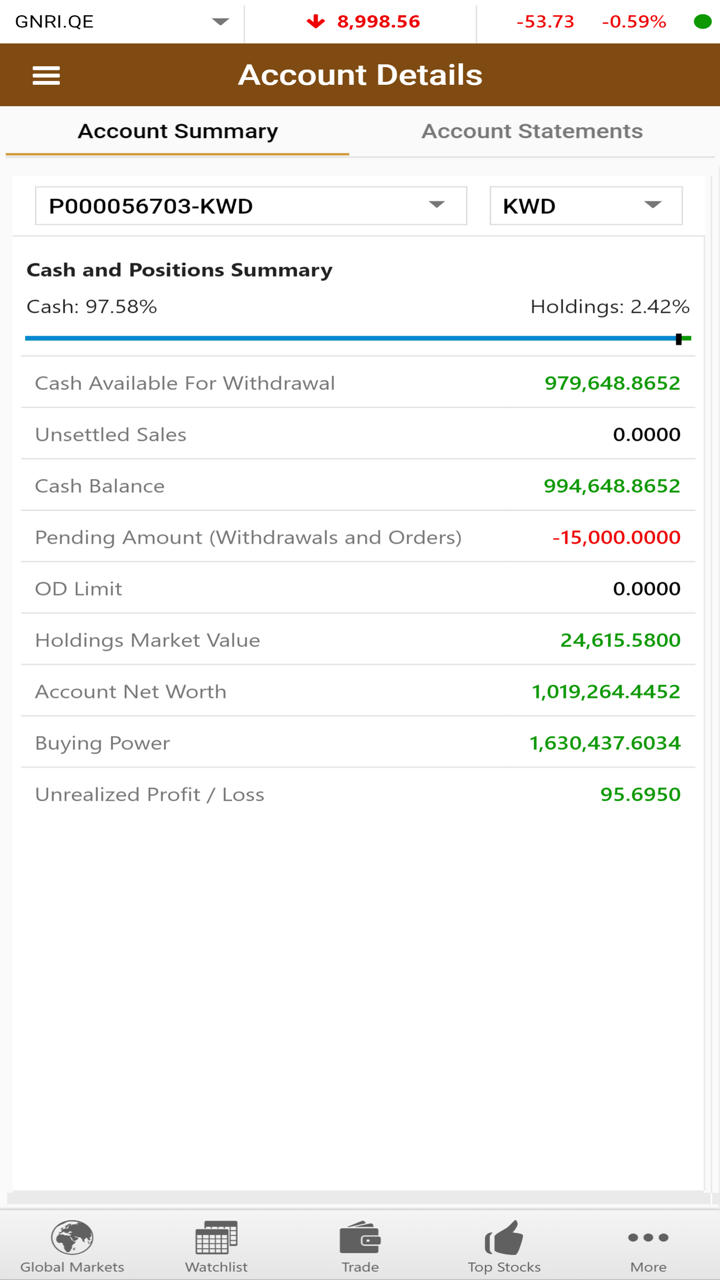

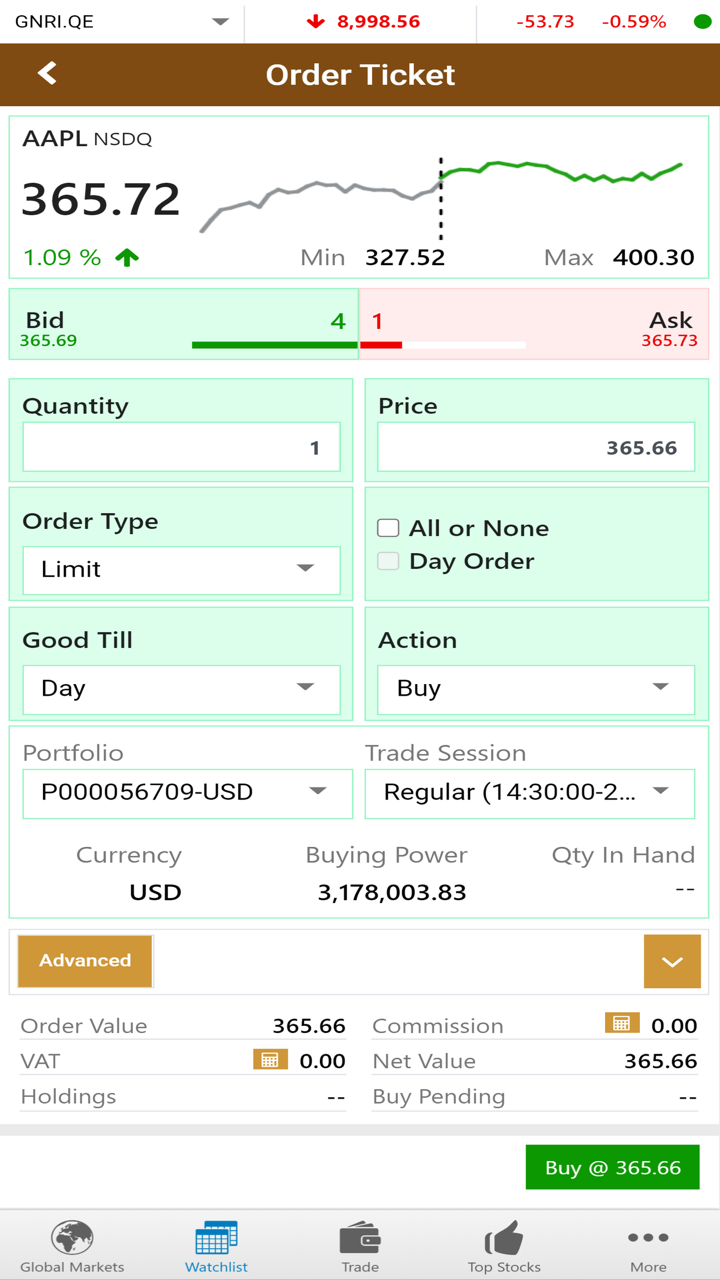

계정 유형 및 수수료

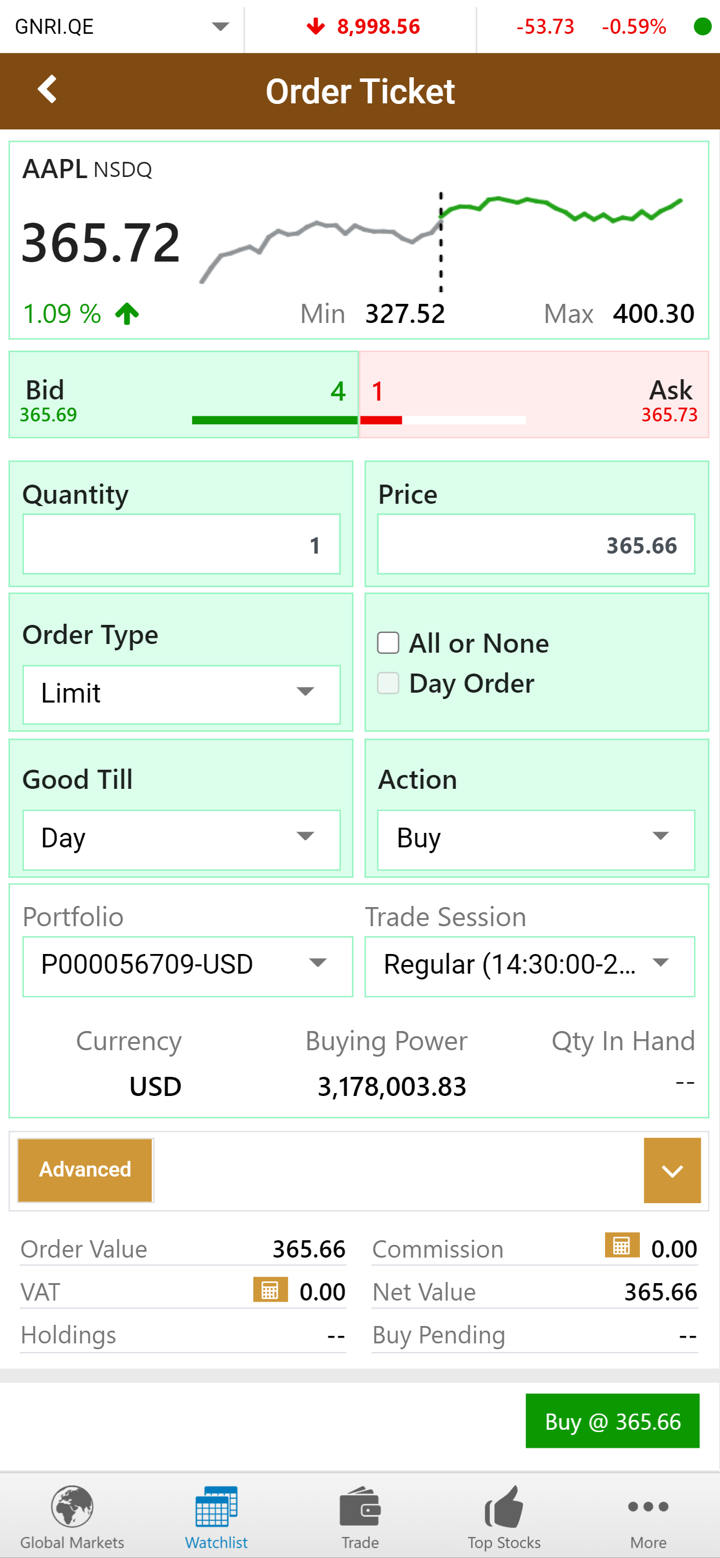

