Riepilogo dell'azienda

Informazioni generali e regolamento

AXAgestori di investimenti ( AXA im) è un gestore patrimoniale globale ed è una controllata di AXA gruppo. in asia offre soluzioni di investimento ai clienti dal 1998. AXA investment manager asia limited (aap809) è autorizzata dalla sfc di hong kong.

Capacità di investimento

reddito fisso: attraverso l'analisi del credito bottom-up e la ricerca macroeconomica top-down, AXA im mira a fornire soluzioni orientate ai risultati per i clienti attraverso una suite di prodotti che abbracciano lo spettro del reddito fisso.

Azioni: azioni Framlington e azioni Rosenberg

Multi Asset: i fondi multi-asset sono in grado di investire in tutto l'orizzonte di investimento e possono essere costituiti da azioni, obbligazioni, liquidità e altri veicoli di investimento. Ciò può fornire un grado di diversificazione potenzialmente maggiore rispetto all'investimento in una singola classe di attività.

lResponsible Investing: un processo di investimento che incorpora fattori ambientali, sociali e di governance (ESG) nel suo approccio.

Servizio Clienti

se i clienti hanno domande o dubbi, inviare un'e-mail a AXA imasiasalesmarketing@ AXA -im.com per la consultazione.

Avviso di rischio

Quando investono nel reddito fisso, i clienti devono essere attenti ai rischi di tasso di interesse, rischi di credito, rischi di liquidità e rischi di inflazione.

