Riepilogo dell'azienda

Informazioni generali e regolamento

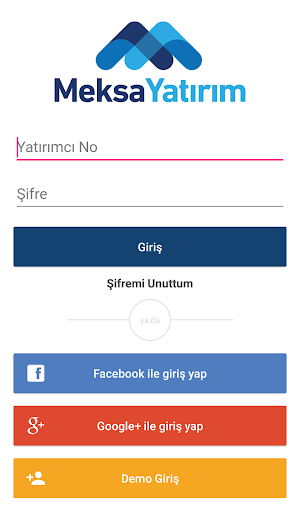

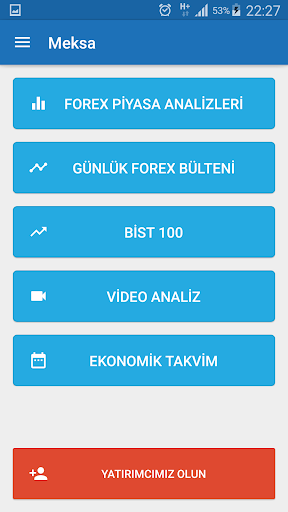

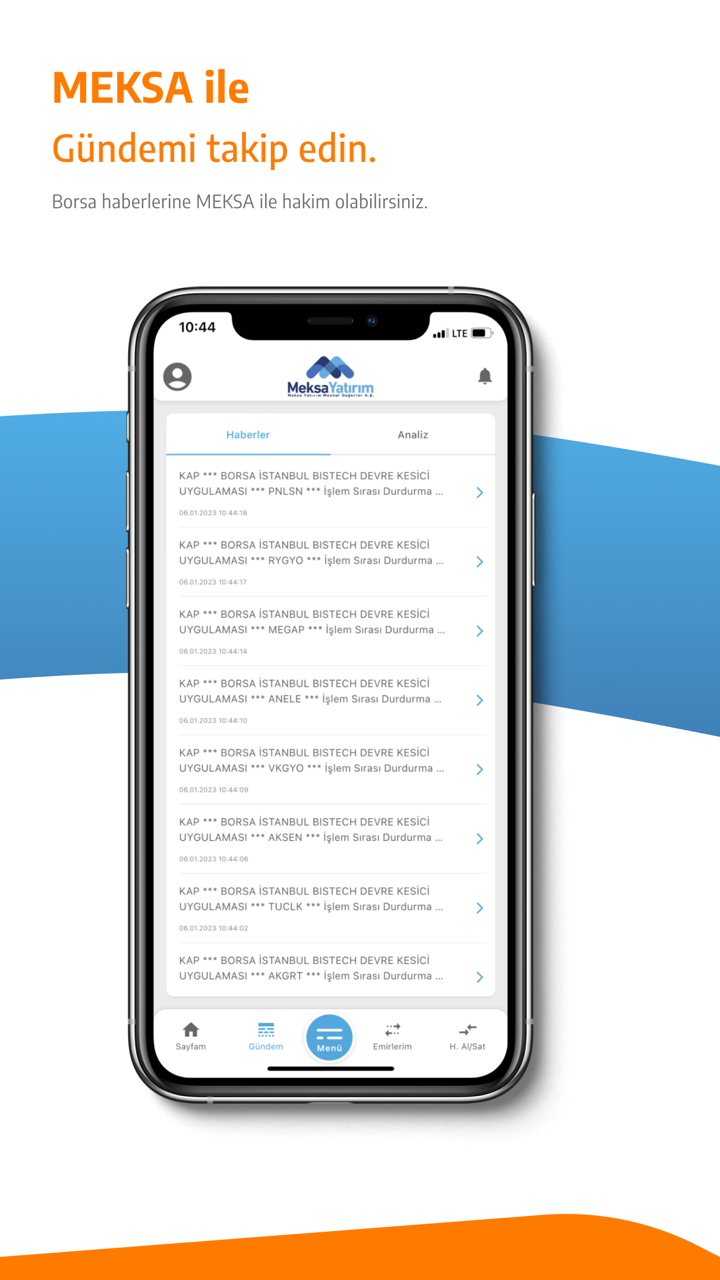

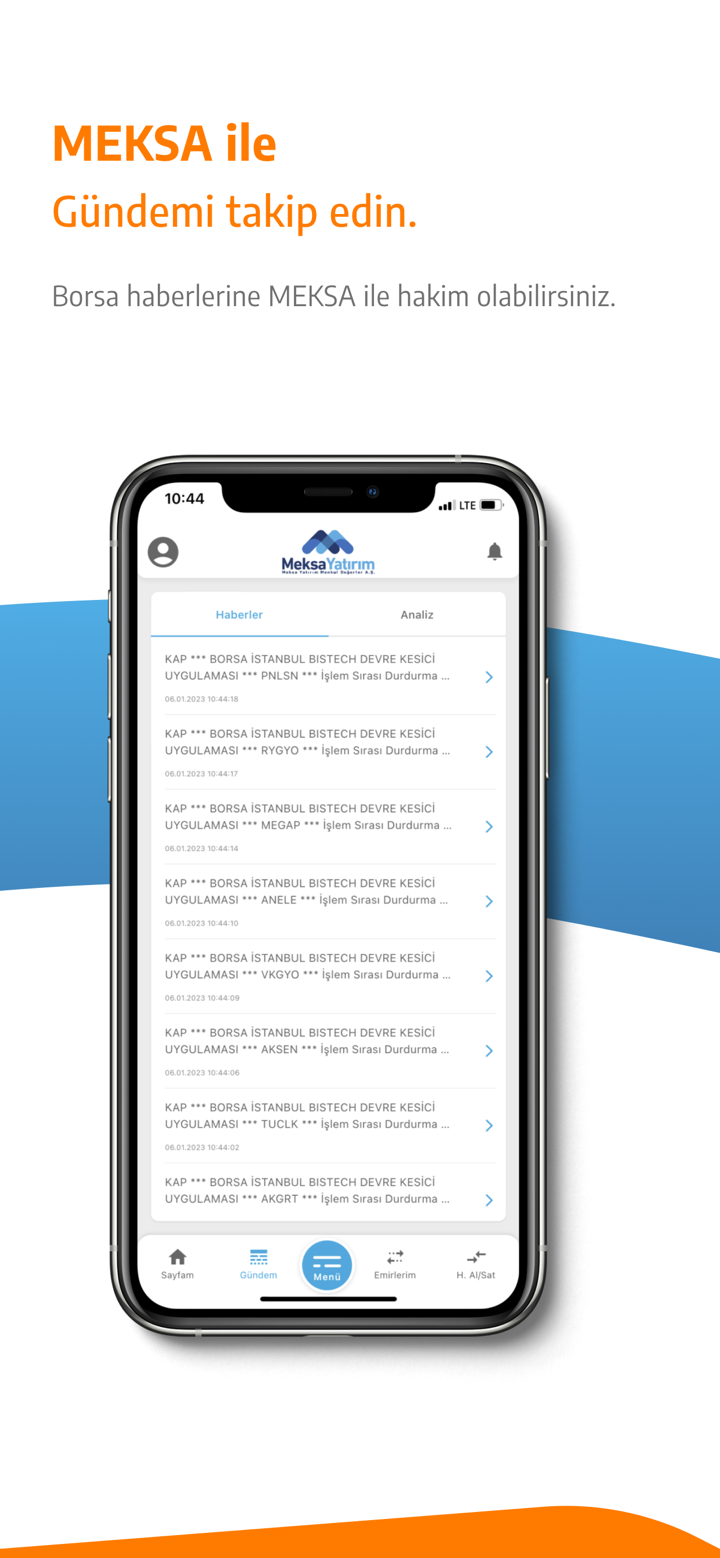

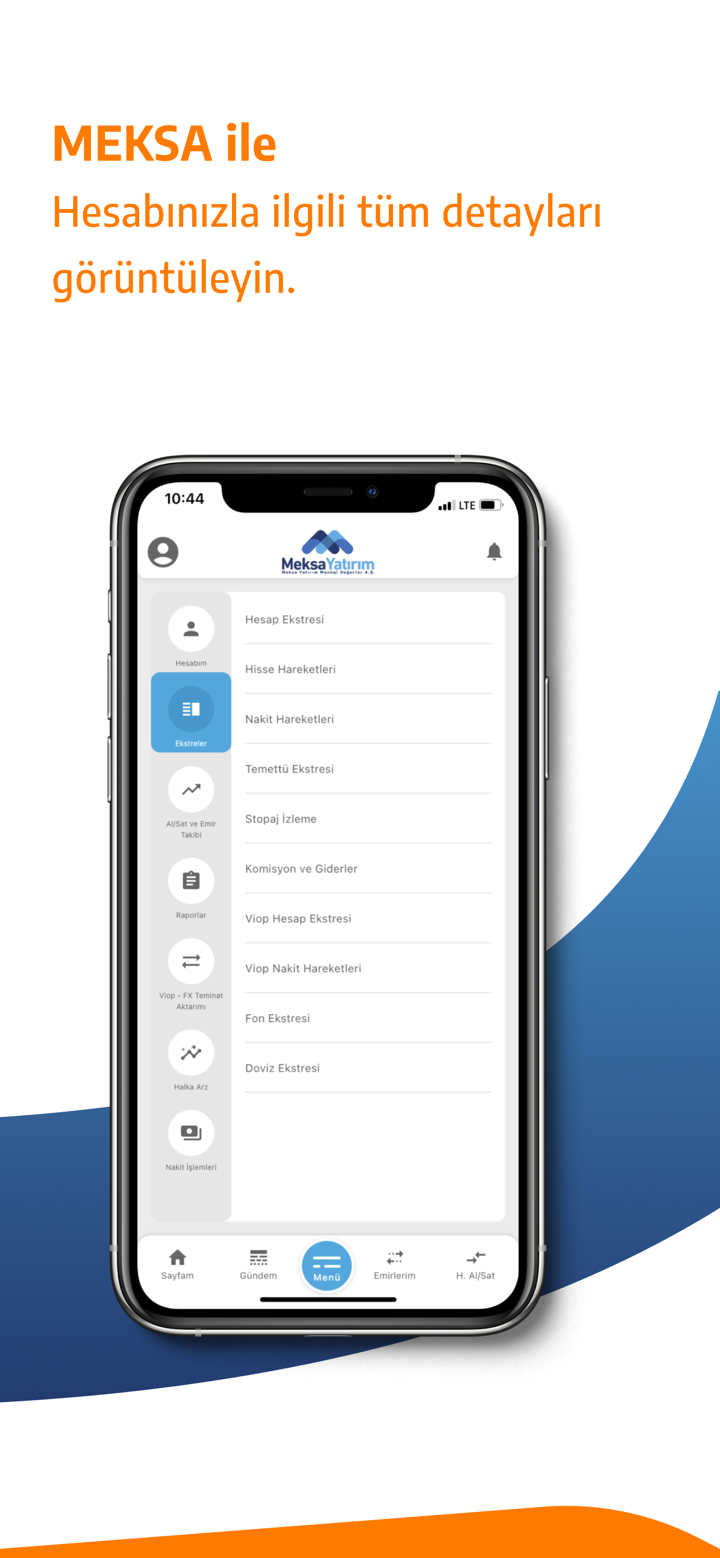

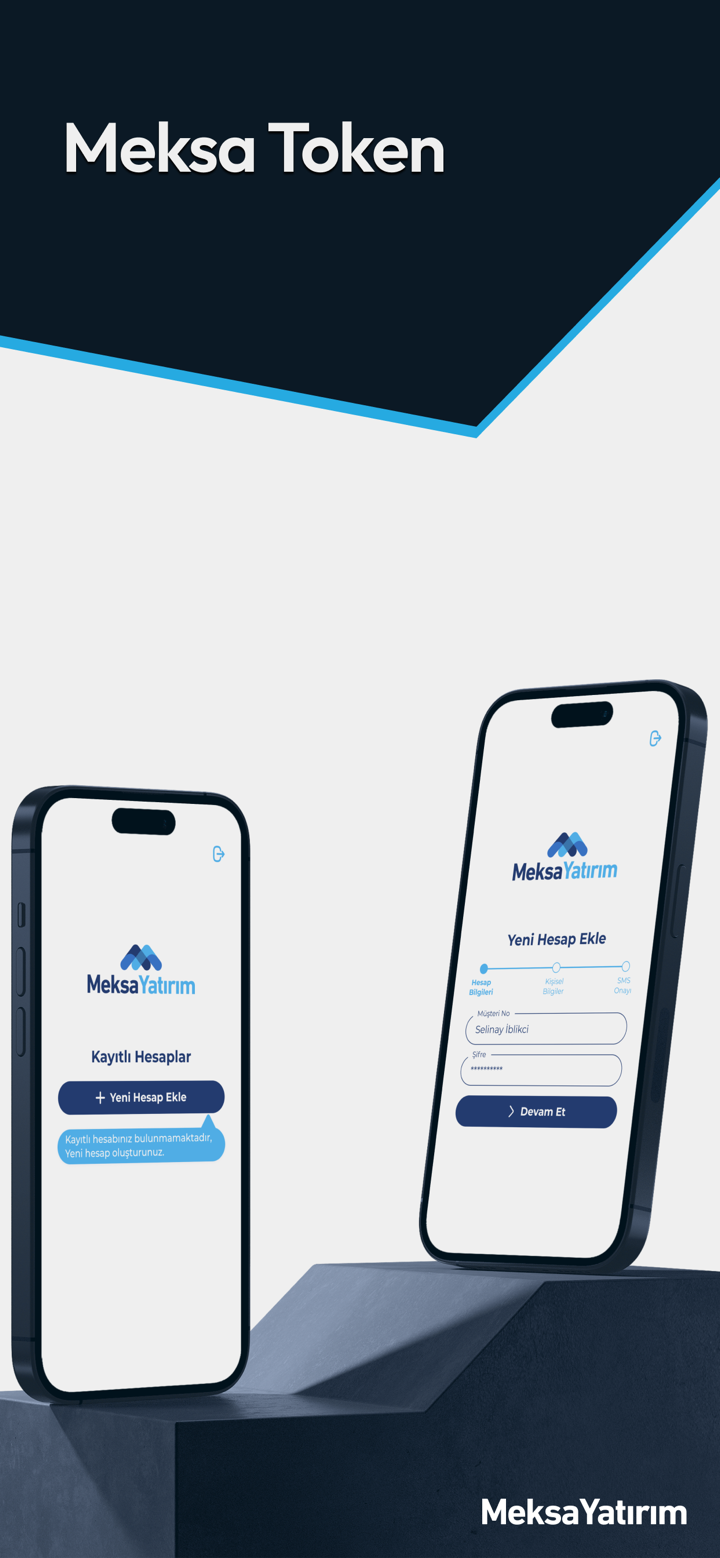

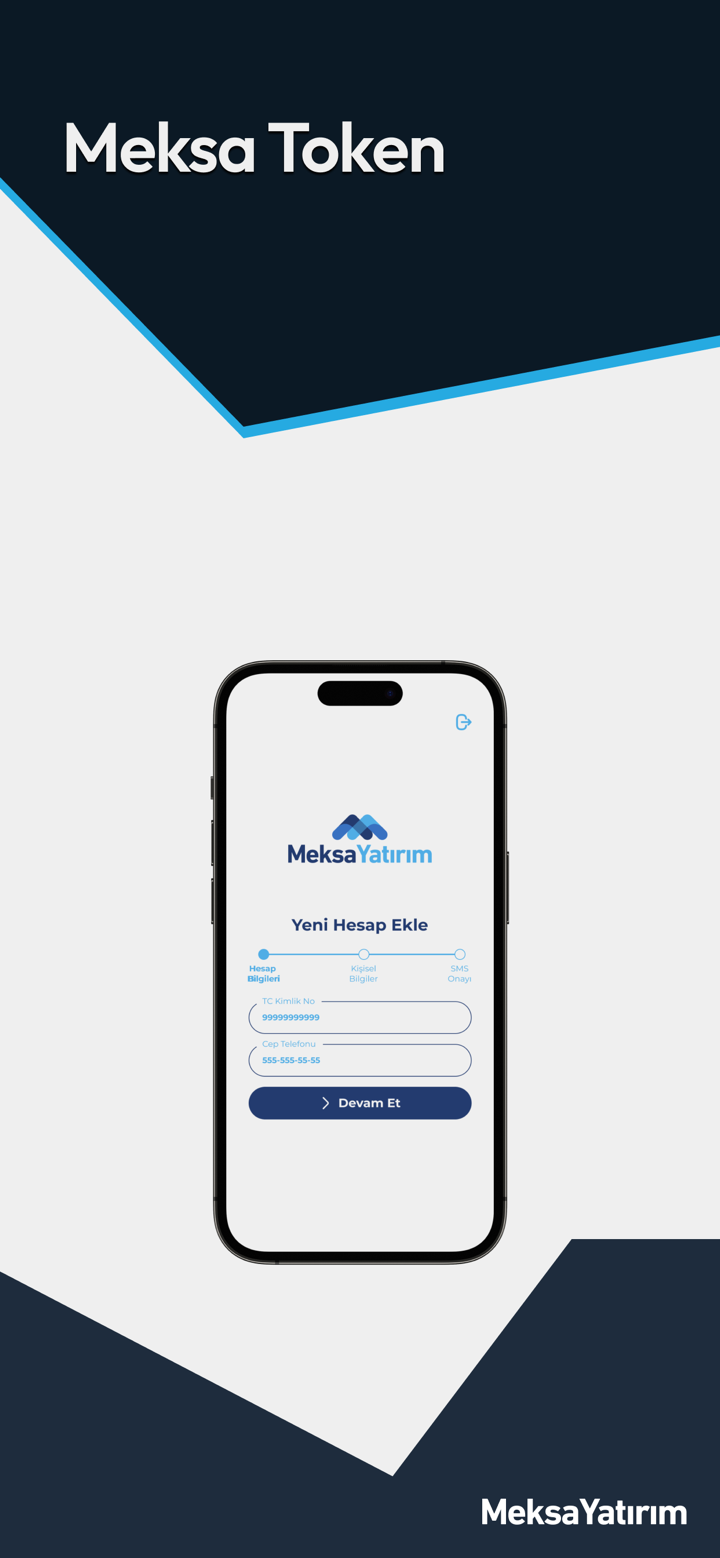

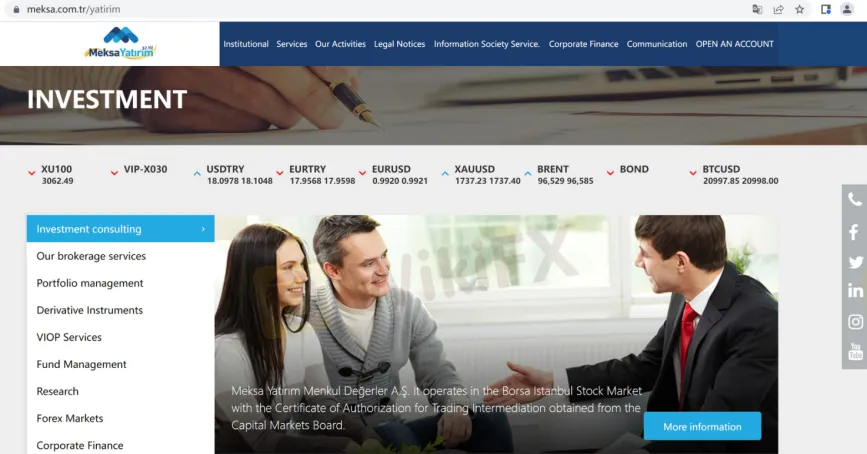

MEKSA, nome commerciale di Meksa Yatırım Menkul Değerler A.Ş , è presumibilmente una società di intermediazione finanziaria fondata il 28 giugno 1990 e registrata in turchia. il broker afferma di operare nel mercato