Punteggio

R Wadiwala

India | 5-10 anni |

India | 5-10 anni |http://www.rwsec.com

Sito ufficiale

Indice di valutazione

Influenza

Influenza

C

Indice di influenza NO.1

India 4.97

India 4.97 Contatto

Licenza Forex

Licenza Forex

Nessuna licenza di trading sul forex trovata. Si prega di essere consapevoli dei rischi.

- Questo broker non è soggetto a una regolamentazione valida per il mercato forex. Si prega di essere consapevoli del rischio!

Informazioni di base

India

India Gli utenti che hanno visualizzato R Wadiwala hanno visualizzato anche..

VT Markets

TMGM

EC markets

taurex

Sito web

rwsec.com

123.108.43.92Posizione del serverIndia

Registrazione ICP--Principali paesi/aree visitati--Data di validità del dominio--Nome del sito--Azienda--

Relazioni Genealogia

Società collegate

Domande e risposte Wiki

Can you tell me the highest leverage R Wadiwala provides on major forex pairs, and how their leverage policies differ across other asset classes?

From my research and personal due diligence, I haven't been able to verify the specific leverage levels offered by R Wadiwala on major forex pairs or other asset classes. When I looked into R Wadiwala, one of the main issues I found was the lack of transparent and reliable regulatory information; the broker currently operates without a recognized license. This absence of oversight means critical trading parameters like leverage are neither easily accessible nor clearly outlined by the broker. For me, that’s a considerable red flag because leverage policies directly impact trading risk. As an experienced trader, I’m well aware that regulated brokers must disclose leverage limits as part of their compliance with financial authorities, making it easier for traders to assess and manage risk. In contrast, brokers with “suspicious regulatory licenses” and “high potential risk” scores, as I noted R Wadiwala has, are not bound by such consumer protections. Without clear regulatory guidelines or published details, there’s an inherent uncertainty about leverage arrangements for forex, equities, or any other assets on their platform. For this reason, I would proceed with extreme caution. Personally, I would not engage live capital with any provider that cannot clearly and transparently communicate its leverage structure and risk policies, especially in the absence of credible oversight. My experience has taught me that lack of clarity on such essential matters can expose traders to unacceptable levels of risk.

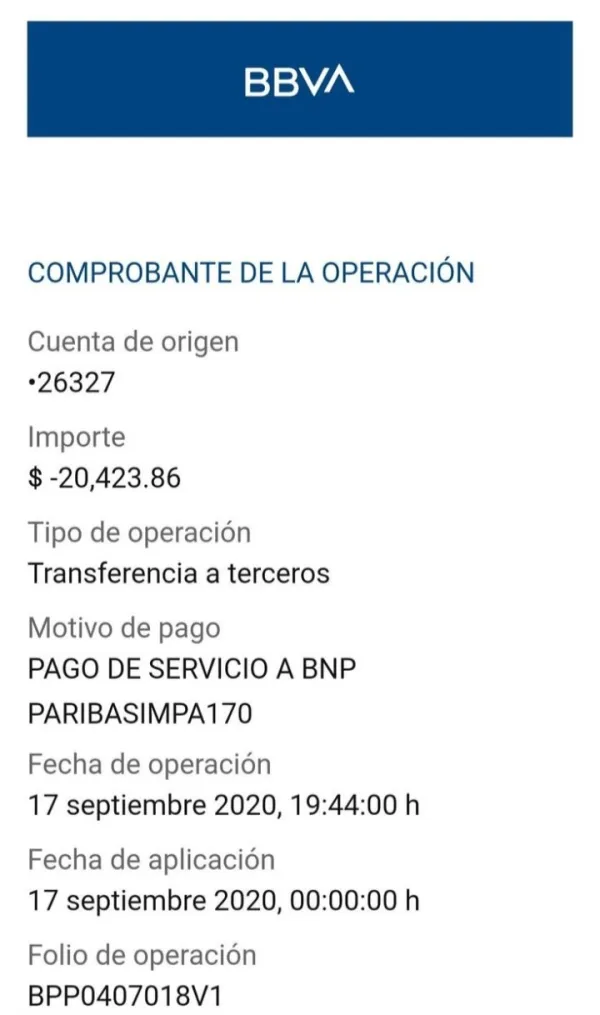

What documents do I usually need to provide in order to complete my initial withdrawal with R Wadiwala?