山27387

Hong Kong

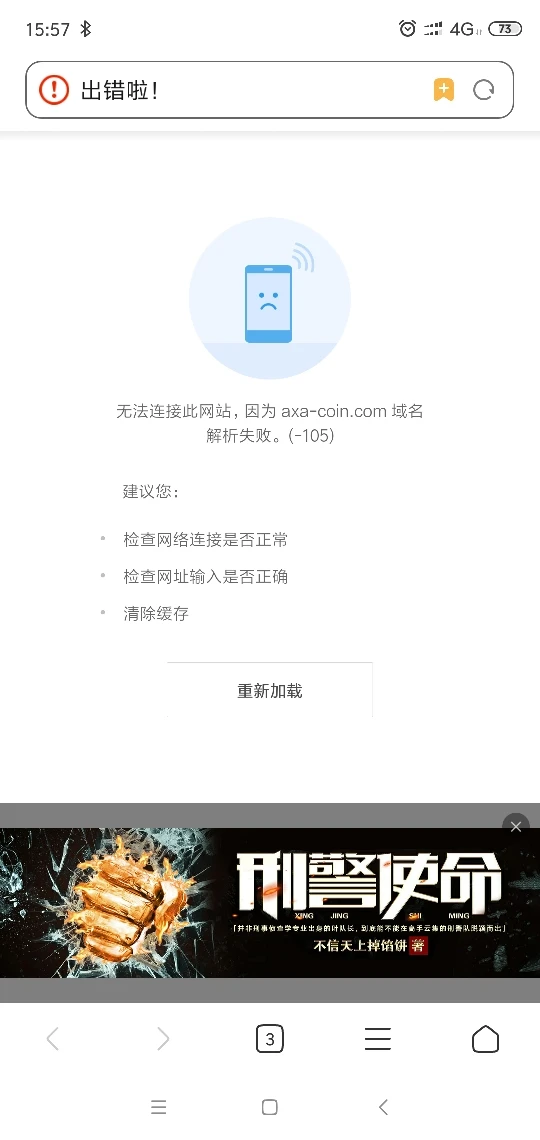

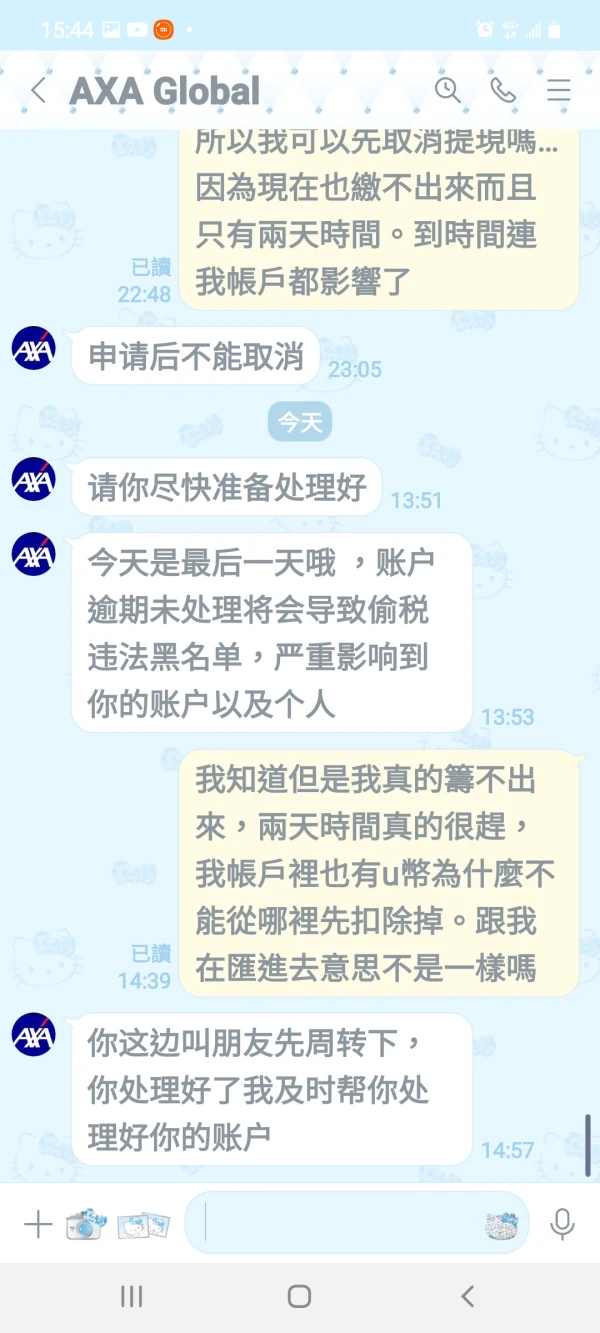

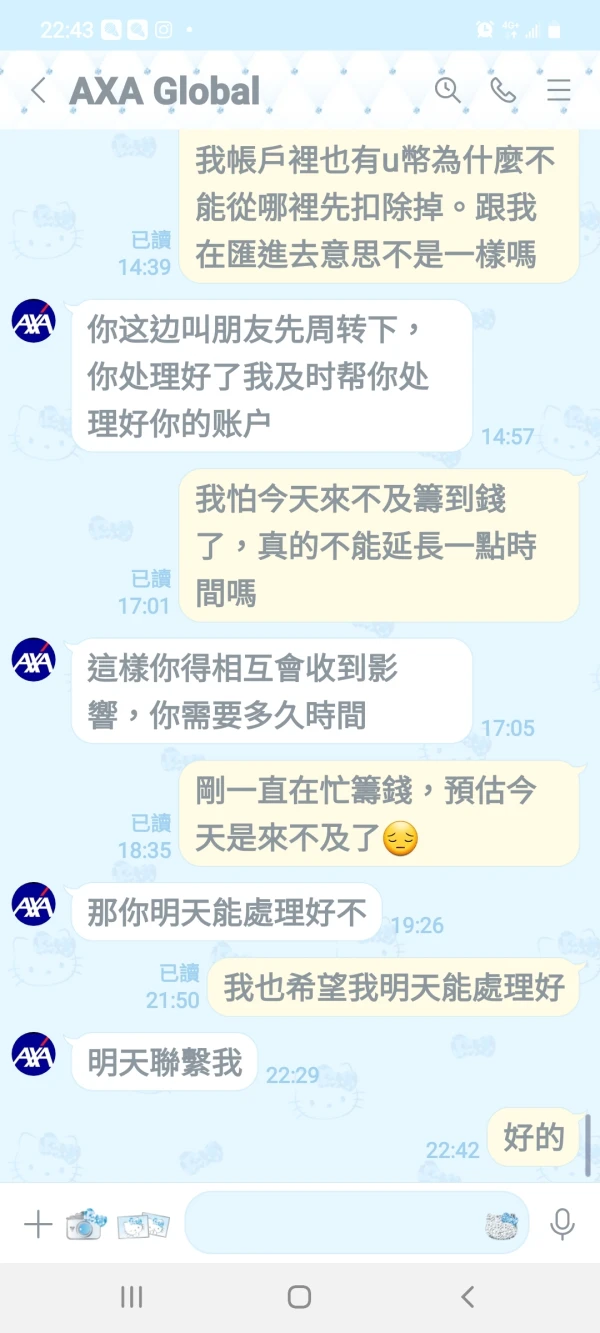

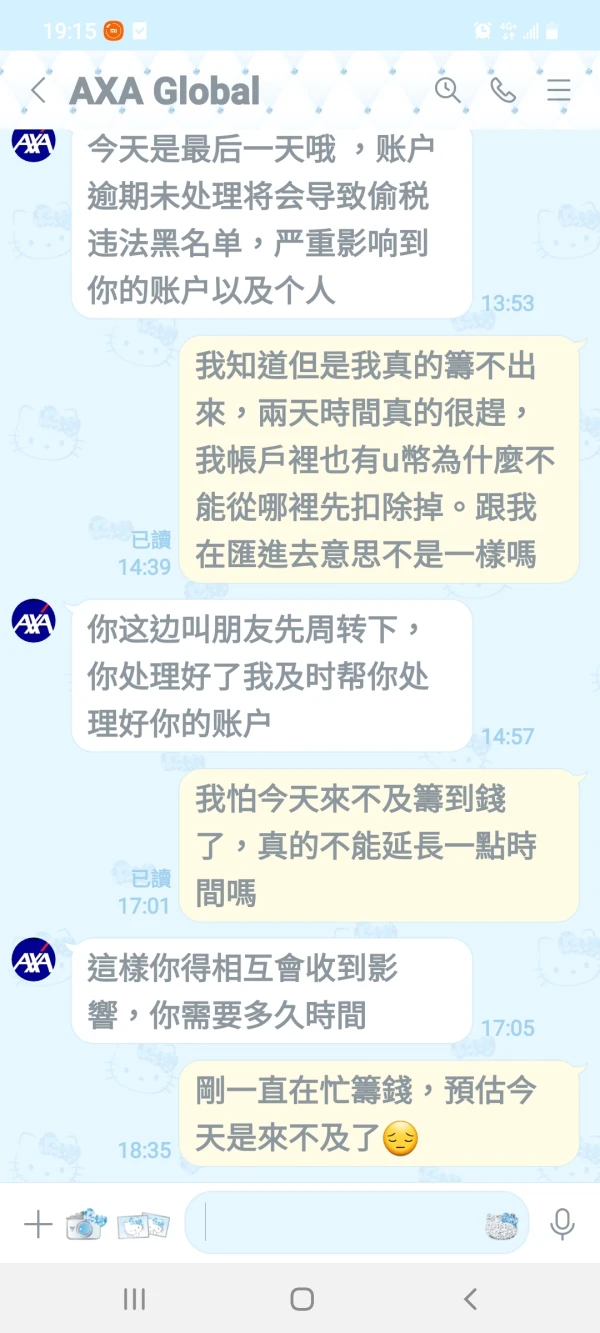

AXA congelare il mio account e non posso ritirarmi. Il servizio clienti è fuori contatto. Il sito web puo 'essere aperto.

Esposizione

FX1236648509

Taiwan

Il servizio clienti si è rifiutato di pagarmi il prelievo.