azionario borsa istanbul con il certificato di autorizzazione all'intermediazione commerciale ottenuto dal consiglio dei mercati dei capitali, affermando di fornire ai propri clienti privati e aziendali vari servizi finanziari. ecco la home page del sito ufficiale di questo broker:

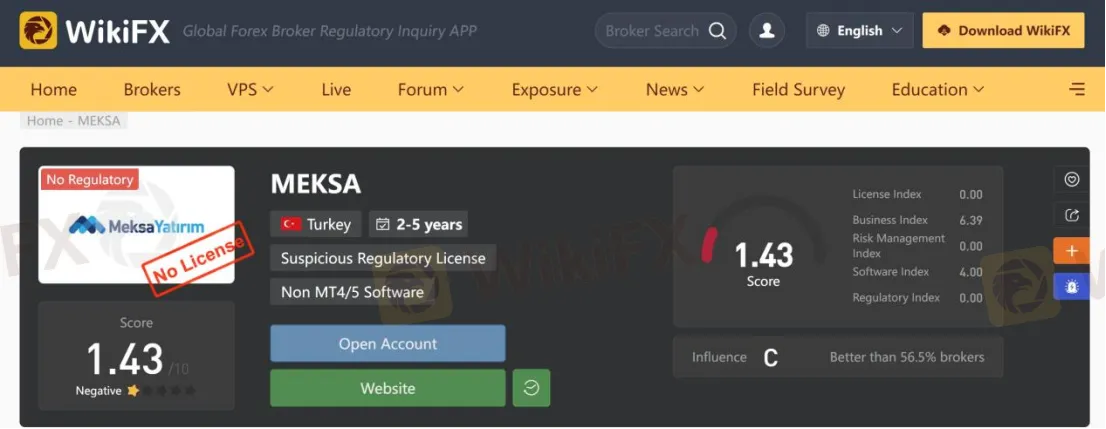

per quanto riguarda il regolamento, è stato verificato che MEKSA non rientra in nessun regolamento valido. ecco perché il suo stato normativo su wikifx è elencato come "nessuna licenza" e riceve un punteggio relativamente basso di 1,43/10. si prega di essere consapevoli del rischio.