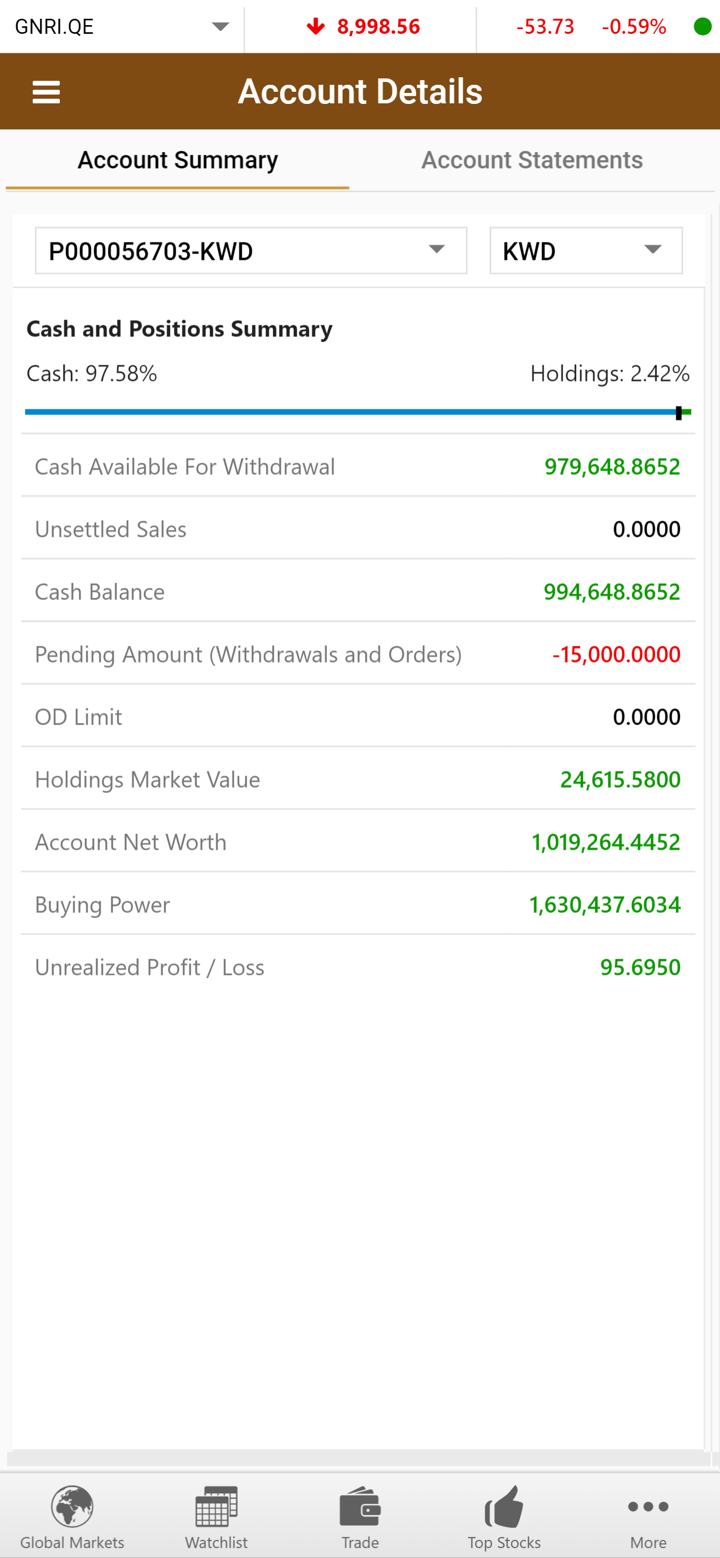

| 계정 유형 | 최소 입금액 | 최대 레버리지 | 스프레드 | 수수료 |

| 전문가 | $1,000 | 1:300 | 0 pips | $4/side |

| 표준 | $100 | 1:300 | 1 pip | ❌ |