Esposizione

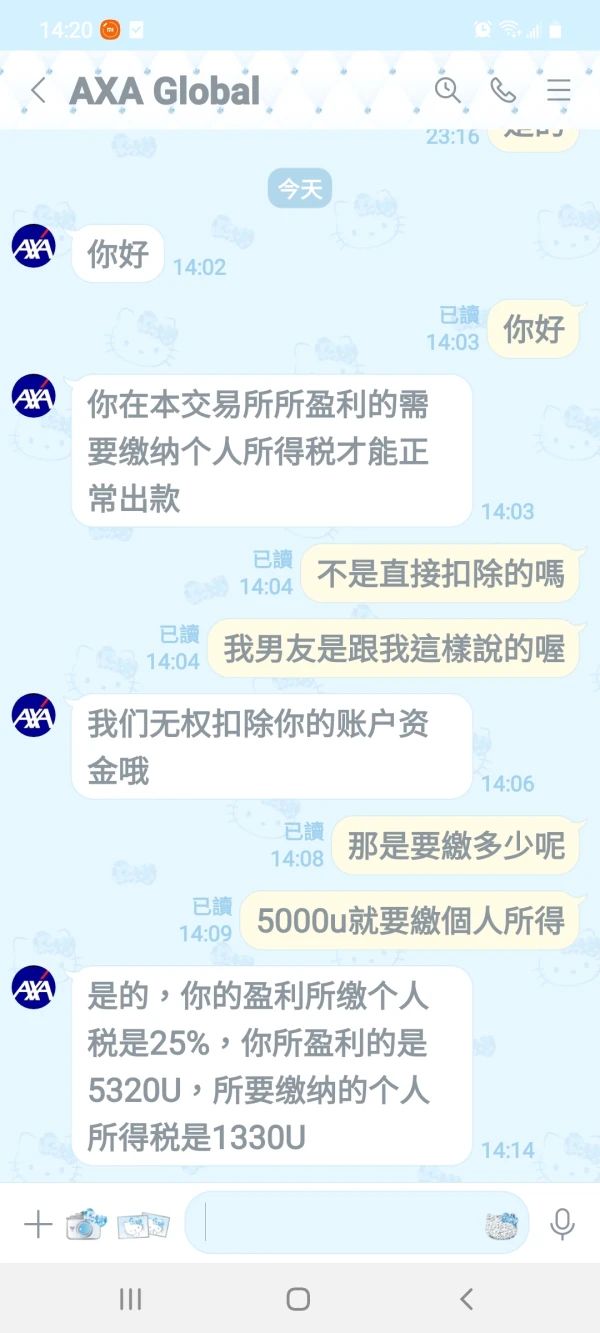

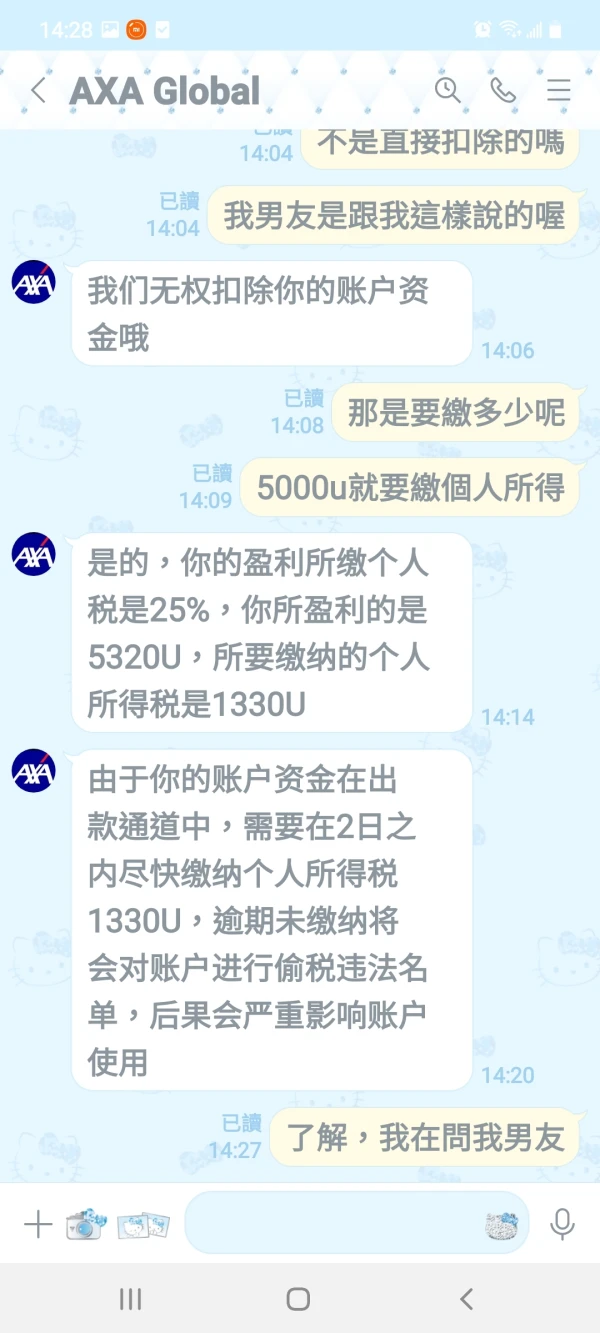