Recensioni negative

un commerciante ha condiviso la sua terribile esperienza di trading nel MEKSA piattaforma su wikifx. Lui ha detto che MEKSA è un broker di truffe e non ha ricevuto il deposito promesso del 50% quando è arrivata la data. è necessario che i trader leggano le recensioni lasciate da alcuni utenti prima di scegliere i broker forex, nel caso in cui vengano truffati da truffe.

Servizi

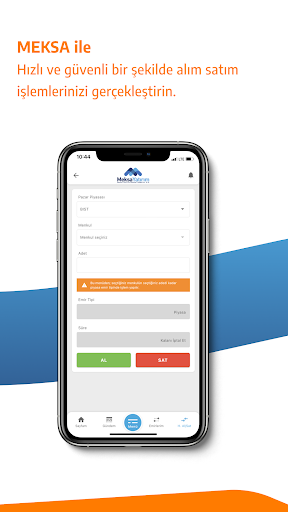

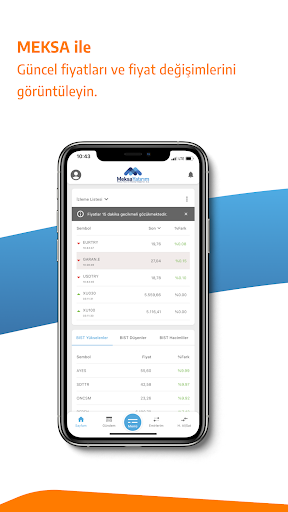