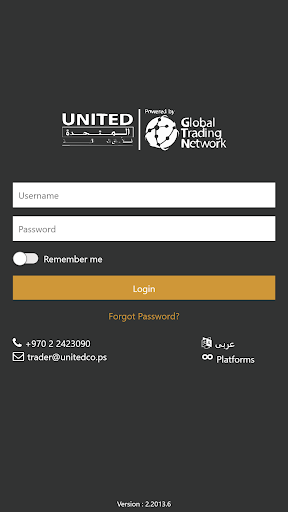

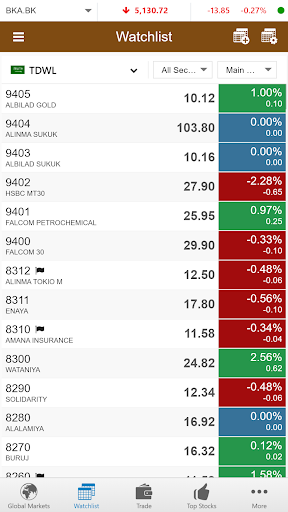

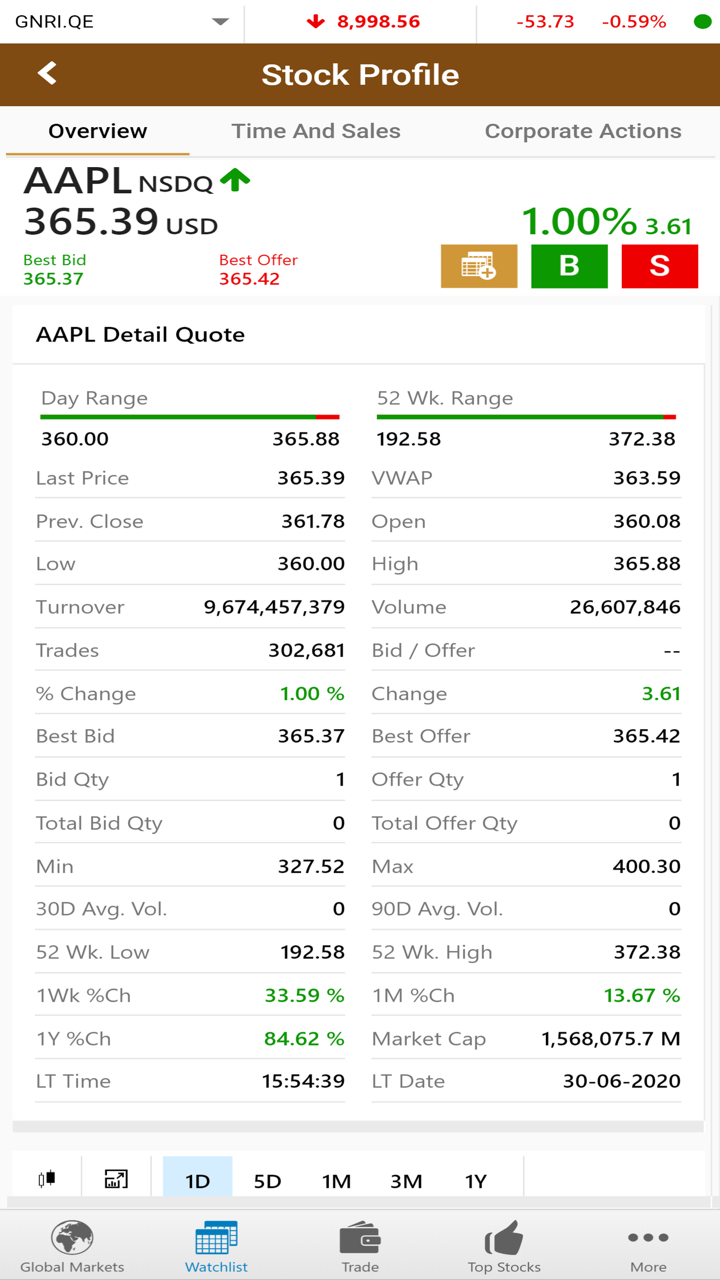

거래 플랫폼

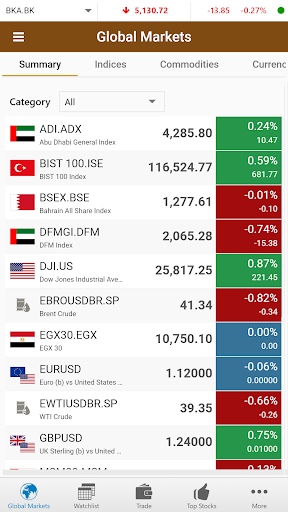