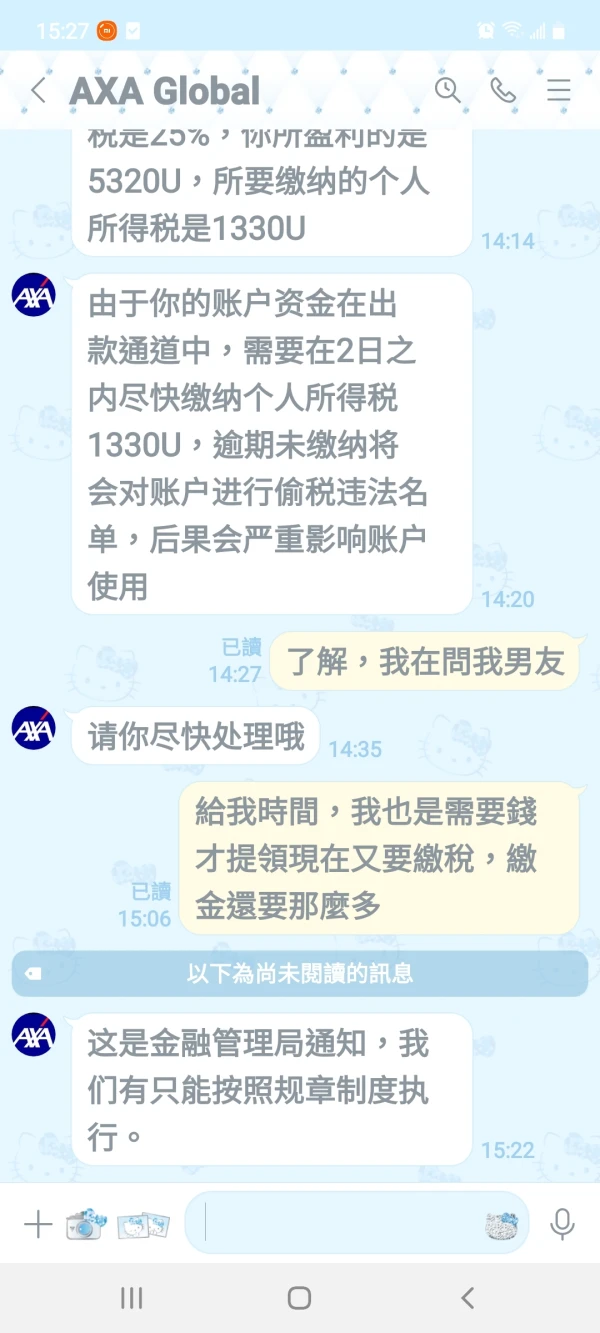

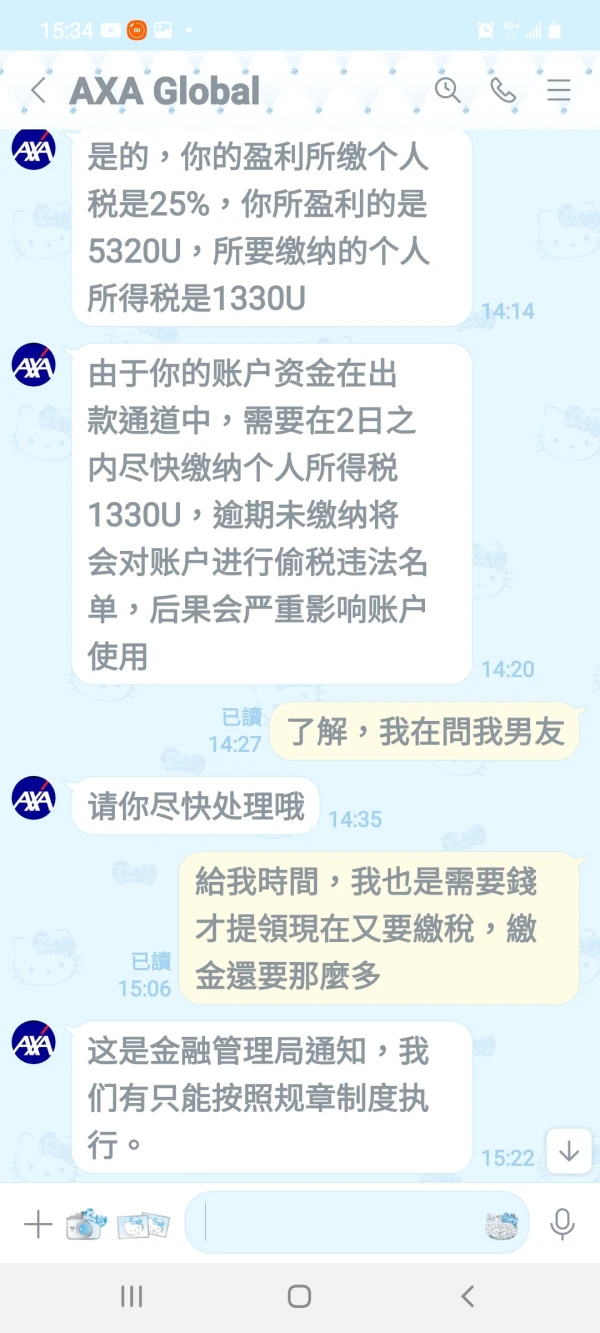

詹孟玟