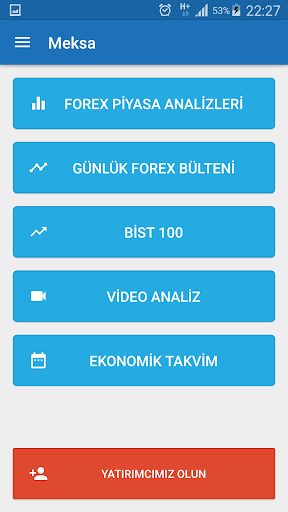

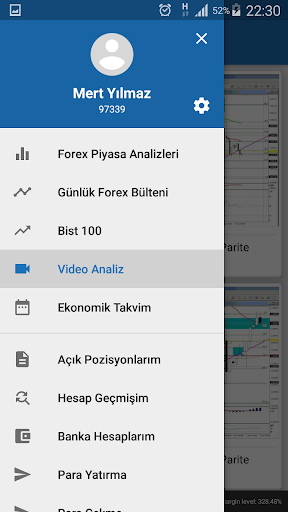

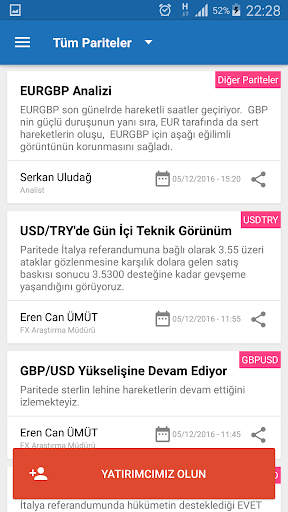

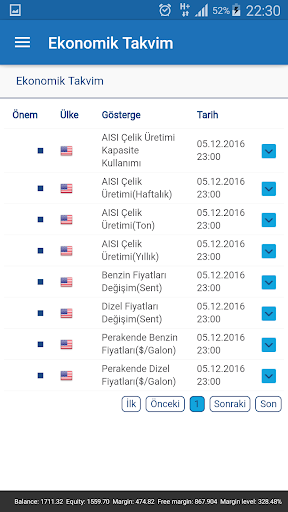

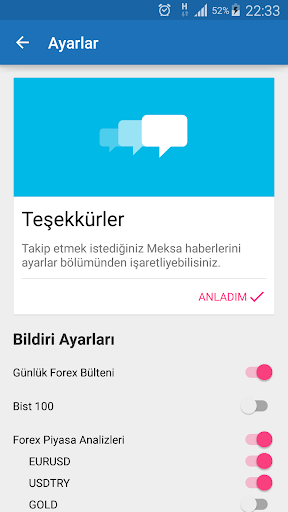

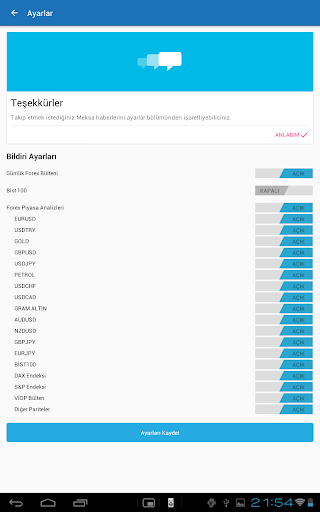

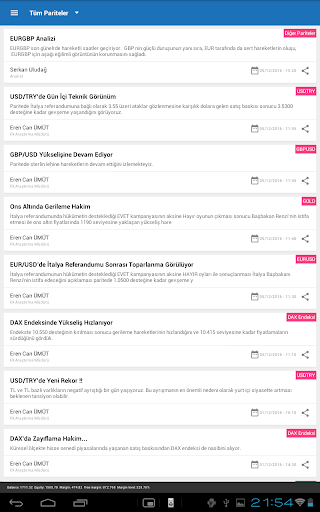

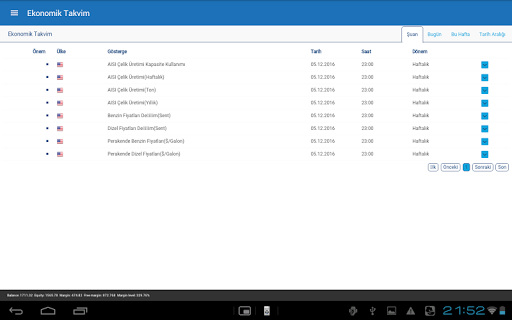

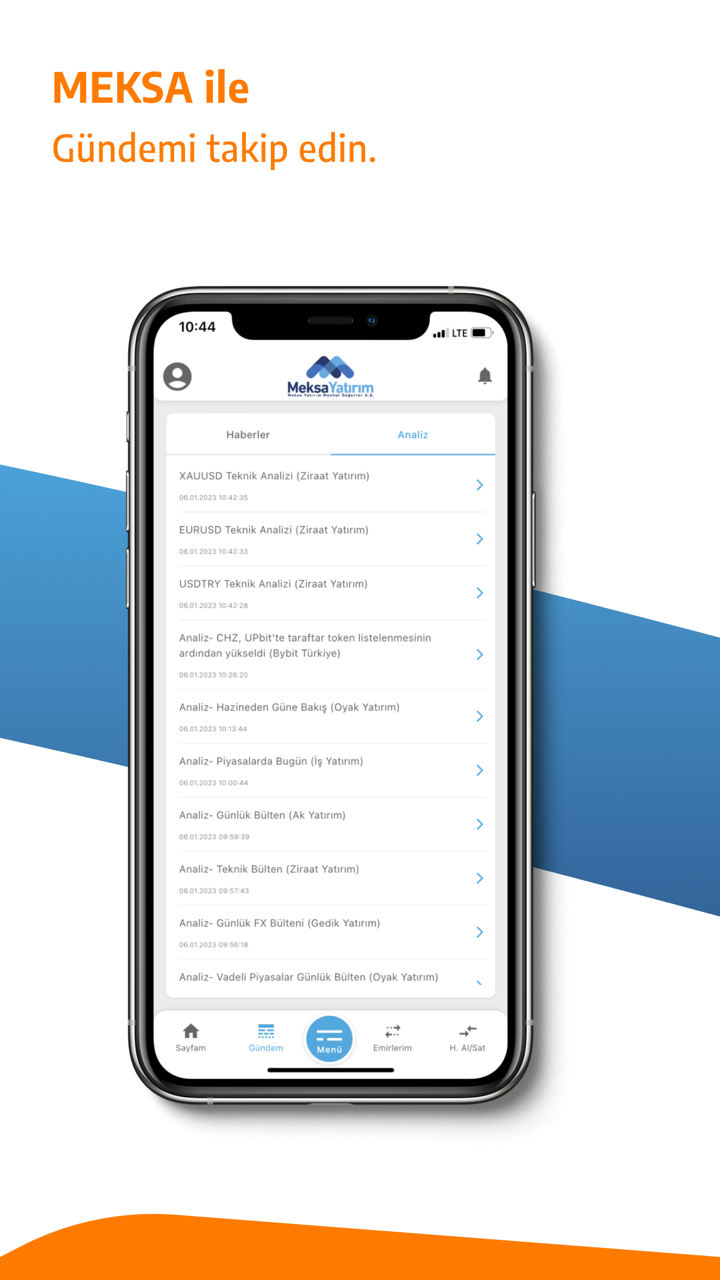

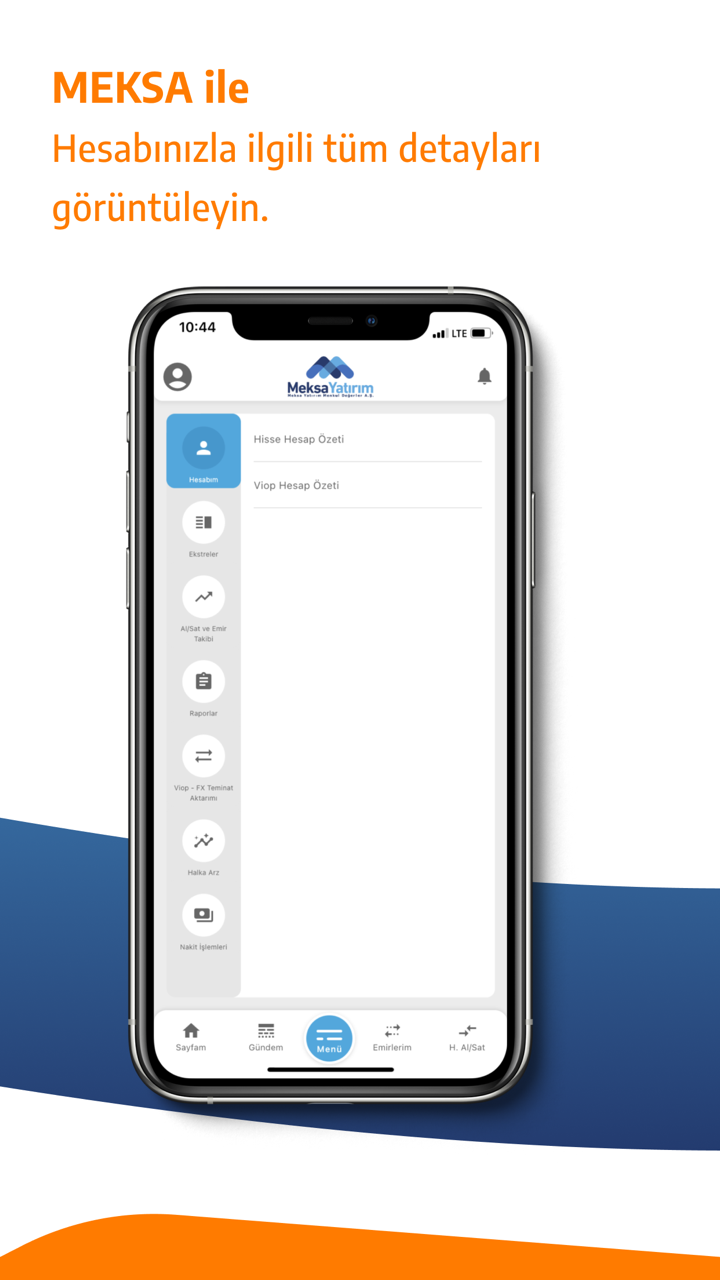

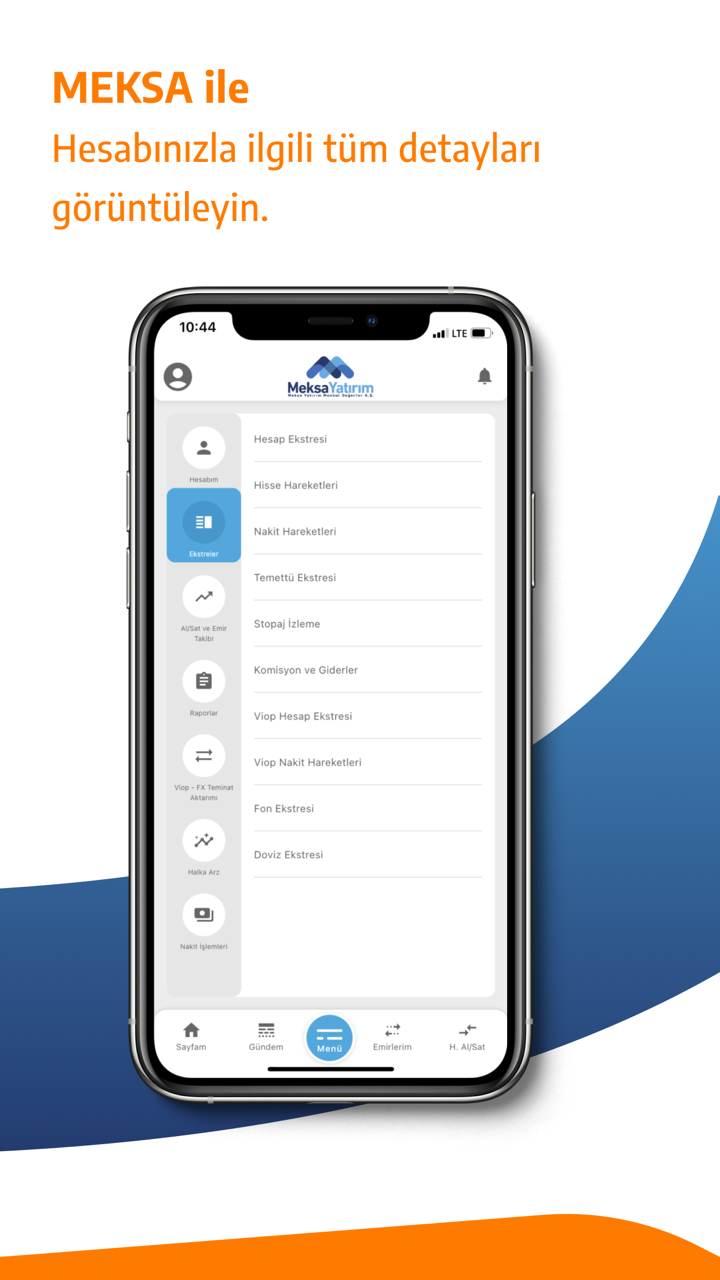

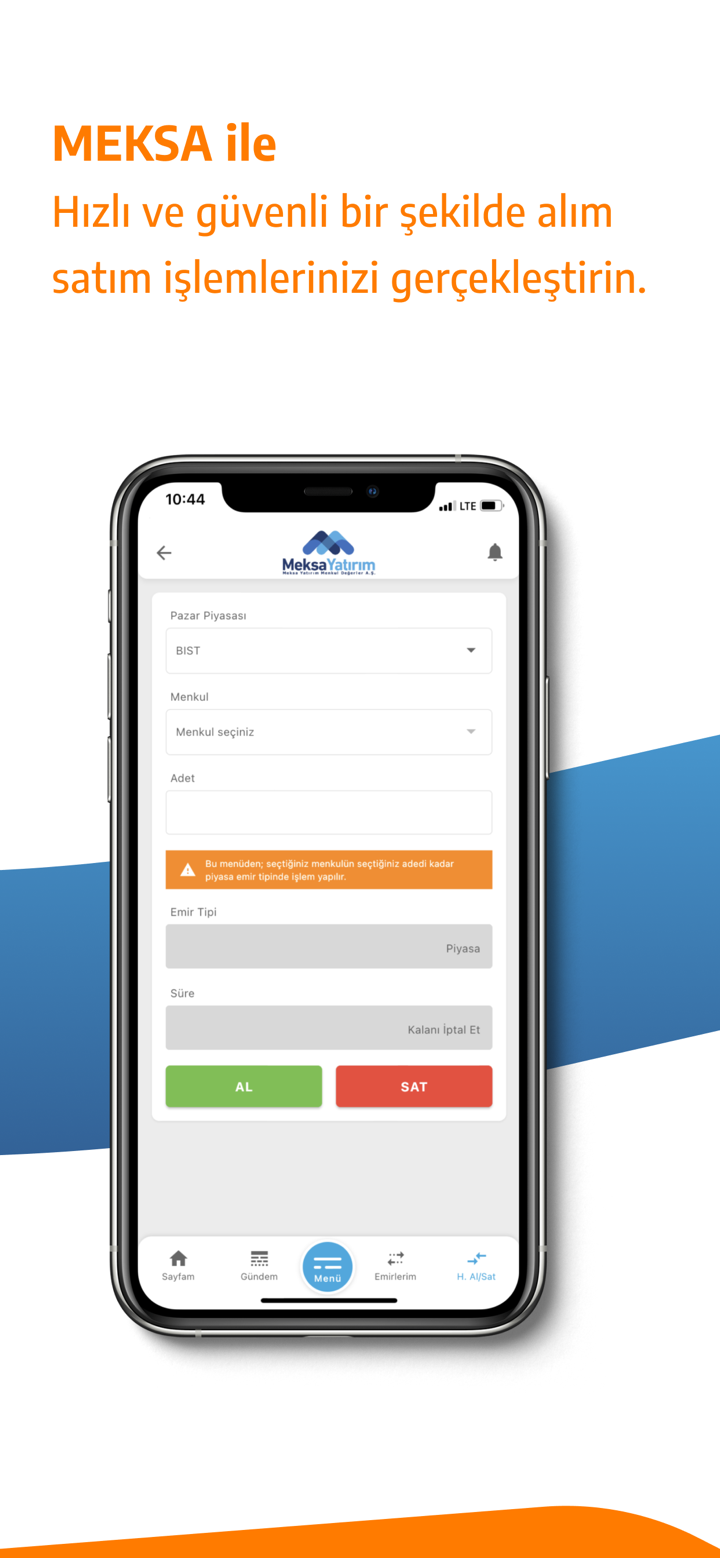