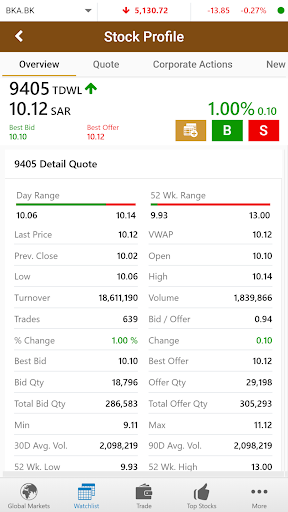

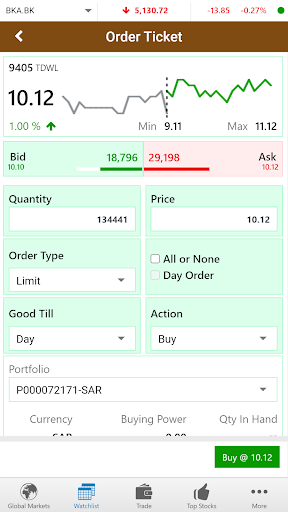

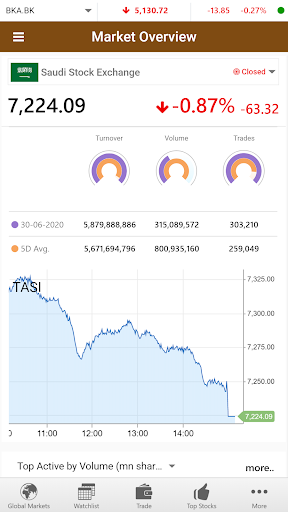