Taiwan

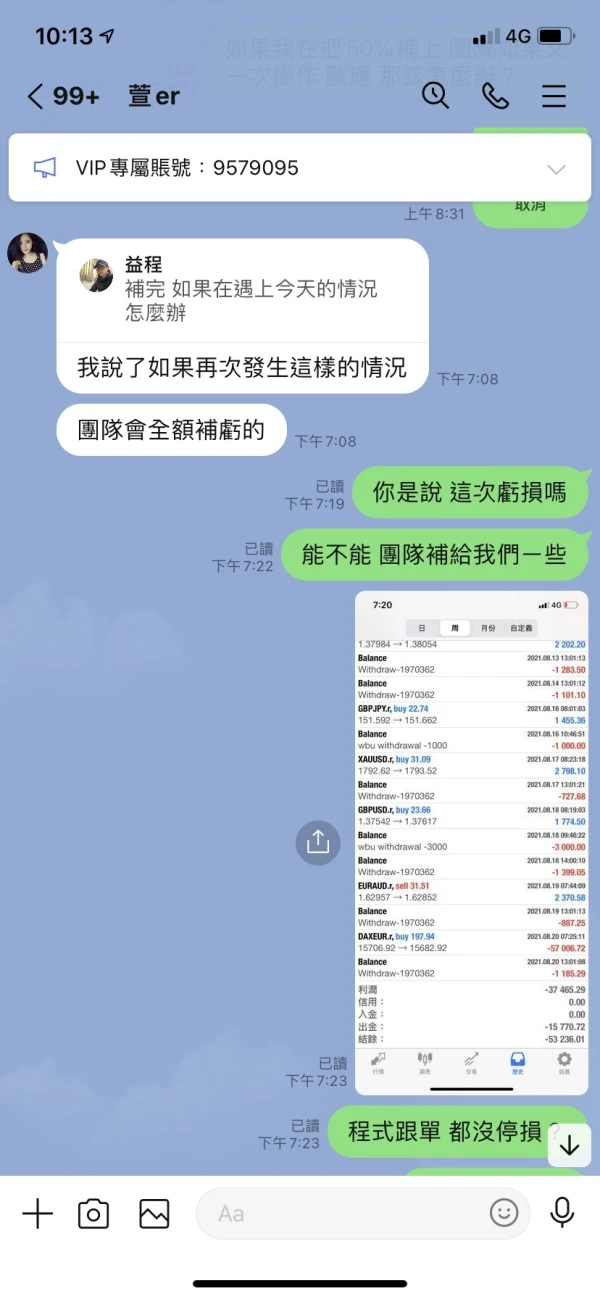

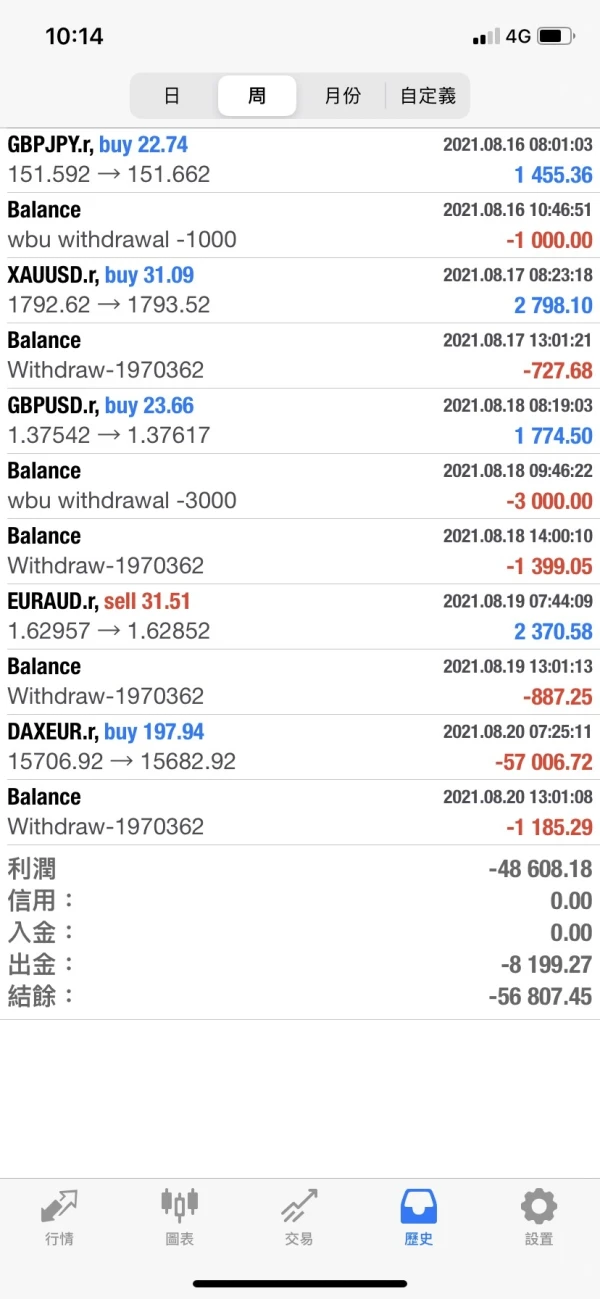

Il servizio clienti lo ha detto e non ero sicuro della sua realtà. Potrei riavere i miei soldi?