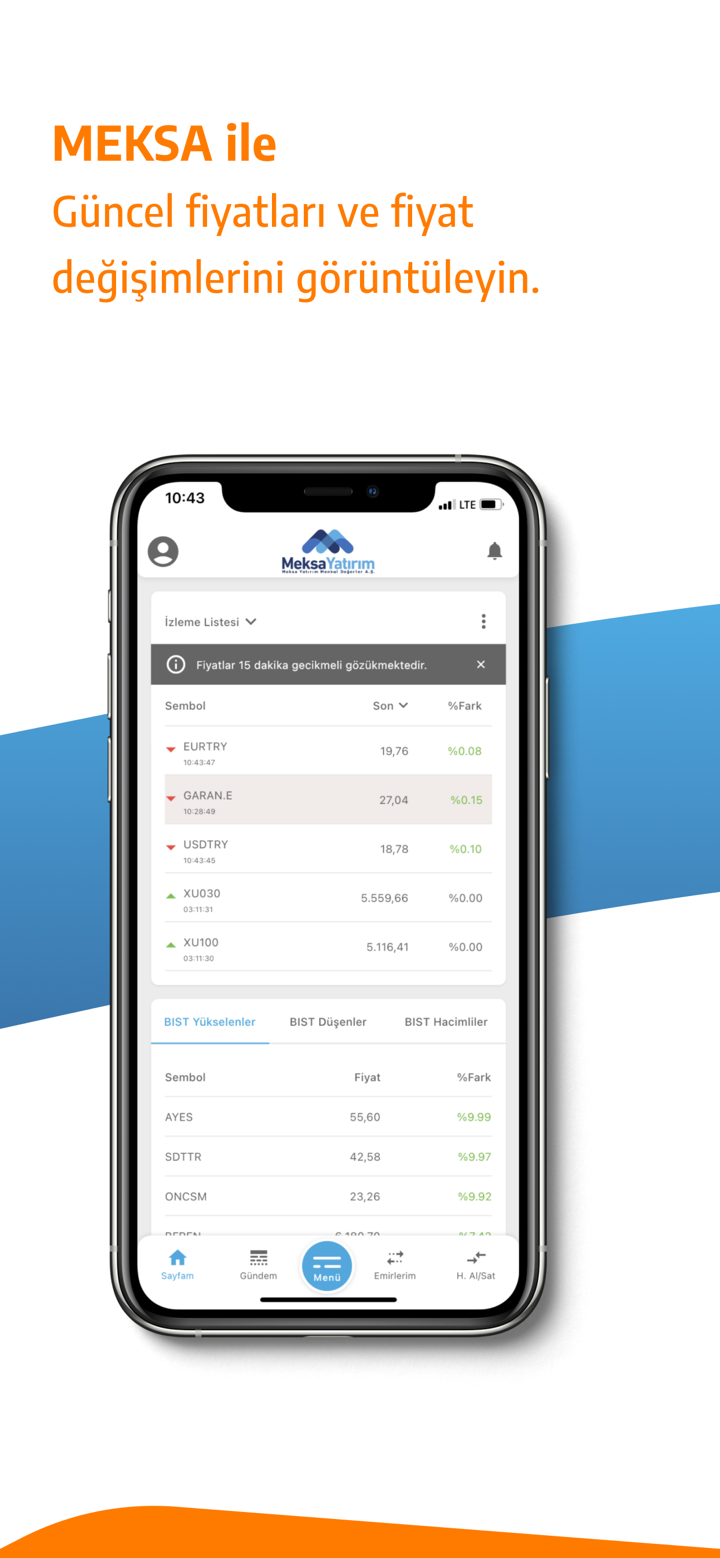

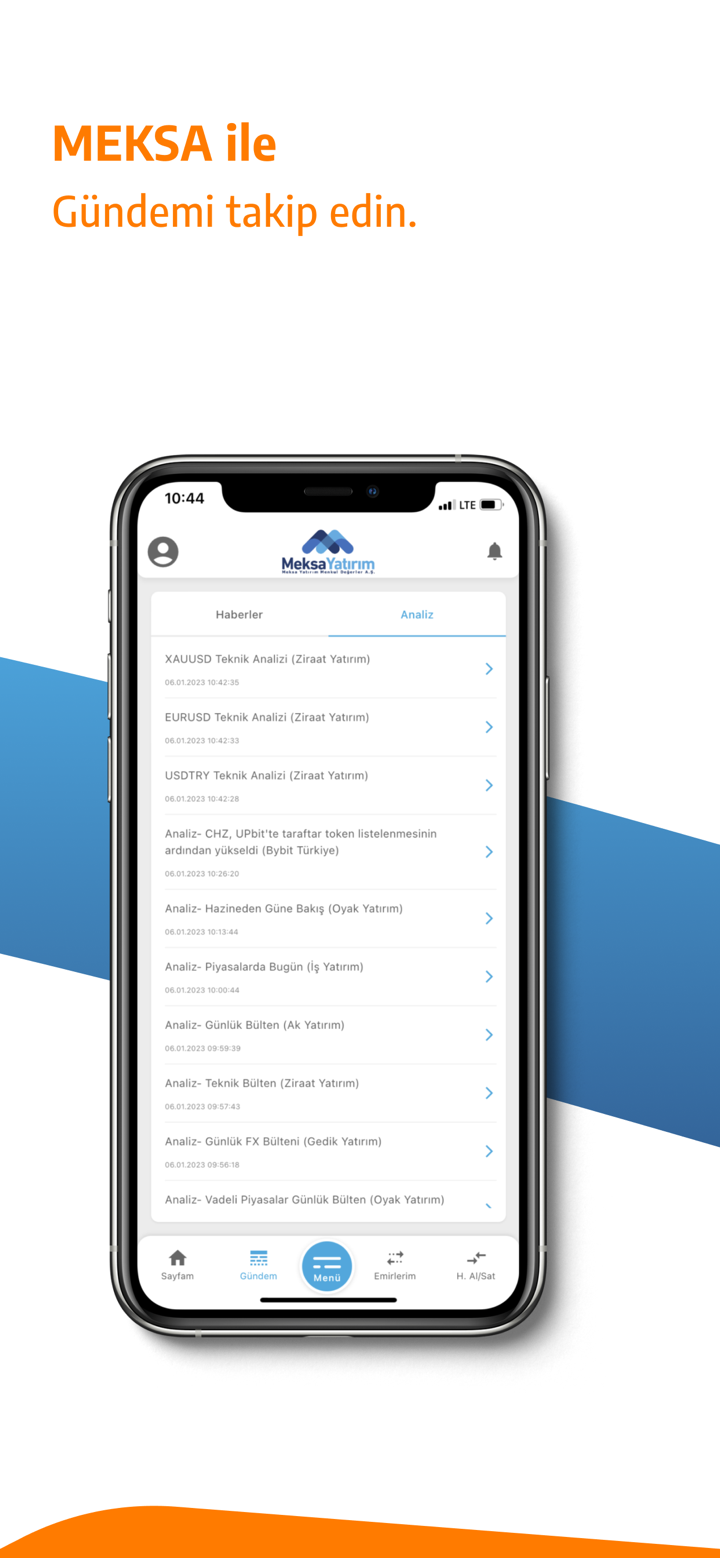

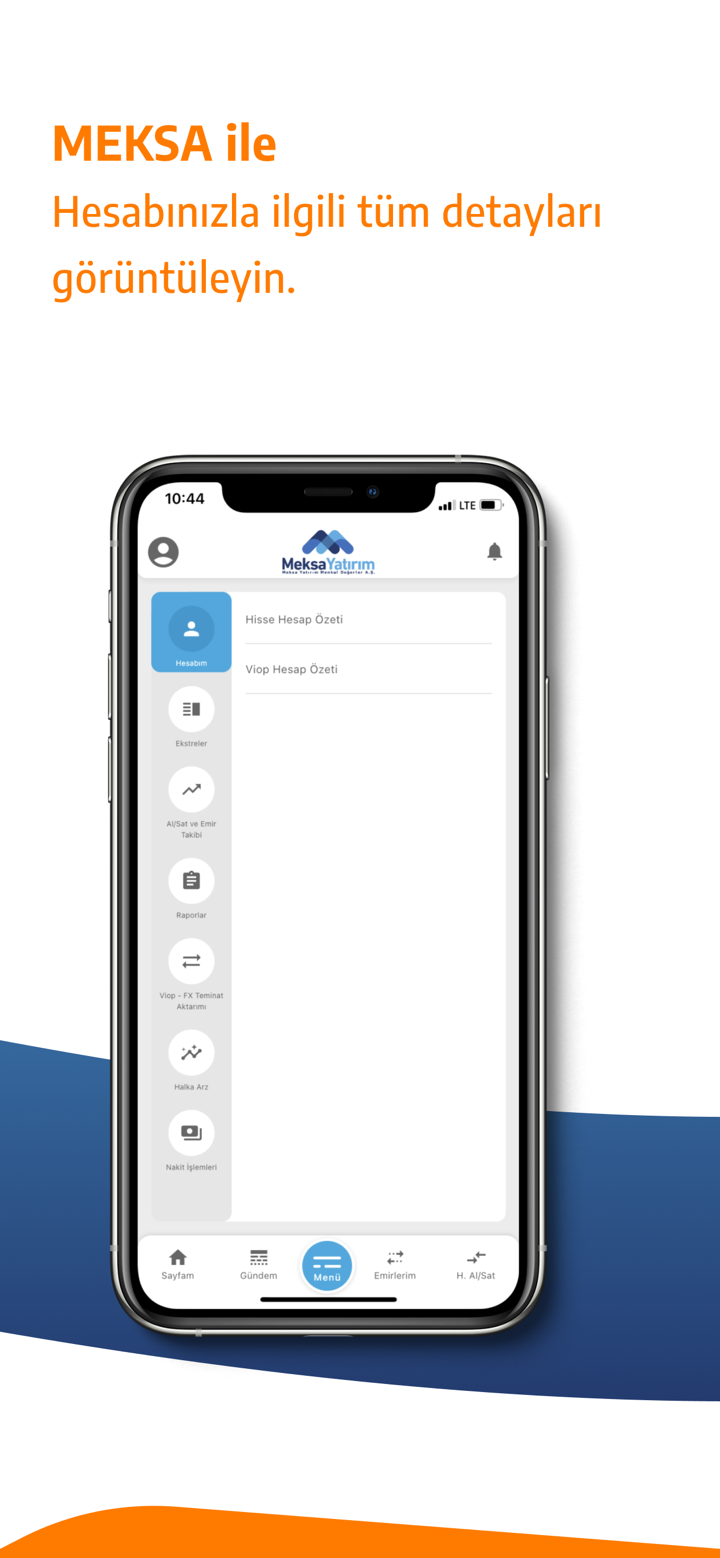

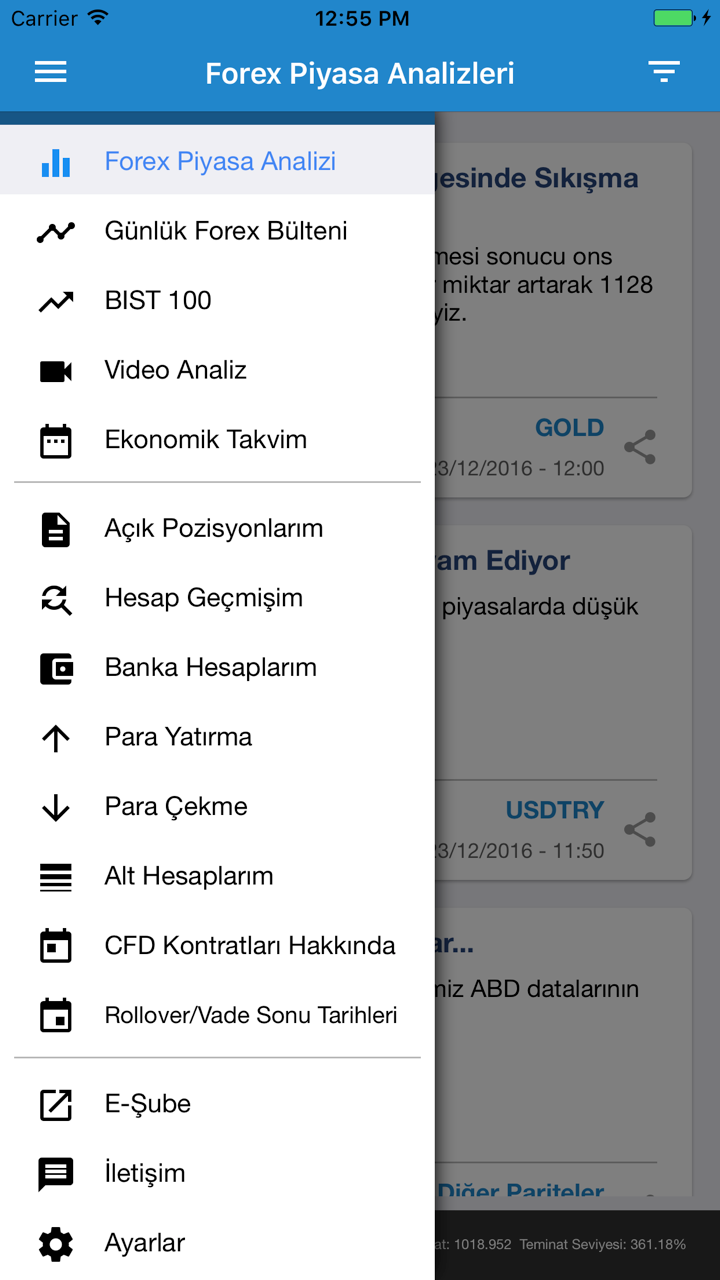

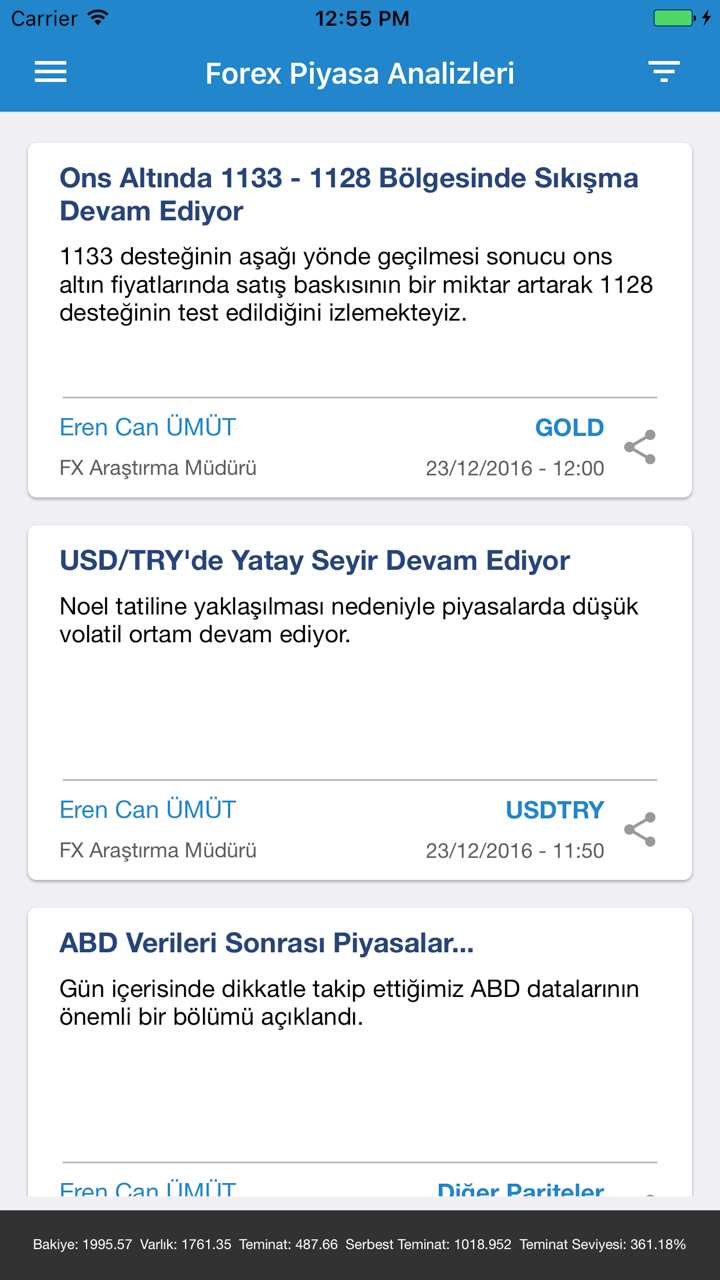

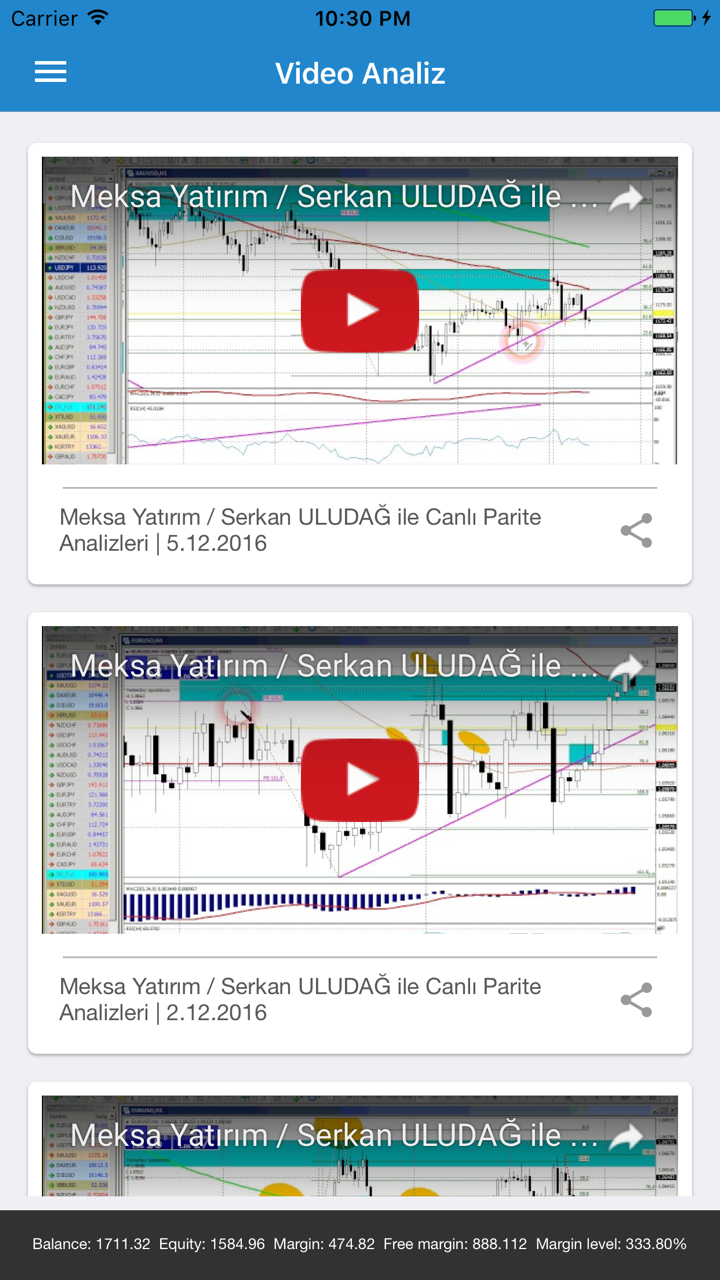

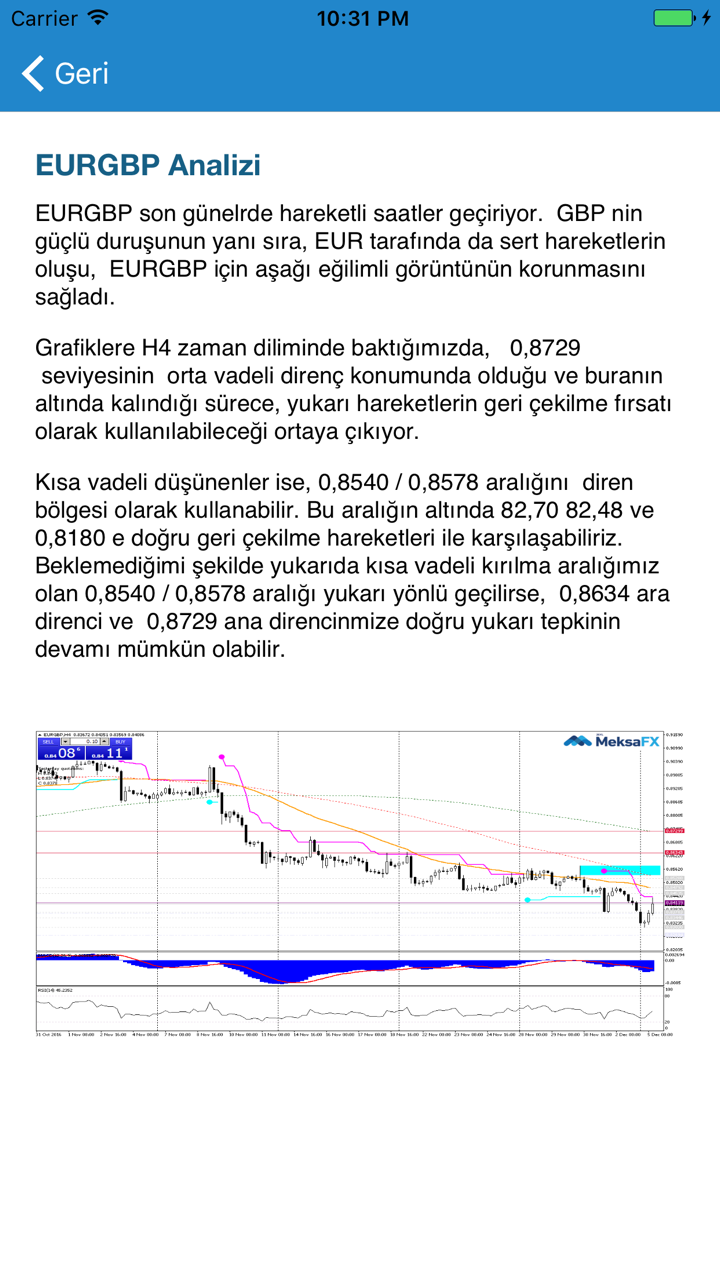

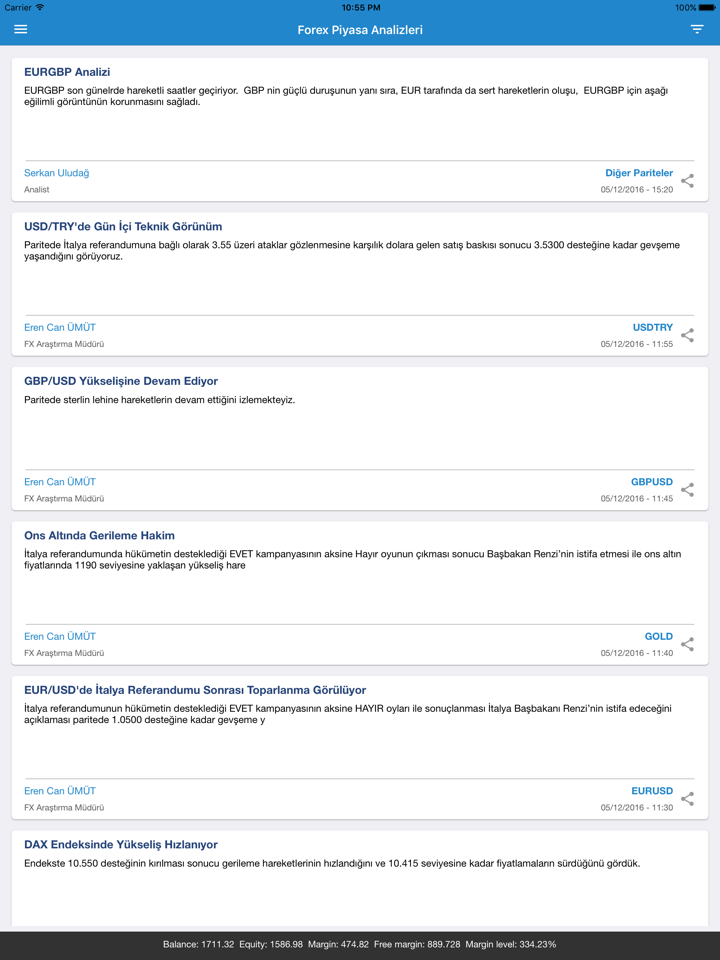

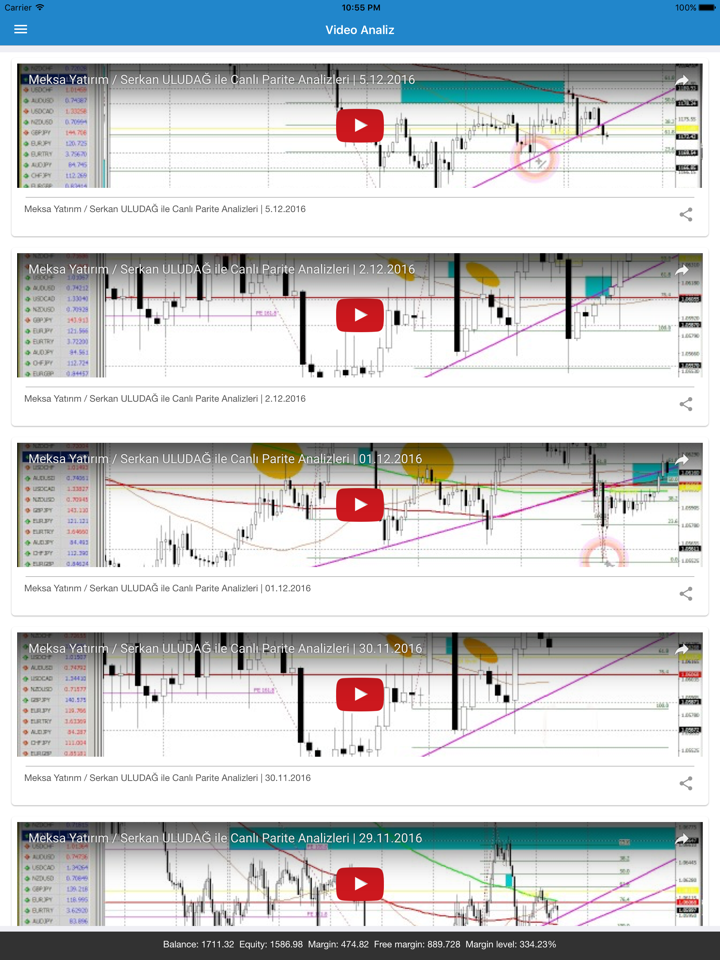

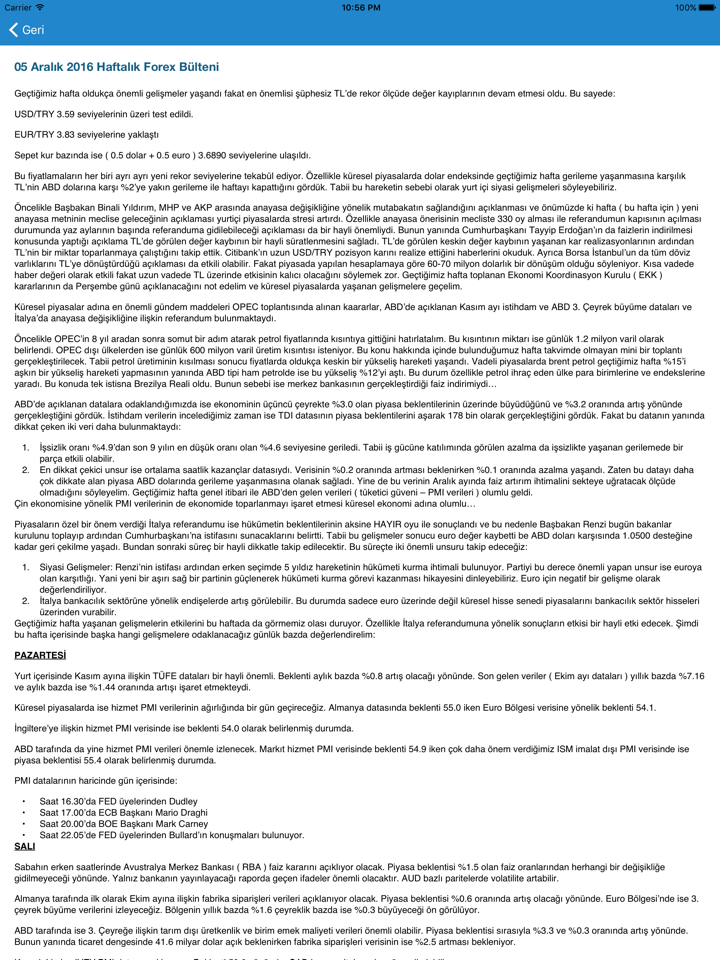

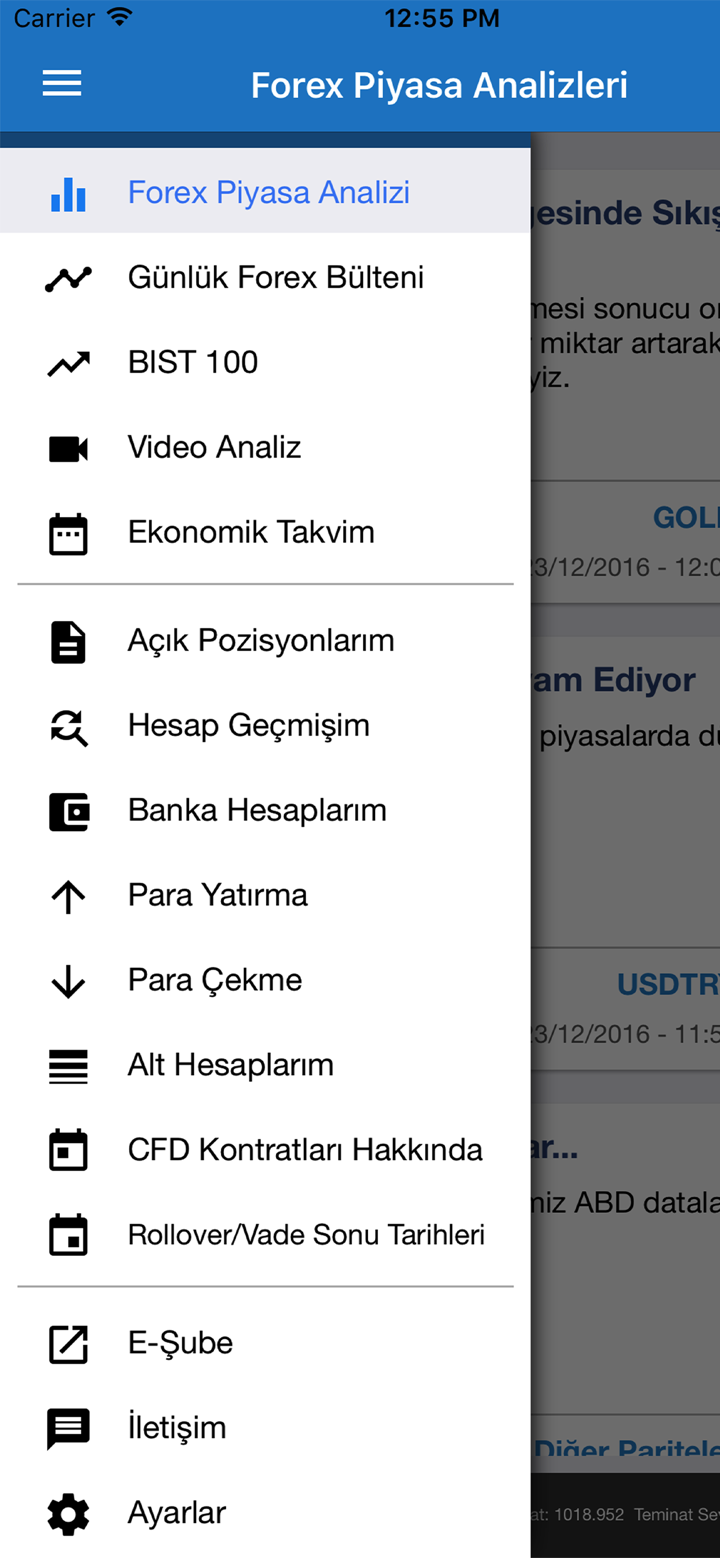

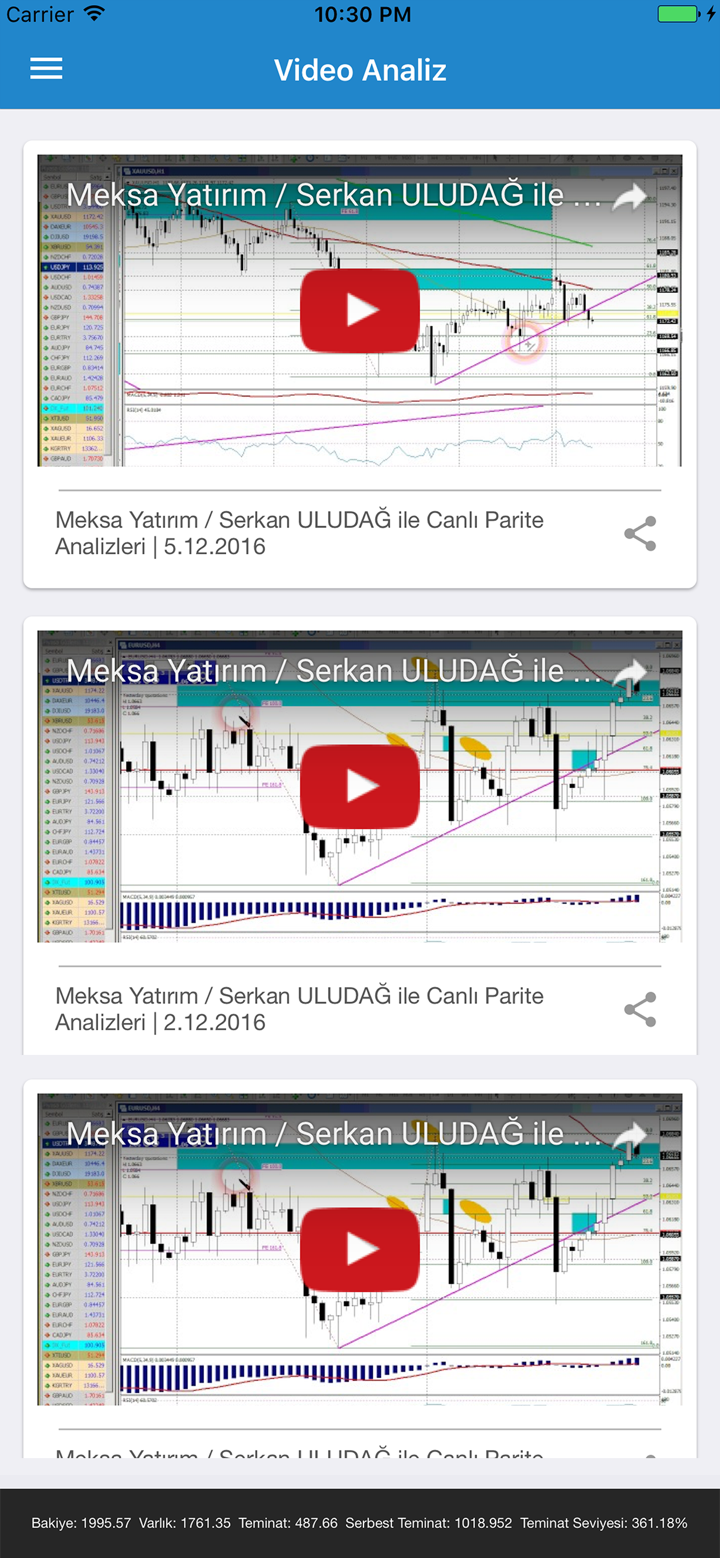