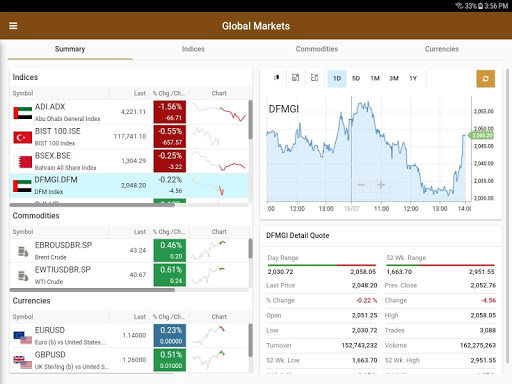

| 거래 플랫폼 | 지원 | 사용 가능한 장치 | 적합한 대상 |

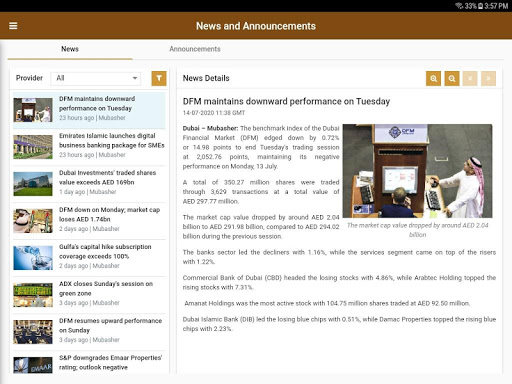

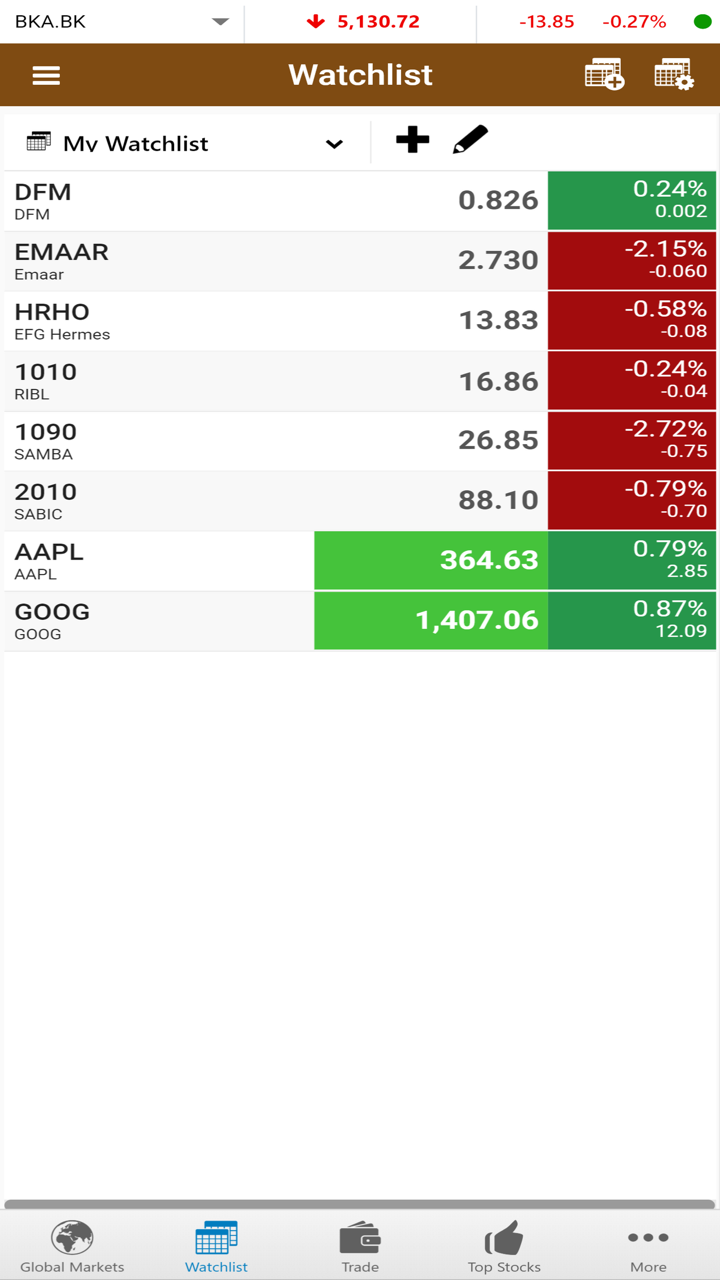