Esposizione

FX1566795049

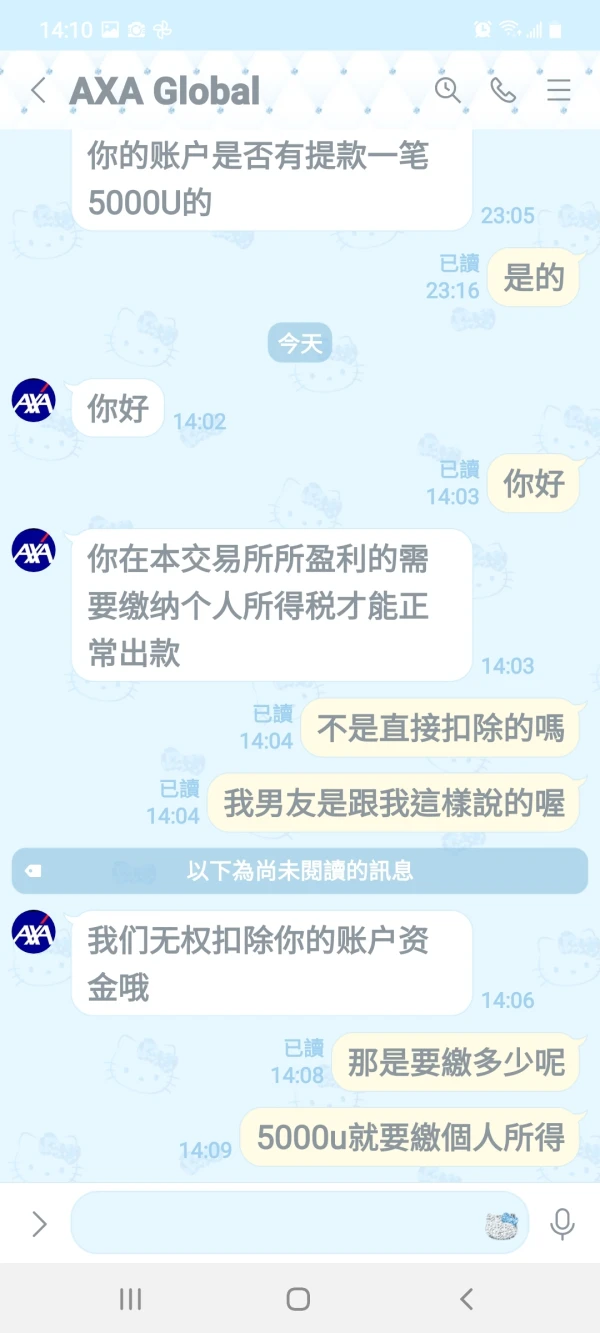

Cipro

La mia recente chiacchierata con il servizio clienti AXA ha rivelato che per i prelievi è richiesta un'imposta sul reddito personale del 25%. Non ho chiarezza sulla procedura e sul potenziale rimborso, sono preoccupato per la trasparenza e l'affidabilità dei servizi AXA. La chiarezza su questi argomenti migliorerebbe notevolmente l’esperienza dell’utente.

Neutro

贫僧悟道ing......

Stati Uniti

Fornisce una varietà di prodotti di investimento, inclusi fondi azionari, fondi obbligazionari, ecc., Anche i prodotti di fondi sono completi, fornendo dati dettagliati sui fondi e analisi dei grafici, la pagina del sito Web è semplice e facile da capire, il processo di transazione è relativamente semplice, è una piattaforma di investimento che vale la pena considerare.

Positivo