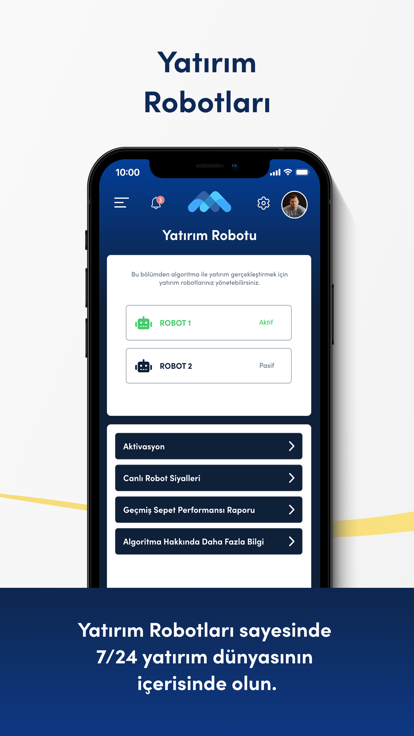

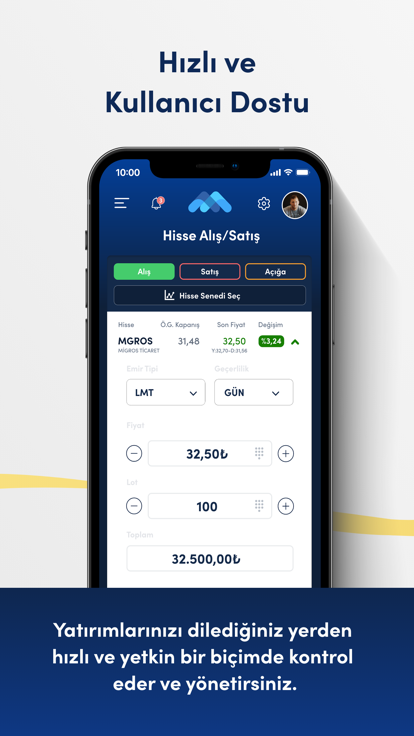

MEKSApubblicizza che offre una vasta gamma di servizi, che includono consulenza sugli investimenti, servizi di intermediazione, gestione del portafoglio, strumenti derivati, servizi viop, gestione di fondi, ricerca, mercati forex e finanza aziendale.

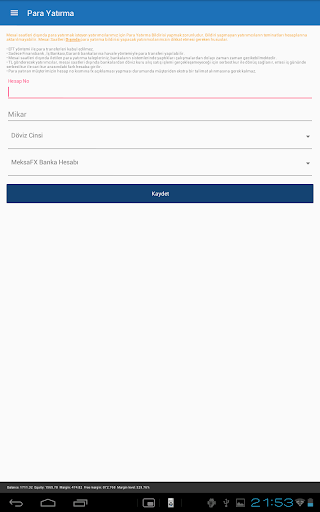

Deposito e prelievo

l'importo minimo del deposito per realizzare gli investimenti forex all'interno MEKSA si dice che sia 50.000 tl