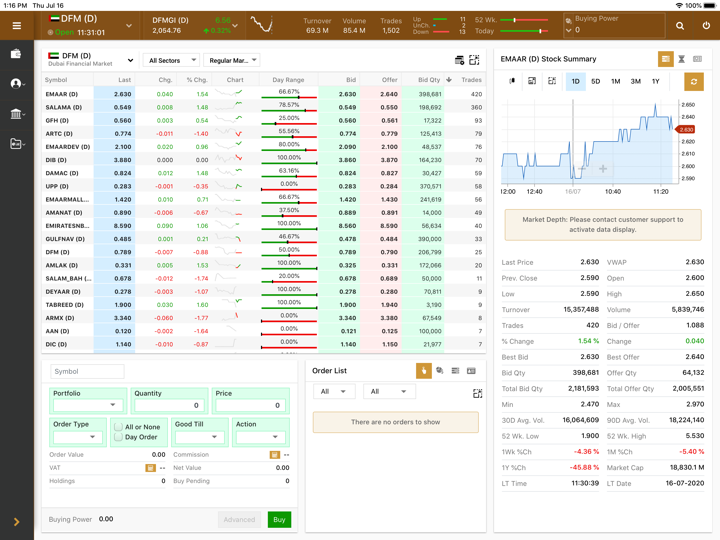

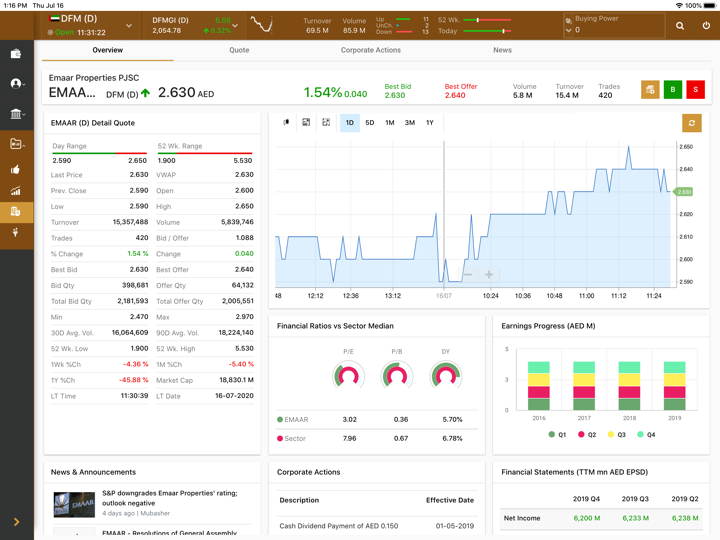

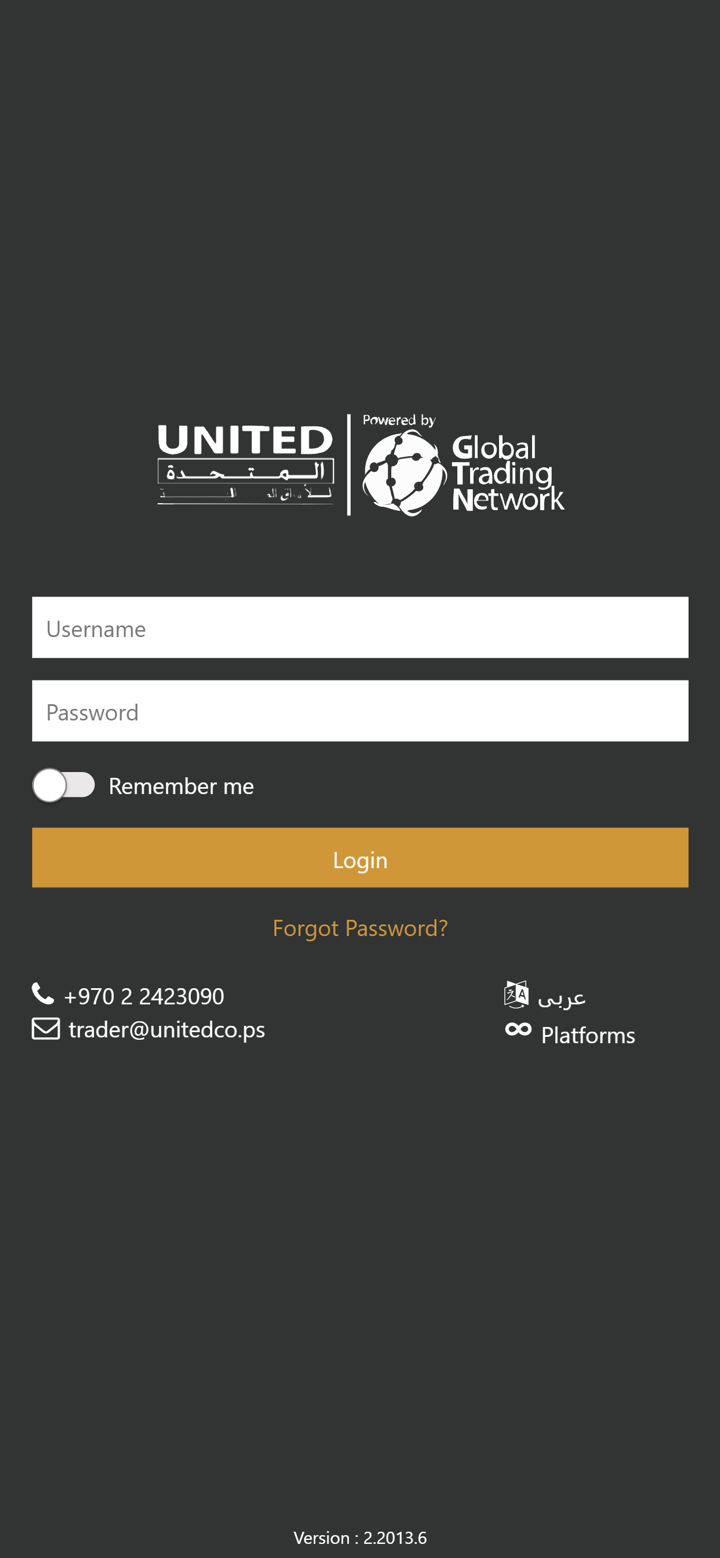

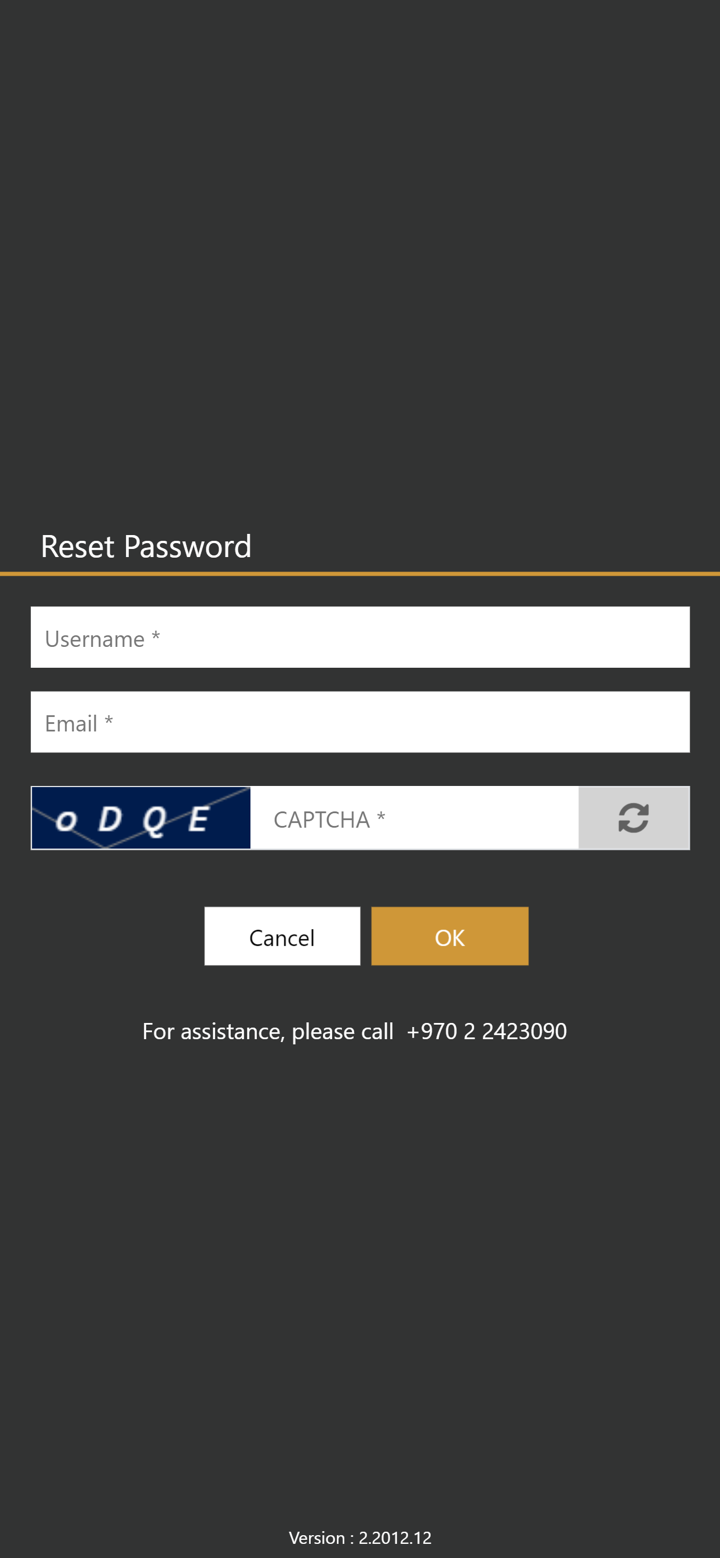