Based on my experience, whenever I approach a broker like R Wadiwala—especially one that is flagged with a suspicious regulatory license and lacks valid oversight—I proceed with heightened caution regarding document requirements for withdrawals. While the specific instructions are not clearly outlined in the available details, my general practice, especially with brokers operating in India or similar markets, has been to expect requests for a government-issued photo ID, recent proof of address (such as a utility bill or bank statement), and possibly documentation verifying the source of funds. This is typical to adhere to local compliance practices and anti-money laundering policies, even if regulation is questionable. Due to the high potential risk associated with R Wadiwala and the concerning user report of unapproved withdrawals and significant financial loss, I would personally ensure that any documents I submit do not expose unnecessary personal data beyond the essential requirements. My past experience has taught me that it is prudent to confirm document submission protocols directly with the broker via official support channels, and to retain copies of every communication. Given these risks, I only provide the minimum acceptable verification documents and always hesitate if I feel my information might not be handled securely. Ultimately, clarity and security around document handling are priorities for me, especially when there is a persistent lack of regulatory transparency.

How do the different account types available at R Wadiwala differ from each other?

Drawing from my thorough review of R Wadiwala as a trading platform, one of the most significant challenges I encountered was the lack of transparent information regarding account types. In my experience as a forex trader, a broker’s clarity on its offerings—be it account minimums, spreads, commissions, or available trading platforms—is critical for making informed decisions. However, after carefully reviewing available details, I found no specific outlines or distinctions regarding differing account types at R Wadiwala. This absence of clear account differentiation makes it difficult for me, or any trader, to accurately assess which type of account, if any, might meet particular trading needs or preferences. For someone like myself who relies on comparing costs, leverage options, and platform features, this is a considerable drawback. Further compounding my reservations, the broker is flagged for a suspicious regulatory license, no verified regulation, and high potential risk. The overall low score and reports of unresolved withdrawal issues underline why I approach such a broker with great caution. Given these factors, I cannot provide a reliable comparison of R Wadiwala’s account types, simply because the broker does not supply this information transparently. In my professional judgment, this lack of clarity is, itself, a risk that all serious traders should weigh heavily before opening an account.

Does R Wadiwala offer swap-free or Islamic trading account options for its clients?

Based on my careful review of R Wadiwala’s available information, I see no clear indication that they provide swap-free or Islamic trading account options for clients. As someone who has encountered brokers of varying standards over the years, I tend to be especially vigilant when it comes to regulatory status and transparency around account offerings—particularly for features as crucial as swap-free accounts, given their importance for traders with religious considerations. One of my top priorities when evaluating a broker is established, credible oversight. In R Wadiwala’s case, not only is there a lack of valid regulatory information, but there is also an explicit warning about their suspicious license and scope of business. The risk highlighted by their extremely low regulatory score weighs heavily for me, as I strongly prefer brokers that operate under strict international supervision and offer clearly documented account types with all relevant conditions spelled out. In my experience, legitimate brokers prominently detail whether they support Islamic accounts, either on their website or during the onboarding process. Here, I could not identify any such offering, nor sufficient transparency on specialized account types. Such gaps are concerning and, for me, would be a decisive factor in choosing to move forward with caution or to consider better-regulated alternatives, especially if swap-free trading is a must for my strategy or beliefs.

Recensioni utenti1

Cosa vuoi valutare

inserisci...

Commento 1

TOP

TOP

Chrome

Estensione Chrome

Inchiesta sulla regolamentazione del broker Forex globale

Sfoglia i siti Web dei broker forex e identifica accuratamente i broker legittimi e fraudolenti

Installa ora