per cmb. tuttavia, il broker non ha rivelato alcuna informazione sui metodi di deposito e prelievo accettabili.

Servizio Clienti

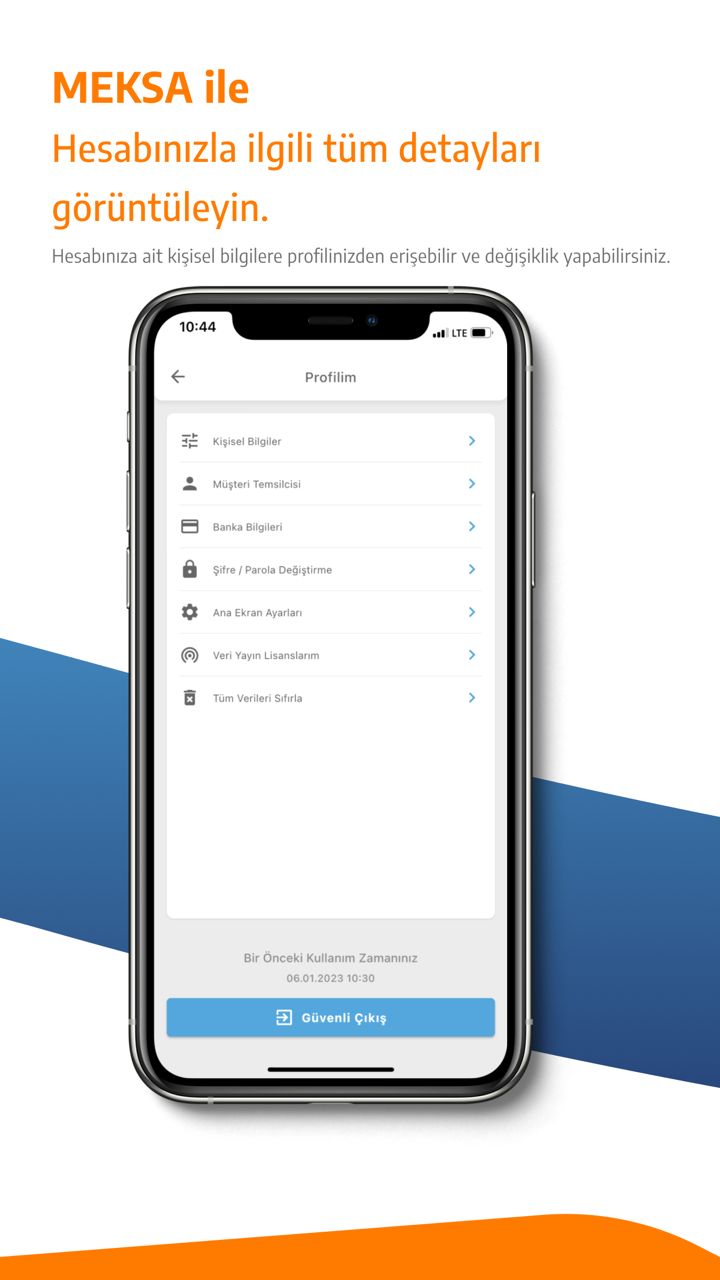

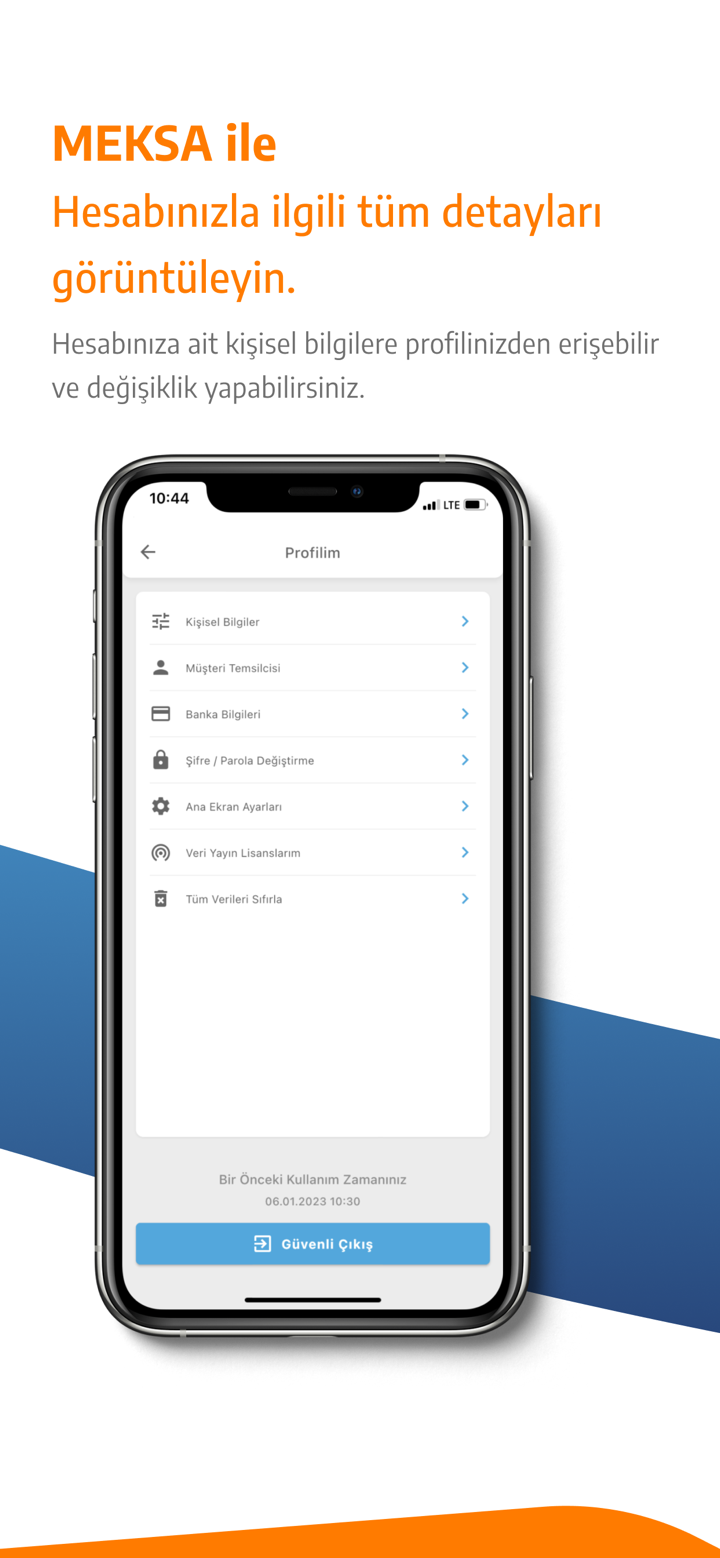

MEKSAs assistenza clienti può essere contattata per telefono: 02166813400, fax: +90 (216) 6930570, +90 (216) 6930571, +90 (216) 6930572, e-mail: destek@ MEKSA fx.com o invia messaggi online per metterti in contatto. puoi anche seguire questo broker su piattaforme di social media come twitter, facebook, instagram, youtube e linkedin. indirizzo dell'azienda: şehit teğmen ali yılmaz sok. güven sazak plaza a blok no:13 kat: 3-4 34810 kavacık - beykoz / istanbul.

Avviso di rischio

Il trading online comporta un livello di rischio significativo e potresti perdere tutto il capitale investito. Non è adatto a tutti i trader o investitori. Assicurati di aver compreso i rischi coinvolti e tieni presente che le informazioni contenute in questo articolo sono solo a scopo informativo generale.