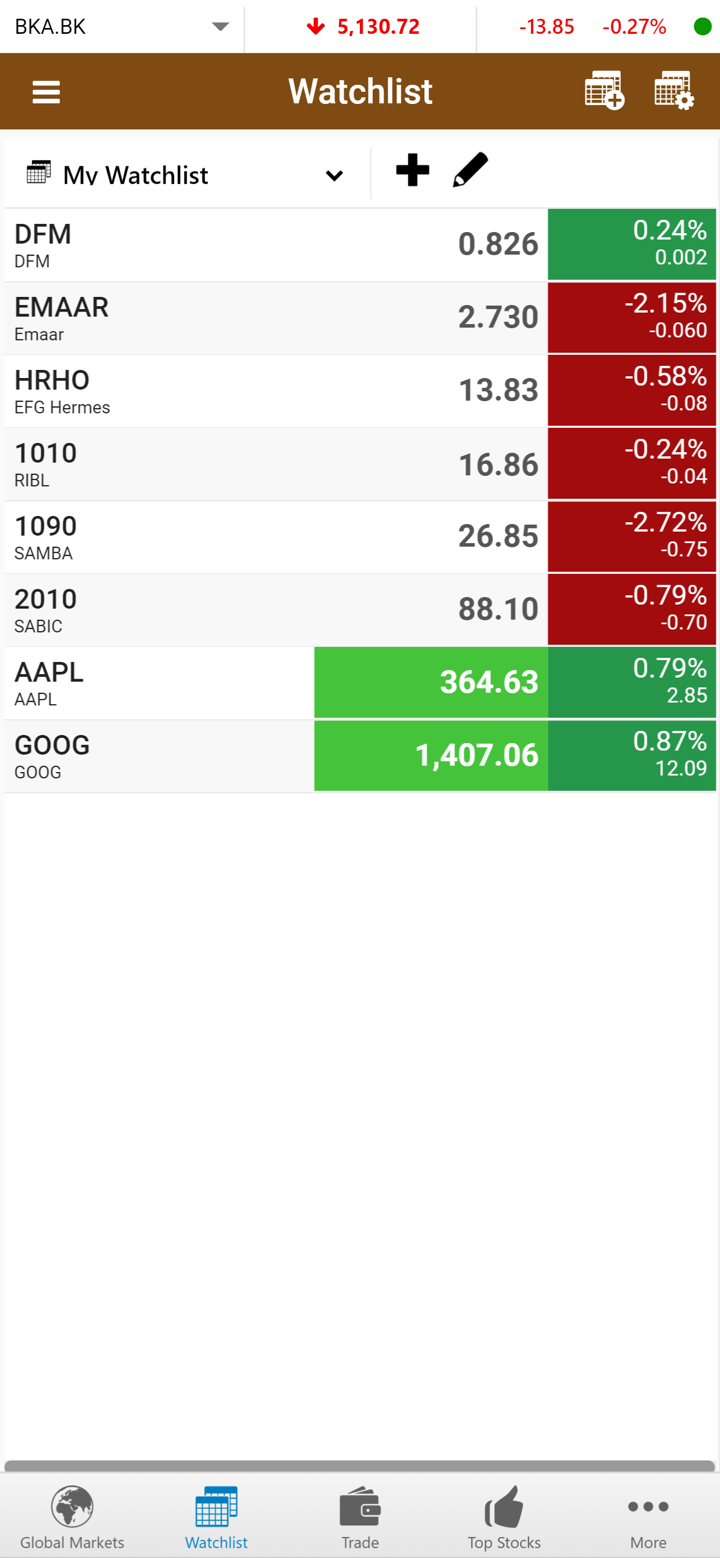

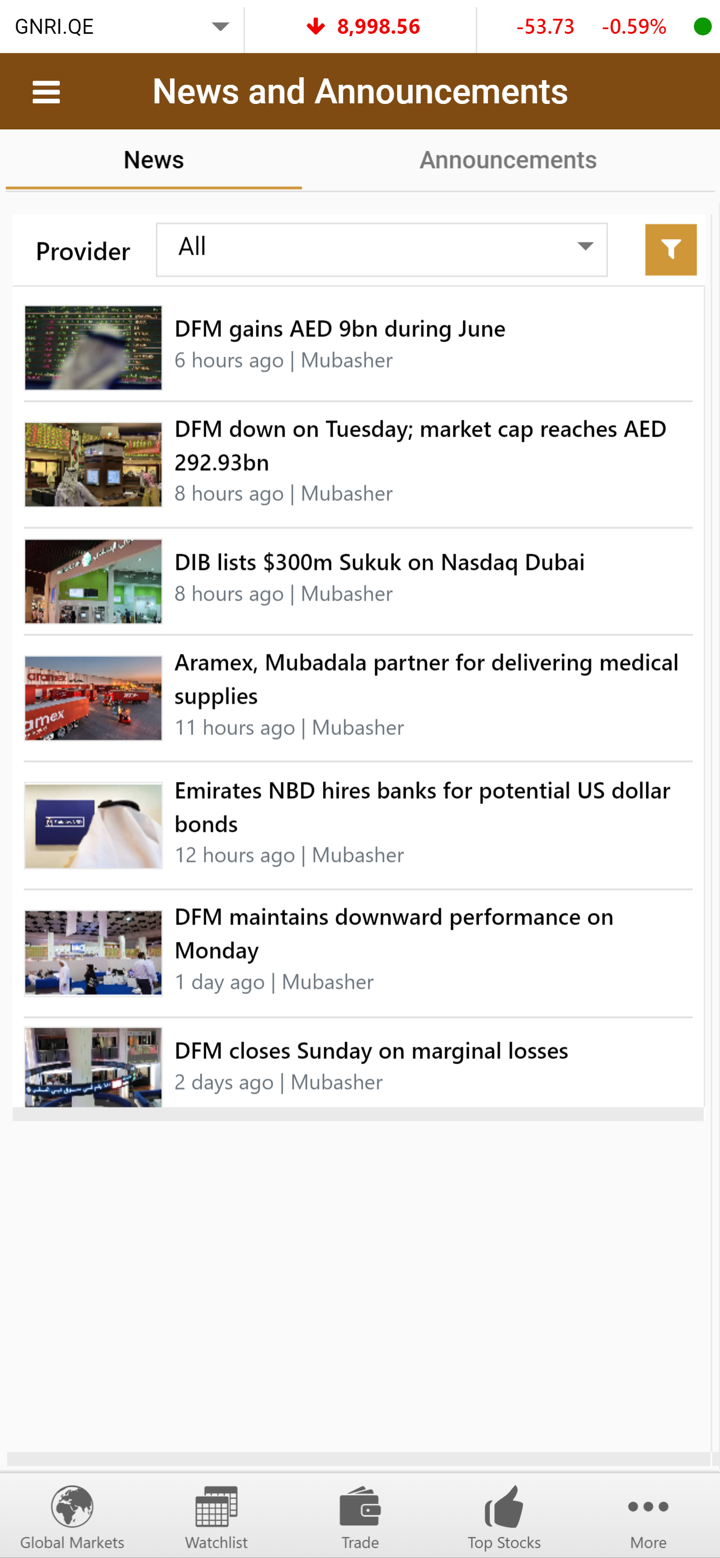

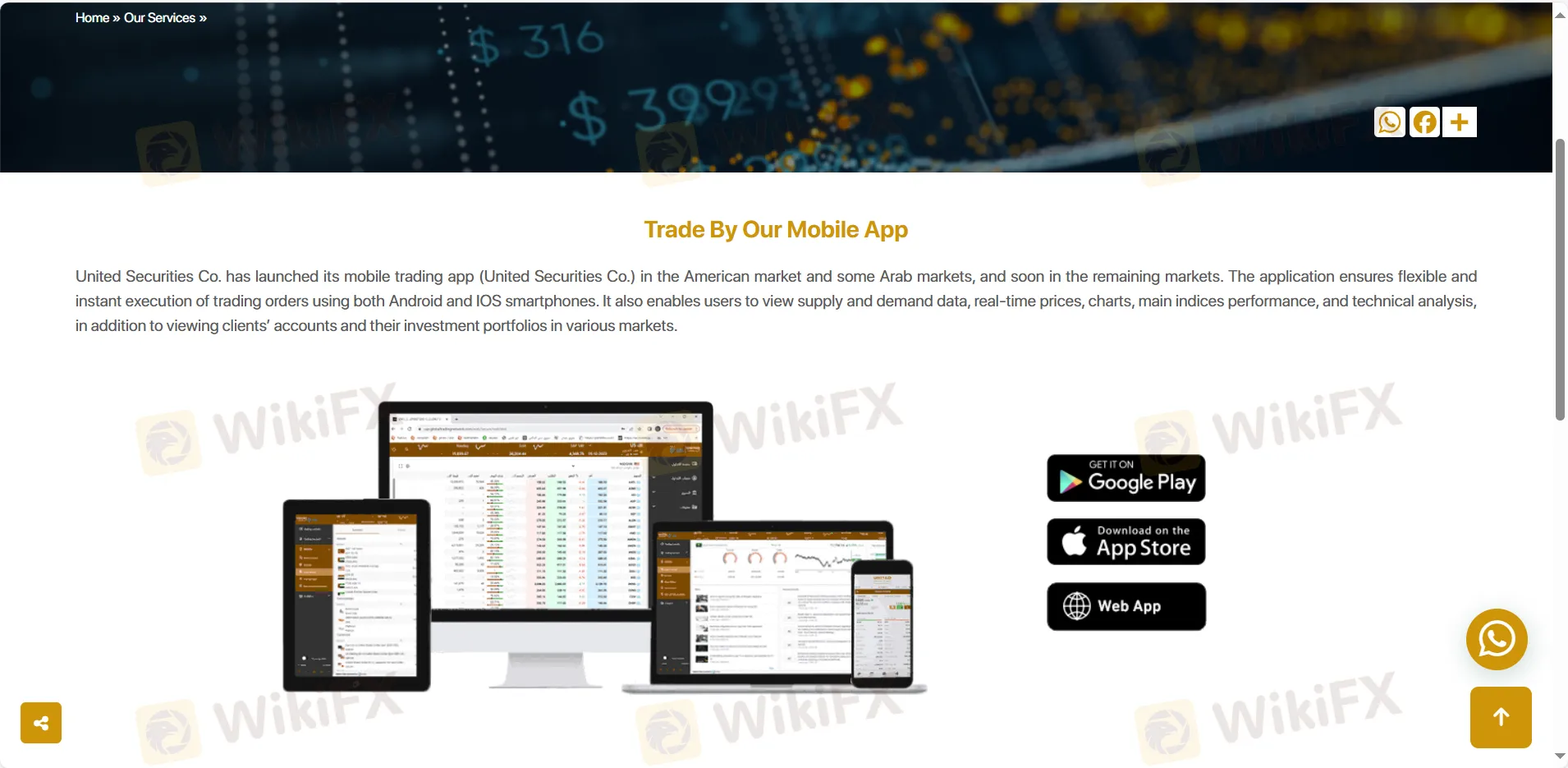

| United Securities Co. 앱 | ✔ | 모바일, 데스크톱, 노트북 | / |

| MT5 | ✔ | 모바일, 데스크톱, 웹 | 경험 있는 트레이더 |

| MT4 | ❌ | / | 초보자 |

입금 및 출금

United Securities Co.은(는) VISA, mastercard 및 은행송금을 통한 결제를 받습니다.